Alacer Gold Announces the Results of the Updated Prefeasibility Study for the Gediktepe Project

TORONTO, April 03, 2019 (GLOBE NEWSWIRE) -- Alacer Gold Corp. (“Alacer” or the “Corporation”) [TSX: ASR and ASX: AQG] is pleased to announce the results of the updated Prefeasibility Study (PFS) for the Gediktepe Project (Project) located in western Turkey. The updated PFS results reflect the positive economics of the Gediktepe Project with an after-tax Internal Rate of Return (IRR) of 27% and a $252M after-tax Net Present Value (NPV5%). Gediktepe is owned through the Polimetal joint venture on a 50% - 50% basis with Lidya Madencilik San. ve Tic. A.Ş. (Lidya Mining), the Gediktepe Project operator.

Rod Antal, Alacer’s President and Chief Executive Officer, stated, “The updated Gediktepe PFS continues to demonstrate the economic value and technical viability of the Project. A material amount of work has been completed since 2016 to define, with a higher level of confidence, the development and operational parameters for the Project.

With the completion of the updated PFS, we will continue to progress the requisite technical work that will allow us to make a construction decision in the future, while also evaluating our strategic alternatives for Gediktepe in conjunction with our JV partner. While we will continue to advance the Gediktepe Project, Ardich has become the highest priority development target in Alacer’s portfolio given its potential and near-term development optionality.”

Highlights

- Measured and Indicated Mineral Resource of 878,000 ounces of gold, 29.8 million ounces of silver, 537 million pounds of copper, and 1.05 billion pounds of zinc.

- Total recovered metals, to both doré and concentrates, of 345,000 ounces of gold, over 8 million ounces of silver, 254 million pounds of copper and 626 million pounds of zinc for a total of 1.6 million recovered Gold Equivalent Gold Ounces (AuEq1).

- Life-of-Mine (LOM) production of 11 years, with a Project payback of 4.1 years.

- After-tax project economics of 27% IRR with a $252 million NPV5%.

- Oxide ore will be processed predominantly for the first 2 years. The oxide ore treatment rate is 1.1 million tonnes per annum (Mtpa) in a carbon-in-pulp (CIP) plant. The sulfide treatment rate is 2.4 Mtpa, processing the polymetallic sulfide ore in a concentrator to produce separate copper and zinc concentrates.

- Pre-production capital expenditure of $164 million is required for the oxide ore phase with an additional $71 million in Project capital required for the sulfide ore flotation plant and related infrastructure. LOM sustaining capital is $57 million for a total of $292 million.

- The total Project LOM gross revenue from doré and concentrates, after smelter recoveries, is estimated to be $1,880 million, which is equal to 1.43 million AuEq ounces.

- After-tax free cash flow of $412 million is generated over the LOM. Total Cash Costs2 of $817 per ounce AuEq. All-in Sustaining Costs2 of $857 per ounce AuEq and All-in Costs2 of $1,021 per ounce AuEq.

- The 2019 Gediktepe PFS identified a positive business case recommending a relatively small amount of work be completed for progression of the Gediktepe Project to a feasibility study level. This work requires additional drill permitting and drilling followed by metallurgical test work and analysis.

| 1 | Gold Equivalent Ounce (AuEq) is a non-IFRS measure (no standardized definition under IFRS) that converts non-gold production into gold equivalent ounces. Calculation of AuEq converts recoverable metals into revenue using metal prices of $1,315 per ounce for gold, $18.00 per ounce for silver, $3.20 per pound for copper, $1.10 per pound for zinc, and then the total revenue is divided by the gold price of $1,315 per ounce. |

| 2 | Total Cash Costs per ounce, All-in Sustaining Costs per ounce, and All-in Costs are non-GAAP performance measures with no standardized definitions under IFRS. |

An updated National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101) compliant Technical Report on the Gediktepe Project has been filed on www.sedar.com and on the Australian Securities Exchange simultaneously with this announcement.

Gediktepe Overview

The Gediktepe Project is located in the Balıkesir Province, about 370 km west of Ankara and 190 km to the south of Istanbul. Gediktepe is owned through the Polimetal joint venture on a 50% - 50% basis with our joint venture partner, Lidya Mining.

Gediktepe is a polymetallic orebody containing economic values for gold, silver, copper, and zinc. The sulfide deposit is overlain with oxide ore containing gold and silver, which is amenable to leaching. Gediktepe will be an open pit mine with oxide ore processed first, providing cash flow for the development of the sulfide plant for subsequent processing of the more prevalent sulfide ore. The oxide and sulfide ore processing circuits share some plant unit operations, with some additional grinding capacity and the sulfide float plant commissioned after the initial two-year oxide processing campaign. The sulfide ore contains gold, silver, copper, and zinc and will be processed through a multi-stage flotation circuit producing three marketable concentrates.

Polimetal Madencilik Sanayi ve Ticaret A.Ş. (Polimetal), was formed in 2011 as a joint venture company between Lidya Madencilik San. ve Tic. A.Ş. (Lidya Mining) and Alacer Gold Corp. (Alacer). Gediktepe mining licenses are held by Polimetal. The Gediktepe Project studies are being managed by Polimetal. The property consists of one operating license (RN 85535) on which the entire Gediktepe deposit is located, and one additional operating license (200700250) that has not yet been fully explored.

The Gediktepe deposit was discovered in April 2013 with the second drill hole (DRD-002) intersecting 26.5 m at 7.9 g/t gold and 77 g/t silver from surface. Drilling for resource definition continued through February 2018. A total of five drilling phases by both diamond core and reverse circulation drilling were completed by local contractor companies. The majority of holes have been drilled vertically to intersect the low angle zones of mineralization.

In 2017, Polimetal assembled a study team made up of Polimetal personnel and independent consultants to carry out further feasibility assessment of the Project. The previous Technical Report was the Gediktepe 2016 Prefeasibility Study (PFS16).

