Centerra Gold Records Net Earnings of $80.7 million or $0.27 per Common Share, Adjusted Net Earnings (Non-GAAP) of $97.8 million or $0.33 per Common Share and Cash from Operations of $268.1 million; Increases Quarterly Dividend by 25%

All figures are in United States dollars and all production figures are on a 100% basis unless otherwise stated. This news release contains forward looking information regarding Centerra Gold’s business and operations. See “Caution Regarding Forward-Looking Information”

TORONTO, July 31, 2020 (GLOBE NEWSWIRE) -- Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG) today reported its second quarter 2020 results. Key events and operating results of the second quarter included:

- Net earnings of $80.7 million and adjusted net earningsNG of $97.8 million, $0.27 and $0.33 per common share (basic), respectively.

- Cash flow from operations was $268.1 million.

- Production totalled 219,692 ounces of gold and 19.1 million pounds of copper.

- Production costs per ounce of gold sold were $410 per ounce.

- Production costs per pound of copper sold were $1.20 per pound.

- All-in sustaining costs on a by-product basis per ounce soldNG were $804 per ounce.

- Cash position of $212 million at quarter end with total liquidity of $712 million. As at June 30, 2020, the Company’s $500 million corporate credit facility was undrawn.

- Commercial production achieved on May 31, 2020 at the Öksüt Mine which generated positive operating cash flow of $13.5 million and free cash flowNG of $5.0 million during the quarter.

- Robust spring melt at Mount Milligan resulting in stored water inventory in excess of 6 million cubic metres at the end of the second quarter.

- An updated Kumtor 43-101 technical report is expected to be released in the fall of 2020.

- No change to 2020 production and cost guidance and a modification to growth capitalNG guidance.

- Quarterly Dividend increased by 25% to C$0.05 per common share.

All references in this document denoted with NG, indicate a non-GAAP term which is discussed under “Non-GAAP Measures” and reconciled to the most directly comparable GAAP measure.

Commentary

Scott Perry, President and Chief Executive Officer of Centerra stated, “We continue to stay vigilant at all of our operations to prevent an outbreak and avoid the spread of the COVID-19 virus and to ensure the health, safety and well-being of our employees, contractors and communities. At our Öksüt operation, we have celebrated a recent safety milestone, when on July 19, 2020, Öksüt achieved 3 million work hours without a lost time injury. Our continued commitment to Work Safe Home Safe is a driving force behind achieving such milestones.”

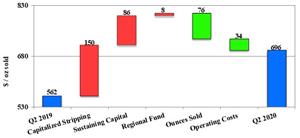

“The strong operating performance at Kumtor and Mount Milligan continued into this quarter and our Öksüt Mine achieved commercial production during the quarter. Our operations in the quarter delivered consolidated gold production of 219,692 ounces at all-in sustaining costsNG on a by-product basis of $804 per ounce sold in the quarter. Kumtor had another strong quarter producing 173,245 ounces of gold at all-in sustaining costsNG on a by-product basis of $696 per ounce sold. Mount Milligan produced 35,656 ounces of gold and 19.1 million pounds of copper at all-in sustaining costsNG on a by-product basis of $679 per ounce sold and Öksüt produced 10,791 ounces of gold, 5,619 ounces were commercial production. During the quarter, Öksüt’s all-in sustaining costsNG on a by-product basis was $537 per ounce, being our lowest cost mine in the quarter.”

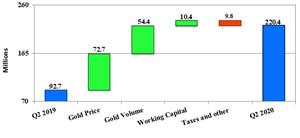

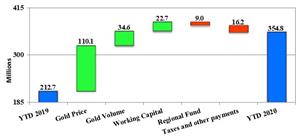

“Financially, the Company generated $268.1 million of cash from operations for the second quarter of 2020, which includes $220.4 million from Kumtor, $41.6 million from Mount Milligan and $13.5 million from Öksüt. During the second quarter of 2020, Kumtor, Mount Milligan and Öksüt delivered free cash flowNG of $156.9 million, $34.4 million and $5.0 million, respectively. Company-wide, free cash flowNG in the second quarter of 2020 was $169.1 million and we finished the quarter with cash of $212.2 million and no debt outstanding after repaying our corporate revolving credit facility in the quarter.”

“The decision of Centerra’s Board to increase the quarterly dividend by 25% to C$0.05 per common share announced today and planned into the future was based on our strong operating performance and the higher gold price environment, both of which contributed to our growing free cash flow and a debt-free balance sheet as at June 30, 2020.”

COVID-19 Update

Centerra continues to prioritize the health, safety and well-being of its employees, contractors, communities and other stakeholders during the current outbreak of COVID-19 and to take steps to minimize the effect of the pandemic on its business. Centerra has taken a series of measures to provide its employees with accurate information, help prevent infection and reduce the potential transmission of COVID-19, including activation of a global crisis management team, frequent communication with and compassionate support of all our people, travel restrictions, and the temporary closure of various administration offices including our head office in Toronto. Each Centerra site rapidly and successfully implemented proactive measures to minimize the impact of COVID-19 on operations, including strict protocols for access to operating sites, temperature checks and questioning upon entry, increased cleaning and hygiene protocols, modifications to work shifts and accommodation at site and an offsite quarantine facility established specifically for employees travelling to the Kumtor Mine site. In addition, our operating mine sites continue to assess the resiliency of their supply chain, are increasing mine site inventories of key materials and developing contingency plans to allow for continued operations.

The Company completed a company-wide COVID-19 employee survey in June to obtain feedback from employees on Centerra’s response to the pandemic and most importantly, on whether the Company is keeping employees well-informed and providing adequate support both physically and emotionally. The responses company-wide were favorable and Centerra will continue to address concerns and adapt its practices as necessary throughout the stages of this crisis.

While the majority of Centerra’s operating sites are currently operating without significant interruption, there has been an increase in the infection rates of COVID-19 and other illnesses in the Kyrgyz Republic which is beginning to have an impact on the available workforce for the Kumtor Mine. While Kumtor’s performance during the second quarter was unaffected, the Company is putting in place measures to manage the reduced workforce at Kumtor by mining waste below capacity while maintaining gold production levels by processing stockpiles as planned for the year. For further details on the impact of COVID-19 on Centerra’s operating sites and development projects please see “Operating Mines and Facilities” and “Pre-Development Projects”.

The Company notes that the effects of COVID-19 on its business continue to change rapidly. The measures enacted to date reflect the Company’s best assessment at this time but will remain flexible and be revised as necessary or advisable and/or as recommended by the public health and governmental authorities.

Exploration Update

Exploration activities in the second quarter of 2020 included drilling, surface sampling, geological mapping and geophysical surveying at the Company’s various projects (including earn-in properties); targeting gold and copper mineralization in Canada, Mexico, Turkey, Finland, USA and the Kyrgyz Republic. The Company has expanded its 2020 exploration program when compared to 2019 and is primarily focused on brownfield exploration at Kumtor, Mount Milligan and Öksüt. Exploration expenditures totalled $6.6 million in the second quarter of 2020, which included the impact of delays associated with COVID-19, compared to $6.3 million in the same quarter of 2019.

Kumtor Mine

The 2020 planned drilling program at Kumtor includes 55,000 metres of exploration and 15,000 metres of infill drilling, which are focused on priority primary and potential targets. Primary targets include various zones of the Central, Southwest and Sarytor deposits (areas) based on enhanced geological modelling from the recently updated Kumtor resource block model, and positive drilling results from 2018 and 2019. In addition, the 2020 planned drilling program at Kumtor includes the underexplored segments of the Kumtor Gold Trend – the Northeast targets, Bordoo, Akbel and conceptual targets (Hope Zone and others). An exploration potential update will be included in an updated Kumtor 43-101 technical report expected to be released in the fall of 2020.

In April, due to COVID-19 preventive measures, exploration drilling at Kumtor was temporarily suspended, resuming in June 2020. Due to the delay, a certain portion of the planned drilling program could be deferred to 2021.

During the second quarter of 2020, exploration drilling programs continued with the completion of fifteen diamond drill holes for 4,663 metres. Exploration drilling focused on testing zones of sulfide and oxide mineralization along the corridor between the Central and Southwest pits (Kosholuu, Hope and Southwest Oxide Deep zones), on the periphery of the Sarytor Pit, Northeast targets and Muzdusuu area.

Southwest Deposit (Area)

In the second quarter of 2020, a total of eleven diamond drill holes were completed in the Southwest area for a total of 2,902 metres.

Three drill holes have been completed between Southwest and Central pits in the Hope Zone for a total of 508 metres. Results from recent drilling have delineated a lens-shaped oxide gold mineralization. This mineralization extends along the hanging wall of the Kumtor Lower Thrust for more than 400 metres and is opened in both directions along the main NE strike.

Hole SW-20-319 intersected broad dispersed gold mineralization in Tertiary sediments.

