Chilean Metals Intersects 716 g / t Silver and 0.453% Copper over 2 meter in Hole 3 at the Chanchero zone - Tierra de Oro project, Chile.

TORONTO, ON / ACCESSWIRE / February 1, 2021 / Chilean Metals Inc. ("Chilean Metals," "CMX" or the "Company") (TSX.V:CMX, SSE:CMX, MILA:CMX) is pleased to report results from Phase 1 of drilling at its Tierra de Oro (Land of Gold) project in 3rd Region of Atacama about 75 km south of Copiapó, Chile.

The phase 1 drilling program at Tierra de Oro was focused on the Chanchero zone and further confirmed the existence of a strong hydrothermal system in the local area. Drilling demonstrated discontinuous fault bound zones of characteristic phyllic-propylitic-argillic alteration and widespread pyrite mineralization in stockworks and veins in most of the drill holes. A total of five diamond drill holes were completed for a total of 1,500 m of recovered core, resulting in approximately 850 collected samples. Laboratory results have been received for all of the 5 holes completed. The preliminary highlight of the program was intersected in Hole 3 where a two-meter sample at 120 m depth encountered anomalous grades of 716 g/t Silver and 0.453% Copper, adjacent to a highly fractured fault zone with no core recovery.

The project area is structurally controlled by the Elisa de Bordos fault, separating 2 domains; an intrusive one associated with Gold, where the Chancheros project is located, and another volcanoclastic domain associated with Copper - Silver, where the Las Lomitas and Jaqueline projects are located.

