Leagold Reports High Grade Drill Results at Guadalupe Open Pit and Los Filos Underground

VANCOUVER, Sept. 12, 2019 /CNW/ - Leagold Mining Corporation (TSX:LMC; OTCQX:LMCNF) ("Leagold" or the "Company") reports drilling results from the Los Filos underground and the Guadalupe open pit at the Los Filos mine complex in Mexico. Highlights from the Los Filos underground mine include 8.86 grams per tonne (gpt) over 27.45 metres and 6.59 gpt over 15.46 metres. Highlights from the Guadalupe area include 1.40 gpt over 32.73 metres, including 7.71 gpt over 2.67 metres, and 6.20 gpt over 10.61 metres, including 10.55 gpt over 5.20 metres (all capped grades and true widths; see Tables 1 to 3).

Leagold CEO Neil Woodyer stated: "These drill programs at Los Filos will contribute to the reserve base and extend the mine life. At the Los Filos underground mine, we have encountered a new zone of mineralization and have confidence of adding this to reserves.

"At Guadalupe, we are testing for extensions of the mineralization at depth and also confirming the limited nature of old underground workings prior to open pit mining in this area.

"The mine expansion program is now under way and stripping at the Guadalupe open pit will begin in October. The Guadalupe open pit, with reserve grades of 1.37 gpt, provides high margin ore for our near-term production schedule. These initial exploration results are demonstrating that Guadalupe also has significant growth potential."

Los Filos Underground Step-Out Drilling

The Los Filos underground drilling program totals 12,750 metres in 55 holes for $3M. The objective of the program is to add to reserves and extend the mine life for this important high-grade ore source at Los Filos. The program began in July and is expected to be complete by the end of Q1 2020.

Table 1: Drill Program Highlights for Los Filos Underground Step-Out

Hole ID | Zone | Type | From | To (m) | Length | True | Grade | Capped |

LFE-01-19 | SILL | Endoskarn | 200.70 | 203.25 | 2.55 | 2.49 | 3.57 | |

CON | Oxide | 360.00 | 380.80 | 20.80 | 15.46 | 11.45 | 6.59 | |

includes | CON | Oxide | 375.15 | 380.80 | 5.65 | 4.20 | 34.65 | 16.76 |

INTR | Endoskarn | 400.50 | 405.50 | 5.00 | 3.54 | 3.94 | ||

LFE-02-19 | SILL | Oxide/Endo | 176.40 | 208.10 | 31.70 | 27.45 | 16.87 | 8.86 |

includes | SILL | Oxide | 176.40 | 182.40 | 6.00 | 5.20 | 61.81 | 23.79 |

and | SILL | Endoskarn | 189.90 | 198.25 | 8.35 | 7.23 | 11.14 | 8.09 |

and | SILL | Endoskarn | 199.45 | 208.10 | 8.65 | 7.49 | 7.10 |

Notes: | |

• | Intervals in bold are shown on cross sections or in the text of the news release |

• | INTR = intrusive; CON = at intrusive contact; SILL = diorite |

• | Endo = endoskarn within intrusive; Exo = exoskarn within carbonate |

• | Only intercepts with over 3 gpt when diluted to a minimum true width of 3 metres are shown |

• | Individual assays within the intercepts were capped using 30 gpt limit |

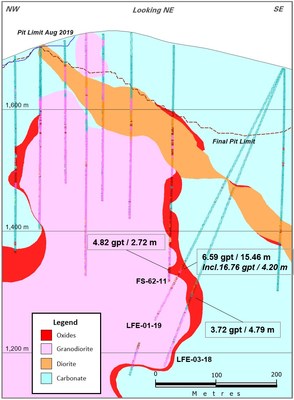

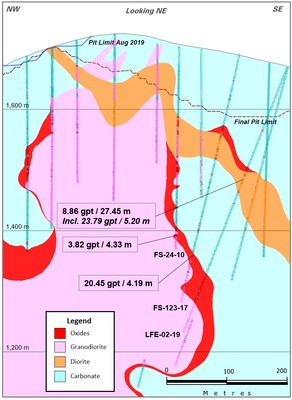

The program targets areas of mineralization close to existing underground workings that have a high probability of adding to mineral resources and reserves. Four holes have been completed and assays were received for two, and composites are shown in Table 1. These holes are a follow-up to previous exploration holes that identified an additional mineralized zone, the Encino zone, located east of the current workings (see Table 2).