Significant intersections are reported below:

| SW-20-313 | 9.0 metres @ 1.13 g/t Gold (“Au”), from 277.8 metres 4.3 metres @ 4.78 g/t Au from 289.2 metres |

| SW-20-319 | 39.0 metres @ 0.45 g/t Au from 19.6 metres Including 15.0 metres @ 0.92 g/t Au from 29.6 metres |

In the Kosholuu Zone, three drill holes were completed for a total of 708.2 metres. Selected best intercepts are listed below.

| SW-20-318 | 15.9 metres @ 1.65 g/t Au from 196.8 metres 10.4 metres @ 4.29 g/t Au from 221.7 metres |

| SW-20-320 | 18.3 metres @ 6.50 g/t Au from 225.0 metres Including 5.0 metres @ 13.08 g/t Au from 234.7 metres |

Five drill holes were completed for a total of 1,686.5 metres in the Hope Zone and tested inferred oxide mineralization. A selected best intercept is listed below:

| SW-20-324 | 21.7 metres @ 6.09 g/t Au from 226.0 metres Including 3.0 metres @ 12.93 g/t Au from 238.0 metres |

Sarytor Deposit (Area)

In the second quarter, drilling was not conducted at the Sarytor area, but results were obtained for the hole drilled in the first quarter. Significant intervals are shown below.

| SR-20-244 | 66.4 metres @ 2.05 g/t Au from 262.3 metres Including 9.9 metres @ 4.77 g/t Au from 285.6 metres |

Northeast Deposit (Area)

In the Northeast area, one diamond drill hole was completed during this quarter and results were obtained for previously completed reverse circulation (RC) drilling.

A few broad and low-grade intervals of sulfide and oxide mineralization were intersected. Oxide mineralization was identified in the northwestern part of the area, along the tectonic mélange zone.

Muzdusuu Area

Four diamond drill holes were completed in the Muzdusuu Area for a total of 1,040 metres. Results were also obtained for holes completed in the first quarter. Drilling in the Muzdusuu Area (outside Central Pit) is designed to explore for oxide and mixed gold mineralization along the Kumtor Lower Thrust. A few drill holes intersected broad intervals (up to 68 metres) of a mixed (oxide + sulfide) gold mineralization.

Hole DM2067 has tested inferred dispersed gold mineralization target in the Tertiary sediments (Parking Lot target) and intersected broad interval of a low-grade mineralization.

Significant intervals are shown below.

| DM2059 | 68.8 metres @ 1.38 g/t Au from 120.7 metres Including 31.0m @ 2.75 g/t Au from 136.0 metres |

| DM2062 | 57.3 metres @ 1.02 g/t Au from 96.2 metres Including 25.2m @ 2.06 g/t Au from 127.6 metres |

| DM2067 | 234.6 metres @ 0.20 g/t Au from 78.6 metres Including 31.0m @ 0.39 g/t Au from 147.6 metres |

The above mineralized intercepts were calculated using a cut-off grade of 1.0 g/t Au for sulfide and 0.1 g/t Au for oxide mineralization, minimum interval of 4.0 metres and a maximum internal dilution interval of 5.0 metres. The true widths for sulfide mineralized intervals reported represent approximately 70 to 95% of the stated down hole interval. Significant assay intervals reported for oxide mineralization represent apparent widths due to the uncertainty of the nature of the mineralization at the time of reporting. Drill collar locations and associated graphics are available at the following link: http://ml.globenewswire.com/Resource/Download/8e9ad544-6c3b-4ea5-b386-8e57ddd0746d

A full listing of the drill results, drill hole locations and plan map (including the azimuth, dip of drill holes, and depth of the sample intervals) for the Kumtor Mine have been filed on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and are available at the Company’s web site www.centerragold.com.

Mount Milligan Mine

The 2020 planned drilling program at Mount Milligan includes 17,500 metres (at approximately 40 drill sites) in five target zones of in-pit exploration, 10,000 metres of brownfield exploration and 3,000 metres of greenfield exploration. In March, due to COVID-19 preventive measures, exploration drilling at Mount Milligan was temporarily suspended and resumed in June 2020, with no impact to the planned drilling programs anticipated for the remainder of 2020. In the second quarter, two drill holes were completed in the Great Eastern Fault target area (20-1240, 20-2141), and one was in progress, totalling 1,274 metres drilled. Assay results were returned for two drill holes during the quarter and best weighted average intersections are reported below.

Saddle/66 Gap zone (In-Pit)

DDH 20-1237 and 20-1238 tested for an extension of mineralization into a gap in known reserves between the Saddle and 66 zones; and a deep geophysical target. DDH 20-1237 was abandoned at 26.8 metres for technical reasons. Significant pyrite mineralization in both drill holes is related to dykes (monzonite and trachyte) proximal to faults. The deep interval in 20-1238 was intersected in the immediate footwall of Harris fault.

| DDH 20-1237 | 17.1 metres @ 0.62 g/t Au, 0.10% Copper (“Cu”) from 9.8 metres including 6.7 metres @ 1.07 g/t Au, 0.17% Cu from 20.1 metres |

| DDH 20-1238 | 16.0 metres @ 1.19 g/t Au, 0.03% Cu from 82.0 metres including 3.6 metres @ 4.79 g/t Au, 0.05% Cu from 83.5 metres 76.1 metres @ 0.81 g/t Au, 0.03% Cu from 440.0 metres including 13.2 metres @ 1.57 g/t Au, 0.07% Cu from 449.8 metres and 2.0 metres @ 3.50 g/t Au, 0.05% Cu from 489.0 metres and 2.0 metres @ 3.20 g/t Au, 0.08% Cu from 496.8 metres and 2.0 metres @ 4.57 g/t Au, 0.02% Cu from 510.0 metres 13.0 metres @ 2.17 g/t Au, 0.02% Cu from 524.0 metres including 11.5 metres @ 2.41 g/t Au, 0.02% Cu from 524.0 metres. |

The above mineralized intercepts were calculated using a cut-off grade of 0.1 g/t Au and a maximum internal dilution interval of 4 metres. Significant assay intervals reported represent apparent widths due to the undefined geometry of mineralization in this zone, relationship between fault blocks, and conceptual nature of the exploration target. Drill collar locations and associated graphics are available at the following link: http://ml.globenewswire.com/Resource/Download/8e9ad544-6c3b-4ea5-b386-8e57ddd0746d

Greenfield exploration (MAX project)

The 2020 greenfield Phase-1 drilling program was completed in the second quarter of 2020 at the Max project. The Max project consists of a block of 12 mineral claims (4,869 ha) under option from Jama Holdings Inc., 21 kilometres south of the Mount Milligan mine processing facilities and adjoins the Mount Milligan property on the south. The program was supported by helicopter in June 2020, completing seven drill holes (3,573 metres) from five pads in two target areas. The prospect has similar geology, structure, geophysical and geochemical signature as the Mount Milligan MBX deposit. Assay results are pending.

A full listing of the drill results, drill hole locations and plan map (including the azimuth, dip of drill holes, and depth of the sample intervals) for the Mount Milligan Mine have been filed on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and are available at the Company’s web site www.centerragold.com.

Öksüt Mine

The 2020 planned drilling program at Öksüt includes 20,000 metres of diamond drilling, focused on near pit resource expansion and other oxide gold targets. The 2020 diamond drilling program has been designed to:

- expand the oxide gold resources around the known deposits at Keltepe and Güneytepe as well as at Keltepe North and Keltepe North-West,

- further test the oxide gold potential at Yelibelen, Büyüktepe, Boztepe and other targets,

- further delineate the supergene copper mineralization at depth, and test other deeper targets.

Drilling, which commenced towards the end of the second quarter of 2020 with one exploration hole being completed for 246 metres at the periphery of Güneytepe, will continue into the third quarter of 2020.

The 2020 planned drilling program has not been impacted by the COVID-19 preventive measures at the Öksüt mine site.

Assay results have been received for the completed drill hole. The highlights are:

| ODD0391 | 9.6 metres @ 0.29 g/t Au from 81.1 metres 115.8 metres @ 0.60 g/t Au from 95.8 metres including 18.6 metres @ 1.28 g/t Au from 129.4 metres and 6.7 metres @ 1.01 g/t Au from 169.6 metres |

The above mineralized intercepts were calculated using a cut-off grade of 0.2 g/t Au and a maximum internal dilution interval of 5 metres. The true widths of the mineralized intervals reported represent approximately 60 to 90% of the stated downhole interval. Drill collar locations and associated graphics are available at the following link: http://ml.globenewswire.com/Resource/Download/8e9ad544-6c3b-4ea5-b386-8e57ddd0746d

A full listing of the drill results, drill hole locations and plan map (including the azimuth, dip of drill holes, and depth of the sample intervals) for the Öksüt Gold Mine have been filed on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and are available at the Company’s web site www.centerragold.com.

