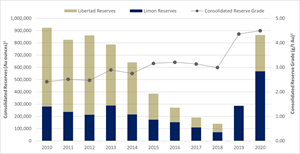

Calibre Increases Mineral Reserves by Over 200% to 864,000 ounces of Gold

VANCOUVER, British Columbia, March 29, 2021 (GLOBE NEWSWIRE) -- Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF) (the "Company" or "Calibre") is pleased to announce the results of the Company’s updated Mineral Reserves and Mineral Resources at our El Limon and La Libertad mining complexes in Nicaragua as of December 31, 2020. Calibre’s 202% increase in Mineral Reserves supports a strong foundation for a multi-year “Hub-and-Spoke” production and growth strategy. With the largest Mineral Reserve base in the last 10 years, and the highest reserve grade on record, we have increased confidence in our ability to generate strong cash flow providing a platform to fund organic growth.

100% Owned Mineral Reserves and Mineral Resources highlights:

- 202% increase in Mineral Reserves to 864,000 ounces since year-end 2019 and after 2020 depletion;

- Largest Mineral Reserve since 2010 with the highest grade on record, 4.49 g/t Au;

- 296,000 ounce increase in Libertad Mineral Reserves, from zero at year-end 2019;

- 137% increase in Limon Open Pit Mineral Reserves after depletion;

- Total Indicated Mineral Resources of 1,532,000 ounces;

- Total Inferred Mineral Resources of 1,314,000 ounces;

- New discoveries at Atravesada and Panteon during 2020; and

- 60,000 metre, exploration and resource growth drilling program underway.

Darren Hall, President and CEO, stated: “Our investment in exploration in 2020 has resulted in the largest Mineral Reserve since 2010 and the highest reserve grade of 4.49 g/t Au on record which provides an excellent foundation for future growth. I am very pleased with how the team has integrated our assets utilizing our ‘Hub and Spoke’ operating model and positively exceeded production and cost guidance in our first full year of operation.”

“These assets have produced over 5 million ounces and yet during 2020 we discovered two new zones at Limon demonstrating the continued upside discovery potential from this long lived and prolific epithermal gold district. With the largest Mineral Reserve base in a decade and a 60,000-metre discovery and resource expansion drilling program underway, Calibre is well positioned to execute and expand our multi-year ‘Hub-and-Spoke’ operating model including advancing satellite sources like our Eastern Borosi Project in northeastern Nicaragua.”

An infographic accompanying this announcement is available at: https://www.globenewswire.com/NewsRoom/AttachmentNg/3cf60ac8-f8c5-4ecd-9e73-c42163dd5120

Priority Resource Expansion Opportunities:

- Expansion potential at the Limon underground deposits including Veta Nueva, Atravesada and Panteon;

- Expansion potential along strike and down plunge of the Limon open pits;

- Good potential within the Pavon mineral concessions for new discoveries and resource expansion; and

- 60,000 metre drilling program underway at Limon, Libertad, Eastern Borosi and Pavon.

Mineral Reserves at Limon and Libertad – December 31, 20202,3

| Category | Tonnage | Grade | Grade | Contained Au | Contained Ag | |

| (kt) | (g/t Au) | (g/t Ag) | (koz) | (koz) | ||

| Limon UG | Probable | 617 | 5.14 | 8.25 | 102 | 164 |

| Limon OP | Probable | 3,389 | 4.24 | 1.22 | 462 | 133 |

| Limon Stockpile | Probable | 29 | 3.82 | 0 | 4 | 0 |

| Sub-total Limon | Probable | 4,036 | 4.38 | 2.29 | 568 | 297 |

| Libertad UG | Probable | 477 | 3.92 | 20.00 | 60 | 307 |

| Libertad OP Sources | Probable | 1,420 | 4.80 | 11.29 | 219 | 515 |

| Libertad Stockpile | Probable | 55 | 9.30 | 0 | 16 | 0 |

| Sub-total Libertad | Probable | 1,952 | 4.71 | 13.08 | 296 | 822 |

| Total Mineral Reserves | Probable | 5,988 | 4.49 | 5.81 | 864 | 1,119 |

Indicated Mineral Resources at Limon and Libertad Inclusive of Mineral Reserves – December 31, 20204,5

