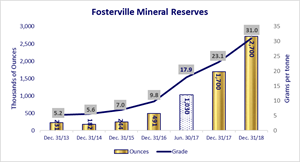

Kirkland Lake Gold Increases 2019 Production Guidance to 920,000 - 1,000,000 Ounces, Fosterville Mineral Reserves Increase 60% to 2.7 Million Ounces at 31.0 g/t

TORONTO, Feb. 21, 2019 (GLOBE NEWSWIRE) -- Kirkland Lake Gold Ltd. (“Kirkland Lake Gold” or the “Company”) (TSX:KL) (NYSE:KL) (ASX:KLA) today announced that the Company has revised and increased its consolidated three-year production guidance and improved its unit-cost guidance for 2019. The Company also announced today Mineral Reserve and Mineral Resource estimates for December 31, 2018, which include growth in Mineral Reserve ounces and average grades at both Fosterville and Macassa, as well as on a consolidated basis.

|

|||||

Key Highlights of the Production Guidance and Mineral Reserve Estimates Include:

- Potential for a million ounces in 2019 with three-year production guidance increased to 920,000 – 1,000,000 ounces for this year, 930,000 – 1,010,000 ounces for 2020 and 995,000 – 1,055,000 for 2021; Fosterville three-year guidance revised to 550,000 – 610,000 ounces for 2019 and 2020, with production guidance for 2021 remaining unchanged at 570,000 – 610,000 ounces, respectively; Production to resume at Holloway, with 20,000 ounces expected in 2019 increasing to 50,000 ounces by 2021

- Consolidated unit-cost guidance for 2019 improved, with operating cash costs per ounce guidance revised to $300 – $320 from $360 – $380 previously, with AISC per ounce sold improved to $520 – $560 compared to previous guidance of $630 – $680; Fosterville’s 2019 operating costs per ounce sold guidance improved to $170 – $190 from $200 – $220 previously

- Consolidated Mineral Reserves increase 1.1 million ounces or 24% to 5,750,000 ounces @ 15.8 grams per tonne (“g/t”) at December 31, 2018 (total additions of 1,860,000 ounces before depletion of 750,000 ounces)

- Fosterville Mineral Reserves increase 1,020,000 ounces or 60% to 2,720,000 ounces @ 31.0 g/t at December 31, 2018 from 1,700,000 ounces @ 23.1 g/t (total additions in 2018 of 1,386,000 ounces before depletion of 366,000 ounces); Growth in Mineral Reserves at December 31, 2018 reflects 34% increase in average grade and 19% growth in total tonnes, to 2,720,000 tonnes from 2,290,000 tonnes at December 31, 2017

- Mineral Reserves at Macassa increase 11% to 2,250,000 ounces @ 21.9 g/t from 2,030,000 ounces @ 21.0 g/t at December 31, 2017 (total additions of 464,000 ounces before depletion of 244,000 ounces)

Tony Makuch, President and Chief Executive Officer of Kirkland Lake Gold, commented: “Since November 2016, Fosterville has been transformed into one of the world’s highest-grade, most profitable gold mines, which has greatly benefited Kirkland Lake Gold and its shareholders. The completion of Fosterville’s December 31, 2018 Mineral Reserve and Mineral Resource estimates, with the related revisions to its life of mine plan and production profile, have taken that transformation to an even higher level, with the potential for much more to come. Largely driven by the 34% increase in the Fosterville Mineral Reserve grade, we are now on track to achieve significantly higher levels of production at Fosterville in 2019 than previously expected and could reach one million ounces of annual gold production as early as this year. Just as encouraging as the growth in ounces, is the fact that with a higher average grade at Fosterville, as well as at Macassa, our Mineral Reserve ounces are more valuable, which means improved unit costs and increased cash flow per ounce going forward based on current gold prices.

“Looking at our Mineral Reserves in more detail, the 24% increase in consolidated Mineral Reserves is a testament to the effectiveness of the infill drilling programs at Fosterville and Macassa. At Fosterville, there is considerable potential for further Mineral Reserve growth at a number of areas, including the Swan Zone, other parts of the Lower Phoenix system, Harrier and a number of other targets, like Robbin’s Hill, where early exploration results demonstrate the potential for attractive economic orebodies. Turning to Macassa, we converted close to half a million ounces of Mineral Resources to Mineral Reserves in 2018 and have a number of high-potential areas in and around the South Mine Complex (“SMC”) that we are targeting for future growth in Mineral Reserves and Mineral Resources.”

Improved 2019 Full-Year Guidance

On February 21, 2019, the Company announced revised and improved full-year 2019 consolidated guidance. The revision included increasing guidance for consolidated production to 920,000 – 1,000,000 ounces from the previous guidance of 740,000 – 800,000 ounces, announced on December 11, 2018. The revision to consolidated production guidance resulted from an increase in production guidance in 2019 for Fosterville to 550,000 – 610,000 ounces from 390,000 – 430,000 ounces, with the improvement related to changes to the mine plan to provide access to high-grade Swan Zone stopes earlier than previously expected, as well as increased average grades at the mine included in the December 31, 2018 Mineral Reserve and Mineral Resource estimates. Also contributing to the increase in consolidated production guidance was the decision to resume operations at the Holloway mine, which is expected to contribute approximately 20,000 ounces of production in 2019.

