Canada Nickel Company Announces Additional Property Acquisition and Options

TORONTO, March 4, 2020 /CNW/ - Canada Nickel Company Inc. (TSX-V:CNC) ("Canada Nickel" or the "Company") today announced the signing of a Memorandum of Agreement with Noble Mineral resources to acquire an additional property and enter into option agreements on 5 other targets near its 100% owned Crawford Nickel-Cobalt Sulphide Project ("Crawford") near Timmins, Ontario.

Mark Selby, Chair and CEO of Canada Nickel commented "Given our demonstrated success at Crawford, this transaction provides us the larger footprint to fully develop Crawford, along with additional exploration targets which can potentially host nickel-cobalt deposits that are similar to Crawford."

The Crawford Nickel-Cobalt Sulphide Project is located in the heart of the prolific Timmins-Cochrane mining camp in Ontario, Canada, and is adjacent to well-established, major infrastructure associated with over 100 years of regional mining activity. An initial resource for the project was recently published (see Canada Nickel news release February 28, 2020)

Transaction Summary:

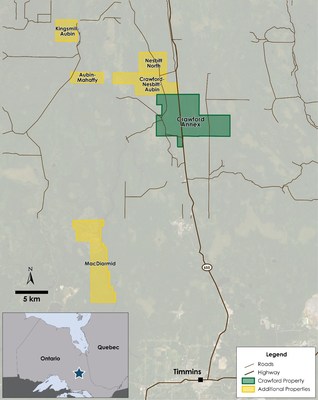

Canada Nickel has agreed to pay to Noble $500,000 in cash and issue 500,000 Canada Nickel common shares to acquire the Crawford Annex property and the option to earn up to an 80% interest in 5 additional nickel targets within the Project 81 land package. The Crawford Annex comprises 4,909 hectares in Crawford and Lucas township and the 5 option areas (Crawford-Nesbitt-Aubin, Nesbitt North, Aubin-Mahaffy, Kingsmill-Aubin, and MacDiarmid) ("Option Properties") range in size of 903 to 5,543 hectares. See Figure 1 for a map of property locations.

Canada Nickel can earn up to an 80% interest in each of the Option Properties on the following terms and conditions.

1) Canada Nickel can initially earn a 60% interest in each of the Option Properties within 2 years by:

- funding at least $500,000 of exploration and development expenditures on each option property;

- paying all property maintenance costs for each option property, including all applicable mining land taxes

- making a payment to Noble of an additional $250,000 in cash or, at Noble's election, Canada Nickel common shares.

2) Canada Nickel has the right to then increase their interest to 80% in each of the Option Properties within 3 years by funding an additional $1,000,000 of exploration and development expenditures on each option property (for a total of $1,500,000 per option property)

If the conditions to earn a 60% interest or 80% interest have been satisfied, a joint venture would be formed on that basis and a 2% net smelter return royalty would be granted to Noble on the portion of the property which are mining claims and currently do not have any royalty on them. (The overall result would be a total of 2% on each property)

Vance White, Chair and CEO of Noble Minerals commented "This transaction continues our project generator strategy to unlock the potential of our Project 81 holdings, which we believe have potential for gold, VMS, and nickel deposits, through joint ventures and other transactions. Given Canada Nickel's success to date and their nickel industry expertise, we are very happy to partner with that team on these additional properties, and the additional equity that we'd receive on this transaction would allow our shareholders to potentially realize additional value on these properties as they are explored. If Canada Nickel were to fully exercise all its rights and options it could mean additional cash and/or shares to the Noble treasury of up to $2 million and additional exploration expenditures over the term of the options."

The transaction is subject to certain specific conditions, including prior approval of the TSX Venture Exchange and third party approvals.

Grant of Restricted Share Units

The Company also announced today that it has issued a total of 1,987,500 restricted share units under its Restricted Share Unit Plan to its directors, officers and other key employees and contractors (who have agreed to receive RSUs in lieu of cash compensation for their services). Conditional upon receipt of shareholder approval in accordance with the policies of the TSX Ventures Exchange at the next meeting of Canada Nickel shareholders, these RSUs will vest one year from the date of grant.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/canada-nickel-company-announces-additional-property-acquisition-and-options-301016291.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/canada-nickel-company-announces-additional-property-acquisition-and-options-301016291.html

SOURCE Canada Nickel Company Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2020/04/c6133.html