Americas Silver Announces 250% Increase in Gold Equivalent Reserves, Rebrands to Americas Gold and Silver, and Updates on Relief Canyon Construction

Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas Gold and Silver” or the “Company”), a growing North American precious metals producer, today announces increased gold and silver reserves, an update on the progress at Relief Canyon, and a name change and rebrand to Americas Gold and Silver Corporation. This name change reflects the increasing importance of gold in the Company’s portfolio and the transition from a silver focused developer and producer to a diversified gold and silver company. Please see the Company’s website at www.americas-gold.com for further information.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190905005983/en/

(Photo: Business Wire)

Reserve and Resource Update

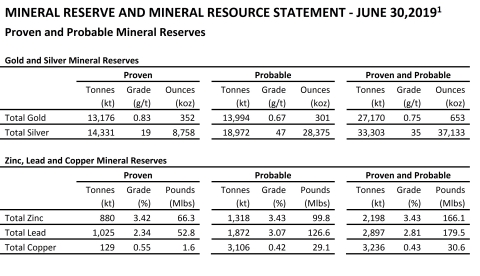

Americas Gold and Silver today announces its 2019 Mineral Reserve and Resource statement showing increased gold and silver reserves. Highlights include:

- Gold proven and probable reserves increased to 653,000 ounces as a result of the acquisition of Pershing Gold Corporation and the Relief Canyon Mine on April 3, 2019.

- Silver proven and probable reserves increased 45%, from 25.6 million ounces to 37.1 million ounces, primarily from the inclusion of the EC120 project (“EC120”) silver reserves. This increase was partially offset by mine depletion and a reduction in silver reserves at the Galena Complex.

- Gold equivalent reserves (including silver reserves) increased approximately 250% from 320,000 ounces to 1.12 million ounces. Gold equivalent reserves increased by 90% on a per share basis year-over-year.

“The recent acquisition of the Relief Canyon Mine and reserve growth from our existing operations have increased our gold equivalent reserves by approximately 250%, and is expected to increase our precious metals production by more than 500% by 2021,” said Darren Blasutti, President & CEO of Americas Gold and Silver. “This significant increase in our leverage to gold creates a unique re-rating opportunity for our shareholders as we transition to a diversified precious metals producer with multiple assets in North America.”

The 2019 Mineral Reserve and Resource statement shows an increase of 653,000 ounces of gold from the previous year as a result of the acquisition of the Relief Canyon property. Silver contained in the consolidated proven and probable reserves increased by 45%, or 11.5 million ounces, to 37.1 million ounces. This was due to the addition of silver reserves at EC120, following the completion of the EC120 Preliminary Feasibility Study and the Relief Canyon acquisition. EC120 added approximately 14.5 million ounces of probable silver reserves and Relief Canyon added 1.1 million ounces of proven and probable silver reserves.

The increase in silver reserves was offset slightly by decreases in silver reserves at San Rafael and Galena. The decrease in silver reserves at San Rafael was mainly due to mining depletion from July 1, 2018 to June 30, 2019 in the Main Central and Main Superior areas of the orebody. The silver reserves at San Rafael decreased by 11% or approximately 1.2 million ounces. Development towards the higher-grade silver reserves contained in the Upper Zone is in progress and production from this zone is expected to start in early 2020. The decrease in silver reserves at Galena is due to mining depletion and adoption of more conservative estimation parameters. The silver reserves at Galena decreased by 20% or approximately 3.0 million ounces. See the Notes for Mineral Reserve and Mineral Resource Estimates for further information.

Relief Canyon Update

Construction continues to advance at the fully-funded Relief Canyon Project in Nevada, USA. Leach pad construction has advanced with earthworks roughly 85% complete and the majority of the pad liner currently fabricated and onsite. Approximately 35% of the liner is installed and over 35% of the leach pad overliner has been crushed, with completion of both scheduled for early in the fourth quarter of this year.

Several key milestones are expected to be met this September including delivery and installation of both the crusher and conveyor system and refinery equipment. Ledcor Group has mobilized equipment to begin pioneering work and major mining equipment will begin mobilization in September as well. First gold pour continues to be anticipated for December of this year.

Further information on the Relief Canyon development and the Mineral Reserve and Resource update will be made available on the Company’s website at www.americas-gold.com.

About Americas Gold and Silver Corporation

Americas Gold and Silver is a high-growth, low-cost, precious metals mining company with multiple assets in North America. The Company expects to begin producing gold in the fourth quarter of 2019 at its fully-funded Relief Canyon Project in Nevada, USA, which is currently in construction. It owns and operates the Cosalá Operations in Sinaloa, Mexico and the Galena Complex in Idaho, USA. The Company also holds an option on the San Felipe development project in Sonora, Mexico. For further information, please see SEDAR or www.americas-gold.com

Shawn Wilson, VP Technical Services and a Qualified Person under Canadian Securities Administrators guidelines, has approved the applicable contents of this news release. For further information please see SEDAR or americas-gold.com.

