Endeavour Announces Maiden Reserve for the Le Plaque Discovery at its Ity Mine

ENDEAVOUR ANNOUNCES MAIDEN RESERVE FOR THE

LE PLAQUE DISCOVERY AT ITS ITY MINE

LE PLAQUE HIGHLIGHTS:

- Le Plaque maiden reserve of 5.5Mt at 2.34 g/t Au for 415koz

- High M&I resource to reserve conversion rate of 91%

- Significantly higher grade: 51% higher than the Ity mine reserve grade of 1.55g/t Au

- Located only 6km south of the processing plant

- Permitting process underway with mining license expected to be received in H2-2020

- Le Plaque resource and reserve estimates are expected to further increase in Q2-2020 based on the H2-2019 drill results and the ongoing H1-2020 drill program

- Maiden reserve is based on the resource announced in July 2019. An additional 194 DD and RC holes totaling 25,695m were drilled in H2-2019 over Le Plaque. These drill results indicate that the deposit remains open in various directions and at depth with a significant extension delineated to the south.

- An aggressive 41,000m RC and DD drilling campaign is underway with results expected to be included in the upcoming resource and reserve estimate update

- 244 regional AC holes drilled in H2-2019, totaling 12,177m, confirmed the potential of 7 targets near Le Plaque and an additional 30,000m AC drilling campaign has been scheduled for H2-2020 to advance them

- A $14m exploration program, totaling circa 100,000m, has been budgeted for the Ity area in 2020, with the aim of delineating additional resources at Le Plaque and Bakatouo SW deposits, as well as testing other targets

Abidjan, February 24, 2020 – Endeavour Mining (TSX:EDV)(OTCQX:EDVMF) is pleased to announce a 415koz maiden Probable Reserve for the Le Plaque discovery at its flagship Ity mine in Côte d’Ivoire.

The maiden Le Plaque reserve, as summarized in Table 1 below, is based on the resource published in July 2019. An updated reserve and resource estimate is expected to be published in late Q2-2020 to incorporate the drill results obtained from the 25,695 meters of additional RC and DD drilling conducted in the H2-2019 and the results of the recently initiated 41,000 meter drill program.

Sébastien de Montessus, President and CEO of Endeavour Mining, stated:

“We are very pleased with the maiden reserve at Le Plaque, which is significantly higher grade than the current reserve grade at Ity. Once again, the exploration team has demonstrated their ability to swiftly unlock exploration value by moving from discovery to production in under three years.

We are currently updating the Ity mine plan to incorporate both the Le Plaque maiden reserve as well as the 25% increase in plant capacity, following last year’s volumetric upgrades. We expect the updated technical report to be published in Q2-2020, with the goal of demonstrating that Ity has a +10 year mine life at an average production of circa 250kozpa.

The Ity area continues to be highly prospective and we’re planning a further $14 million exploration program totaling approximately 100,000 meters in 2020 to grow the Le Plaque, Bakatouo, extend the Daapleu deposits and test other high priority targets such as Floleu and Samuel.”

Table 1: Le Plaque Reserves and Resources

| On a 100% basis. Resources shown inclusive of reserves. | Tonnage | Grade | Content |

| (Mt) | (Au g/t) | (Au koz) | |

| Proven Reserves | - | - | - |

| Probable Reserves | 5.5 | 2.34 | 415 |

| P&P Reserves | 5.5 | 2.34 | 415 |

| Measured Resource | - | - | - |

| Indicated Resources | 4.63 | 3.20 | 476 |

| M&I Resources | 4.63 | 3.20 | 476 |

| Inferred Resources | 0.50 | 3.08 | 50 |

Mineral Reserve estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for mineral resources and reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Le Plaque reserves were calculated based on a gold price of $1,300/oz and a cut-off of 0.4 g/t Au. For more details on the Le Plaque reserve calculation please consult the below section entitled “Le Plaque Design Parameters”. Resources were constrained by MII $1,500/oz Pit Shell and based on a cut-off of 0.5 g/t Au. For the notes related to the resource estimate, please consult July 8, 2019 press release available on the Company’s website.

ABOUT THE LE PLAQUE RESERVE

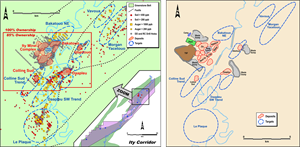

Le Plaque, located only 6km south of the processing plant, is a high-grade discovery made in the northern part of the wholly-owned Floleu exploration license, as shown in Figure 1 below.

Figure 1: Ity Mine Gold-in-Soil Map and Simplified Map with Exploration Targets

Table 2 below outlines that a total of 415koz were converted into Probable reserves, representing a high conversion ratio of 91% based on a $1,250/oz Indicated resource pit shell and 87% based on a $1,500/oz Indicated resource pit shell.

