Canstar Options District-Scale, High Grade Gold Project in Newfoundland and Announces Private Placement

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION IN THE UNITED STATES OR TO U.S. NEWS AGENCIES

Golden Baie Project Highlights

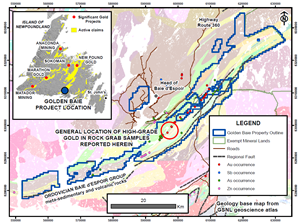

- Approximately 2,600 mineral claims over 66,000 hectares covering more than 95 km of strike length along a major regional gold structure.

- Recent prospecting along a 5 km strike length has identified new high-grade gold occurrences, including multiple outcrop and float samples with visible gold in quartz stockwork and quartz breccia associated with intense silicification.

- Excellent year-round access, simple permitting/logistics, and power nearby.

TORONTO, Aug. 26, 2020 (GLOBE NEWSWIRE) -- CANSTAR RESOURCES INC. (TSXV: ROX) (“Canstar” or the “Company”) is pleased to announce that it has signed a binding letter agreement with Altius Resources Inc. (“Altius”), a wholly owned subsidiary of Altius Minerals Corporation (TSX: ALS), and other arm’s length parties for the option to acquire a 100% interest in mineral claims covering approximately 66,000 hectares (660 km2) located in southern Newfoundland (Figure 1), which will be called the Golden Baie Project. The acquisition of the Golden Baie Project allows Canstar to build on its exploration focus in Newfoundland as a complement to the Buchans-Mary March and Daniel’s Harbour projects and adds significant exposure to precious metals exploration.

Prospecting at the Golden Baie Project over the last three years by the arm’s length vendors resulted in the discovery of several new gold occurrences in bedrock with multiple grab samples containing coarse free gold occurring in quartz veins in an area with limited historic drilling. Samples collected by the vendors of the Project assayed as high as 2,213 g/t gold (sample 2019-33) and the re-assay of the associated rock pulp returned 4,485 g/t gold (sample 2019-33 (a)). Other rock grab samples reported by the vendors near this location assayed 1,199 g/t gold (sample 2019-34) and 471 g/t gold (sample 2019-35). All samples were reportedly of argillite-hosted quartz veins. The Company has not yet independently verified the vendors’ data.

In July of this year, Altius personnel visited the Project site and confirmed the occurrences of visible gold in outcrop. Altius’ check rock grab samples collected within a 30 metre radius of these samples and from similar material assayed 153 g/t gold (sample 19179), 178 g/t gold (sample 19180), and 11 g/t Au (sample 19178). The true widths and known extent of the mineralized zone have not yet been determined. Note that rock grab samples are selective by nature and values reported may not represent the true grade or style of mineralization across the property.

Exploration has been both sporadic and limited on the Golden Baie Project over the past 40 years, with the last program finishing up almost 10 years ago. The Project area has seen no modern geophysics and only piecemeal soil and silt geochemistry. Westfield Minerals Limited drilled approximately 60 shallow holes in the region in the 1980s, of which 9 holes occur on the property, and Mountain Lake Minerals Inc. drilled approximately 50 shallow holes from 2009 to 2011, of which 38 occur on the property. Some of the historic drill holes intersected gold mineralization, such as hole DDH LR-09-02 which intersected 4.8 g/t Au over 3.0 metres starting at 3.5 metres down hole. However, these exploration programs appear to have missed the multiple occurrences of visible gold in outcrops on the claims (Table 1).

Table 1- 2018 & 2019 Assay Highlights (Source: Unpublished reports from Kendell & Northcott, 2020)

| Sample ID | Source | UTM Easting | UTM Northing | Au (ppb) | Comments | ||

| 2019-33 (A) | Outcrop | 596832 | 5297889 | 4,485,400 | pulp re-run of 2019-33 | ||

| 2019-33 | Outcrop | 596832 | 5297889 | 2,213,867 | |||

| 2019-34 | Float | 596829 | 5297888 | 1,198,620 | |||

| 2019-34 (A) | Float | 596829 | 5297888 | 1,073,100 | pulp re-run of 2019-34 | ||

| 2019-35 | Outcrop | 596833 | 5297891 | 471,338 | |||

| 2019-35 (A) | Outcrop | 596833 | 5297891 | 395,684 | pulp re-run of 2019-35 | ||

| LRCN18-12 | Float | 596685 | 5298097 | 33,377 | |||

| LRCN18-09 | Outcrop | 598964 | 5301057 | 30,623 | |||

| 64296 | Float | 596764 | 5298307 | 23,700 | |||

| LRCN18-13 | Float | 596685 | 5298082 | 20,150 | |||

| LRCN18-10 | Outcrop | 598956 | 5301061 | 18,787 | |||

| LRCN18-01 | Float | 599195 | 5301279 | 16,732 | |||

| 373374 | Outcrop | 596809 | 5297889 | 12,080 | |||

| 2019-07 | Float | 596701 | 5298184 | 11,814 | |||

| 2019-10 | Float | 597297 | 5299085 | 10,846 | |||

| CN-41-18 | Float | 597960 | 5298927 | 10,373 | |||

| Select rock grab samples > 10,000 ppb collected and reported by Kendell and Northcott (2020) from the Golden Baie Property. | |||||||

| All samples have been assayed by Eastern Analytical Ltd, Springdale, Newfoundland. | |||||||

| UTM coordinates projected in NAD 27, Zone 21. | |||||||

Note: the reader is cautioned that rock grab samples are selective by nature and values reported may not represent the true grade or style of mineralization across the property.

