Corvus Gold, Preliminary Economic Assessment Results for Combined North Bullfrog and Mother Lode Deposits, Nevada

- 2.54M recoverable ounces gold & 3.5M recoverable ounces silver using base case $1,250 gold price

- First 4 years of commercial production averaging 347,100 ounces of gold per year at cash costs of $591/oz Aueq with LOM cash costs of $680/oz Aueq

- Pre-tax Cash Flow: $970M; IRR 45% with Post-tax NPV5%: $586M; IRR 38%

- Initial Capex of $424M with $60M of LOM sustaining capital & a 2.1-year payback

- The majority of PEA resource are measured and indicated with a 1.08-1 overall strip ratio

- Ongoing exploration work is underway with the intention of expanding the deposits with potential for other new discoveries across the Corvus Gold land package

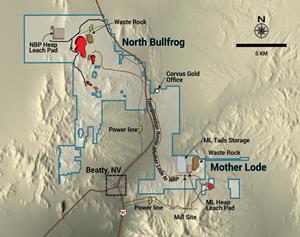

VANCOUVER, British Columbia, Nov. 01, 2018 (GLOBE NEWSWIRE) -- Corvus Gold Inc. (“Corvus” or the “Company”) - (TSX: KOR, OTCQX: CORVF) announces results for its initial Preliminary Economic Assessment (“PEA”) combining the North Bullfrog-Mother Lode projects in southwest Nevada (Figure 1). Results outline a large new Nevada mining project with attractive preliminary production statistics that include estimated 347,100 ounces of annual gold production during the first four years and an after-tax 5% discounted Net Present Value (“NPV”) of USD $586M with an IRR of 38% and estimated payback period of 2.1 years (Table 1, 2, 4 & 5).

|

|||||

The PEA is preliminary in nature, includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

The project is modelled on a large open pit mining operation utilizing both milling and run of mine heap leaching of the mineralized material. The initial PEA results indicate robust economics at lower gold prices and strong leverage for higher gold prices with a USD $1.47B pre-tax cash flow at $1,450 gold price (Table 3). The National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) technical report for the North Bullfrog-Mother Lode PEA and initial Mother Lode mineral resource estimate will be filed on the Company’s Sedar profile by the end of the business day on November 1, 2018. For readers to fully understand the information in this news release, they should read the technical report in its entirety, including all qualifications, assumptions and exclusions that relate to the PEA. The technical report is intended to be read as a whole, and sections should not be read or relied upon out of context.

The PEA of the combined projects only includes drill results completed up until July 2018. Ongoing exploration work at the Mother Lode project is promising and there may be expansion potential of the deposit in multiple directions with further work. In addition, Corvus will begin follow-up mineral resource expansion work and new discovery drilling on priority targets at North Bullfrog in early 2019. An updated mineral resource estimate is also planned for later next year.

Jeffrey Pontius, President and CEO of Corvus states, “The results from our initial PEA study of the combined North Bullfrog-Mother Lode project is encouraging. The PEA outlined a project that has the scale and economics similar to many existing major gold mines in Nevada. The projected annual gold production during the first 4 years is significant, especially as a new open pit deposit in Nevada. The PEA demonstrates the potential for the project to produce nearly 350,000 ounces of gold per year. This initial analysis in conjunction with our continued positive Mother Lode exploration drill results is encouraging for expanding and improving the economic model as our programs move forward. Furthermore, the greater Bullfrog District is seeing a resurgence of exploration activity with multiple mining companies conducting large scale drilling programs. The North Bullfrog-Mother Lode PEA study has highlighted the re-emergence of the Bullfrog District and with Corvus Gold’s commanding land position we believe we have a strong asset with excellent growth potential for our shareholders.”

The PEA study has outlined a number of areas for future work to enhance the project that include:

- Expanding the higher grade, mineral resource base at both the Mother Lode and North Bullfrog projects with continued mineral resource expansion drilling, including new deep targeting of high-grade feeder zones. Ongoing results from the Mother Lode indicate the deposit has the potential to grow and expand beyond its existing mineral resource, in particular mineralization is thickening to the north (current northern most hole, ML18-083 with 65.5m @ 1.53 g/t Au reported NR18-17, October 17, 2018).

- Continued metallurgical studies of other lower cost sulfide processing opportunities and refinement of the proposed milling operation including sulfide heap leaching studies.

- Improved open pit mining and development plans to enhance project economics.

