Ascendant Resources Outlines 2020 Exploration Program at Its Lagoa Salgada Project in Portugal

- Drilling contractor on standby to begin extensive drill program to expand and upgrade the Mineral Resources in the prospective copper-rich South Zone and better define North Zone

TORONTO, April 23, 2020 (GLOBE NEWSWIRE) -- Ascendant Resources Inc. (TSX: ASND) ("Ascendant" or the "Company”) is pleased to outline its proposed 2020 exploration program at the Lagoa Salgada VMS project (“Lagoa Salgada”) located on the prolific Iberian Pyrite Belt in Portugal. On the back of the robust Preliminary Economic Assessment results released on January 14, 2020, the exploration program includes downhole IP and drilling aimed at expanding and upgrading the Central and South Zones and the copper-rich resource. Additional drilling of the southern extension of the high-grade massive sulphide mineralization of the North Zone is also expected to expand the Indicated Mineral Resources. The program includes four metallurgical drill holes for further metallurgical testing.

The main objective of the proposed program is to increase and upgrade tonnage at the copper-rich South Zone while increasing and upgrading tonnage and grade in the North Zone.

Results from the exploration program are expected to form the basis for an updated Mineral Resource Estimate in the latter half of the year which the Company will use to commence a Feasibility Study (“FS”) by the end of the year. The Company is engaged with the drilling company and is set to commence drilling as soon as labour restrictions due to the COVID-19 pandemic are lifted which is expected in the third quarter of 2020. The drill program is subject to funding, but Ascendant is currently talking to financial partners and is hopeful that the drill program can be funded by alternative non-dilutive measures for its shareholders.

Chris Buncic, President & CEO of Ascendant stated, “With the agreement for the sale of El Mochito signed and pending closure, we are excited to focus all our efforts on Lagoa Salgada and executing this comprehensive exploration program. Given the success and knowledge gained from the 2019 exploration campaign, which grew the Measured and Indicated Resource to over 12.8 million tonnes with 10.3 million tonnes of Inferred Resources, we expect to expand and upgrade Mineral Resources in 2020 using the same process of guided drilling by the use of IP analysis. We are especially interested in the South and Central Zones where we hope to greatly improve CuEq tonnage and grade, as drilling in these zones has been very limited to date. Data suggests that these zones have the potential to be larger than the North Zone and may also be connected at depth in one large deposit.”

He continued, “With the expectation to replicate the exploration success achieved in previous programs, the Company plans to complete an updated Mineral Resource Estimate in the latter half of the year and commence a Feasibility Study by end of the year following up on the robust results of the Preliminary Economic Assessment the Company announced in January.”

Targeted Drilling Program Details

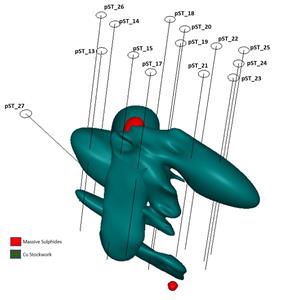

The planned 2020 exploration program is set to include approximately 8,000 metres of drilling with the majority of drilling targeting the South and Central Zones where the Company believes there is significant opportunity to expand the current copper-rich Resource.

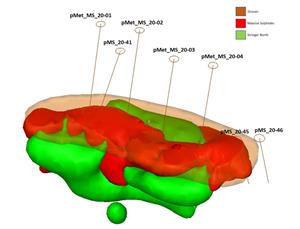

The drilling allocated to the North Zone will focus on converting and upgrading Mineral Resources with the goal of increasing overall tonnage and ZnEq grade of the resource.

Figure 1: South Zone 2020 Planned Drill Holes

https://www.globenewswire.com/NewsRoom/AttachmentNg/63e52f3e-da02-453e-8900-722fa06f8ee2

Figure 2: North Zone 2020 Planned Drill Holes

https://www.globenewswire.com/NewsRoom/AttachmentNg/00e9296f-2acd-4d01-91ff-3c01ac9e2db0

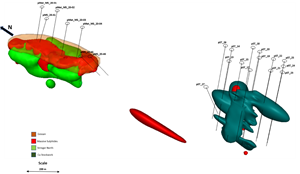

Figure 3: LS West Region (incl. North & South Zones) 2020 Planned Drill Holes

https://www.globenewswire.com/NewsRoom/AttachmentNg/7f17ec4c-83a1-4aa8-8e9b-98e33236cea2

Geophysics Program

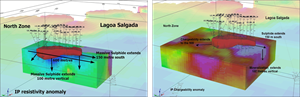

The Company’s planned 2020 exploration program will also include extensive follow on work on the geophysical anomalies identified from Induced Polarization (“IP”) resistivity and chargeability surveys conducted in 2019, as this has been a very useful tool to date in identifying mineralization and possible extensions at Lagoa Salgada.

