London gold market comes clean: it's not as big as thought

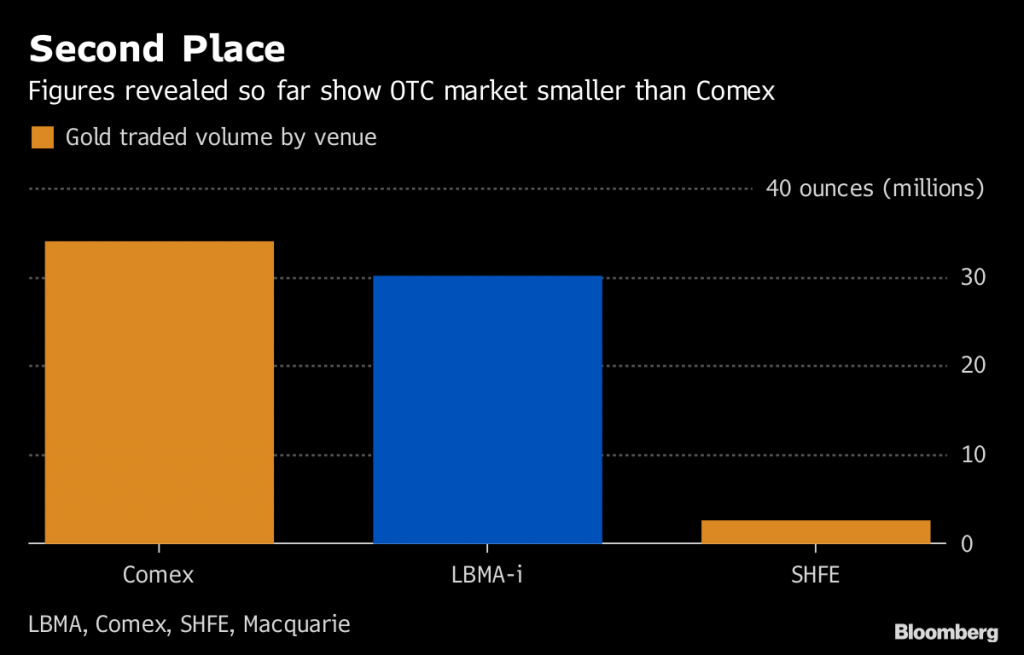

London's gold market owned up to the biggest secret in bullion: it's not as big as some thought and, for last week at least, smaller than New York's.

An average of $36.9 billion of gold and $5.2 billion of silver changed hands each day in the city's over-the-counter market, including metal for delivery in Zurich, according to figures released for the first time on Tuesday by the London Bullion Market Association. Previous World Gold Council estimates, based on 2016 data, were between three and six times higher. The earlier over-estimates for the size of the London market arise from volume projections in a member survey carried out by the LBMA in 2011

While the data was only for a single week, it shows the Comex futures market in New York is a slightly bigger venue for gold than London, LBMA Chief Executive Officer Ruth Crowell said in an interview with Bloomberg Television. That upends conventional wisdom, but a longer trading period may tell a different story as volatility in both centers is smoothed out.

"This is just a week's snapshot," said Crowell, who said the LBMA will start reporting daily once it has three months of data. "In 12 months time, it will be very interesting to look at the figures again."

For the video of Crowell's interview earlier on Tuesday, click here

The earlier over-estimates for the size of the London market arise from volume projections in a member survey carried out by the LBMA in 2011. Still, its size is comparable to the gilts market and the data will provide clarity, according to Matthew Turner, an analyst at Macquarie Group Ltd.

"For the first time in the long history of the London gold market, its size is not guesswork, but a reliable measurement " Turner said. "The real benefit of the data is seeing how it moves over time."

Gold futures for December delivery declined 0.35 to settle at $1,221.20 an ounce Tuesday on the Comex in New York, falling for the first time in five sessions.

Comex, owned by the CME Group, has seen rising volume in recent years.

"As customers seek to hedge a variety of macro factors impacting gold prices, including uncertainty around trade policies, and emerging market events, we have seen double-digit growth across our Comex gold futures and options markets, " according to Young-Jin Chang, global head of metals at CME Group.

The London gold market, which traces its roots back to 1676, has sought to increase transparency and rebuild confidence after some members faced allegations of price manipulation and of accepting metal from illegal mines. Those measures included publishing vault holdings and modernizing auctions that once took place by phone, while seeking to convince regulators that gold is a highly liquid asset.

Today's data release is a breakthrough for the LBMA, which struggled to get members to sign up last year, and as one of the firms tasked with delivering the data collapsed.

The association is also seeking ways to attest to the provenance of gold and has sought proposals on ways to track the precious metal throughout the supply chain. It closed a request for proposals on ways to achieve that earlier this year, but has yet to implement any measures.

(By Eddie van der Walt, Rupert Rowling and Anna Edwards)