Ascot Files Feasibility Study to Restart the Premier Mill

VANCOUVER, British Columbia, May 22, 2020 (GLOBE NEWSWIRE) -- Ascot Resources Ltd. (TSX: AOT; OTCQX: AOTVF) (“Ascot” or the “Company”) is pleased to announce that it has filed on SEDAR the Premier & Red Mountain Gold Project Feasibility Study NI 43-101 Technical Report (“FS”) prepared by Sacre-Davey Engineering Inc. as previously announced on April 15, 2020 (see press release at https://ascotgold.com/news-releases/2020/ascot-reports-robust-feasibility-study-with-after-tax-irr-of-51/.)

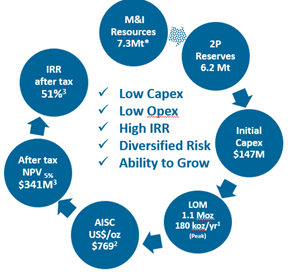

The FS, prepared for the Company’s 100% owned Premier and Red Mountain Gold Project (the "Project") located in the Golden Triangle near Stewart, British Columbia, Canada, supports robust economics including Base case After-tax NPV5% of C$341 million and IRR 51% (based on US$1400/oz gold price, $17/oz silver price and CAD to US exchange rate of 0.76.) The FS is based on a proven and probable reserve of 6.2 million tonnes (“Mt”) from the Project. In addition to the reserves, the Company has inferred resources of 5.1Mt at 7.25 grams per tonne (“g/t”) gold at Premier, with approximately 2.2Mt of this resource material at similar grade, near the planned development, which may potentially be converted to reserves during operations.

Ascot’s President and CEO, Derek White commented, “The feasibility study is very robust at the base case assumptions and given the current strong gold price4 environment, the after-tax NPV5% increases to over $600 million and IRR to nearly 80%. This was a huge collaboration and I am proud of the effort put forth to complete the FS and look forward to additional optimizations in the future. We are now focused on advancing our permitting efforts and reviewing various funding proposals for the Project.”

Notes

1. Fully ramped up yrs. @ 2500 tpd in year 3

2. All in Sustaining Cost ( non GAAP)

3. Base Case US$1400/oz. Gold: US CAD 0.76

4. Spot US$1710/oz Gold, Silver US$15.32/oz :US:CAD 0.71

* Premier & Red Mountain Total Resources M&I of 7.3Mt @ 7.85g/t &Inferred of 5.5Mt @ 7.11g/t

Annual General Meeting - As previously disclosed, with regards to the timing its Annual General Meeting, the Company is relying on temporary relief measures provided by the Canadian Securities Administrators ("CSA") and the Toronto Stock Exchange ("TSX") due to the COVID-19 pandemic. The Company is also relying on an exemption set out in BC Instrument 51-516 from the requirement under subsection 9.3.1.(1) of NI 51 -102 to file executive compensation disclosure no later than 140 days after the company’s most recently completed financial year end. The Company will hold its 2020 Annual General Meeting ("AGM") in the second half of 2020. Management continues to monitor the COVID-19 situation and details for the AGM will be communicated in due course.

Qualified Persons and NI 43-101 Disclosure

John Kiernan, P.Eng., Chief Operating Officer of the Company is the Company’s Qualified Person (QP) as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this news release.

ON BEHALF OF THE BOARD OF DIRECTORS OF

ASCOT RESOURCES LTD.

“Derek C. White”, President and CEO

For further information contact:

Kristina Howe

VP, Investor Relations

778-725-1060 / khowe@ascotgold.com

About Ascot Resources Ltd.

Ascot is a Canadian-based exploration and development company focused on re-starting the past producing historic Premier gold mine, located in British Columbia's Golden Triangle. The Company continues to define high-grade resources for underground mining with the near-term goal of converting the underground resources into reserves, while continuing to explore nearby targets on its Premier/Dilworth and Silver Coin properties (collectively referred to as the Premier Gold Project). Ascot's acquisition of IDM Mining added the high-grade gold and silver Red Mountain Project to its portfolio and positions the Company as a leading consolidator of high-quality assets in the Golden Triangle.

For more information about the Company, please refer to the Company’s profile on SEDAR at www.sedar.com or visit the Company’s web site at www.ascotgold.com, or for a virtual tour visit www.vrify.com under Ascot Resources.

The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

All statements, trend analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. All statements, other than statements of historical fact, included herein are forward-looking statements, including statements in respect of the closing of the Private Placement and the use of proceeds. Although Ascot believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Ascot can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Ascot’s periodic filings with Canadian securities regulators, and assumptions made with regard to: the estimated costs associated with construction of the Project; the timing of the anticipated start of production at the Projects; the ability to maintain throughput and production levels at the Premier Mill; the tax rate applicable to the Company; future commodity prices; the grade of Resources and Reserves; the ability of the Company to convert inferred resources to other categories; the ability of the Company to reduce mining dilution; the ability to reduce capital costs. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Important factors that could cause actual results to differ materially from Ascot’s expectations include risks associated with the business of Ascot; risks related to exploration and potential development of Ascot’s projects; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and indigenous groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; risks associated with COVID-19 including adverse impacts on the world economy, construction timing and the availability of personnel; and other risk factors as detailed from time to time and additional risks identified in Ascot’s filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). The timing of future economic studies; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of Project as well as those factors discussed in the Annual Information Form of the Company dated March 13, 2020 in the section entitled "Risk Factors", under Ascot’s SEDAR profile at www.sedar.com. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. Ascot does not undertake any obligation to update forward-looking statements.

Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration; however, there is no certainty that these inferred mineral resources will be converted into mineral reserves, once economic considerations are applied. The mineral resource estimates referenced in this release use the terms "Indicated Mineral Resources" and "Inferred Mineral Resources". While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission ("SEC"). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Ascot is not an SEC registered company.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/bd9f8011-362d-4ebe-b632-c6fcafecedaa