A number of other components of the Company’s full-year 2019 guidance have been revised as a result of the increase in target production. Operating cash costs per ounces sold in 2019 are now targeted at $300 –$320 compared to $360 - $380 previously. Fosterville’s operating cash costs per ounce sold guidance is revised to $170 – $190 from $200 – $220. New full-year 2019 guidance for operating cash costs per ounces sold at Holloway is introduced at $760 – $780 as a result of the restart of operations at the mine. Full-year 2019 operating cash costs on a consolidated basis is revised to $290 – $300 from $270 – $280 to reflect the addition of close to $20 million of operating cash costs related to production at the Holloway mine. AISC per ounce sold guidance for full-year 2019 is also improved, to $520 – $560 compared to $630 – $680 in the initial guidance released on December 11, 2018. The significant improvement in AISC per ounce guidance mainly reflects the increase in target production at Fosterville.

Full-Year 2019 Consolidated Guidance

| Revised Guidance | Initial Guidance | |

| ($ millions unless otherwise stated) | February 21, 2019 | December 11, 2018 |

| Gold production (kozs) 1 | 920 - 1,000 | 740 – 800 |

| Operating cash costs/ounce sold ($/oz)2 | 300 - 320 | 360 – 380 |

| AISC/ounce sold ($/oz)2 | 520 - 560 | 630 – 680 |

| Operating cash costs2 | 290 - 300 | 270 – 280 |

| Royalty costs | 25 - 30 | 25 – 30 |

| Sustaining capital2 | 150 - 170 | 150 – 170 |

| Growth capital2,3 | 155 - 165 | 155 – 165 |

| Exploration and evaluation | 100 - 120 | 100 – 120 |

| Corporate G&A expense3 | 26 - 28 | 26 – 28 |

(1) Production and unit-cost guidance for 2019 does not include results for the Northern Territory.

(2) See “Non-IFRS Measures” set out starting on page 35 of the MD&A for the three and nine months ending September 30,2 018 for further details. The most comparable IFRS Measure for operating cash costs is production costs, as presented in the Consolidated Statements of Operations and Comprehensive Income, and total additions and construction in progress for sustaining and growth capital. Operating cash costs per ounce and AISC per ounce sold are comparable to production costs on a unit basis. Operating cash costs, operating cash cost per ounce sold and AISC per ounce sold reflect an average US$ to C$ exchange rate of 1.33 and a US$ to A$ exchange rate of 1.39.

(3) Includes general and administrative costs and severance payments. Excludes non-cash share-based payment expense.

Improved Three-Year Production Guidance1

On February 21, 2019, the Company announced revisions to its three-year production guidance. The increases reflected higher levels of target production at Fosterville due to a significant increase in the average grade in the mine’s December 31, 2019 Mineral Reserve and Mineral Resource estimates. In addition, the planned restart of operations at the Holloway mine is expected to contribute an additional 20,000 ounces of production in 2019, 30,000 ounces in 2020 and 50,000 ounces in 2021.

Three-Year Production Guidance

| Revised (Feb. 21/19) | Macassa | Holt Complex2 | Fosterville | Consolidated |

| 2019 (kozs) | 230 – 240 | 140 – 150 | 550 – 610 | 920 – 1,000 |

| 2020 (kozs) | 230 – 240 | 150 – 160 | 550 – 610 | 930 – 1,010 |

| 2021 (kozs) | 245 – 255 | 180 – 190 | 570 – 610 | 995 – 1,055 |

| (1) Three-year production guidance does not include any production from the Northern Territory. | ||||

| (2) Includes production from the Holt mine, Holloway mine and Taylor mine. | ||||

| Initial (Dec. 11/18) | Macassa | Holt Complex2 | Fosterville | Consolidated |

| 2019 (kozs) | 230 – 240 | 120 – 130 | 390 – 430 | 740 – 800 |

| 2020 (kozs) | 230 – 240 | 120 – 130 | 500 – 540 | 850 – 910 |

| 2021 (kozs) | 245 – 255 | 130 – 140 | 570 – 610 | 970 – 1,005 |

| (1) Three-year production guidance does not include any production from the Northern Territory. | ||||

| (2) Includes production from the Holt mine, Holloway mine and Taylor mine. | ||||

CONSOLIDATED MINERAL RESERVES AND MINERAL RESOURCES AS AT DECEMBER 31, 2018

Mineral Reserves and Mineral Resources as at December 31, 2018 were estimated using a long-term gold price of $1,230 per ounce (C$1,635 per ounce; A$1,710 per ounce). All Mineral Resource estimates are provided exclusive of Mineral Reserves. Comparisons to previous Mineral Reserves and Mineral Resources in this news release are to estimates as at December 31, 2017. For more historical comparisons, Mineral Resource estimates for the Australian operations prior to the mid-year 2017 Mineral Reserve and Mineral Resource estimates for Fosterville, released in June 2017, were calculated inclusive of Mineral Reserves and, therefore, are not directly comparable to the December 31, 2018 and December 31, 2017 estimates. Detailed footnotes for the December 31, 2018 Mineral Reserve and Mineral Resource estimates are provided later in this news release.

