Environmental Case For Black Iron's Expected High Grade 68% Iron Ore

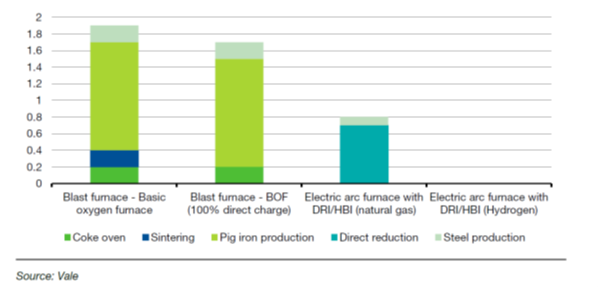

TORONTO, ON / ACCESSWIRE / June 7, 2021 / Black Iron Inc. ("Black Iron" or the "Company") (TSX:BKI)(OTC PINK:BKIRF)(FWB:BIN) announces that the production of steel using Black Iron's anticipated high grade 68% iron magnetite pellet feed reduces green house gas (GHG) emissions by ~30%[i] as compared to more typically consumed 62% iron hematite fines. Black Iron can also easily further upgrade its product to direct reduction pellet feed as is required to produce steel using green hydrogen which is getting a lot of attention in the media as a promising technology to achieve carbon neutrality.

Investors poured a record US$51 billion into Environment, Social and Governance (ESG) focused investments in 2020 which is more than double the prior year[ii]. Climate change in particular is a prominent focus with several countries including the UK, France, Japan and most recently China setting future carbon neutral targets. Given carbon emissions account for ~81% of green house gas emissions (GHG), major corporations including steel producers ArcelorMittal, Baowu, Thyssenkrupp and Voestalpine are following suit by targeting carbon neutrality by 2050.

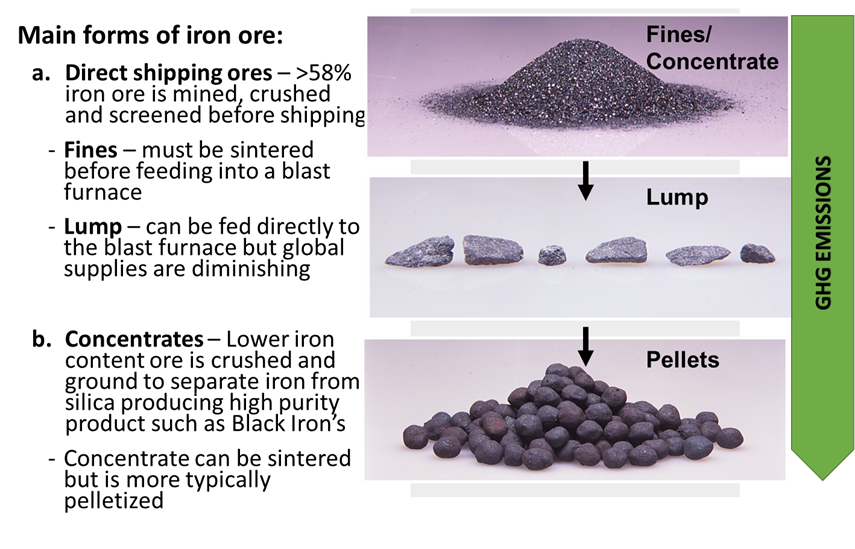

As such there is a fundamental shift occurring in the type of iron ore consumed by steel mills from fines which need to be first sintered (an emission intensive process to fuse fine iron ore particles into larger rocks of various size) to pellets which are small balls of uniform size.

When a steel blast furnace is fed with sinter or lumps, energy needs to be continually added until the last lump, typically the largest, is fully melted. Since pellets are all uniform in size, they melt at roughly the same rate thereby substantially reducing the amount of time, energy and resulting emissions generated to produce steel. When looking at the total energy consumed through the full value chain to produce steel, the net GHG emissions using high grade magnetite pellet feed, as Black Iron plans to produce, are reduced by an estimated 30%[iii].

