Americas Silver Corporation Provides an Exploration Update

Americas Silver Corporation (TSX: USA) (NYSE “American”: USAS) (“Americas Silver” or the “Company”) is pleased to provide an update on exploration activities at its two operating properties, the 100%-owned Cosalá Operations in Sinaloa, Mexico and the 100%-owned Galena Complex in Wallace, Idaho. The Cosalá Operations includes the Zone 120 deposit, adjacent to the San Rafael Mine.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180405006098/en/

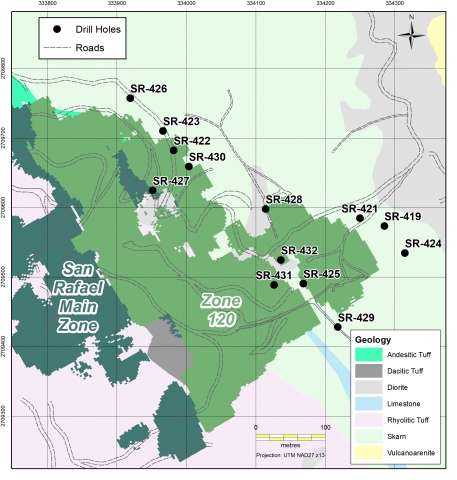

Figure 1: Location of Latest Reported Holes (Graphic: Business Wire)

Exploration Highlights

Cosalá Operations - Zone 120

- Hole SR-419 with 4.941 meters grading 33g/t Ag, 7.20g/t Au, and 0.13% Cu (567g/t AgEq2)

- Hole SR-425 with 41.68 meters grading 148g/t Ag, 0.25g/t Au and 0.32% Cu (203g/t AgEq)

- Hole SR-427 with 26.24 meters grading 181g/t Ag, 0.11g/t Au and 0.51% Cu (247g/t AgEq)

- Hole SR-429 with 12.32 meters grading 84g/t Ag, 0.17g/t Au and 0.23% Cu (122g/t AgEq)

Galena Complex

-

4900 Level - Strike extension of the 366 Foot Wall (“FW”) silver-lead

zone

- Hole 49-464 with 7.5 meters grading 160g/t Ag and 8.71% Pb (508g/t AgEq)

- Hole 49-465 with 6.5 meters grading 173g/t Ag and 11.43% Pb (631g/t AgEq)

-

4900 Level - Step-out success to extend silver-lead mineralization in

the 164-168 vein system

- Hole 49-481 with 8.1 meters grading 416g/t Ag and 14.04% Pb (978g/t AgEq)

- Hole 49-497 with 7.5 meters grading 270g/t Ag and 13.95% Pb (828g/t AgEq)

“We are excited about the strong success of the infill and near-mine drill programs so far in 2018 at both of our properties,” said Darren Blasutti, President and CEO of Americas Silver Corporation. “At Zone 120, eleven of the latest thirteen holes delivered significant mineralization over impressive widths. Zone 120 is becoming a substantial deposit with the potential to become the Company’s next operating mine. At Galena, high-grade strike extensions on the 366 FW and step out success on the 164-168 vein system both on the 4900 level means higher grade near-term production and resource additions in these areas.”

Cosalá Operations - Zone 120 Drill Results

Drill results are now available for holes SR-419 through SR-432 (SR-420 was previously reported). Notable intercepts were found in all holes. Significant intercepts in excess of 100g/t AgEq and with widths wider than 4 meters are shown in Table 1.

