Aura Provides Exploration Update and Plans for 2023

ROAD TOWN, British Virgin Islands, July 18, 2023 (GLOBE NEWSWIRE) -- Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) (“Aura” or the “Company”) is pleased to provide an update on exploration activities to date and advancement plans across its portfolio in 2023. Readers are encouraged to read the Company’s most recent Annual Information Form dated March 30, 2023 (the “2022 AIF”), which is available on www.sedar.com and the Company’s website, which includes current mineral resources and mineral reserves (“MRMR”).

Highlights:

Evolving Exploration Strategy to Support Future Growth

- Since 2018, Aura’s exploration strategy has focused on replacing depleted ounces across its core operating assets and increase LOM, while expanding production. During this time, combined proven and probable mineral reserves increased by 59% and combined measured and indicated mineral resources have increased by 194% as result of investment in exploration increasing from about US$8 million in 2018 to US$22 million in 2022, taking advantage of over 650,000 hectares of under-explored mining rights across its portfolio.

- In 2022, Aura’s exploration initiatives played an increasing role in its capital allocation strategy, forming a solid basis for future growth including:

- 123,895 meters drilled across greenfield and brownfield projects.

- Increased mineral reserves and mineral resources, with over 100% conversion of inferred mineral resources into measured and indicated mineral resources.

- New targets identified both surrounding mine workings and regionally across the portfolio, through soil sampling, mapping, and geophysics.

- Important mineral rights acquisitions at EPP Mines to potentially expand the mineral footprint, and at Matupá to test the regional potential.

- New projects were added to the exploration pipeline including the Borborema Project (located in Rio Grande do Norte, NE Brazil), and Serra da Estrela Copper Project in the prolific Carajás region, to support future growth in mineral resources and mineral reserves and new discoveries.

2023 Objectives

- With a strong foundation and increased confidence in the exploration pipeline as result of successful exploration programs particularly especially in the last 2 years, Aura has increased its exploration budget for 2023 to between US$22 million and US$26 million and is planning an additional 110,000 meters of diamond drilling.

- The strategy for 2023 and beyond includes work intended to increase mineral resources and mineral reserves, developing earlier stage targets, drill testing the regional potential of several assets and allowing for future production expansion. The targeted programs for 2023 for select assets include:

- EPP: Increase mineral reserves through conversion of measured and indicated and inferred mineral resources so as to expand its LOM.

- Aranzazu: Testing the continuity of mineralization of GH at Aranzazu to expand LOM and drilling in new potential deposits to build the foundation for a potential future increase in annual production.

- Matupá: Advancing regional targets in order to increase mineral resources inventories through the development of nearby deposits, mainly at Serrinhas.

- Aura Carajás: Conducting an initial exploration program at the newly acquired Serra da Estrela Copper Project to understand its potential and build a basis for a focused exploration program in 2024.

- Borborema: Feasibility Study currently underway, with and expected to be published in Q3 2023.

Rodrigo Barbosa, President, and CEO of Aura commented, “We are excited to share for the first time, a comprehensive update on our exploration initiatives and growth plans across our portfolio. Exploration continues to play a significant part in our capital allocation strategy, with investments increasing significantly since 2018 to up to US$26 million budgeted for 2023. Our priority over the years has been to more than replace our depleted ounces and generate cash flow, which we have successfully and consistently done. We believe we are now in a strong position to focus on growth for future years, by aggressively developing immediate and regional targets and exploring our robust pipeline.”

Mr. Barbosa continued, “We are proud of the unmatched exploration potential across our portfolio, with over 650,000 hectares and several new projects added to the pipeline. Many of our projects are located in prolific jurisdictions, including several productive mineral belts that have seen little to no modern-day exploration. We are excited about the prospect of using our strong cashflows to replace, define and discover new ounces. We have several immediate targets particularly at the Aranzazu and EPP Mines that are expected to contribute to resource and reserve growth and regional exploration across various projects to contribute to future new discoveries.”

