Avino Reports Oxide Tailings Project Prefeasibility Study With After-Tax NPV of US$61 Million and 26% IRR

VANCOUVER, BC / ACCESSWIRE / February 5, 2024 / Avino Silver & Gold Mines Ltd. (TSX:ASM)(NYSE American:ASM)(FSE:GV6) is pleased to report the results of the Preliminary Feasibility Study (the "PFS") prepared in accordance with National Instrument 43-101 - Standards for Disclosure for Mineral Projects ("NI 43-101") for its Oxide Tailings Project (the "OTP" or the "Project") at the Company's Avino Mine Operations located near Durango in west-central Mexico (the "Property"). The work that was completed as the basis for the PFS was managed by Tetra Tech Canada Inc. of Vancouver, BC.

Highlights include:

- NPV US$98 million (pre-tax) and US$61 million (post-tax) at a 5% discount rate.

- IRR 35% (pre-tax) and 26% (post-tax).

- Payback Period 2.9 years (pre-tax) and 3.5 years (post-tax).

- Initial Capital Cost: US$49.1 million, including a complete on-site tailing leaching plant for silver and gold extraction and a contingency provision in the amount of US$5.3 million. The ongoing sustaining capital cost is US$5.1 million.

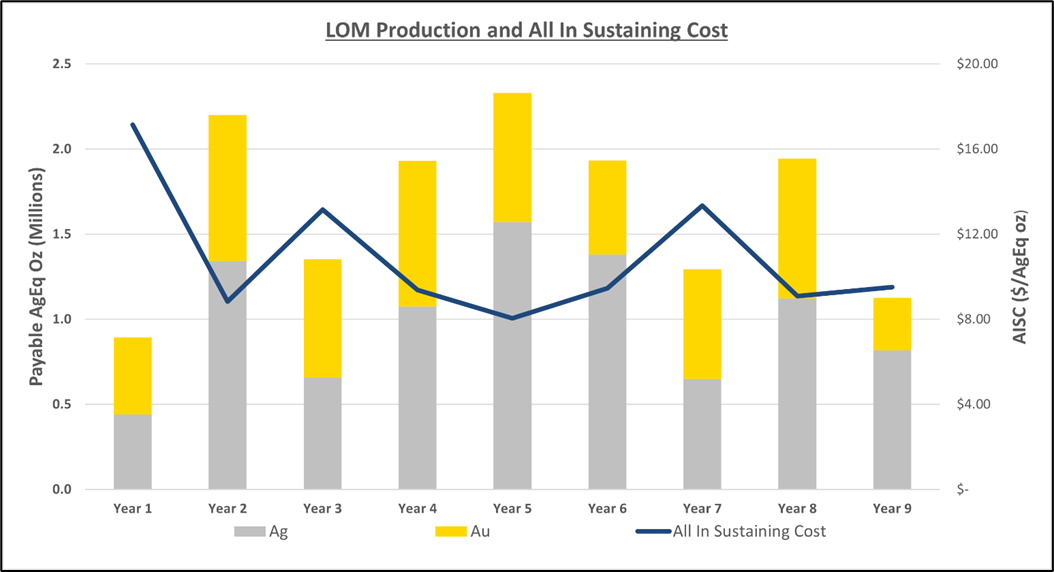

- LOM Average Production Unit Cost: On-site Operating Costs (OOC) and All-In Sustaining Cost (AISC) of US$9.71 and US $10.23 per tr oz silver equivalent, respectively.

- Proven and probable mineral reserves of 6.70 Million tonnes at a silver and gold grade of 55 g/t and 0.47 g/t respectively.

- Nominal Processing Rate over a 9-year LOM: 2,250 tonnes per day or 821,250 tonnes per year, with a 92% plant availability.

- Metal Recoveries: 77.2% Ag and 74.9% Au.

- Doré Production: Total 9,073,000 oz Ag and 76,000 oz Au, life-of-project (averaging 1,008,000 oz Ag and 8,445 oz Au per year).

- Direct Employment: 121 employees, with additional job positions related to indirect employment and contracted services.

- Ease of Construction and Operation: The Project is located within the existing Avino Mine operations. Site infrastructure such as power, water, and road network are well established.

- Elimination of risks associated with the conventional tailings design: A secondary Dry Stack Tailings Management Facility will comprise dewatered tailings being stored in a geotechnically stable impoundment.

- Elimination of risks associated with the heap leach design, which is replaced with a conventional tank leach design with a compact footprint. The process plant containment areas and berms on site will provide an additional layer of safety.

