My Goodness, What Is Happening to Platinum? / Commodities / Platinum

You may have noticed the platinumprice has fallen well below gold’s price and it continues to underperform the otherprecious metals. What is happening in the platinum market?

We see a handful of factors driving the recent declines inplatinum. For starters, it is facing the same challenges we find in the goldand silver markets.

The dollarhas been getting stronger, interest rates are rising, and traders on WallStreet have rarely been more carefree. Mainstream investors are positioning foreconomic strength, not looking for safety.

The dollarhas been getting stronger, interest rates are rising, and traders on WallStreet have rarely been more carefree. Mainstream investors are positioning foreconomic strength, not looking for safety.

Platinum is trading like the other precious metals, which is tosay performing poorly. As of this writing, platinum is down 16% for the year.

Compare that to silver’s decline of 17%and the price action looks pretty much in-line.

Compare that to silver’s decline of 17%and the price action looks pretty much in-line.

There are some other fundamentals behind platinum’sunderperformance in the past few years though. Demand from automobilemanufacturers is weakening significantly – forecast to be down 6% this year.

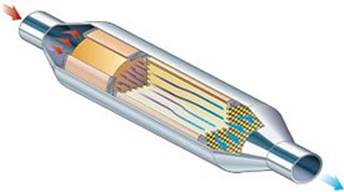

The prognosis for diesel cars is even worse, and that has hurtplatinum demand more than the other metals. Diesel vehicles demand primarily platinumfor their catalytic converters, while gasoline exhaust systems use mostlypalladium.

The 2015 scandal involving Volkswagen revealed that diesel isnot nearly as clean as thought previously. The car maker had been gaming theemissions testing system, and platinum-based catalytic converters were lessefficient at scrubbing out unspent fuel from diesel engine exhaust.

Those revelations have had a serious impact on platinum demand –particularly in Europe where diesel had widespread adoption based on the falseassumption that it was dramatically more “green” than gasoline.

Platinum is currently in surplus. Experts anticipate supply willoutstrip demand by nearly 300,000 ounces this year.

The foreign exchange markets may also be contributing toplatinum’s lower price. Recently the South African Rand has fallensignificantly. Miners, who are typically paid in dollars or euros, arerealizing much higher prices when those funds are converted to Rand.

For bullion investors looking tospeculate as well as diversify their holdings, platinum looksinteresting at these levels.

The political environment in South Africa has long been achallenge for miners. It may be about to get far worse. That may mean even moreweakness in the Rand, but it can also mean a serious disruption to supply.

We also question how much longer the platinum price will remainat a significant discount to palladium. The two metals are largelyinterchangeable in automotive catalytic converters. If car makers see a goodopportunity to save by switching to platinum, look for them to do it.

By Clint Siegner

Clint Siegner is a Director at MoneyMetals Exchange,perhaps the nation's fastest-growing dealer of low-premium precious metalscoins, rounds, and bars. Siegner, a graduate of Linfield College in Oregon,puts his experience in business management along with his passion for personalliberty, limited government, and honest money into the development of MoneyMetals' brand and reach. This includes writing extensively on the bullionmarkets and their intersection with policy and world affairs.

© 2018 Clint Siegner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.