Ascendant Resources Initiates 2020 Exploration Program Focusing on the Copper-Rich South Zone and Announces Non-Brokered Private Placement

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

(All dollar amounts are in U.S. dollars (“$”) unless otherwise specified)

TORONTO, Sept. 17, 2020 (GLOBE NEWSWIRE) -- Ascendant Resources Inc. (TSX: ASND) ("Ascendant" or the "Company”) is pleased to announce the start of its updated 2020 exploration program, which consists of 2,700m of drilling and downhole IP surveys which will be completed in several phases. The main objective of the proposed program is to significantly increase and upgrade tonnage at the copper-rich South Zone. This is designed to build upon the existing 2.47Mt of Measured and Indicated resource and 6.09Mt of Inferred resource delineated in the South Zone as highlighted in the Company’s technical report titled, "Technical Report and PEA for the Lagoa Salgada Project Setúbal District, Portugal" dated February 27, 2020 with an effective date of December 19, 2019 (the "Preliminary Economic Assessment").

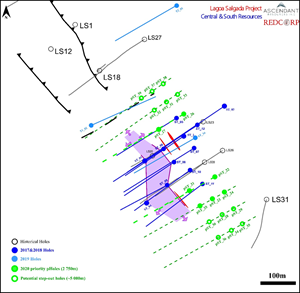

The South Zone remains open in all directions according to geological data collected during the Company’s previous exploration activities. The most southern drill hole in the South Zone (LS_ST_11) was one of the best holes encountered, with assays reporting 67.6m true width at a 1.57% Copper Equivalent ("CuEq") grade. Indications are that the mineralization is open and expanding southward where the Company’s first drill targets in this program are situated. Figure 1 highlights the initial and follow-up planned drill holes.

Chris Buncic, President & CEO of Ascendant, stated, “We are excited to continue our exploration activities in the South Zone where we hope to greatly improve CuEq tonnage and grade. Information collected to date suggests that the South Zone has the potential to be significantly larger than the North Zone, and it is largely comprised of a copper-rich stockwork mineralization that may be amenable to bulk mining methods at sufficient size."

He continued, “We have achieved tremendous success with our previous drill programs, as highlighted by an exceptional drilling-to-tonnage ratio. This is characteristic of a project in the early stages of discovery, and we are confident that we have only scratched the surface of what is possible at Lagoa Salgada. We have yet to find the feeder system, but substantial showings of chalcopyrite within the copper stockwork mineralization discovered to date, leads us to believe we are on the right track, and this exploration program is designed to further the Company on this path.”

Figure 1: South Zone planned exploration program

https://www.globenewswire.com/NewsRoom/AttachmentNg/e2d60f72-0418-44ee-bde4-3932446251ef

Non-Brokered Private Placement of Units

The Company has also initiated a non-brokered private placement of up to approximately 12.6 million units of the Company (each, a "Unit") at a price of C$0.10 per Unit for gross proceeds of up to approximately C$1.26 million (the "Offering"). Each Unit will consist of one common share of the Company (each, a "Common Share") and one-half of one Common Share purchase warrant (each whole warrant, a "Warrant"). Each Warrant will entitle the holder thereof to acquire one Common Share at a price of C$0.15 per share for a 24-month period following the closing date of the Offering.

The net proceeds from the Offering will be used for the Company’s proposed 2020 exploration program, as described above, as well as for working capital and general corporate purposes.

The Offering is expected to close on or about September 30, 2020 or such other date as the Company may determine. Closing of the Offering is conditional upon receipt of all required approvals, including the approval of the Toronto Stock Exchange. The securities to be issued under the Offering will be subject to a statutory hold period of four months from the closing date of the Offering in accordance with applicable securities laws.

Certain insiders of the Company (within the meaning of applicable securities laws) may participate in the Offering. Accordingly, any such participation would be considered a "related party transaction" under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). In connection with any such participation, the Company intends to rely on exemptions from the formal valuation and majority of the minority shareholder approval set out in MI 61-101 since, at the time the transaction was agreed to: (i) neither the fair market value of the securities to be distributed in the Offering nor the consideration to be received for those securities, insofar as the transactions involves interested parties, would exceed 25% of the Company's market capitalization; (ii) neither the fair market value of the securities to be distributed in the Offering nor the consideration to be received for those securities, insofar as the transactions involves interested parties, would exceed $2,500,000; and (iii) the Company has one or more independent directors and, at least two thirds of said independent directors approved the transaction, as required pursuant to sections 5.5 and 5.7 of MI 61-101.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

Technical Disclosure/Qualified Person

All technical information contained herein has been reviewed and approved by Robert A. Campbell, M.Sc, P.Geo, an officer and director of the Company. Mr. Campbell is a "qualified person" within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

About Ascendant Resources Inc.

