Abcourt releases its first Mineral Resources Estimate on its Flordin Gold Project

ROUYN-NORANDA, Quebec, May 18, 2023 (GLOBE NEWSWIRE) -- Abcourt Mines Inc. (“Abcourt” or the “Corporation”) (TSX Venture: ABI) is pleased to announce its first Mineral Resource Estimate (“MRE”) for the Flordin Project, a 100% owned gold deposit located in the Abitibi greenstone belt, 85 km east of the Sleeping Giant plant 100% owned by Abcourt, and 30 km north of the town of Lebel-sur-Quévillon, Quebec.

Figure 1: Regional Map

This MRE reflects the results of approximately 73.4 thousand metres of drilling, of which 34.9 thousand metres were carried out from 2010 to 2020. The MRE was carried out by the firm InnovExplo of Val d'Or. The MRE uses a base case valued at a gold price of $1,650/oz. Please read the notes below Table 1 for the full list of the MRE evaluation criteria.

Highlights

- 134,700 ounces of Measured and Indicated Resources in 1,758,000 tonnes at an average grade of 2.38 g/t Au;

- 59,700 ounces of Inferred Resources in 575,000 tonnes at an average grade of 3.23 g/t Au;

- This MRE as well as the 3D model of the veins and the mineral structures will serve as a basis for carrying out an exploration campaign in the summer of 2023 with the aim of exploring the extensions of the deposit and potentially increasing the mineral resources.

Pascal Hamelin, President and CEO of Abcourt, said: “We are pleased to now own a third deposit with a mineral resource estimate near our Sleeping Giant mill. With our ore processing plant having all its permits, having processing and storage capacity, Abcourt has the potential to become a significant producer in a mining camp without any mill and several orphan deposits belonging to several companies.

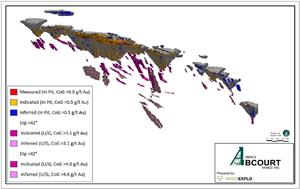

Figure 2: Longitudinal View of the Flordin deposit

Table 1: Mineral Resources Estimate of the Flordin Gold Project

| Potential open pit mining (cut off at 0,5 g/t Au) | Potential long holes mining (cut off at 3,1 g/t Au) | Potential room & pillars mining (cut off at 4,6 g/t Au) | ||||||

| Tonnes | Grade (g/t Au) | Ounces Au | Tonnes | Grade (g/t Au) | Ounces Au | Tonnes | Grade (g/t Au) | Ounces Au |

| Measured Resources | ||||||||

| 86,000 | 2.58 | 7,100 | 0 | 0.00 | 0 | 0 | 0.00 | 0 |

| Indicated Resources | ||||||||

| 1,444,000 | 2.15 | 99,900 | 227,000 | 3.75 | 27,500 | 1,000 | 5.46 | 200 |

| Measured & Indicated Resources | ||||||||

| 1,530,000 | 2.18 | 107,000 | 227,000 | 3.77 | 27,500 | 1,000 | 6.22 | 200 |

| Inferred Resources | ||||||||

| 244,000 | 2.38 | 18,600 | 323,000 | 3.83 | 39,800 | 8,000 | 5.16 | 1 300 |

Notes to the 2023 MRE

- The effective date of the 2023 MRE is May 15, 2023.

- The independent and qualified persons (as defined by NI 43-101) for the 2023 MRE are Olivier Vadnais-Leblanc, P.Geo., Carl Pelletier, P.Geo., Eric Lecomte, P.Eng., and Simon Boudreau, P.Eng., from InnovExplo Inc,

- The mineral resource estimate follows the CIM Definition Standards (2014) and follows the CIM MRMR Best Practice Guidelines (2019).

- These mineral resources are not mineral reserves because they do not have demonstrated economic viability. The results are presented undiluted and are considered to have reasonable prospects for eventual economic extraction (RPEEE).

- The estimate encompasses 364 mineralized veins and structures developed using Genesis and interpolated using LeapFrog Edge.

- 1 m composites were calculated within the mineralized zones using the grade of the adjacent material when assayed or a value of zero when not assayed. High-grade capping supported by statistical analysis was done on composites and was set to 25 g/t Au.

- The estimate was completed using a sub-block model in Leapfrog Edge. A 10m x 2m x 2m (X,Y,Z) parent block size and a 1.25m x 0.25m x 0.25m (X,Y,Z) sub block size was used.

