Candente Copper Announces Positive PEA Results for the Ca??ariaco Copper Project

NPV of US$1.01 B with CapEx of $1.04 B

Annual Average Copper Production of 173 Million Pounds Over Mine Life of 28 Years

VANCOUVER, British Columbia, Feb. 08, 2022 (GLOBE NEWSWIRE) -- Candente Copper Corp. (TSX:DNT, BVL:DNT, US:CDOUF) ("Candente Copper” or “the Company") is very pleased to announce completion by Ausenco Engineering Canada Inc. (“Ausenco”) of a positive Preliminary Economic Assessment (“the 2022 PEA”) for its 100% owned Cañariaco copper project in Northern Peru.

Based on projected average annual metal production of 173 million (“M”) pounds (“lb”) (78,543 tonnes) copper, 31,395 ounces (“oz”) gold (“Au”), and 703,588 oz silver (“Ag”) for 28 years and an initial capital cost estimate (“CapEx") of $1.04 B, the Cañariaco Norte project has an after-tax net present value (“NPV”) of US$1,010 M, and after-tax internal rate of return (“IRR”) of 16.3% using a copper price of US$3.50 /lb, US$1,650/oz Au, US$21.50/oz Ag and a discount rate of 8%.

The NPV increases to US$1,833 M, with an IRR of 21.9% and payback of 4.5 years when using a copper price of US$4.50/lb, US$1,650/oz Au and US$21.50/oz Ag. The C1 cash operating cost (*see below under Operating Costs) is estimated to be US$1.28/lb of copper. The forecast strip ratio is 0.66.

Commenting on the results, President and CEO Joanne C. Freeze stated, “We are very pleased with the results of this new PEA which has achieved three key project objectives: 1) a lower initial capital cost; 2) a subsequent project expansion financed from cash flow and 3) enhanced environmental, social, and governance (“ESG”) practices. The lower CapEx offers many more opportunities to finance the project. The focus on enhancing ESG practices led to a single dry stack waste management facility (WMF) with co-mingling and co-disposal of waste rock and filtered mill tailings, would produce an overall smaller footprint for the project that is further distanced from farming communities. Building on the ESG mandate, geometallurgical modelling of the Cañariaco Norte deposit gives a better understanding of the mineralization, resulting in a highly marketable concentrate with no need for arsenic treatment and lowers the projected operating cost estimate (“OpEx”)”.

“The 2022 PEA presents an alternative business case for developing the Cañariaco Project with a smaller initial CapEx, however larger companies could prefer to develop it as a larger project with a much higher throughput on start-up. The Cañariaco project offers many advantages. It is reasonably close to key road and power infrastructure, has a low strip ratio, moderately soft rock (BWI 11.2), low operating cost and offers excellent potential for discovery of additional mineralization. The very large data base from previous engineering work supports the 2022 PEA which together could allow moving directly into a feasibility evaluation phase,” also stated Joanne Freeze.

The 2022 PEA by Ausenco builds on earlier advanced engineering studies conducted from 2010 through 2014. Key highlights follow:

- Initial CapEx of $1.04 B – 40,000 tonnes per day (“tpd”) mine and plant;

- Mine and plant expansion to 80,000 tpd in year 7 with additional CapEx of $305 M from cash flow;

- Cash operating cost of US$1.28/lb of copper including all on-site and off-site costs, treatment and refining charges (“TC/RC"), net of by-product credits;

- Advanced ESG development strategies result in improved Infrastructure Design including a single waste management facility (WMF) with co-mingling and co-placement of waste rock and filtered mill tailings creating a smaller overall footprint further distanced from populated areas;

- Waste to mineralized material strip ratio of 0.66:1

- After-tax NPV of US$1,010 M for base case of US$3.50/lb Cu, US$1,650/oz Au, US$21.50/oz Ag, and 8% discount rate;

- After-tax IRR of 16.3% for base case of US$3.50/lb Cu, US$1,650/oz Au, and US$21.50/oz Ag;

- After-tax NPV increases to US$1,833 M, with an IRR of 21.9% and payback of 4.5 years when using a copper price of US$4.50/lb.

