GoGold Announces Initial Mineral Resource Estimate at Los Ricos South

Shares Outstanding: 224,126,309

Trading Symbols: TSX: GGD

OTCQX: GLGDF

HALIFAX, NS, July 29, 2020 /CNW/ - GoGold Resources Inc. (TSX: GGD) (OTCQX: GLGDF) ("GoGold", "the Company") is pleased to announce their Initial Mineral Resource Estimate for their Los Ricos South Project located in Jalisco State, Mexico. In addition, the Company has updated the Mineral Reserve at the Parral Tailings operation, and the Mineral Resource Estimate at its Esmerelda Tailings Project located near Parral.

Highlights of the Mineral Resource Estimate and Mineral Reserve:

- Measured & Indicated Mineral Resource at Los Ricos South of 63.7 million ounces silver equivalent ("AgEq") grading 199 g/t AgEq contained in 10.0 million tonnes ("Mt")

- Inferred Resource at Los Ricos South of 19.9 million ounces AgEq grading 190 g/t AgEq contained in 3.3 Mt

- Total Company Measured & Indicated Mineral Resources of 108.6 million ounces AgEq

- Proven & Probable Mineral Reserve at Parral of 31.6 million ounces AgEq grading 64 g/t AgEq contained in 15.4 Mt

- Measured & Indicated Mineral Resource at Esmerelda of 13.3 million ounces AgEq grading 72 g/t AgEq contained in 5.7 Mt

- Los Ricos South Mineral Resource is amenable to both open pit and bulk underground mining methods

- Los Ricos South Mineral Resource Estimate will form the basis of a Preliminary Economic Assessment ("PEA") expected to be completed by the end of 2020

- Inferred out of pit grades range from 355 g/t AgEq to 512 at higher cut-off rates, as per Table 3.

"This initial Mineral Resource Estimate demonstrates Los Ricos South is a premium asset, in grade and quantity of ounces. Our Mineral Reserve at Parral is generating cash flows that are being reinvested into the Los Ricos district. Over the past 16 months, we have aggressively explored and developed the Los Ricos South Mineral Resource, which we will base our PEA study upon. Concurrently, we are accelerating our exploration effort on the Los Ricos North project where we are drilling the first of multiple targets which we believe will highlight the potential of the entire Los Ricos district," said Brad Langille, President and CEO. "Drilling is still underway at Los Ricos South targeting the northern extensions and extensions at depth."

The effective date of these Mineral Resource and Mineral Reserve Estimates is July 28, 2020 and a Technical Report on Los Ricos will be filed on the Company's website and SEDAR within 45 days of this news release. The pit constrained and out-of-pit Mineral Resources for Los Ricos South are summarized below in Table 1, and cut-off sensitivities are provided in Tables 2 and 3. The Updated Parral Mineral Reserve is summarized below in Table 4. The Updated Esmerelda Mineral Resource is summarized below in Table 5. Table 6 summarizes the Company's total Mineral Resources.

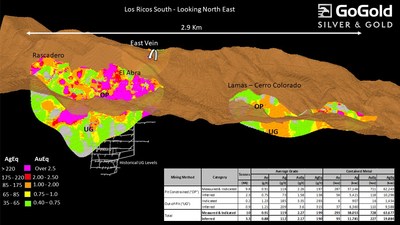

Figure 1 is a visualization of the block model and is available at https://gogoldresources.com/images/uploads/files/20200729_LRS_Resource.png

Table 1: Los Ricos South Mineral Resource Estimate – Pit Constrained and Out-of-Pit(1-8)

Mining Method | Category | Tonnes | Average Grade | Contained Metal | ||||||

Au | Ag | AuEq | AgEq | Au | Ag | AuEq | AgEq | |||

(Mt) | (g/t) | (g/t) | (g/t) | (g/t) | (koz) | (koz) | (koz) | (koz) | ||

Pit Constrained5 | Measured | 1.1 | 1.10 | 152 | 2.84 | 249 | 39 | 5,464 | 102 | 8,917 |