Table 1: Zone 120 Drill Results

| Hole | From | To | True Width | Ag | Au | Cu | AgEq | ||||||||||||||||||||||||

| (m) | (m) | (m) | (g/t) | (g/t) | (%) | (g/t) | |||||||||||||||||||||||||

| SR-419 | 162.55 | 169.10 | 6.40 | 110 | 0.58 | 0.33 | 190 | ||||||||||||||||||||||||

| SR-419 | 169.10 | 174.15 | 4.94 | 33 | 7.20 | 0.13 | 567 | ||||||||||||||||||||||||

| SR-421 | 170.15 | 174.43 | 4.04 | 63 | 0.11 | 0.28 | 103 | ||||||||||||||||||||||||

| SR-422 | 19.80 | 36.25 | 16.45 | 78 | 0.23 | 0.11 | 107 | ||||||||||||||||||||||||

| Including | 28.00 | 30.00 | 2.00 | 221 | 1.12 | 0.35 | 342 | ||||||||||||||||||||||||

| SR-422 | 178.00 | 184.00 | 6.00 | 121 | 0.42 | 0.20 | 174 | ||||||||||||||||||||||||

| Including | 182.00 | 184.00 | 2.00 | 221 | 1.15 | 0.32 | 340 | ||||||||||||||||||||||||

| SR-424 | 201.15 | 205.35 | 3.97 | 116 | 0.13 | 0.48 | 180 | ||||||||||||||||||||||||

| SR-425 | 294.70 | 299.83 | 4.67 | 71 | 0.03 | 0.17 | 93 | ||||||||||||||||||||||||

| SR-425 | 359.85 | 366.00 | 5.53 | 368 | 0.18 | 0.90 | 484 | ||||||||||||||||||||||||

| SR-425 | 375.90 | 421.65 | 41.68 | 148 | 0.25 | 0.32 | 203 | ||||||||||||||||||||||||

| Including | 386.25 | 387.80 | 1.41 | 327 | 0.23 | 0.54 | 406 | ||||||||||||||||||||||||

| Including | 396.15 | 401.00 | 4.42 | 415 | 0.20 | 0.76 | 516 | ||||||||||||||||||||||||

| Including | 416.20 | 417.46 | 1.15 | 398 | 2.48 | 0.66 | 652 | ||||||||||||||||||||||||

| SR-427 | 0.00 | 9.50 | 9.50 | 51 | 0.59 | 0.05 | 100 | ||||||||||||||||||||||||

| SR-427 | 155.20 | 184.00 | 26.24 | 181 | 0.11 | 0.51 | 247 | ||||||||||||||||||||||||

| Including | 179.20 | 182.10 | 2.64 | 696 | 0.43 | 1.50 | 899 | ||||||||||||||||||||||||

| SR-428 | 166.36 | 179.00 | 11.80 | 70 | 0.09 | 0.21 | 100 | ||||||||||||||||||||||||

| SR-428 | 242.70 | 246.80 | 3.69 | 103 | 0.06 | 0.13 | 122 | ||||||||||||||||||||||||

| SR-429 | 375.70 | 389.55 | 12.32 | 84 | 0.17 | 0.23 | 122 | ||||||||||||||||||||||||

| SR-430 | 126.00 | 134.50 | 8.03 | 15 | 1.27 | 0.08 | 116 | ||||||||||||||||||||||||

| Including | 130.40 | 131.75 | 1.27 | 11 | 7.70 | 0.06 | 574 | ||||||||||||||||||||||||

| SR-431 | 338.50 | 346.20 | 6.86 | 95 | 0.05 | 0.26 | 128 | ||||||||||||||||||||||||

| SR-431 | 354.70 | 362.20 | 6.67 | 158 | 0.14 | 0.38 | 211 | ||||||||||||||||||||||||

| Including | 358.40 | 360.40 | 1.78 | 318 | 0.34 | 0.71 | 423 | ||||||||||||||||||||||||

| SR-432 | 345.20 | 349.55 | 4.21 | 88 | 0.05 | 0.33 | 129 | ||||||||||||||||||||||||

| SR-432 | 366.95 | 372.20 | 5.08 | 151 | 0.10 | 0.29 | 192 | ||||||||||||||||||||||||

| Including | 366.95 | 367.75 | 0.77 | 424 | 0.22 | 0.91 | 544 | ||||||||||||||||||||||||

