K92 Mining Announces Q1 Production Results, Achieving Record Development and Monthly & Daily Mill Tonnes Processed

- Quarterly ore processed of 117,903 tonnes or 1,310 tpd (“tonnes per day”), our third highest on record, even after encountering 8 days of unplanned process plant downtime as previously reported.

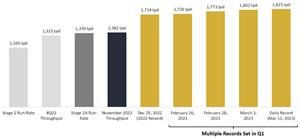

- Record monthly mill average daily throughput achieved in March of 1,490 tpd, 9% above the Stage 2A Expansion run-rate of 1,370 tpd, plus multiple new daily records set during the quarter, with the highest mill tonnes processed to date being 1,815 tonnes on March 11. Importantly, these records have been achieved prior to commissioning of the final major Stage 2A Expansion plant upgrade, the flotation expansion, planned for commissioning in Q2 2023.

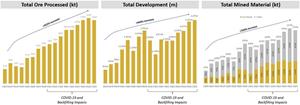

- Head grade during the quarter of 5.21 g/t gold, 0.70% copper and 10.14 g/t silver (6.35 g/t gold equivalent (“AuEq”)) with metallurgical recoveries for gold of 89.1% and copper of 91.3%. As previously reported, head grade was notably impacted by underground mining encountering an area with more challenging ground conditions than expected, impacting production stoping rates and access to higher grade material. Generally, mill feed would be supplemented by mining from additional mining fronts in these situations; however, due to development rates being below budget for several quarters during the COVID-19 pandemic, many of the alternative mining areas were not yet developed, therefore supplementing from the low grade stockpile was required. We expect a moderate impact from this in Q2, with the second half of 2023 being our strongest for production driven by a significant increase in our operational flexibility and stope sequencing, and 2023 production in the bottom half of the guidance range.

- Quarterly production of 21,488 oz AuEq(1) or 17,593 oz gold, 1,651,297 lbs copper and 29,859 oz silver and quarterly sales of 17,602 oz gold, 1,538,590 lbs copper and 29,164 oz silver.

- Record overall mine development of 2,278 m, an increase of 48% from Q1 2022, and significant advancement of the twin incline in Q1, with incline #2 (6m x 6.5m) advanced to 2,172 metres and #3 (5m x 5.5m) advanced to 2,230 metres as of March 31, 2023. Twin incline advance in Q1 was 22% ahead of budget.

Note (1): Gold equivalent for Q1 2023 is calculated based on: gold $1,890 per ounce; silver $22.55 per ounce; and copper $4.05 per pound.

VANCOUVER, British Columbia, April 06, 2023 (GLOBE NEWSWIRE) -- K92 Mining Inc. (“K92” or the “Company”) (TSX: KNT; OTCQX: KNTNF) announces production results for the first quarter (“Q1”) of 2023 at its Kainantu Gold Mine in Papua New Guinea, of 21,488 oz AuEq or 17,593 oz gold, 1,651,297 lbs copper and 29,859 oz silver. Sales during the first quarter were 17,602 oz gold, 1,538,590 lbs copper and 29,164 oz silver.

During the first quarter, the process plant delivered a strong quarterly ore processing rate of 117,903 tonnes or 1,310 tpd, our third highest quarter on record despite experiencing 8 days of combined unplanned maintenance. The unplanned plant maintenance occurred in February due to a mill trunnion bearing failure (2 days downtime) and a limited electrical fire in a cable tray, which damaged a number of cables feeding the wet section of the process plant (6 days downtime) (see February 27, 2023 press release).

After completion of the unplanned maintenance in February, the process plant performed very strongly, setting a new monthly ore processed record of 1,490 tpd in March which is 9% greater than the Stage 2A Expansion design throughput of 1,370 tpd. Additionally, multiple new daily throughput records were achieved during the quarter including 1,726 tonnes processed on February 26, 1,773 tonnes processed on February 28, 1,802 tonnes processed on March 3 and 1,815 tonnes processed on March 11. Importantly these records were achieved prior to the final major upgrade to the Stage 2A Expansion process plant, the flotation expansion to double rougher capacity, which is planned for commissioning in Q2 and is expected to provide a boost to metallurgical recoveries and flexibility to potentially increase throughput further.