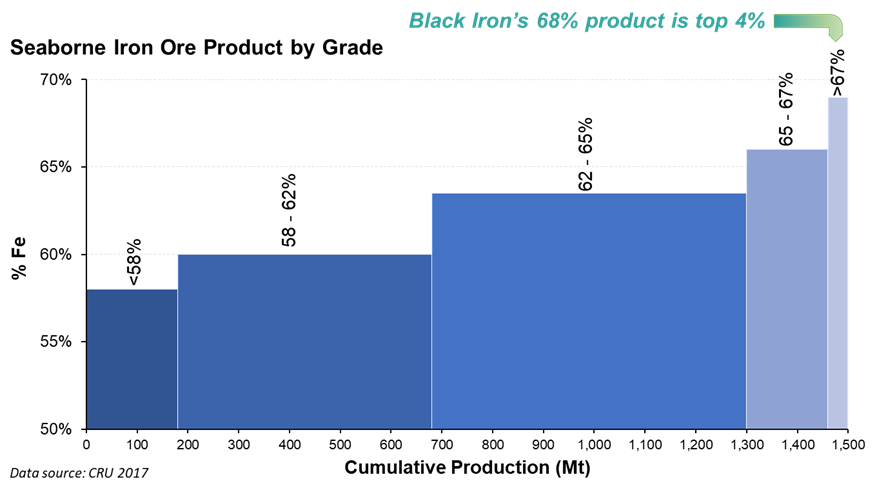

Black Iron's Shymanivske mine will be ideally placed to deliver high grade 68% iron content pellet feed which sits at the top 4% purity in the world as shown in the chart below.

To meet future anticipated demand for high purity pellet feed, CRU business intelligence estimates that an additional 133 million tonnes of supply will need to be brought on stream by 2035. Out of this 133 million tonne shortfall, 40 million tonnes will be required for Direct Reduction (DR) steel mills who use natural gas instead of metallurgical coal to produce steel cutting emissions by roughly 50%[iv]. The production of steel using DR technology requires a very high purity iron feedstock and there are few iron ore mines that can meet this stringent quality requirements. Fortunately, Black Iron would only need to make a slight incremental investment to add a floatation circuit to the end of its currently planned process to be one of the mines able to produce DR quality pellet feed.

Production of steel using green hydrogen is a very promising future source of energy because the only emission generated from the burning of hydrogen is water. Multibillion dollar iron ore mining companies including RioTinto and Ferrexpo are currently investing in technologies to produce green hydrogen as an alternative future source of energy to make steel[v]. Although it is likely a decade away, green hydrogen is showing great promise to reduce the net emissions in the production of steel to negligible levels as seen below but will place an even greater demand on the need for DR grade iron ore pellets and pellet feed as Black Iron could produce.

In conclusion, Black Iron provides a unique opportunity for investors to profit from the Shymanivske projects projected low-cost operation while at the same time providing ESG focused investors a great chance to invest in a cause they can strongly support.

About Black Iron

Black Iron is an iron ore exploration and development company, advancing its 100% owned Shymanivske project located in Kryviy Rih, Ukraine. The Shymanivske project contains a NI 43-101 compliant mineral resource estimated to be 646 Mt Measured and Indicated mineral resources, consisting of 355 Mt Measured mineral resources grading 32.0% total iron and 19.5% magnetic iron, and Indicated mineral resources of 290 Mt grading 31.1% total iron and 17.9% magnetic iron, using a cut-off grade of 10% magnetic iron. Additionally, the Shymanivske project contains 188 Mt of Inferred mineral resources grading 30.1% total iron and 18.4% magnetic iron. Full mineral resource details can be found in the NI 43-101 compliant technical report entitled "Preliminary Economic Assessment of the Re-scoped Shymanivske Iron Ore Deposit" effective November 21, 2017 (the "PEA") under the Company's profile on SEDAR at www.sedar.com. The Shymanivske project is surrounded by five other operating mines, including ArcelorMittal's iron ore complex. The PEA is preliminary in nature, and it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please visit the Company's website at www.blackiron.com for more information.

For more information, please contact:

Matt Simpson |

Forward-Looking Information

This press release contains forward-looking information. Forward-looking information is based on what management believes to be reasonable assumptions, opinions and estimates of the date such statements are made based on information available to them at that time. Forward-looking information may include, but is not limited to, statements with respect to the financial viability of the Company's Shymanivske project (the "Project"), , the price of iron ore, the demand for iron ore, the Company's ability to obtain adequate financing, including offtake financing, the impact of new legislation in Ukraine, the Company's ability to acquire the requisite land for Project construction, the Company's ability to develop the Project, the ceasefire of conflict in Ukraine and the Company's future plans. Generally, forward looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of current exploration activities; other risks of the mining industry and the risks described in the annual information form of the Company. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws. The Company notes that mineral resources that are not mineral reserves do not have demonstrated economic viability.

[i]2011 J. Herbertson and L. Strezov "Implications for the Australian Magnetite Industry of the Introduction of a Price/Tax on Carbon"

[iii]2011 J. Herbertson and L. Strezov "Implications for the Australian Magnetite Industry of the Introduction of a Price/Tax on Carbon"

View source version on accesswire.com:

https://www.accesswire.com/650518/Environmental-Case-For-Black-Irons-Expected-High-Grade-68-Iron-Ore