Capstone Generates Record Net Income in 2021 and Increases Net Cash1 to $264.4 Million

Capstone Mining Corp. (“Capstone” or the “Company”) (TSX:CS) today announced production and financial results for the quarter (“Q4 2021”) and full year (“FY 2021”) ended December 31, 2021. Quarterly consolidated copper production totaled 51.6 million pounds at C1 cash costs1 of $1.72 per payable pound of copper produced. Annual consolidated copper production totaled 187.1 million pounds at C1 cash costs1 of $1.81 per payable pound of copper produced. Link HERE for Capstone’s Q4 2021 management’s discussion and analysis (“MD&A”) and financial statements and HERE for the webcast presentation.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220215006115/en/

(Graphic: Business Wire)

Darren Pylot, CEO of Capstone, commented, “Our investments in optimization and expansion over the past two years have allowed us to take advantage of robust copper prices, positioning us now with a large net cash balance sheet ahead of a period of transformational growth.” Mr. Pylot continued, “We announced the upcoming business combination with Mantos Copper on November 30th. After the special meeting of the shareholders on February 28th, we look forward to building on the strengths of both organizations as we create Capstone Copper, a Canadian copper champion that will deliver leading growth in our sector. We remain committed to strengthening communities and building resilient long-life operations.”

Q4 2021 AND 2021 OPERATIONAL & FINANCIAL HIGHLIGHTS

- Record net income of $252.9 million, or $0.56 per share for 2021 and net income of $41.4 million, or $0.10 per share for Q4 2021. Adjusted net income1 of $241.6 million or $0.60 per share for 2021, and $73.2 million or $0.18 per share for Q4 2021; main reconciling item for Q4 2021 was share based compensation expense.

- Record Adjusted EBITDA1 of $432.2 million for 2021 and $113.3 million for Q4 2021. The increase in adjusted EBITDA1 is reflective of Capstone’s 19% growth in production and strong operational performance and financial leverage in a robust copper price environment.

- Record Operating cash flow before changes in working capital1 of $556.3 million in 2021 and $104.9 million in Q4 2021driven by strong revenue in a plus $4.40 price copper environment. Included in 2021 Operating cash flow is the receipt of the $150.0 million upfront payment for the Cozamin Silver Stream and $30.0 million upfront payment for the Santo Domingo Gold Stream Agreement.

- Cash and short term investments grew by $56.2 million during the three months ending December 31, 2021 and by $389.3 million during 2021 to $264.4 million. The Company's total available liquidity1 was $489.4 million with nil long term debt. The balance sheet was further enhanced by continued strong operating cash flow generation during Q4 2021.

- Consolidated copper production of 51.6 million pounds at C1 cash costs1 of $1.72 per payable pound of copper produced for Q4 2021. Full year guidance achieved with consolidated copper production for 2021 of 187.1 million pounds at C1 cash costs1 of $1.81 per payable pound of copper produced.

- Cozamin Mine achieved another record quarterly copper production of 14.5 million pounds at $0.99 per payable pound of copper produced for Q4 2021. Q4 2021 production was 41% higher than in Q4 2020 following commissioning of the Calicanto one-way ramp in Q1 2021.

- Pinto Valley Mine produced 37.1 million pounds at $2.00 per payable pound of copper for Q4 2021. The mine's processing plant achieved rates of approximately 58,500 tonnes per day (“tpd”) in Q4 2021 following completion of Phase 2 of PV3 Optimization.

- Capstone announced the Transaction to combine with Mantos Copper (Bermuda) Limited (“Mantos”) to create Capstone Copper Corp.The Transaction will establish Capstone Copper Corp. as a premier copper producer with a diversified portfolio of high-quality, long-life operating assets focused in the Americas with an extensive pipeline of near-term fully-permitted organic growth opportunities. Completion of the Transaction is expected in March or April 2022.

|

Operational Overview

Refer to Capstone’s Q4 2021 and FY 2021 MD&A and Financial Statements for detailed operating results.