To view Figure 1. Gediktepe Project Location Map, visit the following link:

http://www.globenewswire.com/NewsRoom/AttachmentNg/2ebef117-ff5b-4ace-a14d-2b864a6dbeae

Geology and Mineralization

The Gediktepe regional geology comprises Upper Paleozoic metamorphics and Lower to Middle Miocene intrusives and volcanics. The metamorphics are generally composed of gneiss, schists, phyllite, amphibolite, marble, and quartzite, with varying degrees of metamorphism.

Massive sulfide type mineralization occurs as lens shaped units trending northeast / southwest and dipping approximately 20° to 40° to the northwest. Minerals include pyrite, sphalerite, tetrahedrite, tenantite, chalcopyrite, galena, and magnetite. The units are cut by later northwest / southeast trending post-mineralization structures causing dislocation of the various units. Post-mineralization weathering processes have caused remobilization of the mineralization, particularly evident within the oxide zone, in which the sulfide mineralization has been completely leached out, leaving gold and silver relatively intact.

The characteristics of the Gediktepe mineralization have been interpreted as a convex massive sulfide type deposit, with sulfide mineralization deposited about the same time and from the same process as the host rock. Subsequent weathering and oxidation have been responsible for the development of oxide and gossan horizons.

Production and Cost Summary

Gediktepe will be an open pit mine and is close to existing infrastructure and connected to the national power grid. Production at Gediktepe will start with the processing of oxide ore using a single stage semi-autogenous grinding mill circuit followed by a carbon in pulp (CIP) gold circuit. Average LOM recoveries for the oxide ore is 90.2% for gold and 70.7% for silver.

Production will transition from oxide processing to sulfide processing during the third year of production. The oxide processing plant will be expanded to process the polymetallic sulfide ore by flotation. A 5.5 MW secondary grinding ball mill will be added to the grinding circuit. Sequential flotation will be employed to produce separate copper and zinc concentrates for export.

The major unit operations of the oxide and sulfide process flowsheets have been tested at bench scale, along with specialist vendor test work as required.

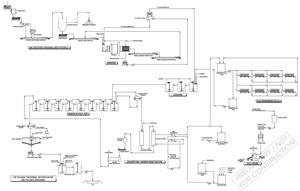

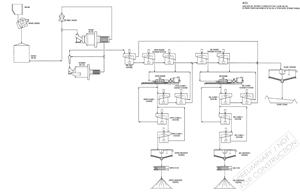

The proposed oxide and sulfide ore flowsheets are presented in Figures 2 and 3.

To view Figure 2. Flowsheet for Oxide Ore Processing, visit the following link:

http://www.globenewswire.com/NewsRoom/AttachmentNg/e8da1618-d5c7-48b4-9f08-f5397a2f2bf4

To view Figure 3. Flowsheet for Sulfide Ore Processing, visit the following link:

http://www.globenewswire.com/NewsRoom/AttachmentNg/a8aec30f-c035-4ef1-bab1-51e09be3c5ed

Metallurgical tests for the sulfide flotation of Gediktepe ores yielded recoveries in copper concentrate of 68% for copper, and recoveries in zinc concentrate of 77% for zinc and overall recoveries 31% for gold and 24% for silver in concentrates.

Financial Highlights

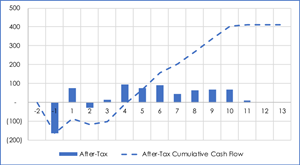

The base case economic analysis returns an after-tax NPV, at a 5% discount rate, of US$252M. It has an after‑tax Internal Rate of Return of 27% and a payback period of 4.1 years. The analysis calculates annual cash flows over the life of the mine and incorporates Turkish taxes, permit and license fees, and government royalties on metal sales.

The Financial results are summarized in Figure 4. Analysis is based on 2018 fourth quarter US Dollars and

- Gold price of $1,315 per ounce

- Silver price of $18.00 per ounce

- Copper price of $3.20 per pound

- Zinc price of $1.10 per pound

- Turkish Lira‑to‑US Dollar exchange rate of 6.0

To view Figure 4. Undiscounted After‑Tax Cash Flow (US$M), visit the following link:

http://www.globenewswire.com/NewsRoom/AttachmentNg/e699cc0f-076a-4d40-87b3-883c977a8300