Aranzazu Mine, Mexico

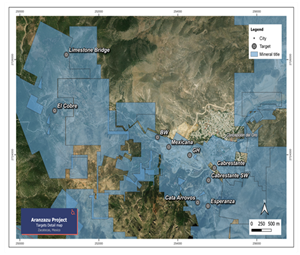

Aranzazu is an underground copper mine in operation, producing gold as a by-product, located in a world-class polymetallic district where Aura controls approximately 11,000 hectares of mineral rights (Figure 1). To date, only 5% of the mineral claims have been drilled. Mining activity in the area dates almost 500 years and it hosts multiple world class deposits including Tayahua (Minera Frisco SAB de CV), Camino Rojo (Orla Mining Ltd.) and Peñasquito Mine (Newmont Corporation). The Aranzazu deposit is characterized as an Endo-skarn and Exo-skarn deposit replaced in Mesozoic limestone strata.

Figure 1. Aranzazu location map, Zacatecas State, Mexico. https://www.globenewswire.com/NewsRoom/AttachmentNg/0e94ee1b-57af-46ac-ad7b-4a13934619a3

Since the restart of operations in 2018, exploration efforts have focused on (i) extending the life of mine (“LOM”) and (ii) building the basis to allow for an increase in production capacity. As a result, Aura has been able to increase LOM from five years at the time of the restart to currently more than seven years based on mineral reserves only. In addition, production capacity was expanded by 30% during 2021.

In 2022, Aura invested approximately US$7.5 million in exploration at Aranzazu, with 37,685 meters drilled, resulting in:

- Substantial increase in MRMR.

- Current Measured and Indicated Mineral Resources (as of December 31, 2022, inclusive of Mineral Reserves) includes 1.59 MGEO1, an increase of 12% (170 kGEO) compared to 2018.

- Proven and Probable Mineral Reserves of 852 kGEO, an increase of 61% (325 kGEO) compared to 2018.

- Production capacity increased by 30% in 2021.

Current exploration initiatives include multiple targets being advanced near existing mine infrastructure to support further increases in LOM (Figure 2). Aura has also made important advances in finding new deposits. The priority targets include:

- Initiatives to increase LOM in the short term, such as at GHFW Zone, where skarn mineralization was intercepted in a deeper hole indicating that the ore body is still open down dip.

- Initiatives to allow expansion of mineral resource and reserve and potential increase in production in the medium term, such as:

- Several small skarn pipes identified with surface exposures in NW of Aranzazu mine and may be a continuation of Aranzazu structure and possible connection zone towards NW.

- Drilling below historical underground workings at Cabrestante SW, Cata-Arroyo, Esperanza, Limestone Bridge and El Cobre tested the continuity and potential of mineralization downdip below mined areas. Drilling confirmed skarn alteration with low occurrence of sulfides. The drill holes demonstrated important geological information in all targets, with indications that there may be economic mineralization, information which will be used for future targeting.

- Regionally, geological mapping and sampling generated several early-stage targets including new copper-gold skarns, manto type polymetallic mineralization, and high-grade gold/silver veins. Low grade Au-Cu porphyry mineralization could possibly occur as well.

Figure 2. Aranzazu detailed map showing all the near mine exploration targets. https://www.globenewswire.com/NewsRoom/AttachmentNg/d0514d6b-ec3e-434f-943b-f2046ba43f0d

For 2023, Aura intends to complete 29,400 meters of drilling which will focus on testing the continuity of GH and Cabrestante areas, with the goal of increasing mineral resources and mineral reserve of existing deposits. In parallel, drilling is planned for El Cobre and Aranzazu extensions, a potential connection zone to find and delineate new skarn mineralization near-mine workings.

Ernesto and Pau-a-Pique Mines, Brazil

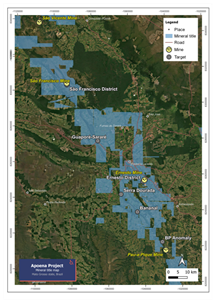

EPP is located on the prolific Guapore Belt in Mato Grosso, Brazil (Figure 3), and previously owned and operated by Yamana Gold. The belt has several historic mines but has seen very little modern-day exploration. Aura acquired EPP in 2016 and its land package includes 296,796 hectares along a 200 km trend, which represents a dominant land position controlling most of the belt, and an excellent opportunity for growth.

