Cornerstone Board Formally Rejects Hostile Bid by SolGold for the Second Time

OTTAWA, July 14, 2020 (GLOBE NEWSWIRE) -- Cornerstone Capital Resources Inc. (“Cornerstone” or “the Company”) (TSXV:CGP) (Frankfurt:GWN) (Berlin:GWN) (OTC:CTNXF) today announced that its Board of Directors, upon the unanimous recommendation of an independent committee of the Board (the “Independent Committee”) and following a detailed review conducted in consultation with its financial and legal advisors, has unanimously rejected SolGold plc’s (“SolGold”) unsolicited offer to acquire Cornerstone (the “Hostile Bid”) for the second time. The Hostile Bid was formalized by SolGold on June 30, 2020 nearly a year and a half after SolGold announced its intention to make an unsolicited offer to acquire Cornerstone. The Board previously announced its first rejection of the proposed bid as outlined in Cornerstone’s press release dated March 8, 2019.

The Board unanimously recommends that Cornerstone shareholders REJECT the Hostile Bid and not tender their shares. In the Board’s view, the Hostile Bid:

- is wholly inadequate and is not in the best interests of Cornerstone and its shareholders – in fact, the Hostile Bid has been swiftly rejected by holders of a majority of Cornerstone shares following the formal commencement of the Hostile Bid;

- is exploitive, as SolGold has withheld and continues to withhold material non-public information in respect of the Cascabel Project (including information on the progress of the ongoing pre-feasibility study at the Cascabel Project) from both the market and Cornerstone shareholders;

- is not compliant with Canadian securities laws, including the requirement that an insider (which would include SolGold by virtue of its participation, including as operator, in Exploraciones Novomining S.A. (“ENSA”), the Ecuadorian company owned by SolGold and Cornerstone that holds 100% of the Cascabel concession) provide enhanced disclosure and a formal valuation in connection with a take-over bid; and

- offers consideration consisting solely of SolGold shares and exchangeable shares of SolGold Canadian ExchangeCo Corp. (“ExchangeCo”) which exposes Cornerstone shareholders to shares of an illiquid company with a history of significant dilution, suspect corporate governance and self-dealing practices

Greg Chamandy, Chairman of the Cornerstone Board and holder of over 10% of the outstanding Cornerstone shares, said:

“For the second time, the Board is unanimous that SolGold’s proposal substantially undervalues Cornerstone, a fact that has clearly been recognized by our shareholders, as holders of approximately 65% of the outstanding Cornerstone shares have advised Cornerstone that they will not support SolGold’s Hostile Bid.

As one of the largest shareholders of SolGold, we are very disappointed that the current SolGold management team and board continue to waste significant resources and divert benefits to insiders, all while making a bid that fails to comply with Canadian securities laws, and all at the expense of shareholders. SolGold’s proposed royalty financing, which will see SolGold transfer significant value to Franco-Nevada, is but one example of SolGold’s mismanagement and questionable decisions.

Additionally, the timing of the Hostile Bid is highly suspect given it is set to expire five days before BHP is free from their unusual standstill, which extends not only to shares of SolGold but also Cornerstone shares.

I would also like to personally thank each and every supportive Cornerstone shareholder for their prompt and decisive rejection of the SolGold Hostile Bid which will enable Cornerstone to minimize the costs of responding to this failed Hostile Bid.”

The Cornerstone Board believes that SolGold’s Hostile Bid has no chance of success. The reasons for the Board of Directors’ recommendation are outlined in the Directors’ Circular which has been filed with Canadian regulators, is being mailed to Cornerstone's shareholders and is available on Cornerstone's website. These reasons include, but are not limited to, the following:

1. SOLGOLD’S HOSTILE BID CANNOT BE SUCCESSFUL

Shareholders that, together with their respective associates and affiliates, collectively own or exercise control over approximately 65% of the outstanding Cornerstone shares (63% on a fully-diluted basis) have advised Cornerstone of their intention to reject SolGold’s Hostile Bid and, accordingly, NOT to tender their Cornerstone shares to the Hostile Bid.