IP surveys at depth in the North Zone show the massive sulphide as a clearly outlined conductivity anomaly, defined by the blue area in Figure 4 below, that extends deeper and to the northwest beyond the 2019 drilling. The anomaly extends 150m to the south and 100m deeper than the North Zone massive sulphide mineralization identified from the 2019 drilling.

Figure 4: IP Resistivity and Chargeability Anomalies

https://www.globenewswire.com/NewsRoom/AttachmentNg/b87312c8-eb9d-4e30-9df0-470f7158fde1

As part of the drill program, the Company has planned 4 large diameter metallurgical drill holes to support additional metallurgical test work to improve the PEA results. The Company plans to complete an updated Mineral Resource Estimate with the new drilling and commence a Feasibility Study by year-end focused on mine development at the North Zone based on the results of this program.

Mineral Resource Estimate

As outlined in the Mineral Resource Estimate, with an effective date of September 5, 2019, Lagoa Salgada currently has 10.33 million tonnes of Measured and Indicated Resources at 9.06% ZnEq1 and 2.50 million tonnes of Inferred Resources at 5.93% ZnEq in the North Zone. In the South Zone, there is 2.47 million tonnes of Indicated Resources at 1.54% CuEq and 6.08 million tonnes of Inferred Resources at 1.37% CuEq. An additional, 1.71 million tonnes of Inferred Resources at 1.66% CuEq sits in the Central Zone, which lies between the other two larger zones.

Table 1: Lagoa Salgada Updated Mineral Resource Estimate

North Zone Mineral Resource Estimate - Effective September 5, 2019

| Average Grade | Contained Metal | |||||||||||||||||

| Deposit | Category | Min | Tonnes | Cu | Zn | Pb | Sn | Ag | Au | ZnEq | AuEq | Cut-off | Cu | Zn | Pb | Sn | Ag | Au |

| Zones | (kt) | (%) | (%) | (%) | (%) | (g/t) | (g/t) | (%) | (g/t) | ZnEq% | (kt) | (kt) | (kt) | (kt) | (koz) | (koz) | ||

| North | Measured(M) | GO | 234 | 0.13 | 0.70 | 4.32 | 0.36 | 51 | 1.50 | 11.38 | 7.18 | 2.5 | 0.3 | 1.6 | 10.1 | 0.9 | 385.2 | 11.3 |

| Indicated(I) | GO | 1,462 | 0.08 | 0.43 | 2.55 | 0.26 | 37 | 0.51 | 6.63 | 4.18 | 2.5 | 1.2 | 6.2 | 37.3 | 3.8 | 1,742.1 | 23.8 | |

| M & I | GO | 1,696 | 0.09 | 0.47 | 2.79 | 0.27 | 39 | 0.64 | 7.28 | 4.60 | 2.5 | 1.5 | 7.9 | 47.4 | 4.6 | 2,127.2 | 35.1 | |

| Inferred | GO | 831 | 0.08 | 0.48 | 2.62 | 0.17 | 27 | 0.37 | 5.66 | 3.57 | 2.5 | 0.7 | 4.0 | 21.8 | 1.4 | 727.6 | 9.9 | |

| Measured(M) | MS | 2,444 | 0.40 | 3.12 | 2.97 | 0.15 | 72 | 0.74 | 10.95 | 6.91 | 3.0 | 9.7 | 76.3 | 72.5 | 3.7 | 5,623.9 | 58.4 | |

| Indicated(I) | MS | 5,457 | 0.45 | 2.35 | 2.30 | 0.13 | 75 | 0.67 | 9.55 | 6.03 | 3.0 | 24.5 | 128.1 | 125.6 | 7.3 | 13,221.5 | 116.9 | |

| M & I | MS | 7,902 | 0.43 | 2.59 | 2.51 | 0.14 | 74 | 0.69 | 9.98 | 6.30 | 3.0 | 34.2 | 204.4 | 198.1 | 10.9 | 18,845.5 | 175.2 | |

| Inferred | MS | 1,529 | 0.23 | 1.96 | 1.32 | 0.09 | 45 | 0.49 | 6.36 | 4.01 | 3.0 | 3.6 | 30.0 | 20.2 | 1.4 | 2,219.7 | 24.0 | |

