Ascendant Resources Reports Expansion PEA for Its El Mochito Mine That Reduces All-In Sustaining Costs to US$0.96 Per Pound ZnEq for Life of Mine

- Optimization program to ensure El Mochito mine generates robust returns in any reasonable zinc price environment

TORONTO, Oct. 22, 2018 (GLOBE NEWSWIRE) -- Ascendant Resources Inc. (TSX: ASND) (OTCQX: ASDRF; FRA: 2D9) ("Ascendant" or the "Company”) is very pleased to announce the results of a Preliminary Economic Assessment (“PEA”) for the expansion and optimization of operations at its El Mochito mine in Honduras.

Highlights of the Preliminary Economic Assessment for the Expansion Project include:

- 27% increase in processed tonnes to 2,800 per day (approximately 1 million tonnes per annum)

- 26% increased average annual contained ZnEq1 production to 126 million lbs per year

- 22% reduction in average direct operating costs

- 18% reduction in average mine AISC2 to $0.96/lb payable ZnEq produced

- $83M project NPV8% incrementally added to El Mochito cash flow

- 57% project IRR after taxes & royalties

- $32.8 million project capex funded through non-dilutive financing

- 2-year project construction & commissioning period

(All dollar amounts are in US Dollars unless otherwise specified)

The PEA outlines a substantial Internal Rate of Return (“IRR”) with a payback period of just under two years. The PEA further presents a robust and compelling opportunity for the Company to position El Mochito as a long-term profitable operation. The PEA assumes a mine life of 10 years inclusive of Inferred Mineral Resources excluding any additional Mineral Resources added from the current 30,000 metre exploration program. The Expansion Project mine plan is based upon the Company’s current Mineral Resource Estimate recently released in a National Instrument 43-101 Technical Report in May 2018.

The Company is currently in advanced negotiations with numerous local and multilateral financial institutions to secure non-dilutive financing required for the Expansion Project. The Company has received considerable interest from potential financing partners to fund the capital program. Management is confident it will be able to provide an update on the status of the financing in the fourth quarter of this year and anticipates project development will commence in Q1 2019.

"The strong results of this PEA represents a key milestone and another positive step for the Company to continue to unlock the full potential of El Mochito and position the mine to deliver robust economics and free cash flow over the long-term in any reasonable metals price environment.” Stated Chris Buncic, President & CEO of Ascendant. He continued, “The Company has received very strong support from potential funders as well as from our labour force and all levels of the government in Honduras for the expansion and optimization program which will create additional jobs and benefits for the local community.”

Neil Ringdahl, COO of Ascendant remarked: “The Company has made substantial progress over the last 18 months reducing operating costs by over 30% and restoring operations and achieving record production levels. El Mochito is in its 70th year of operations and the mining infrastructure is expansive. We can see that reducing haulage distance is among the most impactful way to reduce costs. In November 2017, we began working on several longer-term initiatives to reduce costs and improve productivity in addition to immediate opportunities. This Expansion Project will continue our optimization and growth strategy, with the potential to increase metal production by 26% and at the same time reducing both sustaining capital and operating costs by 29%. Direct operating costs could be reduced to approximately 50% of the level they were when Ascendant took control of the mine just twenty-two months ago. In addition, with further Mineral Resource expansion expected in the eastern part of the mine, this new investment opens up significant new ground for economic extraction over the longer-term as these Mineral Resources are defined.”

The PEA considers increasing mining and processing capacity to approximately 2,800 tonnes per day (one million tonnes per year) from 2,200 tpd (750,000 tonnes per year) without significantly interfering with ongoing operations. In addition to increased revenues, the major benefit of the program is an expected reduction in operating costs of between $13/t processed to $18/t processed in the future as the mine gets deeper. Contained annual zinc equivalent (“ZnEq”) metal production would average 121 million lbs over the Life-of-Mine (“LOM”). Capital costs to complete the development program have been estimated at $32.8 million with a construction period of approximately two years and an expected payback of less than two years.

This project presents a significant opportunity to bring the All-In Sustaining Costs (“AISC”) at El Mochito down to less than $0.96 payable zinc equivalent per pound produced two years after the commencement of construction. This cost level would support the longevity of the operation and sustain robust positive free cash flow even if a sustained depressed metals price environment were to occur.