Table 1. PFS19 Results Summary

| Metric | Unit | Value | |

| Ore | kt | 21,335 | |

| Waste | kt | 169,206 | |

| Total Movement | kt | 190,541 | |

| Stripping Ratio | waste:ore | 7.9 | |

| Oxide Ore | kt | 2,755 | |

| Oxide Grade – Au | g/t | 2.34 | |

| Oxide Grade – Ag | g/t | 56.7 | |

| Sulfide Mill Ore | kt | 18,580 | |

| Sulfide Grade – Cu | % | 0.92 | |

| Sulfide Grade – Zn | % | 1.98 | |

| Sulfide Grade – Au | g/t | 0.85 | |

| Sulfide Grade – Ag | g/t | 31.8 | |

| Copper Concentrate | kt | 387 | |

| Zinc Concentrate | kt | 503 | |

| Total Gold | koz | 345 | |

| Total Silver | koz | 8,148 | |

| Copper in Concentrate | kt | 115 | |

| Zinc in Concentrate | kt | 284 | |

| Before-Tax Undiscounted Cash Flow | US$M | 420.4 | |

| Before-Tax NPV 5% Discount Rate | US$M | 258.4 | |

| Before-Tax NPV 8% Discount Rate | US$M | 191.0 | |

| Before-Tax IRR | % | 27 | % |

| After-Tax Undiscounted Cash Flow | US$M | 412.0 | |

| After-Tax NPV 5% Discount Rate | US$M | 252.5 | |

| After-Tax NPV 8% Discount Rate | US$M | 186.1 | |

| After-Tax IRR | % | 27 | % |

| Project Payback years | years | 4.1 | |

| Initial Capital (incl. contingency) | US$M | 164.1 | |

| Operating Cost | |||

| Mine | $/t ore | 14.54 | |

| Oxide Process | $/t ore | 20.85 | |

| Sulfide Process | $/t ore | 19.88 | |

| Administration | $/t ore | 5.07 | |

| Total Operating Cost | $/t ore | 39.62 | |

Table 2. Financial Results

| NPV | |||||

| Before‑Tax | After‑Tax | ||||

| US$M | US$M | ||||

| Undiscounted | 420.4 | 412.0 | |||

| 5% | 258.4 | 252.5 | |||

| 8% | 191.0 | 186.1 | |||

| 10% | 154.8 | 150.5 | |||

| 15% | 86.8 | 83.5 | |||

| IRR | 27 | % | 27 | % | |

| Peak Funding (US$M) | –164.1 | ||||

| Payback (Years) | 4.09 | 4.12 | |||

Table 3. Life‑of‑Mine Production and Processing Quantities

| Life-of-Mine Production | Unit | Quantity |

| Oxide Ore | kt | 2,755 |

| Oxide Grade – Au | g/t | 2.34 |

| Oxide Grade – Ag | g/t | 56.7 |

| Sulfide Ore | kt | 18,580 |

| Sulfide Grade – Cu | % | 0.92 |

| Sulfide Grade – Zn | % | 1.98 |

| Sulfide Grade – Au | g/t | 0.85 |

| Sulfide Grade – Ag | g/t | 31.8 |

| Weathered Waste | kt | 26,449 |

| Fresh Waste | kt | 142,757 |

| Total Material | kt | 190,541 |

| Copper Concentrate | kt | 387 |

| Zinc Concentrate | kt | 503 |

Table 4. Life‑of‑Mine Metal Production

| Copper in Concentrate | kt | 115 |

| Zinc in Concentrate | kt | 284 |

| Gold | ||

| Oxide | koz | 187 |

| Copper Concentrate | koz | 128 |

| Zinc Concentrate | koz | 31 |

| Total Gold | koz | 345 |

| Silver | ||

| Oxide | koz | 3,547 |

| Copper Concentrate | koz | 2,329 |

| Zinc Concentrate | koz | 2,272 |

| Total Silver | koz | 8,148 |

Total project initial and deferred capital costs are summarized in Table 5.

Table 5. Project Capital Costs

| Capital Costs | Initial | Expansion | Sustaining | Total |

| US$M | ||||

| Plant | 44.4 | 53.2 | 2.9 | 100.5 |

| Infrastructure | 53.8 | – | 21.8 | 75.6 |

| Closure | – | – | 22.7 | 22.7 |

| EPCM | 9.4 | 9.0 | – | 18.4 |

| Owners EPCM Management Team | 9.4 | 4.5 | – | 13.9 |

| Pre-Production Mining | 25.9 | – | – | 25.9 |

| Contingency | 21.2 | 3.8 | 9.5 | 34.5 |

| Capital Costs | 164.1 | 70.6 | 56.9 | 291.6 |

Table 6 shows the breakdown of estimated Life-of-Mine project operating costs.

Table 6. Project Operating Costs

| Total (US$M) | Breakdown Unit | $ (US) | |

| Mine | |||

| Owner Staff | 40.2 | $/t total moved | 0.21 |

| Mining Cost | 270.0 | $/t total moved | 1.42 |

| Mine | 310.2 | $/t total moved | 1.63 |

| Process | |||

| Oxide Direct Cost | 57.4 | $/t ore Oxide | 20.85 |

| Sulfide Mill Direct Cost | 369.3 | $/t ore Sulfide | 19.88 |

| Process | 426.8 | $/t ore | 20.08 |

| Administration | |||

| Sitewide G&A | 43.8 | $/t ore | 2.06 |

| Site camp costs | 41.4 | $/t ore | 1.94 |

| Land Usage / Forestry Fee | 22.4 | $/t ore | 1.05 |

| License and Compliance Fees | 0.6 | $/t ore | 0.03 |

| Administration | 108.3 | $/t ore | 5.07 |

| Total Operating Cost | 845.2 | $/t ore | 39.62 |

Gediktepe Mineral Resource and Mineral Reserve Estimates

The appendices to this announcement provide information on the data, assumptions and methodologies underlying these estimates. Further information is provided in the NI 43-101 Technical Report on the Gediktepe Project filed simultaneously with this announcement.

The updated Mineral Resource estimate for PFS19 includes two main ore types: oxide ore containing gold and silver, and sulfide ore containing copper, zinc, gold, and silver.

Table 7. Gediktepe Mineral Resource Statement

| Mineral Resource Statement for the Gediktepe Deposit (as of March 5, 2019) | ||||||||||

| MEASURED | Tonnes (kt) | Grade | Metal | |||||||

| Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) | Pb (%) | Au (koz) | Ag (koz) | Cu (kt) | Zn (kt) | ||

| Total Oxide | – | – | – | – | – | – | – | – | – | – |

| Total Sulfide | 3,999 | 0.67 | 25.1 | 1.01 | 1.83 | 0.34 | 86 | 3,221 | 40 | 73 |

| Total Measured | 3,999 | 0.67 | 25.1 | 1.01 | 1.83 | 0.34 | 86 | 3,221 | 40 | 73 |

| INDICATED | Tonnes (kt) | Grade | Metal | |||||||

| Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) | Pb (%) | Au (koz) | Ag (koz) | Cu (kt) | Zn (kt) | ||

| Total Oxide | 2,674 | 2.71 | 66.3 | 0.10 | 0.10 | 0.47 | 233 | 5,703 | 3 | 3 |

| Total Sulfide | 23,544 | 0.74 | 27.6 | 0.85 | 1.69 | 0.33 | 560 | 20,865 | 200 | 399 |

| Total Indicated | 26,217 | 0.94 | 31.5 | 0.78 | 1.53 | 0.34 | 792 | 26,568 | 203 | 402 |

| INFERRED | Tonnes (kt) | Grade | Metal | |||||||

| Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) | Pb (%) | Au (koz) | Ag (koz) | Cu (kt) | Zn (kt) | ||

| Total Oxide | 23 | 0.95 | 21.8 | 0.23 | 0.14 | 0.12 | 1 | 16 | 0 | 0 |

| Total Sulfide | 2,958 | 0.53 | 20.2 | 0.76 | 1.16 | 0.27 | 51 | 1,926 | 22 | 34 |

| Total Inferred | 2,981 | 0.54 | 20.3 | 0.76 | 1.16 | 0.27 | 51 | 1,941 | 23 | 34 |

| MEASURED + INDICATED | Tonnes (kt) | Grade | Metal | |||||||

| Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) | Pb (%) | Au (koz) | Ag (koz) | Cu (kt) | Zn (kt) | ||

| Total Oxide | 2,674 | 2.71 | 66.3 | 0.10 | 0.10 | 0.47 | 233 | 5,703 | 3 | 3 |

| Total Sulfide | 27,542 | 0.73 | 27.2 | 0.87 | 1.71 | 0.33 | 645 | 24,086 | 241 | 472 |

| Total M + I | 30,216 | 0.90 | 30.7 | 0.81 | 1.57 | 0.34 | 878 | 29,790 | 243 | 475 |