CONSOLIDATED MINERAL RESERVE ESTIMATE (EFFECTIVE DECEMBER 31, 2018)

| December 31, 2018 | December 31, 2017 | ||||||

| Tonnes (000's) | Grade (g/t) | Gold Ozs (000’s) | Depleted Oz 2017 (000’s) | Tonnes (000's) | Grade (g/t) | Gold Ozs (000’s) | |

| Macassa | 3,190 | 21.9 | 2,250 | 244 | 3,010 | 21.0 | 2,030 |

| Taylor | 751 | 4.9 | 117 | 64 | 1,090 | 4.8 | 167 |

| Holt | 3,580 | 4.3 | 491 | 75 | 3,600 | 4.2 | 486 |

| Hislop(1) | 176 | 5.8 | 33 | 0 | 176 | 5.8 | 33 |

| Holloway(1) | 257 | 4.3 | 36 | 1 | 54 | 5.8 | 10 |

| Total CDN Operations | 7,950 | 11.4 | 2,920 | 384 | 7,930 | 10.7 | 2,730 |

| Fosterville | 2,720 | 31.0 | 2,720 | 366 | 2,290 | 23.1 | 1,700 |

| Northern Territory(1) | 666 | 5.0 | 107 | 0 | 2,800 | 2.4 | 215 |

| Total AUS Operations | 3,390 | 25.9 | 2,820 | 366 | 5,090 | 11.7 | 1,910 |

| Total | 11,340 | 15.8 | 5,750 | 750 | 13,020 | 11.1 | 4,640 |

| (1) The Hislop mine is a formerly producing open-pit mine acquired as part of the St Andrew Goldfields acquisition in January 2016. Hislop has not been operated by the Company since the acquisition. The Holloway mine was placed on care and maintenance effective December 31, 2016. The Cosmo mine and Union Reefs mill were placed on care and maintenance effective June 30, 2017. | |||||||

CONSOLIDATED MEASURED & INDICATED MINERAL RESOURCES (EFFECTIVE DECEMBER 31, 2018)

| Measured & Indicated | December 31, 2018 | December 31, 2017 | ||||

| Tonnes (000's) | Grade (g/t) | Gold Ozs (000’s) | Tonnes (000's) | Grade (g/t) | Gold Ozs (000’s) | |

| Macassa | 1,787 | 17.1 | 982 | 3,800 | 17.1 | 2,090 |

| Taylor | 826 | 5.0 | 133 | 1,830 | 6.2 | 370 |

| Holt | 6,883 | 4.0 | 895 | 6,510 | 4.1 | 860 |

| Aquarius | 22,300 | 1.3 | 926 | 22,300 | 1.3 | 930 |

| Holloway | 1,955 | 4.0 | 251 | 1,370 | 5.3 | 230 |

| Hislop | 1,147 | 3.6 | 132 | 1,150 | 3.6 | 130 |

| Ludgate | 522 | 4.1 | 68 | 520 | 4.1 | 70 |

| Canamax | 240 | 5.1 | 39 | 240 | 5.1 | 40 |

| Total CDN Operations | 35,660 | 3.0 | 3,426 | 37,720 | 3.9 | 4,720 |

| December 31, 2018 | December 31, 2017 | |||||

| Fosterville | 14,800 | 4.4 | 2,110 | 13,900 | 4.8 | 2,150 |

| Northern Territory | 22,200 | 2.5 | 1,750 | 24,100 | 2.3 | 1,810 |

| Total AUS Operations | 36,900 | 3.3 | 3,860 | 38,000 | 3.2 | 3,960 |

CONSOLIDATED INFERRED MINERAL RESOURCES (EFFECTIVE DECEMBER 31, 2018)

| Inferred | December 31, 2018 | December 31, 2017 | ||||

| Tonnes 000's) | Grade (g/t) | Gold Ozs (000’s) | Tonnes (000's) | Grade (g/t) | Gold Ozs (000’s) | |

| Macassa | 610 | 16.7 | 328 | 1,920 | 22.2 | 1,370 |

| Taylor | 1,988 | 5.3 | 337 | 2,570 | 5.2 | 430 |

| Holt | 8,523 | 4.7 | 1,286 | 8,000 | 4.8 | 1,220 |

| Holloway | 5,309 | 4.1 | 706 | 2,710 | 5.2 | 460 |

| Hislop | 797 | 3.7 | 95 | 800 | 3.7 | 100 |

| Ludgate | 1,396 | 3.6 | 162 | 1,400 | 3.6 | 160 |

| Card | 238 | 3.3 | 25 | 240 | 3.3 | 30 |

| Canamax | 170 | 4.3 | 23 | 170 | 4.3 | 20 |

| Runway | 213 | 3.7 | 25 | 210 | 3.7 | 20 |

| Total CDN Operations | 19,240 | 4.8 | 2,990 | 18,020 | 6.6 | 3,810 |

| Fosterville | 10,300 | 5.5 | 1,830 | 8,280 | 7.1 | 1,900 |

| Northern Territory | 18,100 | 2.6 | 1,490 | 16,300 | 2.5 | 1,280 |

| Total AUS Operations | 28,400 | 3.6 | 3,320 | 24,580 | 4.0 | 3,180 |

CANADIAN OPERATIONS MINERAL RESERVES AND MINERAL RESOURCES AS AT DECEMBER 31, 2018

Macassa

Mineral Reserves at Macassa in 2018 increased 11% after depletion of approximately 244,000 ounces, with total Mineral Reserves at December 31, 2018 of 2,250,000 ounces at an average grade of 21.9 g/t, which compared to Mineral Reserves of 2,030,000 ounces at an average grade of 21.0 g/t at December 31, 2017.