Kemess Project

The 2020 Kemess brownfield drilling program is focused on the Kemess North Trend and comprises three drill holes (2,700 metres) at the Nugget historic resource to test for mineralization up-dip of the 2019 drilling and up to three drill holes (2,000 metres) at the Kemess East resource to test for an extension of known mineralization. Drilling at Kemess East will attempt to reuse and extend 2017 drill holes, or alternatively, a single drill hole (2,000 metres) may be drilled from surface. In late June, crews mobilized to site and began preparations, but no drill core was produced. The program is expected to run until late August.

Other Projects

During the second quarter of 2020, greenfield exploration programs targeting gold and copper were ongoing in Canada, Turkey, Mexico, USA and Finland.

Qualified Person & QA/QC – Exploration

Exploration information and related scientific and technical information in this document regarding the Kumtor Mine were prepared in accordance with the standards of National Instrument 43-101 (“NI 43-101”) and were prepared, reviewed, verified and compiled by Boris Kotlyar, a member with the American Institute of Professional Geologists (AIPG), Chief Geologist, Global Exploration with Centerra, who is the qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used, and quality assurance-quality control protocols used during the exploration drilling programs are done as described in the Kumtor Technical Report dated December 31, 2014. The Kumtor deposit is described in the 2019 Annual Information Form and the Kumtor Technical Report, which are both filed on SEDAR at www.sedar.com.

Exploration information and related scientific and technical information in this document regarding the Mount Milligan Mine were prepared in accordance with the standards of NI 43-101 and were prepared, reviewed, verified and compiled by C. Paul Jago, Member of the Engineers and Geoscientists British Columbia, Exploration Manager at Centerra’s Mount Milligan Mine, who is the qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used, and quality assurance quality control protocols used during the exploration drilling programs are done consistent with industry standards and independent certified assay labs are used. The Mount Milligan deposit is described in the 2019 Annual Information Form and a technical report dated March 26, 2020 (with an effective date of December 31, 2019) prepared in accordance with NI 43-101, both of which are available on SEDAR at www.sedar.com.

Exploration information and related scientific and technical information in this document regarding the Öksüt Gold Mine were prepared, reviewed, verified and compiled in accordance with NI 43-101 by Mustafa Cihan, Member of the Australian Institute of Geoscientists (AIG), Exploration Manager Turkey at Centerra’s Turkish subsidiary Centerra Madencilik A.Ş., who is the qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used, and quality assurance-quality control protocols used during the exploration drilling programs are done consistent with industry standards and independent certified assay labs are used. The Öksüt deposit is described in Centerra’s most recently filed Annual Information Form and in a technical report dated September 3, 2015 (with an effective date of June 30, 2015) prepared in accordance with NI 43-101, both of which are available on SEDAR at www.sedar.com.

About Centerra

Centerra Gold Inc. is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold properties in North America, Asia and other markets worldwide and is one of the largest Western-based gold producers in Central Asia. Centerra operates two flagship assets, the Kumtor Mine in the Kyrgyz Republic, the Mount Milligan Mine in British Columbia, Canada and has a third operating gold mine, the 100%-owned Öksüt Mine in Turkey. Centerra's shares trade on the Toronto Stock Exchange (TSX) under the symbol CG. The Company is based in Toronto, Ontario, Canada.

Conference Call

Centerra invites you to join its 2020 second quarter conference call on Friday, July 31, 2020 at 9:00 AM Eastern Time. The call is open to all investors and the media. To join the call, please dial toll-free in North America 1 (800) 926-9871. International participants may access the call at +1 (212) 231-2911. Results summary slides are available on Centerra Gold’s website at www.centerragold.com. Alternatively, an audio feed webcast will be broadcast live by Intrado and can be accessed live at Centerra Gold’s website at www.centerragold.com. A recording of the call will be available on www.centerragold.com shortly after the call and via telephone until midnight Eastern Time on August 7, 2020 by calling (416) 626-4100 or (800) 558-5253 and using passcode 21965212.

For more information:

John W. Pearson

Vice President, Investor Relations

Centerra Gold Inc.

(416) 204-1953

john.pearson@centerragold.com

Additional information on Centerra is available on the Company’s web site at www.centerragold.com and at SEDAR at www.sedar.com.

A PDF accompanying this announcement is available at http://ml.globenewswire.com/Resource/Download/1ec1438d-f0e7-410c-b105-bea826b46ced

Management’s Discussion and Analysis

For the Period Ended June 30, 2020

This Management Discussion and Analysis (“MD&A”) has been prepared as of July 30, 2020, and is intended to provide a review of the financial position and results of operations of Centerra Gold Inc. (“Centerra” or the “Company”) for the three and six months ended June 30, 2020 in comparison with the corresponding period ended June 30, 2019. This discussion should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements and the notes thereto for the three and six months ended June 30, 2020 prepared in accordance with International Financial Reporting Standards (“IFRS”). This MD&A should also be read in conjunction with the Company’s audited annual consolidated financial statements for the years ended December 31, 2019 and 2018, the related MD&A and the Annual Information Form for the year ended December 31, 2019 (the “2019 Annual Information Form”). The Company’s unaudited condensed consolidated interim financial statements and the notes thereto for the three and six months ended June 30, 2020, 2019 Annual Report and 2019 Annual Information Form are available at www.centerragold.com and on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com. In addition, this discussion contains forward looking information regarding Centerra’s business and operations. Such forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward looking statements. See “Caution Regarding Forward-Looking Information” in this discussion. All dollar amounts are expressed in United States dollars (“USD”), except as otherwise indicated.

Caution Regarding Forward-Looking Information

Information contained in this document which are not statements of historical facts, and the documents incorporated by reference herein, may be “forward-looking information” for the purposes of Canadian securities laws. Such forward-looking information involves risks, uncertainties and other factors that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward looking information. The words “believe”, “expect”, “anticipate”, “contemplate”, “plan”, “intends”, “continue”, “budget”, “estimate”, “may”, “will”, “schedule”, “understand” and similar expressions identify forward-looking information. These forward-looking statements relate to, among other things: the Company’s expectations regarding timing for an updated Kumtor Technical Report and the potential for expanding the Kumtor life of mine; possible impacts to its operations relating to COVID-19; planned exploration activities for the remainder of 2020; the achievement of 2020 guidance and the Company’s expectations at each of our operating sites; the Company’s expectations regarding having sufficient liquidity for 2020; the Company’s expectations regarding accessing water at its Mount Milligan Mine for the remainder of 2020 and its plans for a longer-term solution; time frame for completing the Öksüt Mine construction; future payments by Kumtor Gold Company to the Kyrgyz Republic Regional Fund and expectations regarding outstanding investigations and litigation involving the Company including the HRS litigation impacting the Mount Milligan Mine, and the litigation involving the Greenstone Gold Property.

Forward-looking information is necessarily based upon a number of estimates and assumptions that, while considered reasonable by Centerra, are inherently subject to significant technical, political, business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking information. Factors and assumptions that could cause actual results or events to differ materially from current expectations include, among other things: (A) strategic, legal, planning and other risks, including: political risks associated with the Company’s operations in the Kyrgyz Republic, Turkey and Canada; the failure of the Kyrgyz Republic Government to comply with its continuing obligations under the Strategic Agreement, including the requirement that it comply at all times with its obligations under the Kumtor Project Agreements, allow for the continued operation of the Kumtor Mine by KGC and KOC and not take any expropriation action against the Kumtor Mine; actions by the Kyrgyz Republic Government or any state agency or the General Prosecutor's Office that serve to restrict or otherwise interfere with the payment of funds by KGC and KOC to Centerra; resource nationalism including the management of external stakeholder expectations; the impact of changes in, or to the more aggressive enforcement of, laws, regulations and government practices, including unjustified civil or criminal action against the Company, its affiliates or its current or former employees; risks that community activism may result in increased contributory demands or business interruptions; the risks related to outstanding litigation affecting the Company; the impact of the delay by relevant government agencies to provide required approvals, expertises and permits; potential impact on the Kumtor Project of investigations by Kyrgyz Republic instrumentalities; the impact of constitutional changes in Turkey; the impact of any sanctions imposed by Canada, the United States or other jurisdictions against various Russian and Turkish individuals and entities; potential defects of title in the Company’s properties that are not known as of the date hereof; the inability of the Company and its subsidiaries to enforce their legal rights in certain circumstances; the presence of a significant shareholder that is a state-owned company of the Kyrgyz Republic; risks related to anti-corruption legislation; risks related to the concentration of assets in Central Asia; Centerra not being able to replace mineral reserves; Indigenous claims and consultative issues relating to the Company’s properties which are in proximity to Indigenous communities; and potential risks related to kidnapping or acts of terrorism; (B) risks relating to financial matters, including: sensitivity of the Company’s business to the volatility of gold, copper and other mineral prices, the use of provisionally-priced sales contracts for production at Mount Milligan, reliance on a few key customers for the gold-copper concentrate at Mount Milligan, use of commodity derivatives, the imprecision of the Company’s mineral reserves and resources estimates and the assumptions they rely on, the accuracy of the Company’s production and cost estimates, the impact of restrictive covenants in the Company’s credit facilities which may, among other things, restrict the Company from pursuing certain business activities or making distributions from its subsidiaries, the Company’s ability to obtain future financing, the impact of global financial conditions, the impact of currency fluctuations, the effect of market conditions on the Company’s short-term investments, the Company’s ability to make payments including any payments of principal and interest on the Company’s debt facilities depends on the cash flow of its subsidiaries; and (C) risks related to operational matters and geotechnical issues and the Company’s continued ability to successfully manage such matters, including the movement of the Davidov Glacier, waste and ice movement and continued performance of the buttress at the Kumtor Project; the occurrence of further ground movements at the Kumtor Project and mechanical availability; the risk of having sufficient water to continue operations at Mount Milligan and achieve expected mill throughput; the success of the Company’s future exploration and development activities, including the financial and political risks inherent in carrying out exploration activities; inherent risks associated with the use of sodium cyanide in the mining operations; the adequacy of the Company’s insurance to mitigate operational risks; mechanical breakdowns; the Company’s ability to replace its mineral reserves; the occurrence of any labour unrest or disturbance and the ability of the Company to successfully re-negotiate collective agreements when required; the risk that Centerra’s workforce and operations may be exposed to widespread epidemic including, but not limited to, the COVID-19 pandemic; seismic activity in the vicinity of the Company’s properties; long lead times required for equipment and supplies given the remote location of some of the Company’s operating properties; reliance on a limited number of suppliers for certain consumables, equipment and components; the Company’s ability to accurately predict decommissioning and reclamation costs; the Company’s ability to attract and retain qualified personnel; competition for mineral acquisition opportunities; risks associated with the conduct of joint ventures/partnerships; and the Company’s ability to manage its projects effectively and to mitigate the potential lack of availability of contractors, budget and timing overruns and project resources. For additional risk factors, please see section titled “Risks Factors” in the Company’s most recently filed Annual Information Form available on SEDAR at www.sedar.com.