- The Project will generate US$52.4 million in tax contributions to the local economy and government.

The PFS will be filed on SEDAR+ (www.sedarplus.ca) under the Company's profile and filed on Form 6-K with the U.S. Securities and Exchange Commission within 45 days of this release. All currency values are presented in US$ unless otherwise specified.

"The completion of the PFS is a key milestone in Avino's path to transformational growth, said David Wolfin, President & CEO of Avino. "The economics of our oxide tailings project combined with the relatively low capital requirements has the potential to significantly enhance the current Avino operation and grow cashflow."

Peter Latta, VP Technical Services of Avino commented, "For the first time in Avino's lengthy history, we are proud to demonstrate Proven and Probable Mineral Reserves. We have taken a dynamic leaching approach to the tailings reprocessing to improve overall recoveries and mitigate the potential recovery variability compared with heap leaching. We have selected, in this design, a simple, conventional flowsheet to keep capital costs low and allow for a faster and simpler build if and when a construction decision is made."

The most notable improvement in the PFS financial results compared to the 2017 PEA is the 100% increase in Net Present Value (NPV) to US$98 million from US$49 million on a pre-tax basis. Other PFS highlights of significance include strong project economics, long mine life, minimal payback period, and exceptional ESG and tax contributions to the local economy.

Table 1 -Comparison to Previous Study

| Financials | Unit | 2024 PFS | 2017 PEA |

| NPV (pre-tax) | US$ million | 98 | 49 |

| NPV (post-tax) | US$ million | 61 | 28 |

| IRR (pre-tax) | % | 35 | 48 |

| IRR (post-tax) | % | 26 | 32 |

| Payback (pre-tax) | Years | 2.9 | 2.0 |

| Payback (post-tax) | Years | 3.5 | 2.6 |

| Project Life | Years | 9 | 7 |

| LOM Mill Feed | Million Tonnes | 6.7 | 3.1 |

| LOM Silver Production | tr oz | 9,073,000 | 6,173,000 |

| LOM Gold Production | tr oz | 76,000 | 33,000 |

| Processing Rate | Tpd | 2,250 | 1,370 |

| LOM Silver Recovery | % | 77 | 79 |

| LOM Gold Recovery | % | 75 | 73 |

| Initial CapEx | US$ million | 49.1 | 24.4 |

| Sustaining CapEx | US$ million | 5.1 | 4.4 |

| Onsite Operating Cost | US$/tr oz AgEq | 9.71 | 5.56 |

| All-In Sustaining Cost | US$/tr oz AgEq | 10.41 | 6.08 |

The 2024 PFS features improvements in comparison to the PEA that was completed in 2017. The life of the project has increased by 2 years, the silver production has increased almost 3 million ounces, and the gold production has more than doubled. The PFS includes processing rates of 2,250 tpd and an increase of 880 tpd.

Economic Analysis and Sensitivity Analysis

The economic analysis is based on the PFS mineral reserve estimate totalling 6.7 million tonnes of Proven and Probable Mineral Reserves at an average grade of 54.46 g/t Ag and 0.47 g/t Au. This reserve is adequate to allow for a 9-year project life, based on current tailings recovery assumptions including a processing rate of 2,250 tonnes per day. Metal recoveries are expected to average 77.2% and 74.9% for silver and gold, respectively.

The gold and silver prices for the financial analysis are based on 3-year trailing averages on Nov 7, 2023, as below:

- Silver price: US23.45/tr. oz

- Gold Price: US$1,839.51/tr. oz.

The exchange rate for US$ to MXN$ used for the project is 1.00:18.15.

These assumptions, together with capital cost and operating cost estimates noted above, result in a pre- tax NPV, at a 5% discount rate of $98M ($61M post-tax). The pre-tax payback period for the project is 2.9 years from the start of production (3.5 years post-tax). The project generates a pre-tax IRR of 35% (26% post-tax).