| Measured(M) | Str | 94 | 0.37 | 0.88 | 0.28 | 0.05 | 17 | 0.12 | 3.08 | 1.94 | 2.5 | 0.3 | 0.8 | 0.3 | 0.0 | 51.0 | 0.4 | |

| Indicated(I) | Str | 643 | 0.34 | 0.90 | 0.23 | 0.09 | 17 | 0.06 | 3.23 | 2.04 | 2.5 | 2.2 | 5.8 | 1.5 | 0.6 | 354.0 | 1.3 | |

| M & I | Str | 737 | 0.34 | 0.90 | 0.24 | 0.09 | 17 | 0.07 | 3.21 | 2.03 | 2.5 | 2.5 | 6.6 | 1.7 | 0.6 | 405.0 | 1.7 | |

| Inferred | Str | 142 | 0.24 | 1.12 | 0.39 | 0.04 | 17 | 0.09 | 2.95 | 1.86 | 2.5 | 0.3 | 1.6 | 0.6 | 0.1 | 75.6 | 0.4 | |

| North | M & I | All zones | 10,334 | 0.37 | 2.12 | 2.39 | 0.16 | 64 | 0.64 | 9.06 | 5.72 | 2.9 | 38.2 | 219.0 | 247.2 | 16.2 | 21,377.7 | 212.0 |

| North | Inferred | All zones | 2,502 | 0.18 | 1.42 | 1.70 | 0.12 | 38 | 0.43 | 5.93 | 3.74 | 2.8 | 4.6 | 35.6 | 42.6 | 2.9 | 3,022.8 | 34.3 |

Central and South Zones Mineral Resource Estimate - Effective September 5, 2019

| Average Grade | Contained Metal | |||||||||||||||||||

| Deposit | Category | Min | Tonnes | Cu | Zn | Pb | Sn | Ag | Au | CuEq | Cut-off | Cu | Zn | Pb | Sn | Ag | Au | |||

| Zones | (kt) | (%) | (%) | (%) | (%) | (g/t) | (g/t) | (%) | CuEq% | (kt) | (kt) | (kt) | (kt) | (koz) | (koz) | |||||

| Central | Inferred | Str | 1,707 | 0.15 | 0.16 | 0.06 | 0 | 12 | 2.22 | 1.66 | 0.9 | 2.5 | 2.7 | 1.0 | - | 635.2 | 121.9 | |||

| South | Measured(M) | Str/Fr | 0 | — | — | — | — | — | — | — | 0.9 | |||||||||

| Indicated(I) | Str/Fr | 2,473 | 0.47 | 1.53 | 0.83 | 0.00 | 19 | 0.06 | 1.54 | 0.9 | 11.5 | 37.9 | 20.6 | 0.0 | 1,484.7 | 4.7 | ||||

| South | M & I | Str/Fr | 2,473 | 0.47 | 1.53 | 0.83 | 0.00 | 19 | 0.06 | 1.54 | 0.9 | 11.5 | 37.9 | 20.6 | 0.0 | 1,484.7 | 4.7 | |||

| South | Inferred | Str/Fr | 6,085 | 0.40 | 1.34 | 0.80 | 0.00 | 17 | 0.05 | 1.37 | 0.9 | 24.6 | 81.6 | 48.7 | 0.0 | 3,285.2 | 10.0 | |||

Notes to tables:

(1) Mineralized Zones: GO=Gossan, MS=Massive Sulphide, Str=Stringer, Str/Fr=Stockwork

(2) ZnEq% = ((Zn Grade*25.35)+(Pb Grade*23.15)+(Cu Grade*67.24)+(Au Grade*40.19)+(Ag Grade*0.62)+(Sn Grade*191.75))/25.35

(3) CuEq% = ((Zn Grade*25.35)+(Pb Grade*23.15)+(Cu Grade*67.24)+(Au Grade*40.19)+(Ag Grade*0.62))/67.24

(4) AuEq(g/t) = ((Zn Grade*25.35)+(Pb Grade*23.15)+(Cu Grade * 67.24)+(Au Grade*40.19)+(Ag Grade*0.62) )+(Sn Grade * 191.75))/40.19

(5) Metal Prices: Cu $6,724/t, Zn $2,535/t, Pb $2,315/t, Au $1,250/oz, Ag $19.40/oz, Sn $19,175/t

(6) Densities: GO=3.12, MS=4.76, Str=2.88, Str/Fr=2.88

The Lagoa Salgada project represents an attractive VMS exploration opportunity in a low risk, well established and prolific jurisdiction. The project covers 10,700 hectares with numerous gravity anomalies identified with only the LS West area having been significantly tested.

