Anaconda Mining Delivers Positive Preliminary Economic Assessment for the Goldboro Gold Project

Pre-tax Net Present Value 5% of $805M with a pre-tax IRR of 29.0%

After-tax Net Present Value 5% of $547M with an after-tax IRR of 24.4%

TORONTO, ON / ACCESSWIRE / June 23, 2021 / Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX) (OTCQX:ANXGF) is pleased to report the results of the Preliminary Economic Assessment ("PEA") prepared in accordance with National Instrument 43-101 ("NI 43-101") for its 100% owned Goldboro Gold Project in Nova Scotia, Canada ("Goldboro", or the "Project"). All currency is presented in Canadian dollars (C$) and referenced as "C$" or "$", unless otherwise stated.

Based on the significantly expanded Mineral Resource Estimate ("Mineral Resource") with an effective date of February 7, 2021, the PEA demonstrates the potential for strong economics from both open pit ("OP") and underground ("UG") mine operations over an estimated 17.6-year life of mine ("LOM"), with continued opportunity for growth as the Goldboro Deposit remains open in all directions. The PEA is supported with advanced metallurgical testing, refined mine and mill designs reflecting the expanded Mineral Resource, and updated operating and capital cost estimates.

Highlights of the Goldboro Gold Project PEA

- After-tax Net Present Value at a 5% discount rate ("NPV 5%") of $547 million and an after-tax Internal Rate of Return ("IRR") of 24.4%, with an after-tax payback of 3.2 years based on a gold price of $2,000 per ounce (US$1,550 at an exchange rate of 1.29 C$:US$);

- Pre-tax NPV 5% of $805 million and a pre-tax IRR of 29.0%, with a pre-tax payback period of 2.9 years;

- Total gold recovered of over 1,950,000 ounces over a 17.6-year life of mine, based on 15.0 Mt at 2.09 grams per tonne ("g/t") gold from surface mining, 6.0 Mt at 4.89 g/t gold from underground mining, and 3.2 Mt at 0.63 g/t gold from a low-grade stockpile;

- Goldboro could generate an estimated $3.9 billion of gross revenue, approximately $ 1.6 billion in undiscounted pre-tax net cash flow, and over $481 million in federal and provincial tax payments;

- Initial capital cost ("Capex") of $286 million resulting in an after-tax NPV 5% to Capex ratio of 1.9;

- Average gold production of over 89,500 ounces per year over the first 7 years of production from surface mining, increasing to average annual production of over 120,000 ounces in years 8 through 18;

- Life-of-Mine Operating Cash Costs of $862 (US$668) per ounce sold and All-In Sustaining Costs ("AISC") of $1,031 (US$799) per ounce sold;

- Mill capacity of 4,000 tonnes per day ("tpd") based on combined gravity and leaching circuit, demonstrating an average gold recovery of 96.4%; and

- At a gold price of $2,200 (US$1,705), Goldboro could generate cumulative after-tax net cash flows of approximately $1.4 billion, an after-tax NPV 5% of over $700 million and an after-tax IRR of 29.2%.

1 Refer to Non-IFRS Financial Measures below.

* Cautionary statement NI 43-101: The PEA was prepared in accordance with NI 43-101. Readers are cautioned that the PEA is preliminary in nature. It includes inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not mineral reserves do not have demonstrated economic viability.

"Anaconda Mining is extremely pleased to announce its Preliminary Economic Assessment for the Goldboro Gold Project. The PEA was initiated following the announcement of a significantly expanded Mineral Resource at Goldboro in February 2021, which represented a potential step change to the economic value of the Project. The PEA outlines the capacity for a long mine life with estimated average gold production of 112,000 ounces over more than 17 years, generating an after-tax NPV of $547 million and an after-tax IRR of 24.4% using a US$1,550 gold price. Based on the technical and financial merits demonstrated by the PEA, the Company is undertaking a phased development approach which will initially focus on the surface mining phase of the mine plan, which is subject to an ongoing Feasibility Study expected to be released in Q4 2021.

Importantly, the Goldboro Deposit is open in all directions and the Company is initiating exploration to the west of the deposit towards the past producing Dolliver Mountain gold mine. We believe Goldboro has potential to be a multi-generational gold mine, which can create significant value for our shareholders and Project stakeholders, including the community of Guysborough and the Mi'kmaq of Nova Scotia."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc.

Next Steps - Towards the Development of Goldboro

The results of the Goldboro PEA indicate that the Project has technical and financial merit using the base case assumptions and in many cases inputs from advanced studies being undertaken in anticipation of a Feasibility Study. The Company plans to execute the mine plan outlined in the PEA in phases, commencing initially with a Feasibility Study focused on the initial 10 years of surface mining, which is anticipated to be released in Q4 2021. An Environmental Assessment Registration Document will be filed shortly thereafter on that basis. Throughout 2021, the Company will continue with ongoing work to support the Feasibility Study, including geotechnical drilling, expanded surface water monitoring, comminution studies and infill drilling.

If a production decision is made, Anaconda will then commence the next phase of planning for underground mining, including infill and expansion drilling from drifts off benches in the open pit, allowing for more effective and less expensive diamond drilling. Pending those results, the Company would then consider a supplementary study that will focus on adding the underground mining phase to the Project.

The Company believes there is further potential to expand the Goldboro Deposit along strike, and at depth, and is planning a 50-line kilometre Induced Polarization ("IP") geophysical survey over the area west of the Goldboro Deposit for approximately one kilometre up to the past producing Dolliver Mountain gold mine. There is significant opportunity to further expand the Mineral Resource and the IP geophysical survey will assist in identifying strike continuity to the west as well as any potential parallel zones north and south of the currently known extents of the deposit.

The Goldboro Gold Project Preliminary Economic Assessment

The PEA was completed by Nordmin Engineering Ltd. ("Nordmin") as Lead, Mining, and Geological Consultant. Knight Piésold Ltd. ("Knight Piésold") acted as Tailings Consultant, GHD Ltd. ("GHD") as Site Water Management and Environmental Consultant, Ausenco Engineering Canada Inc. ("Ausenco") as Metallurgical and Processing Consultant, Lorax Environmental Services Limited ("Lorax") as Geochemistry Consultant, and McCallum Environmental Ltd. ("McCallum") as Consultation and Permitting Consultant. The Goldboro Gold Project Mineral Resource Estimate, effective February 7, 2021, was prepared by Nordmin.