Canadian take-over bid rules require that the majority of the outstanding shares subject to a take-over bid (excluding those shares held by the bidder and any parties acting jointly or in concert with the bidder) be tendered to a formal offer before any shares can be taken up. Given that this statutory minimum tender condition cannot be waived by SolGold, the proposed Hostile Bid is incapable of being completed on the basis that it lacks sufficient shareholder support.

2. THE HOSTILE BID SIGNIFICANTLY UNDERVALUES CORNERSTONE AND IS OPPORTUNISTICALLY TIMED

SolGold is offering consideration of, for each Cornerstone common share not already owned by SolGold and its affiliates, either: (i) 11 SolGold shares; or (ii) at the election of certain shareholders subject to tax in Canada, 11 exchangeable shares of ExchangeCo. As at July 13, 2020, this would imply approximately $4.33 per common share, or total consideration for all of the outstanding Cornerstone shares of approximately $140 million. The Board views this consideration as wholly inadequate based on the substantial value of Cornerstone’s assets.

The Hostile Bid Fails to Recognize the Strategic Value of Cornerstone’s Asset Base

ENSA, an Ecuadorian company owned by SolGold and Cornerstone, holds 100% of the Cascabel concession, widely considered to have the potential to be a world class mineral property due to its significant copper and gold resources. Subject to the satisfaction of certain conditions, including SolGold fully funding the project through to feasibility, SolGold will own 85% of the equity of ENSA and Cornerstone will own the remaining 15% of ENSA. Cornerstone also owns approximately 7.6% of the outstanding shares of SolGold. In effect, Cornerstone has a combined direct and indirect 21.4% interest in the Cascabel Project and the projects falling within the Cascabel area of mutual interest in addition to Cornerstone’s ENAMI Strategic Exploration Alliance and other assets.

SolGold is responsible for funding 100% of the operations and activities at Cascabel, including funding Cornerstone’s 15% interest, until completion of a bankable feasibility study. Following completion of a bankable feasibility study, SolGold is entitled to receive 90% of Cornerstone’s distribution of earnings or dividends from ENSA until such time as the amounts so received equal the aggregate amount of expenditures incurred by SolGold that would have otherwise been payable by Cornerstone, plus interest thereon from the dates such expenditures were incurred at a rate per annum equal to LIBOR plus 2%.

The benefit to shareholders of Cornerstone’s strategic 15% carried interest in ENSA is apparent considering the significant dilution that SolGold’s shareholders have experienced, and are likely to continue to experience, as a result of SolGold’s attempts to finance the substantial ongoing development costs associated with the Cascabel Project.

The significant value of Cornerstone’s carried interest is clearly demonstrated in the following example. Assuming that the total costs of the Cascabel Project to completion of feasibility will be US$347 million1, SolGold must fund US$52 million to cover Cornerstone’s portion of the development costs in addition to the US$295 million required for SolGold’s interest.

In effect, SolGold must fund US$100 million for every US$85 million it needs to finance for its 85% interest.

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ff0b3cf8-10f9-4952-a3bc-e8558874b3f8

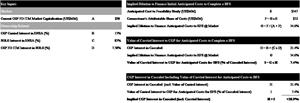

More generally, the value of Cornerstone’s carried interest can be expressed by the following equation:

| Value of Carried Interest to CGP (% of Cascabel Interest) | = | CGP Carried Interest [B]×CGP Interest in Cascabel [H]×Cost to Feasbility Study [E] |

| CGP FD ITM Market Cap [A]+(CGP Carried Interest [B]×Cost to Feasibility Study [E]) |

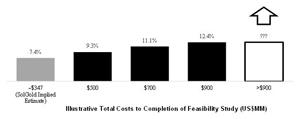

The chart below depicts the value of the carried interest to Cornerstone based on a range of illustrative potential costs until completion of a bankable feasibility study.

| Value of Carried Interest to Cornerstone (% of Cascabel Interest) |

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/17376bfb-aa88-4475-bd77-86cdad8bc4a5

Conservatively assuming that Cornerstone could otherwise finance its carried interest on a zero discount and zero cost basis, the value of Cornerstone’s carried interest is equal to approximately an additional 7.4% interest in the Cascabel Project. The strategic benefit and value to Cornerstone of its carried interest is even greater when considering the costs of development through to a bankable feasibility study on comparable projects are well in excess of US$350 million.

