Latest Hole Drilled at Loncor's Adumbi Deposit Intersects Significant Widths and Grades in Multiple Gold Zones

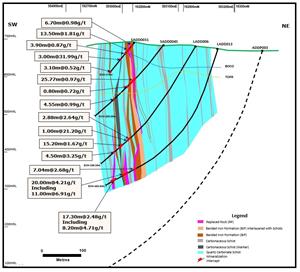

- Results include 20.00 metres grading 4.21 g/t gold (including 11.0 metres grading 6.91 g/t gold) and 17.30 metres grading 2.48 g/t gold (including 8.20 metres grading 4.71 g/t gold)

Loncor also provides update on Barrick Joint Venture exploration

TORONTO, May 25, 2021 (GLOBE NEWSWIRE) -- Loncor Resources Inc. ("Loncor" or the "Company") (TSX: "LN"; OTCQX: "LONCF”; FSE: "LO51") is pleased to announce further significant assay results from its drilling program within its 84.68%-owned Imbo Project in the eastern part of the Ngayu greenstone belt in the Democratic Republic of the Congo. Borehole LADD013 drilled at its flagship Adumbi deposit, intersected 20.00 metres grading 4.21 grammes per tonne (g/t) gold (including 11.00 metres grading 6.91 g/t Au), 17.30 metres grading 2.48 g/t gold (including 8.20 metres grading 4.71 g/t Au) and 7.04 metres grading 2.68 g/t gold.

Mineralized sections for borehole LADD013 are summarised in the table below:

| Borehole Number | From (m) | To (m) | Intersected Width (m) | Grade (g/t) Au |

| LADD013 | 394.06 | 401.10 | 7.04 | 2.68 |

| LADD013 | 418.65 | 438.65 | 20.00 | 4.21 |

| LADD013 including | 419.75 | 430.75 | 11.0 | 6.91 |

| LADD013 | 452.30 | 469.60 | 17.30 | 2.48 |

| LADD013 including | 457.35 | 465.55 | 8.20 | 4.71 |

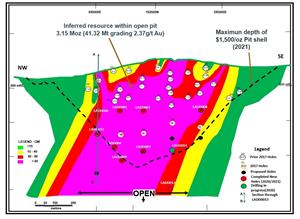

Borehole LADD013 had an inclination of minus 72 degrees and azimuth of 218 degrees at the start of hole and regular measurements of inclination and azimuth were taken at 30 metre intervals down the hole. All core was orientated, and it is estimated that the true widths of the mineralised sections are approximately 85% of the intersected width. All intercepted grades are uncut with maximum internal dilution equal to or less than 4 metres of intersected width. Borehole LADD013 intersected the mineralization at a depth of approximately 65 metres below the open pit shell (see Figure 1 below).

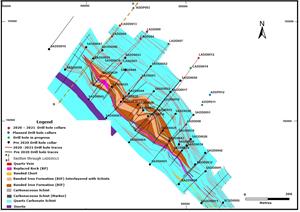

Commenting on these latest drilling results, Loncor President Peter Cowley said: “Borehole LADD013 was targeting the northwest edge of the mineralization but encountered a better than expected thickness of the banded ironstone package as well as grades due to the increased higher grade zones of “Replacement Rock” drilled. This suggests a shallower northwest plunge to the mineralization than the previously indicated sub vertical plunge at depth (see Figures 1, 2 & 3 below). Our focus now is to outline substantial underground resources at depth below the 3.15 million ounce inferred resource pit shell where higher grades are being intersected.”

The gold mineralization at Adumbi is associated with a thick package (up to a maximum of 130 metres) of interbedded banded ironstone formation (BIF) and quartz carbonate and chlorite schist with higher grade sections being found in a strongly altered siliceous unit termed “Replaced Rock” (RP) where structural deformation and alteration has completely destroyed the primary host lithological fabric. Disseminated sulphide assemblages include pyrite, pyrrhotite and arsenopyrite which can attain up to 20% of the total rock in places.

The objective of the current drilling program at Adumbi is to outline additional mineral resources to the current inferred mineral resource of 3.46 million ounces of gold on Loncor’s 84.68%-owned Imbo Project which contains the Adumbi, Kitenge and Manzako deposits (total inferred mineral resources of 43.0 million tonnes grading 2.51 g/t Au on these three deposits).

