Capstone to Advance Cobalt Project at Santo Domingo to Feasibility; Opportunity to Build a Vertically Integrated Cobalt Business in Chile

Capstone Mining Corp. ("Capstone" or the “Company”) (TSX:CS) announces it intends to advance the Cobalt Project at Santo Domingo in Region III, Chile, ("Santo Domingo" or the "Project") to Feasibility as described in the Santo Domingo Project, Region III, Chile NI 43-101 Technical Report and Preliminary Economic Assessment1 (the “Technical Report” or “PEA”). The production of battery-grade cobalt sulphate at Santo Domingo is expected to significantly add to the robust copper-iron-gold project and maximizes the recovery of future facing metals from this rich resource.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210325005352/en/

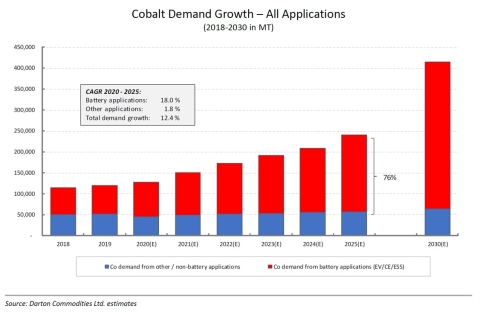

Figure 1 : Cobalt Demand Growth – All Applications (2018-2030 in metric tonnes). By 2025, an estimated 184,000 tonnes of cobalt (or 76% of total cobalt demand) is needed in Li-ion batteries, of which 118,000 tonnes is required for various EV applications. (Source: Darton Commodities Ltd. estimates)

Darren Pylot, Capstone President and CEO said, “Capstone has an incredible opportunity to produce ethically-sourced battery-grade cobalt sulphate from Santo Domingo’s future copper-iron tailings stream. The process is a series of conventional steps, with below zero costs given significant by-product credits.”

“The potential of cobalt production in Chile has been underappreciated for decades while copper and, recently, lithium have been the main focus of investment. Although this market is small, projections for demand growth suggest that it could triple in size by 2030 mainly due to the development of electromobility. As the chemical properties of cobalt extends the life of rechargeable lithium batteries used in electric vehicles, we are seeing a significant boost to exploration and extraction activity. Capstone’s plans for a cobalt feasibility study at Santo Domingo could represent a great step forward and an example of Chile’s potential to become an important world producer.” said Edgar Blanco, Chile’s mining ministry undersecretary.

The Santo Domingo Advantage in the Global Cobalt Supply Landscape2

- Downstream cobalt users are actively seeking ethical supply to meet future demand needs and Chile is one of the best mining jurisdictions in the world.

- In 2020, an estimated 71% of the 133,000 tonnes of cobalt produced globally originated from the Democratic Republic of Congo (DRC) and the majority of this was shipped to China, the leading importer of mined cobalt and exporter of refined cobalt.

- Global cobalt sulphate production in 2020 is estimated at 43,000 tonnes of cobalt contained. Of this, greater than 85% was produced in China and greater than 90% originated from DRC intermediates.

- By 2025, an estimated 140,000 tonnes of cobalt contained in cobalt sulphate will be required for lithium-ion (Li-ion) batteries.

- Cobalt contained in sulphate currently sells at a premium over the cobalt metal benchmark price3.

- The bulk of global cobalt sulphate production is dependent on refining third-party feedstock imported from other countries. The majority of cobalt sulphate producers are currently processing feed that is priced at around 93-94% of the cobalt metal benchmark price.

- Santo Domingo’s PEA estimated costs of -$4 per pound (net of by-products in cobalt operation) positions it to be a unique, fully integrated producer of battery-grade cobalt sulphate4.

- Santo Domingo will be the only cobalt sulphate project in the Americas not dependent on third-party DRC feed5.

- Santo Domingo’s cobalt processing capacity could supply enough battery-grade material for more than 500,000 electric vehicles (EV’s) annually6.