Furthermore, as noted above, Cornerstone’s attributable costs prior to feasibility will be repaid in the future out of 90% of Cornerstone’s share of earnings from ENSA. If a mine is built, Cornerstone repays its carried interest at an interest cost per annum equal to LIBOR plus 2%, which is well below the cost of capital for both Cornerstone and SolGold. In effect, SolGold is required to fund Cornerstone’s 15% carried interest on terms much more favourable to Cornerstone than SolGold’s cost to finance, which is value-accretive to Cornerstone’s shareholders and further dilutes SolGold’s shareholders.

For example, SolGold is currently paying a minimum of 12% per annum to Franco-Nevada on a secured bridge loan. The bridge loan agreement, which is not publicly available and has not been filed by SolGold on SEDAR, may include other fees and costs. Assuming the loan maturity is extended to eight months, SolGold will be required to issue 12.2 million warrants to Franco-Nevada. Using a Black-Scholes model2, the value of the warrants imply an effective interest rate of over 30% per annum for the bridge loan.

The Proposed Exchange Ratio is Vastly Out of Proportion to Cornerstone’s Combined Direct and Indirect Interest in Cascabel

As of July 13, 2020, the exchange ratio proposed by SolGold would result in Cornerstone’s shareholders owning approximately 14.7% of the issued and outstanding SolGold shares when compared to Cornerstone’s combined direct and indirect 21.4% interest in the Cascabel Project (assuming zero additional value for Cornerstone’s carried interest). This represents an approximate 32% reduction for Cornerstone’s shareholders (assuming zero value is ascribed to Cornerstone’s other assets). Including the value of Cornerstone’s carried interest (as more particularly described above), the discount for Cornerstone’s shareholders increases to over approximately 49%. Assuming SolGold had liquid shares acceptable to Cornerstone’s shareholders, SolGold would need to increase the exchange ratio to in excess of 22 SolGold shares per Cornerstone common share to provide Cornerstone shareholders with an interest equivalent to their interest currently held through their Cornerstone shares.

The Value Offered in the Hostile Bid is Well Below the Value Offered in Precedent Transactions

The Hostile Bid represents a significant discount to the multiples in precedent transactions involving other mineral exploration companies. Assuming SolGold had liquid shares acceptable to shareholders, the Hostile Bid represents an implied valuation for Cornerstone of US$0.014 per copper equivalent resource pound, whereas precedent transactions with assets of lower grade and smaller size represent an average implied valuation of approximately US$0.07 per copper equivalent resource pound. SolGold would need to increase its implied bid by approximately five times its current amount for Cornerstone to match the average from precedent transactions.

The Implied Offer Price of the Hostile Bid is at a Significant Discount to the Implied Value for Cornerstone’s Interest in the Cascabel Project Paid by BHP and Newcrest for Their Non-Controlling Interest in SolGold

Since 2018, BHP Billiton Holdings Limited (“BHP”) has acquired 282,721,826 SolGold shares at an average cost of approximately £0.33 per SolGold share, which would result in an implied Cornerstone share price of approximately $10.65 per Cornerstone common share. In addition, the SolGold shares acquired by BHP are encumbered by an unusual standstill, which extends not only to shares of SolGold but also common shares of Cornerstone, precluding BHP from making a competing offer for, or working with any third party to effect a change of control of, Cornerstone prior to October 19, 20203 in the absence of another third party bid for Cornerstone.

On December 14, 2018, Newcrest acquired 27,870,000 SolGold shares at a price of £0.40 per SolGold share, which would result in an implied Cornerstone share price of approximately $12.99 per Cornerstone common share.