| Category | Tonnage | Grade | Grade | Contained Au | Contained Ag | |

| (kt) | (g/t Au) | (g/t Ag) | (koz) | (koz) | ||

| Limon UG | Indicated | 1,475 | 5.46 | 5.40 | 259 | 256 |

| Limon OP | Indicated | 4,393 | 4.45 | 1.57 | 628 | 222 |

| Limon Stockpile | Indicated | 29 | 3.82 | 4 | ||

| Tailings | Indicated | 7,329 | 1.12 | 263 | ||

| Sub-total Limon | Indicated | 13,226 | 2.71 | 1.12 | 1,154 | 478 |

| Libertad UG | Indicated | 421 | 5.72 | 28.15 | 77 | 381 |

| Libertad OP Sources | Indicated | 2,012 | 4.41 | 12.57 | 285 | 813 |

| Libertad Stockpile | Indicated | 55 | 9.30 | 16 | ||

| Sub-total Libertad | Indicated | 2,488 | 4.74 | 14.93 | 378 | 1,194 |

| Total Mineral Resources | Indicated | 15,714 | 3.03 | 3.31 | 1,532 | 1,672 |

Inferred Mineral Resources at Limon, Libertad and Borosi – December 31, 20204,5,6

| Category | Tonnage | Grade | Grade | Contained Au | Contained Ag | |

| (kt) | (g/t Au) | (g/t Ag) | (koz) | (koz) | ||

| Limon UG | Inferred | 1,149 | 5.22 | 3.90 | 193 | 144 |

| Limon OP | Inferred | 260 | 4.07 | 0.84 | 34 | 7 |

| Sub-total Limon | Inferred | 1,409 | 5.01 | 3.33 | 227 | 151 |

| Libertad UG | Inferred | 1,585 | 5.40 | 13.44 | 275 | 685 |

| Libertad OP Sources | Inferred | 1,246 | 2.77 | 5.37 | 111 | 215 |

| Sub-total Libertad | Inferred | 2,831 | 4.24 | 9.89 | 386 | 900 |

| Eastern Borosi | Inferred | 4,418 | 4.93 | 80.00 | 701 | 11,359 |

| Total Mineral Resources | Inferred | 8,658 | 4.72 | 44.58 | 1,314 | 12,410 |

Limon Complex

Limon’s total Mineral Reserves increased 98% since December 31, 2019 to 568,000 ounces of gold, net of 2020 production. This was driven by Mineral Reserves at the Limon open pits increasing by 137% to 462,000 ounces of gold and Mineral Reserves at Limon underground deposits increasing from 91,000 to 102,000 ounces of gold, both net of depletion. Limon open pit Mineral Reserve grade remained flat while Limon underground Mineral Reserve grade increased by 12% to 5.14 g/t Au from 4.60 g/t Au on December 31, 2019. Limon’s underground Mineral Reserve growth was largely driven by two new mineralized shoots at Panteon discovered during the year. Total Mineral Reserve and Resource depletion at Limon during the year amounted to 94,000 ounces with the Limon Central pit being the largest contributor.

Infill drilling during the year upgraded Inferred Mineral Resources into the Indicated Mineral Resource category with total Indicated Mineral Resources growing 46% to 1,154,000 ounces (inclusive of reserves) with grades increasing by 22% from 2.23 g/t Au to 2.71 g/t Au.

The Limon mineral concessions have historically produced over three million ounces and continue delivering reliable production with new opportunities for resource discovery and expansion potential. Having discovered the Panteon ore shoots earlier in 2020, the Company is excited to announce that the December 31, 2020 resource includes an Atravesada maiden Indicated Mineral Resource of 171,000 tonnes grading 6.20 g/t Au containing 34,000 ounces and an Inferred Mineral Resource of 215,000 tonnes grading 6.36 g/t Au containing 44,000 ounces. We expect to grow our Mineral Resources in 2021 with our multi-rig exploration program which continues to focus on high-grade resource extensions at Panteon, Atravesada, Veta Nueva and the Limon open pits.

