Chilean Metals Options High Grade Nickel Copper PGE Deposit in James Bay from Critical Elements

TORONTO, ON / ACCESSWIRE / December 23, 2020 / Chilean Metals Inc. ("Chilean Metals," "CMX" or the "Company") (TSXV:CMX)(SSE:CMX)(MILA:CMX) is pleased to announce it has reached subject to TSX.V approval and agreement to acquire up to 80% of the NISK property via a series of option payments and work commitments as further detailed below.

Option Terms:

Grant of first option

The Corporation grants to the Optionee the exclusive right and option to acquire, on or before the date that is three (3) years from the TSX.V approval (the "Effective Date") (the "First Option Period"), an initial 50% Earned Interest in the Property (the "First Option"), free and clear of all Encumbrances other than the Permitted Encumbrances and the Royalty, subject to the terms and conditions in this Agreement.

Requirements to Exercise the First Option

In order to acquire the 50% Earned Interest under the First Option, the Optionee must:

(a) make cash payments totalling $500,000 to the Corporation (the "Cash Payments") on or before the dates set out below:

(i) a non-refundable amount of $25,000 on the date of execution of the agreement;

(ii) an amount of $225,000 within a delay of five (5) Business Days following the Effective Date; and

(iii) an amount $250,000 within a delay of six (6) months from the Effective Date;

(b) issue to the Corporation within a delay of five (5) Business Days following the Effective Date, 12,051,770 Shares (the "Share Payment") of the Optionee. The Shares issued will be issued as fully paid and non-assessable free and clear of all liens, charges and Encumbrances, and subject only to such resale restrictions and hold periods as may be imposed by applicable Securities Laws and the policies of the TSXV;

(c) incur an aggregate of $2,800,000 of Work Expenditures on the Property on or before the dates set out below:

(i) $500,000 in Work Expenditures on or before the date that is one (1) year from Effective Date;

(ii) $800,000 in Work Expenditures on or before the date that is two (2) years from Effective Date; and

(iii) $1,500,000 in Work Expenditures on or before the date that is three (3) years from Effective Date; and

Upon the Optionee having completed the Cash Payments, the Share Payment and incurred or funded the Work Expenditures on or before the expiry of the First Option Period, the Optionee may exercise the First Option by delivering notice to Critical Elements to that effect and confirming exercise of the First Option (the "First Option Exercise Notice"). Upon delivery of the First Option Exercise Notice, the Optionee shall have earned a 50% Earned Interest in the Property.

Grant of second option

Subject to the Optionee having exercised the First Option, the Corporation hereby also grants to the Optionee the exclusive right and option (the "Second Option") to increase its Earned Interest in and to the Property from 50% to 80% by incurring or funding additional Work Expenditures for an amount of $2,200,000, including the delivery of a Resource Estimate, for a period commencing on the delivery of the First Option Exercise Notice and ending on the date that is four (4) years from Effective Date (the "Second Option Period").

Following the exercise of the Second Option, until such time as a definitive Feasibility Study (the "Definitive Feasibility Study") regarding extraction and production activities on the Property is delivered to the Joint Venture, Critical Elements shall maintain a 20% non-dilutive interest in the Joint Venture and shall not contribute to any Joint Venture costs.

Operatorship

During the currency of the Agreement, except as otherwise contemplated under the Agreement, Chilean shall act as the operator (the "Operator"), and as such, shall be responsible for carrying out and administering the Work Expenditures on the Property, in accordance with work programs (the "Programs") approved by the Technical Committee. The Operator shall be entitled to receive a management fee equal to 10% of the amount of Work Expenditures incurred on internal work and equal to 5% of the amount of Work Expenditures incurred on contract work carried by third party contractors or consultants.

In the event Chilean exercises the First Option and subsequently elects not to exercise the Second Option, or in the event the Second Option is terminated, whichever the case, Chilean's right to act as Operator shall immediately terminate and Critical Elements shall become the Operator for the future conduct of Work Expenditures and Programs on the Property.