Indicated | 8.7 | 0.89 | 113 | 2.18 | 191 | 247 | 31,681 | 610 | 53,330 | |

Measured & Indicated | 9.8 | 0.91 | 118 | 2.26 | 197 | 287 | 37,146 | 711 | 62,243 | |

Inferred | 2.3 | 0.75 | 73 | 1.58 | 138 | 56 | 5,421 | 118 | 10,296 | |

Out-of-Pit6,7 | Indicated | 0.2 | 1.23 | 185 | 3.35 | 293 | 6 | 907 | 16 | 1,434 |

Inferred | 0.9 | 1.21 | 209 | 3.60 | 315 | 37 | 6,360 | 110 | 9,588 | |

Total | Measured | 1.1 | 1.10 | 152 | 2.84 | 249 | 39 | 5,464 | 102 | 8,917 |

Indicated | 8.8 | 0.89 | 115 | 2.20 | 193 | 253 | 32,588 | 626 | 54,765 | |

Measured & Indicated | 10.0 | 0.91 | 119 | 2.27 | 199 | 293 | 38,053 | 728 | 63,677 | |

Inferred | 3.3 | 0.88 | 112 | 2.17 | 190 | 93 | 11,781 | 227 | 19,884 | |

1. | Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. |

2. | The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration. |

3. | The Mineral Resources in this news release were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council. |

4. | Historically mined areas were depleted from the Mineral Resource model. |

5. | The pit constrained AuEq cut-off grade of 0.43 g/t Au was derived from US$1,400/oz Au price, US$16/oz Ag price, 93% process recovery, US$18/tonne process and G&A cost. The constraining pit optimization parameters were $2.00/t mineralized mining cost, 1.50/t waste mining cost and 50-degree pit slopes. |

6. | The out-of-pit AuEq cut-off grade of 1.4 g/t Au was derived from US$1,400/oz Au price, US$16/oz Ag price, 93% process recovery, $40/t mining cost, US$18/tonne process and G&A cost. The out-of-pit Mineral Resource grade blocks were quantified above the 1.4 g/t AuEq cut-off, below the constraining pit shell and within the constraining mineralized wireframes. Out–of-Pit Mineral Resources are restricted to the Los Ricos and Rascadero Veins, which exhibit historical continuity and reasonable potential for extraction by cut and fill and longhole mining methods. |

7. | No out-of-pit Mineral Resources are categorized as Measured. |

8. | AgEq and AuEq calculated at an Ag/Au ratio of 87.5:1. |

Mineral Resource Estimate Methodology – Los Ricos South

A total of 286 drill holes totalling 39,409 metres were used in the Mineral Resource Estimate. The nearest neighbour mean distance between drill hole collars is 24 m.

P&E Mining Consultants Inc. ("P&E") collaborated with GoGold personnel to develop the mineralization models, estimates, and reporting criteria for the Mineral Resources at Los Ricos. Mineralization models were initially developed by GoGold and were reviewed and modified by P&E. A total of five individual mineralized domains have been identified through drilling and surface sampling. The modeled mineralization domains are constrained by individual wireframes based on a 0.40 g/t AuEq cut-off. The average true thickness of the modeled Los Ricos Domain is 15.3 m. The average true thickness of the modeled Rascadero Domain is 11.5 m.

Mineralization wireframes were used as hard boundaries for the purposes of estimation.

A 5m x 5m x 5m three-dimensional block model was used for the Mineral Resource Estimate. The block model consists of estimated Au and Ag grades, estimated bulk density, classification criteria, and a block volume inclusion percent factor. Au equivalent block grades were subsequently calculated from the estimated Au and Ag grades.