SolGold would need to increase its implied price for Cornerstone’s shares under the Hostile Bid by approximately 146% and 200% to match the implied price paid by BHP and Newcrest, respectively, for their non-controlling interests in SolGold.

The Timing of the Proposed Hostile Bid is Highly Suspect

The Board believes that SolGold launched the Hostile Bid to:

- exploit its inside knowledge about the Cascabel Project prior to the release of the pre-feasibility study for Cascabel, and before material information was appropriately disseminated to Cornerstone and the market;

- pre-empt Cornerstone’s ability to enter into a value enhancing transaction with third parties such as BHP, given BHP's unusual standstill that does not expire until October 19, 2020 (five days after SolGold’s Hostile Bid expires); and

- deny Cornerstone’s shareholders the opportunity to realize the full value of Cornerstone’s carried interest in the Cascabel Project.

- SOLGOLD’S TRACK RECORD DEMONSTRATES THAT IT IS INCAPABLE OF FINANCING THE CASCABEL FEASIBILITY STUDY ON REASONABLE TERMS

SolGold’s Proposed Royalty Financing with Franco-Nevada Transfers Massive Value to Franco-Nevada at the Expense of SolGold Shareholders

SolGold’s proposed royalty financing with Franco-Nevada (the “Royalty Financing”), is extremely onerous and transfers enormous value to Franco-Nevada without any discernable risk to Franco-Nevada. Assuming SolGold fully exercises its rights to “up-size” its initial royalty payment in order to receive a total of US$150 million in funding, Franco-Nevada will be entitled to a perpetual 1.5% NSR royalty based on the gross proceeds of ENSA less certain allowable deductions payable by SolGold alone. Consequently, SolGold has effectively given a royalty interest on all minerals from the entire Cascabel concession (i.e., not just the Alpala Deposit) that still contains many un-drilled highly prospective targets.

According to SolGold, the Royalty Financing will be used to finance anticipated costs through to a Definitive Feasibility Study. Based on the Alpala Deposit alone and applying consensus prices, the Royalty Financing implies at least a 12% cost of capital to SolGold, with Franco-Nevada paying well below 0.4x net present value at a 5% discount rate. By contrast, most royalty transactions are completed at levels two-and-a-half times higher, or approximately 1.0x net present value. Although the royalty interest granted to Franco-Nevada covers the entire gross proceeds of ENSA, SolGold alone is liable for the royalty which, assuming SolGold’s 85% interest in Cascabel is perfected4, is equivalent to an approximate 1.8% NSR royalty on SolGold’s interest in Cascabel.

The Royalty Financing also includes highly burdensome terms in favour of Franco-Nevada, such as a “top-up” mechanism that requires SolGold to make certain additional payments to Franco-Nevada if production levels do not meet specified projections. Furthermore, Franco-Nevada will be entitled to minimum royalty payments to backstop its rate of return at the expense of all SolGold shareholders. In addition, if SolGold does not satisfy certain conditions (including SolGold fully funding the Cascabel Project through to feasibility) and fails to perfect its 85% interest in ENSA, the NSR royalty on SolGold’s interest in Cascabel will effectively increase to over 3%.

SolGold also has a "make-whole" obligation under the Royalty Financing with Franco-Nevada which requires SolGold to make additional payments to Franco-Nevada in cases where its NSR payments to Franco-Nevada fall below certain thresholds. Such "make-whole" payments may be made by SolGold through the issuance of additional SolGold shares at a discount to market prices, leading to the prospect of further dilution to SolGold's shareholders.

Accordingly, SolGold has effectively written a “blank cheque” to Franco-Nevada that may expose SolGold shareholders to an attributable royalty on SolGold’s interest in Cascabel in excess of 3%. Despite key taxation and other terms of the Royalty Financing being redacted, the non-redacted terms alone demonstrate a significant transfer of value to Franco-Nevada at the expense of SolGold shareholders. Furthermore, given SolGold’s practices to date, Cornerstone has serious doubts that SolGold’s entrenched management team and board will prudently use the proceeds of the financing for the benefit of all shareholders. See the section below entitled "Cornerstone Shareholders would be Exposed to SolGold's Suspect Corporate Governance and Self-Dealing Practices" for a discussion of SolGold's suspect governance practices.