There can be no assurances that forward-looking information and statements will prove to be accurate, as many factors and future events, both known and unknown could cause actual results, performance or achievements to vary or differ materially from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements contained herein or incorporated by reference. Accordingly, all such factors should be considered carefully when making decisions with respect to Centerra, and prospective investors should not place undue reliance on forward looking information. Forward-looking information is as of July 30, 2020. Centerra assumes no obligation to update or revise forward-looking information to reflect changes in assumptions, changes in circumstances or any other events affecting such forward-looking information, except as required by applicable law.

TABLE OF CONTENTS

| Overview | 14 |

| Consolidated Financial and Operational Highlights | 15 |

| Overview of Consolidated Results | 16 |

| 2020 Outlook | 17 |

| Financial Performance | 20 |

| Balance Sheet Review | 23 |

| Cash Flow Review | 24 |

| Market Conditions | 25 |

| Financial Instruments | 28 |

| Operating Mines and Facilities | 28 |

| Pre-Development Projects | 44 |

| Quarterly Results – Previous Eight Quarters | 45 |

| Contingencies | 46 |

| Accounting Estimates, Policies and Changes | 47 |

| Disclosure Controls and Procedures and Internal Control Over Financial Reporting | 48 |

| Non-GAAP Measures | 48 |

| Qualified Person & QA/QC – Production, Mineral Reserves and Mineral Resources | 53 |

Overview

Centerra is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold properties worldwide and is one of the largest Western-based gold producers in Central Asia. Centerra’s principal operations are the Kumtor Gold Mine located in the Kyrgyz Republic, the Mount Milligan Gold-Copper Mine located in British Columbia, Canada, and the Öksüt Gold Mine located in Turkey. The Company has two properties in Canada in the pre-development stage, the Kemess Underground Gold Property and the Greenstone Gold Project (50% ownership), owns exploration properties in Canada, the United States of America and Turkey and has options to acquire exploration joint venture properties in Canada, Finland, Mexico, Turkey, and the United States of America. The Company owns various assets included in its Molybdenum Business Unit consisting of the Langeloth metallurgical processing facility and two primary molybdenum mines currently on care and maintenance, Thompson Creek Mine in Idaho, United States of America, and the Endako Mine in British Columbia, Canada (75% ownership).

As of June 30, 2020, Centerra’s significant subsidiaries are as follows:

| Current | Property | |||

| Entity | Property - Location | Status | Ownership | |

| Kumtor Gold Company (“KGC”) | Kumtor Mine - Kyrgyz Republic | Operation | 100 | % |

| Thompson Creek Metals Company Inc. | Mount Milligan Mine - Canada | Operation | 100 | % |

| Öksüt Madencilik A.S. (“OMAS”) | Öksüt Mine - Turkey | Operation | 100 | % |

| Langeloth Metallurgical Company LLC | Langeloth - United States | Operation | 100 | % |

| AuRico Metals Inc. | Kemess Underground Project - Canada | Pre-development | 100 | % |

| Greenstone Gold Mines LP | Greenstone Gold Property - Canada | Pre-development | 50 | % |

| Thompson Creek Mining Co. | Thompson Creek Mine - United States | Care and Maintenance | 100 | % |

| Thompson Creek Metals Company Inc. | Endako Mine - Canada | Care and Maintenance | 75 | % |

Centerra’s common shares are listed for trading on the Toronto Stock Exchange under the symbol CG. As of July 30, 2020, there are 294,518,989 common shares issued and outstanding, options to acquire 4,229,720 common shares outstanding under its stock option plan and 1,339,796 units outstanding under its restricted share unit plan (exercisable on a 1:1 basis for common shares).

The Company reports the results of its operations in U.S. dollars, however not all of its costs are incurred in U.S. dollars. As such, the movement in exchange rates between currencies in which the Company incurs costs and the U.S. dollar also impacts reported costs of the Company.

Consolidated Financial and Operational Highlights

| Unaudited ($ millions, except as noted) | Three months ended June 30 | Six months ended June 30 | ||||||||

| Financial Highlights | 2020 | 2019 | % Change | 2020 | 2019 | % Change | ||||

| Revenue | $ | 412.7 | $ | 340.5 | 21% | $ | 786.7 | $ | 674.5 | 17% |

| Production costs | 141.9 | 182.7 | (22%) | 306.6 | 354.4 | (14%) | ||||

| Depreciation, depletion and amortization | 85.4 | 59.0 | 45% | 158.5 | 113.4 | 40% | ||||

| Earnings from mine operations | 185.3 | 98.9 | 87% | 315.0 | 206.7 | 52% | ||||

| Net earnings | $ | 80.7 | $ | 33.4 | 142% | $ | 100.8 | $ | 83.8 | 20% |

| Adjusting items | ||||||||||

| - ARO revaluation at sites on care and maintenance | 17.1 | - | 43.5 | - | ||||||

| Adjusted net earnings (3) | $ | 97.8 | $ | 33.4 | 193% | $ | 144.3 | $ | 83.8 | 72% |

| Cash provided by operations | 268.1 | 91.0 | 195% | 389.2 | 209.8 | 86% | ||||

| Cash provided by operations before changes in working capital | 216.1 | 101.4 | 113% | 359.4 | 215.6 | 67% | ||||

| Free cash flow (3) | 169.1 | 30.7 | 451% | 245.9 | 87.7 | 180% | ||||

| Capital expenditures - sustaining | 33.1 | 20.8 | 59% | 47.5 | 40.6 | 17% | ||||

| Capital expenditures - growth and development projects | 18.1 | 38.2 | (53%) | 32.2 | 63.7 | (49%) | ||||

| Capital expenditures - stripping | 46.8 | 15.6 | 200% | 86.7 | 38.4 | 126% | ||||

| Total assets | $ | 2,769.3 | $ | 2,887.9 | (4%) | $ | 2,769.3 | $ | 2,887.9 | (4%) |

| Long-term debt and lease obligations | 15.5 | 90.6 | (83%) | 15.5 | 90.6 | (83%) | ||||

| Cash, cash equivalents and restricted cash (5) | 214.2 | 167.5 | 28% | 214.2 | 167.5 | 28% | ||||

| Per Share Data | ||||||||||

| Earnings per common share - $ basic (1) | $ | 0.27 | $ | 0.11 | 145% | $ | 0.34 | $ | 0.29 | 17% |

| Adjusted net earnings per common share - $ basic (1)(3) | $ | 0.33 | $ | 0.11 | 200% | $ | 0.49 | $ | 0.29 | 69% |

| Per Ounce Data (except as noted) | ||||||||||

| Average gold spot price ($/oz) (2) | 1,714 | 1,309 | 31% | 1,648 | 1,306 | 26% | ||||

| Average realized gold price ($/oz) (3)(4) | 1,620 | 1,237 | 31% | 1,555 | 1,232 | 26% | ||||

| Average copper spot price ($/lb) (2) | 2.42 | 2.78 | (13%) | 2.50 | 2.79 | (10%) | ||||

| Average realized copper price ($/lb) (3)(4) | 2.06 | 1.95 | 6% | 1.83 | 2.16 | (15%) | ||||