- Payback of pre-production capital in 7.1 years using base case price of US$3.50/lb Cu and 4.5 years using US$4.50/lb Cu;

- Highly leveraged to copper prices;

- Life-of mine (“LOM”) metal production of 4,848 Mlb (2,199,215 tonnes) Cu, 879,051 oz Au, and 19,700,467 oz Ag;

- Average annual metal production of 173 Mlb (78,543 tonnes) Cu, 31,395 oz Au, and 703,588 oz Ag during the LOM;

- Average annual metal production of 120 Mlb (54,539 tonnes) Cu, 24,375 oz Au, and 548,667 oz Ag for the first six years;

- Average annual metal production of 193 Mlb (87,475 tonnes) Cu, 34,243 oz Au per year, and 766,753 oz Ag per year for the second mine phase, which will run for 21.4 years;

- Average LOM metal recoveries of 88.1% for Cu, 64.7% for gold and 57.2% for silver;

- Concentrate grades are forecast to average approximately 26% Cu, 3.63 g/t Au and 84.16 g/t Ag for first six years;

- LOM Concentrate grades are projected to average approximately 26% Cu, 3.27 g/t Au and 75.40 g/t Ag;

- Conventional crush/grind and flotation technology;

- Decreased OpEx with marketable concentrate with no need for arsenic treatment;

- Pre-production capital cost of US$1.04 B is based on leased mining equipment and includes a contingency allocation of 18.5%;

- All-in capital cost of US$1.57 B based on leased mining equipment and including life-of-mine sustaining capital, expansion capital and closure cost;

- 28-year mine life, with potential for extension if additional resources identified below proposed pit can be included in a mine plan;

- Located at a moderate elevation with pit centroid and process plant at approximately 3,000 metres above sea level;

- Connection to the national power grid is planned to be by direct line approximately 55 km from the project site to the Carhuaquero substation site;

- Significant potential for discovery of additional mineralization at nearby Cañariaco Sur and Quebrada Verde targets.

The Cañariaco Norte Mineral Resource estimate has been updated (see Table 5 below and also the Company’s news release NR 144 dated January 28, 2022) and using a 0.15% Cu applied cut-off, which represents an approximate breakeven cut-off, contains 9.29 Blb Cu, 2.14 Moz Au and 59.43 Moz Ag in the Measured and Indicated categories as well as 2.66 Blb Cu, 0.55 Moz Au and 18 Moz Ag in the Inferred category.

Measured, Indicated and Inferred Mineral Resources were used in the 2022 PEA mine plan. Within the ultimate pit, at the $6.52/t NSR cut-off the classification breakdown of the mill feed material is 54% Measured Mineral Resources, 38% Indicated Mineral Resources and 8% Inferred Mineral Resources.

The 2022 PEA is preliminary in nature. It includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty that the 2022 PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

An Inferred Mineral Resource estimate was also recently completed for a portion of Cañariaco Sur which contains 2.2 Blb Cu, 1.2 Moz Au and 15 Moz Ag (NR 144), however the 2022 PEA mine plan only includes resources from Cañariaco Norte.

The current scope of development incorporates open pit mining, crushing, semi-autogenous grinding (“SAG”), and flotation followed by a waste management facility using co-mingling (mixed together) and co-placement (not mixed together) deposition strategies for filtered tailings and waste rock. The initial production rate is expected to be 40,000 tpd with an expansion to 80,000 tpd in year 7 of operation. The LOM waste to mineralized material stripping ratio is very low at 0.66:1, with the majority of waste coming out by year 10. Incorporation of the filtered tailings technology is favoured for new mining projects as it eliminates the need for wet slurry tailings deposition along with being considered best practice for environmental compliance and social acceptance. The 2022 PEA mine plan calls for a mine life of 28 years, however additional mineral resources exist below the current pit outline which may offer potential to extend the mine life.

Importantly, updated geometallurgical modelling of Cañariaco Norte has provided a more detailed understanding of the deposit and mineralization and enabled development of a mine plan that could produce a marketable copper concentrate with no requirement for treatment to reduce arsenic.

Financial Analysis

The NPV of the Cañariaco project at various copper price points and discount rates are presented in Table 1. Candente Copper has selected as the base case long-term metal prices of US$3.50/lb Cu, US$1,650/oz Au and US$21.50/oz Ag. The Cañariaco project is highly leveraged to the price of copper. At long term copper prices above US$3.50/lb, the after tax NPVs and IRRs increase significantly. Sensitivity to the copper price is also presented in Tables 1 and 2.

Table 1: Project Net Present Value & IRR (After Tax)*

| Cu Price (US$/lb) | 3.00 | 3.25 | 3.50 | 4.00 | 4.50 | 5.00 | ||

| Undiscounted Cumulative Net Cash Flow (US$ M) | 3,990 | 4,680 | 5,368 | 6,734 | 8,092 | 9,444 | ||

| Discounted Cash Flow (US$ M) | 6% | 1,014 | 1,286 | 1,556 | 2,092 | 2,624 | 3,153 | |