Ascendant is a Toronto-based mining company focused on the exploration and development of the highly prospective Lagoa Salgada VMS project located on the prolific Iberian Pyrite Belt in Portugal. Through focused exploration and aggressive development plans, the Company aims to unlock the inherent potential of the project, maximizing value creation for shareholders.

Lagoa Salgada contains over 12.8 million tonnes of M&I Resources and 10.3 million tonnes in Inferred Resources and demonstrates typical mineralization characteristics of Iberian Pyrite Belt VMS deposits containing zinc, copper, lead, tin, silver and gold. Extensive exploration upside potential lies both near deposit and at prospective step-out targets across the large 10,700ha property concession. The project also demonstrates compelling economics with scalability for future resource growth in the results of the Preliminary Economic Assessment. Located just 80km from Lisbon, Lagoa Salgada is easily accessible by road and surrounded by exceptional Infrastructure. Ascendant holds a 21.25% interest in the Lagoa Salgada project through its 25% position in Redcorp - Empreendimentos Mineiros, Lda, (“Redcorp”) and has an earn-in opportunity to increase its interest in the project to 80%. Mineral & Financial Investments Limited owns the additional 75% of Redcorp. The remaining 15% of the project is held by Empresa de Desenvolvimento Mineiro, S.A., a Portuguese Government owned company supporting the strategic development of the country’s mining sector. The Company’s interest in the Lagoa Salgada project offers a low-cost entry to a potentially significant exploration and development opportunity, already demonstrating its mineable scale.

Ascendant is also engaged in the ongoing evaluation of producing and development stage mineral resource opportunities. The Company's common shares are principally listed on the Toronto Stock Exchange under the symbol "ASND". For more information on Ascendant, please visit our website at www.ascendantresources.com.

Additional information relating to the Company, including the Preliminary Economic Assessment referenced in this news release, is available on SEDAR at www.sedar.com.

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

For further information please contact:

Katherine Pryde

Communications & Investor Relations

Tel: 888-723-7413

info@ascendantresources.com

Forward Looking Information

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking information") within the meaning of applicable Canadian securities legislation. All information contained in this news release, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects", "budget", "guidance", "scheduled", "estimates", "forecasts", "strategy", "target", "intends", "objective", "goal", "understands", "anticipates" and "believes" (and variations of these or similar words) and statements that certain actions, events or results "may", "could", "would", "should", "might" "occur" or "be achieved" or "will be taken" (and variations of these or similar expressions). Forward-looking information is also identifiable in statements of currently occurring matters which may continue in the future, such as "providing the Company with", "is currently", "allows/allowing for", "will advance" or "continues to" or other statements that may be stated in the present tense with future implications. All of the forward-looking information in this news release is qualified by this cautionary note.

Forward-looking information in this news release includes, but is not limited to, statements regarding the exploration activities and the results of such activities at the Lagoa Salgada Project, the ability of the Company to advance the Lagoa Salgada Project, and the ability of the Company to fund the exploration with funds from operations. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by Ascendant at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information. The material factors or assumptions that Ascendant identified and were applied by Ascendant in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to, the success of the exploration activities at Lagoa Salgada Project, the Company advancing the project, the ability of the Company to fund the exploration program at Lagoa Salgada with funds from operations , and other events that may affect Ascendant's ability to develop its project; and no significant and continuing adverse changes in general economic conditions or conditions in the financial markets.

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks generally associated with the mining industry, such as economic factors (including future commodity prices, currency fluctuations, energy prices and general cost escalation), uncertainties related to the development and operation of Ascendant's projects, dependence on key personnel and employee and union relations, risks related to political or social unrest or change, rights and title claims, operational risks and hazards, including unanticipated environmental, industrial and geological events and developments and the inability to insure against all risks, failure of plant, equipment, processes, transportation and other infrastructure to operate as anticipated, compliance with government and environmental regulations, including permitting requirements and anti-bribery legislation, volatile financial markets that may affect Ascendant's ability to obtain additional financing on acceptable terms, the failure to obtain required approvals or clearances from government authorities on a timely basis, uncertainties related to the geology, continuity, grade and estimates of mineral reserves and resources, and the potential for variations in grade and recovery rates, uncertain costs of reclamation activities, tax refunds, hedging transactions, as well as the risks discussed in Ascendant's most recent Annual Information Form on file with the Canadian provincial securities regulatory authorities and available at www.sedar.com.

Should one or more risk, uncertainty, contingency, or other factor materialize, or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, the reader should not place undue reliance on forward-looking information. Ascendant does not assume any obligation to update or revise any forward-looking information after the date of this news release or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.