|

Q4 2021 |

Q4 2020 |

FY 2021 |

FY 2020 |

Copper production (million pounds) |

|

|

|

|

Pinto Valley |

37.1 |

34.1 |

133.3 |

119.0 |

Cozamin |

14.5 |

10.3 |

53.8 |

37.9 |

Total |

51.6 |

44.4 |

187.1 |

156.9 |

Copper sales |

|

|

|

|

Copper sold (million pounds) |

46.8 |

39.3 |

178.7 |

147.4 |

Realized copper price ($/pound) |

4.61 |

3.64 |

4.42 |

2.99 |

C1 cash costs1 ($/pound) produced |

|

|

|

|

Pinto Valley |

2.00 |

2.00 |

2.16 |

2.21 |

Cozamin |

0.99 |

0.63 |

0.96 |

0.69 |

Consolidated |

1.72 |

1.68 |

1.81 |

1.84 |

Consolidated

Q4 2021 production was 16% higher than Q4 2020 mainly as a result of higher mine grades at both mines plus record copper production at Cozamin driven by the mine expansion related to the completion of the new one-way ramp at the end of 2020.

2021 consolidated production of 187.1 million pounds of copper is at the upper end of the full year guidance of 175 to 190 million pounds of copper. The production results reflect a 19% increase compared to prior year, benefiting from Cozamin achieving the higher mill rates (3,800 tpd) and benefits of the PV3 Optimization projects at Pinto Valley. The increase in production was the main driver for the $0.03 per payable pound of copper decrease in C1 cash costs1 in 2021 compared to 2020, offset by $0.09/lb related to the Cozamin silver stream, thus overall pre-stream the C1 cash costs1 were $0.12/lb lower than 2020. 2021 YTD C1 cash costs1 are within annual guidance of $1.75 to $1.90 per payable pound of copper.

Pinto Valley Mine

Q4 2021 production was higher than the same period last year primarily on higher grades for Q4 2021 (0.37% versus 0.31% in Q4 2020) as a result of mine sequencing and an increase in cut off grade to the mill, sending the lower grade ore to leach, partially offset by lower recoveries in Q4 2021 compared to Q4 2020.

2021 production increased by 12% compared to the same period last year due to higher head grades for 2021 (0.35% versus 0.30% in 2020) and improved flotation plant recovery performance (85.7% versus 85.0% in 2020).

C1 cash costs1 of $2.00 per payable pound of copper in Q4 2021 were consistent with the same period last year. Lower capitalized stripping costs of $0.12 per pound during the quarter ($0.2 million versus $4.1 million in Q4 2020) were fully offset by higher Q4 2021 production compared to Q4 2020.

A decrease in 2021 C1 cash cost1 by $0.05 per payable pound of copper was primarily attributed to higher production compared to the same period last year.

Cozamin Mine

Production in Q4 2021 was 41% higher than the same period last year and another record production quarter for Cozamin. Higher copper production was primarily due to the successful utilization of the Calicanto one-way ramp which increased mill rates from 3,086 tpd in Q4 2020 to 3,863 tpd in Q4 2021. In addition, with the optimized technical report mine plan, the mine is delivering significantly higher mine grades (1.92% in Q4 2021 versus 1.72% in Q4 2020) from the copper rich San Jose and Calicanto zones.

2021 production increased by 42% compared to the same period last year mainly due to higher mill throughput (3,724 tpd versus 2,949 tpd in 2020 YTD) and head grades (1.86% versus 1.67% in 2020).

C1 cash costs1 in Q4 2021 were higher than the same period last year due to $0.29 per payable pound of copper impact of the Cozamin silver stream with Wheaton for 50% of the silver sales and higher production costs attributed to higher operating development meters executed.

C1 cash costs1 in 2021 were higher than the same period last year due to $0.30 per payable pound of copper impact of the Cozamin silver stream with Wheaton for 50% of the silver sales. The cost per payable pound impact of the Cozamin silver stream was partially offset by higher production.

Financial Overview

Refer to Capstone’s Q4 2021 and FY 2021 MD&A and Financial Statements for detailed financial results.