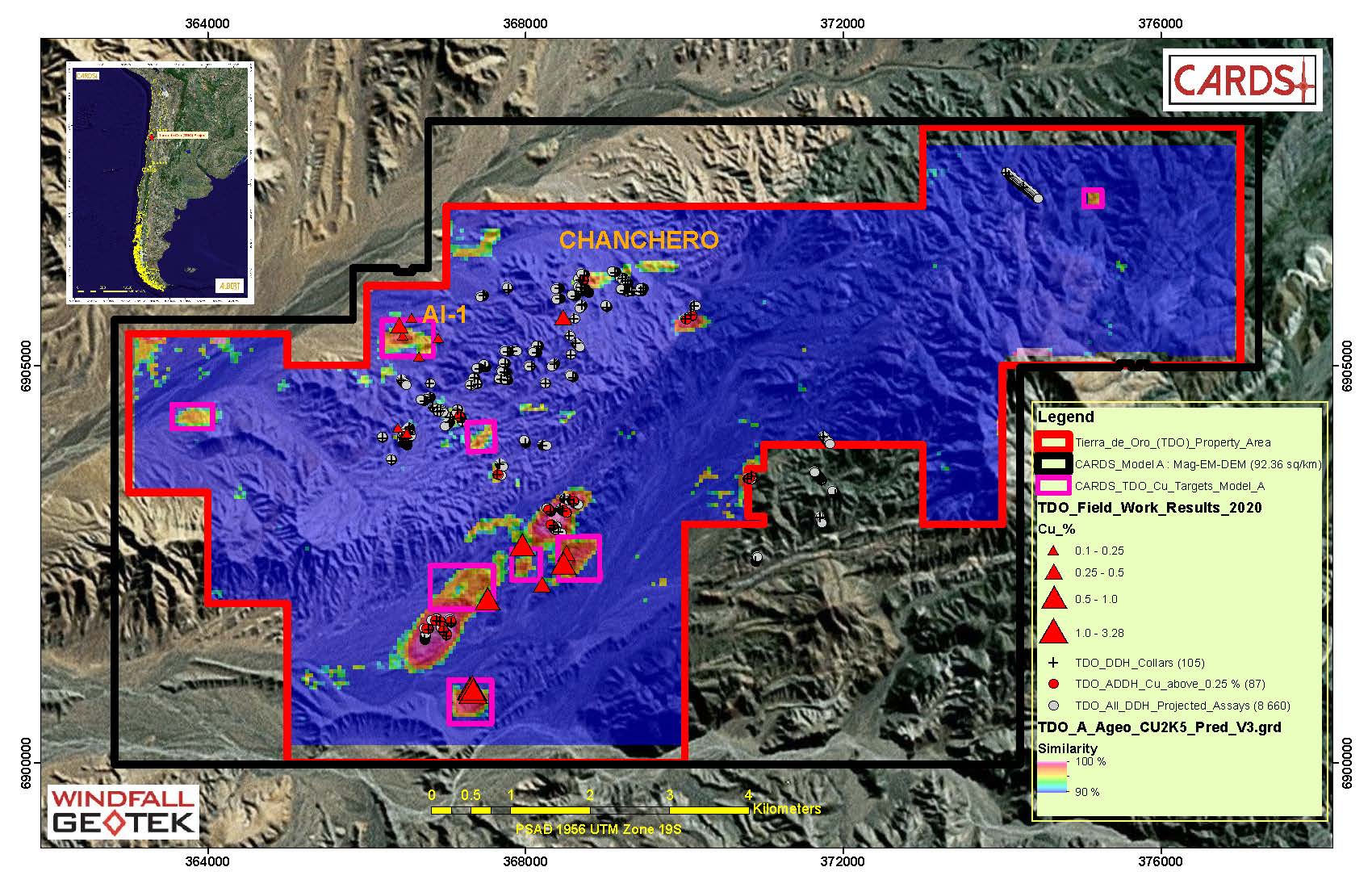

The AI study delivered targets for surface exploration at Las Lomitas where the results obtained from ground truth sampling from nine (9) rock chip samples graded between 0.77% to 3.23% Copper and 22 to 169 g/t Silver. The next step to follow is to perform geophysics on these areas to identify new targets of drilling.

The 5,675-hectare project has several geological areas of interest the Company will be exploring following an Artificial Intelligence (AI) analysis generated by leading AI mining service provider Windfall Geotek (TSX.V:WIN).

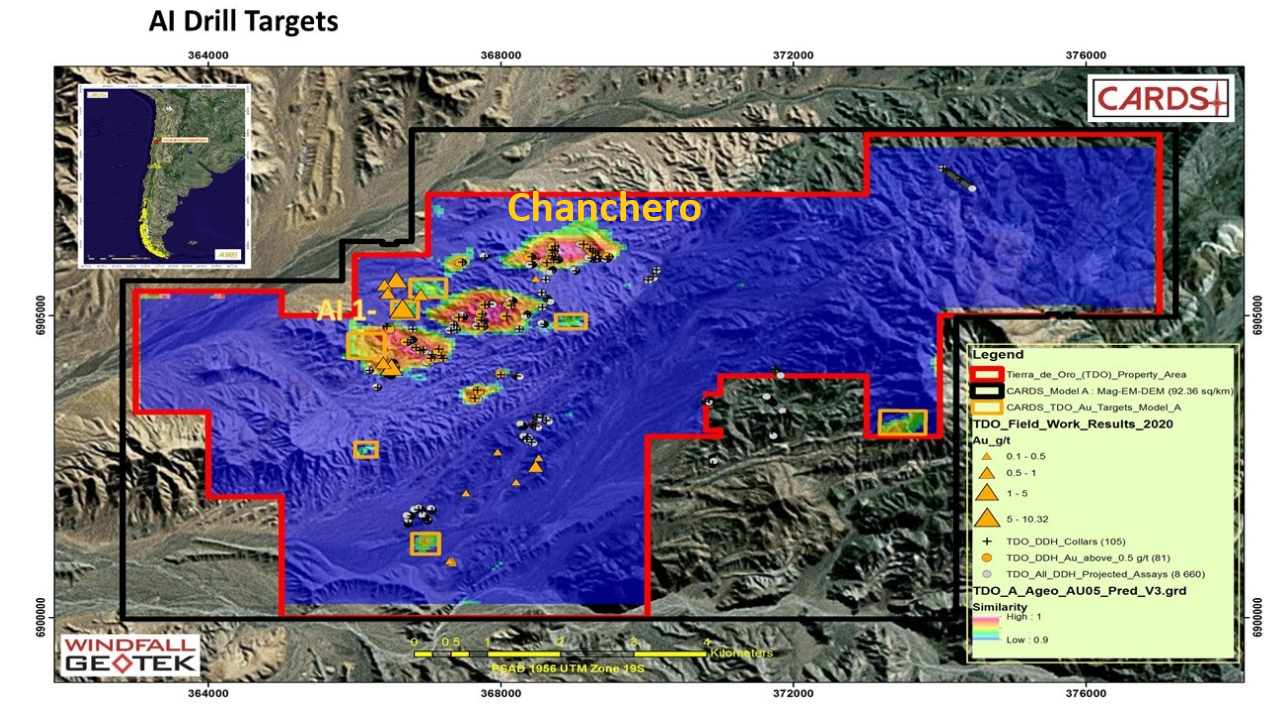

Previous exploration data generated by both the company and other historic operators have been compiled and 8,660 training points were subjected to evaluation by Windfall's propriety CARDS AI model. CARDS uses data mining techniques to analyze compiled exploration data and to identify areas target zones with high statistical similarity to known "signatures" of areas of copper, gold, and silver mineralization (Figures 3 and 4 below). A total of thirteen (13) prospective target zones were identified by the prediction analysis, of which in Phase 1 the company has elected to drill test two of the zones.