The three principal areas of development considered by the PEA are:

- Installation of a new 442 metre subvertical rock-only hoisting shaft shortening the average underground truck hauling distances by 26%, increasing hoisting capacity, ventilation and services access and mining capacities. Shorter distances translate into additional trucking capacity and underutilized drilling and blasting equipment would be able to increase production by 26% without the need for additional mining equipment.

- Upgrading the underground pumping and water management system, reducing overhead costs by changing and reducing the number of pumps, rationalizing pumping columns and installing an effective water clarification system to pump clean water.

- Upgrading the crushing circuit, process plant, and tailings handling capacity to meet the increased production from the mine.

Key highlights3 of the PEA are summarized below:

| Table of Key Project Highlights | ||||||

| Project IRR after taxes & royalties | 57% | |||||

| Project NPV (8%) after taxes & royalties | $82.7 million | |||||

| Project undiscounted after-tax cash flow | $146.5 million | |||||

| Project construction period | 2 years | |||||

| Project Payback period | 2 years | |||||

| Life of mine (including current operations) | 10 years | |||||

| Metal Prices assumed | ||||||

| Zinc | $1.21/lb | |||||

| Lead | $1.09/lb | |||||

| Silver | $15/oz | |||||

| LOM Process recovery | ||||||

| Zn | 90% | |||||

| Pb | 75% | |||||

| Ag | 75% | |||||

| Average Annual Metal production (rounded) | ||||||

| Zn | 41,000t | |||||

| Pb | 11,000t | |||||

| Ag | 727,000 oz | |||||

| ZnEq | 121 million lbs | |||||

| Average Annual Payable ZnEq production (rounded) | 105 million lbs | |||||

| Project Development Capital Expenditures | $32.8 million | |||||

| LOM Sustaining Capital Expenditure (excluding closure) | $129.7 million | |||||

| Average annual operating costs after construction | $61.90/t processed | |||||

| Average annual operating costs after construction | $0.57/lb ZnEq payable | |||||

| Average annual AISC after construction | $0.96/lb ZnEq payable | |||||

The PEA was prepared by InnovExplo Inc. under the supervision of Mr. Neil Ringdahl, Chief Operating Officer of Ascendant along with the Ascendant Resources’ technical team and included contributions from the engineering team at InnovExplo Inc, P&E Mining Consultants Inc. and Mercator Geological Services Limited.

Mineral Resource Estimate

The current Mineral Resource Estimate prepared in accordance with NI 43-101 and the CIM Standards and used in the PEA, has an effective date of January 1, 2018, and is set out in the table below.

| El Mochito Mineral Resource Estimate - Effective 01 January 2018 | ||||||||||

| Category | Tonnes | Grade | Contained Metal | |||||||

| Zn | Pb | Ag | ZnEq. | Zn | Pb | Ag | ZnEq. | |||

| (kt) | (%) | (%) | (g/t) | (%) | Mlbs | Mlbs | Moz | Mlbs | ||

| Measured Resources | 1,100 | 5.5 | 2.0 | 65 | 8.2 | 134 | 48 | 2.3 | 198 | |

| Indicated Resources | 6,452 | 5.2 | 1.7 | 41 | 7.2 | 735 | 241 | 8.4 | 1,019 | |

| Measured & Indicated Resources | 7,553 | 5.2 | 1.7 | 44 | 7.3 | 869 | 289 | 10.7 | 1,216 | |

| Inferred Resources | 4,972 | 5.1 | 1.4 | 33 | 6.7 | 556 | 156 | 5.4 | 739 | |

| Notes: | ||||||||||

| (1) Tonnage, grade and contained metal values have been rounded, totals may vary due to rounding. (2) Price assumptions used were US$1.21/lb Zn, US$1.06/lb Pb and US$18/troy oz Ag. Zinc equivalent metal grade (ZnEq. %) was calculated as follows: Zn% +(Pb % x 0.82) +(Ag g/t x 0.0149) = ZnEq% and is based on 88.9% Zn recovery, 74.3% Pb recovery and 77.7% Ag recovery. (3) A cut-off of 3.1% ZnEq. was used to estimate Mineral Resources and is based on fourth quarter 2017 marginal direct operating costs. (4) Results of an interpolated bulk density deposit model have been applied, and contributing 5ft downhole assay composites were capped at 38% Zn, 36% Pb and 2000g/t Ag. (5) Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. (6) The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration. | ||||||||||