Royalty

Following the exercise of the First Option by Chilean, and in addition to the obligations of Chilean under the First and Second Option, if applicable, Critical Elements shall receive, in the event of a Lithium discovery, a royalty equal to 2% net smelter returns (the "Royalty") resulting from the extraction and production of Lithium products, including Lithium ore, concentrate and chemical, resulting from the extraction and production activities on the Property, including transformation into chemical products. Chilean shall have the right at any time to purchase 50% of the Royalty and thereby reduce the Royalty to 1% by paying to Critical Elements a total cash amount of $2,000,000.

Lithium Marketing Rights

In the event of a Lithium discovery, Critical Elements will retain Lithium Marketing Rights meaning the exclusive right of Critical Elements to market and act as selling agent for any and all Lithium products, including Lithium ore, concentrate and chemical, resulting from the extraction and production activities on the Property, including transformation into chemical products.

There will be a Finders Fee of 5% in cash on the cash paid to CRE and 5% of the stock paid CRE payable to Paradox Equity Partners Ltd., payable on closing.

"We are excited to reach agreement to explore and hopefully expand the high grade NISK deposit.

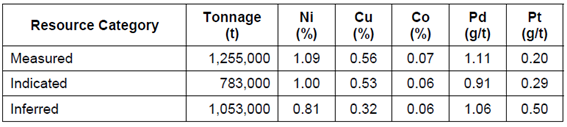

(Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec. Dated "December 2009" - Historical Resource)

- Measured resource: 1,255,000 tonnes at 1.09% Ni; 0.56% Cu; 0.07% Co; 1.11 g/t Pd and 0.20 g/t Pt;

- Indicated resource: 783,000 tonnes at 1.00% Ni; 0.53% Cu; 0.06% Co; 0.91 g/t Pd and 0.29 g/t Pt;

- Inferred resource: 1,053,000 tonnes at 0.81% Ni; 0.32% Cu; 0.06% Co; 1.06 g/t Pd and 0.50 g/t Pt.

The deposit is open in all directions and there are several MAG anomaly's similar to the ones drilled to create the initial resource that have been yet untested. We believe growing this resource to make it a viable mine project is well within reason. We look at the great work Talon Metals has done on its Tamarack project and believe we have a very similar project albeit with lower Nickel grades and higher PGE on the NISK," commented Terry Lynch Chilean CEO.