Measured and Indicated (“M&I”) Mineral Resources at December 31, 2018 totaled 982,000 ounces at an average grade of 17.1 g/t, while Inferred Mineral Resources totaled 328,000 ounces at an average grade of 16.7 g/t. By comparison, Mineral Resources at December 31, 2017 totaled M&I Mineral Resources of 2,090,000 ounces at an average grade of 17.1 g/t, and Inferred Mineral Resources of 1,370,000 ounces at an average grade of 22.2 g/t. The change in Mineral Resources compared to the prior year resulted from conversion of 464,000 ounces of Mineral Resources to Mineral Reserves. In addition, following a review of existing Mineral Resources, the Company determined that approximately 1.0 million ounces of Inferred Mineral Resources and 0.6 million ounces of M&I Mineral Resources should be removed from Mineral Resources, largely in areas of historic mining outside of the SMC, with some additional deletions relating to reinterpretations based on new drilling.

During 2019, the Company is planning approximately 90,000 metres of underground drilling at Macassa, using three underground drills. The 2019 drilling program is mainly targeting the continued expansion of the SMC to the east, the west and to depth, with the aim of growing Mineral Resources in support of future growth in Mineral Reserves.

| December 31, 2018 | December 31, 2017 | % Change | ||||||||

| Macassa | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Gold Grade | Gold Ounces | ||

| Mineral Reserves | ||||||||||

| Proven | 288 | 21.7 | 201 | 386 | 16.7 | 207 | 30 | -3 | ||

| Probable | 2,900 | 22.0 | 2,050 | 2,620 | 21.7 | 1,830 | -1 | 12 | ||

| Proven + Probable | 3,190 | 21.9 | 2,250 | 3,010 | 21.0 | 2,030 | 4 | 11 | ||

| Mineral Resources | Exclusive of Mineral Reserves | Exclusive of Mineral Reserves | ||||||||

| Measured | 453 | 18.4 | 268 | 1,570 | 17.8 | 900 | 3 | -70 | ||

| Indicated | 1,335 | 16.6 | 714 | 2,230 | 16.6 | 1,190 | -1 | -40 | ||

| Measured + Indicated | 1,787 | 17.1 | 982 | 3,800 | 17.1 | 2,090 | 4 | 58 | ||

| Inferred | 610 | 16.7 | 328 | 1,920 | 22.2 | 1,370 | -25 | -76 | ||

Taylor

Mineral Reserves at Taylor at December 31, 2018 totaled 117,000 ounces at an average grade of 4.9 g/t, which compared to Mineral Reserves at December 31, 2017 of 167,000 ounces at an average grade of 4.8 g/t. The reduction in Mineral Reserves in 2018 reflected 64,000 ounces of depletion that was not replaced through the conversion of Mineral Resources. M&I Mineral Resources at Taylor at December 31, 2018 totaled 133,000 ounces at an average grade of 5.0 g/t, which compared to M&I Mineral Resources at December 31, 2017 of 370,000 ounces at an average grade of 6.2 g/t. Inferred Mineral Resources totaled 337,000 ounces at an average grade of 5.3 g/t at December 31, 2018 versus 430,000 ounces at an average grade of 5.2 g/t at the end of 2017. The reduction in Mineral Resources compared to the December 31, 2017 estimates reflected reinterpretations of zones and weaker than expected grade continuity in some areas, as well as a concentration of drill metres on step-out drilling aimed at identifying new areas of gold mineralization and following up on previous extensions of gold mineralization rather than resource conversion.

In 2019, the Company is planning approximately 44,000 metres of surface and underground drilling (26,000 metres from surface and 18,000 metres from underground). Key targets of the 2019 drilling program will be areas below and to the East of the 1004 Zone of the West Porphyry Deposit.

| December 31, 2018 | December 31, 2017 | % Change | |||||||

| Taylor | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Gold Grade | Gold Ounces | |

| Mineral Reserves | |||||||||

| Proven | - | - | - | 445 | 5.5 | 78 | N/A | N/A | |

| Probable | 751 | 4.9 | 117 | 646 | 4.3 | 89 | 14 | 31 | |

| Proven + Probable | 751 | 4.9 | 117 | 1,090 | 4.8 | 167 | 2% | -30% | |

| Mineral Resources | Exclusive of Mineral Reserves | Exclusive of Mineral Reserves | |||||||

| Measured | - | - | - | 590 | 8.1 | 150 | N/A | N/A | |

| Indicated | 826 | 5.0 | 133 | 1,240 | 5.3 | 210 | -6 | -37 | |

| Measured + Indicated | 826 | 5.0 | 133 | 1,830 | 6.2 | 370 | -19 | -64 | |

| Inferred | 1,988 | 5.3 | 337 | 2,570 | 5.2 | 430 | 2 | -22 | |

Holt

Mineral Reserves at the Holt mine at December 31, 2018 totaled 491,000 ounces at an average grade of 4.3 g/t, a slight increase from 486,000 ounces at an average grade of 4.2 g/t at December 31, 2017. The mine converted 81,000 ounces of Mineral Resources to Mineral Reserves, which more than offset the 75,000 ounces of depletion during 2018. Measured and indicated resources totaled 895,000 ounces at an average grade of 4.0 g/t, a 4% increase from 860,000 ounces at an average grade of 4.1 g/t at December 31, 2017. Inferred Mineral Resources at December 31, 2018 totaled 1,286,000 ounces at an average grade of 4.7 g/t, 5% higher than 1,220,000 ounces at an average grade of 4.8 g/t at the same time the previous year.