Mr. Pylot added, “A cobalt operation at Santo Domingo would unlock Chile’s vast potential for this critical metal and it is exciting that Capstone is leading this vision. The selection of a strategic partner due later this year, will accelerate this unique project to recover a future-facing, green metal from a waste stream, a plan that I’m set on making a reality.”

Table 1 and Table 2 outline the top 10 cobalt miners and refiners outside of the DRC and top three cobalt projects to come online within the next five years.

Table 1: Top 10 Cobalt Miners / Refiners Outside of DRC

|

Miner/Operator |

Mine |

Refinery |

End Product |

2021 Est. Volume (t) |

1 |

Sumitomo Metal Mining |

Philippines |

Japan |

Metal + Chloride |

6,000 |

2 |

Vale |

Canada + New Caledonia |

Canada |

Metal + Intermediates |

4,700 |

3 |

Nornickel |

Russia |

Russia |

Metal + Intermediates |

4,600 |

4 |

Glencore |

Various |

Norway |

Metal |

4,400 |

5 |

Sherritt / General Nickel (Moa JV) |

Cuba |

Canada |

Metal |

3,300 |

6 |

Glencore |

Australia |

Australia |

Metal |

3,300 |

7 |

MCC |

Papua New Guinea |

N/A |

Intermediates |

3,000 |

8 |

Cengiz Holding |

Turkey |

Turkey |

Intermediates |

2,700 |

9 |

Cubaniquel |

Cuba |

N/A |

Concentrates |

2,000 |

10 |

Ambatovy |

Madagascar |

Madagascar |

Metal |

1,900 |

Source: Darton Commodities Limited (2020-2021 Report)

Table 2: Top Three Cobalt Projects Within Next Five Years Outside of DRC

Mine/Operator |

Mine |

Refinery |

End Product |

Future Volume (t) |

|

1 |

QMB New Energy JV |

Indonesia |

Indonesia |

Intermediates + Cobalt Sulphate |

5,000 |

2 |

Capstone Mining Santo Domingo |

Chile |

Chile |

Cobalt Sulphate |

4,700 |

3 |

Cleanteq Sunrise |

Australia |

Australia |

Cobalt Sulphate |

4,000 |

NOTE: First Cobalt in Canada is expected to produce up to 4,500 MT of Cobalt by 2023 in sulphate form but will be processing mostly DRC feed. Source: Darton Commodities Limited (2020-2021 Report).

Cobalt Sulphate Demand Growth

According to Darton’s recently published 2020-2021 Cobalt Market Review, Nickel Cobalt Manganese (NCM) is to remain the dominant cathode chemistry in EV batteries and cobalt sulphate is the prime ingredient for NCM precursor materials. By 2025, an estimated 184,000 tonnes of cobalt (or 76% of total cobalt demand) is needed in Li-ion batteries, of which 118,000 tonnes is required for various EV applications. Refer to Figure 1 for Darton’s Cobalt Demand forecast.

Expert Hire to Lead Cobalt Feasibility Work at Santo Domingo

Romke Kuyvenhoven joined Capstone in February 2021 and is leading the cobalt feasibility work and overall metallurgical strategy for Santo Domingo. She has a M.Sc. in Mining Engineering from Delft University of Technology in The Netherlands and a Degree in Geo-Mining-Metallurgy from the Universidad de Chile. Previously, Romke worked at the Sustainable Minerals Institute in Santiago, where one of her focus areas was the characterization and metallurgical assessment of IOCG ores in Chile’s Atacama Region, where Santo Domingo is located. She is co-author on several recent international publications related to cobalt and was also the technical lead of the First International Cobalt Workshop in November 2018 in Santiago. As an independent consultant and formally registered QP, she has been involved in several NI 43-101 based due diligence studies and has acted as geometallurgical consultant for international financial institutions involved in these studies of Chilean mineral properties.

