Atlantic Gold Announces Additional Drill Results from the 149 Deposit Intersections from Limb & Axis Zones Extend Mineralized Zone

HIGHLIGHTS INCLUDE:

149 GOLD DEPOSIT |

31m @ 1.84g/t Au from 80m |

33m @ 1.16g/t Au from 40m |

30m @ 1.11g/t Au from 69m |

34m @ 0.92g/t Au from 18m |

20m @ 1.53g/t Au from 131m |

15m @ 1.72g/t Au from 75m |

15m @ 1.20g/t Au from 44m |

VANCOUVER, Jan. 22, 2019 /CNW/ - Atlantic Gold Corporation (TSX-V: AGB) ("Atlantic" or the "Company") is pleased to provide an update of drill results for recently completed programs of diamond drilling to further define gold mineralization in the Limb and Axis Zones of the 149 Gold Deposit, recently discovered as part of the Corridor Regional Program.

Atlantic's producing Touquoy Gold Mine and future satellite development deposits at Beaver Dam and Fifteen Mile Stream lie within the Moose River Corridor, a geologically prospective 45km trend underlain by the Moose River Formation, a unit composed of a sequence of folded argillite and greywacke which hosts the known gold mineralization.

The 149 Deposit was discovered by traverses of widely-spaced diamond drilling testing favorable interpreted geological and geophysical targets and historical anomalous drill hole results as part of the "Phase 4 Corridor Regional Program" which was initiated in 2018 to evaluate the under-explored and geologically prospective Moose River Corridor. Encouraging initial results were followed-up and shallow mineralization was intersected over a strike length of 350m. (See News Release dated June 28, 2018).

Additional infill drilling identified two zones of gold mineralization: a shallow, generally higher grade "Axis Zone" in the core of a tight anticlinal fold which dips 60-75° to the north and a thicker, but lower grade, "Limb Zone" on the over-turned limb of the anticline. The mineralized zones were extended to over 475m in strike length and were still open to the east. (See News Release dated September 19, 2018).

In November-December 2018, additional drilling was completed to extend the higher grade "Axis Zone" to depth and to follow the "Limb Zone" closer to surface. A total of 2,497m of diamond drilling was completed in 21 drill holes. Results for 13 of these holes have been received with significant results reported in Table 1 below; additional results will be provided when received.

Visual mineralization (carbonate alteration, pyrrhotite banding, minor quartz veining and specks of visible gold) was intersected in targeted zones and is consistent with the style of mineralization that previously returned significant gold grades.

Assay results received to date confirm that the lower grade, disseminated Limb Zone mineralization extends to surface but also is open at depth. Narrow zones of higher-grade argillite hosted gold mineralization do occur within the thicker disseminated mineralization.

Results also confirm that the Axis Zone mineralization continues from surface to depths of approximately 125m vertical and is open at depth. The argillite hosted disseminated mineralization within the Axis Zone is also accompanied by high-grade intersections associated with broad zones of anomalous pyrrhotite and carbonate alteration, but generally devoid of the quartz veining seen in the Fifteen Mile Stream deposits.

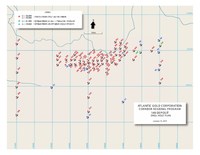

The mineralized zone has been traced over approximately 500m, with closely spaced 25m fences of diamond drilling over a strike length of 300m between Section 14400E to 14700E and further wider spaced drilling which has intersected mineralization over an additional 200m to Section 14900E. Airborne geophysical data suggests the structure continues to the east; to date insufficient drilling has been completed to determine the eastward extent of the 149 Deposit mineralization.

Additional infill drilling will be required to better evaluate the eastern end of this zone and to continue to test the down dip extension of the mineralization. Planning has commenced for this program, likely to commence in early February.

Aeromagnetic interpretation also indicates the potential for similar geological settings to be repeated further to the east and additional reconnaissance-spaced drilling will be undertaken to test these zones.

Table 1

Significant Drill Results

(Gold Assay (g/t Au) * Sample Length (m) ≥3.0g/t Au * m)

149 GOLD DEPOSIT

January 10, 2019

Hole ID | Easting | Northing | Dip | Az. | Depth (m) | Significant Intervals** | Target Zone | |||