Table 2: Le Plaque June 2019 Mineral Resource Estimate

| On a 100% basis. Resources shown inclusive of reserves. | Tonnage | Grade | Content |

| (Mt) | (Au g/t) | (Au koz) | |

| PROBABLE RESERVES | |||

| Based on a gold price of $1,300/oz | 5.5 | 2.34 | 415 |

| INDICATED RESOURCE | |||

| Based on a gold price of $1,500/oz | 4.63 | 3.20 | 476 |

| Based on a gold price of $1,250/oz | 4.36 | 3.25 | 455 |

| INFERRED RESOURCE | |||

| Based on a gold price of $1,500/oz | 0.50 | 3.08 | 50 |

| Based on a gold price of $1,250/oz | 0.42 | 3.13 | 42 |

No Measured resources have been estimated. Mineral Reserve estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for mineral resources and reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Resources were constrained by MII $1,500/oz Pit Shell and for sensitivity purpose by MII $1,250/oz pit shell and based on a cutoff of 0.5 g/t Au. Le Plaque reserves were calculated based on a gold price of $1,300/oz and a cut-off of 0.4 g/t Au. For more details on the Le Plaque reserve calculation please consult the below section entitled “Le Plaque Design Parameters”.

LE PLAQUE EXPLORATION UPDATE

Since the publication of the updated Le Plaque resource estimate in July 2019, a total of 51 Diamond Drill (“DD”), 143 Reverse Circulation (“RC”) and 1 RC/DD holes totaling 25,695 meters have been drilled in H2-2019 over the extensions of the Le Plaque deposit and 244 AC holes totaling 12,177m over other previously defined regional targets. The DD and RC drill results obtained were very encouraging as they confirmed mineralization of the lateral extensions of the Le Plaque deposit. As such, an updated reserve and resource estimate is expected to be published in late Q2-2020 to incorporate the drill data from the H2-2019 campaign and the ongoing H1-2020 drill campaign.

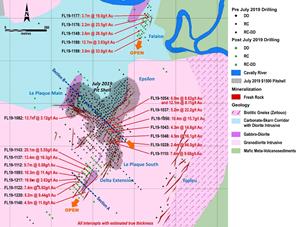

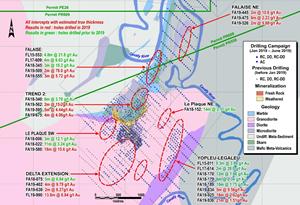

Figure 2: Le Plaque H2-2019 Drill Map and Selected Intercepts (true width/grade) Per Area

The RC and DD drill results confirmed the mineralized extension of the Le Plaque Main deposit towards the southeast (named Le Plaque Main Flat Extension) and defined a significant high-grade extension south of Le Plaque South (named Delta Extension). Positive results were also obtained on the Falaise target.

Selected best RC intercepts of H2-2019 campaign include (true width uncapped):

› Le Plaque Main Flat Extension:

FL19-1012 : 15.9m at 4.18 g/t Au, including: 0.86m at 32.1 g/t Au

FL19-1037 : 5.2m at 22.20 g/t Au, including 0.86m at 124.3 g/t Au

FL19-1039 : 3.4m at 13.1 g/t Au, including 1.72m at 23.83 g/t Au

FL19-1043 : 4.3m at 14.58 g/t Au, including 0.86m at 64.5 g/t Au

FL19-1054 : 12.1m at 8.11 g/t Au, including 1.72m at 21.63 g/t Au

› Delta Extension:

FL19-1048 : 4.5m at 16.14 g/t Au, including 1.5m at 34.8 g/t

FL19-1093 : 10.4m at 11.81 g/t Au, including 0.74m at 49.9 g/t Au

FL19-1102: 8.4m at 4 g/t Au, including 0.61m at 21.6 g/t Au

FL19-1110 : 7.4m at 9.68 g/t Au, including 2.25m at 28.2 g/t Au

FL19-1121: 6.0m at 4.05 g/t Au, including 1.5m at 11.34 g/t Au

FL19-1122: 7.4m at 5.92 g/t Au, including 1.5m at 21.35 g/t Au

FL19-1137 : 13.4m at 10.32 g/t Au, including 3.7m at 28.9 g/t Au

FL19-1143 : 20.1m at 5.55 g/t Au, including.2m at 24.9 g/t Au and 1.5m at 20.13 g/t Au

FL19-1217 : 19.9m at 3.63 g/t Au, including 0.75m at 19.27 g/t Au and 0.75m at 27.3 g/t Au

› Falaise:

FL19-1149 : 2.6m at 26.5 g/t Au, including 1.05 at 61.6 g/t Au

FL19-1177 : 3.7m at 19.0 g/t Au, including 1.5m at 44.7 g/t Au

FL19-1188: 12.7m at 3.83 g/t Au, including 1.5m at 18.75 g/t Au

FL19-1189 : 3m at 33.02 g/t Au, including 0.75m at 126.1 g/t Au

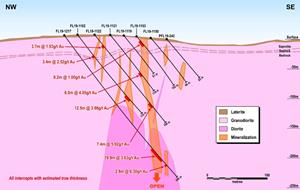

Delta Extension

The new Delta Extension has been defined to the southwest of Le Plaque South. It extends over a length of at least 400 meters along a north-northeast to south-southwest trend of mineralization, within the granodiorite domain. The mineralization is associated with subvertical, steeply southeast or northwest, dipping shears near the apex of a blind diorite plug within the granodiorite. The quartz-veined and silicified biotitic shears host sulfides, including pyrite (locally with pyrrhotite), minor chalcopyrite and sphalerite, and local trace galena. The trend remains open to the south-southwest and at depth.

Figure 3: Delta Extension – Section A

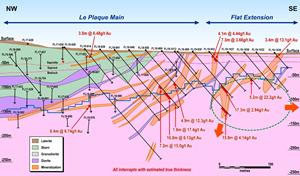

Le Plaque Main - Flat Extension

The extension of Le Plaque Main towards the southeast has been demonstrated through drilling performed in the flat area between the Le Plaque deposit and the Cavally river. The mineralization which are shear zone related within the granodiorite domain (probable northern extension of Le Plaque South trend) has been encountered close to surface and is still open at depth and to the east.

Figure 4: Le Plaque Main Flat Extension – Section B

Regional exploration targets – such as Falaise

The 2019 regional AC and RC drilling campaign also confirmed the potential of at least 7 additional targets which had previously been defined during the initial 2017 and 2018 reconnaissance campaigns. Following a strong concentration of exploration efforts over the Le Plaque deposit in 2019, priority will progressively shift in 2020 towards the neighboring targets while simultaneously expanding the Le Plaque deposit which remains open.

Figure 5: Selected 2019 drilling results over previously defined exploration targets near Le Plaque

NEXT STEPS

› A new 14,000 meter DD and 27,000 meter RC drilling program has been launched in early 2020 over the greater Le Plaque deposit with the aim of converting all the defined extensions into resources.

› An updated resource and reserve estimate is expected to be published in late Q2-2020.

› An updated mine plan and technical report for the Ity mine are expected to be released during Q2-2020.

› The Le Plaque permitting process is well underway with a mining license expected to be received in H2-2020.

› A 30,000 AC drilling program is planned at nearby Le Plaque targets with the goal of advancing them towards the resource stage during H2-2020.

LE PLAQUE RESERVES PARAMETERS

Whittle pit optimization and stage design works have been carried out by Snowden.

In estimation of the reserve, a $1,300/oz gold price has been used together with the parameters from the scoping study report from Snowden below:

- 0.4 g/t Au cut-off grade

- Resource model is reblocked to Selective Mining Unit (SMU) and inherent dilution through reblocking process

- Average mining and haulage unit cost of US$3.00 per total of material tonne mined, average processing unit cost of US$11.99/ore tonne oxide, US$12.35/ore tonne transition, US$16.91/ore tonne fresh, and average G&A unit cost of US$3.32/ore tonne

- Gold recovery rates are estimated at 94.6% for oxide ore, 93.2% for transition ore, and 81.3% for fresh ore ore

- Doré freight, security and refining rate of US$9.10/oz

Snowden have completed pit staging designs and resultant mining and ore processing schedules. The mining method planned for Le Plaque is conventional selective open pit mining, with the run of mine ore hauled for processing to the Ity CIL plant. Ore and waste mining are expected to be conducted with owner operator equipment.

A geotechnical program has been completed to determine parameters for pit shell optimization and the pit stage designs. The geotechnical program was initiated in Q4-2019 and incorporates eight geotechnical boreholes to investigate the rock mass for the Le Plaque project. The boreholes were sited to cover as much of the various rock types as possible. All geotechnical drill hole collars were surveyed with a differential GPS. Down hole surveys of the holes were carried out to confirm the borehole orientation.