Figure 3. Guapore Gold Belt, Mato Grosso, Brazil. https://www.globenewswire.com/NewsRoom/AttachmentNg/5a0d7edf-cf99-487b-b579-8862b2b411ca

EPP is located near Pontes e Lacerda (Figure 4) and consists of multiple gold deposits: the Lavrinha open-pit mine (“Lavrinha”), the Ernesto open-pit mine (“Ernesto”), the Pau-a-Pique underground mine (“Pau-a-Pique” or “PPQ”), the Japonês open-pit mine ("Japonês") and the Nosde open pit-mine (“Nosde”). These deposits are composed of metasediments from a foreland basin folded and sheared under ductile-brittle conditions commonly in tectonic contact with the basement. Strong hydrothermal alteration associated with gold mineralization occurs in fault zones associated with the lower contact of the Aguapeí Group with the basement.

Figure 4. EPP location map, Mato Grosso State, Brazil. https://www.globenewswire.com/NewsRoom/AttachmentNg/7dd465b3-b039-48d4-a4dc-c2c2eb504ae3

Current mineral reserves support a four-year LOM, and Aura is carrying out exploration work with the goal of extending the LOM in the short term as the ore bodies remain open at depth and between the ore bodies. In 2022, Aura spent approximately US$8.7 million on exploration at EPP, with 56,053 meters drilled. Results have supported the exploration strategy, mainly:

- Continued increase in Resources, exceeding depletion, of 91%.

- Recent exploration successfully confirmed the connection between the Lavrinha and Nosde mines in the schist and new areas around Ernesto pit (Figure 5) with further exploration and potential conclusions to happen during 2023.

- Surface sampling and mapping was completed further north of Pau-a-Pique, GP targets, the BP anomaly to better define the regional potential.

- 107 km of a ground magnetic survey and 10.5 km of IP ground survey were completed with results indicating that the quartz veins associated with sulfides with surface exposure has continuity at depth in the BP target anomaly. This structure is similar to the PPQ mine structure and it is interpreted as new ore shoot with the same strike continuity.

Figure 5. Ernesto mine complex showing open pits and targets. https://www.globenewswire.com/NewsRoom/AttachmentNg/a729f270-ffce-4358-a9ad-b6be5ac1c536

For 2023, a significant portion of the exploration budget (US$8 million) is expected to be used for work carried out at EPP, including 36,500 meters of drilling with the goal of:

- converting inferred mineral resources to indicated mineral resources and supporting increases in mineral reserves from Nosde-Lavrinha and additional near mine targets

- Drilling will also target Japonês West, a recently acquired area that has surface indications of similar mineralization as Lavrinha and Japonês mines (mylontic schist). Of the regional targets, drilling is planned for 2023 at the BP anomaly.

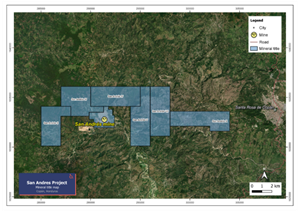

San Andres Mine, Honduras

San Andres is an open-pit heap leach gold mine located in the highlands of western Honduras, in the municipality of La Union, Department of Copan, approximately 150 km southwest of the city of San Pedro Sula (Figure 6).

Figure 6. San Andres location map, Copan, Honduras. https://www.globenewswire.com/NewsRoom/AttachmentNg/0bfac838-4a68-4842-ab58-de48e778a7ec

The San Andres deposit is classified as an epithermal gold deposit associated with extension structures within tectonic rift settings. Gold occurs in quartz veins predominantly comprised of colloform banded quartz (generally chalcedony with lesser amounts of fine quartz, adularia, dark carbonate, and sulfide material). Aura’s district scale land package includes 6,162 hectares with most of the exploration focused near mine (Figure 7).

Last year, Aura’s exploration efforts focused on better understanding the alteration zones and recovery of production areas.

This involved a US$0.6 million budget with 5,966 meters drilled. Results were supported the exploration strategy, and in particular:

- Infill drilling increased the confidence and filled the structural gaps in the alteration models at Esperanza and Banana Ridge targets.

- Drilling at Esperanza expanded both measured and indicated mineral resources by 144k GEO.

- Geochemical sampling (soil and rock) was performed in San Andres IV and geophysical work was in progress during Q4 2022 in the San Andres concessions.

