Australia recovers lost ground, named world's top mining investment destination

Despite a painful readjustment caused by a recent global collapse in commodity prices, Australia is seen as the world's most attractive region for mining investment, according to the latest annual global survey of mining executives released Thursday by the Fraser Institute.

Mining has been the driving force of Australia's economy, helping GDP growth average 3.6% a year for most of this century.Mining has been the driving force of Australia's economy for longer than anyone cares to remember, helping GDP growth average 3.6% a year for most of this century.

But the last two years were brutal and the country's mining titans - such us BHP Billiton and Rio Tinto - had to tighten their belt and implement a series of cost cutting measures to weather the storm.

The worst, however, seems to be over. At least for Australia, which has been able to offer competitive, transparent, and stable mining policies to encourage exploration and investment despite the global rout, the Fraser Institute's report shows.

Canada's policy think-tank's Annual Survey of Mining Companies rated 109 jurisdictions around the world based on geologic attractiveness and the extent government policies encourage or deter exploration and investment.

Western Australia took the world's top position for mining investment. "In addition to being blessed with an abundance of mineral potential, miners give the jurisdiction's government credit for having transparent mining policies, a strong legal system, clear regulations and skilled labour force," the study shows.

Western Australia took the world's top position for mining investment. "In addition to being blessed with an abundance of mineral potential, miners give the jurisdiction's government credit for having transparent mining policies, a strong legal system, clear regulations and skilled labour force," the study shows.

Other two Australian jurisdictions secured a spot among the world's top 10 with Northern Territory in seventh place and South Australia as number 10.

Canada and the United States also fare prominently in this year's survey, with five out of the top 10 spots taken by North Americam jurisdictions, the Fraser Institute said.

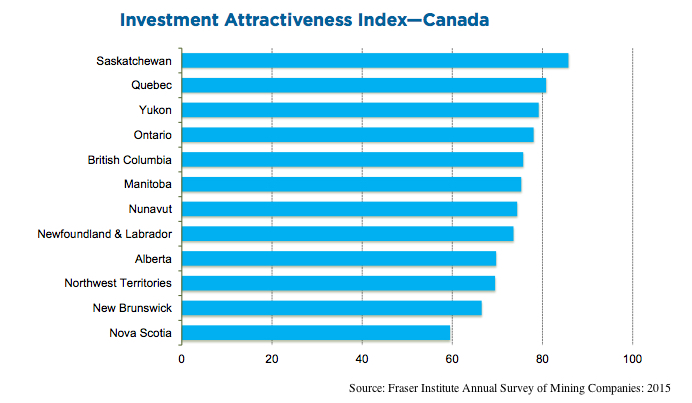

Saskatchewan remains the top-ranked Canadian province - second worldwide - while Nevada is the top US state placing third.

Europe picks up, Chile remains No.1

While only two European jurisdictions made it to the top 10 list this year -Ireland (4) and Finland (5), the region's median investment attractiveness score experienced a notable increase.

"As in previous years, a number of European countries continue to be praised for their attractive policy environments, which include clear licensing policies and efficient permitting processes," said Taylor Jackson, Fraser Institute policy analyst.

Chile, which ranked 11th overall, remains the most attractive jurisdiction for mining investment in Latin America and the Caribbean Basin, while Honduras (107th) and Venezuela (108th) continue to be among the least attractive jurisdictions in the world for investment.

Africa continued to better its performance, a trend that began in 2012, buoyed by Burkina Faso (29th). As a region, Africa now ranks ahead of Oceania, Asia, Latin America and the Caribbean and Argentina for its investment attractiveness.