Endeavour Extends Mine Life and Increases Production Outlook at its Ity and Hounde Flagship Assets

ENDEAVOUR EXTENDS MINE LIFE AND INCREASES PRODUCTION OUTLOOK AT ITS ITY AND HOUNDE FLAGSHIP ASSETS

Combined average annual production of ~500koz over next 5 years at low AISC of ~$823/oz

HIGHLIGHTS:

- Houndé and Ity mine plans updated to include exploration success achieved over the past few years as Kari Pump, Kari West and Le Plaque discoveries have resulted in 2.0Moz of additional reserves

- Individual mine plans have been developed with a focus on providing long-term cash flow visibility ahead of implementing a dividend policy

- Combined annual production expected to average ~500koz over next 5 years (2021-2025) and ~465koz over next 10 years (2021-2030), up 27% and 58% respectively compared to the outlook provided in the construction decision studies

- Further maiden reserves expected by year-end for the newly discovered Kari area deposits at Houndé

- Strong potential to continue to extend mine lives at both operations given the ongoing exploration programs to drill the numerous identified near-mill targets

- Mining permits have been granted for both the Kari and Le Plaque areas, at Houndé and Ity, respectively

Abidjan, November 12, 2020 – Endeavour Mining (TSX:EDV) (OTCQX:EDVMF) is pleased to announce that it has significantly extended the mine lives and increased the production outlook at its flagship assets, the Houndé mine in Burkina Faso and the Ity mine in Côte d’Ivoire, following recent near-mine exploration success.

The mine plans have been developed with a focus on sustaining a 250koz per year production profile to provide long-term cash flow visibility ahead of implementing a dividend policy. Key operational and environmental metrics for the five-year period from 2021 through 2025 have been summarized in Table 1 below.

Table 1: Average Annual Metrics over next 5 years (2021-2025)

| Production (koz Au) | AISC ($/oz) | GHG Emissions Intensity (t CO2e/oz) | Energy Intensity (GJ/oz) | |

| Houndé | 250 | 865 | 0.54 | 5.32 |

| Ity | 248 | 780 | 0.34 | 5.63 |

| Combined | 498 | 823 | 0.44 | 5.48 |

The combined annual production of both mines is expected to average approximately 500koz over the next five years (2021-2025) and 465koz over the next 10 years (2021-2030). The Company expects that near-mine exploration will continue to add further ounces and generate the flexibility to bring forward higher grade production while maintaining long mine life visibility. In addition, Endeavour will continue to monitor its impact on the environment and seek to improve its environmental impact metrics to continue to be better than industry average.

Sebastien de Montessus, President and CEO of Endeavour Mining, said:

“Having successfully built and operated the Houndé and Ity mines over the past few years, we are delighted to be able to present updated mine plans which confirm the value unlocked through exploration and which demonstrate the high quality of these assets. Moreover, we have continued to refine the individual mine plans with a focus on providing long-term cash flow visibility ahead of implementing a dividend policy.

With the combined addition of more than 2 million ounces of higher grade reserves from the newly discovered deposits, we have been able to both increase production and extend the mine lives of Houndé and Ity. We are very pleased with the value created as our discovery cost per ounce of reserves has averaged below $25 since 2017, whereas the mine plans show that our combined all in sustaining cost of production over the next five years is below $850/oz, therefore generating significant returns on exploration.

We believe that exploration potential exists at both mines to sustain production at 250kozpa beyond the current life of mine plans. We expect further reserves additions in the coming months with maiden reserves expected at the Kari Center and Kari Gap discoveries. In addition, given the strong value creation potential, we will continue to have a strong focus on exploration at both operations given the numerous identified near-mill targets.”

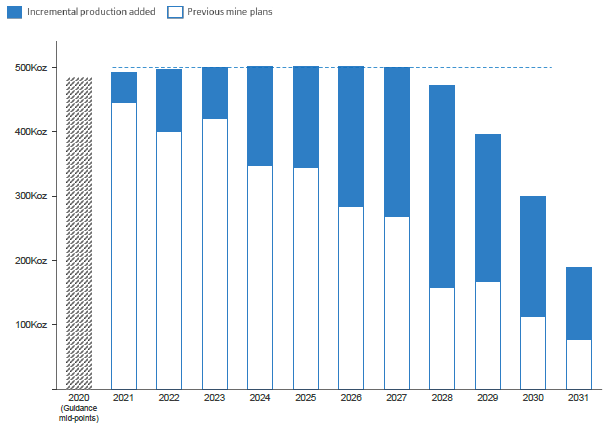

Compared to the outlook provided in the optimization studies published ahead of commencing construction (Houndé in 2016 and Ity in 2017), Houndé and Ity are expected to produce an incremental 106koz per year on aggregate over the next 5 years (2021-2025) and 170koz per year over next 10 years (2021-2030), up 27% and 58%, respectively, as illustrated in Figure 1 below.

Figure 1: Combined Houndé and Ity production profile

The main additions to the mine plans were the integration of the newly discovered Kari Pump and Kari West deposits at Houndé and the Le Plaque deposit at Ity, which combined have resulted in the delineation of 2.0Moz of Proven and Probable Reserves (“reserves”) since the discoveries were made, as shown in Table 2 below. The maiden reserve at Kari West and the increase at Le Plaque has resulted in a 0.8Moz increase over the year-end 2019 reserve estimate published in March 2020.

Table 2: Mineral Proven and Probable Reserves for new discoveries (current as at Dec 31, 2019)

| AS PUBLISHED IN MARCH 2020 | UPDATED RESERVES | Δ AU CONTENT | ||||||

| Tonnage | Grade | Content | Tonnage | Grade | Content | |||

| On a 100% basis | (Mt) | (Au g/t) | (Au koz) | (Mt) | (Au g/t) | (Au koz) | (Au koz) | |

| Le Plaque (Ity) | 5.5 | 2.34 | 415 | 9.0 | 1.91 | 556 | +141 | |

| Kari Pump (Houndé) | 7.3 | 3.00 | 704 | 7.3 | 3.00 | 704 | 0 | |

| Kari West (Houndé) | - | - | - | 15.1 | 1.43 | 694 | +694 | |

| Total | 12.8 | 2.72 | 1,119 | 31.4 | 1.93 | 1,954 | +835 | |

Mineral Reserve Estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for mineral resources and reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Estimates are current as at December 31, 2019 and do not include 2020 mine depletion. Estimates will be revised at year-end to account for 2020 depletion, changes in mining parameters, costs, gold price and other modifying factors.