Table 1

Life of Mine Preliminary Economic Assessment - North Bullfrog-Mother Lode Project

@ USD $1,250/oz Gold Price

| Parameter | Summary Data | |||

| Pre-Tax Cash Flow; IRR | USD $970.2 M; 45% | |||

| Post-Tax NPV5%; IRR | USD $585.6 M; 38% | |||

| Overall Strip Ratio | 1.08 to 1 (overburden – process tonne) | |||

| Cash Cost Years 1-4 (USD per Aueq ounce) | $591 | |||

| Year 1-4 Average Annual Gold Production | 347,000 ounces | |||

| LOM Cash Cost (USD per Aueq ounce) | $680 | |||

| LOM Average Annual Gold Production | 282,000 ounces | |||

| Initial Capital Cost (USD) | $424M | |||

| Sustaining Capital Cost (USD) | $60M | |||

| LOM Capital Cost (USD per Au Eq oz) | $187 | |||

| Average Mill Recovery (%) | Au | 83% | ||

| Au | 74% | |||

| Average Heap Leach Recovery (%) | Au | 74% | ||

| Ag | 6% | |||

| Average Total Mining Rate* (t/day) | 169,860 | |||

| Average Mineralization Mining Rate* (t/day) | 81,680 | |||

| AISC (USD/produced Au oz) | $694 | |||

*-10 year rate including capitalized mining in year -1

Table 2

Select Statistics for first 4 years of PEA production Plan for North Bullfrog-Mother Lode Project

| First 4 Years of Production (Mill & Heap Leach) | |||||||

| Heap Leach | Mill | Total | |||||

| Total Estimated Ozs of Mineralized Material Processed | Au | 909,000 | 914,000 | 1,823,000 | |||

| Ag | 2,052,000 | 3,337,000 | 5,390,000 | ||||

| Recovery (%) | Au | 69% | 84% | 76% | |||

| Ag | 5% | 74% | 48% | ||||

| Total Estimated Ozs of Mineralized Material Recoverable | Au | 624,670 | 764,000 | 1,388,000 | |||

| Ag | 110,080 | 2,480,000 | 2,591,000 | ||||

| Estimated Average Annual Ozs Gold Production | 156,170 | 191,000 | 347,090 | ||||

Table 3

Sensitivity Analysis for Preliminary Economic Assessment, North Bullfrog-Mother Lode Project

| Gold Price ($/Oz) | Pre-tax Cash Flow (USD $M) | IRR | Post-tax NPV@5% (USD $M) | IRR | Payback (Yrs) | |||||

| $1,050 | $456 | 25% | $237 | 20% | 2.9 | |||||

| $1,150 | $713 | 35% | $413 | 30% | 2.4 | |||||

| $1,250 (base case) | $970 | 45% | $586 | 38% | 2.1 | |||||

| $1,350 | $1,227 | 54% | $756 | 46% | 1.8 | |||||

| $1,450 | $1,470 | 63% | $914 | 53% | 1.7 | |||||

Table 4

Cost & Resource Assumptions for North Bullfrog-Mother Lode Project PEA

| Parameter | Unit | Mayflower | Jolly Jane* | Sierra Blanca | YellowJacket | Mother Lode |

| Mining Cost | USD/total tonne | 1.42 | 1.42 | 1.42 | 1.42 | 1.42 |

| Au Cut-Off | g/tonne | 0.1 | 0.1 | 0.06 | 0.35 | 0.76 |

| Processing Cost | USD/process tonne | 1.20 | 1.20 | 1.20 | 16.74 | 18.89 |

| Au Recovery | % | 72 | 72 | 74 | 86.8 | 80 |

| Ag Recovery | % | 6 | 6 | 6 | 74.3 | na |

| Administrative Cost | USD/process tonne | 0.46 | 0.46 | 0.46 | 0.46 | 0.46 |

| Refining & Sales | USD/Au oz | 2.50 | 2.50 | 2.50 | 2.50 | 2.50 |

| Au Selling Price | USD/oz | 1,250 | 1,250 | 1,250 | 1,250 | 1,250 |

| Slope Angle | Degrees | 50 | 50 | 50 | 50 | 65 |

Table 5

North Bullfrog-Mother Lode Project PEA Mineral Resource Summary (effective Sept. 18, 2018)

| Mill Resource (oxide & sulfide) | Run of Mine Heap Leach | |||||

| (0.63-0.78 g/t cut-off grade) | (0.06-0.10 g/t cut-off grade) | |||||

| Resource Category | Tonnes (M) | Gold (g/t) | Gold (kozs) | Tonnes (M) | Gold (g/t) | Gold (kozs) |

| Measured | 9.31 | 1.59 | 475 | 34.56 | 0.27 | 305 |

| Indicated | 18.25 | 1.68 | 988 | 149.37 | 0.24 | 1,150 |

| Total M & I | 27.56 | 1.65 | 1,463 | 183.93 | 0.25 | 1,455 |

| Inferred | 2.28 | 1.61 | 118 | 78.74 | 0.26 | 549 |

- See Cautionary Note to US Investors below

- The Mineral Resources above are effective as of September 18, 2018

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability

- There are no known legal, political, environmental, or other risks that could materially affect the potential development of the Mineral Resources