4. SOLGOLD’S SHARES ARE HIGHLY ILLIQUID AND SOLGOLD SHAREHOLDERS HAVE SUFFERED A HISTORY OF SIGNIFICANT DILUTION

SolGold Shares are Illiquid

SolGold’s average daily liquidity is extremely limited which would adversely impact the ability of Cornerstone’s shareholders to monetize their SolGold shares without creating significant selling pressure. Based on the 12 months’ average daily trading to June 29, 2020 of the SolGold shares in both the U.K. and Canada, it would take nearly three years of trading (over 680 trading days) to monetize the SolGold shares that would be issued as consideration under the Hostile Bid, assuming responsible trading at 15% of SolGold's total trading volume on the LSE. On the TSX, where the SolGold shares are even more illiquid, it would take over 294 years or over 74,000 trading days to monetize the SolGold shares.

SolGold is Expected to Dilute Existing Shareholders Further to Fund Through to Feasibility

SolGold shareholders have experienced, and are likely to continue to experience, significant dilution as a result of SolGold’s efforts to finance its substantial ongoing development costs associated with the Cascabel Project. Despite public statements by SolGold asserting that it would not need to issue additional equity after the Royalty Financing, SolGold completed an equity financing at a 9% discount (plus commissions and other issue costs) and raised only US$40 million. Since SolGold’s announcement of the financing, SolGold has traded consistently below the financing price which is likely due to its shareholders recognizing that there is meaningful dilution ahead and understanding the true cost of the Royalty Financing.

In the past five years, SolGold has issued over 1.3 billion shares and increased the total number of SolGold shares outstanding by over 170%, meaning that SolGold shareholders have seen their effective per share interest in the Cascabel Project decline significantly compared to the per share interest of Cornerstone shareholders in the Cascabel Project over the same period. On the other hand, for Cornerstone to maintain its current direct interest in Cascabel, no financing is required until after the completion of a bankable feasibility study. Cornerstone’s Shareholders will benefit if a robust feasibility study is delivered, following which Cornerstone will only be required to fund its 15% interest in Cascabel and SolGold will be required to fund its 85% interest.

5. CORNERSTONE SHAREHOLDERS WOULD BE EXPOSED TO SOLGOLD’S SUSPECT CORPORATE GOVERNANCE AND SELF-DEALING PRACTICES

SolGold is Largely Controlled by a Group with Conflicting Loyalties and Divided Attention

Many of SolGold’s directors and officers overlap with those of one of its major shareholders, DGR Global Limited (“DGR”). DGR was founded by Nick Mather, the Chief Executive Officer of SolGold, who also acts as Managing Director and Chief Executive Officer of DGR. As founder, Mr. Mather directly or indirectly owns 18.3% of DGR and appears to commonly staff his associates to the management team and/or board of directors of DGR’s “portfolio” companies, including SolGold.

Many of SolGold’s directors and officers divide their attention with three other publicly traded entities related to DGR: Aus Tin Mining, IronRidge Resources and Dark Horse Resources Limited. Brian Moller, the chairman of the board of SolGold, is perhaps the most egregious example of Mr. Mather staffing his associates at DGR’s various portfolio companies, as he serves alongside Mr. Mather as a non-executive director of DGR itself as well as two of its publicly traded portfolio companies. Despite the common directorship and clear connection to Mr. Mather, Mr. Moller was previously touted as the “independent” chairman of SolGold.

This pattern of rewarding associates for their loyalty continues with SolGold’s management team, as each of Mr. Mather, Karl Schlobohm (SolGold’s Corporate Secretary) and Priy Jayasuriya (SolGold’s Chief Financial Officer) all fill similar positions with each of DGR and three of its publicly traded portfolio companies.