Table 1: Summary of Key Estimated Results and Assumptions in the Preliminary Economic Assessment

Production Data | Values | Units |

Life of Mine | 17.6 | Years |

Processing Rate | 4,000 / 1.46 | tpd / Mtpa |

Recovered Gold | 1.95 | Moz |

Average Gold Recovery | 96.4% | |

Pre-production Mined Tonnage | 3.1 | Mt |

Total Mined Tonnage (including pre-production) from Open Pit Mining | 114.2 | Mt |

Total Milled Tonnage from Open Pit Mining | 15.0 | Mt |

Overall Strip Ratio | 6.6 | waste:ore |

Total Milled Tonnage from Underground Mining | 6.0 | Mt |

Total Milled Tonnage from Low-Grade Stockpile | 3.2 | Mt |

Total Milled Tonnage | 24.3 | Mt |

Average Annual Gold Production | 112 | koz |

Average Mill Feed Grade | 2.59 | g/t gold |

Capital Costs | Values | Units |

Initial Capital, Direct Cost Estimate | $183.1 | C$M |

Initial Capital, Indirect Costs and Contingency | $97.4 | C$M |

Other Costs and Working Capital | $5.9 | C$M |

Total Initial Capital Costs | $286.3 | C$M |

LOM Sustaining Capital | $229.2 | C$M |

LOM Sustaining Capital, Indirect Costs and Contingency | $40.0 | C$M |

Total LOM Sustaining Capital | $269.2 | C$M |

Reclamation and Closure Costs | $57.7 | C$M |

Fisheries Offsetting and Wetland Compensation | $8.4 | C$M |

LOM Total Capital | $615.7 | C$M |

Capital Intensity (Initial Capital / Ounces Produced) | $147 | C$/oz |

LOM Operating Costs | Values | Units |

Open Pit Mining (per tonne OP mined) | $4.86 | C$/t |

Underground Mining (per tonne UG mined) | $92.48 | C$/t |

Processing (per tonne milled) | $12.51 | C$/t |

Refining and Transport | $4.06 | C$/oz |

Water Management and Treatment (per tonne milled) | $0.95 | C$/t |

Site Support Costs (per tonne milled) | $10.14 | C$/t |

Total Operating Cost (per tonne milled) | $68.92 | C$/t |

Average Operating Cash Cost per Ounce Sold 1 | C$862 (US$668) | $/oz |

Average All-In Sustaining Cost per Ounce Sold 1 | C$1,031 (US$799) | $/oz |

Financial Analysis | Values | Units |

Gold Price Assumption | $1,550 | US$/oz |

US$:C$ Exchange | 1:1.29 | |

Gold Price Assumption - C$ | $2,000 | C$/oz |

Pre-Tax NPV 5% | $805.0 | C$M |

Pre-Tax IRR | 29.0% | |

Pre-Tax Payback | 2.9 | years |

After-Tax NPV 5% | $547.0 | C$M |

After-Tax IRR | 24.4% | |

After-Tax Payback | 3.2 | years |

Pre-Tax Unlevered Free Cash Flow | $1,591.1 | C$M |

After-Tax Unlevered Free Cash Flow | $1,110.0 | C$M |

LOM Direct Income and Provincial Mining Taxes | $481.1 | C$M |

Notes:

- See note below on "Non-IFRS Financial Measures".

Goldboro Gold Project - Mineral Resource Estimate

The Mineral Resource, as announced on February 22, 2021 and presented in Table 2, was prepared by Independent Qualified Person Glen Kuntz, P. Geo. of Nordmin. The Mineral Resource is based on validated results of 635 surface and underground drill holes, for a total of 113,132.9 metres of diamond drilling, including 45,408.7 metres conducted by Anaconda, that was completed between 1984 and the effective date of February 7, 2021. Please refer to the technical report entitled "NI 43-101 Technical Report and Mineral Resource Estimate, Goldboro Gold Project, Eastern Goldfields district, Nova Scotia" dated February 22, 2021, which is available on the Company's SEDAR profile at www.sedar.com.

Table 2: Mineral Resource Statement for the Goldboro Gold Project

Resource Type | Gold Cut-off (g/t) | Category | Tonnes ('000) | Gold Grade (g/t) | Troy Ounces |

Open Pit | 0.44 | Measured | 6,137 | 2.73 | 538,500 |

Indicated | 5,743 | 2.99 | 551,300 | ||

Measured + Indicated | 11,880 | 2.86 | 1,089,900 | ||

Inferred | 1,580 | 1.75 | 89,000 | ||

Underground | 2.60 | Measured | 1,384 | 7.36 | 327,700 |

Indicated | 2,772 | 5.93 | 528,600 | ||

Measured + Indicated | 4,156 | 6.41 | 856,200 | ||

Inferred | 3,726 | 5.92 | 709,100 | ||

Combined^ | 0.44/2.60 | Measured | 7,521 | 3.58 | 866,200 |

Indicated | 8,515 | 3.95 | 1,079,900 | ||

Measured + Indicated | 16,036 | 3.78 | 1,946,100 | ||

Inferred | 5,306 | 4.68 | 798,100 |

^ Combined Open Pit and Underground Mineral Resources; The Open Pit Mineral Resource is based on a 0.44 g/t gold cut-off grade, and the Underground Mineral Resource is based on 2.60 g/t gold cut-off grade.

Mineral Resource Estimate Notes

- Mineral Resources were prepared in accordance with NI 43-101 and the CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (2019). Mineral Resources that are not mineral reserves do not have demonstrated economic viability. This estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Open Pit Mineral Resources are reported at a cut-off grade of 0.44 g/t gold that is based on a gold price of C$2,000/oz (~US$1,550/oz) and a gold processing recovery factor of 96%.