Note: Mineral Resources are inclusive of Mineral Reserves. Mineral Resources are shown on a 100% basis, of which Alacer owns 50%. The key assumptions, parameters, and methods used to estimate the Mineral Resources and Mineral Reserves are provided in the appendices to this announcement and the NI 43-101 Technical Report filed simultaneously with this announcement. We are not aware of any new information or data that materially affects the information included in this announcement and that all material assumptions and technical parameters underpinning the estimates in the announcement continue to apply and have not materially changed. Rounding differences will occur.

Table 8. Gediktepe Mineral Reserve Statement

| Mineral Reserve Statement for the Gediktepe Deposit (as of March 5, 2019) | |||||||||

| Classification | Tonnes (kt) | Grade | Contained Metal | ||||||

| Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) | Au (koz) | Ag (koz) | Cu (kt) | Zn (kt) | ||

| Oxide | |||||||||

| Proven | – | – | – | – | – | – | – | – | – |

| Probable | 2,755 | 2.34 | 56.7 | – | – | 207 | 5,020 | – | – |

| Proven & Probable | 2,755 | 2.34 | 56.7 | – | – | 207 | 5,020 | – | – |

| Sulfide | |||||||||

| Proven | 3,620 | 0.68 | 26.7 | 1.03 | 1.93 | 79 | 3,105 | 37 | 70 |

| Probable | 14,960 | 0.89 | 33.1 | 0.89 | 1.99 | 429 | 15,903 | 133 | 298 |

| Proven & Probable | 18,580 | 0.85 | 31.8 | 0.92 | 1.98 | 509 | 19,008 | 170 | 368 |

Note: Mineral Reserves are shown on a 100% basis, of which Alacer owns 50%. The Mineral Reserves methodology, cut-off grades, and the key assumptions, parameters, and methods used to estimate the Mineral Resources and Mineral Reserves are provided in the appendices to this announcement and the NI 43-101 Technical Report filed simultaneously with this announcement. We are not aware of any new information or data that materially affects the information included in this announcement and that all material assumptions and technical parameters underpinning the estimates in this announcement continue to apply and have not materially changed. Rounding differences will occur.

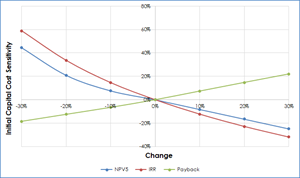

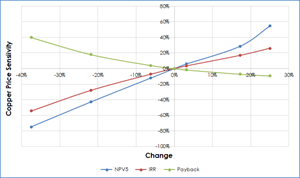

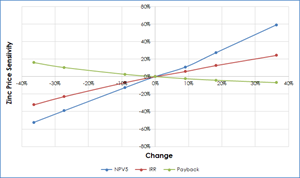

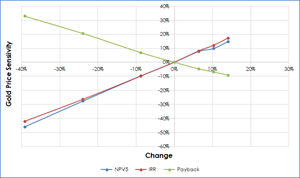

Economic Sensitivity

The economic sensitivity of the Project was evaluated with respect to initial capital costs, operating costs and metal prices between +/–30% of base case values. Changes in metal prices is also indicative of relative changes in metal recoveries and/or the processed head grades.

To view Table 9. Sensitivity to Initial Capital Costs, visit the following link:

http://www.globenewswire.com/NewsRoom/AttachmentNg/eec15d16-62fb-47e6-8333-7d12764e73e4

To view Table 10. Sensitivity to Copper Price, visit the following link:

http://www.globenewswire.com/NewsRoom/AttachmentNg/9f22f56e-1ebc-49de-9e6e-21232fec933d

To view Table 11. Sensitivity to Zinc Price, visit the following link:

http://www.globenewswire.com/NewsRoom/AttachmentNg/a8e10d81-7d12-46fe-887f-61289a0b2e4f

To view Table 11. Sensitivity to Gold Price, visit the following link:

http://www.globenewswire.com/NewsRoom/AttachmentNg/c8c677b5-e740-4013-b556-16b7417fae67

Gediktepe 2019 Studies

A substantial amount of work was completed subsequent to the PFS16. Most of this work was completed at Feasibility Study (FS) level, with limited work remaining to bring the entire study to FS level. However, work required for metallurgical testing and recovery performance will require additional drilling to obtain material. It is estimated the remaining test work will take at least 18 months to complete, which reflects the time needed to access the site (permits and weather), drilling, sampling, metallurgical testing and analysis.

Key developments since the PFS16 study include:

- Diligent work was undertaken by Polimetal in documenting, interrogating, interpreting, and modelling the Gediktepe deposit. Confidence was gained through the predominant use of diamond core drilling and development of important relationships between mineralization types and grade characteristics. The estimated Mineral Resource tonnage, grades, and contained metal were adjusted based on these advancements.

- The resource classification categories (Measured, Indicated, Inferred) denote different levels of confidence or uncertainty within the deposit. Lower confidence in mineralized continuity at a local resolution may impact short-term forecasting due to ore variability. To account for these local uncertainties, modifications to the Mineral Resource model classification were made.

- The study included logging core from geotechnical drill holes and obtaining orientation measurements where possible. Laboratory testing on samples of core is currently being performed. Some of the geotechnical studies are pending, hence preliminary pit slope design recommendations are based on the data collected to date. Based on site geotechnical investigations, pit slope angles range from 25° to 47° inter-ramp slopes.

- The PFS16 proposed waste dump site was relocated to the west of the mine to be placed in an area with better foundation conditions.