1Notes for Mineral Reserve and Mineral Resource Estimates:

CIM (2014) Definition and Standards were followed for Mineral Reserve and Mineral Resource Estimates. Mineral Reserves are estimated at a net smelter return (“NSR”) cut-off value of US$50/tonne at San Rafael, $40/tonne at El Cajón, $40/tonne at Zone 120 and $198/tonne at Galena. Mineral Reserves are estimated at a 0.17g/tonne gold cut-off grade constrained by an open pit design based on a $1,300 gold pseudoflow pit shell. The NSR cut-off is calculated using recent operating results for recoveries, off-site concentrate costs, and on-site operating costs. Mineral Reserves are estimated using metal prices of US$1,300 per ounce of gold, $16.00 per ounce of silver, $2.50 per pound of copper, $0.90 per pound of lead and $0.90 per pound of zinc. Numbers may not add or multiply accurately due to rounding.

Mineral Resources are estimated at a NSR cut-off value of US$34/tonne at San Rafael, $US40/tonne at El Cajón, $40/tonne at Zone 120 and $198/tonne at Galena. Mineral Resources are estimated at a 90g/tonne silver equivalent cut-off grade at Nuestra Señora. Mineral Resources are estimated at a 2.5% zinc equivalent cut-off grade at San Felipe. Mineral Resources are estimated at a 0.17g/tonne gold cut-off grade at Relief Canyon and are constrained by a $1,500 gold pseudoflow pit shell. Inferred Mineral Resources at Relief Canyon include existing low-grade stockpiles. Mineral Resources are estimated using metal prices of US$1,500 per ounce of gold, $18.00 per ounce of silver, $3.00 per pound of copper, $1.05 per pound of lead and $1.05 per pound of zinc. Mineral Resources are reported exclusive of Mineral Reserves and as such the Mineral Resources do not have demonstrated economic viability. Numbers may not add or multiply accurately due to rounding.

All Mineral Resource estimates, except for San Felipe, were prepared internally by or by Company personnel under the supervision of Niel de Bruin, P.Geo., a Qualified Person for the purpose of NI 43-101. The San Felipe Mineral Resource estimate was prepared by Paul Tietz, C.P.G., an independent consultant and Qualified Person for the purpose of NI 43-101. All Mineral Reserve estimates were prepared internally by or by Company personnel under the supervision of Shawn Wilson, P.Eng., a Qualified Person for the purpose of NI 43-101.

Varying cut‐off grades have been used depending on the mine, methods of extraction and type of ore contained in the reserves. Mineral resource metal grades and material densities have been estimated using industry‐standard methods appropriate for each mineral project with support of various commercially available mining software packages. The Company’s normal data verification procedures have been employed in connection with the calculations. Verification procedures include industry standard quality control practices. Sampling, analytical and test data underlying the stated mineral resources and reserves have been verified by employees of the Company under the supervision of Qualified Persons, for purposes of 43‐101 and/or independent Qualified Persons. The Company is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant issues that would materially affect the Mineral Reserve and Mineral Resource Estimates. Additional details regarding Mineral Reserve and Mineral Resource estimation, classification, reporting parameters, key assumptions and associated risks for each of the Company’s mineral properties are provided in the respective NI 43‐101 Technical Reports which are available at www.sedar.com and the Company’s website at www.americas-gold.com.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas Gold and Silver’s expectations, intentions, plans, assumptions and beliefs with respect to, among other things, the Company’s financing efforts; exploration, production and cost performance at the Cosalá Operations and the Galena Complex; construction, production, development plans and performance expectations at the Relief Canyon Mine and the impact on Americas Gold and Silver’s financial performance; Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas Gold and Silver as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas Silver to be materially different from those expressed or implied by such forward-looking information. With respect to the business of Americas Gold and Silver, these risks and uncertainties include interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; the ability to develop, complete construction and operate the Relief Canyon Mine; and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions and other factors limiting mine access, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities, labor relations, social and political developments and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Americas Gold and Silver’s filings with the Canadian Securities Administrators on SEDAR and with the SEC. Americas Gold and Silver does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Americas Gold and Silver does not give any assurance (1) that Americas Gold and Silver will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward‐looking information concerning Americas Gold and Silver are expressly qualified in their entirety by the cautionary statements above.

Cautionary Note to U.S. Investors:

The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource”, “inferred mineral resource” used in the press release are Canadian mining terms used in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum Standards. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

While the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource”, and “inferred mineral resource” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States and normally are not permitted to be used in reports and registration statements filed with the Securities & Exchange Commission (“SEC”). As such, information contained in the Company's disclosure concerning descriptions of mineralization and resources under Canadian standards may not be comparable to similar information made public by U.S companies in SEC filings. With respect to “inferred mineral resource” there is a great amount of uncertainty as to their existence and a great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190905005983/en/