Dennis Peterson, Interim Chief Executive Officer and Chairman of Canstar, commented: “We are extremely pleased to acquire such a large, prospective gold exploration project in Newfoundland to complement our existing portfolio of high-quality projects, including Buchans/Mary March and Daniels Harbour. With our already established base in Newfoundland and the concurrent financing the Company will be able to begin work on the Golden Baie Project immediately.”

Kerry Sparkes, Exploration Advisor to Canstar, commented: “The Golden Baie project offers Canstar shareholders a unique opportunity to participate in the early stages of a strong gold bull market with the acquisition of an extensive, underexplored, highly prospective land package in Newfoundland. The recent discovery of significant occurrences of visible gold within a belt that also displays many geological and mineralogical similarities to other highly productive gold belts worldwide makes this an exciting opportunity.”

Private Placement Details

The Company also announces that it plans to complete a non-brokered private placement for gross proceeds of up to $2,000,000 (the "Offering") through the sale of up to 22,222,222 units of the Company at $0.09 per unit (each a “Unit”). Each Unit will consist of one common share in the equity of the Company (each, a "Common Share") and one share purchase warrant (each, a "Warrant"). Each Warrant will entitle the subscriber to purchase one additional Common Share at a price of $0.15 until the fourth (4th) anniversary of the closing date of the Offering.

The Company intends to use the net proceeds raised from the Offering for general corporate purposes, working capital, and exploration expenses on the Company’s properties, including Buchans/Mary March, Daniel’s Harbour, and Golden Baie. The Company may pay finder's fees in respect to the Offering. Closing of the Offering is expected on or about September 15, 2020. The Offering is subject to the final approval of the TSX Venture Exchange (“Exchange”). Securities issued pursuant to the Offering shall be subject to a four-month plus one day hold period commencing on the day of the closing of the Offering under applicable Canadian securities laws.

It is expected that certain directors, officers and other insiders of the Company (collectively, the “Insiders”) will participate in the Private Placement. The participation of Insiders in the Private Placement constitutes a “related party transaction”, as such terms are defined by Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company is relying on an exemption from the formal valuation requirements of MI 61-101 available on the basis of the securities of the Company not being listed on specified markets, including the Toronto Stock Exchange, the New York Stock Exchange, the American Stock Exchange, the NASDAQ or certain overseas stock exchanges. The Company is also relying on the exemption from minority shareholder approval requirements under MI 61-101 as the fair market value of the participation in the Offering and Private Placement by the Insiders does not exceed 25% of the market capitalization of the Company.

Prior to entering into the Altius Agreement (as defined below), Altius owned or controlled 3,669,024 common shares of Canstar, representing approximately 7.5% of the total number of issued and outstanding common shares. Following the completion of the Altius Agreement and before closing the private placement, Altius will own or control an aggregate of 7,669,024 common shares representing approximately 14.0% of the total number of issued and outstanding common shares. Under the Altius Agreement, Altius has the right to receive additional common shares of Canstar on the first and second anniversary of the Altius Agreement that would increase Altius’ ownership to 12,169,024 common shares, representing approximately 19.9% of the total number of issued and outstanding shares without taking into account shares to be issued in the Offering or any other share issuances outside of the Altius Agreement.

In satisfaction of the requirements of National Instrument 62-104 – Take-Over Bids and Issuer Bids and National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues, an early warning report respecting the acquisition of securities by Altius will be filed under the Company’s SEDAR Profile at www.sedar.com.

Altius is acquiring the common shares of Canstar for investment purposes only, and depending on market and other conditions, Altius may from time to time in the future increase or decrease its ownership, control or direction over securities of the Company, through market transactions, private agreements, or otherwise. The head office of Altius is located at 38 Duffy Place, 2nd Floor, St John's, NL A1B 4M5. For further information regarding this share acquisition by Altius, please contact Chad Wells, Vice-President, Business Development, Altius Minerals Corporation, Tel. 1-877-576-2206.

Adventus Mining Corporation (TSXV: ADZN), which currently owns approximately 36% of outstanding shares of Canstar and is its largest shareholder, supports this transaction and associated financing to reinvigorate the Company just as new gold exploration interest in Newfoundland is developing.

Golden Baie Project Terms

The Company has entered into a binding letter agreement with Altius (the “Altius Agreement”) that sets out the principal terms and conditions upon which Altius will grant to the Company the exclusive right and option (the “Option”) to acquire, subject to retention by Altius of certain rights related to a 2% net smelter return (“NSR”) royalty, its 100% interest in mineral in the Baie d’Espoir region of Newfoundland (the “Baie d’Espoir Claims”). Altius has also agreed to assign a binding letter agreement (the “Little River Agreement”) to Canstar that sets out the principal terms and conditions under which Corwn Northcott and Colin Kendell (collectively the “Optionors”) will grant the exclusive right and option to acquire, subject to retention by the Optionors of a royalty, their 100% interest in mineral claims known as the Little River Claims (the “Little River Claims”). Collectively, the Baie d’Espoir Claims and the Little River Claims, as well as any future claims added within a defined area of interest around the Little River Claims and the Baie d’Espoir Claims, will be called the Golden Baie Project.