The Mineral Resource Estimate was prepared by Mercator Geological Services Limited. The effective date of this Mineral Resource Estimate is January 1, 2018, and it is based on 26 contiguous areas of “manto” and/or “chimney” style skarn mineralization defined by 2,176 diamond drill holes up to December 31st, 2017. 3D solid models of skarn mineralization reflecting a minimum grade of 3% ZnEq. were depleted for previously mined areas to constrain Mineral Resource volumes. GEOVIA Surpac® 6.8.1 software was used to assign block grades for zinc (%), lead (%), silver (g/t) and density (g/cm3) for Measured, Indicated and Inferred Mineral Resources using inverse distance squared (ID2) interpolation methodology and capped 5-foot down hole assay composites. Up to four interpolation passes were applied using progressively increasing ellipsoid ranges to cover the range of 3D solid model sizes present. Block size is 10 feet (x) by 10 feet (y) by 10 feet (z) with two levels of sub-blocking allowed to a minimum block size of 2.5 feet (x) by 2.5 feet (y) by 2.5 feet (z). Mineral Resource categorization was applied using discrete solid models developed from contributing drill hole and assay composite parameters.

Mining Operations Expansion

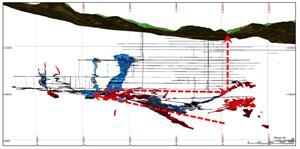

Figure 1: Current Mining Layout -

Long section of El Mochito Mine looking North (horizontal and vertical haulage routes in red)

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/e3b9ae23-e33f-4039-8281-cf4f46172b61

The bulk of the current Mineral Resources are located below the current shaft bottom, extending and remaining open to the east. Mining this material requires a long ramp haulage system to deliver mineralized material to the main underground crusher and hoisting facilities, which will only extend even longer over time as mining and exploration work for additional Mineral Resource definition continues. The long hauling distances result in higher operating costs in terms of diesel costs, ventilation needs, fleet replacement requirements and the resulting higher maintenance requirements.

The PEA has focused on how to shorten the future haul distances and open the mine to monopolize on future exploration success expected further east of the current infrastructure. The PEA has determined that the construction of a new, subvertical shaft and underground crushing station would shorten average hauling distances from all areas by 26% over the LOM, thus significantly contributing to lowering LOM operating costs. The design of the new hoisting and crushing system was undertaken in conjunction with WorleyParsons Limited, an international engineering and construction company.

The PEA envisages a new subvertical shaft (No. 8 shaft) sited close to the current No 2 shaft, constructed as a 5-metre diameter raise-bored hole from the 2100 to 3250 level with the final portion of the shaft either raise bored or drop raised to the 3530 level for a total vertical extent of 1,430 feet (442 metres). This positioning would overlap vertically over two levels and allow for transfer of mineralized material from the new No. 8 shaft to the current No. 2 shaft.

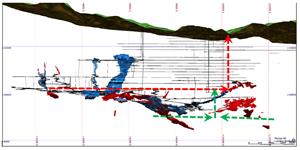

Figure 2: Impact of the Proposed Subvertical Shaft - Long section of El Mochito Mine looking North (revised horizontal and vertical haulage routes in red and green).

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/33143247-f223-4ff4-8173-928098bd6354

A new grizzly and crushing circuit will be located on the 3360 level with a nameplate capacity of 2,800 tpd. The new subvertical shaft will reduce the average haulage distance by well over 40% for the areas affected, and 26% over the life of mine for all material, as the haulage arrangements in the western side of the mine will remain largely unchanged, however, this area is only around 15-20% of known Mineral Resources. Hoisting capacity would be expected to increase to around 2,800 tpd and is easily achieved with the No. 2 shaft regularly demonstrating its ability to do so during 2018. The new subvertical shaft would not have men and material transporting capability (the existing ramps will be used for this purpose) but will be equipped with power cables, compressed air, water, backfill lines and will also form part of a significantly improved ventilation circuit for the mine going forward.

With the reduced haulage distance, the truck mining fleet capacity essentially increases by the same amount, thereby doing away with the need to procure additional equipment for the increased tonnage envisaged. Drilling, blasting and support equipment is currently underutilized with trucking typically being the historical bottleneck and thus the current fleet is well positioned to support the 26% increase in production.