Q4 2021 |

Q4 2020 |

FY 2021 |

FY 2020 |

|

Revenue ($ millions) |

215.9 |

148.1 |

794.8 |

453.8 |

|

|

|

|

|

Net income ($ millions) |

41.4 |

27.6 |

252.9 |

12.4 |

|

|

|

|

|

Net income attributable to shareholders ($ millions) |

41.4 |

27.6 |

226.8 |

12.6 |

Net income attributable to shareholders per common share – basic ($) |

0.10 |

0.07 |

0.56 |

0.03 |

Net income attributable to shareholders per common share – diluted ($) |

0.10 |

0.07 |

0.55 |

0.03 |

|

|

|

|

|

Adjusted net income1 ($ millions) |

73.2 |

35.6 |

241.6 |

26.4 |

Adjusted net income attributable to shareholders1 ($ millions) |

73.2 |

35.6 |

242.1 |

26.4 |

Adjusted net income attributable to shareholders per common share – basic1($) |

0.18 |

0.09 |

0.60 |

0.07 |

Adjusted net income attributable to shareholders per common share – diluted1($) |

0.18 |

0.09 |

0.58 |

0.07 |

|

|

|

|

|

Adjusted EBITDA1 ($ millions) |

113.3 |

63.5 |

432.2 |

139.2 |

|

|

|

|

|

Cash flow from operating activities2 ($ millions) |

94.5 |

67.4 |

553.3 |

147.2 |

Cash flow from operating activities per common share1 - basic ($) |

0.23 |

0.17 |

1.36 |

0.37 |

Operating cash flow before changes in working capital1,2 ($ millions) |

104.9 |

65.3 |

556.3 |

131.2 |

Operating cash flow before changes in working capital per common share1 – basic ($) |

0.26 |

0.16 |

1.37 |

0.33 |

2 2021 includes $180.0 million silver and gold stream proceeds |

|

December 31, 2021 |

December 31, 2020 |

Total assets ($ millions) |

1,728.0 |

1,391.6 |

Long term debt (excluding financing fees) ($ millions) |

- |

184.9 |

Total non-current financial liabilities ($ millions) |

38.4 |

183.6 |

Total non-current liabilities ($ millions) |

481.3 |

408.5 |

Cash and cash equivalents and short-term investments ($ millions) |

264.4 |

60.0 |

Net cash/(debt)1 ($ millions) |

264.4 |

(124.9) |

CORPORATE UPDATE

Mantos Transaction

On November 30, 2021, the Company announced it had entered into a definitive agreement (the "Agreement") with Mantos to combine, pursuant to a plan of arrangement (the “Transaction”). Mantos is a copper-producing company that, through its subsidiaries, is engaged in the exploration, development, extraction, and processing of sulphide and oxide ores, and the production and sale of London Market Exchange Grade “A” copper cathodes and clean copper concentrates, with gold and silver by-products from its mining assets. Mantos Copper currently operates the open pit copper mines and processing plants of Mantos Blancos, located forty-five kilometers northeast of Antofagasta, and Mantoverde, located fifty kilometers southeast of Chañaral, in the region of Atacama.

The Transaction will require the approval of at least 66 2/3% of the votes cast by the shareholders of Capstone voting at a special meeting of shareholders to be held on February 28th, 2022. Officers and directors of Capstone, along with Capstone’s largest shareholder, have entered into support and voting agreements, agreeing to vote their shares in favour of the Transaction (representing approximately 26.5% of the issued and outstanding common shares of Capstone). The management information circular dated January 27th, 2022 has been posted to the Company’s website and filed on its profile on SEDAR.

Institutional Shareholder Services (“ISS”) and Glass Lewis (“GL”), two leading independent third party proxy advisory firms, have recommended that shareholders vote FOR the proposed business combination with Mantos. ISS and GL, among other services, provide proxy-voting recommendations to pension funds, investment managers, mutual funds and other institutional shareholders.

In its report, ISS stated, “The arrangement makes strategic sense as the combined company will possess a diversified collection of long-life operating assets, planned and fully financed copper production growth of 45% by 2024, and material production growth opportunities represented by the Santo Domingo project as well as expansion projects across the combined company asset portfolio.”