Preliminary Economic Assessment Highlights Recap

The Technical Report entitled, “Technical Report and PEA for the Lagoa Salgada Property, Setúbal District, Portugal”, supporting the robust results from the maiden Preliminary Economic Assessment (“PEA”) for the North Zone only at the Lagoa Salgada VMS project, was prepared in accordance with Canadian National Instrument 43-101 (“NI 43-101”) with an effective date of December 19, 2019.

The report outlines a robust and compelling economic assessment for Lagoa Salgada as it assumes a two-stage underground mining development scenario, with single trackless ramp access, transverse sub-level open stoping method with paste backfill. Ventilation and secondary escape ways are planned through raise-bored holes to surface. Milling rates of 2,700 tonnes per day in a standard process circuit is anticipated, with primary crushing, grinding, flotation and leaching of tailings to produce concentrates including lead, zinc, copper and tin, as well as gold and silver doré. There is ample opportunity for extensive expansion from future exploration work to define additional resources to extend the mine life or increase the scale of the outlined operation.

Highlights from the PEA for the North Zone include:

- After-tax IRR of 31% and NPV8% of $106M (C$139M @$1.31CAD/USD)

- Nine-year mine life with production scenario of 2,700 tpd

- Four-year payback period of initial Capex of $162.7 million

- Average operating costs of $49.43/t milled represents low cost production scenario

- Low average annual cash costs of $0.44/lb ZnEq and average annual All-In Sustaining Cost (AISC) of $0.66/lb ZnEq

- Significant upside opportunities remain with near-resource exploration targets identified with multiple deposits open laterally and at depth, and broader targets untested

Highlights of the key project metrics are provided in the following table on a 100% basis:

PEA Key Highlights | ||

| Project IRR pre-tax | 37% | |

| NPV8% pre-tax | $137 million | |

| Project IRR after-tax | 31% | |

| NPV8% after-tax | $106 million | |

| Life of mine pre-tax cash flow | $ 250 million | |

| Life of mine after-tax cash flow | $ 202 million | |

| Construction period | 2 years | |

| Payback period | 4 years | |

| Life of mine | 9 years | |

| Average Annual Production | 1.0 million tonnes | |

| Initial Capital Expenditure | $ 162.7 million | |

| LOM Sustaining Capital Expenditure & Closure | $ 20.2 million | |

| Average annual operating costs | $ 49.43 /t milled | |

| Average Annual operating costs (C1) | $0.44 /lb ZnEq | |

| Average annual All-In Sustaining Costs (AISC) | $0.66 /lb ZnEq | |

| Metal Price Assumptions1 | ||

| Zinc | $1.20/lb | |

| Lead | $1.05/lb | |

| Copper | $2.70/lb | |

| Silver | $18/oz | |

| Gold | $1,400/oz | |

| Tin | $7.50/lb | |

| Recovery Assumptions | Massive Sulphide | |

| Zn | 80% | |

| Pb | 65% | |

| Cu | 25% | |

| Ag | 75% | |

| Au | 75% | |

| Sn | 30% | |

| Recovery Assumptions | Gossan | |

| Pb | 65% | |

| Sn | 40% | |

| Ag | 66% | |

| Au | 86% | |

| Average Annual Metal Production | ||

| Zn | 12.5kt | |

| Pb | 13.7kt | |

| Cu | 0.2kt | |

| Ag | 1.1Moz | |

| Au | 13koz | |

| Sn | 0.3kt | |

Notes to Table:

1 The project economics have been calculated using consensus prices at the time of the Resource Estimate report in September 2019.

The PEA was prepared by AMC Mining Consultants (Canada) Ltd (AMC) with contributions from Resource Development Inc (RDI) for Mineral Processing and Micon International Limited (Micon), who estimated the Mineral Resources.

The PEA is preliminary in nature, as it includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the preliminary economic assessment will be realized.

The Technical Report is available for review under the Company’s profile on SEDAR and on the Company’s website.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Robert Campbell, P.Geo., Vice President, Exploration and Director for Ascendant Resources Ltd, who is a Qualified Persons as defined in National Instrument 43-101.

About Ascendant Resources Inc.