Figure 1: LOM Production and All In Sustaining Cost

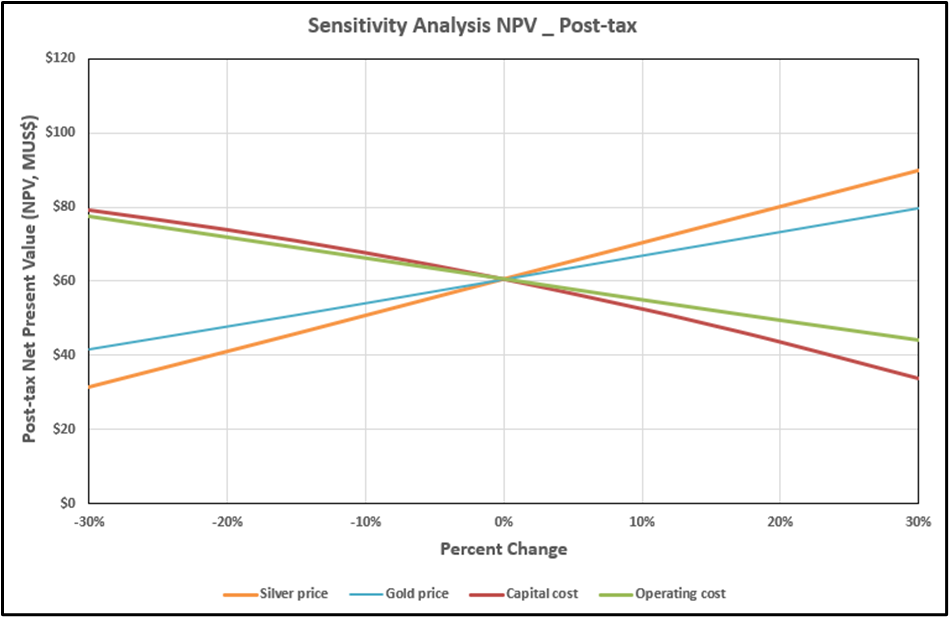

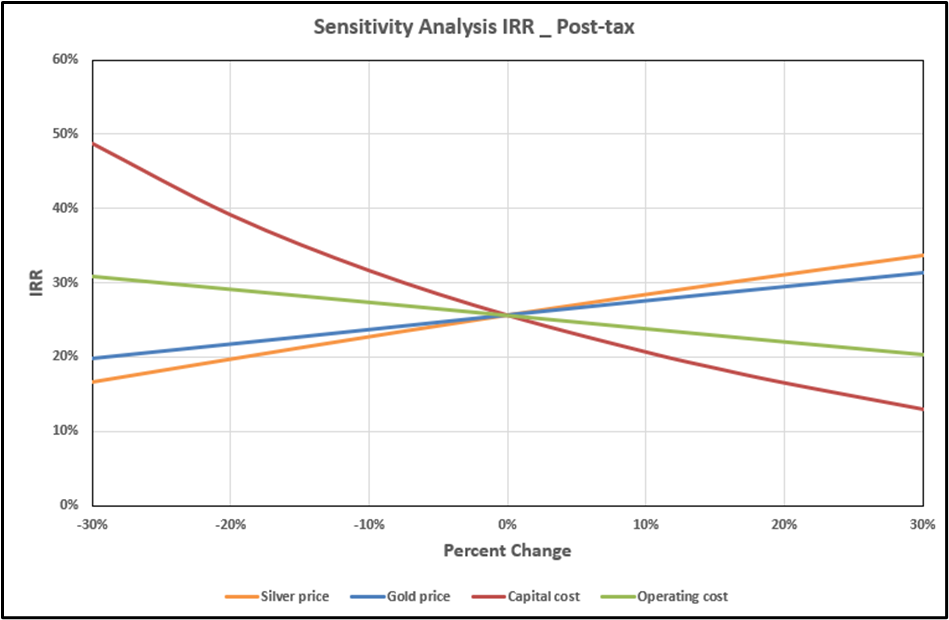

A sensitivity analysis was performed to test the impact of changes to several key assumptions included in the economic model, with the results shown in following Figures and Table:

Figure 2: NPV (5%) Sensitivity (Post-Tax)

Figure 3: IRR Sensitivity (Post-Tax)

Table 2: Post-Tax Financial Result Summary

| Metrics | Gold Price | Silver Price | Undiscounted Cashflow | NPV @ 5% | IRR | Payback Years |