Glass Lewis’ report noted, “We ultimately believe the board and special committee established a sound basis upon which to conclude the proposed transaction represents an attractive opportunity for the Company and its shareholders. The merger will result in a larger, more diversified copper producer with an opportunity to achieve meaningful synergies.”

Upon completion of the Transaction, the combined company is expected to be renamed Capstone Copper Corp. ("Capstone Copper"). Capstone Copper will remain headquartered in Vancouver, B.C. and has received conditional approval to be listed on the TSX. Pursuant to the Agreement, each Capstone shareholder will receive 1 newly issued Capstone Copper share per Capstone share (the "Exchange Ratio") and the existing Mantos shareholders will continue to hold Capstone Copper shares. Upon completion of the Transaction, former Capstone and Mantos shareholders will collectively own approximately 60.75% and 39.25% of Capstone Copper, respectively, on a fully-diluted basis. The Transaction is subject to certain regulatory approvals, consents from certain third parties and other customary closing conditions for a transaction of this nature, including approvals by the security holders, the TSX and the Supreme Court of British Columbia. The Agreement includes a non-solicitation provision, a right to match a superior proposal and a C$75 million termination fee payable in certain circumstances. Completion of the Transaction is expected in March or April 2022.

Subject to shareholder approval and the satisfaction of all other conditions, the Transaction is anticipated to close in March or April 2022.

PV3 Optimization Completed

PV3 Optimization work was completed in Q3 2021. The $31 million two year program involved investments in the fine crushing plant, two new ball mill shells, tailings thickeners, and tailings pumping upgrades. The optimization work has enabled the reliability of higher throughput rates at Pinto Valley from 51,000 tpd average in 2019 to over 58,000 tpd average in Q4 2021.

PV4 Study

During 2021, the study work progressed on the pre-feasibility study ("PFS") for PV4 which aims to maximize the conversion of approximately one billion tonnes of mineral resources to mineral reserves, significantly extending Pinto Valley’s mine life and increasing the mine’s copper production profile. The application of the following new technologies and innovation is being considered:

- Expansion of the use of Jetti Catalytic Leach Technology which has the potential to increase mill cut-off-grades and increase tonnage available for leaching. Column leach testing is ongoing through H1 2022 and results will be included in the PV4 Study.

- Pyrite Agglomeration has strong Environmental, Social and Governance ("ESG") implications as it will divert acid-generating minerals including pyrite and chalcopyrite from tailings to the dump leach operation. Additional copper recovery and lower costs via self–generation of free acid are also key economic drivers for this project. The project’s initiation is targeted for H2 2022 subject to board approval. Based on preliminary study results, the project is expected to require a low capex with a short payback period.

Higher mill throughput will be considered targeting up to 65,000 to 70,000 tpd. Key areas of investment include upgrades to ball mill motors, grinding circuit cyclones, and improvements to the rougher flotation circuit and evaluation of coarse particle flotation. A low capital strategy is currently under review to improve coarse particle recovery with some modest investment in the current conventional flotation circuit. An expanded dump leach strategy would translate to higher grades sent to the mill for processing and increased copper cathode production by expanding dump leach tonnage.

Santo Domingo Project

Following consolidation of Capstone’s 100% ownership of the Santo Domingo Project ("Santo Domingo" or “the Project") in Region III, Chile during Q1 2021, the Company continued to advance the Project on several fronts:

- With respect to the reduced initial capital estimate, the Company and its port partner, Puerto Abierto, S.A., a subsidiary of Puerto Ventanas, S.A., are executing on early works in the framework agreement. In addition, the Company is advancing the analysis of the pipeline versus rail capital trade-off in which the proposals replace the pipeline capital to become a rail customer. This work is now being done in conjunction with the Mantoverde synergies analysis discussed below.