The Company does not consider the change in mineral reserves to be a material change to the Company and, as such, no requirement for new technical reports for the Ity and Houndé mines has been triggered. The latest technical reports were filed on SEDAR, under the Company’s profile, on June 15, 2020. The information within this press release is not to be used as formal guidance as the Company expects to provide formal annual guidance for production, costs and capital based on Board approved budgets in early 2021.

HOUNDÉ MINE

Mine Plan Update

The Houndé mine plan has been updated, since last published in 2016 as part of the Optimization Study, to reflect exploration success by adjusting mine sequencing to include the newly discovered Kari Pump and Kari West deposits. The updated mine plan also reflects the increased plant capacity of more than 4.0Mtpa, outperforming its nameplate 3.0Mtpa capacity, and accounts for mine depletion and recent operating data.

Additional recent discoveries at Kari (Kari Center, Gap, Pump NE and South) have not yet been included in the updated mine plan and are expected to be included within the year-end reserve statement following additional drilling and completion of metallurgical testwork and engineering.

The Houndé mine plan has been developed with a focus on sustaining a 250koz per year production profile. As shown in Table 3 below, the Houndé mine is now expected to produce approximately 2.3 million ounces through 2031, with average production of circa 250koz for the 5-year period starting in 2021 and 202koz for the following 5-year period starting in 2026.

The Company expects that conversion of existing resources into reserves and near-mine exploration will continue to add further ounces and extend the mine life.

Table 3: Houndé Life of Mine Summary

| FIRST 5 YEARS | NEXT 5 YEARS | LIFE OF MINE | ||||

| Unit | (2021-2025) | (2026-2030) | (2021-2031) | |||

| PRODUCTION DATA | ||||||

| Strip ratio | W:O | 8.66 | 5.28 | 7.51 | ||

| Total tonnes processed | Mt | 20.3 | 20.3 | 43.7 | ||

| Average grade processed | Au g/t | 2.12 | 1.69 | 1.81 | ||

| Total gold contained processed | Moz | 1.4 | 1.1 | 2.5 | ||

| Average recovery rate | % | 91% | 92% | 91% | ||

| Total gold production | koz | 1,252 | 1,011 | 2,326 | ||

| Average gold production | kozpa | 250 | 202 | 216 | ||

| OPERATING COSTS | ||||||

| Cash costs | $/oz | 556 | 694 | 634 | ||

| AISC1 | $/oz | 865 | 931 | 908 | ||

| ENVIROMENTAL DATA | ||||||

| GHG emissions intensity2 | t CO2e/oz | 0.54 | 0.34 | 0.39 | ||

| Energy consumption intensity | GJ/oz | 5.32 | 6.59 | 6.18 |

1Royalties based on a gold price of $1,700/oz.2 GHG Emissions Intensity calculated as Scope 1 and 2.

Compared to the outlook provided in the 2016 Optimization Study, Houndé is expected to produce an incremental 63koz per year over the next 5 years (2021-2025) and 113koz per year over the next 10 years (2021-2030), up 34% and 100%, respectively, as illustrated in Figure 7 below. The updated plan also adds several years to the mine life compared to the previous mine plan.

Figure 2: Houndé Production Profile

Figure 3 below demonstrates the sequencing of production from the various pits which comprise the whole of the Houndé operation. Tonnes mined, processed and recoveries are expected to vary from year to year depending on the ore blend, as well as the characteristics of the various deposits.

Figure 3: Houndé Mining Schedule by Deposit (current as at Dec 31, 2019)

The summarized mining and processing schedules, along with operating and capital cost estimates have been provided in Appendix A. Key capital projects now underway or planned to commence in 2021 include: Kari West compensation, waste dump sterilisation, advanced grade control programme, fencing and infrastructure, plus some fleet upgrades to cater for the higher mining volumes planned for the next few years as we open up both Kari West and Kari Pump.

A Tailing Storage Facility (“TSF”) with an initial capacity of approximately 25Mt was required to store the tailings generated by the process plant over a period of 8 to 9 years, at a rate of approximately 3Mtpa. Due to the increased reserves, the TSF design was expanded to 38Mt and scheduled to be built in 10 stages. The first 4 stages have been completed and the 5th stage is planned to be completed by the end of 2020 with a capacity of 19Mt.

Hounde has sufficient mining equipment to execute its current mine plan with a total of eight excavators composed of one PC3000, three PC2000 and four PC1250. In addition, there are 31 Komatsu HD785-7 dump trucks and sufficient ancillary equipment (dozers, graders, water carts and other service trucks). To achieve the increase to >50Mtpa for the next 5 years, an additional excavator and 5 trucks will be brought in.

Reserves and Resources

As shown in Table 4 below, the mine plan is based on a total of 2.9Moz of reserves, inclusive of the Kari Pump and Kari West discoveries which together resulted in the addition of 1.4Moz to reserves.