Sample assays were composited to 1m standard length composites. Au and Ag grades were estimated using Inverse Distance Cubed weighting of between 4 and 12 composites, with a maximum of 3 composites per drill hole. Composites were capped prior to estimation by mineralization domain. Composite samples were selected within an anisotropic search ellipse oriented down the plunge of identified high grade trends.

A bulk density model was estimated from 592 measurements taken from drill hole core using Inverse Distance Squared weighting.

Classification criteria were determined from observed grade and geological continuity as well as variography. Measured Mineral Resources are informed by 4 or more drill holes within 30 m; Indicated Mineral Resources are informed by 3 or more drill holes within 60 m.

P&E is of the opinion that the Mineral Resource Estimates are suitable for public reporting and are a reasonable representation of the mineralization and metal content of the Los Ricos Deposits.

Table 2: Cut-off Sensitivities – Pit Constrained Mineral Resource1

Cut-off (AuEq) | Tonnes | Average Grade | Contained Metal | |||||||

Pit Constrained | Au | Ag | AuEq | AgEq | Au | Ag | AuEq | AgEq | ||

(g/t) | (Mt) | (g/t) | (g/t) | (g/t) | (g/t) | (koz) | (koz) | (koz) | (koz) | |

Measured | 3.0 | 0.4 | 2.20 | 293 | 5.54 | 485 | 26 | 3,517 | 67 | 5,828 |

2.0 | 0.6 | 1.79 | 238 | 4.51 | 395 | 32 | 4,295 | 81 | 7,119 | |

1.0 | 0.9 | 1.33 | 181 | 3.39 | 297 | 38 | 5,146 | 97 | 8,453 | |

0.8 | 1.0 | 1.24 | 170 | 3.18 | 279 | 39 | 5,285 | 99 | 8,660 | |

0.6 | 1.0 | 1.16 | 160 | 2.99 | 261 | 39 | 5,394 | 101 | 8,818 | |

0.43 | 1.1 | 1.10 | 152 | 2.84 | 249 | 39 | 5,464 | 102 | 8,917 | |

Indicated | 3.0 | 1.8 | 2.33 | 270 | 5.42 | 474 | 131 | 15,250 | 306 | 26,741 |

2.0 | 3.1 | 1.74 | 209 | 4.13 | 361 | 174 | 20,866 | 413 | 36,107 | |

1.0 | 6.0 | 1.17 | 145 | 2.83 | 248 | 227 | 28,104 | 548 | 47,950 | |

0.8 | 6.9 | 1.06 | 133 | 2.58 | 225 | 236 | 29,578 | 574 | 50,240 | |

0.6 | 8.0 | 0.95 | 121 | 2.33 | 204 | 244 | 30,943 | 597 | 52,275 | |

0.43 | 8.7 | 0.89 | 113 | 2.18 | 191 | 247 | 31,681 | 610 | 53,330 | |

Measured & Indicated | 3.0 | 2.1 | 2.31 | 274 | 5.44 | 476 | 158 | 18,766 | 372 | 32,568 |