Libertad Complex

Mineral Reserves at Libertad and Pavon increased from zero on December 31, 2019 to 296,000 ounces of gold at a grade of 4.71 g/t Au, net of 2020 production. Jabali underground added 477,000 tonnes grading 3.92 g/t Au containing 60,000 ounces of Mineral Reserves while Jabali open pits contributed 139,000 tonnes grading 4.25 g/t Au containing 19,000 ounces. As recently announced, Pavon added 200,000 open pit ounces, 1.28 million tonnes grading 4.86 g/t Au (see news release dated March 16, 2021). Pavon will play an integral role in our “Hub-and-Spoke” model over the coming years with the first ore delivered to Libertad in early 2021. The Pavon project represents a newly emerging gold district in Nicaragua in a region that has remained largely underexplored until now. Two diamond drill rigs are currently testing the potential for lateral and vertical extensions to the Pavon Norte and Central vein systems.

Total Indicated Mineral Resources at Libertad and Pavon increased by 18% from 320,000 to 378,000 ounces of gold (inclusive of Reserves) as a portion of Jabali underground and Socorro open pit material was upgraded from Inferred Mineral Resources, partially offsetting depletion at the Jabali Antenna open pit. Stockpiles of high-grade ore purchased from artisanal mining collectives added 55,000 tonnes grading 9.30 g/t Au containing 16,000 ounces.

The Libertad mineral concessions have produced over two million ounces historically. Current exploration drilling is testing near mine targets with potential for additional near surface open pit resources. In addition, our field crews continue to identify new areas of prospective gold mineralization and follow-up drilling on emerging resource growth opportunities at satellite targets such as Amalia located within 35 km of the Libertad mill.

Eastern Borosi Project

Calibre controls a 100% interest in the Eastern Borosi Gold-Silver Property (“EBP”), located in northeastern Nicaragua. The EBP concession block encompasses a past producing district scale system of near surface epithermal gold-silver veins that hosts Inferred Resources totaling 4.4 million tonnes averaging 4.9 g/t Au and 80 g/t Ag containing 700,500 ounces of gold and 11,359,500 of silver6. The project is located approximately 400 km by road from the Company’s Libertad Complex, which has approximately 1.5 million tonnes per annum of surplus processing capacity, providing a low-cost opportunity for organic growth. Calibre’s interest in EBP grew from 30% to 100% during the year, increasing our attributable Inferred ounces over year-end 2019.

Exploration to date at EBP has delineated approximately 20 km of prospective vein structures that occur along three principal northeast trending fault zones. A comprehensive re-interpretation of available exploration data was recently completed to define the broader regional scale controls to mineralization at EBP. This work has resulted in a new targeting framework that our exploration team is incorporating into its plans for a 7,500 metre reconnaissance drilling program which is expected to commence during the second half of 2021.

The Company is actively advancing the EBP satellite to be the next potential “Spoke” providing mill feed to the Libertad processing facility. During 2021, Calibre will complete 7,500 metres of infill, geotechnical and metallurgical drilling to advance EBP to a Pre-Feasibility Study with results expected by this time next year.

Quality Assurance/Quality Control

Calibre maintains a Quality Assurance/Quality Control ("QA/QC") program for all its exploration projects using industry best practices. Key elements of the QA/QC program include verifiable chain of custody for samples, regular insertion of certified reference standards and blanks, and duplicate check assays. Drill core is halved and shipped in sealed bags to Bureau Veritas in Managua, Nicaragua, an independent analytical services provider with global certifications for Quality Management Systems ISO 9001:2008, Environmental Management: ISO14001 and Safety Management OH SAS 18001 and AS4801. Prior to analysis, samples are prepared at Veritas' Managua facility and then shipped to its analytical facility in Vancouver, Canada. Gold analyses are routinely performed via fire assay/AA finish methods. For greater precision of high-grade material, samples assaying 10 g/t Au or higher are re-assayed by fire assay with gravimetric finish. Analyses for silver and other elements of interest are performed via Induction Coupled Plasmaspectrometry ("ICP").

Qualified Person

The El Limon Technical Report effective December 31, 2020 prepared by SLR Consulting (Canada) Ltd., (formerly Roscoe Postle Associates Inc.) in accordance with NI 43-101 will be filed on SEDAR (www.sedar.com) within 45 days of this news release. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Reserves and Mineral Resources. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context. This news release has been reviewed and approved by Grant A. Malensek, M.Eng., P. Eng., José M. Texidor Carlsson, M.Sc., P. Geo., Hugo M. Miranda, M.Eng., MBA, ChMC(RM), Stephan R. Blaho, MBA, P.Eng., Andrew P. Hampton, M.Sc., P.Eng., and Luis Vasquez, M.Sc., P.Eng. of SLR Consulting (Canada) Limited (“SLR”) (the “El Limon Complex Technical Report”).