Dr. Albert Garcia, Ph.D., PE, Capstone’s Vice President of Projects commented, “I am very pleased to announce that we have hired Romke Kuyvenhoven as her experience in IOCG deposits and cobalt metallurgy is invaluable. Santo Domingo benefits from simple metallurgy and as it relates to cobalt recovery, means that we can recover nearly 80% of the cobalt contained in run-of-mine ore to refined battery-grade cobalt sulphate product that sells for a premium. Costs will be amongst the lowest in the world at negative $4 per pound given the by-product credits in the cobalt process in the form of increased copper recovery, sulphuric acid production and energy generation.”

Table 3: Santo Domingo Cobalt PEA Recap

Key Metrics |

2020 Colbalt Opportunity PEA |

Life of Mine "LOM" (years) |

18 |

Cobalt production period (years) |

16 |

Initial capital cost (US$ billions) |

$0.67 |

Net Present Value "NPV" (after-tax, 8% discount) (US$ billions) |

$0.63 |

Internal Rate of Return "IRR" (after-tax) (%) |

27% |

Cobalt production LOM (tonnes per annum) |

4,700 |

Sulphuric Acid (millions tonnes per annum) |

1.4 |

C1 cash costs7 per pound of cobalt (net of by-products) |

-$4.11 |

Note: PEA assumptions include $20 per pound cobalt with no premium attributed to cobalt sulphate, $45 per tonne sulphuric acid prices ex-Santo Domingo Mine, $3.00 copper, and power credits from cogeneration process.

Santo Domingo Cobalt Project Timeline & Feasibility Stage-Gates

The $20 million work program will consist of two phases and several stage gates as outlined in Figure 2. Following the Phase 1 work program in Q1-2022, Capstone will provide an update to the market on final met work, final process design and updated cobalt resources. The feasibility report is expected by Q4 2022 with construction to start in 2023 or 2024 following permitting. The integration of the cobalt project with the copper-iron concentrator has been designed so that, if necessary, pyrite-cobalt concentrate can be safely stored in a lined, wet pond for two years, allowing for the cobalt plant to be built later than the mill. Figure 3 illustrates key pre-production milestones and expected life of mine cobalt production anticipated to commence by 2025 or 2026.

Cobalt Process is a Series of Conventional Metallurgical Steps

Capstone’s concept for cobalt recovery is based on its bond with pyrite, which is concentrated by preferential flotation on a tailings stream. Approximately 840,000 tonnes per year of pyrite containing 0.6% cobalt and 0.4% copper is expected to be recovered at this step. The concentrate is fed through a five-stage process consisting of roasting, leaching, copper precipitation, cobalt solvent extraction and crystallization to yield battery-grade cobalt sulfate heptahydrate. Recovery of cobalt from pyrite concentrate is expected to be approximately 90% at very low cost due to significant by-products from increased copper recovery, sulfuric acid production and energy generation. The flowsheets are simple and incorporate a series of conventional technologies that are used extensively in the mining industry, as shown in Figure 4 and Figure 5. The Santo Domingo concentrator is expected to commence construction in late 2021, with first year of operation in 2024.

ABOUT CAPSTONE MINING CORP.

Capstone Mining Corp. is a Canadian base metals mining company, focused on copper. Our two producing mines are the Pinto Valley copper mine located in Arizona, US and the Cozamin copper-silver mine in Zacatecas State, Mexico. In addition, Capstone owns 100% of Santo Domingo, a large scale, fully-permitted, copper-iron-gold project in Region III, Chile, as well as a portfolio of exploration properties. Capstone's strategy is to focus on the optimization of operations and assets in politically stable, mining friendly regions, centred in the Americas. We are committed to the responsible development of our assets and the environments in which we operate. Our headquarters are in Vancouver, Canada and we are listed on the Toronto Stock Exchange (TSX). Further information is available at www.capstonemining.com.