2.0 | 3.7 | 1.75 | 213 | 4.19 | 366 | 207 | 25,161 | 494 | 43,231 | |

1.0 | 6.9 | 1.19 | 150 | 2.90 | 254 | 265 | 33,250 | 645 | 56,399 | |

0.8 | 7.9 | 1.08 | 137 | 2.65 | 232 | 275 | 34,864 | 673 | 58,895 | |

0.6 | 9.0 | 0.98 | 125 | 2.41 | 211 | 283 | 36,338 | 698 | 61,087 | |

0.43 | 9.8 | 0.91 | 118 | 2.26 | 197 | 287 | 37,146 | 711 | 62,243 | |

Inferred | 3.0 | 0.2 | 1.83 | 246 | 4.64 | 406 | 12 | 1,598 | 30 | 2,635 |

2.0 | 0.4 | 1.38 | 181 | 3.44 | 301 | 20 | 2,613 | 50 | 4,355 | |

1.0 | 1.5 | 0.96 | 93 | 2.02 | 177 | 47 | 4,553 | 99 | 8,691 | |

0.8 | 1.8 | 0.88 | 85 | 1.85 | 162 | 51 | 4,905 | 107 | 9,388 | |

0.6 | 2.1 | 0.81 | 78 | 1.69 | 148 | 54 | 5,215 | 114 | 9,946 | |

0.43 | 2.3 | 0.75 | 73 | 1.58 | 138 | 56 | 5,421 | 118 | 10,296 | |

1. | See Table 1 notes for assumptions |

Table 3: Cut-off Sensitivities – Out-of-Pit Mineral Resource1,2

Cut-off (AuEq) | Tonnes | Average Grade | Contained Metal | |||||||

Out-of-Pit | Au | Ag | AuEq | AgEq | Au | Ag | AuEq | AgEq | ||

(g/t) | (Mt) | (g/t) | (g/t) | (g/t) | (g/t) | (koz) | (koz) | (koz) | (koz) | |

Indicated | 3.0 | 0.1 | 1.69 | 281 | 4.90 | 429 | 3 | 565 | 10 | 864 |

2.5 | 0.1 | 1.56 | 243 | 4.34 | 379 | 4 | 663 | 12 | 1,036 | |

2.0 | 0.1 | 1.35 | 201 | 3.65 | 319 | 6 | 818 | 15 | 1,296 | |

1.8 | 0.2 | 1.23 | 185 | 3.35 | 293 | 6 | 907 | 16 | 1,434 | |

1.6 | 0.2 | 1.12 | 169 | 3.05 | 267 | 7 | 1,008 | 18 | 1,592 | |

1.39 | 0.2 | 1.02 | 154 | 2.78 | 243 | 7 | 1,114 | 20 | 1,759 | |

Inferred | 3.0 | 0.4 | 2.04 | 334 | 5.86 | 512 | 24 | 3,886 | 68 | 5,963 |

2.5 | 0.5 | 1.77 | 293 | 5.12 | 448 | 27 | 4,466 | 78 | 6,832 | |

2.0 | 0.7 | 1.38 | 233 | 4.05 | 355 | 33 | 5,616 | 98 | 8,528 | |

1.8 | 0.9 | 1.21 | 209 | 3.60 | 315 | 37 | 6,360 | 110 | 9,588 | |

1.6 | 1.1 | 1.09 | 191 | 3.27 | 286 | 40 | 7,015 | 120 | 10,526 | |

1.39 | 1.4 | 0.98 | 173 | 2.96 | 259 | 44 | 7,726 | 132 | 11,548 | |

1. | See Table 1 notes for assumptions |

2. | No Mineral Resources are categorized as Measured in the out-of-pit area. |

Parral & Esmerelda

In addition to announcing the Initial Mineral Resource Estimate at Los Ricos South, the Proven & Probable Mineral Reserve at Parral was updated to reflect the mining of material since the Project's inception, as well as for updated gold and silver pricing consistent with that of Los Ricos South's. The Updated Mineral Reserve at Parral resulted in a positive reconciliation of 14% on tonnage and 27% on AgEq ounces.

The Mineral Resource Estimate for the Esmerelda Project was updated as well based on the updated metal pricing, which resulted in an increase of 6% on AgEq ounces.