| 8% | 591 | 802 | 1,010 | 1,423 | 1,833 | 2,241 | ||

| 10% | 299 | 465 | 630 | 955 | 1,278 | 1,599 | ||

| IRR (%) | 13.2 | 14.8 | 16.3 | 19.2 | 21.9 | 24.4 | ||

| Average Annual Cash Flow (US$M) | 180 | 204 | 229 | 278 | 326 | 375 | ||

| Payback (Years) | 8.6 | 7.9 | 7.1 | 6.3 | 4.5 | 3.8 | ||

Table 2: Project Net Present Value & IRR (Pre-Tax)*

| Cu Price (US$/lb) | 3.00 | 3.25 | 3.50 | 4.00 | 4.50 | 5.00 | ||

| Undiscounted Cumulative Net Cash Flow (US$ M) | 6,762 | 7,968 | 9,174 | 11,586 | 13,998 | 16,410 | ||

| Discounted Cash Flow (US$ M) | 6% | 1,969 | 2,443 | 2,917 | 3,866 | 4,814 | 5,762 | |

| 8% | 1,291 | 1,657 | 2,023 | 2,754 | 3,485 | 4,216 | ||

| 10% | 821 | 1,109 | 1,397 | 1,974 | 2,550 | 3,126 | ||

| IRR (%) | 17.2 | 19.4 | 21.6 | 25.7 | 29.5 | 33.3 | ||

| Average Annual Cash Flow (US$M) | 279 | 322 | 365 | 451 | 537 | 623 | ||

| Payback (Years) | 7.4 | 6.6 | 6.1 | 3.9 | 3.3 | 2.8 | ||

*Gold and silver prices used did not vary and are US$1,650/oz Au and US$21.50/oz Ag

The financial model is based on open pit mining by the owner with financed mobile mining equipment including scheduled additions and replacements. All other project costs are the responsibility of the Owner, including process and infrastructure preproduction capital, LOM sustaining capital, and closure costs.

Taxes have been estimated by a third-party tax consultant and include a Peruvian corporate income tax of 29.5% (plus 2% during the term of an assumed Stability Agreement), employee profit sharing of 8% of taxable income and mining taxes for the exploitation of mineral resources which are based on the operating profit (mining royalties on a sliding scale of 1% to 12% with a minimum of 1% of sales and special mining tax on a sliding scale of 2% to 8.4%). Depreciation on capital equipment, development and exploration cost as permitted by Peru tax regulations has been applied. Finance charges for project construction capital have not been applied in the financial model.

Capital Costs

Pre-production direct capital costs for the 40,000 tpd initial phase of the project are estimated to be US$744 M, which includes US$119 M for mine preproduction development, US$49 M for mining infrastructure and equipment, US$360 M for the process plant, US$116 M for the waste management facility, and US$85 M for infrastructure (including access road, and external power line), US$7 M for site-wide water services, and US$7 M for site-wide power and lighting. The total indirects, Owner’s costs, and contingency are estimated to total US$299 M.

The capital cost estimate is predominantly based on Q4 2021 costs. In addition to the pre-production capital cost, the financial analysis includes LOM sustaining capital costs of US$119 M, Phase II expansion capital costs of US$305 M, and closure costs of US$104 M.

Table 3: Capital Cost Summary

| PHASE I (40,000 tpd) | PHASE II (80,000 tpd) | |

| Cost Area | Cost (US$M) | Cost (US$M) |

| Pre-stripping | 119 | - |

| Mining Infrastructure & Equipment | 49 | - |

| Process Plant | 360 | 204 |

| Site Related Infrastructure (inc. Ext Power) | 85 | 2 |

| Tailings and Waste Rock Management | 116 | - |

| Sitewide Water Services | 7 | 1 |

| Sitewide Power and Lighting | 7 | - |

| Subtotal – Directs | 744 | 207 |

| Indirects | 137 | 42 |

| Owner's Cost | 14 | 5 |

| Contingency | 148 | 50 |

| Subtotal - Indirects | 299 | 97 |

| TOTAL PREPRODUCTION CAPITAL | 1,043 | 305 |

| Sustaining Capital (Life-of-Mine) | 45 | 74 |

| Closure Costs | 104 | |

| Subtotal Life-of-Mine | 45 | 178 |

| TOTAL PROJECT CAPITAL COSTS* | 1,088 | 483 |

*Note to Table 3 - Totals may not sum due to rounding

Capital cost for the mobile mining equipment including drills, haul trucks and shovels (LOM total of US$71M) is assumed to be financed at 20% down, 4.25% interest and terms up to 60 months.

Operating Costs

Life of mine operating costs are summarized in Table 4. C1 cost of US$1.28/lb of payable copper consists of mining, processing, site general and administrative (“G&A”), off-site treatment and refining, transport, and royalties net of by-product credits (Au and Ag). C3 cost of US$1.39/lb of payable copper includes C1 plus sustaining capital, expansion capital, and closure costs.