The Company is not planning extensive exploration drilling in 2019 subject to completing a revised royalty agreement relating to the Holt properties.

| December 31, 2018 | December 31, 2017 | % Change | |||||||

| Holt | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Gold Grade | Gold Ounces | |

| Mineral Reserves | |||||||||

| Proven | 1,930 | 4.1 | 253 | 1,770 | 4.0 | 229 | 3 | 10 | |

| Probable | 1,660 | 4.5 | 238 | 1,830 | 4.4 | 257 | 2 | -7 | |

| Proven + Probable | 3,580 | 4.3 | 491 | 3,600 | 4.2 | 486 | 2 | 1 | |

| Mineral Resources | Exclusive of Mineral Reserves | Exclusive of Mineral Reserves | |||||||

| Measured | 4,036 | 4.1 | 527 | 3,730 | 4.1 | 500 | - | 5 | |

| Indicated | 2,847 | 4.0 | 367 | 2,780 | 4.1 | 370 | -2 | -1 | |

| Measured + Indicated | 6,883 | 4.0 | 895 | 6,510 | 4.1 | 860 | -2 | 4 | |

| Inferred | 8,523 | 4.7 | 1,286 | 8,000 | 4.8 | 1,220 | -2 | 5 | |

Holloway

The Company announced today plans to resume operations at the Holloway mine as a result of entering into an amended and restated royalty agreement with Franco-Nevada Corporation, which will establish a fixed 3% net smelter returns royalty from the Holloway properties. With a planned restart of production activities, the Company is now targeting approximately 20,000 ounces of production in 2019, growing to approximately 50,000 ounces by 2021.

At December 31, 2018, Mineral Reserves at the Holloway mine totaled 36,000 ounces at an average grade of 4.3 g/t, which compared to Mineral Reserves of 10,000 ounces at an average grade of 5.8 g/t at December 31, 2017. M&I Mineral Resources at December 31, 2018 totaled 251,000 ounces at an average grade of 4.0 g/t, while Inferred Mineral Resources totaled 706,000 ounces at an average grade of 4.1 g/t. By comparison, M&I Mineral Resources at December 31, 2017 totaled 230,000 ounces at an average grade of 5.2 g/t, while Inferred Mineral Resources totaled 540,000 ounces at an average grade of 5.2 g/t.

| December 31, 2018 | December 31, 2017 | % Change | |||||||

| Holloway | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Gold Grade | Gold Ounces | |

| Mineral Reserves | |||||||||

| Proven | 24 | 3.8 | 3 | - | - | - | - | 10 | |

| Probable | 233 | 4.4 | 33 | 54 | 5.8 | 10 | -24 | 230 | |

| Proven + Probable | 257 | 4.3 | 36 | 54 | 5.8 | 10 | -26 | 260 | |

| Mineral Resources | Exclusive of Mineral Reserves | Exclusive of Mineral Reserves | |||||||

| Measured | 286 | 3.8 | 35 | 156 | 4.1 | 21 | 83 | 66 | |

| Indicated | 1,669 | 4.0 | 217 | 1,211 | 5.4 | 210 | -26 | 3 | |

| Measured + Indicated | 1,955 | 4.0 | 251 | 1,367 | 5.2 | 230 | 43 | 9 | |

| Inferred | 5,309 | 4.1 | 706 | 2,710 | 5.2 | 460 | -21 | 53 | |

AUSTRALIAN OPERATIONS MINERAL RESERVES AND MINERAL RESOURCES AS AT DECEMBER 31, 2018

Fosterville

In 2018, the transformation of Fosterville into one of the world’s most profitable, highest-grade gold mines gained further momentum. Exploration work during the year at Fosterville focused on infill and extension drilling at a number of in-mine targets, as well as work to evaluate district targets in close proximity to the mine. Encouraging infill drilling results from the Swan Zone were reported in July, September and December in support of Mineral Resource conversion into Mineral Reserves. In addition, development of an exploration drift at Harrier South at Fosterville commenced during Q2 2018, with drilling from the drift commencing in Q4 2018 in order to test the depth potential of the Harrier South system. Harrier is a highly attractive exploration target where concentrations of quartz veining with visible gold have been intersected similar to those found at the Lower Phoenix system near the high-grade Swan Zone.

Largely based on the success of the Swan Zone infill drilling, Mineral Reserves at December 31, 2018 increased 1,020,000 ounces from the December 31, 2017 Mineral Reserve, to 2,720,000 ounces at an average grade of 31.0 g/t from 1,700,000 ounces at an average grade of 23.1 g/t at December 31, 2017. The increase in ounces represented 60% growth, while the average grade was 34% higher than the prior year’s Mineral Reserve estimate. The 60% increase in Mineral Reserve ounces was achieved after depletion of 366,000 ounces through 2018 gold production, resulting in total additions to Mineral Reserves of 1,386,000 ounces. With the completion of the December 31, 2018 Mineral Reserve and Mineral Resource estimates, the Mineral Reserve at Fosterville has grown by a total of 2,476,000 ounces or 1,015% from 244,000 ounces at December 31, 2015 Mineral Reserve estimate, the existing Mineral Reserve when Fosterville was acquired by Kirkland Lake Gold in November 2016.