| Unit | US$/tr. oz | US$/tr. oz | M US$ | M US$ | % | Year |

| Base Case | 1,839.51 | 23.45 | 100.3 | 60.6 | 25.6 | 3.5 |

| +30% Case - Silver Price | 1,839.51 | 30.49 | 141.5 | 90.0 | 33.7 | 2.8 |

| +30% Case - Gold Price | 2,391.36 | 23.45 | 126.7 | 79.8 | 31.4 | 3.0 |

| -30% Case - Silver Price | 1,839.51 | 16.42 | 59.3 | 31.3 | 16.7 | 4.3 |

| -30% Case - Gold Price | 1,287.66 | 23.45 | 74.2 | 41.7 | 19.8 | 4.1 |

| Spot Price* | 2,055.65 | 23.06 | 108.4 | 66.5 | 27.5 | 3.3 |

* PM Trading on Date of January 12, 2024

Avino Oxide Tailings Project Mineral Reserves

The Mineral Reserves were estimated using both oxide and sulphide tailings and are based on Measured and Indicated Resources only. The pit design used for the estimation was at the PFS level. The ultimate pit limit was determined by the Lerchs-Grossman optimizer in Datamine™, with consideration of economic parameters and physical constraints such as pit road widths, mining bench width, and face angles for the recommended mining equipment. The Proven and Probable Mineral Reserves are given below.

Table 3: Mineral Reserve Statement of the Avino Oxide Tailings Project (Effective Date: January 16, 2024)

| Category | Quantity (million tonnes) | Average Ag Grade (g/t) | Average Au Grade (g/t) | Contained Ag Metal (million tr. oz) | Contained Au Metal (thousand tr. oz) |

| Proven | 4.27 | 61 | 0.47 | 8.37 | 65.01 |

| Probable | 2.43 | 43 | 0.47 | 3.38 | 36.53 |

| Total | 6.70 | 55 | 0.47 | 11.75 | 101.54 |

Notes:

- The effective date of the Mineral Reserve estimate is January 16, 2024. The QP for the estimate is Mr. Jay Li, P.Eng. of Tetra Tech.

- The Mineral Reserve estimates were prepared with reference to the 2014 Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards (2014 CIM Definition Standards) and the 2019 CIM Best Practice Guidelines.

- Reserves estimated assuming open pit mining methods.

- Reserves are reported on a dry in-situ basis.

- Reserves are based on a gold price of US $1850/tr oz., and silver price of US $22/tr oz, mining cost of US$1.00/t mined, milling costs of US$18.00/t feed, and G&A cost of US$3.00/t feed.

- Mineral Reserves include consideration for 1% mining dilution and 99% mining recovery.

- Ore-waste cut-off was based on US$21.00/t of NSR.

Mineral Resources

The PFS uses the latest updated mineral resource estimate that is based on US$1,800 per ounce gold, US$21.00 per ounce silver, and US$3.50 per pound copper. In addition, the resources are constrained by conceptual mining shapes. Measured and Indicated Mineral Resources at the Property are estimated at 34.7 million tonnes grading 63 grams per tonne silver, 0.54 grams per tonne gold, and 0.39% copper (70 million ounces of silver, 597 thousand ounces of gold, and 301 million pounds of copper). An additional 19.3 million tonnes are estimated in the Inferred Mineral Resource category grading 46 grams per tonne silver, 0.34 grams per tonne gold, and 0.37% copper (28.4 million ounces of silver, 213 thousand ounces of gold, and 159 million pounds of copper).

The mineral resources of the tailings deposit have been updated during 2023 in accordance with revised topographic data.

For information, the inclusive mineral resources (inclusive of mineral reserves) for the Avino Mine area (not including La Preciosa) are summarized in Table 2.

Table 4: Avino Mine Area - Mineral Resources (inclusive of Mineral Reserves, Effective Date: October 16, 2023)

Area/ Zone | Category | Mass (Mt) | Average Grade | Metal Content | ||||||

| AgEQ (g/t) | Ag (g/t) | Au (g/t) | Cu (%) | AgEQ | Ag | Au | Cu | |||

| (million tr oz) | (million tr oz) | (thousand tr oz) | (million lb) | |||||||

| ET Avino | MEA | 3.88 | 171 | 69 | 0.53 | 0.57 | 21.39 | 8.58 | 67 | 48.91 |

| IND | 23.92 | 146 | 58 | 0.53 | 0.44 | 112.41 | 44.59 | 409 | 234.08 | |

| M&I | 27.80 | 150 | 60 | 0.53 | 0.46 | 133.8 | 53.17 | 476 | 283 | |

| INF | 17.59 | 106 | 37 | 0.34 | 0.4 | 59.76 | 20.72 | 191 | 154.18 | |

| San Gonzalo | MEA | 0.33 | 332 | 244 | 1.17 | 0 | 3.53 | 2.59 | 12.42 | 0 |

| IND | 0.30 | 293 | 230 | 0.84 | 0 | 2.85 | 2.23 | 8.14 | 0 | |

| M&I | 0.63 | 313 | 237 | 1.01 | 0 | 6.38 | 4.83 | 20.56 | 0 | |

| INF | 0.25 | 297 | 271 | 0.35 | 0 | 2.35 | 2.14 | 2.74 | 0 | |

| Guadalupe | MEA | 0.00 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| IND | 0.40 | 169 | 70 | 0.79 | 0.37 | 2.17 | 0.9 | 10.24 | 3.27 | |