- Grade interpolation was obtained by Inverse Distance Squared (ID2) using hard boundaries.

- A density value of 2.8 g/cm3 was assigned to all mineralized zones.

- Mineral resources were classified into Measured, Indicated and Inferred. Measured resources are defined within a distance of 8m from underground or surface channel and from a minimum of three (3) drill holes in areas where the drill spacing is less than 50 m. Indicated resources are defined with a minimum of three (3) drill holes in areas where the drill spacing is less than 50 m. The Inferred category is defined with two (2) drill hole in areas where the drill spacing is less than 75 m where there is reasonable geological and grade continuity.

- The requirement of a reasonable prospect of eventual economic extraction is satisfied by having cut-off grades based on reasonable parameters for potential surface and underground extraction scenarios, minimum widths and constraining volumes. The estimate is presented for potential underground scenarios (realized in Deswik) over a width of 1.7m for blocks 16m high by 16m long at a cut-off grade of 3.10 g/t Au for the long-hole method (LT) and 4.60 g/t Au for the conventional room and pillar (CP) method. Cut-off grades reflect the actual geometry and dip of the mineralized envelopes. The pit of the 2023 mineral resource estimate is locally constrained by an optimized surface in Whittle using a rounded cut-off grade of 0.5 g/t Au. Cut-off grades reflect the actual geometry and dip of the mineralized envelopes. The cut-off grades were calculated using the following parameters: a slope of 50° in the rock and 30° in the overburden, a pit mining cost = C$4.65/t, an underground mining cost of C $169.50/t for LT and C$262.00/t for CP, a processing cost of C$21.50/t, general and administrative costs of C$12.00/t, selling costs of C$5.00/oz, a price of gold of US$1,650 per ounce, a USD/CAD exchange rate of 1.33 and a mill recovery rate of 91.7%. Cut-off grades should be re-evaluated in light of future market conditions (metal prices, exchange rates, mining cost, etc.).

- The number of metric tonnes was rounded to the nearest thousand, following the recommendations in NI 43-101 and any discrepancies in the totals are due to rounding effects. The metal contents are presented in troy ounces (tonnes x grade / 31.10348) rounded to the nearest hundred. Numbers may not add up due to rounding.

- The independent and qualified persons for the 2023 MRE are not aware of any known environmental, permitting, legal, political, title-related, taxation, socio-political, or marketing issues that could materially affect the Mineral Resource Estimate.

Table 2: MRE sensitivities according to the price of gold

| Sensitivities | ||||||||||||

| Measured Resources | Indicated Resources | Inferred resources | ||||||||||

| Potential mining method | Gold Price ($US) | Cutoff grade (g/t Au) | Tonnes | Grade (g/t Au) | Ounces Au | Tonnes | Grade (g/t Au) | Ounces Au | Tonnes | Grade (g/t Au) | Ounces Au | |

| Open pit | 1,320 $ | 0.65 | 37,000 | 3.93 | 4,600 | 587,000 | 2.82 | 53,100 | 133,000 | 2.67 | 11,400 | |

| Long holes | 3.9 | 137,000 | 4.68 | 20,600 | 146,000 | 4.62 | 21,600 | |||||

| Rooms & Pillars | 5.7 | 2,000 | 6.21 | 300 | 3,000 | 6.39 | 700 | |||||

| Open pit | 1,485 $ | 0.6 | 80,000 | 2.71 | 7,000 | 1,102,000 | 2.36 | 83,600 | 193,000 | 2.55 | 15,800 | |

| Long holes | 3.5 | 165,000 | 4.27 | 22,700 | 212,000 | 4.22 | 28,800 | |||||

| Rooms & Pillars | 5.1 | 2,000 | 5.43 | 400 | 5,000 | 5.56 | 900 | |||||

| Open pit | Base Case 1,650 $ | 0.5 | 86,000 | 2.58 | 7,100 | 1,444,000 | 2.15 | 99,900 | 244,000 | 2.38 | 18,600 | |

| Long holes | 3.1 | 227,000 | 3.75 | 27,500 | 323,000 | 3.83 | 39,800 | |||||

| Rooms & Pillars | 4.6 | 1,000 | 5.46 | 200 | 8,000 | 5.16 | 1,300 | |||||

| Open pit | 1,815 $ | 0.45 | 90,000 | 2.50 | 7,200 | 2,432,000 | 1.90 | 148,500 | 504,000 | 1.94 | 31,300 | |