Table 4: Proven & Probable Mineral Reserves – Parral(1-3)

Category | Tonnes | Average Grade | Contained Metal | ||||||

Au | Ag | AuEq | AgEq | Au | Ag | AuEq | AgEq | ||

(Mt) | (g/t) | (g/t) | (g/t) | (g/t) | (koz) | (koz) | (koz) | (koz) | |

Proven | 8.7 | 0.34 | 32.4 | 0.71 | 62 | 95 | 9,088 | 199 | 17,480 |

Probable | 6.7 | 0.35 | 34.8 | 0.74 | 66 | 75 | 7,483 | 159 | 14,106 |

Total | 15.4 | 0.34 | 33.4 | 0.72 | 64 | 171 | 16,570 | 358 | 31,585 |

1. | Mineral Reserves have demonstrated economic viability. The estimate of Mineral Reserves may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues. |

2. | The Mineral Reserves in this press release were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council. |

3. | The Mineral Reserve in this estimate are based on US$1,400/oz Au, US$16/oz Ag, operating costs of US$9.95/t and Au and Ag process recoveries of 65% resulting in a AuEq cut-off grade of 0.34g/t, calculated at an Ag/Au ratio of 87.5:1. |

Table 5: Mineral Resource Estimate – Esmerelda(1-3)

Category | Area | Tonnes | Average Grade | Contained Metal | ||||

Au | Ag | AgEq | Au | Ag | AgEq | |||

(Mt) | (g/t) | (g/t) | (g/t) | (koz) | (koz) | (koz) | ||

Measured | Upper | 3.07 | 0.24 | 64 | 85 | 23.5 | 6,339 | 8,395 |

Lower | 2.60 | 0.29 | 32 | 57 | 24.6 | 2,646 | 4,799 | |

Total | 5.67 | 0.26 | 49 | 72 | 48.1 | 8,985 | 13,194 | |

Indicated | Upper | 0.01 | 0.18 | 62 | 78 | - | 12 | 14 |

Lower | 0.05 | 0.22 | 46 | 65 | 0.3 | 68 | 97 | |

Total | 0.05 | 0.00 | 48 | 67 | 0.3 | 80 | 112 | |

Measured & Indicated | Total | 5.72 | 0.26 | 49 | 72 | 48.4 | 9,065 | 13,305 |

1. | Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues. |

2. | The Mineral Resources in this press release were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council. |

3. | The Mineral Resource in this estimate are based on US$1,400/oz Au, US$16/oz Ag, operating costs of US$10.14/t and Au and Ag process recoveries of 50% resulting in a AgEq cut-off grade of 41 g/t, calculated at an Ag/Au ratio of 87.5:1. |

Table 6: Company Wide Mineral Resources

Project | Classification | Tonnes | Average Grade | Contained Metal | ||||||

Au | Ag | AuEq | AgEq | Au | Ag | AuEq | AgEq | |||

(Mt) | (g/t) | (g/t) | (g/t) | (g/t) | (koz) | (koz) | (koz) | (koz) | ||

Los Ricos South | Measured | 1.1 | 1.10 | 152 | 2.84 | 249 | 39 | 5,464 | 102 | 8,917 |

Indicated | 8.8 | 0.89 | 115 | 2.20 | 193 | 253 | 32,588 | 626 | 54,765 | |

Measured & Indicated | 10.0 | 0.91 | 119 | 2.27 | 199 | 293 | 38,053 | 728 | 63,677 | |

Parral | Measured1 | 8.7 | 0.34 | 32 | 0.71 | 62 | 95 | 9,088 | 199 | 17,480 |

Indicated1 | 6.7 | 0.35 | 35 | 0.74 | 66 | 75 | 7,483 | 159 | 14,106 | |

Measured & Indicated1 | 15.4 | 0.34 | 33 | 0.72 | 64 | 171 | 16,570 | 358 | 31,585 | |

Esmerelda | Measured | 5.67 | 0.26 | 49 | 0.82 | 72 | 48 | 8,985 | 151 | 13,194 |

Indicated | 0.05 | 0.00 | 48 | 0.77 | 67 | 0.3 | 80 | 1 | 112 | |

Measured & Indicated | 5.72 | 0.26 | 49 | 0.82 | 72 | 48 | 9,065 | 152 | 13,305 | |