| M&I | 0.40 | 169 | 70 | 0.79 | 0.37 | 2.17 | 0.9 | 10.24 | 3.27 | |

| INF | 0.35 | 159 | 82 | 0.62 | 0.3 | 1.81 | 0.93 | 7 | 2.3 | |

| La Potosina | MEA | 0.00 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| IND | 0.14 | 220 | 186 | 0.41 | 0.04 | 1 | 0.85 | 1.85 | 0.13 | |

| M&I | 0.14 | 220 | 186 | 0.41 | 0.04 | 1 | 0.85 | 1.85 | 0.13 | |

| INF | 0.84 | 176 | 149 | 0.29 | 0.05 | 4.79 | 4.05 | 7.9 | 1.01 | |

| Tailings Deposit | MEA | 4.25 | 101 | 61 | 0.47 | 0.12 | 13.83 | 8.35 | 64.84 | 11.33 |

| IND | 2.44 | 83 | 43 | 0.47 | 0.12 | 6.51 | 3.40 | 36.67 | 6.21 | |

| M&I | 6.70 | 94 | 55 | 0.47 | 0.12 | 20.34 | 11.75 | 101.50 | 17.55 | |

| INF | 0.34 | 97 | 65 | 0.36 | 0.11 | 1.06 | 0.70 | 3.95 | 0.82 | |

| TOTALS | MEA | 8.47 | 142.35 | 71.72 | 0.53 | 0.32 | 38.75 | 19.52 | 144.26 | 60.24 |

| IND | 27.20 | 142.85 | 59.42 | 0.53 | 0.41 | 124.94 | 51.97 | 465.90 | 243.69 | |

| M&I | 35.67 | 142.73 | 62.35 | 0.53 | 0.39 | 163.69 | 71.50 | 610.15 | 303.95 | |

| INF | 19.37 | 112.02 | 45.83 | 0.34 | 0.37 | 69.77 | 28.54 | 212.59 | 158.31 | |

Notes:

- Figures may not add to totals shown due to rounding.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The Mineral Resource estimate is classified in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves incorporated by reference into NI 43-101 Standards of Disclosure for Mineral Projects.

- Mineral Resources are stated inclusive of Mineral Reserves.

- Based on recent mining costs provided by Tetra Tech, Mineral Resources are reported at cut-off grades 60 g/t, 130 g/t, and 50 g/t AgEQ grade for ET, San Gonzalo, and oxide tailings, respectively.

- AgEQ or silver equivalent ounces are notational, based on the combined value of metals expressed as silver ounces.

- Metal price assumptions are US$21/tr.oz. Ag; US$1800/tr.oz. Au.

- Metal recovery is based on operational results and column testing, 82% Ag and 78% Au, respectively.

- The silver equivalent for the mineral resources was back-calculated using the following formulae:

- ET, Guadalupe, La Potosina: AgEq = Ag (g/t) + 71.43 * Au (g/t) + 113.04 * Cu (%)

- San Gonzalo: Ag Eq = Ag (g/t) + 75.39 * Au (g/t)

- Oxide Tailings: Ag Eq = Ag (g/t) + 81.53 * Au (g/t)

The current mineral resources for the entire Property (Avino and La Preciosa areas) are summarized below.

Table 5: Avino Property (including La Preciosa area) - Mineral Resources (inclusive of Oxide Tailings Mineral Reserves, Effective Date: October 16, 2023)

Area | Category | Mass (Mt) | Average Grade | Metal Content | ||||||

AgEQ (g/t) | Ag (g/t) | Au (g/t) | Cu (%) | AgEQ | Ag | Au | Cu | |||

(million | (million | (thousand tr oz) | (million lb) | |||||||

Avino Mine | MEA | 8.466 | 142.35 | 71.72 | 0.53 | 0.32 | 38.75 | 19.52 | 144.26 | 60.24 |