- The prefeasibility study flowsheet for treatment of the oxide material has been refined from a three-stage crush, heap leach flowsheet to a single stage crush, grind, and tank leach flowsheet.

- During metallurgical testing the enriched ore was found to float vigorously and with poor separation of metals, which causes concentrate cross-contamination. This is problematic where it is the predominant mineralization and further test work is aimed at resolving the issue.

- Alternative approaches to realizing value from the enriched material were completed by blending various amounts of enriched material with sample composites containing massive pyrite and disseminated material types. Results show up to 10%, and possibly 20%, of the enriched material could be blended into the plant feed without overly compromising the copper concentrate quality.

- Overall operating cost estimates were adjusted within the PFS19 to calculate annual cash flows over the LOM. Capital and operating cost estimates include the operation of an open pit mine, construction and operation of both an oxide and sulfide processing plant.

Next Steps

The PFS recommends that the assessment of the Gediktepe Project be continued to a feasibility study level to increase the confidence of the estimates. Areas within the Gediktepe Project that require more study work include:

- Additional drilling to secure fresh core samples for metallurgical testing.

- Additional drilling to increase confidence in the oxide and sulfide ore during Project payback years.

- A short-range variability study to better understand grade distributions of the economic metals.

- Detailed mine grade control plan. This may consider varying techniques for blasthole sampling, RC drill hole sampling, trenching, grab samples, or guidance using a handheld x-ray fluorescence analyzer.

- Further work on strategies to mitigate potential acid generation and subsequent metal leaching of mine overburden.

Once metallurgical test work is analyzed and interpreted, the open pit and waste dump designs will be refined based on new process parameters. The mine waste management plan will also be refined as part of this work.

About Alacer

Alacer is a leading low-cost intermediate gold producer, with an 80% interest in the world-class Çöpler Gold Mine (“Çöpler”) in Turkey operated by Anagold Madencilik Sanayi ve Ticaret A.S. (“Anagold”), and the remaining 20% owned by Lidya Madencilik Sanayi ve Ticaret A.S. (“Lidya Mining”). The Corporation’s primary focus is to leverage its cornerstone Çöpler Gold Mine and strong balance sheet as foundations to continue its organic multi-mine growth strategy, maximize free cash flow and therefore create maximum value for shareholders. The Çöpler Gold Mine is located in east-central Turkey in the Erzincan Province, approximately 1,100 km southeast from Istanbul and 550 km east from Ankara, Turkey’s capital city.

Alacer continues to pursue opportunities to further expand its current operating base to become a sustainable multi-mine producer with a focus on Turkey. The Çöpler Mine is processing ore from three primary sources: Çöpler sulfide ore, Çöpler oxide ore, and Çakmaktepe oxide ore. With the recent completion of the sulfide plant, the Çöpler Mine will produce over 3.5 million ounces at first quartile All-in Sustaining Costs, generating robust free cash flow over the next 20 years.

The systematic and focused exploration efforts in the Çöpler District have been successful as evidenced by the newly discovered Ardich deposit. The Çöpler District remains the focus, with the goal of continuing to grow oxide resources that will deliver production utilizing the existing Çöpler infrastructure. In the other regions of Turkey, targeted exploration work continues, including an updated Prefeasibility Study and ongoing work on the technical studies for the Gediktepe Project.

Alacer is a Canadian company incorporated in the Yukon Territory with its primary listing on the Toronto Stock Exchange. The Corporation also has a secondary listing on the Australian Securities Exchange where CHESS Depositary Interests (“CDIs”) trade.

Cautionary Statements

Except for statements of historical fact relating to Alacer, certain statements contained in this press release constitute forward-looking information, future oriented financial information, or financial outlooks (collectively “forward-looking information”) within the meaning of Canadian securities laws. Forward-looking information may be contained in this document and other public filings of Alacer. Forward-looking information often relates to statements concerning Alacer’s outlook and anticipated events or results, and in some cases, can be identified by terminology such as “may”, “will”, “could”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “projects”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not historical facts.

Forward-looking information includes statements concerning, among other things, preliminary cost reporting in this document; production, cost, and capital expenditure guidance; the ability to expand the current heap leach pad; the results of any gold reconciliations; the ability to discover additional oxide gold ore; the generation of free cash flow and payment of dividends; matters relating to proposed exploration; communications with local stakeholders; maintaining community and government relations; negotiations of joint ventures; negotiation and completion of transactions; commodity prices; mineral resources, mineral reserves, realization of mineral reserves, and the existence or realization of mineral resource estimates; the development approach; the timing and amount of future production; the timing of studies, announcements, and analysis; the timing of construction and development of proposed mines and process facilities; capital and operating expenditures; economic conditions; availability of sufficient financing; exploration plans; receipt of regulatory approvals; and any and all other timing, exploration, development, operational, financial, budgetary, economic, legal, social, environmental, regulatory, and political matters that may influence or be influenced by future events or conditions.

Such forward-looking information and statements are based on a number of material factors and assumptions, including, but not limited in any manner to, those disclosed in any other of Alacer’s filings, and include the inherent speculative nature of exploration results; the ability to explore; communications with local stakeholders; maintaining community and governmental relations; status of negotiations of joint ventures; weather conditions at Alacer’s operations; commodity prices; the ultimate determination of and realization of mineral reserves; existence or realization of mineral resources; the development approach; availability and receipt of required approvals, titles, licenses and permits; sufficient working capital to develop and operate the mines and implement development plans; access to adequate services and supplies; foreign currency exchange rates; interest rates; access to capital markets and associated cost of funds; availability of a qualified work force; ability to negotiate, finalize, and execute relevant agreements; lack of social opposition to the mines or facilities; lack of legal challenges with respect to the property of Alacer; the timing and amount of future production; the ability to meet production, cost, and capital expenditure targets; timing and ability to produce studies and analyses; capital and operating expenditures; economic conditions; availability of sufficient financing; the ultimate ability to mine, process, and sell mineral products on economically favorable terms; and any and all other timing, exploration, development, operational, financial, budgetary, economic, legal, social, geopolitical, regulatory and political factors that may influence future events or conditions. While we consider these factors and assumptions to be reasonable based on information currently available to us, they may prove to be incorrect.

