Amarillo Announces Resource Update With Total Measured and Indicated Resource of 29 Million Tonnes at 1.2 Grams per Tonne Gold for 1,200,000 Gold Ounces

Includes High-Grade core zone of 9 million tonnes at 2.2 grams per tonne gold for 630,000 gold ounces

|

|||||

TORONTO, March 25, 2019 (GLOBE NEWSWIRE) -- Amarillo Gold Corporation (“Amarillo” or the “Company”) (TSX.V: AGC) (OTCQB: AGCBF) is pleased to announce an updated resource model for the Posse deposit at the Mara Rosa gold project in Goias State, Brazil. This new resource model will be used for a Feasibility Study (FS) mine plan that is expected to be finalized later this year. Keith Whitehouse of Australian Exploration Field Services Ltd, (“AEFS”) estimated the new resource with three contiguous grade zones as listed in Table 1 below.

Highlights include:

- Total Measured and Indicated Resource of 29M tonnes at 1.2 g/t and 1.2M Au ounces.

- Includes a high-grade core zone of 9M tonnes at 2.2 g/t for 630K Au ounces that can be accessed early in the mine life.

- Includes two additional contiguous grade zones of 12M tonnes at .88 g/t for 330K Au ounces and 9M tonnes of .73 g/t for 330K Au ounces.

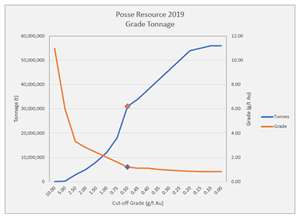

- The deposit contains a significant halo of lower grade mineralization as can be seen in the Grade Tonnage Curve listed below in Table 2.

- Ordinary kriging was used to produce a more conservative and robust resource.

- The cutoff grade was increased to 0.5 g/t to maximize the use of permitted space for waste rock dumps and a tailings dam. Substantial additional mineralization can be added at lower cutoff grades.

- The deposit remains open both down dip and down plunge to the southwest.

Amarillo President and CEO Mike Mutchler commented, “This new resource model for the Posse deposit at Mara Rosa allows the Company to proceed with a new mine plan for the Feasibility Study to be completed later this year. We were successful in converting nearly all the Inferred Resources into Measured and Indicated Resources to potentially extend the planned mine life. The change to ordinary kriging has resulted in a more conservative and robust resource for use in the FS, and the 0.5 g/t cutoff grade allows us to maximize the use of the areas already permitted for waste rock dumps and a tailings dam under the Preliminary License. The high-grade core zone that can be accessed and mined in the early mining years is largely responsible for the one-year payback demonstrated in the September 2018 Updated Pre-Feasibility Study. As seen in the Grade Tonnage Curve in Table 2, there remains a significant amount of lower grade gold mineralization surrounding the resource to potentially extend the mine life in the future. The new resource will now be run through the Whittle Consulting Prober optimization model to produce an optimal mine plan for the FS. With the FS engineering already underway, we are pursuing the regulatory and resultant financial prerequisites necessary to keep us on track to submit our application for the License to Install (LI) mid-year with the FS to be completed in the second half of the year.”

Table 1: AEFS March 2019 Resource Estimate*

| Tonnes | Au (g/t) | Au (oz) | Category |

| Zone 1 (Core) | |||

| 4,000,000 | 2.30 | 300,000 | Measured |

| 4,900,000 | 2.10 | 330,000 | Indicated |

| 8,900,000 | 2.20 | 630,000 | M&I |

| 1,900 | 2.10 | 120 | Inferred |

| Zone 2 | |||

| 3,700,000 | 0.87 | 100,000 | Measured |

| 7,900,000 | 0.89 | 230,000 | Indicated |

| 12,000,000 | 0.88 | 330,000 | M&I |

| 120,000 | 0.81 | 3,200 | Inferred |

| Zone 3 | |||

| 2,500,000 | 0.72 | 57,000 | Measured |

| 6,300,000 | 0.73 | 150,000 | Indicated |

| 8,800,000 | 0.73 | 210,000 | M&I |

| 1,200,000 | 0.68 | 27,000 | Inferred |

| Total | |||

| 10,000,000 | 1.40 | 460,000 | Measured |

| 19,000,000 | 1.20 | 710,000 | Indicated |

| 29,000,000 | 1.20 | 1,200,000 | M&I |

| 1,400,000 | 0.70 | 30,000 | Inferred |

* Table 1 Notes:

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves.

- Due to rounding numbers may not sum.