Table 4: Life of Mine Operating Costs Summary

| Area | Unit | US$ | Unit | US$ /lb Cu | |

| On-site Costs | |||||

| Mining | $/t processed | 2.62 | $/lb Cu | 0.38 | |

| Processing | $/t processed | 4.76 | $/lb Cu | 0.69 | |

| Co-mingle Tailings | $/t processed | 0.12 | $/lb Cu | 0.02 | |

| General & Administration | $/t processed | 0.70 | $/lb Cu | 0.10 | |

| Sub-total Site Costs | $/t processed | 8.21 | $/lb Cu | 1.19 | |

| Off-site Costs | |||||

| Concentrate Transport | $/t concentrate | 127.47 | $/lb Cu | 0.24 | |

| Smelting & Refining | $/t concentrate | 119.10 | $/lb Cu | 0.22 | |

| Sub-total Off-site Costs | $/t concentrate | 246.57 | $/lb Cu | 0.46 | |

| Total Cost On-Site & Off-Site | $/lb Cu | 1.64 | |||

| Credits (Gold, Silver) | $/lb Cu | (0.39 | ) | ||

| Total Cost | $/lb Cu | 1.28 | |||

Cañariaco Norte Project Description

An outline of the Cañariaco Norte project including mineral resources, mining, processing, product handling, and financial analysis is provided above. The development scope for Cañariaco Norte is based on proven industry technology.

Cañariaco Norte Mineral Resources

The mine plan for the 2022 PEA is based on the 2022 Mineral Resources summarized in Table 5.

Table 5: Mineral Resource Estimate (0.15% Copper Cut-off Grade)

| Contained Metal | ||||||||

| Resource Classification | tonnes (Mt) | Cu Eq (%) | Cu (%) | Au (g/t) | Ag (g/t) | Copper (B lbs) | Gold (M Ozs) | Silver (M Ozs) |

| Measured | 423.5 | 0.48 | 0.43 | 0.07 | 1.9 | 4.04 | 0.98 | 25.71 |

| Indicated | 670.7 | 0.39 | 0.36 | 0.05 | 1.6 | 5.25 | 1.16 | 33.72 |

| Measured+ Indicated | 1,094.2 | 0.42 | 0.39 | 0.06 | 1.7 | 9.29 | 2.14 | 59.43 |

| Inferred | 410.6 | 0.32 | 0.29 | 0.04 | 1.4 | 2.66 | 0.55 | 18.09 |

**Notes to accompany Cañariaco Norte Mineral Resource table:

- The Mineral Resources estimate has an effective date of January 27, 2022. The Qualified Person for the estimate is David Thomas, P.Geo. of DKT Geosolutions Inc.

- The Mineral Resources were reported in accordance with the Canadian Institute of Mining and Metallurgy ("CIM") Definition Standards for Mineral resources and Mineral Reserves (2014) and estimated using the CIM "Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines; " (2019);

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The Mineral Resources are reported within a constraining Lerchs Grossmann pit shell developed using Hexagon’s MinePlan 3D™ software using:

- A copper price of US$3.50/lb

- Mining cost of US$1.60/t;

- A combined processing, tailings management and G&A cost of US$6.52/t;

- Variable pit slope angles ranging from 36 to 39 degrees;

- A copper process recovery of 88%;

- Copper concentrate smelter terms: US$75/dry metric tonne treatment charge, US$0.075/lb refining charge and 96.2% payable;

- Estimated concentrate shipping costs of US$133.00/wet metric tonne of concentrate;

- Copper equivalent grades including contributions from gold and silver, were estimated using metal prices (copper US$3.50/lb, gold US$1,650/oz, and silver US$21.50/oz), metallurgical recoveries of copper 88%, gold 65%; silver 57%) and smelter payables of copper 96.5%: gold 93%; silver 90%. Copper grade equivalent calculation: Cu Eq% = Cu % + ((Au grade x Au price x Au recovery x Au smelter payable%) + (Ag grade x Ag price x Ag recovery x Ag smelter payable))/(22.0462 x Cu price x 31.1035 g/t x Cu recovery x Cu smelter payable%);

- All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines;

- The contained metal figures shown are in situ.

David Thomas, P.Geo. of DKT Geosolutions Inc. produced the updated resource estimate for the Cañariaco Norte deposit based on drilling information and geological interpretation provided by Candente Copper. Mr. Thomas undertook quality assurance and quality control studies on the mineral resource data for the Cañariaco Norte project and concluded that the collar, assay and geological data are adequate to support resource estimation.

