Erdene Provides Update on the Bayan Khundii Gold Project

HALIFAX, Nova Scotia, Sept. 12, 2023 (GLOBE NEWSWIRE) -- Erdene Resource Development Corp. (TSX:ERD; MSE:ERDN) (“Erdene” or the “Company”) is pleased to provide an update on progress at its high-grade, open-pit Bayan Khundii Gold Project (“Bayan Khundii”, “BK” or "Project”) in southwestern Mongolia.

Quotes from the Company:

“Development activities at the Bayan Khundii Gold Project are underway with the early works phase of the Project nearing completion,” said Peter Akerley, President and CEO. “As a low-cost project utilizing conventional mining and processing techniques with significant growth potential, Bayan Khundii offers investors and stakeholders exposure and leverage to gold price.”

“With the finalization of the updated Bayan Khundii Project Feasibility Study, we are working to lock in the project financing in advance of a formal construction decision,” continued Mr. Akerley. “Through our Strategic Alliance with Mongolian Mining Corporation (“MMC”), Mongolia’s largest independent miner, we are targeting first gold and cash flow in 2025, while we continue to explore, discover and develop the other mineral deposits in our Khundii Minerals District.”

Early Works and Site Establishment

Erdene executed an early works contract with MCS Properties (“MCSP”), an affiliate of MMC near the end of Q2-2023. MCSP is one of Mongolia’s largest engineering and construction companies, with a staff of over 1,500, including 225 engineers. Established in 1999, MCSP is a major contractor to Mongolia’s mining industry, constructing critical infrastructure for the Oyu Tolgoi copper-gold mine as well as MMC’s Ukhaa Khudag (“UHG”) metallurgical coal operations.

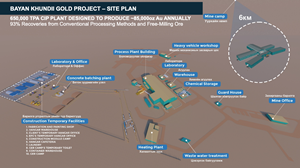

The early works contract scope includes final design and engineering works, establishment of temporary construction facilities, including camp, fuel station, aggregate crushing and concrete batch plant, and bulk earthworks. Work is largely complete under this contract, with aggregate and concrete batch plants established, construction office and accommodations erected, bulk earthworks, including site levelling and process plant footing excavation well progressed, and off-site and on-site road improvements largely complete. In aggregate, the early works phase of the project represents approximately 5% of the total construction effort. Pictures of early works progress are attached to this release. Approximately 80,000 work hours have been recorded at the Bayan Khundii Project Site under the early works contract without lost time incidents or environmental infractions.

Building upon the success of the early works phase, Erdene is in negotiations with MCSP on an Engineering, Procurement and Construction contract for the balance of the build, targeting execution in Q4-2023. Additionally, Erdene is negotiating with a Mongolian power producer to secure the Project’s energy needs.

Bayan Khundii NI 43-101 Feasibility Study Update

On August 15, 2023, Erdene announced results of an updated Feasibility Study (“FS”) for Bayan Khundii. The FS was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and incorporates updated mineral resources and reserves, including maiden resources and reserves from the high-grade Dark Horse Mane deposit (“DH”), as well as current capital and operating cost estimates and metals prices.

Highlights of the FS are included below (US$1,800/oz Gold Price, unless otherwise noted), and further details are available in the Company’s August 15, 2023 press release. The Technical Report will be filed on SEDAR in late September 2023.

- Base Case after-tax Net Present Value of US$170 million (NPV5%) and 35.3% Internal Rate of Return (IRR), increasing to US$196 million and 38.95% IRR, respectively, at current gold price of US$1,900/oz

- Life of Mine Earnings Before Interest, Taxes and Depreciation of US$451 million, increasing to US$495 million at a US$1,900/oz gold price

- Total recovered gold of 476,000 ounces, a 25% increase compared to the 2020 Feasibility Study from an average gold recovery rate of 93%

- All-in sustaining cost (“AISC”) of US$869 per ounce and upfront capital costs of US$88 million, plus a 12% contingency, and $2 million of pre-production costs

- Measured and Indicated Resources of 674,700 ounces gold at an average grade of 2.6 g/t gold, and 319,000 ounces silver at an average grade of 1.38 g/t silver

- Proven and Probable Reserves of 513,700 ounces gold at an average grade 4.0 g/t gold, and 220,500 ounces silver at an average grade of 1.7 g/t silver

