Junior miners: Doom, gloom or boom?

If it wasn't already clear, the junior companies that explore, develop, and mine the world's metals are struggling. PwC recently recapped the malaise of these companies in its latest Junior Mine 2015 report, along with highlighting some success stories of those that have been able to bypass the onslaught.

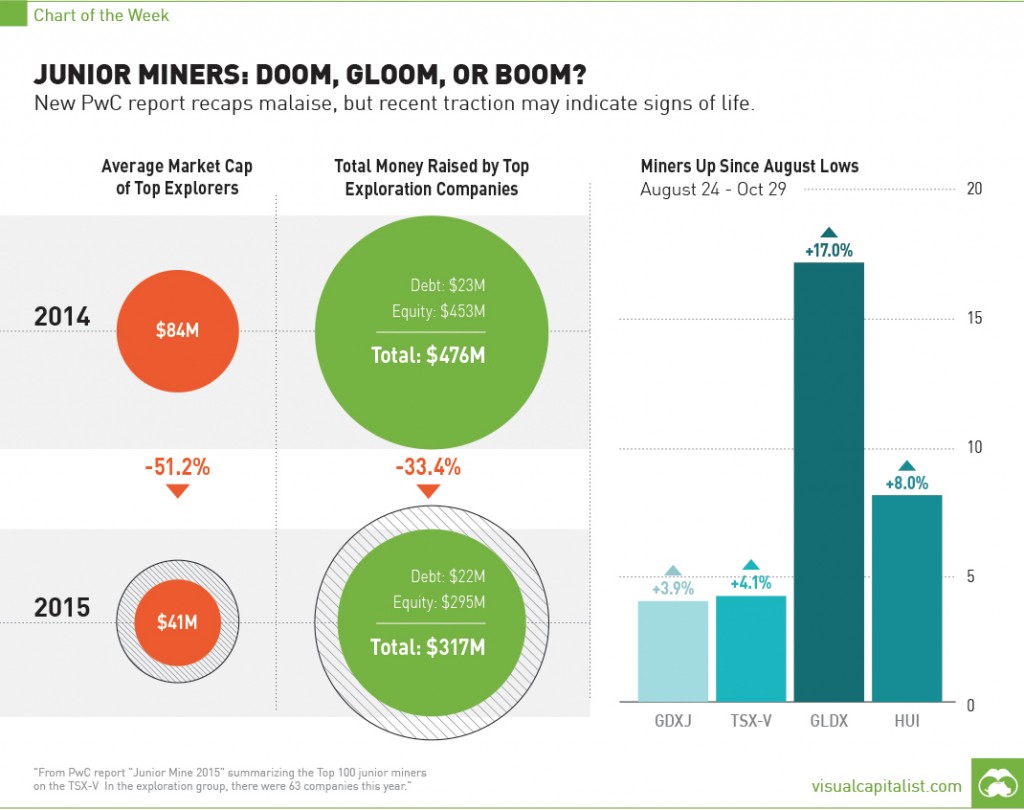

The report, which looks at the Top 100 junior mining companies traded on the TSX Venture exchange, had findings that makes junior mining executives want to bury their heads in the sand. The average market capitalizations of exploration companies is down -51.2% from 2014 to 2015. The amount of money raised in equity and debt markets for exploration companies is down -33.4% over the same timeframe.

Furthermore, the average company on the Top 100 list has $7 million cash, which is down from $10 million last year. In 2011 the average cash in the bank was $22.7 million.

Remember, these are the results of the "best" companies in the space. This doesn't include the zombies or any of the other hurting companies.

Signs of Life?

Every coin has two sides, and here's the other side to this one. Over the last two months, data shows that things aren'tgetting worse. In fact, it could even be argued that things are getting better.

Since the end of the "flash crash" that hit markets on August 24th, when the Dow dropped 1,100 points in the first five minutes of trading, miners have been up.

The TSX Venture is up 4.1%, the GDXJ (Junior Gold Miners ETF) is up 3.9%, and the HUI (Basket of Unhedged Gold Stocks) is up 8.0%. Even more spectacular is the GLDX (Global X Gold Explorers ETF), which is up a solid 17.0% since the August lows.

This is obviously not anything definitive. However, seeing all four of these major indices up at the same time is a good sign.