Mineral Reserves in the Swan Zone doubled from the prior year level, increasing to 2,340,000 ounces at an average grade of 49.6 g/t at December 31, 2018 from 1,160,000 ounces at 61.2 g/t at December 31, 2017. A significant proportion of Swan Mineral Resources at December 31, 2017 were converted into Mineral Reserves in the December 31, 2018 estimates, consistent with the priority placed on Mineral Resource conversion in the 2018 drilling program. In addition to continued infill drilling to convert Mineral Resources, future drilling around the Swan Zone will also target continued expansion of the Zone, including following up on drill results in 2018 that intersected the Lower Phoenix Gold System approximately 750 metres down-plunge from the deepest Mineral Resources in the Swan Zone.

Fosterville continues to have a large base of Mineral Resources to support future growth in Mineral Reserves, as well as a number of attractive exploration targets with significant potential to add future Mineral Resources. At December 31, 2018, M&I Mineral Resources totaled 2,110,000 ounces at an average grade of 4.4 g/t, which compared to M&I Mineral Resources of 2,150,000 ounces at an average grade of 4.8 g/t at December 31, 2017. Inferred Mineral Resources at December 31, 2018 totaled 1,830,000 ounces at an average grade of 5.5 g/t, versus 1,900,000 ounces at an average grade of 7.1 g/t at December 31, 2017.

During 2019, exploration work at Fosterville is focusing on continuing to extend known mineralized zones and test new mineralized structures in the Lower Phoenix and Harrier systems, and at Robbin’s Hill. In addition, work is continuing on the LODE (“Large Ore Deposit Exploration”) program, which is evaluating a number of regional targets, some of which are beneath former open pits along known fault structures around the Fosterville mine.

| December 31, 2018 | December 31, 2017 | % Change | |||||||

| Fosterville | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Gold Grade | Gold Ounces | |

| Mineral Reserves | |||||||||

| Proven | 178 | 16.7 | 96 | 236 | 14.8 | 112 | 13 | -14 | |

| Probable | 2,550 | 32.0 | 2,620 | 2,050 | 24.1 | 1,590 | 33 | 65 | |

| Proven + Probable | 2,720 | 31.0 | 2,720 | 2,290 | 23.1 | 1,700 | 34 | 60 | |

| Mineral Resources | Exclusive of Mineral Reserves | Exclusive of Mineral Reserves | |||||||

| Measured | 1,900 | 2.9 | 177 | 1,940 | 2.9 | 181 | - | -2 | |

| Indicated | 12,900 | 4.7 | 1,930 | 11,900 | 5.1 | 1,970 | -8 | -2 | |

| Measured + Indicated | 14,800 | 4.4 | 2,110 | 13,900 | 4.8 | 2,150 | -8 | -2 | |

| Inferred | 10,300 | 5.5 | 1,830 | 8,280 | 7.1 | 1,900 | -23 | -4 | |

| December 31, 2018 | December 31, 2017 | % Change | |||||||

| Swan(1) | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Gold Grade | Gold Ounces | |

| Mineral Reserves | |||||||||

| Proven | 62 | 27.6 | 55 | 0 | 0 | 0 | N/A | N/A | |

| Probable | 1,410 | 50.6 | 2,290 | 588 | 61.2 | 1,160 | -17 | 97 | |

| Proven + Probable | 1,470 | 49.6 | 2,340 | 588 | 61.2 | 1,160 | -19% | 102 | |

| Mineral Resources | Exclusive of Mineral Reserves | Exclusive of Mineral Reserves | |||||||

| Measured | 2 | 59.6 | 4 | 0 | 0.0 | 0 | N/A | N/A | |

| Indicated | 32 | 15.7 | 16 | 46 | 116 | 171 | -86 | -91 | |

| Measured + Indicated | 34 | 18.3 | 20 | 46 | 116 | 171 | -84 | -88 | |

| Inferred | 249 | 13.4 | 107 | 570 | 36.6 | 671 | -63 | -84 | |

(1) The Swan Zone Mineral Reserve and Mineral Resource estimates are components of the estimates for the Fosterville mine.

Figure 1.

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/b130f2c7-7fca-429a-aaa3-11cd0b2e571f

Northern Territory (Cosmo Mine/Union Reefs Mill)

On June 30, 2017, Kirkland Lake Gold suspended operations at the Cosmo mine and Union Reefs mill with the operations being placed on care and maintenance. Following the move to care and maintenance, the Cosmo mine and Union Reef mill are being maintained in a state of readiness to resume operation in the event that new Mineral Reserves are delineated which establish an economic deposit or deposits in the Northern Territory.

In 2018, an extensive program of surface and underground exploration drilling and development was completed involving approximately 114,700 metres of drilling and the development of three exploration drifts at the Cosmo mine into the Lantern Deposit. On April 30, 2018, the Company announced that high-grade, visible-gold bearing mineralization had been intersected 1,000 metres below surface down plunge of former producing open pits at Union Reefs, the location of the Company’s processing facility. The results highlighted the potential that exists to establish additional sources of gold production in the Northern Territory. On November 5, 2018, the Company reported additional high-grade, visible-gold bearing mineralization at the Lady Alice Deposit at Union Reefs and also announced the discovery of high-grade mineralization at depth to the south of the existing Mineral Resources at Union Reefs. On December 11, 2018, the Company announced that work in the Northern Territory was moving to the advanced exploration phase, with a focus on a potential restart of mining and milling operations as early as the second half of 2019.