- In Q4 2022, a magnetic drone survey commenced to better define the 2023 program for SAIV, SAV and SAVII concessions. The survey concluded in late Q1 2023.

Figure 7. San Andres Regional Map. https://www.globenewswire.com/NewsRoom/AttachmentNg/b948208d-f650-4297-bd8e-721f21a3ef87

For 2023, 14,000 meters of drilling is planned, targeting:

- Infill and alteration models at Esperanza with a focus on converting indicated mineral resources to measured mineral resources.

- Additional work to better defines oxide-sulfide limits and to verify the potential of old waste dumps from areas that were mined historically with higher cut-off grades

- Identify the continuity of quartz-carbonate veins in the sulfide zone at depth, which was identified in both in recent and historical drilling. The sulfide zone is not part of current mineral resources and mineral reserves estimate at San Andres and cannot be processed by the heap leach method.

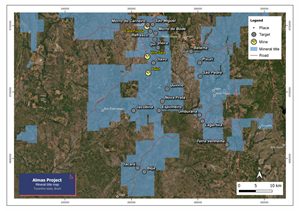

Almas Project, Brazil

The Almas Project, which is located in the municipality of Almas, in Tocantins State, Brazil (Figure 8), is an open pit gold mine wholly owned by Aura. Almas is the first greenfield project constructed by Aura. In April 2023, Aura announced the commencement of operations and ramp-up phase, with commercial production anticipated for Q3 2023.

Figure 8. Almas location map, Tocantins, Brazil. https://www.globenewswire.com/NewsRoom/AttachmentNg/98be2609-c055-4404-8679-992e3caf3dd7

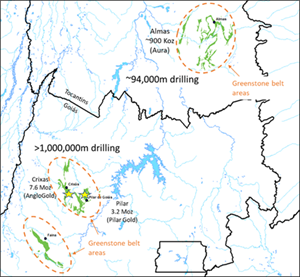

The Almas Project is located on the Almas Greenstone Belt, which is one of the lesser explored greenstone belts in Brazil, with less than 100,000 meters drilled, and has approximately 1,500 km2 of greenstone belt rocks, a highly fertile geological terrain for gold mineralization. Other greenstone belts in Brazil with similar geology such as Crixás, Rio Itapircuru and Iron Quadrangle host meaningful deposits that have been the subject to considerable drilling campaigns (Figure 9). Aura believes that it could potentially find new deposits in the belt to feed the current plant in the upcoming years with regional exploration.

Figure 9. Almas Greenstone Belt one of the less studied/drilled greenstone belts in Brazil. https://www.globenewswire.com/NewsRoom/AttachmentNg/c9089e03-f349-46d2-b402-efbde40ccaf6

The three main gold deposits that comprise the Almas Project include Paiol, Cata Funda, and Vira Saia and are located along a 15 km long corridor on the Almas Greenstone Belt, a Paleoproterozoic volcano-sedimentary sequence which hosts numerous orogenic gold occurrences. The gold-mineralized zone occurs in the core of hydrothermal alteration zones, generally associated with variable amounts of quartz, carbonate, albite, sericite, and sulphide minerals. The Almas Project’s claims consist, in addition to current deposits, of multiple early-stage exploration targets, including Nova Prata, Espinheiro, Jacobina, Morro do Carneiro, Olavo, Vieira and Jacaré, in a total area of 224,141 hectares of mineral rights (Figure 10).

In 2022, Aura invested approximately US$1.3 million in exploration activities at Almas, with 6,373 meters drilled. Results of such exploration activities included:

- Nineteen targets defined targets through mapping and surface sampling.

- Drilled five targets with positive results including Morro do Carneiro, Ijuí, Nova Prata, Quirino and Lagartixa.

- Ijui target located between Cata Funda and Paiol deposits in the same host rock context (chlorite schist) intercepted hydrothermal alteration zones. Differently than observed at Paiol Deposit, hydrothermal alteration zones in Ijucontain pyrite, chalcopyrite, galena and sphalerite.

- Drilling was also completed at three new potential targets, all of which have similar characteristics to the Paiol-Cata Funda deposits, which require further follow up.