-

With respect to the proposed Transaction with Mantos, scoping level work is being performed by the Santo Domingo and Mantos teams starting in late Q4 2021 to identify and refine potential synergies between the Santo Domingo Project with the Mantoverde mine (owned 70% by Mantos). Santo Domingo is situated ~35 kilometres northeast of the Mantoverde mine; significant potential opportunities exist for:

- Infrastructure sharing (including power, water, pipelines, port),

- Transportation synergies for concentrates,

- Potential enabling of product lines (additional iron and cobalt production from Mantoverde, processing oxide ore from Santo Domingo),

- Potential integrated operating approach, and

- Construction synergies (including project teams and camp).

- With respect to potential increases in the Chilean mining royalty tax, Santo Domingo is expected to be protected given the Company retains a foreign investment contract with the state of Chile, which fell under the provisions of DL600. One of the benefits to the Company of this agreement is a tax invariability system for a period of 15 years post commercial production.

- Cobalt Feasibility Update: The drilling program from Q3 and Q4 of 2021 generated sufficient sample mass for 2022 pilot scale testing of the cobalt recovery process. The first of a total of two stages of the cobalt feasibility engineering work, covering pre-feasibility level activities, started in September 2021 and is expected to finalize in March 2022. The proposed cobalt recovery process takes advantage of a tailings side-stream containing pyrite laden with ~0.6% cobalt, which will be recovered through a conventional flowsheet. The concentrate will be sent to pyrite roasting and solvent extraction followed by crystallization to produce battery grade cobalt sulphate heptahydrate. At an expected 10.4 million pounds of cobalt production per year, this will be one of the largest and lowest cost cobalt producers in the world at C1 cash costs1 of minus $4 per pound. Additional benefits of this project include the production of by-product sulphuric acid from the pyrite roasting process, which can be used for heap or dump leaching to produce low-cost copper cathodes at Santo Domingo, Mantoverde, and elsewhere in the district.

Corporate Exploration Update

Cozamin exploration: The focus during Q4 2021 was on testing the Mala Noche Footwall Zone and Mala Noche Main Vein West Target with three surface rigs, along with the in-parallel development of the west exploration drift and crosscuts which will allow more efficient testing of the target from underground once completed in early 2022. One additional surface rig tested other brownfield targets on the property.

Copper Cities, Arizona: On January 20, 2022, Capstone announced that it had entered into an 18-month access agreement with BHP Copper Inc. ("BHP") to conduct drill and metallurgical test-work at BHP's Copper Cities project ("Copper Cities"), located ~10 km east of the Pinto Valley Mine. In 2022, Capstone plans to spend $6.7 million in a two-phase drill program aimed at twinning historical drill holes and to select a portion of these for metallurgical testing.

Planalto, Brazil: Step-out drilling at the Planalto Iron Ore-Copper-Gold prospect in Brazil, under Earn In agreement with Lara Exploration Ltd., commenced in Q4 2021 and will continue into 2022. Lara Exploration Ltd. is expected to report results when appropriate.

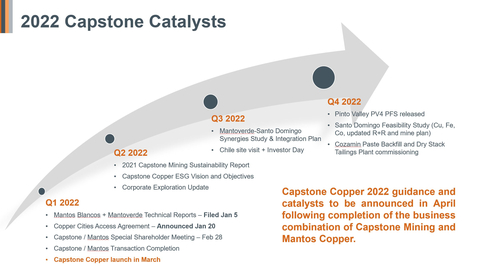

Capstone Copper 2022 Catalysts

The following chart demonstrates key catalysts this year and assumes the completion of the combination with Mantos Copper by the end of Q1 2022. Of note, Capstone Copper's ESG Vision and Objectives will be rolled out in Q2 2022. The Mantoverde-Santo Domingo synergies study & integration plan is expected in September and will be followed by a site visit and investor day for institutional investors and analysts.

At Pinto Valley, the PV4 prefeasibility study is expected to be released by year-end and at Santo Domingo, the updated feasibility and mine plan including the cobalt feasibility study is also expected to be released in Q4 2022. At Cozamin, the paste backfill and dry stack tailings plant is expected to be commissioning by the end of 2022.

2022 PRODUCTION AND COST GUIDANCE

In 2022, Capstone Mining expects to produce between 82,000 and 90,000 tonnes of copper at C1 cash costs1 of between $1.85 and $2.00 per pound payable copper produced from the Pinto Valley and Cozamin mines.