Table 4: Houndé Mineral Reserve and Resource Estimate by Deposit (current as at Dec 31, 2019)

| Resources shown inclusive of Reserves on a 100% basis | CONVERSION | P&P RESERVES | M&I RESOURCES | INFERRED RESOURCES | |||||||||

| P&P Reserve to M&I Resource | Tonnage | Grade | Content | Tonnage | Grade | Content | Tonnage | Grade | Content | ||||

| (Mt) | (Au g/t) | (Au koz) | (Mt) | (Au g/t) | (Au koz) | (Mt) | (Au g/t) | (Au koz) | |||||

| Kari Pump | 71% | 7.3 | 3.00 | 704 | 11.6 | 2.66 | 996 | 0.3 | 2.16 | 20 | |||

| Kari West | 69% | 15.1 | 1.43 | 694 | 20.4 | 1.53 | 1,005 | 2.5 | 1.41 | 114 | |||

| Vindaloo | 75% | 22.4 | 1.72 | 1,242 | 26.8 | 1.92 | 1,654 | 2.6 | 2.63 | 217 | |||

| Bouere | 88% | 0.8 | 4.30 | 113 | 0.8 | 4.94 | 127 | 0.2 | 3.60 | 18 | |||

| Dohoun | 79% | 1.2 | 1.85 | 69 | 1.2 | 2.35 | 87 | 0.1 | 2.91 | 6 | |||

| Kari Center | - | - | - | - | 6.6 | 1.27 | 269 | 0.5 | 1.68 | 25 | |||

| Kari Gap | - | - | - | - | 3.9 | 1.40 | 176 | 0.1 | 1.76 | 8 | |||

| Kari Pump NE | - | - | - | - | 0.3 | 2.18 | 21 | 0.0 | 1.81 | 3 | |||

| Kari South | - | - | - | - | 2.1 | 1.09 | 75 | 1.7 | 1.30 | 69 | |||

| Stockpiles | 100% | 0.9 | 1.20 | 37 | 1.0 | 1.20 | 37 | - | - | - | |||

| Total | 64% | 47.7 | 1.86 | 2,858 | 74.7 | 1.85 | 4,447 | 7.9 | 1.90 | 481 | |||

Mineral Reserve Estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for mineral resources and reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The Company is not aware of any known legal, political, environmental or other risks that could materially affect the potential development of the mineral resources and reserves. Resources were constrained by MII Pit Shell and based on a cut-off of 0.5 g/t Au. Estimates are current as at December 31, 2019 and do not include 2020 mine depletion. Estimates will be revised at year-end to account for 2020 depletion, changes in mining parameters, costs, gold price and other modifying factors.

Houndé’s updated reserves and resources are presented in Table 5 below. Updated resources reflect the Kari Area resource additions as published on July 22, 2020. Updated reserves incorporate the maiden reserve at Kari West while Kari Pump was already included in the year-end 2019 reserve statement.

Table 5: Houndé Mineral Reserve and Resource Evolution (current as at Dec 31, 2019)

| Resources shown inclusive of Reserves on a 100% basis | AS PUBLISHED IN MARCH 2020 | UPDATED WITH KARI AREA ADDITIONS | Δ AU CONTENT | |||||

| Tonnage | Grade | Content | Tonnage | Grade | Content | |||

| (Mt) | (Au g/t) | (Au koz) | (Mt) | (Au g/t) | (Au koz) | (Au koz) | ||

| Proven Reserves | 1.8 | 1.57 | 89 | 1.8 | 1.57 | 89 | 0 | |

| Probable Reserves | 30.9 | 2.09 | 2,075 | 45.9 | 1.87 | 2,769 | +694 | |

| P&P Reserves | 32.6 | 2.06 | 2,164 | 47.7 | 1.86 | 2,858 | +694 | |

| Measured Resources | 1.7 | 1.75 | 96 | 1.7 | 1.75 | 96 | 0 | |

| Indicated Resources | 58.6 | 2.01 | 3,797 | 72.9 | 1.86 | 4,351 | +554 | |

| M&I Resources | 60.4 | 2.01 | 3,893 | 74.7 | 1.85 | 4,447 | +554 | |

| Inferred Resources | 6.9 | 2.07 | 456 | 7.9 | 1.90 | 481 | +24 | |

Mineral Reserve Estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for mineral resources and reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The Company is not aware of any known legal, political, environmental or other risks that could materially affect the potential development of the mineral resources and reserves. Resources were constrained by MII Pit Shell and based on a cut-off of 0.5 g/t Au. Estimates are current as at December 31, 2019 and do not include 2020 mine depletion. Estimates will be revised at year-end to account for 2020 depletion, changes in mining parameters, costs, gold price and other modifying factors.

Permitting

As announced on July 6, 2020, Endeavour was granted a mining permit extension by the Burkina Faso Government, covering the full Kari area at its Houndé Mine, as shown in Figure 4 below. The Kari area has been permitted as an extension of the main Houndé mining permit thereby allowing the area to benefit from Burkina Faso’s 2003 Mining Code which includes a corporate income tax rate of 17.5%, a 10% free-carried State interest, and a royalty based on a 3% to 5% sliding scale linked to prevailing gold prices.

Figure 4: Houndé Operating Permits

Mine life extension potential

Over 2.6Moz of indicated resources have been discovered since late 2016, yet significant exploration potential remains at the Houndé mine with several near-mine targets identified. To date, the Kari area has been the main exploration focus. Over the coming years, exploration is expected to continue to focus on the remaining unexplored Kari area and on the numerous additional targets that are located within 15km of the plant, as shown in Figure 5 below.

Figure 5: Houndé Exploration Map

ITY MINE

Mine Plan Update

The Ity mine plan has been updated, since last published in September 2017 as part of the Ity CIL Optimization Study, to reflect exploration success by adjusting mine sequencing to include newly discovered deposits. It also reflects the increased plant capacity to above 5.0Mtpa, from 4.0Mtpa at the construction decision, and accounts for mine depletion and recent operating data.

The Ity mine plan has been developed with a focus on sustaining a 250koz per year production level. As shown in Table 6 below, the Ity mine is now expected to produce approximately 2.5 million ounces through 2031, with an average production of 248koz for the 5-year period starting in 2021 and 231koz for the following 5-year period starting in 2026.

The Company expects that near-mine exploration will continue to add further ounces and extend the mine life.