Mine performance during the first quarter recorded 117,865 tonnes of ore mined, an 18% increase from Q1 2022, and delivered a total material mined (ore plus waste) of 277,534 tonnes mined, representing an increase of 33% from Q1 2022. During the quarter, operations focused on Kora’s K1 and K2 veins, and Judd’s J1 Vein for a total of 8 levels mined. Mining on Kora was conducted on the 1130, 1150, 1170, 1205, 1265 and 1285 levels, and Judd on the 1285 and 1305 levels.

The operation delivered head grades of 5.21 g/t gold, 0.70% copper and 10.14 g/t silver (6.35 g/t AuEq) in Q1. Metallurgical recoveries averaged 89.1% for gold and 91.3% for copper during the quarter, with recoveries expected to improve upon the commissioning of the flotation expansion planned in Q2 2023. Head grade was notably impacted, during the second half of the quarter, when underground mining encountered an area with more challenging ground conditions than expected, associated with where the K1 and K2 veins almost converge, which impacted our production stoping rates and access to higher grade ore. Generally, in this situation, mill feed would be supplemented by mining from additional mining fronts as we mine through the impacted area more slowly. However, due to development rates being below budget for several quarters during the COVID-19 pandemic, many of the alternative mining areas were not yet developed, therefore supplementing from our low-grade stockpile was required (see March 30, 2023 press release, and see Figure 1).

Operationally, as previously disclosed, we expect Q2 production to be moderately below budget, with the second half of 2023 being our strongest in terms of production and 2023 production being within the bottom half of the guidance range (see March 30, 2023 press release).

The anticipated strength of the second half of 2023 is driven by an expected significant increase to our operational flexibility and stope sequencing. In terms of operational flexibility, it is important to highlight the following positive trends:

- Significant increase in development achieved over the last two quarters: Q1 2023 and Q4 2022 both set new quarterly records for development, of 2,278 m and 2,221 m, respectively. Development for both quarters was also significantly greater than prior quarters, with Q1 2023 development increasing 48% compared to Q1 2022. Strong development rates is a positive leading indicator for operational flexibility, and we note that there are two new sublevels currently being established.

- Multiple equipment recently arrived on site: Recent arrivals include a new loader in Q4 2022, and in Q1 2023 a new jumbo, loader, two integrated tool carriers, Normet explosive charging machine, cement agitator truck and very recently a new long hole drill rig. The arrival of the long hole rig is particularly important as it now doubles our long hole drill fleet, which is expected to drive a notable increase in our drilled stocks (stopes drilled and available for immediate blasting, including more stopes available as “backups” to supplement mill feed if required). The majority of this equipment was originally scheduled to arrive in 2022 and in certain cases was considerably delayed due to the global supply chain. The arrivals of equipment are to both replace existing equipment and expand the fleet. During the remainder of the first half of 2023, two underground trucks and one jumbo are also scheduled for delivery.

- Entirely new mining front to be established in H2 2023: During the second half of the year, we will be accessing the ore body at depth from the twin incline, opening up an entirely new mining front that is serviced by our large and highly productive twin incline infrastructure. As of March 31, 2023, incline #2 (6m x 6.5m) advanced to 2,172 metres and #3 (5m x 5.5m) advanced to 2,230 metres, with development advance during Q1 2023 22% ahead of budget.

See Figure 1: Quarterly Total Ore Processed, Development Metres Advanced and Total Mined Material Chart

See Figure 2: Daily Ore Processed Records Chart

COVID-19 Operational Resiliency

The Kainantu Gold Mine operates under a comprehensive COVID-19 Management Plan that has continuously operated during the pandemic. A considerable focus is on health and safety and risk-mitigation. Under the COVID-19 Management Plan, K92 has established a Government-recognized testing lab facility utilizing qualified medical personnel on site, set up quarantine and isolation facilities for incoming staff (currently not in use), and implemented enhanced hygiene, disinfecting and training systems and procedures. A focus has been towards supporting Government efforts at a national, provincial and local level through the 1.5 million PGK (Papua New Guinea Kina) COVID-19 Assistance Fund, and a further 1.0 million PGK of additional assistance funding to Eastern Highlands Province.