Our cost control strategy included the following actions:

During 2020, financial hedges were executed on foreign exchange rates to protect approximately half of the Company’s Mexican Peso exposure from August 2020 through December 2021. The realized gain on the Mexican Peso zero cost collars was $2.6 million for the twelve months ended December 31, 2021. In November 2021, additional financial hedges were executed for approximate 75% of the Mexican Peso and Chilean Peso operating and capital cost exposure at the Cozamin mine and at Santo Domingo, respectively. The Mexican Peso collars have a floor of 20 and a cap of 24.75 Mexican Pesos to the US dollar, and the Chilean Peso collars have a floor of 750 and a cap of 931 and 939 Chilean Pesos to the US dollar.

Pinto Valley fixed diesel prices with a supplier on its expected 2021 and 2022 diesel consumption at $1.76/gallon and $2.13/gallon, respectively. The fixed diesel prices have resulted in cost savings of $3.0 million and $6.3 million during the three months and year ended December 31, 2021, respectively. At current prices the price fixing is expected to yield additional savings of approximately $4.5 million during 2022.

CONFERENCE CALL AND WEBCAST DETAILS

Capstone will host a conference call and webcast on Wednesday, February 16, 2022 at 08:30 am PT/11:30 am ET.

Link to the audio webcast:

https://produceredition.webcasts.com/starthere.jsp?ei=1524721&tp_key=1dedc36dcb

Dial-in numbers for the audio-only portion of the conference call are below. Due to an increase in call volume, please dial-in at least five minutes prior to the call to ensure placement into the conference line on time.

Toronto: (+1) 416-764-8650

Vancouver: (+1) 778-383-7413

North America toll free: 888-664-6383

Confirmation #50217755

A replay of the conference call will be available until March 2, 2022. Dial-in numbers for Toronto: (+1) 416-764-8677 and North American toll free: 888-390-0541. The replay code is 217755#. Following the replay, an audio file will be available on Capstone’s website at: https://capstonemining.com/investors/events-and-presentations/default.aspx.

This release is not suitable on a standalone basis for readers unfamiliar with Capstone and should be read in conjunction with the Company’s MD&A and Financial Statements for the three and twelve months ended December 31, 2021, which are available on Capstone’s website and on SEDAR, all of which have been reviewed and approved by Capstone's Board of Directors.

ABOUT CAPSTONE MINING CORP.

On November 30, 2021, Capstone Mining and Mantos Copper announced that they have entered into a definitive agreement to combine pursuant to a plan of arrangement under the Business Corporations Act (British Columbia). Upon completion of the Transaction, the new Company would be renamed Capstone Copper Corp. (Capstone Copper).

Capstone Mining Corp. is a Canadian base metals mining company, focused on copper. We are committed to the responsible development of our assets and the environments in which we operate. Our two producing mines are the Pinto Valley copper mine located in Arizona, US and the Cozamin copper-silver mine in Zacatecas State, Mexico. In addition, Capstone owns 100% of Santo Domingo, a large scale, fully permitted, copper-iron-gold project in Region III, Chile, as well as a portfolio of exploration properties. Capstone's strategy is to focus on the optimization of operations and assets in politically stable, mining-friendly regions, centred in the Americas. Our headquarters are in Vancouver, Canada and we are listed on the Toronto Stock Exchange (TSX) under the symbol CS. Further information is available at www.capstonemining.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This document may contain “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). These forward-looking statements are made as of the date of this document and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation.