- Underground Mineral Resource is reported at a cut-off grade of 2.60 g/t gold that is based on a gold price of C$2,000/oz (~US$1,550/oz) and a gold processing recovery factor of 97%.

- Assays were variably capped on a wireframe-by-wireframe basis.

- Specific gravity was applied using weighted averages to each individual wireframe.

- Mineral Resource effective date February 7, 2021.

- All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly.

- Excludes unclassified mineralization located within mined out areas.

- Reported from within a mineralization envelope accounting for mineral continuity.

Mining and Mine Design

This PEA is preliminary in nature. In addition to the Measured and Indicated Mineral Resources, the mine plan presented includes Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that this PEA will be realized.

The Goldboro PEA utilizes the Mineral Resource with an effective date of February 7, 2021, that is conceptually mineable with both open pit and underground mining methods. Only portions of the Mineral Resource that fall within the constraints defined by the open pit and underground parameters of the PEA listed below are used to inform the PEA economics ("Mining Inventory").

Open Pit

Economic limits for the Open Pit were determined using Geovia's Whittle™ 4.7 software that uses the Lerchs-Grossmann ("LG") algorithm. The LG algorithm progressively identifies economic blocks, taking into account waste stripping, that results in a highest possible total value mined within the open pit shell, subject to the specified pit slope constraints. The Pit Limit Analysis was evaluated on the West Goldbrook, Boston Richardson and East Goldbrook Gold Systems.

A 3D geological block model and other economic and operational variables were used as inputs into the LG program. These variables include overall pit slope angle, mining costs, processing costs, selling costs, metal prices, and other variables. The economic parameters used for the pit limit analysis are listed in Table 3.

Table 3: Pit Limit Analysis Parameters

Parameter | Value |

|---|---|

Currency Used for Evaluation | C$ |

Reblocked / Regularized Block Size | 2 m x 2 m x 5 m |

Overall Slope Angle | Rock: Varied by Sector - Range 42o - 50o |

Overburden: 25o | |

Mining Cost | $3.50/tmined Overburden |

$5.00/tmined Rock | |

+ $0.02/t per 10 m for depths between 100 - 200 m | |

+ $0.03/t per 10 m for depths +200 m | |

Process Cost, including milling, site support costs, tailings, rehabilitation | $24.50/tprocessed |

Selling Cost, including transportation of doré and refining costs | $24.84/t.oz. |

% Payable | 99.95% |

Metal Price | US$1,550 per ounce of gold |

US$1 : C$1.29 | |

C$2,000 per ounce of gold | |

Process Recovery | Based on Grade - Recovery Curve |

(GRADE-(0.0262*LN(GRADE)+0.0712))/GRADE*100-0.083 | |

Mining Loss & Dilution | Regularized Block Model |

Resources Used for Pit Shell Generation | Measured + Indicated |

Pit Shell Selection | Revenue Factor RF 0.76 |

Three boundary constraints were used in the pit limit analysis for the Goldboro Deposit:

- A 40 m (X-Y) offset from the Natural Gas pipeline easement, on the west side of the property;

- A 50 m (X-Y) offset from the edges of the Gold Brook Lake; and

- A 20 m (X-Y) offset from the centerline of Gold Brook.

The block models were created in Datamine using 2 m x 2 m x 2 m parent cell and variable sub-celling to 1 metre. For the open pit evaluation, the four block models (for West Goldbrook, East Goldbrook, Boston Richardson, Marker Horizon) were combined into one model. Default waste blocks and overburden blocks were added to the model. The model was reblocked and regularized using Geovia Surpac software. For the PEA analysis, the regularization was completed at a block size of 2 m x 2 m x 5 m. The envisioned selective mining excavator, at the onset of the analysis, would likely have a bucket width of ~ 2 m, the rock is planned to be mined on a 5 m operating bench height. An approximate 24% mining dilution factor and 7% mining loss factor were incorporated as a result of reblocking & regularizing the block model.

To classify the material contained within the open pit limits as material for processing or material for waste, the milling cut-off grade is used. This break-even cut-off grade is calculated to cover the costs of processing, general and administrative costs, and selling costs using the economic and technical parameters listed in Table 3. Mineral Resource material contained within the pit and above the cut-off grade is classified as potential mill feed ("PMF"), while resource material below the cut-off grade is classified as waste.

The cut-off grade has been estimated to be 0.44 g/t gold for the Open Pit. Table 4 provides the Mining Inventory for the Open Pits by Mineral Resource category on a diluted basis.

Table 4: Planned OP Mining Inventory - Tonnage and Grade by Category

Pit Area | Category | Diluted Tonnage | Diluted Grade | Au Contained |

West Pit | Measured | 6,148 | 2.10 | 415 |

Indicated | 3,208 | 2.03 | 210 | |

Total Measured & Indicated | 9,356 | 2.08 | 625 | |

Inferred | 563 | 1.37 | 25 | |

Waste Rock | 66,585 | |||

Total Rock Mined | 76,504 | |||

East Pit | Measured | 1,707 | 2.37 | 130 |

Indicated | 2,602 | 2.33 | 195 | |

Total Measured & Indicated | 4,309 | 2.34 | 324 | |

Inferred | 788 | 1.30 | 33 | |

Waste Rock | 32,612 | |||

Total Rock Mined | 37,708 |

Underground

The Goldboro underground Mining Inventory was determined using Deswik's Mineable Shape Optimizer ("MSO") software tool. The MSO tool uses the geological block model to generate shapes (e.g. - stopes, drifts, etc.) based on the economic and geometric parameters as listed in Table 5 and Table 6. The underground Mining Inventory is a combination of the four separate zones: West Goldbrook, Boston Richardson, East Goldbrook and the Marker Horizon. The Mineral Resource spans along a strike length of 2,000 m to a depth of 480 m below surface.

The Goldboro underground mine plan was designed using a longitudinal retreat long-hole open stoping mining method with cemented paste backfill. Stope dimensions were designed on a 20 m level spacing and maximum 15 m length with an average mineralized width of 2.6 m. Stopes are designed to be accessed and excavated via overcut and undercut development drifts, which connect to central level accesses. Three main ramp systems connect levels and provide ventilation, mine access and secondary egress to four main portals to surface.