In addition to our various control measures, K92 continues to make considerable progress increasing resiliency through vaccinations of our expatriate and PNG national workforce, with vaccinations continuing to be administered on site. Over 75% of our workforce (employees and contractors) have received at least one vaccine dose. The Company is in close communications with the provincial and national health authorities of Papua New Guinea and the Government of Australia in addition to the Papua New Guinea Chamber of Mines and Petroleum to deliver an effective pandemic response.

Table 1 – Q1 2023 & 2022 Annual Production Data

Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | 2022 | Q1 2023 | ||||||||

| Tonnes Processed | T | 99,611 | 108,853 | 117,938 | 121,686 | 448,087 | 117,903 | ||||||

| Feed Grade Au | g/t | 8.3 | 7.2 | 8.7 | 8.8 | 8.3 | 5.2 | ||||||

| Feed Grade Cu | % | 0.76% | 0.56% | 0.72% | 0.74% | 0.70% | 0.70% | ||||||

| Recovery (%) Au | % | 90.9% | 91.0% | 88.9% | 91.2% | 90.4% | 89.1% | ||||||

| Recovery (%) Cu | % | 91.1% | 90.9% | 88.4% | 91.8% | 90.5% | 91.3% | ||||||

| Metal in Conc & Dore Prod Au | Oz | 24,152 | 22,934 | 29,256 | 31,204 | 107,546 | 17,593 | ||||||

| Metal in Conc Prod Cu | T | 692 | 558 | 756 | 829 | 2,834 | 749 | ||||||

| Metal in Conc Prod Ag | Oz | 28,142 | 25,224 | 32,161 | 40,517 | 126,043 | 29,859 | ||||||

| Gold Equivalent Production | Oz | 28,188 | 26,085 | 32,995 | 35,538 | 122,806 | 21,488 | ||||||

Note - Gold equivalent for Q1 2023 is calculated based on: gold $1,890 per ounce; silver $22.55 per ounce; and copper $4.05 per pound. Gold equivalent for 2022 is calculated based on: gold $1,793 per ounce; silver $22 per ounce; and copper $3.95 per pound. Gold equivalent for Q4 2022 is calculated based on: gold $1,728 per ounce; silver $21 per ounce; and copper $3.63 per pound. Gold equivalent for Q3 2022 is calculated based on: gold $1,730 per ounce; silver $19 per ounce; and copper $3.51 per pound. Gold equivalent for Q2 2022 is calculated based on: gold $1,870 per ounce; silver $23 per ounce; and copper $4.32 per pound. Gold equivalent for Q1 2022 is calculated based on: gold $1,879 per ounce; silver $24 per ounce; and copper $4.53 per pound.

John Lewins, K92 Chief Executive Officer and Director, stated, “While the first quarter was more challenging than expected, there were many positives that we can build on for the operation going forward.

Firstly, the performance of the process plant was very strong, setting a new monthly ore processed record in March of 1,490 tpd, 9% greater than the Stage 2A Expansion Rate. Multiple new daily records were also set during the quarter, with the latest record now standing at 1,815 ore tonnes processed on March 11th. Importantly, this strong performance has been achieved prior to the commissioning of the flotation expansion for the Stage 2A Expansion that is planned for Q2 and is expected to provide a boost to metallurgical recoveries and flexibility to potentially increase throughput further.

On the underground mine, we see operational flexibility significantly improving over the coming weeks and months, driven by our recent record development advance rates, multiple key pieces of equipment now on site, and, a new mining front at depth in H2 serviced by our twin incline that is significantly oversized for not just the Stage 2A Expansion (500,000 tpa) throughput rate but also Stage 4 (1.7 mtpa).