Forward-looking statements relate to future events or future performance and reflect our expectations or beliefs regarding future events and the impacts of the ongoing and evolving COVID-19 pandemic. Forward-looking statements include, but are not limited to, statements with respect to the estimation of Mineral Resources and Mineral Reserves, the success of the underground paste backfill and tailings filtration projects at Cozamin, the timing and cost of the construction of the paste backfill and dry stack tailings plant at Cozamin, the timing and results of the PV4 study, timing and success of the Jetti Technology, the successful execution of a port services agreement with Puerto Abierto S.A. and/or rail agreement with Sigdo Kopper’s rail business, the expected reduction in capital requirements for the Santo Domingo project, the timing and success of the Cobalt Study for Santo Domingo, the success of the PV3 Optimization project, the realization of Mineral Reserve estimates, the timing and amount of estimated future production, the costs of production and capital expenditures and reclamation, the budgets for exploration at Cozamin, Santo Domingo, Pinto Valley and other exploration projects, the timing and success of the Copper Cities Project, the success of our mining operations, the continuing success of mineral exploration, the estimations for potential quantities and grade of inferred resources and exploration targets, our ability to fund future exploration activities, our ability to finance the Santo Domingo project, environmental risks, unanticipated reclamation expenses and title disputes, the consummation and timing of the transaction with Mantos Copper (Bermuda) Limited ("Mantos") (the "Transaction”) and, if consummated, the success of the synergies and catalysts related to the Transaction for the combined entity, Capstone Copper Corp., and the anticipated future production, costs of production, capital expenditures and reclamation of Mantos Copper operations and development projects. The potential effects of the COVID-19 pandemic on our business and operations are unknown at this time, including Capstone’s ability to manage challenges and restrictions arising from COVID-19 in the communities in which Capstone operates and our ability to continue to safely operate and to safely return our business to normal operations. The impact of COVID-19 to Capstone is dependent on a number of factors outside of our control and knowledge, including the effectiveness of the measures taken by public health and governmental authorities to combat the spread of the disease, global economic uncertainties and outlook due to the disease, supply chain delays resulting in lack of availability of supplies, goods and equipment, and evolving restrictions relating to mining activities and to travel in certain jurisdictions in which we operate.

In certain cases, forward-looking statements can be identified by the use of words such as “anticipates”, “approximately”, “believes”, “budget”, “estimates”, expects”, “forecasts”, “guidance”, intends”, “plans”, “scheduled”, “target”, or variations of such words and phrases, or statements that certain actions, events or results “be achieved”, “could”, “may”, “might”, “occur”, “should”, “will be taken” or “would” or the negative of these terms or comparable terminology. In this document certain forward-looking statements are identified by words including “anticipated”, “expected”, “guidance” and “plan”. By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, amongst others, risks related to inherent hazards associated with mining operations and closure of mining projects, future prices of copper and other metals, compliance with financial covenants, surety bonding, our ability to raise capital, Capstone’s ability to acquire properties for growth, counterparty risks associated with sales of our metals, use of financial derivative instruments and associated counterparty risks, foreign currency exchange rate fluctuations, market access restrictions or tariffs, changes in general economic conditions, availability and quality of water, accuracy of Mineral Resource and Mineral Reserve estimates, operating in foreign jurisdictions with risk of changes to governmental regulation, compliance with governmental regulations, compliance with environmental laws and regulations, reliance on approvals, licences and permits from governmental authorities and potential legal challenges to permit applications, contractual risks including but not limited to, our ability to meet the completion test requirements under the Cozamin Silver Stream Agreement with Wheaton Precious Metals Corp. ("Wheaton"), our ability to meet certain closing conditions under the Santo Domingo Gold Stream Agreement with Wheaton, acting as Indemnitor for Minto Metals Corp.’s surety bond obligations post divestiture, impact of climate change and changes to climatic conditions at our Pinto Valley and Cozamin operations and Santo Domingo project, changes in regulatory requirements and policy related to climate change and greenhouse gas ("GHG") emissions, land reclamation and mine closure obligations, aboriginal title claims and rights to consultation and accommodation, risks relating to widespread epidemics or pandemic outbreak including the COVID-19 pandemic; the impact of COVID-19 on our workforce, risks related to construction activities at our operations and development projects, suppliers and other essential resources and what effect those impacts, if they occur, would have on our business, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of Capstone relating to the unknown duration and impact of the COVID-19 pandemic, uncertainties and risks related to the potential development of the Santo Domingo project, increased operating and capital costs, increased cost of reclamation, challenges to title to our mineral properties, increased taxes in jurisdictions the Company operates or is subject to tax, changes in tax regimes we are subject to and any changes in law or interpretation of law may be difficult to react to in an efficient manner, maintaining ongoing social licence to operate, seismicity and its effects on our operations and communities in which we operate, dependence on key management personnel, potential conflicts of interest involving our directors and officers, corruption and bribery, limitations inherent in our insurance coverage, labour relations, increasing energy prices, competition in the mining industry including but not limited to competition for skilled labour, risks associated with joint venture partners, our ability to integrate new acquisitions and new technology into our operations, cybersecurity threats, legal proceedings, risks related to the consummation of the Transaction, including failure to receive shareholder and other necessary consents and approvals for the Transaction, the volatility of the price of the Common Shares, the uncertainty of maintaining a liquid trading market for the Common Shares, risks related to dilution to existing shareholders if stock options or other convertible securities are exercised, the history of Capstone with respect to not paying dividends and anticipation of not paying dividends in the foreseeable future and sales of Common Shares by existing shareholders can reduce trading prices, and other risks of the mining industry as well as those factors detailed from time to time in the Company’s interim and annual financial statements and MD&A of those statements and Annual Information Form, all of which are filed and available for review under the Company’s profile on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause our actual results, performance or achievements to differ materially from those described in our forward-looking statements, there may be other factors that cause our results, performance or achievements not to be as anticipated, estimated or intended. There can be no assurance that our forward-looking statements will prove to be accurate, as our actual results, performance or achievements could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on our forward-looking statements.