The Zone 120 deposit is characterized by steeply dipping parallel lenses of Ag-Cu-Au skarn mineralization developed in volcanically derived calcareous sediments adjacent to intermediate intrusive dikes and sills. Skarn mineralization is characterized by disseminated chalcopyrite and tetrahedrite. The mineralization is similar to that at Americas Silver’s nearby El Cajón mine which has been mined and processed in the past. Mineralization at Zone 120 has been found over an area greater than 500 meters in length, 300 meters in width and down to a depth of 550 meters. Individual lenses have widths up to 60 meters.

Figure 1: Location of Latest Reported Holes

In the current program, Americas Silver has drilled over 12,000 meters at Zone 120 extending and delineating the mineralized material in order to expand and upgrade previously reported resources of 2.09 million tonnes measured and indicated of 187 g/t Ag and 0.48% Cu (240g/t AgEq) and 1.38 million tonnes inferred of 216 g/t Ag and 0.59% Cu (260g/t AgEq). Results from the remaining holes are expected to be released in late Q2, 2018.

Evaluation of development scenarios will start following incorporation of all new drilling data into an updated mid-year resource estimate.

Galena Complex Drill Results

Exploration drilling at Galena continues to discover and expand areas of mineralization near existing underground mine infrastructure. Two areas on the 4900 Level, the 366 FW zone and the 164-168 vein system, have provided excellent results which are expected to deliver benefits in early 2019. Significant intercepts for this drilling are shown in Table 2.

Table 2: Galena Complex Drill Results

| Hole | Area |

From

|

To

|

True Width

|

Ag

|

Pb

|

AgEq

|

|||||||||||||||||||||||

| 49-461 | 366 FW | 73.1 | 76.8 | 3.7 | 167 | 6.84 | 441 | |||||||||||||||||||||||

| 49-464 | 366 FW | 63.1 | 70.6 | 7.5 | 160 | 8.71 | 508 | |||||||||||||||||||||||

| 49-465 | 366 FW | 89.9 | 105.2 | 6.5 | 173 | 11.43 | 631 | |||||||||||||||||||||||

| 49-477 | 366 FW | 47.2 | 50.3 | 3.0 | 163 | 6.24 | 413 | |||||||||||||||||||||||

| 49-486 | 366 FW | 68.1 | 73.1 | 4.4 | 123 | 6.54 | 384 | |||||||||||||||||||||||

| 49-481 | 164 Vn | 92.1 | 103.6 | 8.1 | 416 | 14.04 | 978 | |||||||||||||||||||||||

| Including | 164 Vn | 92.1 | 96.0 | 3.3 | 746 | 22.12 | 1,631 | |||||||||||||||||||||||

| 49-483 | 164 Vn | 66.0 | 69.5 | 2.7 | 193 | 11.5 | 653 | |||||||||||||||||||||||

| 49-495 | 167 Vn | 59.7 | 64.3 | 4.3 | 172 | 9.41 | 548 | |||||||||||||||||||||||

| 49-496 | 164 Vn | 70.6 | 78.7 | 7.0 | 462 | 3.16 | 588 | |||||||||||||||||||||||

| 49-497 | 167 HW | 21.3 | 32.0 | 7.5 | 270 | 13.95 | 828 | |||||||||||||||||||||||

| 49-497 | 164 Vn | 67.1 | 71.6 | 3.2 | 169 | 7.61 | 473 | |||||||||||||||||||||||

| 49-497 | 168 Vn | 102.1 | 103.6 | 1.5 | 170 | 8.08 | 493 | |||||||||||||||||||||||

| 49-498 | 167 HW | 29.0 | 30.5 | 1.3 | 355 | 16.26 | 1,005 | |||||||||||||||||||||||

| 49-498 | 167 HW | 36.0 | 38.1 | 1.6 | 588 | 33.46 | 1,927 | |||||||||||||||||||||||

| 49-498 | 164 Vn | 67.1 | 72.5 | 4.2 | 607 | 0.83 | 640 | |||||||||||||||||||||||

| 49-498 | 168 Vn | 78.2 | 80.8 | 2.0 | 400 | 9.73 | 789 | |||||||||||||||||||||||