Ascendant is a Toronto-based mining company focused on its 100%-owned producing El Mochito zinc, lead and silver mine in Honduras and its high-grade Lagoa Salgada VMS project located in the prolific Iberian Pyrite Belt in Portugal.

After acquiring the El Mochito mine in December 2016, Ascendant spent two years implementing a rigorous and successful optimization program restoring the historic potential of El Mochito, a mine in production since 1948. With steady state production achieved, the Company remains focused on further cost reduction and operational improvements to drive profitability.

The Company is engaged in exploration and the advancement of the Lagoa Salgada project with the goal of building upon the defined Mineral Resources and robust results of the maiden Preliminary Economic Assessment completed in January 2020 and advancing the project towards construction. Ascendant holds a 21.25% interest in the Lagoa Salgada project through its 25% position in Redcorp - Empreendimentos Mineiros, Lda, (“Redcorp”) and has an earn-in opportunity to increase its interest in the project to 80%. Mineral & Financial Investments Limited owns the additional 75% of Redcorp. The remaining 15% of the project is held by Empresa de Desenvolvimento Mineiro, S.A. (EDM), a Portuguese Government owned company supporting the strategic development of the country’s mining sector. The Company’s interest in the Lagoa Salgada project offers a low-cost entry to a potentially significant exploration and development opportunity, already demonstrating its mineable scale.

Ascendant Resources is also engaged in the ongoing evaluation of producing and development stage mineral resource opportunities. The Corporation's common shares are principally listed on the Toronto Stock Exchange under the symbol "ASND". For more information on Ascendant Resources, please visit our website at www.ascendantresources.com.

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

For further information please contact:

Katherine Pryde

Director, Communications & Investor Relations

Tel: 888-723-7413

info@ascendantresources.com

Forward Looking Information

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking information") within the meaning of applicable Canadian securities legislation. All information contained in this news release, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects", "budget", "guidance", "scheduled", "estimates", "forecasts", "strategy", "target", "intends", "objective", "goal", "understands", "anticipates" and "believes" (and variations of these or similar words) and statements that certain actions, events or results "may", "could", "would", "should", "might" "occur" or "be achieved" or "will be taken" (and variations of these or similar expressions). Forward-looking information is also identifiable in statements of currently occurring matters which may continue in the future, such as "providing the Company with", "is currently", "allows/allowing for", "will advance" or "continues to" or other statements that may be stated in the present tense with future implications. All of the forward-looking information in this news release is qualified by this cautionary note.

Forward-looking information in this news release includes, but is not limited to, statements regarding the exploration activities and the results of such activities at the Lagoa Salgada Project, the ability of the Company to advance the Lagoa Salgada Project to a Preliminary Economic Assessment, and the ability of the Company to fund the exploration with funds from operations. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by Ascendant at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information. The material factors or assumptions that Ascendant identified and were applied by Ascendant in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to, the success of the exploration activities at Lagoa Salgada Project, the Company advancing the project to a Preliminary Economic Assessment, the ability of the Company to fund the exploration program at Lagoa Salgada with funds from operations , and other events that may affect Ascendant's ability to develop its project; and no significant and continuing adverse changes in general economic conditions or conditions in the financial markets.

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks generally associated with the mining industry, such as economic factors (including future commodity prices, currency fluctuations, energy prices and general cost escalation), uncertainties related to the development and operation of Ascendant's projects, dependence on key personnel and employee and union relations, risks related to political or social unrest or change, rights and title claims, operational risks and hazards, including unanticipated environmental, industrial and geological events and developments and the inability to insure against all risks, failure of plant, equipment, processes, transportation and other infrastructure to operate as anticipated, compliance with government and environmental regulations, including permitting requirements and anti-bribery legislation, volatile financial markets that may affect Ascendant's ability to obtain additional financing on acceptable terms, the failure to obtain required approvals or clearances from government authorities on a timely basis, uncertainties related to the geology, continuity, grade and estimates of mineral reserves and resources, and the potential for variations in grade and recovery rates, uncertain costs of reclamation activities, tax refunds, hedging transactions, as well as the risks discussed in Ascendant's most recent Annual Information Form on file with the Canadian provincial securities regulatory authorities and available at www.sedar.com.

Should one or more risk, uncertainty, contingency, or other factor materialize, or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, the reader should not place undue reliance on forward-looking information. Ascendant does not assume any obligation to update or revise any forward-looking information after the date of this news release or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

1 See notes to Mineral Resource Estimate tables below for ZnEq calculation.