This updated mineral resource estimate is based on 230 drill holes as well as a review of the deposit lithology, alteration and specific gravities.

The recently disclosed (NR 144) Inferred Mineral Resource estimate for Cañariaco Sur are not included in the 2022 PEA mine plan.

Waste Management Facility (Tailings and Waste Rock)

The filtered tailings and waste rock will be placed together using co-mingle (mixing them together at the facility) and co-placement (not mixing them together at the facility) deposition strategies to produce a single dry stack waste management facility (“WMF”). The facility is located west of the process plant, which will significantly reduce site water run-off. During co-placement operations, the waste rock will be used to create exterior berms to reduce erosion and sediment transports of tailings during rainfall events. Both materials will be conveyed to the site using conveyor systems. The waste rock will be crushed and the tailings will be filtered prior to conveying.

In pre-production, waste rock will be placed at the bottom of the WMF to create a stable platform on which the co-mingled and co-placed filtered tailings and waste rock will be deposited. In the initial six years, waste rock and filtered tailings will be conveyed, co-mingled at the WMF, and compacted using dozers and compactors to improve overall stability of the storage facility. In subsequent years when there is less waste rock, the filter tailings and waste rock will continue to be transported by conveyors, but placement will use the co-placement strategy, i.e. the waste rock will be used to create exterior berms along with compact the filtered tailings to contain sediment during rainfall events. Both materials will be spread and compacted using dozers and compactors.

As part of the WMF water management, rock drains, temporary contact water collection ditches, non-contact water diversion channels, and a contact water pond will be constructed to manage the facility waters. Rock drains will be placed along the lowest elevation line (thalweg) of all drainages below the facility to capture near surface groundwater and seepage through the facility and discharge it into a water management pond below the facility. Temporary collection ditches located within the WMF will convey surface water to the contact water pond below the facility. Staged non-contact diversion channels will be constructed to convey non-contact surface runoff around the facility. Water from the contact water pond will be used for process water or treated and discharged to the environment.

For closure, the WMF will be capped with a cover system that will include a vegetative cover.

Mining

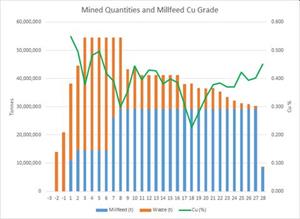

The 2022 PEA envisions a large-scale open pit mine using conventional truck and shovel mining. Mining will be performed on 15 m benches, using 35 m3 electrified hydraulic shovels, diesel blasthole drills, and 218 t haul trucks. The single pit will have four pit phases. The mine plan calls for the extraction of 702.7 Mt of mineralized material and 465.3 Mt of waste over the projected two years of pre-production and 28 years of operating life (strip ratio of 0.66:1). Average LOM head grades to the process plant will be 0.38% Cu, 0.07 g/t Au and 1.7 g/t Ag. Importantly, the mine grades during the first seven years of production will be higher, with average feed grades of 0.45% Cu, 0.08 g/t Au and 2.0 g/t Ag. The mined quantities and Cu grades by year are shown below.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f20aaecb-ade3-4dc4-907c-07bc0509459a

Measured, Indicated and Inferred Mineral Resources were considered for processing. Within the ultimate pit, at the $6.52/t NSR cut-off the classification breakdown of the mill feed material is 54% Measured Mineral Resources, 38% Indicated Mineral Resources and 8% Inferred Mineral Resources.

The open pit slope design was developed based on geotechnical logging of drill core plus rock quality evaluation and compressive strength testing of a limited number of core samples. The amount of geotechnical data available is sufficient to support PEA-level designs for the pit wall slopes. Additional geotechnical drilling in the proposed pit area will be required to permit a feasibility level pit wall design. Candente Copper plans to complete the required geotechnical drilling and rock quality testing as part of a feasibility study program.

Metallurgy and Process

Grinding and flotation test work was performed by SGS Lakefield located in Santiago, Chile, under the direction of Transmin Metallurgical Consultants, based in Lima.

The metallurgical test work indicates that the sulfide mill feed can be processed by conventional crushing, grinding and flotation technologies to recover copper, gold, and silver from the Cañariaco Norte deposit to a copper concentrate.

Cañariaco concentrator throughput for the first six years of production will average 40,000 tpd, ramping up to 80,000 tpd in year seven for the remainder of the mine life. Process equipment will be added and optimised within the concentrator in order to achieve annual average copper production for the LOM of approximately 173 Mlb per year. Average annual production for the first six years is estimated at 120 Mlb Cu.