Barrick Joint Venture

Loncor received exploration reports from joint venture partner Barrick Gold, who are managing and funding the joint venture with Loncor that comprises several joint venture agreements and covers approximately 2,000 square kilometres of the Ngayu Archean greenstone belt (the “Joint Venture”). This Joint Venture area does not include Loncor’s Imbo Project encompassing the Adumbi deposit, Loncor’s Makapela deposit or Loncor’s Yindi prospect. As announced previously, Barrick commenced a scout drilling program on a number of target prospects in the Ngayu greenstone belt, as well as continued to delineate additional priority targets for follow-up drilling. High priority targets were developed at Yambenda/Yasua, Mokepa and Mongaliema with scout drilling completed at Yambenda/Yasua and Mokepa. At Yambenda, four drill sections tested a 3.6 kilometre portion of the 9.5 kilometre long anomalous soil corridor. All the holes intersected mineralization associated to WNW shear structures developed at a contact zone between banded ironstone formation and volcano-sediments including conglomerates (similar host rock assemblage found at Kibali mine). Best drill intercepts included 14 metres grading 0.85 g/t Au in YBDD0001, 49 metres grading 0.52 g/t Au and 14.5 metres grading 1.38 g/t Au in YBDD0002 and 35.05 metres at 0.60 g/t Au in YBDD0006. At Mokepa, six scout holes were drilled with the best holes assaying 19 metres grading 1.04 g/t Au in borehole ADDD0001 and 46.7 metres grading 1.32 g/t Au in hole ADDD0002. Although large mineralized gold systems were delineated at both Yambenda and Mokepa, drill result grades were below Barrick’s Tier 1 hurdle rates and, as a result, no further work is planned at these two targets.

At Mongaliema, the target area is a west-northwest trending shear zone hosted within altered metasediments with cherty units near the contact of a dolerite intrusive. Pitting has demonstrated that much of the area is covered by thick transported cover which hinders near surface exploration. Pitting was undertaken to the southwest of the trench which graded 32 metres grading 1.37 g/t Au. Results from pits in excess of 5 metres deep confirmed the southwestern extension, beneath thick transported alluvial material with an average high grade of 18.13 g/t Au from eleven samples. Further work is warranted from the results received to date at Mongaliema.

Barrick Gold has now informed Loncor that it will not be continuing exploration on the Joint Venture ground. Loncor will be assessing the results of the Barrick Joint Venture program to determine whether further exploration by Loncor on the Joint Venture ground is warranted. In particular, the Mongaliema target, which is only seven kilometres from Loncor’s Makapela deposit, which has an indicated mineral resource of 614,200 ounces of gold (2.20 million tonnes grading 8.66 g/t Au) and an inferred mineral resource of 549,600 ounces of gold (3.22 million tonnes grading 5.30 g/t Au), will be further explored by Loncor especially as this promising target has not been drilled by Barrick. Mongaliema will be evaluated to determine whether it has the resource potential to be combined with the nearby Makapela deposit. The high grade of the Makapela deposit also affords the potential for this resource to be transported to a central processing facility at Adumbi.

Loncor’s aim is to continue to add and upgrade mineral resources to Adumbi’s current 3.15 million ounce inferred resource (41.316 million tonnes grading 2.37 g/t Au), and commence a Preliminary Economic Assessment of Adumbi during this quarter.

Quality Control and Quality Assurance re Adumbi Deposit Drill Results

Drill cores for assaying were taken at a maximum of one-metre intervals and were cut with a diamond saw, with one-half of the core placed in sealed bags by Company geologists and sent to the Company’s on-site sample preparation facility. The core samples were then crushed down to 80% passing minus 2 mm and split with one half of the sample up to 1.5 kg pulverized down to 90% passing 75 microns. Approximately 150 grams of the pulverized sample was then sent to the SGS Laboratory in Mwanza, Tanzania (independent of the Company). Gold analyses were carried out on 50g aliquots by fire assay. In addition, check assays were also carried out by the screen fire assay method to verify high-grade sample assays obtained initially by fire assay. As part of the Company’s QA/QC procedures, internationally recognized standards, blanks and duplicates were inserted into the sample batches prior to submitting to SGS Laboratory.

Qualified Person

Peter N. Cowley, who is President of Loncor and a "qualified person" as such term is defined in National Instrument 43-101, has reviewed and approved the technical information in this press release.