| Long holes | 2.9 | 199,000 | 3.55 | 22,700 | 376,000 | 3.64 | 44,000 | |||||

| Rooms & Pillars | 4.2 | 2,000 | 5.10 | 300 | 13,000 | 4.82 | 1,900 | |||||

| Open pit | 2,063 $ | 0.4 | 93,000 | 2.44 | 7,300 | 4,041,000 | 1.69 | 219,100 | 961,000 | 1.76 | 54,500 | |

| Long holes | 2.5 | 152,000 | 3.14 | 15,300 | 522,000 | 3.21 | 53,900 | |||||

| Rooms & Pillars | 3.7 | 4,000 | 4.38 | 500 | 17,000 | 4.16 | 2,200 | |||||

This MRE adheres to current Canadian standards for the disclosure of mineral resources and reserves as created by the Canadian Institute of Mining (“CIM”) and defined in the CIM Definition Standards for Mineral Resources and Mineral Reserves dated May 2014 (“ICM Definition Standards”). The MRE also complies with the CIM Best Practice Guidance on Estimating Mineral Resources and Mineral Reserves dated November 2019 (“CIM MRMR Best Practice Guidance”).

This MRE includes the amalgamation of blocks of various grades (“mandatory blocks”) included within potential mining forms respecting the reasonable prospect of eventual economic extraction, as specified by the CIM in 2019.

Qualified Persons

The qualified persons independent of the issuer, responsible for estimating the resources of the Discovery property, within the meaning of NI 43-101, are Olivier Vadnais-Leblanc, P.geo., Carl Pelletier, P.geo., Simon Boudreau, P.Eng., and Eric Lecomte, P.Eng., of InnovExplo Inc.

Messrs. Vadnais-Leblanc, Pelletier, Boudreau and Lecomte declare that they have read this press release and that the scientific and technical information relating to the resource estimate presented therein is correct.

Mr. Pascal Hamelin, ing, President and Chief Executive Officer of the Company, has verified and approved the technical information contained in this press release.

ABOUT ABCOURT MINES INC.

Abcourt Mines Inc. is a Canadian exploration corporation with strategically located properties in northwestern Québec, Canada. Abcourt owns the Sleeping Giant mill and mine where it concentrates its activities.

ABOUT INNOVEXPLO INC.

InnovExplo Inc. is a consulting firm offering services in mining exploration, mining geology, mineral resources, mining engineering, environment and sustainable development. Since its founding in 2003, InnovExplo Inc. has worked on 450 different mandates for 170 junior mining exploration and producing companies. The firm has produced more than 300 geological or engineering reports for projects affecting almost all of the spheres of activity of a mining project, from exploration to operation, including mainly the drafting of technical reports in accordance with the Regulation 43-101.

For further information, please visit our website at www.abcourt.com , and consult our filings under Abcourt's profile on www.sedar.com, or contact:

| Pascal Hamelin President and CEO T: (819) 768-2857 E: phamelin@abcourt.com | Dany Cenac Robert, Investor Relations Reseau ProMarket Inc., T: (514) 722-2276, post 456 E: dany.cenac-robert@reseaupromarket.com |

FORWARD-LOOKING INFORMATION

Certain information contained herein may constitute “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “seeks”, “expects”, “estimates”, “intends”, “anticipates”, “believes”, “could”, “might”, “likely” or variations of such words, or statements that certain actions, events or results “may”, “will”, “could”, “would”, “might”, “will be taken”, “occur”, “be achieved” or other similar expressions. Forward-looking statements are based on Abcourt’s estimates and are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Abcourt to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Forward-looking statements are subject to business and economic factors and uncertainties, and other factors that could cause actual results to differ materially from these forward-looking statements, including the relevant assumptions and risks factors set out in Abcourt’s public documents, available on SEDAR at www.sedar.com. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Although Abcourt believes that the assumptions and factors used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements and forward-looking information. Except where required by applicable law, Abcourt disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

The TSX Venture Exchange and its regulatory service provider (as defined in the policies of the TSX Venture Exchange) assume no responsibility for the adequacy or accuracy of this press release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f16a7283-a95c-4b89-900c-8a3c80380755

https://www.globenewswire.com/NewsRoom/AttachmentNg/1e59517e-cde1-4198-a739-743214e437bc