- Assumes heap leach processing of disseminated oxidized mineralization

- Assumes Pressure Oxidation mill processing of MLP & NBP sulfide mineralization

- Au Cut-Off - break-even grade derived from Whittle input parameters at USD $1,250 per ounce gold price

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by NI 43-101, has supervised the preparation of the scientific and technical information that forms the basis for this news release and has reviewed and approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO & President and holds common shares and incentive stock options.

Carl E. Brechtel, (Nevada PE 008744 and Registered Member 353000 of SME), a qualified person as defined by NI 43-101, has coordinated execution of the work outlined in this news release and has also reviewed and approved the disclosure herein. Mr. Brechtel is not independent of Corvus, as he is the COO and holds common shares and incentive stock options.

The work program at Mother Lode was designed and supervised by Mark Reischman, Corvus Gold’s Nevada Exploration Manager, who is responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All mineral resource sample shipments are sealed and shipped to American Assay Laboratories (“AAL”) in Reno, Nevada, for preparation and assaying. AAL is independent of the Company. AAL’s quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to AAL and an ISO compliant third-party laboratory for additional quality control. Mr. Pontius, a qualified person, has verified the data underlying the information disclosed herein, including sampling, analytical and test data underlying the information by reviewing the reports of AAL, methodologies, results and all procedures undertaken for quality assurance and quality control in a manner consistent with industry practice, and all matters were consistent and accurate according to his professional judgement. There were no limitations on the verification process.

Mr. Scott E. Wilson, CPG (10965), Registered Member of SME (4025107) and President of Resource Development Associates Inc., is an independent consulting geologist specializing in Mineral Reserve and Resource calculation reporting, mining project analysis and due diligence evaluations. He is acting as the Qualified Person, as defined in NI 43-101, and is the primary author of the Technical Report for the Mineral Resource estimate and has reviewed and approved the Mineral Resource estimate and the Preliminary Economic Assessment summarized in this news release. Mr. Wilson has over 29 years of experience in surface mining, resource estimation and strategic mine planning. Mr. Wilson is independent of the Company under NI 43-101.

Mr. Wilson, a qualified person, has verified the data underlying the information disclosed herein, including sampling, analytical and test data underlying the information by reviewing the reports of AAL, methodologies, results and all procedures undertaken for quality assurance and quality control in a manner consistent with industry practice, and all matters were consistent and accurate according to his professional judgement. There were no limitations on the verification process.

Metallurgical testing on North Bullfrog and Mother Lode samples has been performed by McClelland Analytical Services Laboratories Inc. of Sparks Nevada (“McClelland”), McClelland is an ISO 17025 accredited facility that supplies quantitative chemical analysis in support of metallurgical, exploration and environmental testing using classic methods and modern analytical instrumentation. McClelland has met the requirements of the IAS Accreditations Criteria for Testing Laboratories (AC89), has demonstrated compliance with ANS/ISO/IEC Standard 17025:2005, General requirements for the competence of testing and calibration laboratories, and has been accredited, since November 12, 2012. Hazen Research Inc. (“Hazen”), an independent laboratory, has performed flotation, AAO testing and cyanide leach testing on samples of sulphide mineralization from the YellowJacket zone and Swale area of Sierra Blanca, and roasting tests on Mother Lode flotation concentrate. Hazen holds analytical certificates from state regulatory agencies and the US Environmental Protection Agency (the “EPA”). Hazen participates in performance evaluation studies to demonstrate competence and maintains a large stock of standard reference materials from the National Institute of Standards and Technology (NIST), the Canadian Centre for Mineral and Energy Technology (CANMET), the EPA and other sources. Hazen’s QA program has been developed for conformance to the applicable requirements and standards referenced in 10 CFR 830.120 subpart A quality assurance requirements, January 1, 2002. Pressure oxidation test work on Mother Lode concentrate samples was performed by Resource Development Inc. of Wheatridge, CO.