Table 6: Ity Life of Mine Summary

| FIRST 5 YEARS | NEXT 5 YEARS | LIFE OF MINE | ||||

| Unit | (2021-2025) | (2026-2030) | (2021-2031) | |||

| PRODUCTION DATA | ||||||

| Strip ratio | W:O | 3.88 | 2.89 | 3.24 | ||

| Total tonnes processed | Mt | 27.3 | 28.0 | 60.6 | ||

| Average grade processed | Au g/t | 1.66 | 1.58 | 1.55 | ||

| Total gold contained processed | Moz | 1.5 | 1.4 | 3.0 | ||

| Average recovery rate | % | 85% | 81% | 84% | ||

| Total gold production | koz | 1,241 | 1,156 | 2,522 | ||

| Average gold production | kozpa | 248 | 231 | 230 | ||

| OPERATING COSTS | ||||||

| Cash costs | $/oz | 545 | 590 | 571 | ||

| AISC1 | $/oz | 780 | 764 | 780 | ||

| ENVIROMENTAL DATA | ||||||

| GHG emissions intensity2 | t CO2e/oz | 0.34 | 0.38 | 0.35 | ||

| Energy consumption intensity3 | GJ/oz | 5.63 | 6.21 | 6.16 |

1Royalties based on a gold price of $1,700/oz.2 GHG Emissions Intensity calculated as Scope 1 and 2.

Compared to the outlook provided in the September 2017 Optimization Study, Ity is expected to produce an incremental 43koz per year over the next 5 years (2021-2025) and 58koz per year over next 10 years (2021-2030), up 21% and 32%, respectively, as illustrated in Figure 6 below.

Figure 6: Ity Production Profile

Figure 7 below demonstrates the sequencing of production from the various pits which comprise the whole of the Ity operation. Tonnes mined, processed and recoveries are expected to vary from year to year depending on the ore blend, as well as the characteristics of the various deposits. The land compensation and haul road construction for the Le Plaque deposit has commenced, which will enable a first grade control drilling campaign in Q1-2021, ahead of mining which is planned to commence after the wet season in late 2021.

Figure 7: Ity Mining Schedule by Deposit (current as at Dec 31, 2019)

The summarized mining and processing schedules, along with operating and capital cost estimates have been provided in Appendix B. Key capital projects now underway or planned to commence in 2021 include: TSF raise 3, Bakatouo and Colline Sud river diversions, Le Plaque land compensation, waste dump sterilisation, advanced grade control drilling program, haul road and infrastructure, in addition to a number of processing upgrades to improve metallurgical recovery in line with the volumetric upgrade completed in 2019.

The Tailings Storage Facility (“TSF”) for the CIL plant has been designed with total capacity of 57Mt based on an average annual throughput rate of 5Mtpa. The TSF construction is scheduled in 12 stages, with the first and second stages completed in January 2019 and April 2020, respectively. The construction of the remaining stages is scheduled throughout the mine life with the last stage expected to be completed in 2030.

The production plan for Ity was developed based on 6 PC1250 excavators for 2021 to 2024 and 7 excavators in 2025 to 2029 and dropping to 5 in 2030. In the last year of mining in 2031, 3 PC1250 were utilised.

The Ity mine utilizes a fleet composed of Articulated Dump Trucks (ADT) Volvo A40 and Dump Trucks (DT) Komatsu HD785-7. Over the next 10 years, an average of 24 ADTs are expected to be utilized, with flexibility to rent additional equipment if required, and approximately 14 DTs. Endeavour may elect to shift from owner-mining to contract mining should it result in additional savings.

The development of the Le Plaque deposit is being prioritized, for which the pit’s haul road construction is set to commence in late 2020. In addition, land compensation and bush clearing for areas outside the current compensation boundary is underway as Endeavour expects to delineate further resources in the Le Plaque area.

A number of plant optimization initiatives and engineering studies are underway, including a processing plant crusher duplication and the addition of two tanks or a pre-leach tank including tank spargers which are expected to increase Ity’s plant capacity from 5.0Mtpa to 5.6Mtpa within minimal capital spend in 2021.

Reserves and Resources

As shown in Table 7 below, the mine plan is based on a total of 3.3Moz of reserves, inclusive of the recently discovered Le Plaque deposit which has resulted in the addition of 556koz of reserves.

Table 7: Ity Mineral Reserve and Resource Estimate by Deposit (current as at Dec 31, 2019)

| Resources shown inclusive of reserves on a 100% basis | CONVERSION | P&P RESERVES | M&I RESOURCES | INFERRED RESOURCES | |||||||||

| P&P Reserve to M&I Resource | Tonnage | Grade | Content | Tonnage | Grade | Content | Tonnage | Grade | Content | ||||

| (Mt) | (Au g/t) | (Au koz) | (Mt) | (Au g/t) | (Au koz) | (Mt) | (Au g/t) | (Au koz) | |||||

| Mont Ity/Flat/Walter | 79% | 7.5 | 1.75 | 422 | 9.7 | 1.71 | 535 | 9.7 | 1.35 | 418 | |||

| ZiaNE | 94% | 6.4 | 1.09 | 223 | 7.2 | 1.03 | 238 | 5.2 | 1.14 | 191 | |||

| Verse Ouest-Teckraie | 94% | 8.1 | 1.02 | 266 | 8.9 | 0.99 | 284 | 0.8 | 0.84 | 21 | |||

| Daapleu | 70% | 16.0 | 1.71 | 880 | 26.3 | 1.49 | 1,256 | 0.6 | 0.90 | 19 | |||

| Gbeitouo | 88% | 2.6 | 1.29 | 109 | 2.9 | 1.35 | 124 | 0.3 | 1.48 | 13 | |||

| Aires Leach Pads | 90% | 3.9 | 1.13 | 141 | 5.0 | 0.96 | 156 | 0.0 | 0.00 | 0 | |||

| Bakatouo | 92% | 7.8 | 2.24 | 560 | 8.8 | 2.15 | 611 | 0.6 | 2.27 | 41 | |||

| Colline Sud | 36% | 0.4 | 1.64 | 24 | 1.0 | 2.14 | 66 | 0.4 | 2.11 | 28 | |||

| Le Plaque | 81% | 9.0 | 1.91 | 556 | 7.9 | 2.66 | 689 | 0.8 | 2.10 | 52 | |||

| Stockpiles | 100% | 4.0 | 0.82 | 105 | 4.0 | 0.83 | 105 | 0.0 | 0.00 | 0 | |||

| Total | 81% | 65.6 | 1.56 | 3,285 | 81.7 | 1.55 | 4,064 | 18.3 | 1.33 | 782 | |||

Mineral Reserve Estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for mineral resources and reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The Company is not aware of any known legal, political, environmental or other risks that could materially affect the potential development of the mineral resources and reserves. Resources were constrained by MII Pit Shell and based on a cut-off of 0.5 g/t Au. Estimates are current as at December 31, 2019 and do not include 2020 mine depletion. Estimates will be revised at year-end to account for 2020 depletion, changes in mining parameters, costs, gold price and other modifying factors.