It is important to note that two-thirds of directors (including the Chairman) of SolGold can hardly be characterized as “independent,” and all of them have been generously compensated at the expense of SolGold shareholders. In addition, SolGold directors Mr. Moller and James Clare and their respective law firms both represent, and are compensated by, SolGold and are assisting SolGold in connection with the Hostile Bid.

SolGold Has Neutralized its Largest Independent Shareholder until October while SolGold’s Second Largest Independent Shareholder has Clearly Lost Confidence in the SolGold Board

BHP is SolGold’s largest independent shareholder, holding 13.64% of SolGold’s ordinary shares. BHP is required to vote alongside the non-independent SolGold Board until October 19, 2020 on certain matters. This arrangement provides Mr. Mather and his associates with significant influence over SolGold until that date and provides one obvious reason for why the Hostile Bid expires on October 14, 2020.

Newcrest is SolGold’s second largest independent shareholder, holding 13.57% of SolGold’s ordinary shares. Newcrest has been publicly critical of SolGold’s mismanagement and governance practices.

On June 25, 2020, Newcrest’s nominee on the SolGold board, Craig Jones, resigned as a director of SolGold at the request of Newcrest. Newcrest previously telegraphed the resignation as a way to relieve Craig Jones of the fiduciary and legal responsibilities of directorship5.

The mismanagement and suspect corporate governance at the helm of SolGold by Mr. Mather and his associates are destroying significant shareholder value while enriching Mr. Mather and his associates. In addition, Cornerstone is considering steps that it may take as a shareholder of SolGold to address its concerns about mismanagement and suspect governance practices at SolGold.

The SolGold Board has a History of Ignoring the Views of Non-related SolGold Shareholders and Diverting Benefits to Insiders at the Expense of those Shareholders

SolGold’s board of directors has repeatedly authorized punitively dilutive financings for the benefit of SolGold insiders and associates of Mr. Mather at the expense of SolGold’s other shareholders. For example, in March 2016, SolGold issued 87,449,092 shares at £0.023 to DGR and Tenstar Trading Limited for settlement of loans and convertible notes, notwithstanding that it is highly unusual for any exploration company to finance its operations with debt given the destructive effect it can have on equity value. A total of 142,311,592 shares were issued to DGR and Tenstar Trading Limited in 2016 for settlement of debts.

In addition, SolGold has established an unusual loan plan in order to provide financial assistance to employees in exercising stock options. The plan essentially allows certain insiders of SolGold to pay for the exercise of options using an interest-free loan from SolGold. On October 29, 2018, SolGold enabled certain insiders to exercise 19,950,000 options through an interest-free loan. However, these employee benefits were not disclosed to the SolGold shareholders or the market until February 13, 2019 – over 108 days after the loans were made. Further, independent shareholders of SolGold were not asked to approve these loans, including an extension of the maturity of these loans for another 12 months to October 29, 2021. As at March 31, 2020 there have been no repayments against the loans provided in 2018. As the same concessions were not available to SolGold’s other securityholders, the loans demonstrate how SolGold's board and management ignore the views of non-related SolGold shareholders and divert benefits to insiders at the expense of those shareholders.

SolGold’s Disclosure with Respect to its Additional Exploration Concessions is Misleading

SolGold cites its additional non-Cascabel early-stage exploration projects in Ecuador as additional upside to which Cornerstone shareholders would gain exposure. The additional projects, most of which were acquired in 2017 through public bidding processes, are subject to work expenditure commitments over an initial four-year period that in total exceed US$500 million, a sum similar to SolGold’s market capitalization. It is highly unlikely that SolGold will be able to fund these massive commitments which could result in not only losing the concessions but also harming SolGold’s credibility with the Ecuadorian government and other important stakeholders.

6. THE HOSTILE BID DOES NOT COMPLY WITH IMPORTANT CANADIAN SECURITIES LAWS INTENDED TO PROTECT SHAREHOLDERS AND WHICH REQUIRE SOLGOLD TO OBTAIN AN INDEPENDENT FORMAL VALUATION

MI 61-101 requires that SolGold obtain, at its own expense, an independent formal valuation, prepared under the supervision of an independent committee of the Board of Cornerstone.