Of the numerous targets defined, Aura believes that the most compelling is the Morro do Carneiro target, located 2 km east of the Cata Funda deposit. The gold mineralization is associated with shear zones in a meta chert rock. Delineation drilling was carried out in the main ore shoot identified during previous work, with 9 drill holes concluded, totaling 2,321 meters. The drilling campaign confirmed the continuity of 4 mineralized lenses with an average of 100 meters length in strike and 160 meters down dip, real thickness varying from 1 to 16 meters. Geological modeling and preliminary resource estimation exercise is underway to better define mineralized zones and future step out drilling in the target.

Figure 10. Almas detailed map showing several near mine exploration targets. https://www.globenewswire.com/NewsRoom/AttachmentNg/e7ae2bd6-93bc-49c2-ab26-3cd59f8e359a

The 2023 exploration plan for Almas includes 12,600 meters of drilling with a focus on infill drilling at Paiol to convert inferred mineral resources to indicated mineral resources. Step-out drilling will also be conducted at least other three regional targets

Borborema Project, Brazil

The Borborema Project is a greenfield open pit gold project, located in the municipality of Currais Novos, Rio Grande do Norte state, in the northeast of Brazil. Aura acquired the project in September 2022, and is currently completing a Feasibility Study. Upon completion of the FS, Aura expects to convert 1.87 million ounces of gold of JORC-Compliant Measured and Indicated Mineral Resource and additional 0.57 million ounces of gold of Inferred Mineral Resource in 43-101 Mineral Resources.

Figure 11. Borborema location map, Rio Grande do Norte, Brazil. https://www.globenewswire.com/NewsRoom/AttachmentNg/bc39146a-19c9-40f1-a8e3-78892c304563

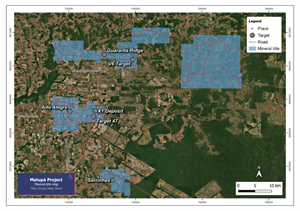

Matupá Project, Brazil

The Matupá Project is a gold project located in the northern part of the state of Mato Grosso, Brazil (Figure 12). This region contains several gold and base metal deposits around 50 km radius of the project. The Project’s claims consist of multiple exploration targets (Figure 13), in a total area of 62,500 hectares of mineral rights.

Figure 12. Matupá location map, Mato Grosso, Brazil. https://www.globenewswire.com/NewsRoom/AttachmentNg/9759f73e-04a0-46ba-a10b-981ab849b2e5

Figure 13. Matupá Project detailed map showing near mine exploration targets. https://www.globenewswire.com/NewsRoom/AttachmentNg/dcf6277e-f0cb-4bf5-b004-6ab36afa8a57

The Matupá Project has three main deposits including: X1 and Serrinhas (gold), and Guarantã Ridge (base metals). The X1 deposit was the main deposit which was delineated for feasibility study of Matupá Gold Project. (See Aura’s Press Release dated October 3, 2022). The X1 deposit has 325 koz of Measured and Indicated Mineral Resources and 3.1 koz of Inferred Mineral Resources. The project has 311 koz in Proven and Probable Mineral Reserves.

During 2022, exploration focused on the development of multiple targets near the X1 deposit including, Serrinhas, Target 47 and V6 zones with exploration drilling to test geochemistry and magnetometry anomalies and step out drilling of previous positive results. A total of 75 drill holes were completed, totaling 17,818 meters. Advancements for each of the targets are listed below.

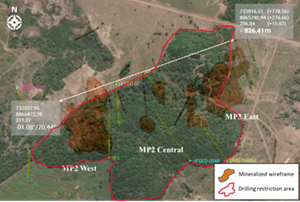

- Serrinhas which is located 22 km south of the X1, consists of 10 km NW trending hills with a series of former artisanal small pits, and large gold anomalies in the soil. Drilling at Serrinhas concentrated on the MP1 and MP2 targets and confirmed the continuity of these targets along strike and down dip. Though the connection between MP2 East and MP2 West (Figure 14) could not be well drilled due to environmental license, directional drilling is planned for 2023 to further test the potential of this area.