- Average annual gold production of 86,900 ounces during years 2 through 5 – Life of Mine annual average production of 74,200 ounces gold

- Eight-year project, comprising one-year pre-production, six and three quarter-year operating life and one-year mine closure period

- Adjacent high-grade resources and recent discoveries provide high probability growth options

- Significant benefits to Mongolia, including Life of Mine royalties and taxes of US$143 million and approximately 500 new jobs in Bayankhongor Province

Strategic Alliance with MMC and Project Finance

On January 10, 2023, Erdene executed a Strategic Alliance Agreement (“SAA”) with MMC to develop the Bayan Khundii Gold Project (see press release here). Highlights of the SAA include:

- MMC is Mongolia’s largest internationally traded mining company, listed on the main board of the Hong Kong Stock Exchange (HKEx: 975).

- MMC to invest US$40 million for a 50% equity interest in Erdene’s Mongolian subsidiary, Erdene Mongol LLC (“EM”), holding the Khundii and Altan Nar mining licenses and the Ulaan exploration license through a three-stage transaction, based on achievement of milestones.

- Erdene retains a 50% equity interest in EM and a 5.0% Net Smelter Return (“NSR”) royalty on all production from the Khundii, Altan Nar and Ulaan licenses, as well as any properties acquired within 5 kilometres of these licenses, beyond the first 400,000 ounces gold recovered.

- The first two stages of the transaction were completed in January 2023 and May 2023, with MMC investing US$10 million to finance technical studies, including the FS, early construction works and exploration for the Bayan Khundii Gold Project.

- The third stage of the transaction, expected to close once EM has reached a construction decision, will see MMC invest a further US$30 million, providing equity capital for the Bayan Khundii Gold Project.

- Erdene will appoint EM’s Chief Executive and Chief Development Officers, and MMC will appoint EM’s Chief Operating and Chief Financial Officers.

- Erdene maintains a 100% interest in its large Zuun Mod Molybdenum-Copper deposit and Khuvyn Khar Copper project, located approximately 30 kilometres east of Bayan Khundii, and adjacent to a planned railway development.

On August 30, 2023, Erdene and MMC amended the SSA to allow MMC to advance US$15M of the US$30M third stage to continue early works, while the parties work to secure the balance of capital prior to reaching a formal construction decision. The remaining US$15M will be advanced by MMC upon a construction decision, and all other major terms of the SSA remain unchanged.

Two international financial institutions are conducting due diligence on the updated FS and are expected to provide the Project’s debt financing. These institutions are active in Mongolia, as major funders to the Oyu Tolgoi Copper-Gold project. It is anticipated that senior debt financing could comprise as much as 65% of the total financing package, with financial close anticipated in late 2023.

Next Steps

In addition to project financing, over the coming months, development work will be focused on:

- Completing early works construction;

- Executing the Engineering, Procurement and Construction contract for the Project;

- Concluding the Project’s Power Purchase Agreement;

- Optimizing the project execution schedule and completing value engineering;

- Securing approval of Erdene and MMC’s Boards of Directors to begin construction; and

- Exploring in the Khundii Minerals District to expand mineralization and convert resources to reserves.

Qualified Person and Sample Protocol

The information in this press release that relates to the financial models for the Bayan Khundii Feasibility Study is based on information compiled and reviewed by Mark Reynolds, engaged through O2 Mining Limited. The information in this press release that relates to the capital and operating cost estimation for the Bayan Khundii Feasibility Study is based on information compiled and reviewed by Julien Lawrence, who is a FAusIMM and the Director of O2 Mining Ltd. The information in this press release that relates to the process design and recovery methods for the Bayan Khundii Feasibility Study is based on information compiled and reviewed by Jeffrey Jardine, who is a FAusIMM and is engaged through O2 Mining Ltd. The information in this press release that relates to the BK Resource Estimate is based on information compiled and reviewed by Paul Daigle, who is a P.Geo and is an employee of AGP Mining Consultants Inc. The information in this press release that relates to the Dark Horse Resource Estimate is based on information compiled and reviewed by Oyunbat Bat-Ochir who is a full-time employee of RPM Global and a Member of the Australian Institute of Geoscientists. The information in this press release that relates to the Bayan Khundii reserve estimate is based on information compiled and reviewed by Julien Lawrence. Each of Mr. Reynolds, Mr. Lawrence, Mr. Jardine, Mr. Daigle and Mr. Bat-Ochir has sufficient experience, which is relevant to the style of mineralization and type of deposit under consideration and to the activity which they have undertaken to qualify as a Qualified Person, as that term is defined by National Instrument 43-101. Each of Mr. Reynolds, Mr. Lawrence, Mr. Jardine, Mr. Daigle and Mr. Bat-Ochir is not aware of any potential for a conflict of interest in relation to this work with Erdene.