Instead of properly disclosing all material non-public information to the market and Cornerstone, SolGold boasts about its insider status by noting in their take-over bid circular that “the prospects of Cornerstone are inextricably linked to those of SolGold” and Cornerstone has a “lack of data room access” and does not “maintain any influence in the [Cascabel] project decision making.”

SolGold’s disregard for Canadian securities laws will not go unchallenged by Cornerstone. In that regard, Cornerstone’s counsel will submit a letter to the Alberta Securities Commission and Ontario Securities Commission describing SolGold's non-compliance with securities laws.

7. THE HOSTILE BID IS FINANCIALLY INADEQUATE

Paradigm Capital Inc. (“Paradigm”) has provided a written opinion to the Independent Committee and the Board that the consideration being offered pursuant to the Hostile Bid was, as of the date of such opinion, inadequate, from a financial point of view, to Cornerstone shareholders (other than SolGold and its affiliates).

8. CORNERSTONE HAS A UNIQUE POSITION THAT MAKES IT VERY ATTRACTIVE FOR THOSE LOOKING TO ACQUIRE CONTROL OF, OR A DIRECT INTEREST IN, CASCABEL

Cornerstone’s combined direct and indirect 21.4% interest in the Cascabel Project is unique, as it provides an attractive opportunity for a potential acquirer to secure a strategic position in the Cascabel Project. The Board believes that this, in part, may be why many of Cornerstone’s shareholders have advised Cornerstone that they do not support the proposed Hostile Bid.

The Board believes it is entirely reasonable for parties other than SolGold to consider a possible acquisition transaction of Cornerstone appealing, as interested third parties have an opportunity to secure a position in Cascabel that is superior to any other SolGold shareholder given the significant value of Cornerstone’s carried interest. In that regard, sophisticated mineral resource companies could leverage Cornerstone’s strategic position to acquire an even larger interest in the Cascabel concession.

The Board does not consider an acquisition of Cornerstone to only be attractive to those looking to acquire a controlling interest in Cascabel. Maintaining both a direct and indirect stake in SolGold creates competitive pressure that would not exist if the Cascabel Project was consolidated under one company. In the Board’s view, Cornerstone’s combined direct and indirect interest in the Cascabel Project also significantly increases the buyer universe for Cornerstone, making it attractive to royalty companies and private equity participants in addition to mining companies.

No one has a right of first refusal on a change of control of Cornerstone.

Take No Action and Reject SolGold’s Hostile Bid

Cornerstone shareholders are urged to REJECT the Hostile Bid. To do so, Cornerstone shareholders should TAKE NO ACTION.

Shareholders are encouraged to carefully review the Directors' Circular in its entirety. This document is available on the Cornerstone website, is being mailed to Cornerstone shareholders and is available free of charge on SEDAR at www.sedar.com.

Cornerstone shareholders who have already tendered their Cornerstone shares to the Hostile Bid and who wish to obtain assistance in withdrawing them are urged to contact their broker or D.F. King Canada, at 1-800-294-4817 (toll-free in North America), or 1-416-682-3825 (collect calls outside of North America), or by email at inquiries@dfking.com.

Advisors

Cornerstone’s financial advisor is Maxit Capital LP and its legal counsel is Davies Ward Phillips & Vineberg LLP. The Independent Committee’s independent financial advisor is Paradigm.

About Cornerstone and the Cascabel Joint Venture:

Cornerstone Capital Resources Inc. is a mineral exploration company with a diversified portfolio of projects in Ecuador and Chile, including the Cascabel gold-enriched copper porphyry joint venture in north west Ecuador. Cornerstone has a 21.4% direct and indirect interest in Cascabel comprised of (i) a direct 15% interest in the project financed through to completion of a feasibility study and repayable at Libor plus 2% out of 90% of its share of the earnings or dividends from an operation at Cascabel, plus (ii) an indirect interest comprised of 7.6% of the shares of joint venture partner and project operator SolGold Plc. Exploraciones Novomining S.A. (“ENSA”), an Ecuadorian company owned by SolGold and Cornerstone, holds 100% of the Cascabel concession. Subject to the satisfaction of certain conditions, including SolGold’s fully funding the project through to feasibility, SolGold Plc will own 85% of the equity of ENSA and Cornerstone will own the remaining 15% of ENSA.