You should not place undue reliance on forward-looking information and statements. Forward-looking information and statements are only predictions based on our current expectations and our projections about future events. Actual results may vary from such forward-looking information for a variety of reasons including, but not limited to, risks and uncertainties disclosed in Alacer’s filings on the Corporation’s website at www.alacergold.com, on SEDAR at www.sedar.com and on the ASX at www.asx.com.au, and other unforeseen events or circumstances. Other than as required by law, Alacer does not intend, and undertakes no obligation to update any forward-looking information to reflect, among other things, new information or future events.

For further information on Alacer Gold Corp., please contact:

Lisa Maestas – Director, Investor Relations at +1-303-292-1299

Appendix 1

Basis for Production Targets and Forecast Financial Information

The production targets in this announcement are underpinned by Proven and Probable Reserves and are based on Alacer's current expectations of future results or events and should not be solely relied upon by investors when making investment decisions.

The estimated Mineral Reserves and Mineral Resources underpinning the production targets have been prepared by a competent person or persons in accordance with the requirements of the JORC Code, as specified in the Appendix 2 - JORC Code Table 1.

All forecast financial information in this announcement has been derived from the production targets set out in this announcement.

The material assumptions which support the Proven and Probable Reserves, the production targets and the forecast financial information derived from the production targets are disclosed in the PFS and in the body of this announcement.

Alacer is satisfied that it has a reasonable basis for making the forward-looking statements in this announcement, including with respect to production targets and forecast financial information. In particular, given Alacer’s financial position and market capitalization relative to its share of the funding requirement for the Gediktepe Project, Alacer believes funding will be available when required by the development timetable for the Project.

Qualified Person Statement

The Mineral Resource referenced in this announcement was estimated in accordance with CIM guidelines as incorporated into NI 43-101, and the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. While terms associated with various categories of “Mineral Resource” or “Mineral Reserve” are recognized and required by Canadian regulations, they may not have equivalent meanings in other jurisdictions outside Canada and no comparison should be made or inferred. The NI 43-101 term Mineral Reserve has been used throughout this news release and it has the same meaning as the term Ore Reserve as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results. Actual recoveries of mineral products may differ from those estimated in the Mineral Resources and Mineral Reserves due to inherent uncertainties in acceptable estimating techniques. In particular, Inferred Mineral Resources have a great amount of uncertainty as to their existence, economic and legal feasibility. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. Investors are cautioned not to assume that all or any part of the Mineral Resources will ever be converted into Mineral Reserves.

The PFS19 Mineral Resources disclosed in this announcement were approved by Ms. Sharron Sylvester, BSc (Geol), MAIG, RPGeo (10125), employed by OreWin Pty Ltd as Technical Director – Geology. Ms. Sylvester has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity which is being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” and is a Qualified Person pursuant to NI 43-101.

The PFS19 Mineral Reserves disclosed in this announcement were approved by Mr. Bernard Peters, BEng (Mining), FAusIMM (201743), employed by OreWin Pty Ltd as Technical Director – Mining. The information in this announcement which relates to Mineral Reserves is based on, and fairly represents, the information and supporting documentation prepared by Mr. Peters. Mr. Peters has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which is being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” and is a Qualified Person pursuant to NI 43-101.

The PFS19 Metallurgical information disclosed in this announcement was approved by Mr. Peter Allen, BEng (Metallurgy), MAusIMM (103637), employed by GR Engineering Services as Manager – Technical Services, was responsible for process plant and infrastructure. The information in this announcement which relates to the process plant and infrastructure is based on, and fairly represents, the information and supporting documentation prepared by Mr. Allen. Mr. Allen has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which is being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” and is a Qualified Person pursuant to NI 43-101.

Ms. Sylvester and Messrs. Peters and Allen consent to the inclusion in this announcement of the matters based on this information in the form and context in which it appears.

Summary for the purposes of ASX Listing Rule 5.8 and 5.9

Please refer to the JORC Code Table 1 contained in Appendix 2 of this announcement for information relating to the estimates of Minerals Resources for the Gediktepe Project. A copy of which can be found on www.sedar.com, the Australian Securities Exchange and on our website www.alacergold.com.

Geology and Geological Interpretation

The Gediktepe project is a massive sulfide hosted in metamorphic schist units. The upper portion of the deposit has been oxidized by surface and ground water. The oxide zone is nearly void of base metals. The sulfide zone is polymetallic with economic values of zinc, copper, gold and silver. The major economic minerals are sphalerite and chalcopyrite. Pyrite is present throughout.

Drilling completed through January 2018 was used to generate the geologic model and estimate mineral resources. The mineral resource is based on a combination of Reverse circulation (RC) and diamond core drilling for a total of 629 holes. RC drilling was utilized for 191 holes and the remaining 438 holes were by diamond drilling.

Mineralized bodies strike to the northeast and dip to the northwest at about 20 degrees. Mineralization resides primarily within the Chlorite-Sericite Schist. Where oxidized, gold and silver remain within iron oxide gossan. For the sulfide zone, massive pyrite forms lenses containing sphalerite, terahedrite, chalcopyrite, and galena.

Drilling Techniques

Drilling is primarily vertically oriented holes with a limited number of high angle drill holes. Approximately 19% of the drilling was RC with 81% diamond drill core. Drill hole spacing in Gediktepe varies from 25 m to 50 m centers. The central portion of the mineralized body is drilled at 25 m spacing with outer regions drilled to 50 m centers. A total of 70,127 m of drilling has been completed.

Diamond drilling was carried out using HQ and PQ sized equipment with standard tube. For RC drilling, a face sampling bit (121 mm) was used.

Sampling and Sub-sampling

Diamond drill core was sampled as half core at 1 m to 2 m intervals to geological contacts.

RC chip samples were collected in bags and chip box trays at 1 m and 2 m intervals. In areas expected to be waste, samples were combined into 2 m intervals. RC samples were collected at the rig using rotary splitters.

Sample Analysis Methods

Drill hole samples were sent off site to recognized and independent analytical laboratories for analyses.

