Endeavour Mining Corporation : Endeavour's Ity CIL Project Construction is Tracking Ahead of Schedule and On-Budget

|

||||||||||||||||||||||||||||||

ENDEAVOUR'S ITY CIL PROJECT CONSTRUCTION

IS TRACKING AHEAD OF SCHEDULE AND ON-BUDGET

Abidjan, October 17, 2018 - Endeavour Mining Corporation (TSX:EDV)(OTCQX:EDVMF) is pleased to announce that the construction of its Ity Carbon-in-Leach ("CIL") Project in Côte d'Ivoire is tracking two months ahead of schedule and remains on-budget. The first gold pour is now expected to occur in early Q2-2019 rather than mid-2019 as previously planned.

Sébastien de Montessus, President & CEO, stated: "I'd like to thank the construction team for their hard work and excellent progress achieved so far. Completing the construction sooner is expected to result in material improvement to our 2019 free-cash flow generation potential as Ity CIL will be a low-cost operation with AISC expected to be below $500/oz over its first 5 years."

Jeremy Langford, COO & Executive Vice-President Projects added: "The experience that our in-house construction team has gained from our previous builds in the region, the early installation of the Ball and SAG mills, combined with the excellent progress made during the rainy season, have been key factors which have helped advance the Ity CIL construction ahead of schedule. We are also particularly pleased with the continued strong safety track record with zero lost-time incidents to date."

KEY MILESTONES ACHIEVED TO DATE INCLUDE:

- More than 6 million man-hours worked with zero lost-time injuries.

- Overall project completion stands at over 75%, tracking approximately 2 months ahead of schedule.

- Nearly all of the $412 million initial capital cost has been committed and approximately 65% has been spent (inclusive of drawn equipment financing).

- The process plant construction is over 70% complete, tracking ahead of schedule as the Ball and SAG mill installation commenced three months earlier than initially planned. Structural, mechanical, piping and electrical installation work is well underway.

- Tailings storage facility (TSF) earthworks are progressing well against schedule with over 70% completed. Rubber lining has commenced.

Picture 2: Tailings Storage Facility

- The 90kv transmission line and 29MW power station construction are progressing well against schedule with over 70% completed. First power drawdown is expected to in Q1-2019.

- The haul road bridge, to access the Daapleau pit, is 92% complete, with substructure concrete completed.

- Employee permanent camp construction is complete with all 312 rooms available for occupation.

- The resettlement program is progressing well against schedule with over 90% completed.

- More than 2,800 personnel, including contractors, are currently employed on-site, approximately 90% of which are locals.

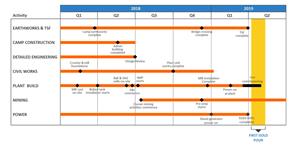

- The main upcoming milestones are presented in the figure below:

Figure 1: Ity CIL Construction Milestones

ABOUT THE ITY CIL PROJECT

The Ity CIL project commenced construction in September 2017, and is being carried out by Endeavour's in-house team following their successful completion of the Houndé and Agbaou constructions. The Optimized study, published in September 2017, demonstrated the significant potential for Ity, which has already been in operation for more than 20 years, to become another flagship asset for Endeavour. The Ity CIL project is expected to produce approximately 204,000 ounces annually for the first 10 years, at a low AISC of $549/oz with robust economics which includes an after-tax NPV5% of $710m based on a gold price of $1,250/oz.

QUALIFIED PERSONS

Jeremy Langford, Endeavour's Chief Operating Officer - Fellow of the Australasian Institute of Mining and Metallurgy - FAusIMM, is a Qualified Person under NI 43-101, and has reviewed and approved the technical information in this news release.

CONTACT INFORMATION

| Martino De Ciccio VP - Strategy & Investor Relations +44 203 011 2719 mdeciccio@endeavourmining.com | Brunswick Group LLP in London Carole Cable, Partner +44 7974 982 458 ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX listed intermediate African gold producer with a solid track record of operational excellence, project development and exploration in the highly prospective Birimian greenstone belt in West Africa. Endeavour is focused on offering both near-term and long-term growth opportunities with its project pipeline and its exploration strategy, while generating immediate cash flow from its operations.

Endeavour operates 5 mines across Côte d'Ivoire (Agbaou and Ity), Burkina Faso (Houndé, Karma), and Mali (Tabakoto) which are expected to produce 670-720koz in 2018 at an AISC of $840-890/oz. Endeavour's high-quality development projects (recently commissioned Houndé, Ity CIL and Kalana) have the combined potential to deliver an additional 600koz per year at an AISC well below $700/oz between 2018 and 2020. In addition, its exploration program aims to discover 10-15Moz of gold between 2017 and 2021 which represents more than twice the reserve depletion during the period. For more information, please visit www.endeavourmining.com.

Corporate Office: 5 Young St, Kensington, London W8 5EH, UK

This news release contains "forward-looking statements" including but not limited to, statements with respect to Endeavour's plans and operating performance, the estimation of mineral reserves and resources, the timing and amount of estimated future production, costs of future production, future capital expenditures, and the success of exploration activities. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", and "anticipates". Forward-looking statements, while based on management's best estimates and assumptions, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the successful integration of acquisitions; risks related to international operations; risks related to general economic conditions and credit availability, actual results of current exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of development or construction activities, changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which Endeavour operates. Although Endeavour has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Please refer to Endeavour's most recent Annual Information Form filed under its profile at www.sedar.com for further information respecting the risks affecting Endeavour and its business. AISC, all-in sustaining costs at the mine level, cash costs, operating EBITDA, all-in sustaining margin, free cash flow, net free cash flow, free cash flow per share, net debt, and adjusted earnings are non-GAAP financial performance measures with no standard meaning under IFRS, further discussed in the section Non-GAAP Measures in the most recently filed Management Discussion and Analysis.

Attachments

- Picture 5: Resettlement.png

- View Press Release in PDF.pdf

- Picture 3: Power Station.jpg

- Figure 1: Ity CIL Construction Milestones.jpg

- Picture 1: Process Plant.jpg

- Picture 2: Tailings Storage Facility.jpg

- Picture 4: Haul Road Bridge.png