- Preliminary metallurgical studies and 1,100 km of drone magnetic geophysical survey were also carried out at Serrinhas. The mineralization in Serrinhas is associated with low mag anomalies and the survey is expected to provide new targets for exploration drilling. The preliminary metallurgical studies were completed, which confirmed the possibility to feed the X1 plant with Serrinhas’ ore (94.5% of recovery considering Gravity Concentration + Gravity Tail Leaching).

Figure 14. MP2 target mineralization wireframes delineated during 2022 drilling program. https://www.globenewswire.com/NewsRoom/AttachmentNg/d5b4797a-34a2-4a93-a46e-c3193841a563

- Target 47 is 1.5 km south of the X1 deposit and is a porphyritic style mineralization target. Drilling tested the continuity at depth of the exploration drillholes completed in 2021, confirming mineralized high-grade zones inside porphyritic mineralization. Next steps of exploration work will concentrate on defining the higher-grade continuity of this corridor.

- V6 Target is located 20 km north of X1 deposit and it is in a trend of Guarantã Ridge epithermal system. In 2022, there were 573 soil samples collected to better detail previous soil campaign, and has confirmed the potential of copper, gold, lead, and zinc mineralization related to quartz veins with phyllic alteration halo in granites. Exploration drilling to test this area started in Q4 2022, with 1 drill hole completed, totaling 243 meters. The assays are still pending but were identified during the log occurrence of veins with chalcopyrite, pyrite, sphalerite and phyllic alteration.

For 2023, 15,000 meters of drilling is planned with the primary focus on directional drilling and environmental licenses to test connections between MP2 West and MP2 East at Serrinhas. The results of the drone magnetic survey are expected and will guide further exploration work. Additionally, exploration in Alto Alegre and GR and V6 targets. Aura strongly believes that continuation of exploration at Matupá can support increases in LOM beyond the disclosed feasibility report.

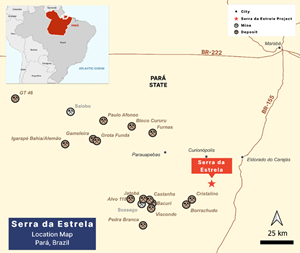

Aura Carajás, Brazil

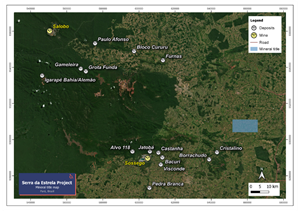

Aura Carajás - the Serra da Estrela project - was recently acquired by Aura, to strategically support potential copper discoveries and the growing exploration pipeline. The project is located in the prolific Carajás Region (Figure 15Figure). The Carajás Mineral Province is one of the most important polymetallic districts in the world and hosts several IOCG (iron oxide copper gold) deposits such as Sossego and Salobo Mines (owned by Vale), Pedra Branca, Igarapé Bahia-Alemão, Cristalino, Gameleira and Alvo 118 (Figure 16). The project is a permitted exploration target of 9,805 hectares.

Figure 15. Serra da Estrela location map, Para State, Brazil. https://www.globenewswire.com/NewsRoom/AttachmentNg/540861ce-1189-4a26-a6fc-b027793559c1

Mineralization targets are along a 6 km strike with a surface anomaly up to 500 ppm Cu. Prior work includes 9 historical mineralized exploration holes totaling 2,552 meters, previously drilled by Anglo American. Aura intends to undertake exploration activities to test the continuity and economic grades of the target with 8,000 meters of drilling planned for 2023, drilling which is expected to commence in the second semester and which results are expected by early 2024.

Figure 16. Serra da Estrela Project map. https://www.globenewswire.com/NewsRoom/AttachmentNg/1855e514-4d32-4283-bd75-cb670e81e174

Quality Assurance and Quality Control

Aura incorporates a rigorous Quality Assurance and Quality Control (“QA/QC”) program for all of its three mines and exploration projects which conforms to industry best practices as outlined by NI 43-101.

For a complete description of Aura’s sample preparation, analytical methods and QA/QC procedures, please refer to 2023 AIF and the applicable Technical Reports, copies of which is available on the Company’s SEDAR profile at www.sedar.com.