Drill samples collected in 2013 were sent to the SGS laboratory in Ankara. From 2014 through 2018, samples were prepared and analyzed at ALS İzmir, Turkey. All analyses for gold were undertaken via fire assay. A 33-element assay suite including Ag, Cu, Pb, and Zn was completed for each sample by inductively coupled plasma (ICP).

Data Verification

A number of data verification activities were conducted, including the independent analyses of QA/QC data. In addition, a set of routine tests of database validity was completed as part of the data preparation phase for the resource estimation work; these include both specific and general tests. No matters of concern were identified.

Metallurgical Test Work

The metallurgical test work has been completed using parallel programs for samples from each of the oxide and sulfide zones of the Gediktepe deposit. Material from the oxide zone has been tested using cyanidation for the recovery of gold and silver. The sulfide material has been assessed using sequential flotation to recover separate, marketable copper and zinc concentrates.

Test work was undertaken from 2014 through 2015 by Resource Development Inc. (RDI; Colorado, USA), SGS (England), and Hacettepe Mineral Technologies (HMT; Ankara, Turkey) for generation the 2016 prefeasibility study. Further test work was performed from 2016 through 2018 at Wardell Armstrong International (WAI; Truro, England), HMT, and ALS (ALS; Perth, Australia).

Metal recoveries used in the PFS19 and Ore Reserve evaluation are listed in Table 9.

Table 9. Gediktepe Metal Recoveries by Material Type and Concentrate

| Parameter | Value/Formula |

| Oxide | |

| Gold Recovery | Fixed at 90.16% |

| Silver Recovery | Fixed at 70.65% |

| Massive Pyrite – Copper Concentrate | |

| Concentrate Grade | Fixed at 30% Cu |

| Copper Recovery | (10.342 x % Cu Feed Assay) + 57.492 |

| Gold Assay in Concentrate | (4.7196 x g/t Au feed assay) + (7.3198 x (g/t Au feed assay)²) |

| Silver Assay in Concentrate | (11.475 x g/t Ag feed assay) – (0.1127 x (g/t Ag feed assay)²) |

| Zinc Recovery | % Cu feed assay x ((10.342x% Cu feed assay)+57.492) x ((0.9852 x % Zn feed assay) + 0.2705) / % Zn feed assay / % Cu concentrate assay |

| Lead Recovery | 15.278 – (15.917 x % Pb feed assay) |

| Arsenic Recovery | % Cu feed assay x ((10.342x% Cu feed assay)+57.492) x ((0.8518 x % As feed assay) + 0.0266) / % As feed assay / % Cu concentrate assay |

| Massive Pyrite – Zinc Concentrate | |

| Concentrate Grade | Fixed at 58% Zn |

| Zinc Recovery | (0.5181 x % Zn feed assay) + 77.379 |

| Gold Assay in Concentrate | (2.293 x g/t Au feed assay) – (0.6249 x (g/t Au feed assay)²) |

| Silver Assay in Concentrate | (4.7899 x g/t Ag feed assay) – (0.0364 x (g/t Ag feed assay)²) |

| Copper Recovery | (9.3369 x % Cu feed assay) + 1.0891 |

| Lead Recovery | 10.414 + (10.944 x % Pb feed assay) |

| Arsenic Recovery | % Zn feed assay x ((0.5181x% Zn feed assay)+77.379) x 0.05 / % As feed assay / % Zn concentrate assay |

| Enriched – Copper Concentrate | |

| Concentrate Grade | Fixed at 32.9% Cu |

| Copper Recovery | Fixed at 67.7% |

| Gold Recovery | Fixed at 10% |

| Silver Recovery | Fixed at 10% |

| Zinc Recovery | Fixed at 29.5% |

| Lead Recovery | Fixed at 45.5% |

| Arsenic Recovery | Fixed at 50% |

| Enriched – Zinc Concentrate | |

| Concentrate Grade | Fixed at 50% Zn |

| Zinc Recovery | Fixed at 56.4% |

| Gold Recovery | Fixed at 10% |

| Silver Recovery | Fixed at 10% |

| Copper Recovery | Fixed at 11.9% |

| Lead Recovery | Fixed at 13.8% |

| Arsenic Recovery | Fixed at 6% |

| Disseminated – Copper Concentrate | |

| Concentrate Grade | Fixed at 25.8% Cu |

| Copper Recovery | (14.576 x % Cu feed assay) + 60.396 |

| Gold Assay in Concentrate | (33.038 x g/t Au feed assay) – (14.246 x (g/t Au feed assay)²) |

| Silver Recovery | (0.0895 x (g/t Ag feed assay)²) – (0.3866 x g/t Ag feed assay) |

| Zinc Recovery | % Cu feed assay x ((14.576x% Cu feed assay)+60.396) x 7.6 / % Zn feed assay / % Cu concentrate assay |

| Lead Recovery | Fixed at 40% |

| Arsenic Recovery | % Cu feed assay x ((14.576x% Cu feed assay)+60.396) x 0.47 / % As feed assay / % Cu concentrate assay |

| Disseminated – Zinc Concentrate | |

| Concentrate Grade | Fixed at 49.5% Zn |

| Zinc Recovery | (4.6259 x % Zn feed assay) + 67.751 |

| Gold Recovery | Fixed at 10% |

| Silver Recovery | Fixed at 20% |

| Copper Recovery | % Zn feed assay x ((4.6259 x % Zn feed assay) + 67.751) x 3.9 / % Cu feed assay / % Zn concentrate assay |

| Lead Recovery | Fixed at 18.1% |

| Arsenic Recovery | % Zn feed assay x ((4.6259 x % Zn feed assay) + 67.751) x 0.68 / % As feed assay / % Zn concentrate assay |

As a result of the test work outcomes and trade-off studies, the treatment of oxide material has been changed from the crush–agglomerate–heap leach–zinc precipitation flowsheet proposed in the scoping and prefeasibility studies to a crush–grind–leach–CIP–elution flowsheet.

The 2016 to 2018 sulfide test work identified variable performance due to surface oxidation (aging effects), mineralogical and head grade variations, material type blends, and pulp chemistry conditions. An understanding of the complexity of the Project geology and mineralogy, and the methods to control the metallurgical performance continue to be investigated.