The La Libertad Technical Report prepared by SLR Consulting (Canada) Ltd., (formerly Roscoe Postle Associates Inc.) in accordance with NI 43-101, which will include the Pavon pre-feasibility study results, will be filed on SEDAR (www.sedar.com) within 45 days of this news release. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Resource. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context. This news release has been reviewed and approved by Grant A. Malensek, M.Eng., P. Eng., José M. Texidor Carlsson, M.Sc., P. Geo., Hugo M. Miranda, M.Eng., MBA, ChMC(RM), Stephan R. Blaho, MBA, P.Eng., Andrew P. Hampton, M.Sc., P.Eng., and Luis Vasquez, M.Sc., P.Eng. of SLR Consulting (Canada) Limited (“SLR”), Todd McCracken, P.Geo, of BBA and Shane Ghouralal, MBA, P.Eng. and Isabelle Larouche, P.Eng of WSP in Canada. (the “La Libertad Complex Technical Report”).

Darren Hall, MAusIMM, President & Chief Executive Officer, Calibre Mining Corp. is a Qualified Person as set out under NI 43-101 and has reviewed and approved the scientific and technical information in this news release.

The scientific and technical data contained in this news release has been reviewed and approved by Mark A. Petersen, P.Geo., Vice President Exploration, Calibre Mining Corp. and a Qualified Person as defined by NI 43-101.

ON BEHALF OF THE BOARD

"Darren Hall"

Darren Hall, President and CEO

For further information, please contact:

Ryan King

Vice President, Corporate Development & IR

T: (604) 628-1012

E: calibre@calibremining.com

W: www.calibremining.com

About Calibre Mining Corp.

Calibre Mining is a Canadian-listed gold mining and exploration company with two 100%-owned operating gold mines in Nicaragua. The Company is focused on sustainable operating performance and a disciplined approach to growth. Since the acquisition of the Limon, Libertad gold mines and Pavon Gold Project, Calibre has proceeded to integrate its operations into a “Hub-and-Spoke” operating philosophy, whereby the Company can take advantage of reliable infrastructure, favorable transportation costs, and multiple high-grade mill feed sources that can be processed at either Limon or Libertad, which have a combined 2.7 million tonnes of annual mill throughput capacity.

Cautionary Note Regarding Forward Looking Information

This news release includes certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are identified by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will", "would", "may", "could", "should" or "might" occur Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of which are beyond Calibre's control. For a listing of risk factors applicable to the Company, please refer to Calibre's annual information form (“AIF”) for the year ended December 31, 2019, available on www.sedar.com. This list is not exhaustive of the factors that may affect Calibre's forward-looking statements.

Calibre's forward-looking statements are based on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information available to management at such time. Calibre does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change other than as required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Accordingly, undue reliance should not be placed on forward-looking statements.

Note 1: B2Gold AIF 2010-2019 available on sedar.com and Calibre AIF 2019, available on sedar.com

Note 2 - Limon Mineral Reserve Notes

- CIM (2014) definitions were followed for Mineral Reserves and rounded and reported in dry tonnes.

- Underground Mineral Reserves are estimated at fully costed and incremental cut-off grades of 3.3 g/t Au and 2.2 g/t Au, respectively, for Santa Pancha 1; 3.5 g/t Au and 2.2 g/t Au, respectively, for Panteon; and 2.6 g/t Au and 1.8 g/t Au, respectively, for Veta Nueva.

- Open pit Mineral Reserves are estimated at a cut-off grade of 1.24 g/t Au, and incorporate estimates of dilution and mining losses.

- Mineral Reserves are estimated using an average long-term gold price of US$1,400 per ounce.

- A minimum mining width of 1.5 m was used for underground Mineral Reserves.

- Bulk density varies between 2.30 t/m3 and 2.41 t/m3 for all open pit Mineral Reserves; Bulk density varies between 2.47 t/m3 to 2.50 t/m3 for all underground Mineral Reserves.

- A mining extraction factor of 95% was applied to the underground stopes. Where required a pillar factor was also applied for sill or crown pillar. A 100% extraction factor was assumed for development.