From (m) | To (m) | Width (m) | Grade (g/t Au) | |||||||

FMS-18-420 | 14500 | 10110 | -45 | 180 | 122 | 74 | 75 | 1 | 3.87 | Limb |

83 | 99 | 16 | 0.60 | Limb | ||||||

FMS-18-422 | 14475 | 10135 | -50 | 180 | 152 | 18 | 52 | 34 | 0.92 | Axis |

132 | 140 | 8 | 0.65 | Limb | ||||||

FMS-18-424 | 14450 | 10140 | -45 | 180 | 152 | 18 | 29 | 11 | 1.19 | Axis |

37 | 40 | 3 | 1.44 | Axis | ||||||

44 | 59 | 15 | 1.20 | Axis | ||||||

136 | 144 | 8 | 0.84 | Limb | ||||||

FMS-18-426 | 14600 | 10150 | -55 | 180 | 140 | 18 | 22 | 4 | 1.02 | Axis |

34 | 43 | 9 | 0.59 | Axis | ||||||

135 | 140 | 5 | 0.88! | Limb | ||||||

FMS-18-429 | 14500 | 10080 | -45 | 180 | 92 | 26 | 42 | 16 | 0.79 | Limb |

50 | 51 | 1 | 4.54 | Limb | ||||||

FMS-18-433 | 14625 | 10145 | -55 | 180 | 167 | 131 | 151 | 20 | 1.53 | Limb |

FMS-18-434 | 14575 | 10175 | -65 | 180 | 125 | 28 | 34 | 6 | 0.53 | Axis |

42 | 63 | 21 | 0.84 | Axis | ||||||

69 | 99 | 30 | 1.11 | Axis | ||||||

FMS-18-435 | 14550 | 10155 | -75 | 180 | 125 | 35 | 50 | 15 | 0.73 | Axis |

74 | 97 | 23 | 0.94 | Axis | ||||||

FMS-18-436 | 14525 | 10158 | -58 | 180 | 125 | 40 | 73 | 33 | 1.16 | Axis |

FMS-18-437 | 14600 | 10165 | -72 | 180 | 137 | 49 | 52 | 3 | 1.90 | Axis |

58 | 64 | 6 | 1.53 | Axis | ||||||

71 | 73 | 2 | 2.09 | Axis | ||||||

80 | 111 | 31 | 1.84 | Axis | ||||||

FMS-18-438 | 14625 | 10165 | -75 | 180 | 110 | 38 | 44 | 6 | 0.77 | Axis |

48 | 62 | 14 | 1.09 | Axis | ||||||

75 | 90 | 15 | 1.72 | Axis | ||||||

Notes:

| ||||||||||

The accompanying drill plans and cross sections can be viewed here:

https://mma.prnewswire.com/media/811290/149_Deposit_Plans___Sections.pdf

Technical Disclosure

All assays reported are 50g charge fire assays of 1kg pulverized sub-sample split from -2mm crushed parent of sawn half 1m NQ core, with 1-in-10 duplicate assays of the same pulp. Certified standards prepared by a third-party laboratory and blind blanks are routinely inserted. Sample preparation and assaying are conducted at the Sudbury and Vancouver laboratories of ALS Canada Ltd, an entity having no other relationship with the Company. ALS employ a standard routine of duplicate and check assays and reference standards. Standards, blind blanks, and duplicate assay results are within an acceptable range of tolerance. Core recovery is estimated for each meter and averages 96%.

Douglas A Currie, P. Geo., General Manager-Exploration, a Qualified Person (QP) as defined by National Instrument 43-101 ("NI 43-101"), has reviewed and approved the contents of this news release.

Further updates will be provided in due course and as new information comes to hand.

On behalf of the Board of Directors,

Steven Dean

Chairman and Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

About Atlantic:

Atlantic is a well-financed, growth-oriented gold development group with a long term strategy to build a mid-tier gold production company focused on manageable, executable projects in mining-friendly jurisdictions.

Atlantic is focused on growing gold production in Nova Scotia beginning with its MRC phase one open-pit gold mine which declared commercial production in March 2018, and its phase two Life of Mine Expansion at industry lowest decile cash and all-in-sustaining-costs (as stated in the Company's news releases dated January 16, 2019 and January 29, 2018).

Atlantic is committed to the highest standards of environmental and social responsibility and continually invests in people and technology to manage risks, maximize outcomes and returns to all stakeholders.

Forward-Looking Statements:

This release contains certain "forward looking statements" and certain "forward-looking information" as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as "may", "will", "expect", "intend", "estimate", "anticipate", "believe", "continue", "plans" or similar terminology. Forward-looking statements and information are not historical facts, are made as of the date of this press release, and include, but are not limited to, statements regarding discussions of future plans, guidance, projections, objectives, estimates and forecasts and statements as to management's expectations with respect to, among other things, the activities contemplated in this news release and the timing and receipt of requisite regulatory, and shareholder approvals in respect thereof. Forward looking information, including future oriented financial information (such as guidance) provide investors an improved ability to evaluate the underlying performance of the Company. Forward-looking statements in this news release include, without limitation, statements related to proposed exploration and development programs, grade and tonnage of material and resource estimates. These forward-looking statements involve numerous risks and uncertainties and actual results may vary. Important factors that may cause actual results to vary include without limitation, the timing and receipt of certain approvals, changes in commodity and power prices, changes in interest and currency exchange rates, risks inherent in exploration estimates and results, timing and success, inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral reserves and resources), changes in development or mining plans due to changes in logistical, technical or other factors, unanticipated operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications, cost escalation, unavailability of materials, equipment and third party contractors, delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), political risk, social unrest, and changes in general economic conditions or conditions in the financial markets. In making the forward-looking statements in this press release, the Company has applied several material assumptions, including without limitation, the assumptions that: (1) market fundamentals will result in sustained gold demand and prices; (2) the receipt of any necessary approvals and consents in connection with the development of any properties; (3) the availability of financing on suitable terms for the development, construction and continued operation of any mineral properties; and (4) sustained commodity prices such that any properties put into operation remain economically viable. Information concerning mineral reserve and mineral resource estimates also may be considered forward-looking statements, as such information constitutes a prediction of what mineralization might be found to be present if and when a project is actually developed. Certain of the risks and assumptions are described in more detail in the Company's audited financial statements and MD&A for the year ended December 31, 2017 and for the quarter ended September 30, 2018 on the Company's SEDAR profile at www.sedar.com. The actual results or performance by the Company could differ materially from those expressed in, or implied by, any forward-looking statements relating to those matters. Accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of the Company. Except as required by law, the Company is under no obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws

SOURCE Atlantic Gold Corporation

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2019/22/c8755.html