Table 5: Underground Design Parameters

Parameter | Value |

Long-hole Open Stoping Size | |

| Length (Maximum) | 15 m |

| Height (Maximum) | 20 m (level spacing) |

| Width (Average) | 2.6 m |

Average Stope Dip | 70.6o |

Development Drift Dimensions: | |

| Ore Sill | 3.5 m (height) x 3.0 m (width) |

| Operation Waste | 3.5 m (height) x 3.0 m (width) |

| Level Access | 4.5 m x 4.5 m |

| Ramp | 4.8 m x 4.8 m |

UG As Designed Mining Dilution & Recovery | UG Mining Dilution 19.3% UG Mining Recovery 91.3% |

Resources Used for MSO Generation and UG Design | Measured + Indicated + Inferred |

Table 6: Underground MSO Cut-off Grade Parameters

Parameter | Value |

Currency Used for Evaluation | C$ |

Underground Mining Cost | $78.99/tprocessed |

| includes assumptions for operating waste development, surface rehandle | |

Underground Support Cost | $20.54/tprocessed |

| includes assumptions for indirect underground operating, technical services, infill diamond drilling | |

Process Cost | $17.80/tprocessed |

| Site Support Costs | $14.82/tprocessed |

| includes assumptions for general and administration, management, camp, and transportation | |

Operating Cost Marginal Allowance | $10.00/tprocessed |

| 7% marginal allowance to cover a portion of capital costs | |

Selling Cost, including transportation of doré and refining costs | $24.84/t.oz. |

UG MSO Cut-off Mining Dilution & Recovery Assumption | UG Mining Dilution 19.0% |

% Payable | 99.95% |

| Metal Price | US$1,550 per ounce of gold |

| US$1 : C$1.29 | |

| C$2,000 per ounce of gold | |

Process Recovery | 96.75% |

Production Rate Assumption | 1,500 tonne per day |

Resulting MSO Cut-off Gold Grade | 3.0 g/t gold |

Four boundary constraints were used in the underground inventory analysis for the Goldboro Deposit:

- A 50 m (X-Y-Z) offset from the Natural Gas pipeline easement, on the west side of the property

- A 30 m (Z) crown pillar from top of the bedrock material

- A 30 m (X-Y) offset from the ultimate West Pit limit

- A 30 m (X-Y) offset from the ultimate East Pit limit

The block models were created in Datamine using 2 m x 2 m x 2 m parent cell and variable sub-celling to 1 metre. For the underground portion of the PEA analysis, the four block models (for West Goldbrook, East Goldbrook, Boston Richardson, and Marker Horizon) were evaluated. The planned Mining Inventory as shown in Table 7 provides the contents of the underground design including estimated mining dilution and mining recovery. The planned mining from underground consists of evaluated tonnes and grade within MSO shapes that met the minimum cut-off gold grade of 3.0 g/t gold, were outside of boundary constraints, and were assessed to be probable minable shapes. The 3.0 g/t gold cut-off as applied to MSO shapes includes material within the shapes below cut-off. The MSO cut-off of 3.0 g/t gold is equivalent to a mill feed gold grade cut-off of approximately 2.3 g/t gold when incorporating a mining dilution factor of 19% and a mining recovery factor of 90%. The planned mining from underground includes additional material from development that met a marginal gold grade cut-off of 0.7 g/t gold.

Table 7: Planned Underground Mining Inventory - Tonnage and Grade by Category

Mineralized Area | Category | Tonnes ('000) | Diluted Gold Grade (g/t) | Troy Ounces ('000) |

East | Measured | 91.4 | 4.99 | 14.6 |

Indicated | 238.9 | 4.19 | 32.2 | |

Total Measured & Indicated | 330.3 | 4.41 | 46.8 | |

Inferred | 337.2 | 5.06 | 54.9 | |

Waste Rock | 439.0 | |||

Total Rock Mined | 1,436.8 | |||

Upper Central | Measured | 693.8 | 5.50 | 122.6 |

Indicated | 826.3 | 4.91 | 130.4 | |

Total Measured & Indicated | 1,520.1 | 5.18 | 253.0 | |

Inferred | 445.5 | 5.58 | 79.9 | |

Waste Rock | 496.1 | |||

Total Rock Mined | 3,981.7 | |||

Lower Central | Measured | 350.3 | 5.06 | 57.0 |

Indicated | 611.2 | 4.01 | 78.9 | |

Total Measured & Indicated | 961.5 | 4.39 | 135.8 | |

Inferred | 1,086.7 | 4.51 | 157.6 | |

Waste Rock | 509.8 | |||

Total Rock Mined | 3,519.4 | |||

Southwest | Measured | 18.0 | 2.74 | 1.6 |

Indicated | 51.2 | 7.39 | 12.2 | |

Total Measured & Indicated | 69.2 | 6.18 | 13.8 | |

Inferred | 129.9 | 4.75 | 19.8 | |

Waste Rock | 203.6 | |||

Total Rock Mined | 471.8 | |||

West | Measured | 234.3 | 4.15 | 31.3 |

Indicated | 397.2 | 4.80 | 61.3 | |

Total Measured & Indicated | 631.5 | 4.56 | 92.6 | |

Inferred | 511.6 | 5.88 | 96.6 | |

Waste Rock | 628.8 | |||

Total Rock Mined | 2,403.4 |

Mine Operations

The operation scenario studied for the PEA involves:

- Open Pit mining at an average mining rate of 10 Mt per year

- Underground mining at a rate of 1,500 tonnes per day with accompanying low-grade stockpile reclamation; and

- Gold process plant with a 1.46 Mt per year (4,000 tonnes per day) capacity,

The PEA is based on a conventional truck-shovel open pit mining operation within two pits that transition to underground mining in year 6. The open pit production period is 10.4 years, while the underground production period is approximately 11 years with two years of pre-production development. The combined operation has a production period of 17.6 years.