Processing Plant Upgrades

To allow for the grinding and concentrator plant to treat the incremental increase in tonnage from the mine to 2,800 tpd from the current average of 2,200 tpd, various upgrades and de-bottlenecking plans are outlined within the PEA. With respect to the crushing and grinding circuit, the increased throughput can be achieved by washing off the fines from the run of mine feed, which is typically very wet, using a newly installed double-deck, vibrating grizzly. The cleaner product delivered to the primary and secondary crushers would significantly reduce downtime. The collected fines would be pumped to a roto-spiral screen in the mill circuit which would allow the very fine material to bypass the primary mills and proceed directly to flotation without milling.

As part of the increase in milling capacity, it is proposed to reconfigure the grinding mills to two parallel circuits consisting of a primary rod mill and a secondary ball mill with the secondary ball mill in closed circuit with a classifier. A roto-spiral screen is proposed for the classifier as this will reduce the circulating load from 250%, which is typical when using a hydrocylone, to an estimated 100% thus allowing for increased tonnage throughput. To accommodate the higher processed capacity, upgrades to the floatation circuits are required where replacement of the old float cells are anticipated in addition to upgrades of the concentrate filtering process to reduce moisture content of the concentrates produced to be consistently between 8-9%.

To accommodate the increased production rates, various updates to the tailings system would also be required. This would include installing a new, larger tailings pipeline with associated pumps while the old line would be used to recirculate and reuse the decant water from the tailings facility as process water for the plant, thus optimizing the mines water balance.

Improved Underground Water Management System

In conjunction with the upgrades noted above, the PEA also outlines upgrades to the underground water management system to improve pumping capacity and thus decrease operating and sustaining capital costs related to the current pumping procedures.

The PEA outlines a proposal to install a new pump station near the bottom of the new shaft and a second station on the 2100 level. These new pumps would pump vertically to the drainage tunnel on level 650, thus replacing a multitude of old and inefficient pumps. In addition, a new water clarification system is planned to reduce wear on all pumps as this would allow for the pumping of clean water versus dirty water. The total installed pumping capacity would be increased from 12,000 US gallons per minute to over 18,000 US gallons per minute.

Capital Costs

The total capital cost of this proposed Expansion Project is $32.8 million, including $4.3 million in contingency. The capital cost breakdown is as follows:

| $ million | ||

| Subvertical Shaft & Crusher | Civil | 0.6 |

| Mechanical | 0.7 | |

| Structural | 2.0 | |

| Electrical & Instrumentation | 0.8 | |

| Piping | 1.3 | |

| Hoisting System | 4.8 | |

| Raiseboring & development | 5.1 | |

| Mining Project Management | 0.4 | |

| Subtotal Subvertical Shaft & Crusher | 15.7 | |

| UG Pumping & Water Management | EPCM | 0.2 |

| Pumps, pipes & clarifiers | 4.7 | |

| Electrical Works | 1.5 | |

| Subtotal Pumping & Water Management | 6.4 | |

| Process Plant | EPCM | 0.5 |

| Crushing | 2.1 | |

| Grinding | 0.4 | |

| Magnetite Recovery | 0.2 | |

| Flotation | 1.8 | |

| Concentrate Filtration | 0.4 | |

| Tailings line & Reclaim water | 0.9 | |

| Subtotal Process Plant | 6.3 | |

| Contingency | 4.3 | |

| TOTAL CAPEX | 32.8 |

Project Economics

The Expansion Project after-tax NPV assuming an 8% discount rate is $83 million, with an after-tax IRR of 57%. The economics are based on consensus long term metal prices of $1.21/lb for zinc, $1.09/lb for lead and $15/oz for silver. A sensitivity analysis based on separately varying long-term prices, development (project) capital expenditures, sustaining capital expenditures and operational expenditures is summarized below:

| Expansion Project Sensitivities to NPV 8% by Factor ($million) | ||||||||||

| Change | -15% | -5% | 0% | 5% | 15% | |||||

| Metal Price | 9.6 | 78.6 | 82.7 | 86.2 | 95.4 | |||||

| Development Capital | 87.1 | 84.2 | 82.7 | 81.3 | 78.3 | |||||

| Sustaining Capital | 92.2 | 85.8 | 82.7 | 79.7 | 71.7 | |||||

| Operating Expenses | 79.6 | 81.6 | 82.7 | 79.7 | 62.6 | |||||

Technical Disclosure

The reader is advised that the PEA summarized in this press release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of Inferred Mineral Resources. Inferred Mineral Resources are considered to be too speculative to be used in an economic analysis except as allowed for by Canadian Securities Administrators’ National Instrument 43-101 in PEA studies. There is no guarantee that Inferred Mineral Resources can be converted to Indicated or Measured Mineral Resources, and as such, there is no guarantee the project economics described herein will be achieved.