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/eb69df14-70cc-4b90-8b74-0ead2e2066e5

https://www.globenewswire.com/NewsRoom/AttachmentNg/124c4c93-af19-44af-8188-017f7590f136

https://www.globenewswire.com/NewsRoom/AttachmentNg/d2aa3328-4c64-41e6-8a38-6df471ccb497

Technical Reports

Additional information with respect to the Company’s Imbo Project (which includes the Adumbi deposit) is contained in the technical report of Minecon Resources and Services Limited dated April 17, 2020 and entitled "Independent National Instrument 43-101 Technical Report on the Imbo Project, Ituri Province, Democratic Republic of the Congo". A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov. Additional information with respect to the current mineral resource estimate for the Adumbi deposit is contained in the Company’s press release dated April 27, 2021, a copy of which can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Additional information with respect to the Company’s Makapela Project, and certain other properties of the Company in the Ngayu gold belt, is contained in the technical report of Venmyn Rand (Pty) Ltd dated May 29, 2012 and entitled "Updated National Instrument 43-101 Independent Technical Report on the Ngayu Gold Project, Orientale Province, Democratic Republic of the Congo". A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

About Loncor Resources Inc.

Loncor is a Canadian gold exploration company focussed on the Ngayu Greenstone Gold Belt in the northeast of the Democratic Republic of the Congo (the “DRC”). The Loncor team has over two decades of experience of operating in the DRC. Loncor’s growing resource base in the Ngayu Belt currently comprises the Imbo and Makapela Projects. At the Imbo Project, the Adumbi deposit and two neighbouring deposits hold an inferred mineral resource of 3.466 million ounces of gold (42.996 million tonnes grading 2.51 g/t Au), with 84.68% of this resource being attributable to Loncor. Loncor is currently carrying out a drilling program at the Adumbi deposit with the objective of outlining additional mineral resources. The Makapela Project (which is 100%-owned by Loncor and is located approximately 50 kilometres from the Imbo Project) has an indicated mineral resource of 614,200 ounces of gold (2.20 million tonnes grading 8.66 g/t Au) and an inferred mineral resource of 549,600 ounces of gold (3.22 million tonnes grading 5.30 g/t Au).

Additional information with respect to Loncor and its projects can be found on Loncor's website at www.loncor.com.

Cautionary Note to U.S. Investors

The United States Securities and Exchange Commission (the "SEC") permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. Certain terms are used by the Company, such as "Indicated" and "Inferred" "Resources", that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in the Company's Form 20-F annual report, File No. 001- 35124, which may be secured from the Company, or from the SEC's website at http://www.sec.gov/edgar.shtml.

Cautionary Note Concerning Forward-Looking Information

This press release contains forward-looking information. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding drill results at the Adumbi deposit, mineral resource estimates, adding to and upgrading mineral resources at Adumbi, commencing a Preliminary Economic Assessment of Adumbi, potential mineralization, exploration results under the Barrick Joint Venture, potential gold discoveries, drill targets, exploration results, and future exploration and development) are forward-looking information. This forward-looking information reflects the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking information is subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking information, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things, the possibility that future exploration (including drilling) or development results will not be consistent with the Company's expectations, the possibility that drilling programs will be delayed, activities of the Company may be adversely impacted by the continued spread of the widespread outbreak of respiratory illness caused by a novel strain of the coronavirus (“COVID-19”), including the ability of the Company to secure additional financing, risks related to the exploration stage of the Company's properties, uncertainties relating to the availability and costs of financing needed in the future, failure to establish estimated mineral resources (the Company’s mineral resource figures are estimates and no assurances can be given that the indicated levels of gold will be produced), changes in world gold markets or equity markets, political developments in the DRC, gold recoveries being less than those indicated by the metallurgical testwork carried out to date (there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in large tests under on-site conditions or during production), fluctuations in currency exchange rates, inflation, changes to regulations affecting the Company's activities, delays in obtaining or failure to obtain required project approvals, the uncertainties involved in interpreting drilling results and other geological data and the other risks disclosed under the heading "Risk Factors" and elsewhere in the Company's annual report on Form 20-F dated March 31, 2021 filed on SEDAR at www.sedar.com and EDGAR at www.sec.gov. Forward-looking information speaks only as of the date on which it is provided and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

For further information, please visit our website at www.loncor.com or contact:

Arnold Kondrat , CEO, Tel: (416) 366-7300

Peter Cowley, President, +44 7904540876

John Barker, VP of Business Development, +44 7547 159 521