Qualified Person

The scientific and technical information contained in this press release has been reviewed and approved by Farshid Ghazanfari, P.Geo., Geology and Mineral Resources Manager, an employee of Aura and a “qualified person” within the meaning of NI 43-101.

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production company focused on the development and operation of gold and base metal projects in the Americas. The Company’s producing assets include the San Andres gold mine in Honduras, the EPP gold mine in Brazil and the Aranzazu copper-gold-silver mine in Mexico. In addition, the Company has the Tolda Fria gold project in Colombia and five projects in Brazil, of which four gold projects: Almas, which is under final phase of construction; Borborema and Matupá, which are in development; and São Francisco, which is on care and maintenance. The Company also owns the Serra da Estrela copper project in Brazil, Carajás region, under exploration stage.

For further information, please visit Aura’s website at www.auraminerals.com or contact:

Rodrigo Barbosa

President & CEO

305-239-9332

Caution Regarding Forward-Looking Information and Statements

This press release contains “forward-looking information” and “forward-looking statements”, as defined in applicable securities laws (collectively, “forward-looking statements”) which include, without limitation, the Company’s intended exploration activities for 2023 and potential results therefrom; expected production from, and the further potential of the Company’s properties; the ability of the Company to achieve its longer-term outlook and the anticipated timing and results thereof; the ability to lower costs and increase production; the economic viability of a project; strategic plans, including the Company’s plans with respect to its properties; amounts of mineral reserves and mineral resources; the amount of future production over any period; and capital expenditure and mine production costs.

Known and unknown risks, uncertainties and other factors, many of which are beyond the Company’s ability to predict or control, could cause actual results to differ materially from those contained in the forward-looking statements if such risks, uncertainties or factors materialize. The Company has made numerous assumptions with respect to forward-looking information contain herein, including among other things, assumptions from the Technical Reports, which may include assumptions on indicated mineral resources, measured mineral resources, probable mineral reserves and/or proven mineral reserves, which could also cause actual results to differ materially from those contained in the forward-looking statements if such assumptions prove wrong. Specific reference is made to the most recent AIF on file with certain Canadian provincial securities regulatory authorities and the Technical Reports for a discussion of some of the risk factors underlying forward-looking statements, which include, without limitation the ability of the Company to achieve its longer-term outlook and the anticipated timing and results thereof, the ability to lower costs and increase production, the ability of the Company to successfully achieve business objectives, copper and gold or certain other commodity price volatility, changes in debt and equity markets, the uncertainties involved in interpreting geological data, increases in costs, environmental compliance and changes in environmental legislation and regulation, interest rate and exchange rate fluctuations, general economic conditions and other risks involved in the mineral exploration and development industry. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements.

All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

Caution Regarding Mineral Resource and Mineral Reserve Estimates

The figures for mineral resources and reserves contained herein are estimates only and no assurance can be given that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that the mineral resources and reserves could be mined or processed profitably. Actual reserves, if any, may not conform to geological, metallurgical or other expectations, and the volume and grade of ore recovered may be below the estimated levels. There are numerous uncertainties inherent in estimating mineral resources and reserves, including many factors beyond the Company’s control. Such estimation is a subjective process, and the accuracy of any reserve or resource estimate is a function of the quantity and quality of available data and of the assumptions made and judgments used in engineering and geological interpretation. Short-term operating factors relating to the mineral resources and reserves, such as the need for orderly development of the ore bodies or the processing of new or different ore grades, may cause the mining operation to be unprofitable in any particular accounting period. In addition, there can be no assurance that metal recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production. Lower market prices, increased production costs, the presence of deleterious elements, reduced recovery rates and other factors may result in revision of its resource and reserve estimates from time to time or may render the Company’s resources and reserves uneconomic to exploit. Resource and reserve data is not indicative of future results of operations. If the Company’s actual mineral resources and reserves are less than current estimates or if the Company fails to develop its resource base through the realization of identified mineralized potential, its results of operations or financial condition may be materially and adversely affected.

_____________________________

1 Gold equivalent ounces, or GEO, is calculated by converting the production of silver, copper and gold into gold using a ratio of the prices of these metals to that of gold. The prices used to determine the gold equivalent ounces are based on the weighted average price of gold, silver and copper realized from sales at the Aranzazu Complex during the relevant period.