| Operating Highlights | ||||||||||

| Gold produced (oz's) | 219,692 | 199,578 | 10% | 410,165 | 383,140 | 7% | ||||

| Gold sold (oz's) | 217,539 | 198,287 | 10% | 420,797 | 394,738 | 7% | ||||

| Payable Copper Produced (000's lbs) | 19,064 | 20,397 | (7%) | 39,136 | 31,837 | 23% | ||||

| Copper Sales (000's payable lbs) | 19,352 | 18,700 | 3% | 39,776 | 31,222 | 27% | ||||

| Unit Costs | ||||||||||

| Production costs per ounce of gold sold (4) | $ | 410 | $ | 479 | (14%) | $ | 417 | $ | 468 | (11%) |

| Gold - All-in sustaining costs on a by-product basis ($/oz sold) (3)(4) | $ | 804 | $ | 716 | 12% | $ | 760 | $ | 693 | 10% |

| Gold - All-in sustaining costs on a by-product basis (including taxes) ($/oz sold) (3) (4) | $ | 999 | $ | 861 | 16% | $ | 947 | $ | 837 | 13% |

| Gold - All-in sustaining costs on a co-product basis (before taxes) – ($/oz sold) (3)(4) | $ | 860 | $ | 712 | 21% | $ | 790 | $ | 705 | 12% |

| Production costs per pound of copper sold (4) | $ | 1.20 | $ | 1.65 | (27%) | $ | 1.27 | $ | 1.65 | (23%) |

| Copper - All-in sustaining costs on a co-product basis (before taxes) – ($/pound sold) (3)(4) | $ | 1.44 | $ | 1.97 | (27%) | $ | 1.46 | $ | 2.01 | (27%) |

(1) As at June 30 2020, the Company had 294,367,946 common shares issued and outstanding.

(2) Average for the period as reported by the London Bullion Market Association (US dollar Gold P.M. Fix Rate) and London Metal Exchange (LME).

(3) Non-GAAP measure. See discussion under “Non-GAAP Measures”.

(4) Combines streamed and unstreamed amounts.

(5 )Includes restricted cash of $2 million as at June 30, 2020 and restricted cash of $27.5 million as at December 31, 2019

Overview of Consolidated Results

Second Quarter 2020 compared to Second Quarter 2019

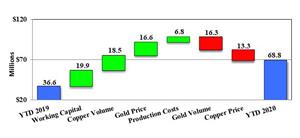

The Company recognized net earnings of $80.7 million and adjusted net earningsNG of $97.8 million in the second quarter of 2020, compared to net earnings and adjusted net earningsNG of $33.4 million in the second quarter of 2019. The increase in net earnings in the second quarter of 2020 compared to 2019 was due to higher average realized gold prices, increased gold doré sold at Kumtor and increased copper pounds sold at Mount Milligan, partially offset by decreased gold ounces sold at Mount Milligan and a $17.1 million non-cash charge for the increase in the asset retirement obligation (“ARO”) for the Company’s non-operating sites caused by a decrease in the risk free interest rate assumption used for discounting the liabilities. There was no change in the underlying remediation programs required at the sites. Öksüt also contributed $10.7 million of earnings from mine operations in the second quarter of 2020.

Cash provided by operations was $268.1 million in the second quarter of 2020, compared to $91.0 million in the same prior year period, due to increased earnings from mine operations including the Öksüt Mine that is now in commercial production and an increase in cash generated from reduced working capital levels, reflecting an increase in the collection of accounts receivable and a reduction in inventory at Kumtor. Free cash flowNG in the second quarter of 2020 was $169.1 million compared to free cash flowNG of $30.7 million in the same period of 2019. The increase was due to higher cash provided by operations together with minimal capital expenditure incurred at the Öksüt Mine compared to the prior year quarter, partially offset by increased capitalized stripping at Kumtor.

Safety and Environment

Centerra incurred five reportable injuries in the second quarter of 2020, including two lost time injuries, two medical aid injuries and one restricted work injury.

Centerra has implemented a number of proactive measures to prevent the spread of COVID-19 and ensure the safety of its employees, contractors, communities and other stakeholders.

There were no reportable releases to the environment in the second quarter of 2020.

First Half 2020 compared to First Half 2019

The Company recognized net earnings of $100.8 million and adjusted net earningsNG of $144.3 million in the first half of 2020, compared to net earnings and adjusted net earningsNG of $83.8 million in the first half of 2019. The increase in net earnings in the first half of 2020 compared to 2019 was due to higher realized gold prices, increased gold doré sold at Kumtor and increased copper pounds sold at Mount Milligan, partially offset by $43.5 million in non-cash charges relating to the reclamation liabilities for the Company’s non-operating sites. The increase in the reclamation liabilities was a result of a decrease in the risk-free interest rate assumption used for discounting the future liabilities. Öksüt also contributed $7.1 million of net earnings in the first half of 2020.

Cash provided by operations was $389.2 million in the first half of 2020, compared to $209.8 million in the same prior year period, due to increased earnings from mine operations including the Öksüt Mine that is now in commercial production and an increase in cash generated from reduced working capital levels, due to a decrease in inventory at Kumtor. Free cash flowNG in the first half of 2020 was $245.9 million compared to free cash flowNG of $87.7 million in the same period of 2019. The increase was due to higher cash provided by operations, partially offset by an increase in sustaining capital and capitalized stripping at Kumtor.

2020 Outlook

Centerra is maintaining its 2020 guidance for gold and copper production, and all-in sustaining costs per ounce soldNG. At the Kumtor operation, although fewer waste tonnes were mined due to reduced workforce on site, the mill operations continue as normal as we process materials from stockpiles throughout 2020 as planned.

Centerra is revising its 2020 guidance for capital spending, excluding capitalized stripping, to $192 million from the initial guidance of $169 million disclosed previously. The company’s 2020 guidance for capitalized striping has been reduced to $223 million, from the initial guidance of $236 million disclosed previously.

Despite its best efforts, the Company notes that COVID-19 has the potential to significantly disrupt Centerra’s operations going forward and affect the Company’s future operating results. Among other things, COVID-19 has the potential to cause significant illness in the workforce, temporarily shut down mining, processing and other operations, and disrupt supply chains as well as rail and shipping networks used to deliver products to customers. While Centerra has taken and will continue to take measures to mitigate such risks, the global effects of COVID-19 are rapidly evolving and cannot be predicted.

2020 Production, Sales and Cost Guidance

Consolidated gold sales in the first half of 2020 was 420,797 ounces, slightly higher than 50% of the full year guidance of 740,000 to 820,000 ounces, consistent with the expectation that sales from the Kumtor Mine for the year would be slightly weighted to the first half of the year.

In the first half of 2020, production costs per ounce of gold sold was $417 per ounce and all-in sustaining costs on a by-product basisNG was $760 per ounce sold, compared to full year guidance of $450 to $500 per ounce and $820 to $870 per ounce sold, respectively. All-in sustaining costs on a by-product basisNG in the first half of 2020 was lower than the full year guidance range, due to slightly higher Kumtor production and sales in the first half of the year, lower capitalized stripping at Kumtor, and lower sustaining capital spending in the first half of 2020.

In the second half of 2020 the Company expects that Kumtor will process lower grade material than in the first half of 2020 but also expects an increase in production from the Öksüt Mine as it continues to ramp up production. Mount Milligan remains on track with gold production in the second half estimated to be slightly higher than 50% of its full year guidance and copper production estimated to be at approximately 45% of full year guidance.

Centerra’s production forecast for the full year 2020 is maintained as follows:

| Units | Kumtor | Mount Milligan(1) | Öksüt | Centerra | |

| Gold | |||||

| Unstreamed Gold Payable Production guidance | (Koz) | 520-560 | 91-104 | 80-100 | 691-764 |

| Streamed Gold Payable Production guidance(1) | (Koz) | - | 49-56 | - | 49-56 |

| Total Gold Payable Production guidance(2) | (Koz) | 520-560 | 140-160 | 80-100 | 740-820 |

| First Half 2020 Gold Payable Production | (Koz) | 326 | 69 | 15 | 410 |

| Copper | |||||

| Unstreamed Copper Payable Production guidance | (Mlb) | - | 65-73 | - | 65-73 |

| Streamed Copper Payable Production guidance(1) | (Mlb) | - | 15-17 | - | 15-17 |

| Total Copper Payable Production guidance(3) | (Mlb) | - | 80-90 | - | 80-90 |

| First Half 2020 Copper Payable Production | (Koz) | - | 39 | - | 39 |

(1) The Mount Milligan Streaming Arrangement entitles Royal Gold to 35% and 18.75% of gold and copper sales, respectively, from the Mount Milligan Mine. Under the Mount Milligan Streaming Arrangement, Royal Gold will pay $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered.

(2) Gold production assumes recoveries of 82.4% at Kumtor, 64% at Mount Milligan and approximately 60% at Öksüt.

(3) Copper production assumes 81.9% recovery for copper at Mount Milligan.