The 2022 PEA eliminates the roasting of the concentrate and associated plant facilities that were envisaged in earlier studies. As a result, the technical challenges associated with roasting of the concentrate and copper cathode production were eliminated from the flow sheet. Instead, the 2022 PEA will produce a lower-grade copper concentrate to manage potential issues with deleterious elements reporting to the concentrate. Average arsenic grade of the concentrate is estimated to be 0.49% for first six years and 0.52% for LOM, resulting in minimal expected penalty charges totalling US$26M for LOM.

The run-of-mine (“ROM”) pad and primary crushing station will be located adjacent to the mine infrastructure area (“MIA”). Mineralized material and waste will be processed through separate primary crushers and conveyed via an overland conveyor to two separate crushed material stockpiles.

Crushed mineralized material for both grinding lines, (the second grinding line will be installed for the plant expansion that starts operations the beginning of year seven), will be stored in a single conical stockpile with a total capacity of up to 250,000 t and a live capacity of 62,500 t.

Coarse mineralized material will be reclaimed from the stockpile by apron feeders onto the SAG mill feed conveyor, two for each grinding line.

The grinding circuit will consist of two identical, parallel lines. Each grinding line will consist of a single SAG mill followed by a single ball mill operating in closed circuit with a cyclone cluster. The SAG mills will be located at the north end of the grinding building while the ball mills will be to the south. A pebble crusher for each grinding line will be housed in an open steel structure near the stockpile.

The copper flotation circuit area will take advantage of the natural ground slope for process slurry flow. The circuit will consist of two parallel trains of rougher flotation cells, rougher concentrate regrinding. followed by first and second stage cleaner cells.

The copper regrind circuit will be adjacent to the copper flotation area. The facility will consist of a concrete containment area with an open structure housing all equipment.

Final copper concentrate will be dewatered and filtered before being stored in a covered stockpile. Copper concentrate will be loaded onto trucks via a front-end loader before trucking to a load-out port facility near Salaverry in Northern Peru for ocean shipment to offshore smelters.

The process plant will be located entirely to the south of the planned Cañariaco Norte pit and west of the Cañariaco River.

Water Management

Candente Copper management recognizes and fully respects the importance of water to both the daily lives of the surrounding communities and agricultural projects downstream. A controlled water management system was developed for the 2022 PEA, and preliminary engineering studies indicate that the Cañariaco project will have minimal impact on the local water resources.

Local ground water and surface water courses within the proposed mine area are expected to be adequate to supply the majority of water required for the proposed mine operation. Discharge of water to the environment is anticipated only after project closure. The water management system will ensure that discharge streams meet the appropriate Peruvian and International regulations for water quality and be suitable for downstream agricultural usage. As part of the next phase of project engineering study Candente Copper plans to work with the local community to assess opportunities for the provision and distribution of water for agricultural purposes.

Environment and Community

The Cañariaco Project is located within the surface rights of the San Juan de Cañaris farming Community, in the district of Cañaris, province of Ferreñafe, department of Lambayeque. The project ecosystem consists of dry plateaus and cloud forests at higher elevations and cultivated land at lower elevations. The project is not located in protected natural areas or buffer zones. Intensive study of the project area has provided a greater understanding of the biodiversity within the ecosystem.

The development of the Cañariaco project could significantly increase local and regional, direct and indirect, employment opportunities. In addition, it would generate significant ongoing revenues for regional and national suppliers of goods and services required for construction and production at the mine. Furthermore, the project would provide a substantial long-term addition to the tax base for the Lambayeque region.

In keeping with industry best practices, Candente Copper intends to follow the Equator Principals and World Bank Standards for the proposed mining development at Cañariaco. These protocols outline best practices for developing projects with regard to protecting the environment, biodiversity and managing social impact. The Company will also continue to comply with Peruvian environmental regulations.

Since 2007, Candente Copper has contracted baseline studies for biodiversity indicators such as species richness, level of endemism (for amphibians, orchids, insects, and small mammals), and the presence of endangered species. These studies have resulted in a greater understanding of the biodiversity of the overall region as well as the project area and have identified diverse flora and fauna assemblages present in the Project area as well as the greater region. In addition, many protected and endangered species have been recorded or sited within the greater project footprint and all of these have also been found in similar habitats within Peru or in neighbouring countries.

To date, Candente Copper instigated two conservation projects that encompass the relocation of protected flora and fauna found at the site and the identification of an area for conservation and environmental management.

Candente Copper has also offered support for a national conservation initiative for the creation of a 60,000 ha National Park south of the project for the protection of similar habitats and species.