Open Pit

A conventional truck-shovel method was considered for the Open Pit portion of the Goldboro Deposit. The open pit analysis results in two distinct open pits separated by the Gold Brook Lake. The dimensions of the West Pit are approximately 980 m long x 470 m wide x 240 m deep. The dimensions of the East Pit are approximately 750 m long x 350 m wide x 195 m deep.

The Open Pit LOM plan proposes to mine approximately 15.0 Mt of Potential Mill Feed ("PMF") at a cut-off grade of 0.44 g/t gold, 9.1 Mt of overburden material, 90.1 Mt of waste rock material. The average stripping ratio is 6.6:1. Approximately 3.2Mt of low-grade material (cut-off grade of 0.35 g/t gold) would be stockpiled for blending with the underground material towards the end of the mine life to fill the mill.

The Goldboro pit was designed with the following preliminary assumptions:

- 9 geotechnical sectors with bench face angles ranging from 70o - 85o, inter-ramp angles ranging from 49o - 59o, and overall slope angles ranging from 43o - 53o;

- Operational bench height of 5 m, final bench height of 15 m;

- Berm width of 7.5 m; and

- Ramp width of 21 m, including 3x truck width (5.5 m) for running surface for double lane traffic, and allowance for safety berm and drainage ditch.

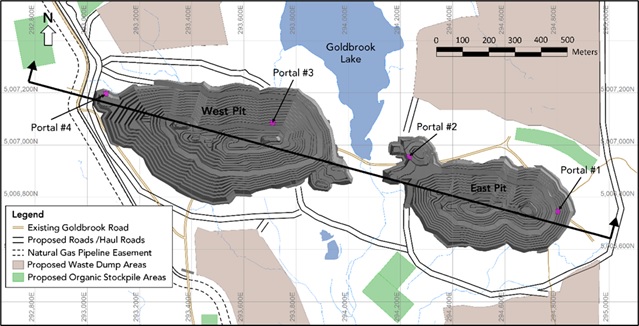

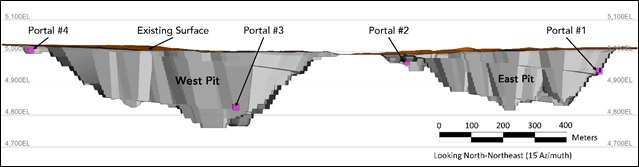

Each pit is currently planned to be developed with two phases each. The East Pit would be completed in Year 8 of production and the West Pit is completed in Year 11 of production (Figures 1 and 2).

Figures 1 and 2 illustrate the PEA Open Pit design.

Figure 1: Goldboro Open Pit, Plan View

Figure 2: Goldboro Open Pit, Long Section View (looking North-Northeast)

The PEA assumes contract mining will be used for the open pit mining activities. The main production fleet, although dependent on the Mining Contractor, is envisioned to consist of approximately three drills (150 mm), one backhoe excavator (5 cubic metres), two wheel loaders (7 cubic metres), up to 16 haul trucks (63 tonne), three tracked dozers, one wheel dozer, and two graders.

Waste rock mined from the open pit is planned to be used for road and pad construction purposes and for the tailings facility embankment. When not used for those purposes, waste rock will be hauled and stored within four on-land waste storage areas.

Underground

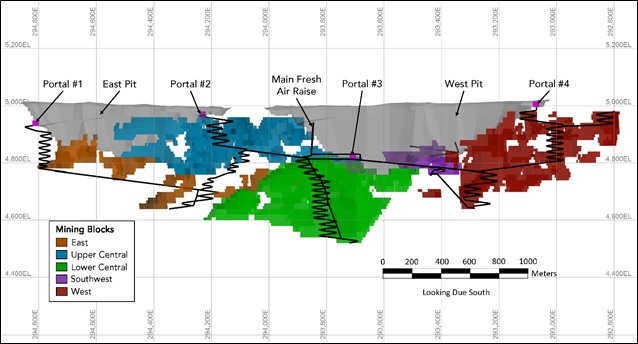

Underground development commences at the beginning of the 6th year of open pit production and targets 200 tpd, ramping up to full production over an approximately two-year period. The ramp-up allows for the main ramp system to connect two portals and the central intake raise, providing ventilation and secondary egress for the mine. Underground production was scheduled based on approximately 1,500 tpd mill feed and 600 tpd waste, excavated using a fleet of 3.5 and 10 tonne load-haul-dump loaders, hauled with 30 tonne trucks using the ramps to portals entrances and rehandled using the surface fleet. Production commences in the East and Upper Central Mining Blocks continues for the first 5 years, then transitions to the remaining Mining Blocks for the final 7 years of mine life. Contract mining will be used for the underground mining activities. See Figure 3 for LOM underground mine design long section.

Figure 3: Goldboro Underground, Long Section View (looking South)

Processing and Recovery

The process plant is expected to treat 1.46 Mt of potential mill feed per year at an average throughput rate of 4,000 tonnes per day with an expected availability of 92%. The plant comminution section includes a three-stage crushing circuit, ball mill, gravity concentration and classification system. Gold recovery is expected to be achieved by standard leach and Carbon-In-Leach ("CIL") technology followed by cyanide detoxification and arsenic precipitation before deposition into a Tailings Management Facility ("TMF").

The process plant has been designed to realize an average potential recovery of 96.4% of the gold sourced from Goldboro over the life of the project. Of the 96.4% overall recovery, the gravity circuit is expected to recover an average of 26% of the gold delivered to the mill, within an overall expected range of 3%-85%. Expected gold recovery has been calculated based on metallurgical test work completed on Goldboro open pit material in 2020, which was consistent with observations made from the metallurgical work performed on Goldboro underground material in 2018 and 2019. Further metallurgical testing has been planned for the third quarter of 2021 with the aim of improving recovery assumptions via further ore variability testing, grind-gravity extraction optimization, as well as further reagent consumption refinement.

Capital and Operating Costs

Capital and operating cost estimates are stated in Canadian dollars and are estimated with an expected accuracy range of +50%/-35% weighted average accuracy of actual costs and were derived from various sources including consultant databases on analogous projects, indicative budget quotes, and from factoring.