Centerra’s 2020 all-in sustaining costs per ounce soldNG (“AISC”) guidance calculated on a by-product basis is maintained as follows:

| Units | Kumtor | Mount Milligan | Öksüt | Centerra(2) | |||||

| All-in sustaining costs on a by-product basis guidance(1)(2) | ($/oz) | $750-$800 | $885-$935 | $650-$700 | $820-$870 | ||||

| First half of 2020 All-in sustaining costs on a by- product basis (1)(2) | ($/oz) | $671 | $798 | $537 | $760 | ||||

(1) All-in sustaining costs on a by-product per ounce sold basis are non-GAAP measures and are discussed under “Non-GAAP Measures”.

(2) Mount Milligan payable production and ounces sold are on a 100% basis (the Mount Milligan Streaming Arrangement entitles Royal Gold to 35% and 18.75% of gold and copper sales, respectively). Unit costs and consolidated unit costs include a credit for forecasted copper sales treated as by-product for all-in sustaining costs and all-in sustaining costs plus taxes. Payable production for copper and gold reflects estimated metallurgical losses resulting from handling of the concentrate and payable metal deductions, subject to metal content, levied by smelters.

2020 Capital Spending

Centerra’s 2020 guidance for capital spending, excluding capitalized stripping, has been revised to $192 million from the initial guidance of $169 million. Sustaining capitalNG is now estimated at $132 million compared to initial guidance of $109 million. The increase in sustaining capitalNG is related the purchase of eleven additional haul trucks at Kumtor in the second quarter of 2020. The new trucks are expected to be in operation in the fourth quarter of 2020, increasing our mining capacity in the near term, and preparing us for future growth opportunities. Capitalized stripping at Öksüt has been reduced to $8 million from the initial guidance of $21 million, reflecting lower tonnes mined in the first half of the year due to poor weather conditions and a workforce reduction as a precautionary measure due to COVID-19.

Growth and sustaining capital spent in the first half of 2020 was $32.2 million and $47.5 million respectively, and capitalized stripping in the first half of 2020 was $86.7 million, all slightly below expected spending due to timing.

Projected capital expenditures include:

| Capitalized | Sustaining | Growth | ||||||

| Projects ($ millions) | Stripping | Capital | Capital | Total | ||||

| Kumtor Mine(1) | 215 | 68 | 18 | 301 | ||||

| Mount Milligan Mine | - | 55 | - | 55 | ||||

| Öksüt Mine(1) | 8 | - | 29 | 37 | ||||

| Kemess Underground Project | - | - | 13 | 13 | ||||

| Other(2) | - | 9 | - | 9 | ||||

| Consolidated Total | $ | 223 | $ | 132 | $ | 60 | $ | 415 |

(1) Capitalized stripping includes a cash component of $173 million (Kumtor Mine), and $8 million (Öksüt Mine).

(2) Thompson Creek Mine, Endako Mine (75% ownership), Langeloth facility, and Corporate.

Material Assumptions

The Company has not modified the material assumptions used to set its initial 2020 guidance. The Company notes that there has been positive movement in current market prices of gold and copper, as well as diesel prices and foreign exchange rates. Those movements have been partially offset by inflationary cost pressures in both the Kyrgyz Republic and Turkey, together with the settlement of historical diesel hedges at higher rates than current market prices.

Material assumptions or factors used to forecast production and costs for 2020 include the following:

- a gold price of $1,350 per ounce,

- a copper price of $2.60 per pound,

- a molybdenum price of $10.75 per pound.

- exchange rates:

º $1USD:$1.30 Canadian dollar,

º $1USD:69.50 Kyrgyz som,

º $1USD:5.50 Turkish lira,

º $1USD:0.85 Euro. - diesel fuel price assumption:

º $0.50/litre at Kumtor,

º $0.81/litre (CAD$1.06/litre) at Mount Milligan.

Material assumptions used in forecasting production and costs for 2020 can be found under the heading “Caution Regarding Forward-Looking Information” in this document. Production, cost and capital forecasts for 2020 are forward-looking information and are based on key assumptions and subject to material risk factors that could cause actual results to differ materially and which are discussed under the heading “Risks That Can Affect Our Business” in the Company’s most recent Annual Information Form.

Sensitivities

Centerra’s revenues, earnings and cash flows for the second half of 2020 are sensitive to changes in certain key inputs or currencies. The Company has estimated the impact of any such changes on revenues, net earnings and cash from operations.

| Impact on ($ millions) | Impact on ($ per ounce sold) | ||||||||

| Production Costs & Taxes | Capital Costs | Financing Costs | Revenues | Cash flows | Net Earnings (after tax) | AISC(2)(3) on by-product basis | |||

| Gold price | $50/oz | 2.2 -2.7 | - | 0.7 - 0.8 | 15.4 - 19.1 | 12.5 - 15.6 | 12.5 - 15.6 | 0.41 - 0.43 | |

| Copper price | 10 | % | 2.4 - 3.0 | - | 0.3 - 0.4 | 8.5 - 10.7 | 5.8 - 7.3 | 5.8 - 7.3 | 21.7 - 26.9 |

| Diesel fuel(4) | 10 | % | 2.4- 3.0 | - | - | - | 2.4 - 3.0 | 2.4 - 3.0 | 6.5 - 8.1 |

| Kyrgyz som(1) | 1 som | 0.8 - 1.0 | - | - | - | 0.8 - 1.0 | 0.8 - 1.0 | 2.1 - 2.6 | |

| Canadian dollar(1)(4) | 10 cents | 4.3 - 5.0 | 2.1 - 2.4 | - | - | 6.4 - 7.4 | 4.3 - 5.0 | 16.7 - 20.7 | |

| Turkish lira(1) | 1 lira | 2.0 - 2.5 | 0.8 - 1.1 | - | - | 2.8 - 3.6 | 2.0 - 2.5 | 7.8 - 9.7 | |

(1) Appreciation of currency against the U.S. dollar will result in higher costs and lower cash flow and earnings, depreciation of currency against the U.S. dollar results in decreased costs and increased cash flow and earnings.

(2) Non-GAAP measure. See discussion under “Non-GAAP Measures”.

(3) AISC is calculated over the second half of the year ounces sold forecast.

(4) Includes the effect of hedging programs.

Financial Performance

Second Quarter 2020 compared to Second Quarter 2019

Revenue:

Revenue increased to $412.7 million in the second quarter of 2020 from $340.5 million in the comparative prior year period, primarily as a result of a 31% higher average realized gold price and higher gold and copper sales.

Production:

Gold production in the second quarter of 2020 was 219,692 ounces compared to 199,578 ounces for the same prior year period. Gold production at Kumtor was 173,245 ounces in the second quarter of 2020, Mount Milligan produced 35,656 ounces of gold and Öksüt produced 10,791 ounces of gold. At Kumtor, the 15% increase was due to higher grades and recovery. At Mount Milligan the 27% decrease was due to lower throughput and lower grades.

Copper production at Mount Milligan during the second quarter of 2020 was 19.1 million pounds, a 7% decrease from the comparative prior year period, reflecting the lower throughput and lower copper recoveries.

Production costs per ounce of gold sold:

Production costs per ounce of gold sold decreased in the second quarter of 2020 to $410 compared to $479 in the same period of 2019, primarily due to higher gold sales volumes at Kumtor and a favourable foreign exchange rate at Kumtor and Mount Milligan, partially offset by decreased gold sales volumes at Mount Milligan due to lower throughput. The Öksüt Mine recorded its first quarter of operation realizing production costs of $393 per ounce, after achieving commercial production on May 31, 2020.

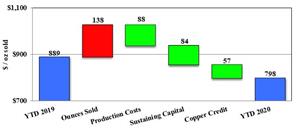

All-in Sustaining CostsNG:

Centerra’s all-in sustaining costs on a by-product basis per ounce of gold soldNG, which excludes revenue-based tax and income tax, increased to $804 per ounce in the second quarter of 2020, from $716 per ounce in the same prior year period due to the purchase of 11 trucks at Kumtor to increase the mining capacity of the mine, higher capitalized stripping costs at Kumtor and lower sales volume at Mount Milligan, partially offset by higher sales volumes from Kumtor and lower production costs at both Mount Milligan and Kumtor. The Öksüt Mine had a positive impact as it recorded its first quarter of all-in sustaining costs on a by-product basis per ounce of gold soldNG at $537, post commercial production.

Exploration:

Exploration expenditures in the second quarter of 2020 were $6.6 million, consistent with the $6.3 million in the comparative prior year period. In both periods, exploration expenditures were mainly focused at the three operating sites.

Financing costs:

Financing costs in the second quarter of 2020 were $3.8 million, reflecting costs associated with the corporate $500 million revolving credit facility which was repaid in full by the end of the quarter. Financing costs of $3.7 million in the second quarter of 2019 were associated with the Öksüt project financing facility and a promissory note with Caterpillar Financial Services Limited, which were both repaid and cancelled in the first quarter 2020 and fourth quarter 2019, respectively.