Ascendant will file with regulatory authorities within 45 days a Technical Report prepared in accordance with NI 43-101 that documents the PEA study and supports the current disclosure.

Note on Exclusion of Mineral Reserves

Given that each year approximately 25% of the depleted mined tonnage is derived from Inferred Mineral Resources, existing Mineral Reserves are no longer current, and a new mining approach is being applied. All Mineral Reserves have been reclassified back to Measured, Indicated and Inferred Mineral Resources for the purposes of this PEA. As such, previously disclosed Mineral Reserves for El Mochito are no longer applicable. Mineral Resources depleted in the LOM of the PEA plan have been constrained by the mine design and the applicable modification factors for mineral loss and mining dilution have also been applied.

Qualified Persons

This PEA was prepared for Ascendant Resources Ltd by InnovExplo Inc and other industry consultants, all Qualified Persons (QP) under National Instrument 43-101. The scientific and technical information in this press release has been reviewed by the following QPs as described below:

- The Mining engineering content of this press release has been reviewed and approved by Eric Vinet, P.Eng. of InnovExplo Inc. who is an “Independent Qualified Person” as defined by National Instrument 43-101.

- The Metallurgical and Process Plant technical contents of this press release have been reviewed and approved by D. Grant Feasby P.Eng. of P&E Mining Consultants Inc. who is an “Independent Qualified Person” as defined by National Instrument 43-101.

- The Mineral Resource Estimate content of this press release has been reviewed and approved by Michael Cullen, P.Geo. of Mercator Geological Services Limited, Mr. Cullen supervised and is responsible for the Mineral Resource Estimate. He is an “Independent Qualified Person” as defined by National Instrument 43-101.

About Ascendant Resources Inc.

Ascendant is a Toronto-based mining company focused on its flagship 100%-owned producing El Mochito zinc, lead and silver mine in west-central Honduras, which has been in production since 1948. After acquiring the mine in December 2016, Ascendant spent 2017 implementing a rigorous and successful optimization program restoring the historic potential of El Mochito delivering record levels of production with profitability restored. The Company now remains focused on cost reduction and further operational improvements to drive robust profitability in 2018 and beyond. Expanding and upgrading El Mochito’s significant current Mineral Resource base through exploration work for near-mine growth is an ongoing focus for the Company. With a significant land package of 11,000 hectares in Honduras and an abundance of historical data, there are several regional targets providing longer term exploration upside which could lead to further Mineral Resource growth.

Ascendant also holds an interest in the high-grade polymetallic Lagoa Salgada VMS Project located in the prolific Iberian Pyrite Belt in Portugal. The Company is engaged in exploration of the Project with the goal of expanding already substantial defined Mineral Resources and testing additional known targets. The Company’s acquisition of its interest in the Lagoa Salgada Project offers a low-cost entry point to a potentially significant exploration and development opportunity. The Company holds an additional option to increase their interest in the Project upon completion of certain milestones.

Ascendant Resources is engaged in the ongoing evaluation of producing and development stage mineral resource opportunities, on an ongoing basis. The Company's common shares are principally listed on the Toronto Stock Exchange under the symbol "ASND". For more information on Ascendant Resources, please visit our website at www.ascendantresources.com.

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

For further information please contact:

Katherine Pryde

Director, Communications & Investor Relations

Tel: 888-723-7413

info@ascendantresources.com

Cautionary Notes to US Investors

The information concerning the Company’s Mineral properties has been prepared in accordance with National Instrument 43-101 (“NI-43-101”) adopted by the Canadian Securities Administrators. In accordance with NI-43-101, the terms “Mineral Reserves”, “Proven Mineral Reserve”, “Probable Mineral Reserve”, “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Definition Standards for Mineral Resources and Mineral Reserves adopted by the CIM Council on May 10, 2014. While the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are recognized and required by NI 43-101, the U.S. Securities Exchange Commission (“SEC”) does not recognize them. The reader is cautioned that, except for that portion of Mineral Resources classified as Mineral Reserves, Mineral Resources do not have demonstrated economic value. Inferred Mineral Resources have a high degree of uncertainty as to their existence and as to whether they can be economically or legally mined. It cannot be assumed that all or any part of any Inferred Mineral Resource will ever be upgraded to a higher category. Therefore, the reader is cautioned not to assume that all or any part of an Inferred Mineral Resource exists, that it can be economically or legally mined, or that it will ever be upgraded to a higher classification. Likewise, you are cautioned not to assume that all or any part of a Measured or Indicated Mineral Resource will ever be upgraded into Mineral Reserves.