COMPLIANCE WITH NATIONAL INSTRUMENT 43-101

Unless otherwise indicated, Capstone has prepared the scientific and technical information in this news release based on information contained in the technical reports and news releases (collectively the “Disclosure Documents”) available under Capstone Mining Corp.’s company profile on SEDAR at www.sedar.com. Each Disclosure Document was prepared by or under the supervision of a qualified person (a “Qualified Person” or “QP”) as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”). For readers to fully understand the information in this news release, they should read the Technical Reports (available on www.sedar.com) in their entirety, including all qualifications, assumptions and exclusions that relate to the information set out in this presentation which qualifies the Scientific and Technical Information. Readers are advised that mineral resources that are not mineral reserves do not have demonstrated economic viability. The Disclosure Documents are each intended to be read as a whole, and sections should not be read or relied upon out of context. The Technical Information is subject to the assumptions and qualifications contained in the Disclosure Documents. For further details refer to the Company’s NI 43-101 Technical Report Santo Domingo Project, Region III, Chile, Feasibility Study Update, published March 24, 2020, effective February 19, 2020. The Scientific and Technical Information in this news release has been prepared in accordance with NI 43-101 and reviewed and approved by the following Qualified Persons, as defined by NI 43-101, who are independent from Capstone (except as noted below) based on content from their respective portions of the 2020 Technical Report:

Mr. Antonio Luraschi, CMC, Wood

Dr. Gregg Bush, P.Eng. (Non-independent)

Mr. David Rennie, P.Eng., RPA

Mr. Lyn Jones, P.Eng., Mplan International

Dr. Albert Garcia III, Ph.D., PE., Capstone Mining Corp. (Non-independent)

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release, and the documents incorporated by reference herein, contains “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). These forward-looking statements are made as of the date of this document and Capstone Mining Corp. (“Capstone” or the “Company”) does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation.

Forward-looking statements relate to future events or future performance and reflect our expectations or beliefs regarding future events. Forward-looking statements include, but are not limited to,statements with respect to the estimation of Mineral Resources and Mineral Reserves, the realization of Mineral Reserve estimates, the timing and amount of estimated future production, costs of production, the timing and possible outcome of legal proceedings and regulatory actions, and capital expenditures, the success of our mining operations, environmental risks, unanticipated reclamation expenses and title disputes, Capstone’s ability to satisfy the conditions of closing the Gold Stream Agreement and complete required corporate matters, Capstone’s ability to complete the required agreements contemplated in the Framework Agreement with Puerto Ventanas, Capstone and Puerto Ventanas’ ability to finance the construction of the Port, Capstone’s ability to finance the Santo Domingo Project, the successful completion of our strategic process for the Santo Domingo Project. In certain cases, forward-looking statements can be identified by the use of words such as “aims”, “plans”, “expects”, “aiming”, “approximately”, “guidance”, “scheduled”, “target”, “estimates”, “forecasts”, “extends”, “convert”, “potential”, “intends”, “anticipates”, “believes” or variations of such words and phrases, or statements that certain actions, events or results “may”, “could”, “should”, “would”, “will”, “might” or “will be taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology. By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, amongst others, permitting risks related to the Santo Domingo Port and other permits required for the Santo Domingo Project our ability to finance the Santo Domingo Project, our ability to find a strategic partner for the Santo Domingo Project, risk related to compliance with our covenants under our RCF, risks related to inherent hazards associated with mining operations and closure of mining projects, the inherent uncertainty of mineral exploration and estimations of exploration targets, future prices of copper and other metals, compliance with financial covenants, surety bonding, our ability to raise capital, Capstone’s ability to acquire properties for growth, counterparty risks associated with sales of our metals, foreign currency exchange rate fluctuations, changes in general economic conditions, accuracy of mineral resource and mineral reserve estimates, operating in foreign jurisdictions with risk of changes to governmental regulation, compliance with governmental regulations, compliance with environmental laws and regulations, reliance on approvals, licences and permits from governmental authorities, changes in governmental tax legislation or interpretation thereof, impact of climatic conditions on our operations, aboriginal title claims, land reclamation and mine closure obligations, uncertainties and risks related to the potential development of the Santo Domingo Project, increased constructions costs, increased operating and capital costs, challenges to title to our mineral properties, maintaining ongoing social license to operate, dependence on key management personnel, potential conflicts of interest involving our directors and officers, corruption and bribery, limitations inherent in our insurance coverage, labour relations, increasing energy prices, competition in the mining industry, risks associated with joint venture partners, our ability to integrate new acquisitions into our operations, cybersecurity threats, legal proceedings, and other risks of the mining industry as well as those factors detailed from time to time in the Company’s interim and annual financial statements and MD&A of those statements, all of which are filed and available for review under the Company’s profile on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause our actual results, performance or achievements to differ materially from those described in our forward-looking statements, there may be other factors that cause our results, performance or achievements not to be as anticipated, estimated or intended. There can be no assurance that our forward-looking statements will prove to be accurate, as our actual results, performance or achievements could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on our forward-looking statements.