Further information is available on Cornerstone’s website: www.cornerstoneresources.com and on Twitter. For investor, corporate or media inquiries, please contact:

Investor Relations:

Mario Drolet; Email: Mario@mi3.ca; Tel. (514) 904-1333

Due to anti-spam laws, many shareholders and others who were previously signed up to receive email updates and who are no longer receiving them may need to re-subscribe at http://www.cornerstoneresources.com/s/InformationRequest.asp

Cautionary Notice:

This news release, including the discussion of the reasons for the Board’s unanimous recommendation that Cornerstone shareholders reject the Hostile Bid and not tender their Cornerstone shares thereto, contains forward-looking information and/or forwardlooking statements within the meaning of applicable securities laws (collectively, “forward looking statements”). The words “may”, “will”, “would”, “should”, “could”, “might”, “expects”, “plans”, “forecasts”, “projects”, “intends”, “trends”, “indicates”, “anticipates”, “believes”, “estimates”, “predicts”, “likely” or “potential” or the negative or other variations of these words or other comparable words or phrases, are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Examples of such forward looking statements in this news release include, but are not limited to, expectations regarding Cornerstone’s and ENSA’s prospects for growth, profitability and shareholder value creation; the availability of financing to fund Cornerstone’s and SolGold’s obligations; the development costs associated with the Cascabel project; the value and trading volumes of SolGold shares; the response to, likelihood of success and consequences of the Hostile Bid; the terms of the Hostile Bid; and the availability of strategic alternative transactions emerging.

Forward-looking statements contained in this news release are based on a number of estimates and assumptions including, but not limited to: assumptions as to competitive conditions in the copper and gold mining industry; general economic conditions; Ecuador country risk; changes in laws, rules and regulations applicable to Cornerstone; and whether or not an alternative transaction financially superior to the Hostile Bid may emerge. These estimates and assumptions are made by Cornerstone as of the date of this news release in light of its experience and perceptions of historical trends, current conditions and expected future developments, as well as other factors that Cornerstone believes are appropriate and reasonable in the circumstances, but there can be no assurance that such estimates and assumptions will prove to be correct.

Although Cornerstone believes that its expectations reflected in these forward looking statements are reasonable, such statements may involve unknown risks, uncertainties and other factors disclosed in our regulatory filings, which are available on the SEDAR website at www.sedar.com. These uncertainties may cause actual results and developments to be materially different than those expressed in our forward looking statements. Although Cornerstone believes the facts and information contained in this news release are reasonable as at the date hereof, Cornerstone does not warrant or make any representation as to the accuracy, validity or completeness of any facts or information contained herein and these statements should not be relied upon as representing its views after the date of this news release. While Cornerstone anticipates that subsequent events may cause its views to change, it expressly disclaims any obligation to update the forward looking statements contained herein except where outcomes have varied materially from the original statements.

On Behalf of the Board,

Brooke Macdonald

President and CEO

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

_______________________

1 Implied anticipated cost based on the SolGold Circular.

2 Assumes 5-year maturity, at-market exercise and approximately 75% volatility per FactSet.

3 SolGold's November 25, 2019 press release indicates that this standstill expires on October 15, 2020. This appears to be inconsistent with the terms of the subscription agreement between BHP and SolGold dated October 16, 2018, which provides that this standstill expires on October 19, 2020.

4 SolGold must complete a bankable feasibility study to secure 85% ownership.

5 Peter Ker, “BHP, Newcrest bypass SolGold fundraising,” The Australian Financial Review (June 5, 2020).