Note 3 - Libertad Mineral Reserve Notes

- CIM (2014) definitions were followed for Mineral Reserves and rounded and reported in dry tonnes.

- Underground Mineral Reserves are estimated at fully costed and incremental cut-off grades of 3.05 g/t Au and 1.90 g/t Au, respectively, and incorporates 0.5 m dilution in both hanging wall and footwall.

- Open pit Mineral Reserves are estimated at a cut-off grade of 1.50 g/t Au for Pavon Norte and Pavon Central, and incorporate estimates of dilution and mining losses.

- Open pit Mineral Reserves are estimated at a cut-off grade of 0.92 g/t Au for Jabali Antena, and incorporate estimates of dilution and mining losses.

- Mineral Reserves are estimated using an average long-term gold price of US$1,400 per ounce.

- A minimum mining width of 1.5 m was used for underground Mineral Reserves.

- Open pit and underground bulk density varies from 1.70 t/m3 to 2.61 t/m3; underground backfill density is 1.00 t/m3.

- A mining extraction factor of 95% was applied to the underground stopes. Where required a pillar factor was also applied for sill or crown pillar. A 100% extraction factor was assumed for development.

Note 4 – Limon Mineral Resource Notes

- Effective dates are December 31, 2020 for all El Limon deposits.

- CIM (2014) definitions were followed for Mineral Resources and numbers may not add up due to rounding.

- A cut-off grade of 1.15 g/t Au is used for Limon OP, 2.40 g/t for Limon UG, 3.05 g/t for SP1 UG, 2.25 g/t for SP2 UG, 2.41 g/t for Veta Nueva UG, 3.25 g/t for Panteon UG, 0.00 g/t for Tailings, and 2.60 g/t for Atravesada UG.

- Reporting shapes were used for reporting Limon UG, SP1 UG, Veta Nueva UG, Panteon UG, and Atravesada UG.

- Mineral Resources are estimated using a long-term gold price of US$1,500/oz Au in all deposits.

- Bulk density varies between 2.30 t/m3 and 2.50 t/m3.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are inclusive of Mineral Reserves.

Note 5 – Libertad Mineral Resource Notes

- Effective dates are December 31, 2020 for all La Libertad deposits except San Antonio OP, with an effective date of August 30, 2020. The Pavon estimate has an effective date of November 12, 2019.

- CIM (2014) definitions were followed for Mineral Resources.

- A cut-off grade of 0.85 g/t Au is used for Jabali Antena OP, 0.81 g/t for Rosario OP, 0.80 g/t for Socorro OP and San Antonio OP, 2.90 g/t for San Juan UG, San Diego UG and Mojon UG, and 2.84 g/t for Jabali West UG and Jabali East UG, and 1.17 g/t Au for Pavon.

- Reporting shapes were used for reporting Jabali West UG.

- Mineral Resources are estimated using a long-term gold price of US$1,500/oz Au in all deposits except Pavón Sur, estimated using a long-term gold price of US$1,400/oz Au.

- Bulk density varies between 1.70 t/m3 and 2.57 t/m3.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are inclusive of Mineral Reserves.

- Numbers may not add up due to rounding.

Note 6 – Eastern Borosi Mineral Resource Notes

- CIM (2014) definitions were followed for Mineral Resources and Numbers may not add due to rounding.

- Mineral Resources are estimated at a cut-off grade of 2.0 g/t AuEq for resources potentially mined by underground methods and 0.42 g/t AuEq for resources potentially mined by open pit methods.

- Gold equivalent values were calculated using the formula: AuEq (g/t) = Au (g/t) + Ag (g/t) / (101.8)

- Mineral Resources are estimated using a long-term gold price of US$1,500 per ounce of gold, US$23 per ounce of silver.

- A minimum mining width of 2.4 m was used for underground and 3 m for open pit.

- Bulk density is 2.65 t/m3 for Blag, East Dome, Riscos, and La Luna, and 2.60 t/m3 for Guapinol and Vancouver.

For Further Details Refer to NI 43-101 Technical Report on the Eastern Borosi Project, Nicaragua dated May 11, 2018 prepared by Roscoe Postle Associates, Inc.(now SLR Consulting (Canada) Ltd.)