And lastly, we are very excited about our exploration plans for 2023. In Q1, exploration continued to expand the drilled deposit extents at our Kora-Kora South and Judd-Judd South vein system (see February 21, 2023 press release), and porphyry drilling also recently commenced on A1, our top copper-gold porphyry target.”

Qualified Person

K92 Mine Geology Manager and Mine Exploration Manager, Andrew Kohler, PGeo, a qualified person under the meaning of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and is responsible for the technical content of this news release. Data verification by Mr. Kohler includes significant time onsite reviewing drill core, face sampling, underground workings, and discussing work programs and results with geology and mining personnel.

About K92

K92 Mining Inc. is engaged in the production of gold, copper and silver at the Kainantu Gold Mine in the Eastern Highlands province of Papua New Guinea, as well as exploration and development of mineral deposits in the immediate vicinity of the mine. The Company declared commercial production from Kainantu in February 2018, is in a strong financial position. A maiden resource estimate on the Blue Lake porphyry project was completed in August 2022. K92 is operated by a team of mining company professionals with extensive international mine-building and operational experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and Director

For further information, please contact David Medilek, P.Eng., CFA, President at +1-604-416-4445

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain “forward-looking information” within the meaning of applicable Canadian securities legislation (“forward-looking statements”), including, but not limited to, the impact of global supply chain and financial market disruptions; projections of future financial and operational performance; statements with respect to future events or future performance; production estimates; anticipated operating and production costs and revenue; estimates of capital expenditures; future demand for and prices of commodities and currencies; estimated mine life of our mine; estimated closure and reclamation costs and statements regarding anticipated exploration, development, construction, production, permitting and other activities on the Company’s properties, including: expected gold, silver and copper production and the Stage 3 Expansion and Stage 4 Expansion. Estimates of mineral reserves and mineral resources are also forward-looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production. All statements in this Annual Information Form that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made.

Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control, that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, without limitation, Public Health Crises, including the COVID-19 Pandemic; changes in the price of gold, silver, copper and other metals in the world markets; fluctuations in the price and availability of infrastructure and energy and other commodities; fluctuations in foreign currency exchange rates; volatility in price of our common shares; inherent risks associated with the mining industry, including problems related to weather and climate in remote areas in which certain of the Company’s operations are located; failure to achieve production, cost and other estimates; risks and uncertainties associated with exploration and development; uncertainties relating to estimates of mineral resources including uncertainty that mineral resources may never be converted into mineral reserves; the Company’s ability to carry on current and future operations, including development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the availability and costs of achieving the Stage 3 Expansion or the Stage 4 Expansion; the ability of the Company to achieve the inputs the price and market for outputs, including gold, silver and copper; inability of the Company to identify appropriate acquisition targets or complete desirable acquisitions; failures of information systems or information security threats; political, economic and other risks associated with the Company’s foreign operations; geopolitical events and other uncertainties, such as the conflict in Ukraine; compliance with various laws and regulatory requirements to which the Company is subject to, including taxation; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions, including relationship with the communities in Papua New Guinea and other jurisdictions it operates; other assumptions and factors generally associated with the mining industry; and the risks, uncertainties and other factors referred to in the Company’s Annual Information Form under the heading “Risk Factors”.

Estimates of mineral resources are also forward-looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production. The estimation of mineral resources and mineral reserves is inherently uncertain and involves subjective judgments about many relevant factors. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, Forward-looking statements are not a guarantee of future performance, and actual results and future events could materially differ from those anticipated in such statements. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other factors that cause actual results to differ materially from those that are anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Figure 1: Quarterly Total Ore Processed, Development Metres Advanced and Total Mined Material Chart

https://www.globenewswire.com/NewsRoom/AttachmentNg/80437b29-a957-4975-81b6-dbc943e628f0

Figure 2: Ore Processed Daily Records Chart

https://www.globenewswire.com/NewsRoom/AttachmentNg/bc591ae1-b6c1-49eb-be02-cf908f2ac5ff