- Cutoff grade of 0.5 g/t.

Table 2 accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/0ef902ad-2936-49d2-b207-29dc36e2d1f0

The new resource estimate is based on 344 drill holes used ordinary kriging and included 44 new diamond drill holes and 11 new reverse circulation holes for a total of 12,701 meters of new infill drilling. The additional drilling has successfully converted Inferred resource to Indicated and Measured resource and has allowed the definition of a high-grade zone which extends through the resource volume. The new resource is based on an updated geological model which fundamentally alters the understanding of the mineralization. The improved understanding of the mineralization has allowed the use of ordinary kriging as the basis of estimation as opposed to multiple indicator kriging used for previous estimates and the current estimate while more conservative, is considered to be more robust than previous estimates.

Keith Whitehouse is the independent Qualified Person (QP) for this resource statement with over thirty years of experience, he is a Member of the AusIMM and Certified Professional (Geology). He has reviewed and approved the content of this news release. The 43-101 technical report will be delivered and filed on SEDAR within the next 45 days.

Marc Ducharme, Chief Exploration Geologist of the Company, is a Qualified Person as defined by NI 43-101 Standards of Disclosure for Mineral Projects guidelines and has reviewed and approved the scientific and technical disclosure relating to the resource update reported in this news release.

ABOUT AMARILLO

Amarillo is developing an open pit gold resource at its Mara Rosa Project in the mining friendly jurisdiction of Goias State in Brazil. The Mara Rosa Project was awarded its main (LP) permit which provides the social and environment permission to mine. Amarillo is progressing toward obtaining an installation permit (LI). Based on the NI 43-101 Pre-Feasibility Study 2018 (PFS 2018) update filed on SEDAR on September 13, 2018, the Posse Deposit at the Mara Rosa Project contains estimated 513,000 ounces of gold in the Proven category from 9.6 Mt at 1.65 g/t Au, and 574,000 ounces gold in the Probable category from 14.2 Mt at 1.26 g/t Au, for total estimated Reserves of 1,087,000 ounces from 23.8 Mt at 1.42 g/t Au. In addition to the Mara Rosa Project, Amarillo has an advanced exploration project with excellent grades at Lavras do Sul, Brazil. A Mineral Resource Estimate Study (NI 43-101 technical report) for Lavras do Sul was filed on SEDAR on October 4, 2010. The Lavras do Sul Project is an advanced exploration stage property (190 sq. km.) comprising of more than 22 prospects centered on historic gold workings. The initial resource estimate at the Butia prospect reported 215,000 ounces of gold in the Indicated category from 6.4 Mt at 1.05 g/t Au, and 308,000 ounces of gold in the Inferred category from 12.9 Mt at 0.74 g/t Au using a 0.3 g/t cut-off grade. Both projects have excellent nearby infrastructure.

Mike Mutchler, President and Chief Executive Officer of the Company, is a Qualified Person as defined by NI 43-101 guidelines and has reviewed and approved the scientific and technical disclosure relating to the 2018 PFS in this section of the news release.

| For further information, please contact: | ||

| Mike Mutchler | or | Karen Mate |

| President & CEO | External Communications | |

| 416-294-0736 | 416-230-6454 | |

| mike.mutchler@amarillogold.com | karen.mate@amarillogold.com | |

| 32 Richmond St. East Suite 201 | ||

| Toronto, ON Canada, M5C 1P1 | ||

| Website: www.amarillogold.com | ||

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of the content of this news release.

FORWARD LOOKING STATEMENTS:

This news release contains Forward Looking Statements regarding the Company’s current expectations regarding future events, including with respect to the Company’s business, operations and condition, and management’s objectives, strategies, beliefs and intentions. Various factors may prevent or delay our plans, including but not limited to, the trading price of the common shares of the Company, contractor availability and performance, weather, access, mineral prices, and success and failure of the exploration and development carried out at various stages of the program. Permission from the Government and community is also required to proceed with future mining production. Readers should review the Company’s ongoing quarterly and annual filings, as well as any other additional documentation comprising the Company’s public disclosure record, for additional information on risks and uncertainties relating to these forward-looking statements. Readers should also review the risk factors applicable to junior mining exploration companies generally to better understand the variety of risks that can affect the Company. The Company undertakes no obligation to update publicly or otherwise revise any Forward-Looking Statements whether as a result of new information or future events or otherwise, except as me be required by law.

PDF available: http://ml.globenewswire.com/Resource/Download/329d48f9-4cd4-431e-acc1-1e8175d7ae89