Permitting Advances

Various environmental studies have been carried out since 2007. Several semi-detailed Environmental Impact Studies (“EIAsd”) were conducted for drilling permits over the years and the Company had consultants begin collecting data for a detailed EIA (EIAd) in 2007. Approved Environmental Permits include: Resolución Directoral No. 0063-2007/MEM-AAM in February 2007; Resolución Directoral No. 354-2007/MEM-AAM in Oct 2007; Resolución Directoral No. 045-2008-MEM/AAM in Feb 2008; Resolución Directoral No. 177-2012-MEM/AAM in May 2012; and Resolución Directoral No. 0462-2014-MEM/DGAAM in September 2014. Most of the work between 2007 and 2014 was conducted and prepared by AMEC Peru S.A., an environmental consultancy based in Lima, Peru.

In 2020, the Company engaged Global Yaku Consulting (“Yaku”), a Peruvian-based environmental consultancy to conduct an updated EIAsd for the Project. No material issues that would affect project permitability have been identified to date.

Candente Copper has received several permits for certain aspects of the Cañariaco project development. A Certificate of Non-existence of Archaeological Remains (CIRA) N° 2008-403 was obtained for the area of the Cañariaco Norte pit. In 2007, 2010, 2011 and 2014, archaeological evaluations were carried out, the results of which were presented as part of the EIAsds and the Modification of the EIAsd, which were approved by the various Directorial Resolutions. Most recently in October 2021, Yaku conducted an archaeological assessment to complement the evaluation of the proposed pit area. No archaeological artefacts were identified in the area.

Opportunities

Based on the work completed to date there are several significant opportunities that may offer the potential to further enhance the Cañariaco project including:

- Further iterations of mine planning may result in reductions of pre-stripping quantities, which could reduce the initial capital cost and potentially improve project economics;

- The Cañariaco Norte deposit is open to depth and the potential exists for the mine life to be extended beyond the assumed 28 years in the 2022 PEA if mineralization below the current pit base can be included in a mine plan;

- There may also be potential to reduce cost by increasing the mining and/or processing rate. Both opportunities offer the potential to enhance the economics of the Cañariaco project;

- The potential exists to discover and delineate additional mineralization at the Cañariaco Sur and Quebrada Verde targets, which are located within 4 km south of the Cañariaco Norte deposit. Such mineralization may provide supplemental mill feed to the proposed Cañariaco plant;

- Additional geotechnical drilling could offer the potential to steepen pit walls which could potentially increase economics.

Risks

Geotechnical investigations in the WMF area have not been completed and as a result there is a risk that the facility design may require revision. The design basis will be reviewed during future more detailed studies.

As with most projects at this level of assessment, risks exist that may affect the development of the project. Factors that could pose a risk to the Cañariaco project include changes in world commodity markets, equity markets, costs and supply of labour and materials relevant to the mining industry, extent of resources actually contained in mineral deposits, geotechnical conditions, actual recoveries achieved in processing mineralized material, marketing of concentrate, technological change, water management, local community opposition, environmental permitting, change in government and changes to regulations affecting the mining industry.

Qualified Persons and NI 43-101 Technical Report

The 2022 PEA summarized here for the Cañariaco project was completed by Ausenco Engineering Canada Inc., of Vancouver British Columbia.

The findings of the 2022 PEA and the Initial Inferred Resource for Cañariaco Sur will be disclosed in a NI 43-101 Technical Report which will be completed and available on SEDAR and Candente Copper’s website by March 14, 2022.

The qualified persons for the 2022 PEA and this News Release are identified below:

Mr. David Thomas, P.Geo. of DKT Geosolutions Inc. and an independent Qualified Person as set forth by NI 43-10 is responsible for the Cañariaco Norte Mineral Resource estimate updated in the 2022 PEA.

Mr. Jay Melnyk, P.Eng. Principal Mining Engineer at AGP Mining Consultants Inc. and an independent Qualified Person as set forth by NI 43-101, is responsible for mine design and mine capital and operating costs.

Mr. Kevin Murray, P.Eng. Manager Process Engineering at Ausenco Engineering Canada Inc. and an independent Qualified Person as set forth by NI 43-101, is responsible for the financial model as well as mineral processing and metallurgical resting, recovery methods, and process and infrastructure capital and operating costs.

Mr. Scott Elfen, P.E., Global Lead Geotechnical and Civil Services at Ausenco Engineering Canada Inc. and an independent Qualified Person as set forth by NI 43-101, is responsible for the waste management facility and associated capital and operating costs, and the site-wide water management design.

Mr. Scott Weston, P.Geo., Vice President of Business Development at Hemmera Envirochem Inc. and an independent Qualified Person as set forth by NI 43-101, is responsible for environmental studies, permitting, and social and community impacts.

Joanne Freeze, P.Geo., President, CEO and Director has reviewed and approved the contents of this release for Candente Copper.