Ity’s reserves and resources have been updated to include the increased Le Plaque resources as announced on July 7, 2020 and its subsequent conversion to reserves as summarized in Table 8 below.

Table 8: Ity Mineral Reserve and Resource (current as at December 31, 2019)

| Resources shown inclusive of reserves on a 100% basis | AS PUBLISHED IN MARCH 2020 | UPDATED TO INCLUDE LE PLAQUE | Δ AU CONTENT | |||||

| Tonnage | Grade | Content | Tonnage | Grade | Content | |||

| (Mt) | (Au g/t) | (Au koz) | (Mt) | (Au g/t) | (Au koz) | (Au koz) | ||

| Proven Reserves | 9.4 | 1.05 | 318 | 9.4 | 1.05 | 318 | 0 | |

| Probable Reserves | 52.7 | 1.67 | 2,825 | 56.2 | 1.64 | 2,966 | +141 | |

| P&P Reserves | 62.1 | 1.57 | 3,144 | 65.6 | 1.56 | 3,285 | +141 | |

| Measured Resources | 10.3 | 1.02 | 337 | 10.3 | 1.02 | 337 | 0 | |

| Indicated Resources | 68.1 | 1.61 | 3,514 | 71.4 | 1.62 | 3,727 | +213 | |

| M&I Resources | 78.4 | 1.53 | 3,851 | 81.7 | 1.55 | 4,064 | +213 | |

| Inferred Resources | 18.0 | 1.35 | 780 | 18.3 | 1.33 | 782 | +2 | |

Mineral Reserve Estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for mineral resources and reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The Company is not aware of any known legal, political, environmental or other risks that could materially affect the potential development of the mineral resources and reserves. Resources were constrained by MII Pit Shell and based on a cut-off of 0.5 g/t Au. Estimates are current as at December 31, 2019 and do not include 2020 mine depletion. Estimates will be revised at year-end to account for 2020 depletion, changes in mining parameters, costs, gold price and other modifying factors.

Permitting

The Government of Côte d'Ivoire recently granted Endeavour the Floleu mining permit which covers the entire Le Plaque area as illustrated in Figure 8 below. The Ity mine is now comprised of three mining licenses, each held within separate entities. The initial mining permit, which hosts notably the Bakatouo and Mont Ity deposits in addition to the processing facility, is held by Société des Mines d’Ity (“SMI”) while the Gbeitouo and Daapleu deposits are held by Société des Mines de Daapleu (“SMD”), both of which are 85%-owned by Endeavour. The Floleu mining permit is now held within the newly formed Société des Mines de Floleu (“SMF”) which is 90% owned by Endeavour. The Floleu permit has been granted as part of the 2014 Mining Code which includes a corporate income tax rate of 25%, and a royalty based on a 3% to 5% sliding scale linked to prevailing gold prices.

Figure 8: Ity Operating Permits

Mine life extension potential

Over 2.3Moz of indicated resources have been discovered since late 2016, yet significant exploration potential remains at the Ity mine with several near-mine targets identified. Over the coming years, exploration is expected to continue to focus on the Le Plaque area targets, as well as other targets where mineralization has already been confirmed. Such targets include Daapleu SW, Walter Deep, Verse Ouest, Le Plaque West, Epsilon Deeps, Falaise, Yopleu, and Delta SE, as shown in Figure 9 below.

Given the high grade nature of the Le Plaque area, it has been the primary exploration target in the greater Ity area since March 2018 with a strong focus placed on understanding the potential of the wider Le Plaque area. During H1-2020, in addition to the Le Plaque resource definition program, a total of 543 Air Core holes totalling 23,186 meters were drilled on a more regional scale on the northern part of the Floleu license on a 200-meter by 50-meter northwest-southeast oriented grid. This reconnaissance drilling outlined that Le Plaque represents only 30% of the large Northern Floleu anomalous area where at least seven other targets were confirmed, as shown in Figure 10 below. Drilling on these targets is ongoing, with the aim of delineating additional maiden resources in 2021.

Figure 9: Ity Map with Exploration Targets

Figure 10: Le Plaque Targets

Intercepts in the figure above are based on a minimum 2-meter length, a 0.5 g/t Au cut-off, and 1.0-meter internal dilution. Please refer to the press release date July 7, 2020, available on the Company’s website, for detailed technical notes.

TECHNICAL NOTES

Kari West Design Study Parameters

Exhaustive metallurgical testing and geotechnical and mining studies performed since November 2018 have allowed for the present Probable Reserves definition to be performed through Whittle optimization and subsequent mine design and planning by the Endeavour Technical Services team based on the following inputs:

- Gold price of $1,300/oz

- 0.5 g/t Au cut-off grade for oxide and 0.6g/t Au cut-off grade for transitional and fresh material were applied for mine planning

- 5% ore and gold loss factor were applied in addition to the inherent ore dilution through the reblocking process to SMU size blocks (5.0m x 5.0m x 2.5m along Easting, Northing and depth, respectively)

- Average mining and haulage unit cost of $2.13 per total of material tonne mined, average processing unit cost of $13.76/ore tonne, and average G&A unit cost of $5.62/ore tonne

- Gold recovery rates are estimated at 96.4% for oxide ore, 89.2% for transition ore, and 92.7% for fresh ore, averaging 93.3% for the deposit

- Doré freight security and refining rate of $5.50/oz

The Mineral Reserve estimation was also carried out by the Endeavour Technical Services team. The mining method planned for Kari West is conventional selective open pit mining, with the run of mine ore hauled for processing to the Houndé CIL plant. Ore and waste mining are expected to be conducted with owner operator equipment whilst overland ore haulage via a local haulage contractor. Based on the selected pit shell and resultant design stages, the average strip ratio (waste t: ore t) for Kari West is 6:1.