About the North Bullfrog & Mother Lode Projects, Nevada

Corvus controls 100% of its North Bullfrog Project, which covers approximately 86.6 km2 in southern Nevada. The property package is made up of a number of private mineral leases of patented federal mining claims and 1,057 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor as well as a large water right. The Company also controls 445 federal unpatented mining claims on the Mother Lode project which totals approximately 36.5 km2 which it owns 100%. The total Corvus Gold 100% land ownership now covers over 123.1 km2, hosting two major new Nevada gold discoveries.

The combined Mother Lode and North Bullfrog Projects contains a Measured Mineral Resource for the mill of 9.3 Mt at an average grade of 1.59 g/t gold, containing 475 k ounces of gold and Indicated Mineral Resources for the mill of 18.2 Mt at an average grade of 1.68 g/t gold containing 988 k ounces of gold and an Inferred Mineral Resource for the mill of 2.3 Mt at an average grade of 1.61 g/t gold containing 118 k ounces of gold. In addition, the project contains a Measured Mineral Resource for oxide, run of mine, heap leach of 34.6 Mt at an average grade of 0.27 g/t gold containing 305 k ounces of gold and an Indicated Mineral Resource for, oxide, run of mine, heap leach of 149.4 Mt at an average grade of 0.24 g/t gold containing 1,150 k ounces of gold and an Inferred, oxide, run of mine, heap leach Mineral Resource of 78.7 Mt at an average grade of 0.26 g/t gold containing 549 k ounces of gold.

About Corvus Gold Inc.

Corvus Gold Inc. is a North American gold exploration and development company, focused on its near-term gold-silver mining project at the North Bullfrog and Mother Lode Districts in Nevada. In addition, the Company controls a number of royalties on other North American exploration properties representing a spectrum of gold, silver and copper projects. Corvus is committed to building shareholder value through new discoveries and the expansion of its projects to maximize share price leverage in an advancing gold and silver market.

On behalf of

Corvus Gold Inc.

(signed) Jeffrey A. Pontius

Jeffrey A. Pontius,

President & Chief Executive Officer

Contact Information:

Ryan Ko

Investor Relations

Email: info@corvusgold.com

Phone: 1-844-638-3246 (toll free) or (604) 638-3246

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the economics and project parameters presented in the PEA, including, without limitation, IRR, all-in sustaining capital costs, NPV and other costs and economic information, possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; potential expansion of the deposit; the rapid and effective capture of the potential of our Mother Lode project; the potential for new deposits and expected increases in the system’s potential; anticipated content, commencement and cost of exploration programs; anticipated exploration program results and expansion of existing programs; the discovery and delineation of mineral deposits/resources/reserves; the potential to discover additional high grade veins or additional deposits; the growth potential of the Mother Lode project; and the potential for any mining or production at the Mother Lode project, are forward-looking statements. Information concerning mineral resource estimates may be deemed to be forward-looking statements in that it reflects a prediction of the mineralization that would be encountered if a mineral deposit were developed and mined. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the Company's inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's inability to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company’s 2017 Annual Information Form and latest interim Management Discussion and Analysis filed with certain securities commissions in Canada and the Company’s most recent filings with the United States Securities and Exchange Commission (the “SEC”). The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities laws. All of the Company’s Canadian public disclosure filings in Canada may be accessed via www.sedar.com and filings with the SEC may be accessed via www.sec.gov and readers are urged to review these materials, including the technical reports filed with respect to the Company’s mineral properties.

Non-IFRS Measures

The Company has included certain non-IFRS performance measures as detailed below. In the gold mining industry, these are common performance measures but may not be comparable to similar measures presented by other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company’s performance and ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Cash Costs per Ounce of Gold – The Company calculates cash costs per ounce by dividing operating expenses per the consolidated statement of operations, net of silver sales by-product revenue, by the gold ounces sold during the applicable period. Operating expenses include mine site operating costs such as mining, processing and administration as well as royalties, however excludes depletion and depreciation and rehabilitation costs.

Sustaining Costs – The Company defines sustaining costs as the sum of operating cash costs (per above), sustaining capital (capital required to maintain current operations at existing levels), corporate administration costs, sustaining exploration, and rehabilitation accretion and amortization related to current operations. Sustaining costs excludes capital expenditures for significant improvements at existing operations deemed to be expansionary in nature, exploration and evaluation related to growth projects, financing costs, debt repayments, and taxes.

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/005704bf-ff4b-4af3-bb1a-88ca2633d9fc