Honey Badger Acquires Clear Lake Deposit in Yukon Territory With Historical Resource of 5.5 Million Ounces of Silver(A)(B)

TORONTO, March 29, 2022 (GLOBE NEWSWIRE) -- Honey Badger Silver Inc. (TSX-V: TUF) (“Honey Badger” or the “Company”) is pleased to announce that it has acquired a 100% interest in the Clear Lake deposit in the Whitehorse Mining District of the Yukon, for a total consideration of $250,000 in cash, subject to a 1% net smelter return royalty (“NSR”) on all metals other than silver. The Clear Lake deposit is classified as a sedimentary-exhalative deposit (“SEDEX”) known to contain a significant amount of silver while representing an important source of zinc and lead.

Highlights:

- Historical inferred resource prepared by SRK Consulting in 2010 in accordance with National Instrument 43-101 ("NI 43-101") of 5.5 million ounces of silver at 22 grams per tonne, in addition to 1.3 billion pounds of zinc grading 7.6% zinc and 185 million pounds of lead grading 1.08%(A)(B);

- Highly accretive acquisition cost;

- Property benefits from Class 3 Land Use Approval valid until 2029, which allows for up to 31,500 metres of diamond drilling and 2000 metres of reverse circulation drilling;

- Good potential to confirm and possibly incrementally expand existing resources with diamond drilling and discovery of additional mineralization on the property.

Chad Williams, Chairman of Honey Badger stated, “The Clear Lake acquisition represents a milestone as we acquire, on an extremely value-accretive basis, a quality asset with in-situ silver resources in one of the best mining jurisdictions in the world, where we are currently active at our higher-grade Plata silver project. This acquisition demonstrates our stated strategy of identifying and executing highly accretive targeted silver acquisitions. Clear Lake not only provides our shareholders with exposure to silver resources but also offers the possibility of unlocking value from the significant zinc and lead endowment, which is not of primary interest to Honey Badger, in a royalty/stream spin-off or even potentially other innovative instruments, such as a commodity-linked non-fungible token (“NFT”) – watch for more news on this front.”

Rationale for the Clear Lake Acquisition and Strategic Options Moving Forward:

With the Clear Lake acquisition, Honey Badger acquires a historical resource of 5.5 million ounces of silver. The transaction marks an important step in the Company’s strategy of aggregating silver assets at various stages of development, to provide shareholders with maximum exposure to silver prices, and the Company remains very active evaluating assets as part of this ongoing strategy. In addition, the Clear Lake historical resource includes significant zinc and lead (1.3 billion pounds of zinc and 185 million pounds of lead). Honey Badger will be exploring various options for monetizing this historical base metal resource, including the possible sale of a stream or royalty on the zinc and/or lead, or other means.

The historical resources were estimated by SRK for Copper Ridge Exploration Inc. and reported in an NI 43-101 technical report dated February 3, 2010 and was 43-101 compliant at the time of signing. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or reserves and the issuer is not treating the historical estimate as current mineral resources or reserves.

About the Clear Lake Deposit:

The Clear Lake deposit is classified as a SEDEX massive-sulphide zinc-lead-silver deposit. SEDEX deposits are known to contain a significant amount of silver while accounting for approximately 50% of the world’s current zinc and lead reserves(C).

The Clear Lake deposit hosts a historical NI 43-101 Inferred Resource prepared by SRK for Copper Ridge Exploration (A)(B), containing 7.76Mt @ 22 g/t silver, 7.6% zinc and 1.08% lead (Table 1).

Table 1: Summary of Clear Lake Historical Inferred Resource Estimate, SRK Technical Report, 2010(1)

| Tonnes Millions | Ag (g/t) | Zn (%) | Pb (%) | Ag (Moz) | Zn (Mlbs) | Pb (Mlbs) |

| 7.76 | 22g/t Ag | 7.6% | 1.08% | 5.5 | 1,300 | 185 |

Notes to Accompany the Clear Lake Inferred Resource Table:

(1) Mineral resources are historical in nature, they were estimated by SRK in February 2010 for Copper Ridge Exploration Inc.

(2) The Mineral Resources were classified in accordance with definitions provided by the Canadian Institute of Mining (“CIM”) as stipulated in NI 43-101

(3) The resource estimate was based upon 63 drill holes totaling 13,168 metres of drilling

(4) The mineral resources are reported at a 4% (lead+zinc) cut-off.

(5) Lead grades were capped to 1.5% and silver grades were capped at 60 g/t.

(6) Grade values for Pb, Zn and Ag were interpolated into 12 metre by 12 metre by 9 metre blocks using ordinary kriging (OK).

(7) Density Model: All air block were assigned a value of zero, all waste blocks were assigned 2.7 t/m3 and all mineralized blocks were assigned 4.07 t/m3

(8) SRK applied a 2 metre minimum thickness requirement to all intersections used in the model; if a high grade interval was less than the minimum thickness the interval was not used to estimate the block model

Clear Lake Mineralization and Geology:

The Clear Lake deposit occurs in Devonian- to Mississippian-aged Earn Group shale.