Under the Altius Agreement and the Little River Agreement, Canstar can earn a 100% undivided interest in the Baie d’Espoir Claims and Little River Claims over a four year period as follows:

- Issuance of 4,000,000 common shares of the Company to Altius upon receipt of Exchange approval;

- Payment of an aggregate cash payment of $50,000 and issuance of an aggregate of 2,000,000 common shares to the Optionors upon signing of the definitive agreements (the “Definitive Agreements”);

- Issuance of 2,000,000 common shares to Altius on the first anniversary of the signing of the Definitive Agreements;

- Payment of an aggregate cash payment of $50,000 and issuance of an aggregate of 1,000,000 common shares to the Optionors on the first anniversary of the Definitive Agreements;

- Issuance of 2,500,000 common shares to Altius on the second anniversary of the Definitive Agreements;

- Payment of an aggregate cash payment of $50,000 and issuance of an aggregate of the lesser of $250,000 worth of common shares or 1,000,000 common shares to the Optionors on the second anniversary of the Definitive Agreements; and

- Payment of an aggregate cash payment of $50,000 and issuance of an aggregate of the lesser of $250,000 worth of common shares or 1,000,000 common shares to the Optionors on the third anniversary of the Definitive Agreements.

As further consideration for the Option, Canstar is required to commit to fund exploration expenditures of a minimum of $1,250,000 over a four-year period. The minimum expenditure commitment for the first year will be $500,000.

In addition, the Optionors will be entitled to an aggregate milestone payment of $1,000,000 by the Company to the Optionors upon the Golden Baie Project claims achieving National Instrument 43-101 defined measured and indicated mineral resources of at least one million contained gold ounces.

The Optionors will transfer title to the Little River Claims to Canstar subject to the Optionors retaining a 2.0% Net Smelter Royalty from all commercial production on the Golden Baie Project (the “Royalty”). Altius shall maintain the right to purchase from the Optionors 1% of the Royalty for the total sum of $1,500,000. Altius will also have a first right of refusal on the purchase of the remaining 1% of the Royalty.

So long as Altius owns more than 9.9% of the Company’s shares outstanding, on any equity financing during the term of the Option, Altius shall have the right, at its sole discretion, to participate in 19.9% of such financing on the same terms as other investors and subject to it not becoming a control person. In the event that Canstar proposes to issue shares (or units consisting of shares and warrants) in a financing at any time after the first anniversary of the Definitive Agreements (a “Financing”), Canstar shall grant to Altius a right, exercisable in Altius’ sole discretion, to sell shares of Canstar (and an option on shares of Canstar, in the event that the Financing includes warrants) for up to 15% of the Financing on a secondary sale basis for as long as Altius owns 9.9% or more of the outstanding shares of Canstar on a partially-diluted basis, and provided that the market capitalization of Canstar is at least $50.0 million. Altius also agreed that during the term of the Definitive Agreements, for so long as it owns 9.9% or more of the outstanding shares of Canstar on a partially-diluted basis that it will vote its shares of Canstar on any matter to be voted upon at a meeting of shareholders in the manner recommended by the management of Canstar.

The parties expect to enter into Definitive Agreements by September 15, 2020. Canstar has also agreed to raise a minimum of $500,000 by way of an equity private placement prior to September 15, 2020.

Qualified Persons, Technical Information, and Quality Control & Quality Assurance

Roderick Smith, P.Geo., Chief Geologist of Altius Resources Inc., and a Qualified Person within the meaning of National Instrument 43-101 Standards of Disclosure for Minerals Projects, has reviewed and approved the technical and scientific information presented herein as accurate and approved this news release.

About Canstar Resources Inc.

Canstar Resources is a mineral exploration and development company focused on creating shareholder value through discovery and development of economic mineral deposits in Newfoundland, Canada. Canstar is in the process of completing option agreements on the Golden Baie Project in south Newfoundland, a large claim package (660 km2) with recently discovered, multiple outcropping gold occurrences. The Company also holds the Buchans-Mary March project and other mineral exploration properties in Newfoundland and Labrador, Canada. Canstar Resources is based in Toronto, Canada and is listed on the TSX Venture Exchange and trades under the symbol ROX-V.

For further information, please contact:

Dennis H. Peterson

Chairman of the Board, Interim President and Chief Executive Officer

Email: info@canstarresources.com

www.canstarresources.com

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions, as well as the anticipated size of the Offering, the Offering price, the anticipated closing date and the completion of the Offering, the anticipated use of the net proceeds from the Offering and the receipt of all necessary approvals. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, an inability to complete the Offering on the terms or on the timeline as announced or at all, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ba5228f3-1db4-4cc4-90d1-3ce5a5d89cbf