The 366 FW zone, originally identified in 2017 through an 18-hole drill program, is located on the eastern side of the 4900 Level, north of the 360 and 366 Veins as shown in Figure 2. An additional 12-hole drill program totaling 998 meters successfully increased the mineralized volume in Q1 of 2018. Based on interpretation of available drill hole results, the 366 FW zone extends approximately 120 meters vertically, has a strike length of 180 meters and averages 3.8 meters in width. Additional drilling continues to support preliminary mine designs utilizing mechanized mining methods given the width and extents of the mineralization. Future drill programs from the 4300 Level will focus on testing the up-dip projection of existing mineralization.

Figure 2: Location of 366FW Zone

A 12-hole vertical extension drill program targeting the up-dip continuity of the 164-168 Vein system was recently completed. Drill results have strengthened geological constraints in this vein system and extended mineralization outside the most recently reported resource. Drilling planned for later in the year will test the extents of the mineralization from the 4300 Level.

Technical Information

Drill core samples from the Cosalá operations are prepared at the Company’s secure facility in Cosalá, Sinaloa. Assaying was done by ALS Chemex Labs in Hermosillo, Sonora.

Drill core samples from the Galena Complex are prepared and assayed at American Analytical Services Inc. in Osburn, Idaho. The Company has a QA/QC program supervised by a Qualified Person.

Daren Dell, Chief Operating Officer and a Qualified Person under Canadian Securities Administrators guidelines, has approved the applicable contents of this news release. For further information please see SEDAR or americassilvercorp.com.

About Americas Silver Corporation

Americas Silver is a silver mining company focused on growth in precious metals from its existing asset base and execution of targeted accretive acquisitions. It owns and operates the Cosalá Operations in Sinaloa, Mexico and the Galena Mine Complex in Idaho, USA. The Company holds an option on the San Felipe development project in Sonora, Mexico.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward‐looking information” within the meaning of applicable securities laws. Forward‐looking information includes, but is not limited to, the Company’s expectations intentions, plans, assumptions and beliefs with respect to, among other things, the realization of exploration, operational and development plans (including further exploration and development of San Felipe), the Cosalá Operations and Galena Complex as well as the Company’s financing efforts. Often, but not always, forward‐looking information can be identified by forward‐looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward‐looking information is based on the opinions and estimates of the Company as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of the Company to be materially different from those expressed or implied by such forward looking information. This includes the ability to develop and operate the Cosalá and Galena properties, risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions and factors other factors limiting mine access, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital expenditures, reclamation activities, social and political developments and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific that contribute to the possibility that the predictions, forecasts, and projections of various future events will not occur. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

Cautionary Note to U.S. Investors regarding mineral resources:

The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource”, “inferred mineral resource” used in the press release are Canadian mining terms used in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum Standards. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

While the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource”, and “inferred mineral resource” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States and normally are not permitted to be used in reports and registration statements filed with the Securities & Exchange Commission (“SEC”). As such, information contained in the Company's disclosure concerning descriptions of mineralization and resources under Canadian standards may not be comparable to similar information made public by U.S companies in SEC filings. With respect to “inferred mineral resource” there is a great amount of uncertainty as to their existence and a great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

1 True widths reported.

2 Silver equivalent

grade (AgEq) calculated using metal prices of $18.00/oz Ag, $1,300/oz Au

and $3.00/lb Cu for Cosalá and $18.00/oz Ag and $1.05/lb Pb for Galena.

View source version on businesswire.com: https://www.businesswire.com/news/home/20180405006098/en/