Corporate administration:

Corporate administration costs were $25.3 million in the second quarter of 2020 compared to $13.7 million in the second quarter of 2019, mainly due to an increase in share-based compensation as a result of the increase in the Company’s share price in the second quarter of 2020.

First Half 2020 compared to First Half 2019

Revenue:

Revenue increased to $786.7 million in the first half of 2020 from $674.5 million in the comparative prior year period, as a result of a 26% higher average realized gold price and 27% more copper pounds sold.

Production:

Gold production in the first half of 2020 was 410,165 ounces compared to 383,140 ounces for the same prior year period. Gold production at Kumtor was 325,551 ounces in the first half of 2020, Mount Milligan produced 69,337 ounces of gold and Öksüt produced 15,277 ounces of gold. At Kumtor the 8% increase in gold production was due to higher grades and recovery and more gold produced from carbon fines. At Mount Milligan the 15% decrease in ounces produced was due to lower grades and lower recoveries.

Copper production at Mount Milligan during the first half of 2020 was 39.1 million pounds, a 23% increase from the comparative prior year period, reflecting higher throughput and higher grades.

Production costs per ounce of gold sold:

Production costs per ounce of gold sold decreased in the first half of 2020 to $417 compared to $468 in the same period of 2019, mainly due to higher gold sales volumes at Kumtor, a favourable foreign exchange rate at Kumtor and Mount Milligan and the addition of the Öksüt Mine. This was partially offset by lower gold sales volumes at Mount Milligan.

All-in Sustaining CostsNG:

Centerra’s all-in sustaining costs on a by-product basis per ounce of gold soldNG, which excludes revenue-based tax and income tax, increased to $760 per ounce in the first half of 2020, from $693 per ounce in the same prior year period, due to higher capitalized stripping costs, partially offset by higher sales volumes from Kumtor and greater copper credits at Mount Milligan.

Exploration:

Exploration expenditures in the first half of 2020 were $14.4 million compared to $11.3 million in the comparative prior year period. The largest contributor to the increase was additional drilling at Kumtor of $1.8 million.

Financing costs:

Financing costs in the first half of 2020 were $7.4 million, reflecting costs associated with the corporate $500 million revolving credit facility and Öksüt project financing facility, which was repaid in full and cancelled in the first quarter of 2020. Financing costs in the first half of 2019 were $7.7 million, reflecting costs associated with the Öksüt project financing facility and a promissory note with Caterpillar Financial Services Limited.

Corporate administration:

Corporate administration costs were $28.7 million in the first half of 2020 compared to $23.4 million in the first half of 2019, primarily due to an increase in share-based compensation as a result of the increase in the Company’s share price during the first half of 2020.

Balance Sheet Review

| $ millions | As at | ||

| June 30, 2020 | December 31, 2019 | %Change | |

| Consolidated: | |||

| Cash | 212.2 | 42.7 | 397% |

| Inventories | 689.5 | 774.1 | (11%) |

| Current assets | 90.9 | 115.9 | (22%) |

| Property, plant and equipment | 1,706.3 | 1,669.5 | 2% |

| Non-current assets | 70.4 | 99.5 | (29%) |

| Total Assets | 2,769.3 | 2,701.7 | 3% |

| Current liabilities | 252.7 | 244.8 | 3% |

| Non-current Debt | - | 70.0 | (100%) |

| Provision for reclamation | 311.3 | 265.0 | 17% |

| Non-current liabilities | 53.6 | 56.1 | (4%) |

| Total Liabilities | 617.6 | 635.9 | (3%) |

| Total Equity | 2,151.7 | 2,065.8 | 4% |

| Total Liabilities and Equity | 2,769.3 | 2,701.7 | 3% |

Cash

Cash at June 30, 2020 was $212.2 million, an increase of $169.5 million from December 31, 2019 as the Company generated $245.9 million in free cash flowNG, released $25 million of restricted cash after repaying and cancelling the Öksüt project financing facility and repaid the outstanding balance on Company’s corporate $500 million revolving credit facility in full.

Inventory

Total inventory as at June 30, 2020 was $689.5 million compared to $774.1 million as at December 31, 2019. Total inventory includes stockpiles of ore, gold in-circuit, gold doré, copper and gold concentrate and molybdenum inventory (collectively “Product Inventory”) of $459.1 million and supplies inventory of $230.4 million, compared to $564.7 million and $209.4 million, respectively, as at December 31, 2019. The decrease in Product Inventory was primarily attributable to a drawdown of the ore stockpiles at Kumtor.

As at June 30, 2020, the inventory balance consisted of 742,536 contained gold ounces on surface at Kumtor, of which roughly 42% is expected to be processed in the remainder of 2020, 85,800 contained gold ounces and 19.7 million contained pounds of copper in stockpiles at Mount Milligan, of which roughly 20% is expected to be processed in the remainder of 2020 and 28,683 contained ounces at Öksüt, of which roughly 100% is expected to be processed in the remainder of 2020.

Property, Plant and Equipment

The book value of property, plant and equipment as at June 30, 2020 was $1.71 billion, which compares to $1.67 billion as at December 31, 2019. The increase in the first half of 2020 of was mainly due to $171.9 million of additions to property, plant and equipment which was primarily related to stripping costs at Kumtor.

Asset Retirement Obligations

The asset retirement obligations of $311.3 million as at June 30, 2020, increased from $265.0 million as at December 31, 2019, primarily due to a reduction in the discount rates used to calculate the present value of reclamation costs at the Company’s various sites.

In 1998, a reclamation trust fund was established to cover the future costs of reclamation, net of salvage values at the Kumtor Gold Mine. As at June 30, 2020, this fund had a balance of $47 million.

Debt

Total bank debt as at June 30, 2020 was nil compared to $70.0 million as at December 31, 2019. The Company’s corporate $500 million revolving credit facility was undrawn as at June 30, 2020 and December 31, 2019.

In the first half of 2020, the Company repaid the outstanding balance of $77.5 million on the Öksüt project financing facility and subsequently cancelled the facility. This resulted in the release of $25 million in restricted cash.

Liquidity

The Company believes its cash on hand, cash flow from the Company’s Kumtor, Mount Milligan and Öksüt operations and available capacity in its existing corporate $500 million revolving credit facility will be sufficient to satisfy working capital needs, fund its development activities and meet other liquidity requirements through to the end of 2020. See “Caution Regarding Forward-Looking Information”.

Cash Flow Review

Cash provided by operating activities

Cash provided by operations increased by 195% in the second quarter of 2020, compared to the second quarter of 2019 as a result of higher revenue and an increase in cash generated from lower working capital levels.

Cash provided by operations increased by 86% in the first half of 2020, compared to the first half of 2019 as a result of higher revenue and an increase in cash generated from lower working capital levels.

Cash used in investing activities

Cash used in investing activities increased by 58% in the second quarter 2020, compared to the second quarter 2019, primarily due to the increase in capitalized stripping at Kumtor.

Cash used in investing activities decreased by 4% in the first half of 2020, compared to the first half of 2019, primarily due to the release of restricted cash upon repayment and cancellation of the Öksüt project financing facility in the first quarter of 2020.

Cash used in financing activities

Cash used in financing activities increased by 117% in the second quarter of 2020 when compared to the second quarter of 2019. The increase was mainly due to the repayment of the Company’s revolving credit facility on June 30, 2020 and dividends paid during the second quarter of 2020.

Cash used in financing activities increased by 4% in the first half of 2020 when compared to the first half of 2019. The increase was primarily due the dividends paid in the first half of 2020, partially offset by higher repayments on the Company’s revolving credit facility in the first half of 2019.

Market Conditions

Gold Price

During the second quarter of 2020, the spot gold price fluctuated between a low of $1,592 per ounce and a high of $1,781 per ounce. The average spot gold price for the second quarter of 2020 was $1,714 per ounce, an increase of 31% from the comparative prior year period of $1,309 per ounce.

The average spot gold price in the first half of 2020 was $1,648 per ounce, an increase of 26% from the comparative prior year period of $1,306 per ounce.

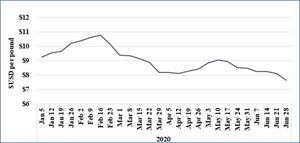

Copper Price

The average spot copper price in the second quarter of 2020 was $2.42 per pound, a 13% decrease compared to the comparative prior year period of $2.78 per pound.

The average spot copper price in the first half of 2020 was $2.50 per pound, a 10% decrease compared to the comparative prior year period of $2.79 per pound.

Molybdenum Price

The average molybdenum price in the second quarter of 2020 was $8.30 per pound, a decrease of 32% from the comparative prior year period of $12.18 per pound.

The average molybdenum price in the first half of 2020 was $9.02 per pound, a decrease of 25% from the comparative prior year period of $11.98 per pound.

Foreign Exchange

The Company receives its revenue through the sale of gold, copper and molybdenum in U.S. dollars. The Company has operations in Canada, including its corporate head office, the Kyrgyz Republic, Turkey and the United States.