Mineral Reserves in the Northern Territory at December 31, 2018 totaled 107,000 ounces at 5.0 g/t, which compared to 215,000 ounces at an average grade of 2.4 g/t at December 31, 2017. The doubling of the average Mineral Reserve grade in the December 31, 2018 estimate resulted from an increase in the cut-off grade for the purpose of Mineral Reserve calculations at the Cosmo mine, the impact of additional drilling at Lantern and the removal of lower-grade ounces at other targets. M&I Mineral Resources totaled 1,750,000 ounces at an average grade of 2.5 g/t versus 1,810,000 ounces at an average grade of 2.3 g/t at December 31, 2017. Inferred Mineral Resources increased 16% at December 31, 2018 to 1,490,000 ounces at an average grade of 2.6 g/t from 1,280,000 ounces at an average grade of 2.5 g/t at December 31, 2016.

In 2019, exploration drilling is focusing on Mineral Resource growth and definition of the Lantern Deposit and the continued evaluation of targets at Union Reefs. Advanced exploration work is progressing towards a possible restart decision.

| December 31, 2018 | December 31, 2017 | % Change | |||||||

| Northern Territory | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Tonnes (000's) | Grade (g/t) | Gold Ounces (000’s) | Gold Grade | Gold Ounces | |

| Mineral Reserves | |||||||||

| Proven | 33 | 3.1 | 3 | 92 | 3.5 | 112 | -11 | -73 | |

| Probable | 633 | 5.1 | 103 | 2,710 | 2.4 | 1,590 | 113 | -50 | |

| Proven + Probable | 666 | 5.0 | 107 | 2,800 | 2.4 | 1,700 | 108 | -50 | |

| Mineral Resources | Exclusive of Mineral Reserves | Exclusive of Mineral Reserves | |||||||

| Measured | 1,770 | 4.7 | 268 | 1,750 | 4.7 | 264 | - | 2 | |

| Indicated | 20,400 | 2.3 | 1,480 | 22,400 | 2.1 | 1,540 | 10 | -4 | |

| Measured + Indicated | 22,200 | 2.5 | 1,750 | 24,100 | 2.3 | 1,810 | 9 | -3 | |

| Inferred | 18,100 | 2.6 | 1,490 | 16,300 | 2.5 | 1,280 | 4 | 16 | |

Technical Reports

The National Instrument 43-101 (“NI 43-101”) 2016 Technical Report for Fosterville dated March 30, 2017 and effective December 31, 2016 along with the 2017 Technical Report for Fosterville dated April 2, 2018 and effective December 30, 2017 supports the Company’s end-of-2018 Mineral Reserve and Mineral Resource disclosure and was prepared by Troy Fuller, MAIG, and Ion Hann, FAusIMM.

An updated NI 43-101 Technical Report effective December 31, 2018 will be available on the Company’s SEDAR profile at www.sedar.com for both the Fosterville and Macassa mines within 45 days of this news release.

Qualified Persons

Pierre Rocque, P.Eng., Vice President, Technical Services operations is a "qualified person" as defined in NI 43-101 and has reviewed and approved disclosure of the Mineral Reserves technical information and data for the Canadian assets included in this news release.

Ian Holland, FAusIMM, Vice President, Australian Operations is a "qualified person" as defined in NI 43-101 and has reviewed and approved the Mineral Reserves technical information and data for the Australian Assets included in this news release.

Simon Hitchman, FAusIMM (CP), MAIG, Principal Geologist, is a "qualified person" as such term is defined in NI 43-101 and has reviewed and approved the Mineral Resources technical information and data for the Australian Assets included in this news release.

Detailed footnotes related to Mineral Reserve Estimates (dated December 31, 2018)

- CIM definitions (2014) were followed in the calculation of Mineral Reserves.

- Mineral Reserves were estimated using a long-term gold price of US$1,230/oz (C$1,635/oz; A$1,710/oz).

- Cut-off grades for Canadian Assets were calculated for each stope, including the costs of: mining, milling, General and Administration, royalties and capital expenditures and other modifying factors (e.g. dilution, mining extraction, mill recovery.

- Cut-off grades for Australian Assets from 0.4 g/t Au to 3.0 g/t Au, depending upon width, mining method and ground conditions; dilution and mining recovery factors varied by property.

- Mineral Reserves estimates for the Canadian Assets were prepared under the supervision of P. Rocque, P. Eng.

- Mineral Reserves estimates for the Fosterville property were prepared under the supervision of Ion Hann, FAusIMM.

- Mineral Reserves estimates for the Northern Territory property were prepared under the supervision of Pierre Rocque. P. Eng.

- Mineral Reserves for Fosterville relate to Underground Mineral Reserves and do not include 649,000 tonnes at an average of 7.7 g/t for 160,000 ounces of Carbon-In-Leach Residues – 25% recovery is expected based on operating performances.

- Totals may not add exactly due to rounding.

Detailed footnotes related to Mineral Resource Estimates for Canadian Assets (dated December 31, 2018)

- CIM definitions (2014) were followed in the calculation of Mineral Resource.

- Mineral Resources are reported Exclusive of Mineral Reserves. Mineral Resources were calculated according to KL Gold’s Mineral Resource Estimation guidelines.