IND | 27.204 | 142.85 | 59.42 | 0.53 | 0.41 | 124.94 | 51.97 | 465.90 | 243.69 | |

M&I | 35.671 | 142.73 | 62.35 | 0.53 | 0.39 | 163.69 | 71.50 | 610.15 | 303.95 | |

INF | 19.373 | 112.02 | 45.83 | 0.34 | 0.37 | 69.77 | 28.54 | 212.59 | 158.31 | |

La Preciosa | MEA | - | - | - | - | - | - | - | - | - |

IND | 17.441 | 202 | 176 | 0.34 | - | 113.14 | 98.59 | 189.19 | - | |

M&I | 17.441 | 202 | 176 | 0.34 | - | 113.14 | 98.59 | 189.19 | - | |

INF | 4.397 | 170 | 151 | 0.25 | - | 24.1 | 21.33 | 35.48 | - | |

TOTALS | MEA | 8.466 | 142.35 | 71.72 | 0.53 | 0.32 | 38.75 | 19.52 | 144.26 | 60.24 |

IND | 44.645 | 165.87 | 104.89 | 0.46 | 0.25 | 238.08 | 150.56 | 655.09 | 243.69 | |

M&I | 53.111 | 162.12 | 99.61 | 0.47 | 0.26 | 276.83 | 170.08 | 799.34 | 303.95 | |

INF | 23.770 | 122.83 | 65.26 | 0.32 | 0.30 | 93.87 | 49.87 | 248.07 | 158.31 | |

Notes: As per Table 4

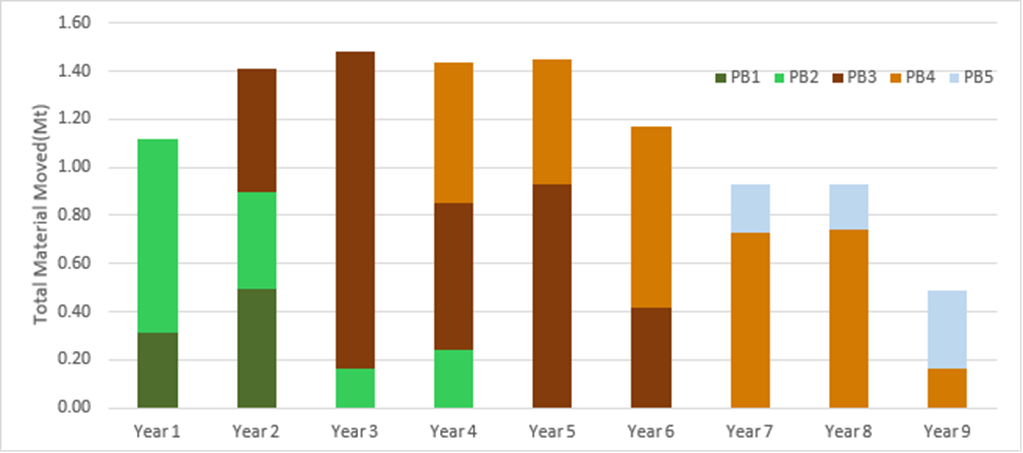

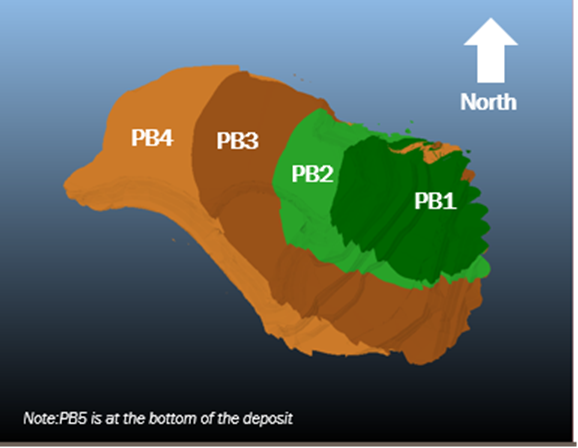

Avino Oxide Tailings Project Mine Plan

The Avino oxide tailings deposit will be extracted using conventional surface mining techniques with excavator, wheel loader, and existing contractor truck fleet on site. Five cashflow-positive mining pushbacks or phases were designed to allow for operational flexibility while stripping the overburden and targeting high-grade material. The rate of mining (total material) by pushback is shown in the figure below.

Note: PB = Pushback

Figure 4 and 4A: Avino Oxide Tailings Deposit Mine Plan (Tetra Tech, 2024)

Figure 4A

The mine life of the tailings deposit is expected to be approximately 9 years. The mining rate will ramp up to 1.4Mt in years 2 to 5 to accommodate a high strip ratio to remove most of the overburden and will start to ramp down in later years as the strip ratio decreases. Over the life of the mine, saturated ground condition is expected as the mining benches are advanced deeper. Numerous practical approaches were considered to address mining equipment trafficability challenges and reduce risks from geotechnical stability. Waste material or overburden material will be placed in dedicated facilities located near the mine.