A geotechnical program has been completed to determine parameters for pit optimization and the pit designs. The geotechnical program was initiated in September 2019 and incorporates five geotechnical boreholes to investigate the rock mass for the Kari West project. The boreholes were sited to cover as much of the various rock types as possible. All geotechnical drill hole collars were surveyed with a differential GPS. Down hole surveys of the holes were carried out to confirm the borehole orientation.

Endeavour undertook a metallurgical test work program at ALS Global Laboratories in Perth on 650kg of NQ and HQ drill core samples from the Kari West deposit. Samples were selected to represent the various lithologies and weathered rock types across the deposit, both spatially and at depth. Testwork included:

- Eight selected samples from the core delivered to ALS. Each comminution test comprised a suite of SMC tests, a Bond Abrasion Index (Ai) and a Bond Ball Mill Work Index (BBWi) determination

- 36 hydrometallurgical variability tests to compare the gold extraction under the same set of standard cyanidation leach conditions for each of the various lithologies and weathered rock types across the deposit

- A range of ancillary testwork for mineralogical analysis, oxygen uptake rate tests, slurry rheology and thickening, gold carbon loading kinetics and cyanide detoxification, to understand and compare the behaviour and characteristics of ore to key design criteria from the existing Houndé Processing Plant.

The testwork program confirmed similar metallurgical properties to that of ores from the Houndé Deposit, providing confidence that Kari West ore can be processed via the existing Houndé processing plant. Ore recoveries based on this testwork are estimated at 94% for oxide ore, 90% for transition ore, and 82% for fresh ore, averaging 88% for the deposit.

Lycopodium Limited were engaged to review testwork results and determine processing impacts for Kari West ore via the Houndé processing plant and determine process unit operating costs.

Le Plaque Reserves Parameters

Whittle pit optimization and stage design works have been carried out by Snowden.

In estimation of the reserve, a $1,300/oz gold price has been used together with the parameters from the scoping study report from Snowden below:

- 0.4 g/t Au cut-off grade

- 5% grade reduction factor was applied to the Resource model in addition to the inherent ore dilution and recovery incorporated within a reblocked resource model, through the reblocking process to SMU sized blocks (5.0m x 5.0m x 2.5m along Easting, Northing and depth, respectively)

- Average mining and haulage unit cost of $2.79 per total of material tonne mined, average processing unit cost of $12.32/ore tonne, and average G&A unit cost of $2.97/ore tonne

- Gold recovery rates are estimated at 95.4% for oxide ore, 93.7% for transition ore, and 90.7% for fresh ore

- Doré freight, security and refining rate of $9.15/oz

The Mineral Reserve estimation study has been carried out by the Endeavour Technical Services team. The mining method planned for Le Plaque is conventional selective open pit mining, with the run of mine ore hauled for processing to the Ity CIL plant. In the study, ore and waste mining were assumed to be undertaken with owner operator equipment.

A geotechnical study has been completed to determine parameters for pit shell optimization and the pit designs. The geotechnical study program was initiated in Q4-2019 and incorporates eight geotechnical boreholes to investigate the rock mass for the Le Plaque project. The boreholes were sited to cover as much of the various rock types as possible. All geotechnical drill hole collars were surveyed with a differential GPS. Down hole surveys of the holes were carried out to confirm the borehole orientation.

Endeavour undertook a metallurgical test work program at ALS Global Laboratories in Perth on drill core samples from the Le Plaque deposit. Samples were selected to represent the various lithologies and weathered rock types across the deposit, both spatially and at depth. Testwork included:

- 23 selected samples from the core were delivered to ALS. Each comminution test comprised a suite of SMC tests, a Bond Abrasion Index (Ai) and a Bond Ball Mill Work Index (BBWi) determination

- 60 hydrometallurgical variability tests were conducted to compare the gold extraction under the same set of standard cyanidation leach conditions for each of the various lithologies and weathered rock types across the Le Plaque deposit

Lycopodium Limited were engaged to review test results and determine processing impacts for Le Plaque ore via the Ity processing plant. Lycopodium also provided an estimate for the process unit operating costs.

QUALIFIED PERSONS

Salih Ramazan, Vice President Mine Planning for Endeavour Mining - a Fellow Member of the AusIMM, is a "Qualified Person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and approved the technical information in this news release.

CONTACT INFORMATION

| Martino De Ciccio VP – Strategy & Investor Relations +44 203 640 8665 mdeciccio@endeavourmining.com | Vincic Advisors in Toronto John Vincic, Principal +1 (647) 402 6375 john@vincicadvisors.com Brunswick Group LLP in London Carole Cable, Partner +44 7974 982 458 ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a multi-asset gold producer focused on West Africa, with two mines (Ity and Agbaou) in Côte d’Ivoire, four mines (Houndé, Mana, Karma and Boungou) in Burkina Faso, four potential development projects (Fetekro, Kalana, Bantou and Nabanga) and a strong portfolio of exploration assets on the highly prospective Birimian Greenstone Belt across Burkina Faso, Côte d’Ivoire, Mali and Guinea.

As a leading gold producer, Endeavour Mining is committed to principles of responsible mining and delivering sustainable value to its employees, stakeholders and the communities where it operates. Endeavour is listed on the Toronto Stock Exchange, under the symbol EDV.

For more information, please visit www.endeavourmining.com.