The estimate of Initial Capital Costs is $286.3 million including working capital, indirect and contingency assumptions, as outlined in Table 8 below (note that columns may not sum exactly due to rounding). A contingency of $47.1 million has been included in the estimate of Initial Capital Costs, which amounts to 26% of Direct Initial Capital Costs.

Table 8: Initial Capital Cost Estimate

Cost Item / Description | Pre-Production Period | % of |

C$ M | ||

Open Pit Mining, Pre-production Mining | 31.0 | 11% |

Underground Mining | 0.0 | 0% |

Process Plant | 66.6 | 23% |

Tailings Management | 23.3 | 8% |

Site Development, Power, Electrical | 47.7 | 17% |

Water Management and Treatment | 14.5 | 5% |

Direct Initial Capital Estimate | 183.1 | 64% |

Other Costs, Working Capital | 5.9 | 2% |

Indirect Capex | 50.3 | 17% |

Contingency | 47.1 | 16% |

Total Capital Estimate | 286.3 | ?EUR? 100% |

The sustaining capital, including rehabilitation and closure costs, fisheries and wetland compensation and the reversal of upfront working capital, is estimated at $329.9 million over the life of the mine. Details of the estimate are shown in Table 9 below (note that columns may not sum exactly due to rounding).

Table 9: Sustaining Capital Cost Estimate

Cost Item / Description | Production Period |

C$ M | |

Open Pit Mining | 5.2 |

Underground Mining | 129.2 |

Infill Drilling - UG | 30.0 |

Paste Plant Facility | 14.0 |

Tailings Management (excludes closure) | 27.8 |

Site Development | 11.6 |

Water Management and Treatment | 7.5 |

Power, Electrical | 3.8 |

Indirect and Contingency | 40.0 |

Subtotal Sustaining Capital Estimate | 269.2 |

Mine Rehabilitation and Closure | 57.7 |

Fisheries and Wetland Compensation | 8.4 |

Working Capital | (5.4) |

Total Estimate | 329.9 |

The Operating Costs, detailed in Table 10, are estimated at $68.92/t of material processed, which is composed of:

- An open pit mining cost of $35.49/t of open pit material processed

- An underground mining cost of $92.48/t of underground material processed, includes surface haulage and infill & grade control costs

- Stockpile rehandling cost of $1.50/t of stockpiled material

- Processing cost of $12.51/t processed

- Site Support costs of $10.14/t processed

- Water Treatment cost of $0.95/t processed

Table 10: Operating Cost Estimate

Cost Item / Description | Total | $/t mined | $/t milled | $/oz Au |

C$ M | ||||

Mining - OP | 540 | 4.86 | 22.27 | 636 |

Mining - UG | 559 | 92.48 | 23.05 | 602 |

Processing | 303 | 12.51 | 156 | |

General and Administration | 246 | 10.14 | 126 | |

Water Treatment | 23 | 0.95 | 12 | |

Total Operating Costs | 1,672 | ?EUR? | 68.92 | 857 |

Note:

| ||||

Notable unit rates include $1.00/L for diesel, $0.102/kWh for electricity, and $0.45/L for propane.

Financial Analysis

An economic analysis was conducted with undiscounted and discounted net cash flows before and after tax. At a US$1,550 per ounce of gold price and a US$:C$ exchange of 1:1.29, resulting in gold price of C$2,000, the Project generates an after-tax NPV 5% of $547 million, an after-tax IRR of 24.4% and an after-tax payback on initial capital of 3.2 years. After-tax net free cash flow on an unlevered basis is estimated a $1,110 million.

On a pre-tax basis, the Project generates NPV 5% of $805 million, and IRR of 29.0%, and payback of 2.9 years. Pre-tax net cash flow for the Project is estimated at $1,591 million.

The gold price sensitivity on an after-tax basis is presented in Table 11. Sensitivities to changes in other parameters are shown in Table 12, on an after-tax basis.

Table 11: After-Tax Valuation Sensitivities to the Gold Price

Description | Unit | Net Present Value (C$ M) | |||||

% Variation | % | -20% | -10% | 0% | +10% | +20% | |

Au Price2 | US$/oz | US$1,240 | US$1,395 | US$1,550 | C$1,705 | US$1,860 | |

C$/oz | C$1,600 | C$1,800 | C$2,000 | C$2,200 | C$2,400 | ||

Discount Rate | 0% | C$M | 562 | 836 | 1,110 | 1,384 | 1,658 |

3% | C$M | 330 | 528 | 724 | 921 | 1118 | |

5% | C$M | 224 | 386 | 547 | 707 | 867 | |

8% | C$M | 115 | 238 | 359 | 479 | 599 | |

10% | C$M | 64 | 167 | 269 | 370 | 470 | |

IRR | % | 13.7% | 19.3% | 24.4% | 29.2% | 33.7% | |

Payback Period3 | years | 9.2 | 4.5 | 3.2 | 2.6 | 2.1 | |

Table 12: After-Tax Valuation Sensitivity to Certain Parameters

Factor | 20% | 10% | 0% | -10% | -20% | |

Operating Cost | C$M | 2,007 | 1,839 | 1,672 | 1,505 | 1,338 |

IRR | 19.6% | 22.1% | 24.4% | 26.7% | 28.9% | |

NPV5% | 404 | 475 | 547 | 619 | 690 | |

Payback (yrs)3 | 4.5 | 3.8 | 3.2 | 2.9 | 2.6 | |

Initial Capital Cost4 | C$M | 337 | 308 | 280 | 252 | 224 |

IRR | 20.6% | 22.3% | 24.4% | 26.9% | 29.9% | |

NPV5% | 508 | 527 | 547 | 567 | 586 | |

Payback (yrs)3 | 4.2 | 3.8 | 3.2 | 2.8 | 2.4 | |

Sustaining Capital Cost | C$M | 323 | 296 | 269 | 242 | 215 |

IRR | 23.7% | 24.1% | 24.4% | 24.8% | 25.1% | |

NPV5% | 522 | 535 | 547 | 559 | 572 | |

Payback (yrs)3 | 3.3 | 3.3 | 3.2 | 3.2 | 3.2 | |

Notes for Table 11 and Table 12:

- See note on "Non-IFRS Financial Measures".