Readers should be aware that the Company’s financial statements (and information derived therefrom) have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board and are subject to Canadian auditing and auditor independence standards. IFRS differs in some respects from United States generally accepted accounting principles and thus the Company’s financial statements (and information derived therefrom) may not be comparable to those of United States companies.

Forward Looking Information

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking information") within the meaning of applicable Canadian securities legislation. All information contained in this news release, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects", "budget", "guidance", "scheduled", "estimates", "forecasts", "strategy", "target", "intends", "objective", "goal", "understands", "anticipates" and "believes" (and variations of these or similar words) and statements that certain actions, events or results "may", "could", "would", "should", "might" "occur" or "be achieved" or "will be taken" (and variations of these or similar expressions). Forward-looking information is also identifiable in statements of currently occurring matters which may continue in the future, such as "providing the Company with", "is currently", "allows/allowing for", "will advance" or "continues to" or other statements that may be stated in the present tense with future implications. All of the forward-looking information in this news release is qualified by this cautionary note.

Forward-looking information in this news release includes, but is not limited to, statements regarding the ability to fully fund planned development, exploration expenditures and the undertaking of various long-term optimization programs, the ability to expand operations at el Mochito mine and commence development in Q1 of 2019, the ability to continue to deliver free cash-flow; the ability to provide non diluting means to fund the Expansion Project; the ability to reduce sustaining capital and cost and improve productivity and the ability to increase metal production. Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by Ascendant at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information. The material factors or assumptions that Ascendant identified and were applied by Ascendant in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to, the ability of the Company to fully fund planned development, exploration expenditures and the undertaking of various long-term optimization programs, the ability to expand operations at el Mochito mine and commence development in Q1 of 2019, the ability to continue to deliver free cash-flow; the ability to provide non diluting means to fund the Expansion Project; the ability to reduce sustaining capital and cost and improve productivity and the ability to increase metal production and other events that may affect Ascendant's ability to develop its project; and no significant and continuing adverse changes in general economic conditions or conditions in the financial markets.

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks generally associated with the mining industry, such as economic factors (including future commodity prices, currency fluctuations, energy prices and general cost escalation), uncertainties related to the development and operation of Ascendant's projects, dependence on key personnel and employee and union relations, risks related to political or social unrest or change, rights and title claims, operational risks and hazards, including unanticipated environmental, industrial and geological events and developments and the inability to insure against all risks, failure of plant, equipment, processes, transportation and other infrastructure to operate as anticipated, compliance with government and environmental regulations, including permitting requirements and anti-bribery legislation, volatile financial markets that may affect Ascendant's ability to obtain additional financing on acceptable terms, the failure to provide non diluting means to fund the Expansion Project, the failure to carry out the Expansion Project as planned with the consequent failure to reduce cost and sustaining capital; the failure to obtain required approvals or clearances from government authorities on a timely basis, uncertainties related to the geology, continuity, grade and estimates of Mineral Reserves and Mineral Resources, and the potential for variations in grade and recovery rates, uncertain costs of reclamation activities, tax refunds, hedging transactions, as well as the risks discussed in Ascendant's most recent Annual Information Form on file with the Canadian provincial securities regulatory authorities and available at www.sedar.com.

Should one or more risk, uncertainty, contingency, or other factor materialize, or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, the reader should not place undue reliance on forward-looking information. Ascendant does not assume any obligation to update or revise any forward-looking information after the date of this news release or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

______________________________

1 ZnEq calculated in the life of mine plan was the sum of all metals produced and expressed in zinc equivalent terms using processing recoveries of 90% for zinc, 75% for lead and silver, payable factors of 85% for zinc, 95% for lead and 80% for silver, long-term metal prices of $1.21/lb zinc, $1.09/lb lead and $15.00/oz for silver.

2 All in Sustaining Cost is a non-GAAP measure that includes mine direct operating production costs (mining, processing, administration and other mine related costs incurred such as variation in inventory) plus smelter treatment and refining charges, freight costs, royalties, and sustaining capital costs. The measure does not include depreciation, depletion, amortization and reclamation expenses.

3 See note on Technical Disclosure