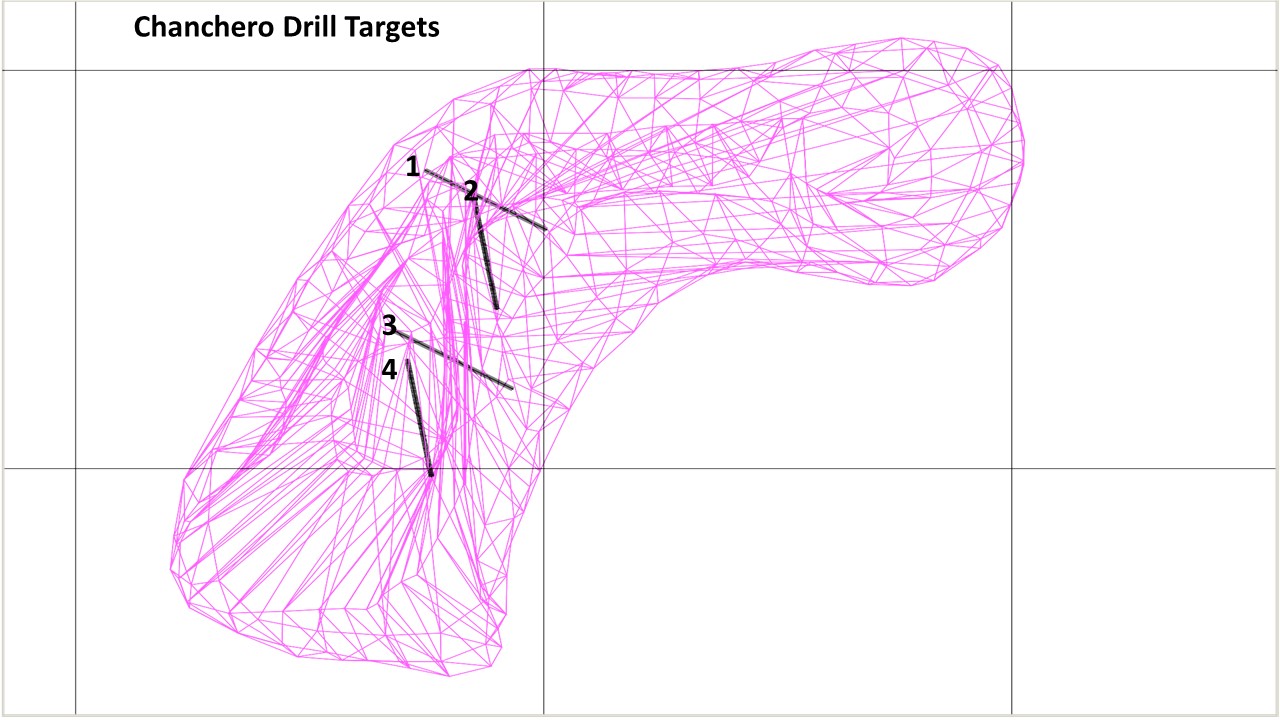

- The 'Chanchero' Zone has previously been identified as being prospective for copper porphyry-style mineralization. The area comprises a 0.75 square kilometers zone of argillic and quartz-sericite-pyrite alteration hosted by augite-hornblende diorite to granodiorite with roof pendants of hornblende monzonite. The area was surveyed by 3-D Induced Polarization (IP) methods in 2008 and generated a chargeability anomaly greater at than 50MV/V at its core which is open at depth. The area was the focus of four (4) core holes that proposed to intersect the chargeability anomaly longitudinally and at depth. A two-meter sample at 120 m depth had a grade of 716 g / t Silver and 0.453% Copper was intersected in hole 3 on the figure below.

Figure 1: Locations of 4 Proposed drill holes at the Chanchero target, relative to the outline/projected shape of the greater at than 50MV/V chargeability anomaly as defined by the 2008 3-D Induced Polarization survey.

- The 'Cobalt' zone is an AI generated target Gold anomaly that occurs along a pronounced structure and is located along strike from existing shallow artisanal gold workings. A single core hole was orientated to intersect the structure at depth below the projected level of the adjacent historical workings. No material results were generated at this target during the drilling.

Figure 3: Tierra De Oro property CARDS target model-A for Gold anomalism.

Figure 4: Tierra De Oro property CARDS target model-A for Copper anomalism.