About the NISK Property

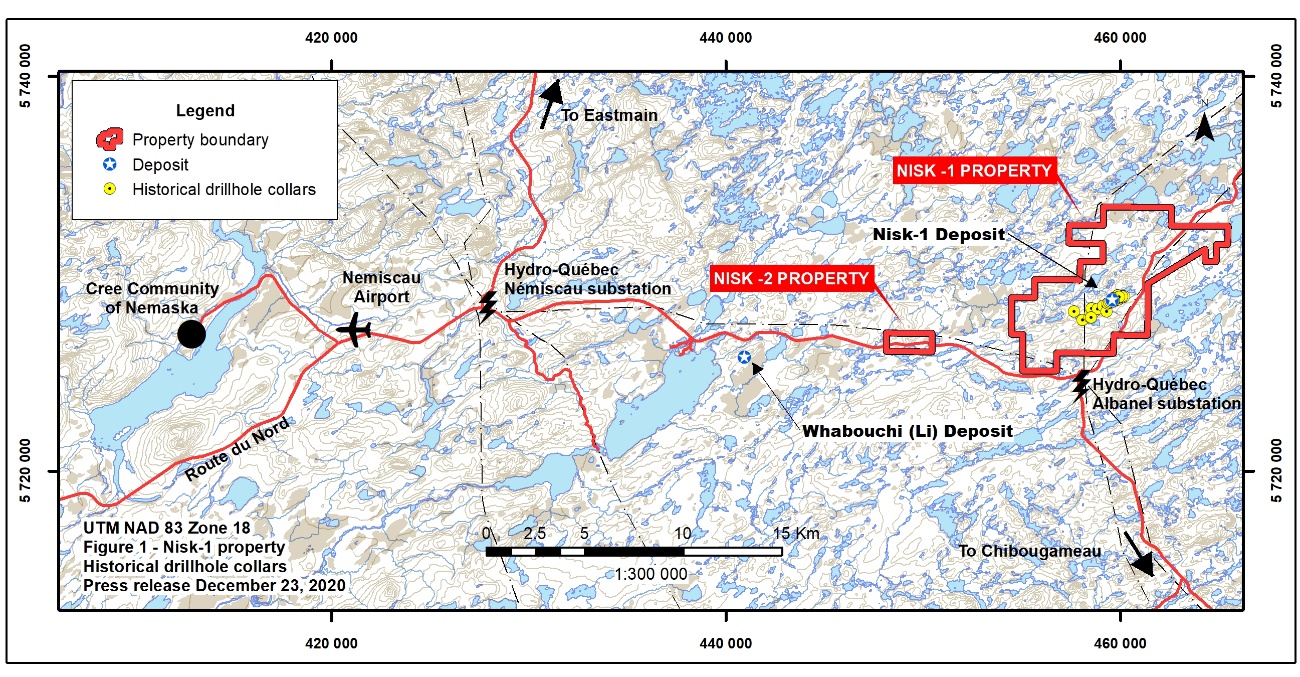

The NISK property lies approximately 284 km by road north of the mining town of Chibougamau and 45 km east of the Nemiscau airport, in the James Bay territory of Quebec.

The NISK property comprises two discontinuous blocks; the NISK-1 block comprises 86 mineral claims for a total of 4,375.55 ha, while the smaller NISK-2 block comprises 4 mineral claims for a total of 312.56 ha. Together these comprise the NISK property comprising a total of 90 mineral claims for a total of 4,589.11 ha, (see Figure 1).

Figure 1 - NISK Property location, near the community of Nemaska, north of Chibougamau, Quebec.

As a result of the James Bay hydroelectric development work by Hydro-Quebec, the Nemiscau area now has excellent infrastructure.

Physiography and Access:

The Property is dominantly covered with Boreal forest, with a gentle topography of rolling hills and numerous small lakes, swamps, and local network of stream drainages. The property is accessible by variably maintained 4x4 trails and is amenable to both winter and summer exploration and drilling.

Capsulate Geology:

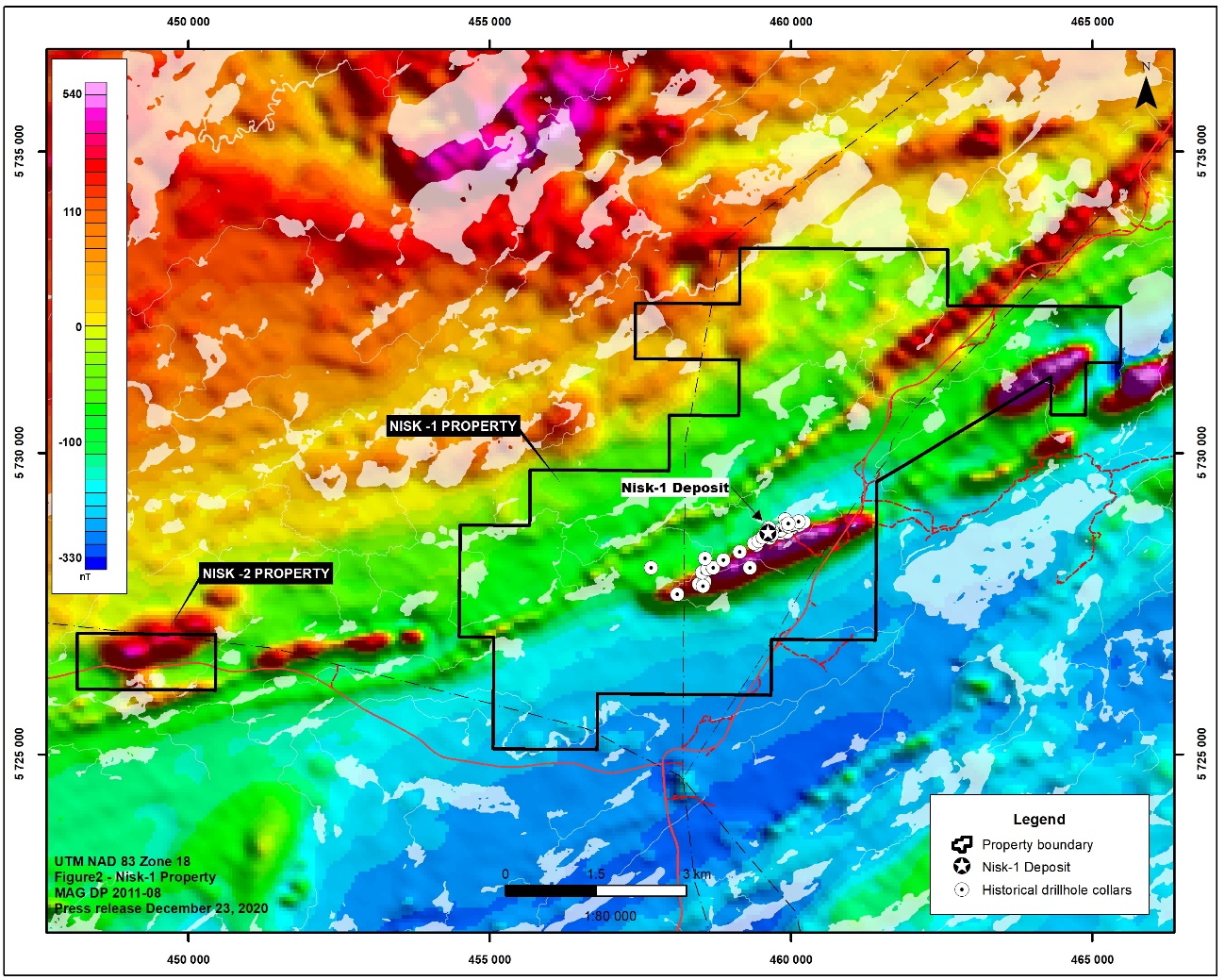

The NISK property is located within the late Archean-age Superior Province and is characterized by a belt of paragneisses interbedded with amphibolites, known at the Bande du Lac des Montagnes (BLM). The BLM is part of a NE orientated overturned syncline with moderately to steeply dipping limbs, which features as a prominent regional magnetic conductor (see Figure 3).

The NISK-1 deposit is hosted in an NE orientated elongated sill of serpentinized ultramafic rocks that intrude the BLM paragneiss and amphibolite sequence. The sill consists of two known intrusive phases: a "grey" unmineralized serpentinized peridotite, and a "black" mineralized serpentinized peridotite. The latter "black" serpentinized peridotite is mineralized towards its base with elevated Ni-Cu-Co-Fe sulphides. Sulphides include massive to disseminated pyrrhotite, with lesser amounts of pentlandite, chalcopyrite and pyrite, this mineralization is noted to commonly occur as a singular continuous zone.

Figure 2 - NISK-1 deposit location, historic drillhole collar locations, and property outline over regional magnetics.

Previous Work:

The NISK-1 property hosts a nickel showing discovered and evaluated by INCO and its subsidiary, Nemiscau Mines, in the period from 1962 to 1969. At the time, the Nemiscau area was very remote and INCO had large quantities of high-grade nickel ore in the Sudbury area, so the property was abandoned.

From 1987 to 1988 Muscocho Explorations Ltd completed surficial explorations that included an airborne VLF-EM and total magnetic field geophysical survey, collection, and analysis of surface rock samples, and completed diamond drilling of 16 holes totalling 1,843 m at the NISK-1 showing.

In 2006 to 2008 Golden Goose Resources completed further surficial explorations that included an airborne AeroTEM 2 - EM and magnetometry geophysical survey, and a ground TEM geophysical survey. Golden Goose Resources also completed diamond drilling of 63 holes totaling 13,088 m at the NISK-1 showing.