All samples have been assayed at SGS Laboratory in Ulaanbaatar, Mongolia. In addition to internal checks by SGS Laboratory, the Company incorporates a QA/QC sample protocol utilizing prepared standards and blanks. All samples undergo standard fire assay analysis for gold and ICP-OES (Inductively Coupled Plasma Optical Emission Spectroscopy) analysis for 33 additional elements. For samples that initially return a grade greater than 5 g/t gold, additional screen-metallic gold analysis is carried out which provides a weighted average gold grade from fire assay analysis of the entire +75 micron fraction and three 30-gram samples of the -75 micron fraction from a 500 gram sample.

Erdene’s drill core sampling protocol consisted of collection of samples over 1 or 2 metre intervals (depending on the lithology and style of mineralization) over the entire length of the drill hole, excluding minor post-mineral lithologies and un-mineralized granitoids. Sample intervals were based on meterage, not geological controls, or mineralization. All drill core was cut in half with a diamond saw, with half of the core placed in sample bags and the remaining half securely retained in core boxes at Erdene’s Bayan Khundii exploration camp. All samples were organized into batches of 30 including a commercially prepared standard, blank and either a field duplicate, consisting of two quarter-core intervals, or a laboratory duplicate. Sample batches were periodically shipped directly to SGS in Ulaanbaatar via Erdene’s logistical contractor, Monrud Co. Ltd.

About Erdene

Erdene Resource Development Corp. is a Canada-based resource company focused on the acquisition, exploration, and development of precious and base metals in underexplored and highly prospective Mongolia. The Company has interests in three mining licenses and an exploration license in Southwest Mongolia, where exploration success has led to the discovery and definition of the Khundii Minerals District. Erdene Resource Development Corp. is listed on the Toronto and the Mongolian stock exchanges. Further information is available at www.erdene.com. Important information may be disseminated exclusively via the website; investors should consult the site to access this information.

Forward-Looking Statements

Certain information regarding Erdene contained herein may constitute forward-looking statements within the meaning of applicable securities laws. Forward-looking statements may include estimates, plans, expectations, opinions, forecasts, projections, guidance or other statements that are not statements of fact. Although Erdene believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Erdene cautions that actual performance will be affected by a number of factors, most of which are beyond its control, and that future events and results may vary substantially from what Erdene currently foresees. Factors that could cause actual results to differ materially from those in forward-looking statements include the ability to obtain required third party approvals, market prices, exploitation and exploration results, continued availability of capital and financing and general economic, market or business conditions. The forward-looking statements are expressly qualified in their entirety by this cautionary statement. The information contained herein is stated as of the current date and is subject to change after that date. The Company does not assume the obligation to revise or update these forward-looking statements, except as may be required under applicable securities laws.

NO REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED THE CONTENTS OF THIS RELEASE

Erdene Contact Information

Peter C. Akerley, President and CEO, or

Robert Jenkins, CFO

| Phone: | (902) 423-6419 |

| Email: | info@erdene.com |

| Twitter: | https://twitter.com/ErdeneRes |

| Facebook: | https://www.facebook.com/ErdeneResource |

| LinkedIn: | https://www.linkedin.com/company/erdene-resource-development-corp-/ |

| YouTube: | https://www.youtube.com/channel/UCILs5s9j3SLmya9vo2-KXoA |

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/baa4891b-fc69-481b-a871-2c5006de9543

https://www.globenewswire.com/NewsRoom/AttachmentNg/73aea655-56e2-4ad9-afa8-d51ca00200e8

https://www.globenewswire.com/NewsRoom/AttachmentNg/fa76cb75-fd63-4924-aad1-71b568fb396f

https://www.globenewswire.com/NewsRoom/AttachmentNg/bf2c7c6a-530c-4504-be78-874b54352d33