Carlyle Commences Phase 1 Diamond Drilling at the Newton Gold Silver Project

Vancouver, British Columbia--(Newsfile Corp. - January 12, 2023) - CARLYLE COMMODITIES CORP. (CSE: CCC) (FSE: BJ4) (OTC Pink: DLRYF) ("Carlyle" or the "Company") is pleased to announce that is has commenced Phase 1 diamond drilling at its 100% owned Newton Gold Silver Project near Williams Lake, British Columbia.

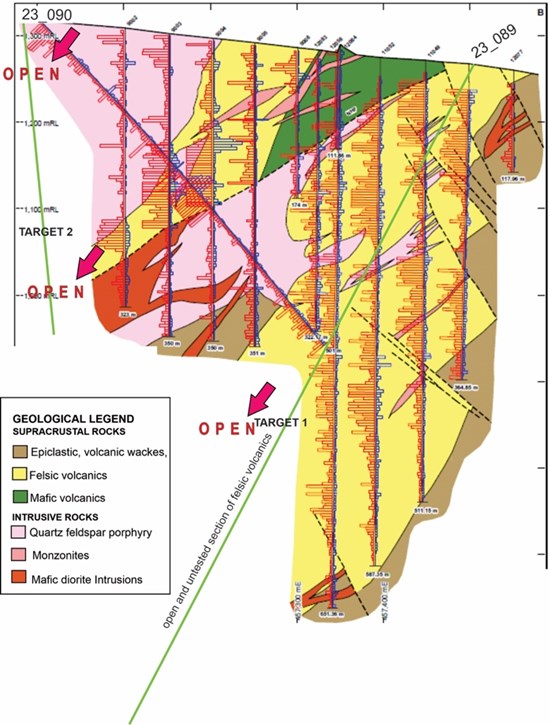

The Company's Phase 1 diamond drill program is intended to test numerous high priority targets with aims of increasing both tonnage and ounces at the Company's current National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") resource calculation. The initial focus will test several zones of felsic volcanic host rock that are outside of the current pit-constrained resource calculation with the intention of discovering new zones of mineralization.

Phase 1 initial drill targets:

Drill site 1: Targets continuity of the well mineralized main felsic domain, which remains open. This will be completed by a 500 meter to 1,000 meter drill hole through the current resource and extending to untested sections of the felsic domain.

Drill site 2: Targets a potential felsic domain starting at surface and extending into a second felsic domain which remains open along trend. Geological modelling suggests that these may represent three stacked mineralized felsic domains.

Drill site 3: Targets an additional felsic domain more than 100 metres outside of the current resource. Historical DDH 12-076 returned 171m of 0.69 Au and 2.1 Ag (288-459m) which has not been followed up on.1

East - West section displaying open mineralized felsic volcanic domains and potential traces for the first two holes of Phase 1 diamond drilling in 2023.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6130/151147_82fde8b294d8a808_001full.jpg

Mr. Jeremy Hanson, VP Exploration stated: "We are very excited to begin this first phase of drilling. We have a number of high priority domains to test. Our modeling is indicating that these mineralized felsic domains extend significantly outside of the current resource and with potential for discoveries of new zones of mineralization."

Image 1 (left): Carlyle's VP of Exploration, Jeremy Hanson (middle), standing at drill site 1 with drill crew.

Image 2 (right): Paycore drill rig positioned at drill site 1.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6130/151147_carlylefigure2ab.jpg

Carlyle President and Chief Executive Officer, Morgan Good, commented: "We believe momentum is building across the junior resource equity markets. Carlyle's timing with its Phase 1 diamond drill program to test high potential targets looks to position the Company well."

Issuance of Shares to Consultants

The Company announces the issuance of an aggregate of 78,606 common shares (collectively, the "Shares") in the capital of the Company at a deemed price of $0.16875 per Share to two corporate strategy and business development consultants currently engaged by the Company. Accordingly, the Shares were issued to each respective consultant pursuant to the terms of a consulting agreement entered into between the Company and such consultant, and all Shares were issued at a price per Share equal to the lowest permitted price by the applicable policies of the Canadian Securities Exchange ("CSE"). The Shares were issued pursuant to the prospectus exemptions provided under Sections 2.24 and 2.14 of National Instrument 45-106 - Prospectus Exemptions. All Shares have a hold period of four months and a day.

Grant of Options

Carlyle also announces that it has granted 1,000,000 options (each, a "Option") to a consultant of the Company for the purchase of up to 1,000,000 Shares, pursuant to the terms of the Company's Omnibus Equity Incentive Plan. Each Option vested immediately and is exercisable for a period of 5 years at an exercise price of $0.31 per Share.

Qualified Person

Jeremy Hanson, M.Sc., P.Geo. a Qualified Person, as such term is defined by NI 43-101, has reviewed the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Historical information contained in this news release cannot be relied upon Mr. Hanson has not prepared nor verified the historical information.

About Carlyle

Carlyle is a mineral exploration company focused on the acquisition, exploration, and development of mineral resource properties. Carlyle owns 100% of the Newton Project in the Clinton Mining Division of B.C., and is listed on the CSE under the symbol "CCC".

ON BEHALF OF THE BOARD OF DIRECTORS OF

CARLYLE COMMODITIES CORP.

"Morgan Good"

Morgan Good

President and Chief Executive Officer

For more information regarding this news release, please contact:

Morgan Good, CEO and Director

T: 604-715-4751

E: morgan@carlylecommodities.com

W: www.carlylecommodities.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward‐looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward‐looking statements. Forward looking statements in this press release include, but are not limited to, statements regarding the anticipated Phase 1 drill program drill targets on the Newton Project, including, but not limited to, their timing and contents. These forward‐looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward‐looking information. Risks that could change or prevent these statements from coming to fruition include, but are not limited to, general business, economic and social uncertainties; litigation, legislative, environmental, and other judicial, regulatory, political, and competitive developments; and other risks outside of the Company's control. Further, the ongoing COVID-19 pandemic, labour shortages, high energy costs, inflationary pressures, rising interest rates, the global financial climate and the conflict in Ukraine and surrounding regions are some additional factors that are affecting current economic conditions and increasing economic uncertainty, which may impact the Company's operating performance, financial position, and future prospects. Collectively, the potential impacts of this economic environment pose risks that are currently indescribable and immeasurable. Readers are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly, are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. These forward-looking statements are made as of the date of this news release and, unless required by applicable law, the Company assumes no obligation to update these forward-looking statements.

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE accepts responsibility for the adequacy or accuracy of this release).

1 A copy of the Company's NI 43-101 compliant "Technical Report on the Updated Mineral Resources Estimate for the Newton Project, British Columbia, Canada" dated June 13, 2022 authored by Michael F. O'Brien, P.Geo., and Douglas Turnbull, P.Geo., which contains the updated Newton Project resource calculation, is available under Carlyle's profile on SEDAR.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/151147