The 63 holes drilled by Golden Goose Resources were utilized to develop a NI 43-101 mineral resource. The resource estimation was completed by RSW INC. by Pierre Trudel Ph.D., P.Eng. and is detailed in their report entitled Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec. Dated "December 2009", the 2009 resource estimation is considered to be a "Historical Estimate" as defined by NATIONAL INSTRUMENT 43-101 STANDARDS OF DISCLOSURE FOR MINERAL PROJECTS.

The historical resource estimation culminated in the definition of Nickel, Copper, Cobalt, Palladium, Platinum resources, containing Measured, Indicated, and Inferred confidence categories as described in Table 1 below. The simplified sectional resource is developed along a single continuous drill hole intersections, developed with a cut-off grade of 0.4% Ni over a minimum width of 0.5 m, within estimation blocks measuring up to 75 m along respective sections to define the nickel-bearing zone.

Table ?EUR'1: Historical Resource Estimate figures for respective confidence categories at the NISK-1 deposit, After RSW Inc 2009: Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec.

The information regarding the NISK-1 deposit was derived from the technical report titled "Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Quebec" dated December 2009. The key assumptions, parameters and methods used to prepare the mineral resource estimates described above are set out in the technical report.

Future Exploration:

The Company plans to further advance the previously defined historic resources with confirmation drilling, additional infill, and resource definition drilling. An updated resource estimate will be prepared upon completion of the additional drilling. Surface exploration is also contemplated of other prospective targets on the property.

Qualified Person

Qualified Person Luke van der Meer, P.Geo. (Licence # 37848), Independent Geological Consultant., Qualified Person under NI 43- 101 on standards of disclosure for mineral projects, has reviewed and approved the technical content of this release.

About Chilean Metals www.chileanmetals.com/

Chilean Metals Inc. is a Canadian Junior Exploration Company focusing on high potential Copper Gold and Battery Metal prospects in Chile and Canada.

Chilean Metals Inc is 100% owner of five properties comprising over 50,000 acres strategically located in the prolific IOCG ("Iron oxide-copper-gold") belt of northern Chile. It also owns a 3% NSR royalty interest on any future production from the Copaquire Cu-Mo deposit, recently sold to a subsidiary of Teck Resources Inc. ("Teck"). Under the terms of the sale agreement, Teck has the right to acquire one third of the 3% NSR for $3 million dollars at any time. The Copaquire property borders Teck's producing Quebrada Blanca copper mine in Chile's First Region.

Chilean Metals has announced subject to TSXV approval acquisition of the Golden Ivan project in the heart of the Golden Triangle. https://chileanmetals.com/press-releases/ The Golden Triangle has reported mineral resources (past production and current resources) in total of 67 million oz of gold, 569 million oz of silver and 27 billion pounds of copper. This property hosts two (2) known mineral showings (Gold Ore, and Magee), and a portion of the past producing Silverado Mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of Silver, Lead, Zinc +/- Gold +/- Copper.

The NISK Project comprises a large land position (20km of strike length) with numerous high-grade intercepts outside the current resource area. Chilean is focused on expanding its current high-grade nickel copper PGE mineralization resource prepared in accordance with NI 43-101; identifying additional high-grade mineralization; and developing a process to potentially produce nickel sulphates responsibly for batteries for the electric vehicles industry.

ON BEHALF OF THE BOARD OF DIRECTORS OF

Chilean Metals Inc.

"Terry Lynch"

Terry Lynch, CEO

Contact: terry@chileanmetals.com

Phone 647-448-8044

Forward-looking Statements: This news release may contain certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that CMX expects to occur, are forward looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements in this document include statements regarding current and future exploration programs, activities and results. Although CMX believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration success, continued availability of capital and financing, inability to obtain required regulatory or governmental approvals and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Chilean Metals, Inc.

View source version on accesswire.com:

https://www.accesswire.com/622142/Chilean-Metals-Options-High-Grade-Nickel-Copper-PGE-Deposit-in-James-Bay-from-Critical-Elements