Conference Call

Candente Copper will host a telephone conference call for investors and analysts on Thursday February 10th, 2022, at 2:00pm EST to discuss the 2022 PEA for the Cañariaco Copper Project, Peru.

Sean Waller, Director and Joanne Freeze, CEO as well as Emin Meka from Ausenco will review the report and take questions.

Details of the conference call, including call-in numbers and passwords, will be available on the Company website at www.candentecopper.com.

The conference call will be archived for later playback and details on how to access it will be available on the Company website at www.candentecopper.com.

About Candente Copper

The Company’s flagship project is Cañariaco, within which Cañariaco Norte, is the 10th largest late-stage copper resource in the world and 6th highest in grade (RFC Ambrian, December 2021 and Haywood, December 2021). In addition to Cañariaco Norte, the Cañariaco Project, includes the Cañariaco Sur deposit and Quebrada Verde prospect, all within a 4km NE-SW trend in northern Peru’s prolific mining district.

The Company is very pleased to now have Cañariaco Norte included in 4 research reports that compare various global copper projects. RFC Ambrian: Cañariaco Norte in top 10 of 23 projects with potential to involve third party M&A (December 2021); Haywood: Cañariaco Norte is one of 18 assets selected as likely to be considered by majors looking to acquire (December 2021); Deutsche Bank: Cañariaco Norte identified as one of 3 projects required to meet the upcoming copper supply-demand gap (February 2021); Goldman Sachs: Cañariaco Norte identified with incentive copper price in the lowest quartile of the top 84 copper projects worldwide (October 2018).

About Ausenco

Ausenco is a global company redefining what's possible. Its team is based across 26 offices in 14 countries, with projects in over 80 locations worldwide. Combining their deep technical expertise with a 30-year track record, Ausenco provides innovative, value-add consulting and engineering studies and project delivery, asset operations and maintenance solutions to the mining & metals, oil & gas and industrial sectors.

This press release contains forward-looking information within the meaning of Canadian securities laws (“forward-looking statements”). Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements. Forward-looking statements in this press release include, without limitation: the results of the 2022 PEA, including the projected CapEx, the estimated after-tax NPV and IRR, the estimated mine life and estimated concentrate grades; the potential production from and viability of the Cañariaco Project; the risks and opportunities outlined in the 2022 PEA; the potential tonnage, grades and content of deposits; the extent of mineral resource estimates; and estimated production and operating costs. These forward-looking statements are made as of the date of this press release. Although the Company believes the forward-looking statements in this press release are reasonable, it can give no assurance that the expectations and assumptions in such statements will prove to be correct. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. Such factors and assumptions include, among others, variations in market conditions; the nature, quality and quantity of any mineral deposits that may be located; metal prices; other prices and costs; currency exchange rates; the Company’s ability to obtain any necessary permits, consents or authorizations required for its activities; the Company’s ability to access further funding and produce minerals from its properties successfully or profitably, to continue its projected growth, or to be fully able to implement its business strategies. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements.

Known risk factors include risks associated with exploration and project development; the need for additional financing; the calculation of mineral resources; operational risks associated with mining and mineral processing; fluctuations in metal prices; title matters; government regulation; obtaining and renewing necessary licenses and permits; environmental liability and insurance; reliance on key personnel; local community opposition; currency fluctuations; labour disputes; competition; dilution; the volatility of our common share price and volume; future sales of shares by existing shareholders; and other risk factors described in the Company’s annual information form and other filings with Canadian securities regulators, which may be viewed at www.sedar.com. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws.

CAUTIONARY NOTE TO U.S. INVESTORS

We advise U.S. investors that this news release uses terms defined in the 2014 edition of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) “CIM Definition Standards on Mineral Resources and Mineral Reserves”, as incorporated by reference in Canadian National Instrument 43-101 “Standards of Disclosure for Mineral Projects”, for reporting of mineral resource estimates. These Canadian standards, including NI 43-101, differ from the requirements of the United States Securities and Exchange Commission (SEC) as set forth in the mining disclosure rules under Regulation S-K 1300. Regulation S-K 1300 uses the same terminology for mineral resources, but the definitions are not identical to NI 43-101 and CIM Definition Standards. Regulation S-K 1300 uses the term “initial assessment” for an evaluation of potential project economics based on mineral resources. This study type has some similarities to a Preliminary Economic Assessment, but the definition and content requirements of an initial assessment are not identical to the definition and content requirements for a PEA under NI 43-101.

On behalf of the Board of Candente Copper Corp.

“Joanne C. Freeze” P.Geo., President, CEO and Director

For further information please contact:

Jonathan Paterson

Jonathan.Paterson@HarborAccessllc.com

+1 475 455 9401

info@candentecopper.com

www.candentecopper.com

NR-145