Base metal mineralization at Clear Lake occurs in two discrete horizons. Firstly, in the massive sulphide-siliceous horizon, combined zinc-lead mineralization grading over 5% occurs in three elongate-shaped lenses, 5 to 30 metres thick and 450 metres in length that extend at least 300 metres down dip. A second tuff-barite horizon, 75 metres into the hanging wall of the deposit, has a number of intersections of greater than 10% zinc over widths of one to six metres.

The deposit has potential for expansion at depth and along strike and SRK’s 2010 report recommends that an additional nine core holes totalling 1,500 metres be drilled to test the lateral and vertical extent of the mineralization at Clear Lake (A).

Property Size, Infrastructure and Access:

The Clear Lake property comprises 121 contiguous claims covering approximately 2,500 hectares, situated 65 kilometers east of Pelly Crossing, 90 kilometers northeast of Carmacks and 225 kilometers north of Whitehorse. A winter road links the property to the all-weather North Klondike Highway at Pelly Crossing, approximately 65 km to the west. The property lies on Category B Settlement Land within the Selkirk First Nations Traditional Territory.

The Clear Lake property has a Class 3 Land Use Approval valid until 2029, which allows for extensive diamond drilling, as well as clearing of airstrip and trail networks.

Past Exploration:

The bulk of the exploration work at Clear Lake was carried out by various mining syndicates and exploration companies from the mid-1970s to the early 1990s. During this period, the Clear Lake property was subject to several drilling campaigns, which has included a total of 18,219 metres of diamond drilling in 71 holes.

In addition to drilling, work included extensive bulldozer gridding, line cutting and mapping, numerous geophysics surveys (electromagnetic (“EM”), magnetometer and gravity surveys), soil sampling programs and overburden drilling programs targeting basal tills. This work led to the discovery of the main sulphide body at Clear Lake in 1978, by drilling a gravity anomaly coincident with magnetic and EM anomalies.

Copper Ridge Exploration Inc. who optioned the property in 2008, engaged Geotech Ltd. to complete a helicopter-borne VTEM survey and follow-up induced polarization and gravity surveys over a number of conductors identified by the VTEM survey. These targets were never drilled. Since 2008, two till and biogeochemical sampling surveys were completed in 2016 and 2018, by Darnley Bay Resources and Eastern Zinc Corp, respectively.

Figure 1: Historical drilling in relation to massive sulphide zone at surface, SRK Technical Report, 2010(A)

https://www.globenewswire.com/NewsRoom/AttachmentNg/705c8682-f8bf-4873-b107-7685919df301

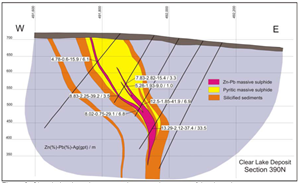

Figure 2: Cross-Section of Clear Lake Deposit, SRK Technical Report, 2010(A)

https://www.globenewswire.com/NewsRoom/AttachmentNg/d8177504-a1e9-4814-96e0-7ddc4d8efb8b

Technical information in this news release has been approved by Heather Burrell, P.Geo., a senior geologist with Archer, Cathro & Associates (1981) Limited and qualified person for the purpose of National Instrument 43-101.

Notes:

(A) Clear Lake Lead-Zinc-Silver Deposit, Yukon, Prepared by SRK Consulting for Copper Ridge Exploration Inc., February 2010, Authors Gilles Arseneau, Ph.D., P. Geo., Donald G. MacIntyre, Ph.D., P. Eng., Reviewed by Gordon Doerksen, P. Eng

(B) The foregoing resource estimate is historical in nature. The historical estimate was not prepared by the Company. The Company considers the 2010 historical estimate to be relevant and reliable given the high quality of the historical estimate completed and the fact that the estimate was prepared in accordance with NI 43-101. The Company has not independently verified the resource estimate, and therefore, it cannot be relied upon as a current mineral resource for the Company.

(C) ZINC INVESTING, SEDEX Deposits: Right Economics to Supply Global Zinc Demand, Investing News Network, Apr. 05, 2018

ON BEHALF OF THE BOARD

Chad Williams

Chairman and Director

About Honey Badger Silver Inc.

Honey Badger Silver is a Canadian Silver company based in Toronto, Ontario focused on the acquisition, development and integration of accretive transactions of silver ounces. The company is led by a highly experienced leadership team with a track record of value creation backed by a skilled technical team. With a dominant land position in Ontario’s historic Thunder Bay Silver District and advanced projects in the southeast and south-central Yukon including the Plata property 180 kms to the east of the Keno Hill silver district, Honey Badger Silver is positioning to be a top-tier silver company.

For more information, please visit our website above, or contact:

Ms. Christina Slater: cslater@honeybadgersilver.com

(647) 848-1009

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release and any other information herein that is not a historic fact may be "forward-looking information".

Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed timeframes or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.