Endeavour undertook a metallurgical testwork program at ALS Global Laboratories in Perth on drill core samples from the Le Plaque deposit. Samples were selected to represent the various lithologies and weathered rock types across the deposit, both spatially and at depth. Testwork included:

- 23 selected samples from the core were delivered to ALS. Each comminution test comprises a suite of SMC tests, a Bond Abrasion Index (Ai) and a Bond Ball Mill Work Index (BBWi) determination

- 60 hydrometallurgical variability tests were conducted to compare the gold extraction under the same set of standard cyanidation leach conditions for each of the various lithologies and weathered rock types across the Le Plaque deposit

Lycopodium Limited were engaged to review testwork results and determine processing impacts for Le Plaque ore via the Ity processing plant and determine process unit operating costs.

ASSAYS AND QUALITY ASSURANCE/QUALITY CONTROL / DRILLING AND ASSAY PROCEDURES

The RC and AC drill program samples were collected on a 1-meter interval using dual tube drill string. The material passes through a cyclone which is thoroughly cleaned after every sample by flushing the hole. Samples were split at the drill site using a 3-tier riffle splitter with both bulk and laboratory sample weights and moisture recorded. Representative samples for each interval were collected with a spear, sieved into chip trays and retained for reference.

Drill core (PQ, HQ and NQ size) samples are selected by Endeavour geologists and sawn in half with a diamond blade at the project site. Half of the core is retained at the site for reference purposes. Sample intervals are generally 1 meter in length.

All samples are transported by road to Bureau Veritas in Abidjan or to SGS. Each laboratory sample is secured in poly-woven bags ensuring that there is a clear record of the chain of custody. On arrival samples are weighed and crushed to 2mm (70% passing), pulverizeing the entire sample to 75μm (85% passing). Samples are analyzed for gold using a standard fire assay technique with a 50-gram charge and an Atomic Absorption (AA) finish. Blanks, field duplicates and certified reference materials (CRM’s) are inserted by Endeavour geologists in the sample sequence for quality control and to ensure there are a suite of QC samples in each fire assay batch.

The sampling and assaying are monitored through the implementation of a quality assurance – quality control (QA-QC) program. This QA-QC program was audited by an international consultant, independent from Endeavour Mining, in 2019 and consequently designed to follow industry best practices.

Full drill results are available by clicking here.

QUALIFIED PERSONS

The scientific and technical content of this news release has been reviewed, verified and compiled by Salih Ramazan, Vice President Mine Planning for Endeavour Mining. Salih Ramazan has more than 20 years within the mining industry in both technical and operational capacities and is a Member of the AusIMM and therefore qualifies as a "Qualified Person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") in regard to reserve estimation. The resource estimation was completed by Kevin Harris, CPG, VP Resources for Endeavour Mining and "Qualified Person" as defined by National Instrument 43-101.

CONTACT INFORMATION

| Martino De Ciccio VP – Strategy & Investor Relations +44 203 640 8665 mdeciccio@endeavourmining.com | Brunswick Group LLP in London Carole Cable, Partner +44 7974 982 458 ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX listed intermediate African gold producer with a solid track record of operational excellence, project development and exploration in the highly prospective Birimian greenstone belt in West Africa. Endeavour is focused on offering both near-term and long-term growth opportunities with its project pipeline and its exploration strategy, while generating immediate cash flow from its operations.

Endeavour operates four mines across Côte d’Ivoire (Agbaou and Ity) and Burkina Faso (Houndé, Karma).

For more information, please visit www.endeavourmining.com.

Corporate Office: 5 Young St, Kensington, London W8 5EH, UK

This news release contains "forward-looking statements" including but not limited to, statements with respect to Endeavour's plans and operating performance, the estimation of mineral reserves and resources, the timing and amount of estimated future production, costs of future production, future capital expenditures, and the success of exploration activities. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", and "anticipates". Forward-looking statements, while based on management's best estimates and assumptions, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the successful integration of acquisitions; risks related to international operations; risks related to general economic conditions and credit availability, actual results of current exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of development or construction activities, changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which Endeavour operates. Although Endeavour has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Please refer to Endeavour's most recent Annual Information Form filed under its profile at www.sedar.com for further information respecting the risks affecting Endeavour and its business. AISC, all-in sustaining costs at the mine level, cash costs, operating EBITDA, all-in sustaining margin, free cash flow, net free cash flow, free cash flow per share, net debt, and adjusted earnings are non-GAAP financial performance measures with no standard meaning under IFRS, further discussed in the section Non-GAAP Measures in the most recently filed Management Discussion and Analysis.

Attachments

- Figure 1: Ity Mine Gold-in-Soil Map and Simplified Map with Exploration Targets

- Figure 2: Le Plaque H2 2019 Drill Map and Selected Intercepts (true width/grade) Per Area

- Figure 3: Delta Extension – Section A

- Figure 4: Le Plaque Main Flat Extension – Section B

- Figure 5: Selected 2019 drilling results over previously defined exploration targets near Le Plaque

- 200224 - NR - Le plaque Reserves - vf