- Mineral Resource estimates were prepared under the supervision of Eric Kallio, P. Geo. Senior Vice President, Exploration.

- Mineral Resources are estimated using a long-term gold price of US$1,230/oz (C$1,635/oz).

- Mineral Resources were estimated using a 8.6 g/t cut-off grade for Macassa, a 2.9 g/t cut-off grade for Holt, and a 2.6 g/t cut-off grade for Taylor, a 3.9 g/t cut-off grade (Holloway), a 2.5 g/t cut-off grade for Canamax, Card, Runway and Ludgate, a 2.2 g/t cut-off grade for Hislop and 0 g/t cut-off grade for Aquarius.

- Totals may not add up due to rounding.

Detailed footnotes related to Mineral Resource Estimates for Australian Assets (dated December 31, 2018)

- CIM definitions (2014) were followed in the estimation of Mineral Resource.

- Mineral Resources are estimated using a long-term gold price of US$1,230/oz (A$1,710/oz)

- Mineral Resources for the Australian assets are reported exclusive of Mineral Reserves.

- Mineral Resources at Fosterville were estimated using cut-off grades 0.7 g/t Au for oxide and 1.0 g/t Au for sulfide mineralization to potentially open-pitable depths of approximately 100m, below which a cut-off grade of 3.0 g/t Au was used.

- Mineral Resources in the Northern Territory were estimated using a cut-off grade of 0.5 g/t Au for potentially open pit mineralization and cut-offs of 1.0 to 2.0g/t Au for underground mineralization.

- Mineral Resource estimates for the Fosterville property were prepared under the supervision of Troy Fuller, MAIG.

- Mineral Resource estimates for the Northern Territory properties were prepared under the supervision of Owen Greenberger, MAIG.

- Totals may not add up due to rounding.

About Kirkland Lake Gold Ltd.

Kirkland Lake Gold Ltd. is a mid-tier gold producer operating in Canada and Australia that produced 723,477 ounces in 2018 and is on track to achieve significant production growth over the next three years, including target production of 920,000 – 1,000,000 ounces in 2019, 930,000 – 1,010,000 ounces in 2020 and 995,000 – 1,055,000 ounces in 2021. The production profile of the Company is anchored by two high-grade, low-cost operations, including the Macassa Mine located in Northern Ontario and the Fosterville Mine located in the state of Victoria, Australia. Kirkland Lake Gold's solid base of quality assets is complemented by district scale exploration potential, supported by a strong financial position with extensive management and operational expertise.

For further information on Kirkland Lake Gold and to receive news releases by email, visit the website www.klgold.com.

Cautionary Note Regarding Forward-Looking Information

This News Release includes certain "forward-looking statements". All statements other than statements of historical fact included in this release are forward-looking statements that involve various risks and uncertainties. These forward-looking statements include, but are not limited to, statements with respect to planned exploration programs, costs and expenditures, changes in Mineral Resources and conversion of Mineral Resources to proven and probable reserves, and other information that is based on forecasts of future operational or financial results, estimates of amounts not yet determinable and assumptions of management. These forward-looking statements include, but are not limited to, statements with respect to future exploration potential, project economics, timing and scope of future exploration, anticipated costs and expenditures, changes in Mineral Resources and conversion of Mineral Resources to proven and probable reserves, and other information that is based on forecasts of future operational or financial results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements." Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual events or results to differ from those reflected in the forward-looking statements. Exploration results that include geophysics, sampling, and drill results on wide spacings may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of Mineral Resource. A Mineral Resource that is classified as "Inferred" or "indicated" has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an "indicated Mineral Resource" or "Inferred Mineral Resource" will ever be upgraded to a higher category of resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into proven and probable reserves.

There can be no assurance that forward-looking statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include, among others, risks related to international operations, risks related to obtaining the permits required to carry out planned exploration or development work, the actual results of current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined as well as future prices of gold, as well as those factors discussed in the section entitled "Risk Factors" in the Company’s Annual Information Form and other disclosures of "Risk Factors" by the Company and its predecessors, available on SEDAR. Although Kirkland Lake Gold has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Cautionary Note to U.S. Investors - Mineral Reserve and Resource Estimates

All resource and reserve estimates included in this news release or documents referenced in this news release have been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Standards"). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The terms "mineral reserve", "proven mineral reserve" and "probable mineral reserve" are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Standards. These definitions differ materially from the definitions in SEC Industry Guide 7 ("SEC Industry Guide 7") under the United States Securities Act of 1933, as amended, and the Exchange Act.

In addition, the terms "Mineral Resource", "measured Mineral Resource", "indicated Mineral Resource" and "Inferred Mineral Resource" are defined in and required to be disclosed by NI 43-101 and the CIM Standards; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the U.S. Securities and Exchange Commission (the "SEC"). Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into reserves. "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in very limited circumstances. Investors are cautioned not to assume that all or any part of a Mineral Resource exists, will ever be converted into a Mineral Reserve or is or will ever be economically or legally mineable or recovered.

FOR FURTHER INFORMATION PLEASE CONTACT

Anthony Makuch, President, Chief Executive Officer & Director

Phone: +1 416-840-7884

E-mail: tmakuch@klgold.com

Mark Utting, Vice-President, Investor Relations

Phone: +1 416-840-7884

E-mail: mutting@klgold.com