Total | Measured | 15.5 | 0.37 | 47 | 0.91 | 80 | 182 | 23,537 | 452 | 39,591 |

Indicated | 15.6 | 0.66 | 80 | 1.57 | 138 | 328 | 40,151 | 786 | 68,983 | |

Measured & Indicated | 31.1 | 0.51 | 64 | 1.24 | 109 | 512 | 63,688 | 1,238 | 108,567 | |

Los Ricos South | Inferred | 3.3 | 0.88 | 112 | 2.17 | 190 | 93 | 11,781 | 227 | 19,884 |

1. | Mineral Reserves are a subset of Mineral Resources |

Qualified Persons

The independent Qualified Person for the Mineral Resource and Mineral Reserve disclosure for the project is Eugene Puritch, P.Eng., FEC, CET, President of P&E, who has reviewed and approved the technical contents of this release. Mr. David Duncan, P. Geo. is the Qualified Person for GoGold as defined by National Instrument 43-101 and is responsible for the technical information of this news release.

Los Ricos Exploration Projects

The Company's two exploration projects at its Los Ricos property are in Jalisco state, Mexico. The South Project began in March 2019 and includes the 'Main' area, which is focused on drilling around a number of historical mines including El Abra, El Troce, San Juan, and Rascadero. The South Project also includes the Cerro Colorado, Las Lamas and East Vein targets. The North Project was launched in March 2020 and includes drilling at the Monte del Favor, Salomon, La Trini, and Mololoa targets.

About GoGold Resources

GoGold Resources (TSX: GGD) is a Canadian-based silver and gold producer focused on operating, developing, exploring and acquiring high quality projects in Mexico. The Company operates the Parral Tailings mine in the state of Chihuahua and has the Los Ricos South and Los Ricos North exploration projects in the state of Jalisco. Headquartered in Halifax, NS, GoGold is building a portfolio of low cost, high margin projects. For more information visit gogoldresources.com.

About P&E Mining Consultants Inc.

P&E Mining Consultants Inc., established in 2004, provides geological and mine engineering consulting reports, Mineral Resource Estimate Technical Reports, Preliminary Economic Assessments and Pre-Feasibility Studies. In addition, they are affiliated with major Toronto based consulting firms for the purposes of joint venturing on Feasibility Studies. Their experience covers over 350 NI 43-101 Technical Reports on diamonds, most metallic deposits including gold, silver, base metals, PGM and iron for both open pit and underground deposits.

CAUTIONARY STATEMENT:

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and may not be offered or sold within the United States or to, or for the benefit of, U.S. persons (as defined in Regulation S under the U.S. Securities Act) except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities laws or pursuant to exemptions therefrom. This release does not constitute an offer to sell or a solicitation of an offer to buy of any of GoGold's securities in the United States.

This news release may contain "forward-looking information" as defined in applicable Canadian securities legislation. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the Parral tailings project, the Los Ricos project, communication with warrant holders, future operating margins, future production and processing, and future plans and objectives of GoGold, constitute forward looking information that involve various risks and uncertainties. Forward-looking information is based on a number of factors and assumptions which have been used to develop such information but which may prove to be incorrect, including, but not limited to, assumptions in connection with the continuance of GoGold and its subsidiaries as a going concern, general economic and market conditions, mineral prices, the accuracy of mineral resource estimates, and the performance of the Parral project There can be no assurance that such information will prove to be accurate and actual results and future events could differ materially from those anticipated in such forward-looking information.

Important factors that could cause actual results to differ materially from GoGold's expectations include exploration and development risks associated with GoGold's projects, the failure to establish estimated mineral resources or mineral reserves, volatility of commodity prices, variations of recovery rates, and global economic conditions. For additional information with respect to risk factors applicable to GoGold, reference should be made to GoGold's continuous disclosure materials filed from time to time with securities regulators, including, but not limited to, GoGold's Annual Information Form. The forward-looking information contained in this release is made as of the date of this release.

SOURCE GoGold Resources Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2020/29/c4601.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2020/29/c4601.html