"716 grams of Silver is a very interesting kicker. The area above the sample was also of interest but drilling did not deliver a bonafide sample due to some drill recovery issues. The alteration looks similar and will need further analysis. Will apply these drill results to our AI model and reinterpret the Las Lomitas silver target. Do some targeted Geophysics and then conduct a second drill program that we expect would take place in Q3.

That timeline will enable us to move this forward while we switch the drilling focus to our newly announced NISK project in James Bay Quebec. This acquisition was announced on December 23rd and is subject to approval by the TSXV which we would anticipate receiving in February. NISK is a high-grade Nickel Copper Cobalt Palladium project with a historical resource as outlined below.

Table ?EUR'1: Historical Resource Estimate figures for respective confidence categories at the NISK-1 deposit, After RSW Inc 2009: Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec.

The information regarding the NISK-1 deposit was derived from the technical report titled "Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec" dated December 2009. The key assumptions, parameters and methods used to prepare the mineral resource estimates described above are set out in the technical report.

Chilean is quite fortunate to be in the position to go from one potentially high impact drill program to the next. Our goal like all junior explorers is to discover enough high-grade resources to justify a mine. While we continue to pursue the Tierra Del Oro opportunity in Chile we are fortunate to have a great head start on the process at NISK in James Bay and will now turn our attention there while we continue to understand and assess the next steps in Chile." commented Terry Lynch Chilean CEO.

About Chilean Metals www.chileanmetals.com/

Chilean Metals Inc. is a Canadian Junior Exploration Company focusing on high potential Copper Gold and Battery Metal prospects in Chile and Canada.

Chilean Metals Inc is 100% the owner of five properties comprising over 50,000 acres strategically located in the prolific IOCG ("Iron oxide-copper-gold") belt of northern Chile. It also owns a 3% NSR royalty interest on any future production from the Copaquire Cu-Mo deposit, recently sold to a subsidiary of Teck Resources Inc. ("Teck"). Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3% NSR for $3 million dollars at any time. The Copaquire property borders Teck's producing Quebrada Blanca copper mine in Chile's First Region.

Chilean Metals has just completed the acquisition of the Golden Ivan project in the heart of the Golden Triangle. https://chileanmetals.com/press-releases/ The Golden Triangle has reported mineral resources (past production and current resources) in a total of 130 million oz of gold, 800 million oz of silver, and 40 billion pounds of copper. (Three Golden Triangle Stocks to Watch - Resource World August 2020) This property hosts two (2) known mineral showings (Gold Ore, and Magee), and a portion of the past-producing Silverado Mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of Silver, Lead, Zinc +/- Gold +/- Copper.

The NISK Project comprises a large land position (20km of strike length) with numerous high-grade intercepts outside the current resource area. Chilean is focused on expanding its current high-grade nickel-copper PGE mineralization and intends to identify additional high-grade mineralization; with a view toward developing a process to potentially produce nickel sulfates responsibly for batteries for the electric vehicles industry.

ON BEHALF OF THE BOARD OF DIRECTORS OF

Chilean Metals Inc.

"Terry Lynch"

Terry Lynch, CEO

Contact: terry@chileanmetals.com

The technical content of this news release has been reviewed and approved by Luke van der Meer, B.Sc., P.Geo., who is independent the company, and is a qualified person as defined by National Instrument 43-101.

During the drilling program, half core samples were collected at two-meter intervals along the entire length of each drill hole. Core recovery was routinely measured, and sampling was undertaking according to typical industry best practice standards. The samples were securely transported to and were analyzed by Activation Geological Services (AGS) of Copiapó, Chile (Acreditación LE1422,LE1423). Gold was tested by Fire Assay Fusion with an atomic absorption finish on a 30g nominal sample, additional analyses for Silver, Copper, and Molybdenum were completed using a four acid digestion. Approximately 15% QA/QC samples were inserted during the sampling program, these comprise ¼ core duplicates, certified reference material, and blank samples. AGS also maintains a rigorous internal (blind) quality assurance and control (QAQC) program throughout the sample preparation and analysis process. Routine quality assurance verification was undertaken no significant data discrepancies were encountered, the data has been accurately transcribed from the original source and is suitable to be used.

Forward-looking Statements: This news release may contain certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that CMX expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements in this document include statements regarding current and future exploration programs, activities, and results. Although CMX believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration success, continued availability of capital and financing, inability to obtain required regulatory or governmental approvals, and general economic, market, or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements.

Neither the TSX Venture Exchange nor it's Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Chilean Metals, Inc.

View source version on accesswire.com:

https://www.accesswire.com/627095/Chilean-Metals-Intersects-716-g-t-Silver-and-0453-Copper-over-2-meter-in-Hole-3-at-the-Chanchero-zone--Tierra-de-Oro-project-Chile