Altius Minerals takes advantage of market weakness

Adrian Day of Adrian Day Asset Management discusses Altius Minerals, one of his core holdings, including how it has continued to make progress through the resources bear market.

Adrian Day of Adrian Day Asset Management discusses Altius Minerals, one of his core holdings, including how it has continued to make progress through the resources bear market.

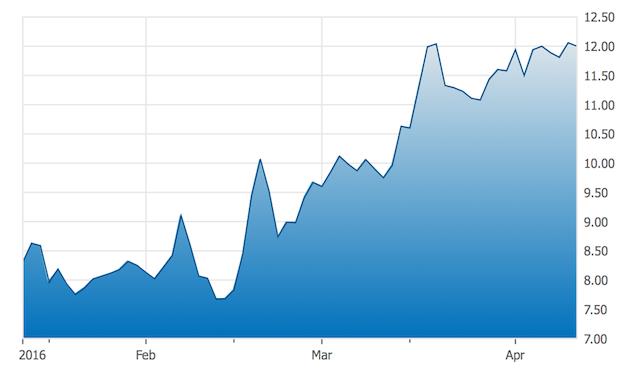

Altius Minerals Corp. (ALS:TSX.V, 11.81) has continued to make progress through the bear market in resources. Most recently, it has entered into a metal purchase agreement with Yamana Gold to purchase some of the future copper production from its Chapada mine.

Altius Minerals will pay US$60 million plus 30% of the spot copper price upon delivery. It will also give Yamana 400,000 warrants exercisable at CA$14 per share. It will receive just under 4% of the copper production from Chapada (with some reductions after 75 million pounds has been delivered and if the mine expands production).

The deal is expected to increase Altius' earnings by around CA$8 million per year at the current price, significantly adding to total revenue (which for the past 12 months was a little over $30 million). It diversifies the resource base, reducing reliance on coal royalties, and adding an interest in another long-life, low-cost mine. To finance the deal, Altius is entering into short-term debt facilities, which will also replace its current term loan at a lower interest rate.

Building a mineral bank

Altius has also been very active, though quietly so, on increasing exposure to exploration projects worldwide, emphasizing zinc, copper, gold, nickel and PGMs, in Newfoundland, Ireland and Chile, as well as Michigan. This is largely low-cost prospect-generation, during what it says was the "best opportunity in more than 15 years" to acquire minerals rights that will be highly sought after as exploration money flows back to the sector, allowing it to retain royalty and minority interests.

Altius is one of our top core holdings. The stock tends to be quite volatile, so we would look for pullbacks to add to positions. Though it is good value at this price, patient investors will likely see better opportunities ahead.

Adrian Day, London-born and a graduate of the London School of Economics, heads the money management firm Adrian Day Asset Management, where he manages discretionary accounts in both global and resource areas. Day is also sub-adviser to the EuroPacific Gold Fund (EPGFX). His latest book is "Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks."

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:1) Adrian Day: I own, or my family owns, shares of the following companies mentioned in this interview: Altius Minerals Corp. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. Clients of Adrian Day Asset Management hold shares of the following companies mentioned in this interview: Altius Minerals Corp.2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment.3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Streetwise - The Gold Report is Copyright (C) 2016 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

Source: Adrian Day

https://www.streetwisereports.com/pub/na/altius-minerals-takes-advantage-of-market-weakness