ALTERNATIVE PERFORMANCE MEASURES

"C1 Cash Costs" and "Total Project Operating Cost" are Alternative Performance Measures. These performance measures are included because these statistics are key performance measures that management uses to monitor performance. Management uses these statistics to assess how the Company is performing to plan and to assess the overall effectiveness and efficiency of mining operations. These performance measures do not have a meaning within International Financial Reporting Standards ("IFRS") and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

CAUTIONARY NOTE TO UNITED STATES INVESTORS REGARDING PRESENTATION OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

As a British Columbia corporation and a “reporting issuer” under Canadian securities laws, we are required to provide disclosure regarding our mineral properties in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. In accordance with NI 43-101, we use the terms mineral reserves and resources as they are defined in accordance with the CIM Definition Standards on mineral reserves and resources (the “CIM Definition Standards”) adopted by the Canadian Institute of Mining, Metallurgy and Petroleum. In particular, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” used in this news release and the documents incorporated by reference herein and therein, are Canadian mining terms defined in accordance with CIM Definition Standards. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained in this news release and the documents incorporated by reference herein may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

United States investors are also cautioned that while the SEC will now recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any “measured mineral resources”, “indicated mineral resources”, or “inferred mineral resources” that we report are or will be economically or legally mineable. Further, “inferred resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist. In accordance with Canadian rules, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

1 Santo Domingo Project, Region III, Chile NI 43-101 Technical Report effective date 19 February 2020 (Joyce Maycock, P.Eng., Antonio Luraschi, CMC, Marcial Mendoza, CMC, Mario Bianchin, P.Geo., David Rennie, P.Eng., Carlos Guzman, CMC, Roger Amelunxen, P.Eng., Michael Gingles, QP MMSA, Tom Kerr, P.Eng., Roy Betinol, P.Eng., Lyn Jones, P.Eng., Gregg Bush., P.Eng.)

2 Darton Commodities Limited (2020-2021 Cobalt Market Review)

3 Fastmarkets MB Standard Grade Cobalt Metals Price on March 22, 2021 was US$ 24/lb.

4 By 2025 there could be two other ‘integrated’ cobalt sulphate producers in operation: (1) Cleanteq (Sunrise project in Australia) – 4,000 MT capacity and (2) QMB New Energy JV (Tsingshan, GEM a.o. in Indonesia) 5,000 MT capacity.

5 First Cobalt in Canada is expected to produce up to 4,500 MT of Co by 2023 in sulphate form but will be processing mostly DRC feed.

6 Assumes by 2025 a 68 KWh average battery pack in BEV with predominantly NCM811 chemistry. Source Darton Commodities

7 This is an Alternative Performance Measure. C1 cash cash costs reflect operating costs related to the cobalt process, net of by-product credits from sulphuric acid sales of $45 per tonne ex-minesite, power credits from cogen plant, and copper recovered in process.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210325005352/en/