Mineral Resource

An update of the Mineral Resources for the Gediktepe Project was completed by AMC Consultants (AMC; Perth, Australia) mid-2018, based on available diamond core and reverse circulation drilling data, geological, mineralization, structural, and weathering interpretations by Polimetal, and supplementary mineralization-constraining interpretations prepared by AMC.

Estimation Methodology

The Gediktepe resource estimate update specified the following grade fields for estimation: Au, Ag, Zn, Cu, As, Hg, Pb, Fe, C, and S. Grades, along with bulk densities, were estimated into the mineralization domains and background material in the cell model using either ordinary kriging (OK) or inverse distance weighting to the power of two (ID2). Depending on the domain being estimated, composites of either 1 m or 2 m lengths were used. Grade estimation was conducted into parent cells under hard bounded domain control.

Model Verification

Global and zonal statistics were generated to confirm that estimated model grades values fall within acceptable limits.

The grade and density estimates in the cell model were checked visually on-screen. Model and drill hole data were overlain and viewed in various sectional and plan views, and in 3D, with color legends highlighting grade or zonal attributes.

The model development and grade estimation procedures were subject to a Peer Review process.

Mineral Resources Classification

Gediktepe estimated resources have been classified with consideration of the following general criteria:

- Confidence in the geological interpretation.

- Knowledge of grade continuities gained from observations and geostatistical analyses.

- Number, spacing, and orientation of drill hole intercepts through mineralized domains.

- Quality and reliability of the raw drill hole data (sampling, assaying, surveying).

- The likelihood of material meeting economic mining constraints over a range of reasonable future scenarios, and expectations of relatively high selectivity of mining.

Reasonable Prospects of Eventual Economic Extraction

The Mineral Resource inventory was reported using NSR cut-offs of $20.72/t for oxide and $17.79/t for sulfide, with NSR calculated using 2018 preliminary reserves metal prices (Au=$1,300.00/oz, Ag=$18.50/oz, Cu=$3.30/lb, Zn=$1.28/lb). To meet the reasonable prospects of eventual economic extraction criteria, Mineral Resources are selected within a pit shell optimized using 2018 preliminary reserves metal prices inflated by 14% (i.e. Au=$1,482.00/oz, Ag=$21.09/oz, Cu=$3.76/lb, Zn=$1.46/lb). Metallurgical recoveries for copper vary from 67% to 69% in the copper concentrate with zinc recovery estimated between 56% to 79% in the zinc concentrate. For oxide ore, gold recoveries are estimated to be 90% and silver about 70%.

Mineral Resources are inclusive of Ore Reserves, except for mining losses and grade dilution, which are determined through re-blocking of the resource model after declaration of the Mineral Resource.

Ore Reserves

Material Assumptions for Ore Reserves

The Ore Reserves were estimated as part of a PFS with all material assumptions being documented in this release and in the JORC Code Table 1 contained in Appendix 2 of this announcement. All operating and capital costs as well as revenue streams were included in the PFS financial model. The PFS finds that the recovery of metals is technically and financially feasible, generating positive returns on plant and infrastructure investments.

Ore Reserves Classification

Ore Reserves are estimated on the basis of detailed design and scheduling of the Gediktepe open pit. The pit boundaries were guided by the results of pit optimization. Metal prices used for economic analysis to demonstrate the Ore Reserve are: Au $1,315.00/oz, Ag $18.00/oz, Cu $3.20/lb and Zn $1.10/lb. These metal values were then varied by revenue factors ranging from 0.4 to 1.4 in order to find the preferred pit size and geometry to use as a basis for detailed design.

All the Ore Reserves are derived from Measured and Indicated Mineral Resources. All Inferred Mineral Resources are considered as waste.

Reported Ore Reserves incorporate and include mining losses and grade dilution that are not reported in the Mineral Resource.

Mining Method

The Gediktepe deposit will be mined by conventional open pit hard rock mining methods. Polimetal currently plans to utilize a contract mining company to move the ore and waste from the mine. Please see Table 1 in the press release.

Ore Processing

Oxide ore is processed via tank leaching and sulfide ore is processed via floatation circuit to generate marketable copper and zinc concentrates.

Cut-off Grade

The PFS19 Ore Reserve is reported using cut-offs based on calculations of NSR. This method is considered to be appropriate for polymetallic deposits such as Gediktepe. Separate NSR cut offs are applied to each of the oxide and sulfide zones. Cut-offs applied to the Ore Reserves were: oxide ore $20.67/t and sulfide ore $17.74/t.

Estimation Methodology

The PFS19 estimate allowed for ore loss and mining dilution using a resource re‑blocking process to simulate expected mine selectivity.

Due to its polymetallic nature, the oxide and sulfide portions of the Ore Reserve are quoted at an NSR cut off based on metal prices, metal recoveries, plus on and off-site processing costs. The metal prices used in the economic analysis to demonstrate the Ore Reserve are $1,315/oz Au, $18.00/oz Ag, $3.20/lb Cu, and $1.10/lb Zn.

Material Modifying Factors

Gold and silver from the tank leach process will be produced in the form of doré and sent to refiners for separation. Sulfide ore will produce gold, silver, copper, and zinc to be sold as either copper or zinc concentrate. The metallurgical testing to date indicates that the gold-silver doré and both concentrates will be of marketable quality.

The Project will require the development of infrastructure items in order to operate. The current approach to the Project is tank leaching of oxides in the first two years, followed by sulfide flotation in the succeeding nine years after modification of the oxide plant. A tailings storage facility will accommodate both oxide and sulfide process tailings.

Most of the Project area falls into forest land and will need forestry permits from the General Directorate of Forestry and Prime Ministry. The Project as shown in the PFS will require a total 370.4 hectares of forest permit area over the life of the mining operation. Additional permits will be needed which include, but not limited to, Environmental Impact Assessment (EIA in progress), Forest permits, underground water usage permit and waste storage permit.

Appendix 2

JORC Code Table 1

The following tables are provided to ensure compliance with the JORC Code (2012) edition requirements for the reporting of Exploration Results and Mineral Resources.