Corporate Office: 5 Young St, Kensington, London W8 5EH, UK

This news release contains "forward-looking statements" including but not limited to, statements with respect to Endeavour's plans and operating performance, the estimation of mineral reserves and resources, the timing and amount of estimated future production, costs of future production, future capital expenditures, and the success of exploration activities. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", and "anticipates". Forward-looking statements, while based on management's best estimates and assumptions, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the successful integration of acquisitions; risks related to international operations; risks related to general economic conditions and credit availability, actual results of current exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of development or construction activities, changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which Endeavour operates. Although Endeavour has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Please refer to Endeavour's most recent Annual Information Form filed under its profile at www.sedar.com for further information respecting the risks affecting Endeavour and its business. AISC, all-in sustaining costs at the mine level, cash costs, operating EBITDA, all-in sustaining margin, free cash flow, net free cash flow, free cash flow per share, net debt, and adjusted earnings are non-GAAP financial performance measures with no standard meaning under IFRS, further discussed in the section Non-GAAP Measures in the most recently filed Management Discussion and Analysis.

APPENDIX A: HOUNDÉ MINE PLAN

| Item | Unit | Total / Average | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 |

| Mining Schedule | |||||||||||||

| Total Material Moved | kt | 366,806 | 55,469 | 54,552 | 54,377 | 56,075 | 54,322 | 47,134 | 29,981 | 7,987 | 5,358 | 1,552 | 0 |

| Total Waste Moved | kt | 323,716 | 49,850 | 47,681 | 47,396 | 52,400 | 49,028 | 39,841 | 25,108 | 6,421 | 4,672 | 1,318 | 0 |

| Total Ore Mined | kt | 43,090 | 5,619 | 6,871 | 6,981 | 3,675 | 5,294 | 7,292 | 4,872 | 1,567 | 686 | 234 | 0 |

| Stripping Ratio | w:o | 7.51 | 8.87 | 6.94 | 6.79 | 14.26 | 9.26 | 5.46 | 5.15 | 4.10 | 6.81 | 5.63 | - |

| Au Grade - Ore Mined | g/t | 1.82 | 1.95 | 1.94 | 1.71 | 2.28 | 1.89 | 1.70 | 1.46 | 1.79 | 1.41 | 1.03 | 0.00 |

| Contained Gold - Ore Mined | oz | 2,515,235 | 352,821 | 429,250 | 384,894 | 268,935 | 321,932 | 399,525 | 228,876 | 90,144 | 31,107 | 7,752 | 0 |

| Processing Schedule | |||||||||||||

| Total Ore Processed | kt | 43,721 | 4,050 | 4,051 | 4,051 | 4,062 | 4,051 | 4,051 | 4,051 | 4,062 | 4,051 | 4,051 | 3,193 |

| Au Grade - Ore Processed | g/t | 1.81 | 2.07 | 2.10 | 2.10 | 2.18 | 2.14 | 2.09 | 2.10 | 1.84 | 1.51 | 0.89 | 0.67 |

| Contained Gold - Ore Processed | oz | 2,546,492 | 269,762 | 273,547 | 273,165 | 284,145 | 278,931 | 272,579 | 273,194 | 240,418 | 196,191 | 115,809 | 68,753 |

| Au Recovery | % | 91.4% | 92.9% | 91.7% | 91.6% | 88.1% | 89.5% | 91.7% | 91.5% | 92.0% | 93.0% | 92.7% | 92.7% |

| Recovered Gold | oz | 2,326,419 | 250,502 | 250,865 | 250,158 | 250,268 | 249,723 | 250,058 | 250,032 | 221,166 | 182,490 | 107,392 | 63,766 |

| Unit Cost | |||||||||||||

| Mining | $/t Mined | 1.98 | 1.92 | 2.05 | 1.83 | 1.82 | 1.92 | 2.21 | 2.29 | 2.60 | 1.59 | 1.49 | - |

| Processing | $/t Ore Processed | 14.74 | 14.56 | 14.19 | 14.26 | 14.84 | 14.60 | 14.92 | 15.05 | 15.53 | 15.15 | 14.47 | 14.50 |

| G&A | $/t Ore Processed | 4.77 | 5.99 | 5.94 | 5.70 | 5.29 | 5.10 | 5.12 | 4.31 | 4.13 | 3.95 | 3.51 | 3.09 |

| Cash cost | $/oz Gold Sold | 634 | 552 | 632 | 520 | 489 | 585 | 650 | 660 | 653 | 693 | 962 | 1,215 |

| AISC | $/oz Gold Sold | 908 | 890 | 873 | 827 | 855 | 879 | 950 | 899 | 851 | 913 | 1,164 | 1,381 |

| Cost Summary | |||||||||||||

| Mining costs (total tonnes moved) | $m | 728 | 106 | 112 | 100 | 102 | 104 | 104 | 69 | 21 | 9 | 2 | 0 |

| Less: capitalized waste | $m | (117) | (23) | (2) | (20) | (42) | (21) | 0 | (3) | (3) | (3) | (0) | 0 |

| Processing cost | $m | 644 | 59 | 57 | 58 | 60 | 59 | 60 | 61 | 63 | 61 | 59 | 46 |

| General & Administrative expenses | $m | 209 | 24 | 24 | 23 | 21 | 21 | 21 | 17 | 17 | 16 | 14 | 10 |

| Inventory adjustments and other | $m | 10 | (28) | (33) | (31) | (20) | (17) | (23) | 21 | 46 | 44 | 28 | 21 |

| Total Cash Cost | $m | 1,474 | 138 | 158 | 130 | 122 | 146 | 163 | 165 | 144 | 126 | 103 | 77 |

| Royalties | $m | 316 | 34 | 34 | 34 | 34 | 34 | 34 | 34 | 30 | 25 | 15 | 9 |

| Sustaining Capital | $m | 321 | 50 | 26 | 43 | 58 | 40 | 41 | 26 | 14 | 15 | 7 | 2 |

| All-In-Sustaining Costs | $m | 2,111 | 223 | 219 | 207 | 214 | 219 | 237 | 225 | 188 | 166 | 125 | 88 |

| Non-sustaining Capital | $m | 60 | 10 | 2 | 3 | 6 | 6 | 6 | 6 | 7 | 12 | 2 | 0 |

| Total Cost | $m | 2,172 | 233 | 221 | 210 | 220 | 225 | 244 | 231 | 195 | 178 | 127 | 88 |

The mine plan and its associated costs are current as at December 31, 2019 and does not include 2020 mine depletion. The Company is not aware of any known legal, political, environmental or other risks that could materially affect the potential development of the mineral resources and reserves. Estimates will be revised at year-end to account for 2020 depletion, changes in mining parameters, costs, gold price and other modifying factors. Reported operating and capital costs may differ due to changes in applicable accounting classification.