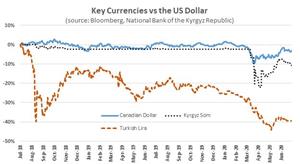

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/408b4c76-c33d-4c67-ac1f-5f08c768996c

USD to CAD

During the second quarter of 2020, the spot price of the exchange rate of the U.S dollar to the Canadian dollar fluctuated between a low of 1.34 and a high of 1.42. The average U.S. dollar to Canadian dollar exchange rate for the second quarter of 2020 was 1.39, which was weaker by 4% when compared with the first quarter of 2020 and the second quarter of 2019, both at 1.34.

The average U.S. dollar to Canadian dollar exchange rate for the first half of 2020 was 1.36, which was weaker by 2% when compared with the first half of 2019 of 1.33.

The Canadian dollar as at June 30, 2020 was 1.36, 5% weaker than its value as at December 31, 2019 of 1.30.

In the second quarter and first half of 2020, Centerra’s Canadian dollar hedging program resulted in a $2.1 million realized loss and $3.4 million realized loss, respectively, compared to nil for both the second quarter and first half of 2019. As at June 30, 2020, the Company has hedged 73% of the estimated Canadian dollar exposure for 2020, using zero cost collars and forwards, 65% of the estimated 2021 exposure and 43% for the first six months of 2022.

USD to Kyrgyz Som

During the second quarter of 2020, the spot price of the U.S. dollar to Kyrgyz som exchange rate fluctuated from 73.5 to 84.9. The average U.S. dollar to Kyrgyz som for the second quarter of 2020 was 77.4, which was weaker by 9% when compared with the first quarter of 2020 of 71.2 and weaker by 11% when compared to the second quarter of 2019 of 69.8.

The average U.S. dollar to Kyrgyz som for the first half of 2020 was 74.3, which was weaker by 6% when compared with the first half of 2019 of 69.8.

The Kyrgyz som as at June 30, 2020 was 76.0, 9% weaker than its value as at December 31, 2019 of 69.6 with inflation approximately 4% during the first half of 2020.

USD to Turkish Lira

The average U.S. dollar to Turkish lira exchange rate for the second quarter of 2020 was 6.9, ranging from 6.6 to 7.2 during the quarter, which was weaker by 13% when compared to the first quarter of 2020 of 6.1 and 17% when compared to the average of the second quarter of 2019 of 5.9. The Turkish lira as at June 30, 2020 was 6.9, 15% weaker than its value as at December 31, 2019 of 6.0, with inflation approximately 6% during the first half of 2020.

Diesel Fuel Prices

Fuel costs represent a significant cost component for Centerra’s mining operations, representing 11% of production costs. Prices for Kumtor diesel fuel in the second quarter and first half of 2020 generally reflected the price movements of Brent crude oil. The average purchase price for diesel fuel for Kumtor in the second quarter and first half of 2020 was $0.31/litre and $0.39/litre, respectively, compared to $0.50/litre and $0.51/litre in the second quarter and second half of 2019, respectively. Kumtor sources its fuel from Russia either directly or through Kyrgyz distributors and prices include additional costs such as seasonal premiums for winterizing fuel and transportation costs from the Russian refineries.

According to the U.S. Energy Information Administration, the Brent crude oil price averaged $30/bbl. and $40/bbl. in the second quarter and first half of 2020, respectively, compared to $69/bbl. and $66/bbl. in the second quarter and first half of 2019, respectively. As at June 30, 2020 the closing Brent spot price was $42/bbl., $26/bbl. lower than the price at December 31, 2019 of $68 /bbl.

The Company utilizes its diesel hedging program in order to manage its exposure to adverse fluctuations in diesel fuel prices, see “Financial Instruments”. In the second quarter of 2020, Centerra’s diesel hedging program resulted in a $0.9 million realized loss compared to a $0.5 million realized gain in the second quarter of 2019. In the first half of 2020, Centerra’s diesel hedging program resulted in a $2.1 million realized loss compared to a $0.6 million realized gain in the first half of 2019. As at June 30, 2020, the Company has hedged 80% of the Company’s estimated diesel fuel exposure for the remainder of 2020 using zero cost collars and swaps, 54% of the 2021 estimated exposure and 24% for the first six months of 2022.

Financial Instruments

The Company seeks to manage its exposure to fluctuations in diesel fuel prices, commodity prices and foreign exchange rates by entering into derivative financial instruments from time-to-time.

The hedge positions for each of these programs as at June 30, 2020 are summarized as follows:

| Settlements | As at June 30, 2020 | ||||||||

| Program | Instrument | Unit | Average strike price | Type | 2020 | 2021 | 2022 | Total position (4) | Fair value($'000's) |

| FX Hedges | |||||||||

| USD/CAD zero-cost collars(3) | CAD | 1.33/1.39 | Fixed | 96.0 million | 184.8 million | 90.0 million | 370.8 million | (788) | |

| USD/CAD forward contracts(2) | CAD | 1.39 | Fixed | 90.0 million | 96.0 million | - | 186.0 million | 2,843 | |

| Fuel Hedges | |||||||||

| Brent Crude Oil zero-cost collars(1) | Barrels | $49/$56 | Fixed | 98,790 | 74,592 | 45,000 | 218,382 | (1,762) | |

| Brent Crude Oil swap contracts(2) | Barrels | $41 | Fixed | 16,000 | 203,925 | 6,000 | 225,925 | 235 | |

| ULSD zero-cost collars(1) | Barrels | $67/$76 | Fixed | 146,440 | 42,116 | 60,000 | 248,556 | (3,740) | |

| ULSD swap contracts(2) | Barrels | $52 | Fixed | 66,000 | 213,255 | 6,000 | 285,255 | 322 | |

| Gold/Copper Hedges (Royal Gold deliverables): | |||||||||

| Gold forward contracts(2) | Ounces | N/A(4) | Float | 17,004 | - | - | 17,004 | 1,640 | |

| Copper forward contracts(2) | Pounds | N/A(4) | Float | 4.9 million | - | - | 4.9 million | 1,370 | |

(1) Under the fuel zero-cost collars, the Company retains the right to buy fuel barrels at the contract’s ‘ceiling’ price if the market price was to exceed this price upon contract expiration, while requiring the Company to buy fuel barrels at the ‘floor’ price if the market price fell below this price upon expiration. At the end of each contract there is no exchange of the underlying item and it is financially settled.

(2) Under the swap and forward contracts, the Company ‘buy’ and ‘sell’ metals, currencies and commodities, at a specified price at a certain future date. The Company retains the right for these contracts to be cash or physically settled.

(3) Under the currency zero-cost collars, the Company retains the right to buy foreign currency at the contract’s ‘floor’ price if the market price was to fall below this price upon contract expiration, while requiring it to buy foreign currency at the ‘ceiling’ price if the market price was to exceed this price upon expiration.

(4) Royal Gold hedging program with a market price determined on closing of the contract.

Centerra does not enter into off-balance sheet arrangements with special purpose entities in the normal course of its business, nor does it have any unconsolidated affiliates.

Operating Mines and Facilities

Kumtor Mine

The Kumtor open pit mine, located in the Kyrgyz Republic, is one of the largest gold mines in Central Asia. It has been in production since 1997 and has produced over 13.0 million ounces of gold to June 30, 2020.

An updated Kumtor technical report for the Kumtor Mine is expected to be completed in the fall of 2020.

During the second quarter, the final waste rock dump design was completed and submitted for Government approval to re-utilize the Lysii Valley for the placement of waste rock going forward. Lysii Valley is expected to be the main mine waste rock dump for the next two years as it is closest to CB20. Permitting to utilize the Lysii Valley was received on July 24 therefore in the 3rd quarter mine waste tonnage movement is expected to increase to planned levels.

COVID-19 update

Kumtor continues to implement mitigation controls and health & safety precautions at the mine site to contain the spread of COVID-19. While Kumtor’s operations in the second quarter were not affected, the Company has begun to notice an effect on the availability of Kumtor’s workforce due to a greater rate of COVID-19 infections and other illnesses in the Kyrgyz Republic. As a result, open pit mining operations have been running below full capacity in July, though mill processing operations continue to work at full capacity and are expected to maintain gold production by processing stockpiles as planned for the year. The Company will continue to adjust its plans as necessary to ensure the safety of Kumtor’s personnel and local communities.

As Kumtor is an isolated mine site with an on-site camp, all employees and contractors are required to undergo comprehensive testing and remain in an offsite quarantine facility prior to traveling to the mine site. As of July 21, 2020, 381 employees and contractors have tested positive for COVID-19, representing approximately 4.3% of 8,837 tests performed on the Kumtor workforce. However, due to Kumtor’s strict quarantine and testing protocols none of the employees or contractors who tested positive for COVID-19 entered the mine site. To the best of the Company’s knowledge, the Kumtor mine site has remained COVID-19 free.

Kumtor Operating Results