Existing Infrastructure at Avino Mine

The Avino mine is currently in operation. A well-established network of internal access roads exists at the Property. The primary internal access roads are used for hauling supplies and heavy equipment access while the secondary internal access roads are used by lighter vehicles for other operational activities. The OTP only requires minor extension of the existing road network. The existing power supply infrastructure has a 3MW capacity which is sufficient to provide the power source required for OTP. Other utilities such as water and waste management are available at the Avino mine and can be provided to OTP by extending the existing utility systems to OTP area.

General Arrangement

The OTP process equipment and buildings, dry stack TMF, and utilities are located within proximity of the existing Avino Mine operation. Most utilities such as power and water pipelines can be extended from the current operations to the OTP area. The OTP process plant and infrastructure will be located on an existing terrace currently occupied by a core storage and guest houses. The site preparation and earthworks required to prepare the OTP site will be minimal. The OTP process plant is conveniently located above the dry stack TMF. The tailings discharge conveyors from the OTP process plant to dry stack TMF follow the downhill terrain can potentially generate supplemental electricity for the OTP operation.

The Proposed Processing Plan

The proposed processing flow sheet consists of:

- Leach feed preparation by trommel screen repulping and thickening,

- 2 stage cyanide leaching of the repulped tailings,

- Countercurrent decantation (CCD) washing and pre-clarification of the pregnant leach solution (PLS),

- De-aeration and gold and silver precipitation using the zinc powder (Merrill-Crowe process),

- Gold and silver precipitate melting to produce doré,

- Cyanide destruction of leach residual tailings,

- Leach residue filtration and deposition to the lined dry stack tailings facility.

Based on the test results, the proposed process and mine plan, the LOM average gold and silver recoveries to doré were projected to be 77.2% for silver and 74.9% for gold.

Capital Cost Estimate

Initial capital cost (including contingency of US$5.3 million) is estimated at US$49.1 million. Initial capital costs include all costs required to bring the facility to production. The ongoing sustaining capital costs are estimated to be US$5.1 million over the 9-year project life.

Table 6: Project Initial Capital Cost Summary

Description | Cost (Million $) |

Site Preparation, Excavations & Demolition | 0.2 |

Mining (Oxide Tailings Reclaim) | 0.5 |

Processing Plant | 26.8 |

TMF and Water Management | 3.3 |

Site Services and Utilities | 4.6 |

| Total Direct Initial Capital Cost | 35.3 |

| Indirect Initial Capital Costs | 7.8 |

| Owner's Cost | 0.7 |

| Contingency | 5.3 |

| Total Initial Capital Cost | 49.1 |

*Sum may not add due to rounding

Operating Cost Estimate

Average mine, process and G&A operating costs over the project's life (including waste mining and on-site power, excluding off-site shipping and smelting costs) are estimated at US$21.34 per tonne processed, including a 5% contingency.

Table 7: Project Operating Cost Summary

Category | US$/t Processed |

|---|---|

| Mining | 2.41 |

| Processing | 15.31 |

| G&A - Onsite (including Site Services) | 3.31 |

| Tailings Management | 0.32 |

| Total Operating Cost (Per Tonne Processed)* | 21.34 |

*Sum may not add due to rounding

Qualified Person(s)

The Qualified Persons as defined by NI 43-101, who are responsible for the technical content of this news release are:

- Hassan Ghaffari, P.Eng., M.A.Sc., Director of Metallurgy, Tetra Tech Canada Inc.

- Michael F. O'Brien, P.Geo., M.Sc., Pr.Scit.Nat., FAusIMM, FSAIMM, Principal Consultant, Red Pennant Communications Corp.

- Jianhui (John) Huang, P.Eng., PhD, Senior Process Engineer, Tetra Tech Canada Inc.

- Jay Li, P.Eng., Senior Mining Engineer, Tetra Tech Canada Inc.

- Peter Latta, P.Eng, MBA, VP Technical Services, Avino who is a qualified person within the context of National Instrument 43-101 has reviewed and approved the technical data in this news release.