CAUTIONARY NOTE TO UNITED STATES INVESTORS REGARDING PRESENTATION OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

As a British Columbia corporation and a “reporting issuer” under Canadian securities laws, we are required to provide disclosure regarding our mineral properties in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. In accordance with NI 43-101, we use the terms mineral reserves and resources as they are defined in accordance with the CIM Definition Standards on mineral reserves and resources (the “CIM Definition Standards”) adopted by the Canadian Institute of Mining, Metallurgy and Petroleum. In particular, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” used in this news release and the documents incorporated by reference herein and therein, are Canadian mining terms defined in accordance with CIM Definition Standards. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained in this news release and the documents incorporated by reference herein may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

United States investors are also cautioned that while the SEC will now recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any “measured mineral resources”, “indicated mineral resources”, or “inferred mineral resources” that we report are or will be economically or legally mineable. Further, “inferred resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist. In accordance with Canadian rules, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

NATIONAL INSTRUMENT 43-101 COMPLIANCE

Unless otherwise indicated, Capstone has prepared the technical information in this news release (“Technical Information”) based on information contained in the technical reports, Annual Information Form and news releases (collectively the “Disclosure Documents”) available under Capstone Mining Corp.’s company profile on SEDAR at www.sedar.com. Each Disclosure Document was prepared by or under the supervision of a qualified person (a “Qualified Person”) as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”). Readers are encouraged to review the full text of the Disclosure Documents which qualifies the Technical Information. Readers are advised that Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The Disclosure Documents are each intended to be read as a whole, and sections should not be read or relied upon out of context. The Technical Information is subject to the assumptions and qualifications contained in the Disclosure Documents.

Disclosure Documents include the National Instrument 43-101 compliant technical reports titled "NI 43-101 Technical Report on the Cozamin Mine, Zacatecas, Mexico" effective October 23, 2020, “Pinto Valley Mine Life Extension – Phase 3 (PV3) Pre-Feasibility Study” effective January 1, 2016 and “Santo Domingo Project, Region III, Chile, NI 43-101 Technical Report” effective February 19, 2020.

The disclosure of Scientific and Technical Information in this news release was reviewed and approved by Brad Mercer, P. Geol., Senior Vice President Exploration and Strategic Projects (technical information related to mineral exploration activities and to Mineral Resources at Cozamin), Clay Craig, P.Eng, Manager, Mining & Evaluations (technical information related to Mineral Reserves and Mineral Resources at Pinto Valley and Mineral Reserves at Cozamin) and Albert Garcia III, PE, Vice President, Projects (technical information related to project updates at Santo Domingo) all Qualified Persons under NI 43-101.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220215006115/en/