- Exchange rate of C$1.29:US$1 was used for the Canadian dollar gold price.

- Payback is defined as achieving cumulative positive free cashflow after all cash costs and capital costs, including sustaining capital costs and is counted from the start of production.

- Excludes initial working capital requirements.

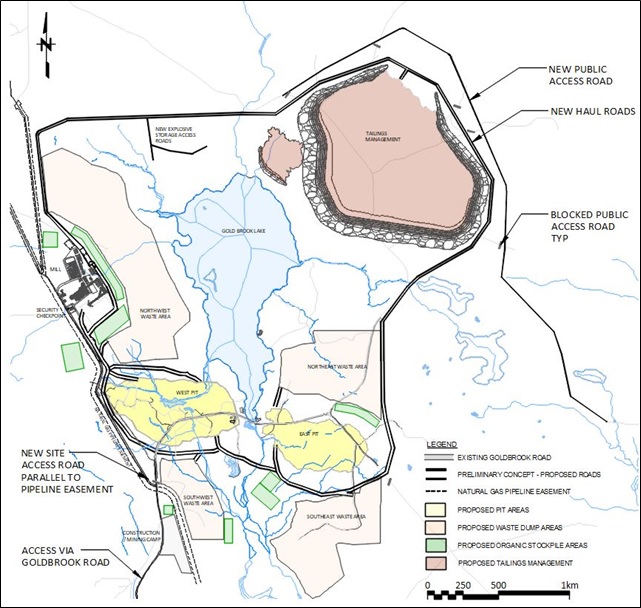

Infrastructure and Facilities

The main project infrastructure components include mine and process plant supporting infrastructure, site accommodation facilities, tailings management facility, external and internal access roads, power supply and distribution, freshwater supply and distribution, water treatment plant and construction/operations camp. The general site layout for the PEA is shown in Figure 4.

Figure 4: General Site Plan

The PEA general mine and process surface facilities assumptions include the following:

- Truck maintenance shop

- Truck wash facility

- Plant maintenance shop

- Mill and laboratory

- Fuel storage facility

- Propane storage facility

- Explosive storage magazine

- Warehouse and laydown area

- Plant administration building

- General administration building with dry

- Core shed and a core storage yard

- Cemented paste backfill plant

In total, approximately 18,500 m2 of general buildings (not including the camp) have been accounted for in the capital cost estimate.

The main operational and support buildings are located to the north west of the West Pit outside of the 500 m buffer zone for blasting. The section of land gently slopes upwards to the west. The mill, specifically the conveyor next to the Run-of-Mine ("ROM") stockpile are closest to the open pit. Further studies are required to determine the materials and method of construction that will be most cost-effective, efficient in construction, and appropriate to the local conditions.

Cost provision has been made for the rerouting of Goldbrook Lake Road. This would require approximately 5.5 km to connect existing roads around the TMF.

With respect to site communications, cellular service is currently available at the site, as is Wi-Fi, but will need to be extended to the office and mill area. Ultra High Frequency ("UHF") radio will be used in the pits and TMF, with a base station at the guardhouse.

Power for the site is anticipated to be provided from a nearby Nova Scotia Power 25 kV distribution line installed along Highway 316. A 1.6 km tap line would be installed along a new right of way to the mine site main substation. Nova Scotia Power would upgrade their existing distribution system as necessary to be able to provide the additional power required. Peak power demand for the site is estimated to be 14 MW. A network of 13.8 kV overhead distribution lines would be installed at site to provide power sourced from the main substation for underground and surface infrastructure.

Tailings Management Facility (TMF)

The TMF will provide secure storage for tailings and process water. The embankments include for adequate freeboard to provide ongoing tailings storage, operational water management, and the required freeboard and spillway for stormwater management. The TMF will be constructed as a single cell facility northeast of the proposed process plant location. A geomembrane lining system will be installed along the TMF basin floor and on the upstream face of the perimeter embankments to minimize seepage. The TMF development will include an initial starter embankment (Stage 1) followed by subsequent stages. Stages 2 through to 6 of the TMF will be expanded using downstream construction methods throughout the approximate 18-year mine life to provide a total of 21.1 million tonnes of tailings storage. An external Polishing Pond constructed to the west of the TMF will be used to manage excess water from the TMF and will act as a settling basin and for clarification prior to treatment and discharge to the environment.

Water Management and Treatment

A water treatment plant will be located close to the mill facilities for process water management. Site water will be collected in a system of ditching and sedimentation ponds for treatment as required.

Environment, Permitting, Mi'kmaq Engagement and Public Consultation

The Goldboro Gold Project is subject to regulation under the Nova Scotia Environmental Act, Part IV. An Environmental Assessment Registration Document ("EARD") for the proposed project will be submitted for Class 1 Environmental Assessment in Q1 2022. The EARD will be authored by Anaconda Mining and GHD and shall utilize extensive baseline data collected at the Project site by Anaconda and its consultants since 2017, when Anaconda acquired the Project.

Baseline scientific studies, combined with modelling efforts, shall inform project planning and provide the required information for various authorizations and permits. The following studies are in progress:

- Wetland delineation

- Archaeological resource impact assessment

- Mi'kmaq Ecological Knowledge Study ("MEKS")

- Aquatic biology and fisheries

- Aquatic effects

- Climate and hydrology

- Mine rock and water geochemistry

- Ground water and surface water modelling

- Water quality

- Air quality

- Noise and light

- Species at risk habitat suitability

- Country foods

- Wildlife

Anaconda shall also apply for an Industrial Approval, planned for late 2022, and make applications for various permits associated with Mining and Crown Land access, mining, and milling permits, water use, wetland alteration, and sewage treatment to support authorization for the construction and operation of the Project. Applications to federal authorities are also required, including but not limited to a Fisheries Act Authorization through Fisheries and Oceans Canada ("DFO") for alteration and destruction of fish habitat, as well as an amendment to Schedule 2 of the Metal and Diamond Mining Effluent Regulations associated tailings placement. These applications will be made in 2022, as regulations, and associated timelines dictate.