C-Suite Webinar

In addition, the Company will be holding a C-Suite Webinar to discuss the Prefeasibility Study for its Oxide Tailings Project on Tuesday, February 6, 2024, at 09:00 am PST (12:00 pm EST). Shareholders, analysts, investors, and media are invited to join the Webinar. To participate in the webinar, register using the meeting link below:

Avino Reports Oxide Tailings Project Prefeasibility Study

When prompted, please allow the application access to use your speakers and microphone. You will be joined to the meeting with your microphone muted.

Alternatively, if you wish to connect by telephone, dial Canada/USA Toll Free: 1-844-763-8274 or International Toll: +1-647-484-8814 and ask to be joined to the Avino conference call.

About Avino

Avino is a silver producer from its wholly owned Avino Mine near Durango, Mexico. The Company's silver, gold and copper production remains unhedged. The Company's mission and strategy is to create shareholder value through its focus on profitable organic growth at the historic Avino Property and the strategic acquisition of the adjacent La Preciosa which was finalized in Q1 2022. Avino currently controls mineral resources, as per NI 43-101, with a total mineral content of 368 million silver equivalent ounces, within our district-scale land package. We are committed to managing all business activities in a safe, environmentally responsible, and cost-effective manner, while contributing to the well-being of the communities in which we operate. We encourage you to connect with us on X (formerly Twitter) at @Avino_ASM and on LinkedIn at Avino Silver & Gold Mines. To view the Avino Mine VRIFY tour, please click here.

For Further Information, Please Contact:

Investor Relations

Tel: 604-682-3701

Email: IR@avino.com

Cautionary note to U.S. Investors concerning estimates of Mineral Reserves and Mineral Resources

All reserve and resource estimates reported by Avino were estimated in accordance with the Canadian National Instrument 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards. The U.S. Securities and Exchange Commission ("SEC") now recognizes estimates of "measured mineral resources," "indicated mineral resources" and "inferred mineral resources" and uses new definitions of "proven mineral reserves" and "probable mineral reserves" that are substantially similar to the corresponding CIM Definition Standards. However, the CIM Definition Standards differ from the requirements applicable to US domestic issuers. US investors are cautioned not to assume that any "measured mineral resources," "indicated mineral resources," or "inferred mineral resources" that the Issuer reports are or will be economically or legally mineable. Further, "inferred mineral resources" are that part of a mineral resource for which quantity and grade are estimated on the basis of limited geologic evidence and sampling. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

This news release contains "forward-looking information" and "forward-looking statements" (together, the "forward looking statements") within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the mineral resource estimate for the Company's Avino Property, including La Preciosa, located near Durango in west-central Mexico (the "Avino Property") with an effective date of November 30, 2022, prepared for the Company, and references to Measured, Indicated, Inferred Resources dated October 16, 2023 as well as the Prefeasibility Study dated January 16, 2024 and references to Measured, Indicated Resources, and Proven and Probable Mineral Reserves referred to in this press release. This information and these statements, referred to herein as "forward-looking statements" are made as of the date of this document. Forward-looking statements relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) the estimated amount and grade of mineral reserves and mineral resources, including the cut-off grade; (ii) estimates of the capital costs of constructing mine facilities and bringing a mine into production, of operating the mine, of sustaining capital, of strip ratios and the duration of financing payback periods; (iii) the estimated amount of future production, both ore processed and metal recovered and recovery rates; (iv) estimates of operating costs, life of mine costs, net cash flow, net present value (NPV) and economic returns from an operating mine; and (v) the completion of the full Technical Report, including a Preliminary Economic Assessment, and its timing. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as "expects", "anticipates", "plans", "projects", "estimates", "envisages", "assumes", "intends", "strategy", "goals", "objectives" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements.

No assurance can be given that the Company's Avino Property, the La Preciosa Property, or the Oxide Tailings Project has the amount of mineral resources or mineral reserves indicated in their reports or that such mineral resources and mineral reserves may be economically extracted. Such factors and assumptions include, among others, the effects of general economic conditions, the price of gold, silver and copper, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations and misjudgments in the course of preparing forward-looking information. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; volatility in the global financial markets; fluctuations in metal prices; title matters; uncertainties and risks related to carrying on business in foreign countries; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain of our officers, directors or promoters with certain other projects; the absence of dividends; currency fluctuations; competition; dilution; the volatility of the our common share price and volume; tax consequences to U.S. investors; and other risks and uncertainties. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. For more detailed information regarding the Company including its risk factors, investors are directed to the Company's Annual Report on Form 40-F and other periodic reports that it files with the U.S. Securities and Exchange Commission.

SOURCE: Avino Silver & Gold Mines Ltd.

View the original press release on accesswire.com