APPENDIX B: ITY MINE PLAN

| Unit | Total / Average | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| Mining Schedule | |||||||||||||

| Total Material Moved | kt | 239,216 | 22,170 | 22,531 | 22,317 | 25,849 | 23,292 | 29,725 | 29,104 | 26,811 | 22,812 | 12,690 | 1,915 |

| Total Waste Moved | kt | 182,839 | 16,289 | 18,287 | 17,546 | 21,579 | 18,636 | 23,476 | 22,138 | 19,180 | 17,940 | 7,304 | 463 |

| Total Ore Mined | kt | 56,377 | 5,882 | 4,244 | 4,771 | 4,270 | 4,656 | 6,249 | 6,966 | 7,631 | 4,872 | 5,386 | 1,453 |

| Stripping Ratio | w:o | 3.24 | 2.77 | 4.31 | 3.68 | 5.05 | 4.00 | 3.76 | 3.18 | 2.51 | 3.68 | 1.36 | 0.32 |

| Au Grade - Ore Mined | g/t | 1.60 | 1.89 | 1.78 | 1.70 | 1.90 | 1.80 | 1.54 | 1.52 | 1.50 | 1.48 | 1.18 | 1.23 |

| Contained Gold - Ore Mined | oz | 2,905,711 | 358,235 | 242,862 | 261,051 | 261,376 | 269,167 | 308,673 | 341,307 | 369,101 | 232,139 | 204,308 | 57,493 |

| Processing Schedule | |||||||||||||

| Total Ore Processed | kt | 60,588 | 5,200 | 5,251 | 5,600 | 5,615 | 5,600 | 5,600 | 5,600 | 5,615 | 5,600 | 5,600 | 5,307 |

| Au Grade - Ore Processed | g/t | 1.55 | 1.85 | 1.65 | 1.60 | 1.61 | 1.62 | 1.65 | 1.77 | 1.77 | 1.52 | 1.19 | 0.80 |

| Contained Gold - Ore Processed | oz | 3,015,022 | 309,196 | 277,876 | 287,820 | 291,516 | 291,064 | 296,299 | 317,803 | 319,260 | 272,910 | 215,053 | 136,224 |

| Au Recovery | % | 83.7% | 78.3% | 88.6% | 87.0% | 86.0% | 86.4% | 84.8% | 78.7% | 78.5% | 77.7% | 89.4% | 92.1% |

| Recovered Gold | oz | 2,522,204 | 242,026 | 246,275 | 250,449 | 250,751 | 251,390 | 251,120 | 250,032 | 250,525 | 212,030 | 192,159 | 125,448 |

| Unit Cost | |||||||||||||

| Mining | $/t Mined | 2.56 | 2.44 | 2.28 | 2.57 | 2.68 | 2.45 | 2.85 | 2.82 | 2.62 | 2.16 | 2.73 | 1.68 |

| Processing | $/t Ore Processed | 10.84 | 11.41 | 10.71 | 11.32 | 11.51 | 11.03 | 11.23 | 11.16 | 10.57 | 10.60 | 10.01 | 9.67 |

| G&A | $/t Ore Processed | 3.33 | 4.13 | 4.15 | 3.93 | 3.64 | 3.52 | 3.54 | 2.96 | 2.93 | 2.83 | 2.77 | 2.27 |

| Cash cost | $/oz Gold Sold | 571 | 540 | 505 | 555 | 575 | 548 | 608 | 631 | 562 | 564 | 580 | 646 |

| AISC | $/oz Gold Sold | 780 | 812 | 750 | 771 | 815 | 752 | 799 | 781 | 701 | 764 | 781 | 925 |

| Cost Summary | |||||||||||||

| Mining costs (total tonnes moved) | $m | 613 | 54 | 51 | 57 | 69 | 57 | 85 | 82 | 70 | 49 | 35 | 3 |

| Less: capitalized waste | $m | (76) | (13) | (8) | (8) | (15) | (9) | (9) | (0) | (0) | (12) | (0) | 0 |

| Processing cost | $m | 657 | 59 | 56 | 63 | 65 | 62 | 63 | 62 | 59 | 59 | 56 | 51 |

| General & Administrative expenses | $m | 202 | 21 | 22 | 22 | 20 | 20 | 20 | 17 | 16 | 16 | 16 | 12 |

| Inventory adjustments and other | $m | 41 | 8 | 3 | 5 | 4 | 8 | (5) | (3) | (5) | 7 | 5 | 14 |

| Total Cash Cost | $m | 1,438 | 130 | 124 | 139 | 144 | 138 | 153 | 158 | 141 | 119 | 111 | 81 |

| Royalties | $m | 236 | 23 | 23 | 23 | 23 | 23 | 23 | 23 | 23 | 20 | 18 | 12 |

| Sustaining Capital | $m | 292 | 43 | 37 | 31 | 37 | 28 | 25 | 14 | 11 | 22 | 21 | 23 |

| All-In-Sustaining Costs | $m | 1,965 | 196 | 184 | 193 | 204 | 189 | 201 | 195 | 175 | 162 | 150 | 116 |

| Non-sustaining Capital | $m | 162 | 40 | 10 | 6 | 11 | 11 | 12 | 13 | 14 | 15 | 15 | 10 |

| Total Cost | $m | 2,127 | 236 | 194 | 199 | 215 | 200 | 213 | 208 | 189 | 176 | 165 | 126 |

The mine plan and its associated costs are current as at December 31, 2019 and does not include 2020 mine depletion. The Company is not aware of any known legal, political, environmental or other risks that could materially affect the potential development of the mineral resources and reserves. Estimates will be revised at year-end to account for 2020 depletion, changes in mining parameters, costs, gold price and other modifying factors. Reported operating and capital costs may differ due to changes in applicable accounting classification.

Attachment