Anaconda recognizes the Aboriginal & Treaty Rights of Nova Scotia Mi'kmaq. The Company maintains an active information sharing relationship with officials of Kwilmu'kw Maw-klusuaqn Negotiation Office ("KMKNO") and representatives of Paqtnkek Mi'kmaw Nation. On June 2, 2019, the Company and the Assembly of Mi'kmaw Chiefs signed a Memorandum of Understanding ("MOU") that governs the process by which the parties shall negotiate a Mutual Benefits Agreement ("MBA") that reflects a desire to build a mutually beneficial relationship with respect to the Project. This process is ongoing. Anaconda maintains its commitment to work collaboratively with Nova Scotia Mi'kmaq regarding environmental and cultural priorities, as well as social and economic opportunities. Baseline information for Indigenous Peoples was gathered through the ongoing engagement with the Mi'kmaq of Nova Scotia and completion of a MEKS in 2017, which identified and documents land and resource use (within 5 km of the Project). A new MEKS will be completed this year as the scope and footprint of the project has changed since the initial MEKS was completed.

Consultations have been ongoing with the Municipality of the District of Guysborough ("MODG"), as well as residents and property owners in the region since 2017. This includes regular meetings of Company senior executives and project consultants with MODG Council. The company participates in the quarterly MODG newsletter and communicates new information through local newspapers. A Community Liaison Committee ("CLC") was established to foster environmental stewardship, and act as a conduit for transparent and ongoing communications between community, stakeholders, and Anaconda on all matters pertaining to potential development. Anaconda has held public consultation open house meetings in Goldboro with more to follow prior to the submission of the EARD.

Technical Report and Qualified Persons

A Technical Report prepared in accordance with NI 43-101 for the Goldboro Gold Project PEA will be filed on SEDAR (www.sedar.com) before August 9, 2021. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Resource. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Disclosure of a scientific or technical nature in this news release has been approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a "Qualified Person". Mr. McNeill has verified the data disclosed in this news release, including sampling, analytical and test data underlying the information it contains.

The Qualified Person responsible for the preparation of the June 2021 Goldboro Gold Project Mineral Resource Estimate is Glen Kuntz, P. Geo. (Ontario) of Nordmin Engineering Ltd. The Qualified Persons responsible for the preparation of the mine planning are Joanne Robinson, P.Eng. of Nordmin Engineering Ltd. (open pit) and Richard Jundis, P.Eng. of Optimize Group Inc. (underground). Tommaso Raponi, P.Eng., of Ausenco Engineering Canada Inc. is the Qualified Person responsible for processing and metallurgy. Timo Kirchner, P.Geo., of Lorax Environmental is the Qualified Person responsible for geochemistry. Steve Pumphrey, P.Eng. of Nordmin Engineering Ltd. is Qualified Person responsible for Surface Infrastructure (excluding process plant). Reagan McIsaac, Ph.D., P.Eng., of Knight Piésold Ltd. is the Qualified Person responsible for design of the TMF, its water management infrastructure. Andrew Betts, P.Eng. (ON, NS), of GHD is the Qualified Person responsible for surface water management.

Each of Mr. Kuntz, Ms. Robinson, Mr. Jundis, Mr. Raponi, Mr. Kirchner, Mr. Pumphrey, Mr. McIsaac and Mr. Betts are considered to be an "Independent Qualified Person" under NI 43-101.

ABOUT ANACONDA

Anaconda Mining is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in the top-tier Canadian mining jurisdictions of Newfoundland and Nova Scotia. The Company is advancing the Goldboro Gold Project in Nova Scotia, a significant growth project with Measured and Indicated Mineral Resources of 1.9 million ounces (16.0 million tonnes at 3.78 g/t gold) and Inferred Mineral Resources of 0.8 million ounces (5.3 million tonnes at 4.68 g/t gold) (Please see above and The Goldboro Technical Report effective February 22, 2021 for further details). Anaconda also operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~15,000 hectares of highly prospective mineral property, including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project.

NON-IFRS MEASURES

Anaconda has included certain non-IFRS performance measures as detailed below. In the gold mining industry, these are common performance measures but may not be comparable to similar measures presented by other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Operating Cash Costs per Ounce of Gold - Anaconda calculates operating cash costs per ounce by dividing operating expenses per the consolidated statement of operations, net of silver sales by-product revenue, by the gold ounces sold during the applicable period. Operating expenses include mine site operating costs such as mining, processing and administration as well as royalties, however, excludes depletion and depreciation and rehabilitation costs.

All-In Sustaining Costs per Ounce of Gold - Anaconda has adopted an all-in sustaining cost ("AISC") performance measure that reflects all of the expenditures that are required to produce an ounce of gold from current operations. The Company defines all-in sustaining costs as the sum of operating cash costs (per above), sustaining capital (capital required to maintain current operations at existing levels), sustaining exploration, and rehabilitation and reclamation costs. All-in sustaining costs excludes initial capital expenditures, financing costs, corporate general and administrative costs and salvage value, and taxes. AISC per Ounce is calculated as AISC divided by payable gold ounces.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable Canadian and United States securities legislation. Forward-looking information includes, but is not limited to, disclosure regarding the economics and project parameters presented in the PEA, including, without limitation, IRR, all-in sustaining costs, NPV and other costs and economic information, possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; the timing and costs of future development and exploration activities on the Company's projects; success of development and exploration activities; permitting time lines and requirements; time lines for further studies; planned exploration and development of properties and the results thereof; and planned expenditures and budgets and the execution thereof. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved". Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including the risks outlined in this news release, risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda's annual information form for the year ended December 31, 2020, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

FOR ADDITIONAL INFORMATION CONTACT:

| Anaconda Mining Inc. Kevin Bullock President and CEO (647) 388-1842 kbullock@anacondamining.com | Reseau ProMarket Inc. Dany Cenac Robert Investor Relations (514) 722-2276 x456 Dany.Cenac-Robert@ReseauProMarket.com |

SOURCE: Anaconda Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/652780/Anaconda-Mining-Delivers-Positive-Preliminary-Economic-Assessment-for-the-Goldboro-Gold-Project