Table 2: Previous Drill Hole Intercepts from Encino Zone at Los Filos Underground

Hole ID | Zone | Type | From | To (m) | Length | True Width | Grade | Capped |

FS-123-17 | CON | Oxide | 340.85 | 346.10 | 5.25 | 4.19 | 21.20 | 20.45 |

LFE-03-18 | CON | Oxide | 385.25 | 391.50 | 6.25 | 4.79 | 3.72 | |

FS-62-11 | CON | Oxide | 323.95 | 329.40 | 5.45 | 2.72 | 4.82 | |

FS-24-10 | CON | Oxide | 311.10 | 316.75 | 5.65 | 4.33 | 3.82 |

Notes: | |

• | Intervals in bold are shown on cross sections or in the text of the news release |

• | INTR = intrusive; CON = at intrusive contact; SILL = diorite |

• | Only intercepts with over 3 gpt when diluted to a minimum true width of 3 metres are shown |

• | Individual assays within the intercepts were capped using 30 gpt limit |

Figure 1: Los Filos Cross Section Showing LFE-01-19

Figure 2: Los Filos Cross Section Showing LFE-02-19

The Los Filos underground Proven and Probable mineral reserve totals 1.91 million tonnes at 5.5 gpt containing 0.34 million ounces gold (refer to Appendix A for a breakdown into categories).

Guadalupe Drilling

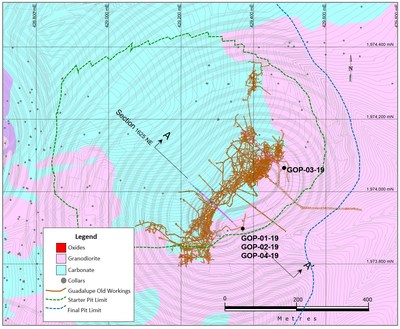

The Guadalupe drilling program totals 22,940 metres in 130 holes for $4M. The program began in July and is expected to be completed by the end of Q1 2020. Four holes have been completed, and assays from two have been received, and composites are shown in Table 3 below.

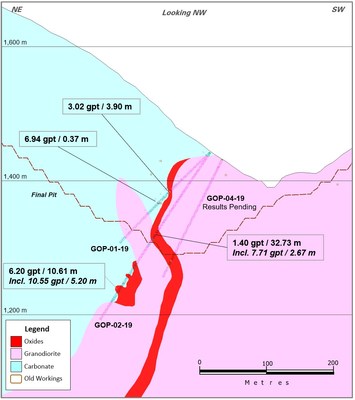

The drilling program at Guadalupe is an opportunity to evaluate several areas that have potential for high-grade mineralization and also to confirm broad widths of lower grade mineralization that are currently classified as Inferred and are being treated as waste in the open pit mining schedule. Leagold has identified several areas to upgrade Inferred to Indicated resources which may result in a reduction of the strip ratio. The program is also designed to test the extension of mineralization at depth and to confirm the limited extent of old underground workings prior to open pit mining in this area. Drilling to date confirms that the underground workings are narrow and are restricted to narrow high-grade intervals within the broader mineralized zone.

Table 3: Drill Program Highlights for Guadalupe Deposit

Hole ID | Zone | Type | From | To (m) | Length | True | Grade | Capped |

GOP-01-19 | CON | Oxide | 80.40 | 87.20 | 6.80 | 3.90 | 3.02* | |

includes | CON | Oxide | 80.40 | 82.30 | 1.90 | 1.09 | 3.88 | |

and | VOID | 82.30 | 83.60 | 1.30 | 0.75 | |||

and | CON | Oxide | 83.60 | 85.50 | 1.90 | 1.09 | 3.23 | |

and | VOID | 85.50 | 86.45 | 0.95 | 0.54 | |||

and | CON | Carbonate | 86.45 | 87.20 | 0.75 | 0.43 | 0.34 | |

RAM | Oxide | 107.90 | 108.505 | 0.65 | 0.37 | 6.94 | ||

GOP-02-19 | INTR | Endoskarn | 81.80 | 87.30 | 5.50 | 3.15 | 0.52 | |

and | INTR | Endoskarn | 92.25 | 152.35 | 60.10 | 32.73 | 1.62* | 1.40* |

includes | INTR | Endoskarn | 92.25 | 125.30 | 33.05 | 18.00 | 0.80 | |

and | VOID | 125.30 | 126.05 | 0.75 | 0.41 | |||

and | CON | Oxide | 126.05 | 152.35 | 26.30 | 14.32 | 2.65 | |

and | CON | Oxide | 136.70 | 141.60 | 4.90 | 2.67 | 10.39 | 7.71 |

CON | Oxide | 196.50 | 203.15 | 6.65 | 5.76 | 0.85 | ||

RAM | Oxide | 217.95 | 223.40 | 5.45 | 4.72 | 2.08 | ||

RAM | Oxide | 238.50 | 250.75 | 12.25 | 10.61 | 6.20 | ||

includes | RAM | Oxide | 238.50 | 244.50 | 6.00 | 5.20 | 10.55 | |

*Average grade excludes voids from underground workings | ||||||||

Notes: | |

• | Intervals in bold are shown on cross sections or mentioned in the text of the news release |

• | INTR = intrusive; CON = at intrusive contact; RAM = mineralization in limestone; VOID = underground workings |

• | Endo = endoskarn within intrusive; Exo = exoskarn within carbonate |

• | Only intercepts with over 0.2 gpt are included |

• | Individual assays within the intercepts were capped using 30 gpt limit |

This program is expected to add to the reserve base and reduce the strip ratio in this area. In hole GOP-02-19, a new mineralized zone was encountered below the Guadalupe pit limit and this zone will continue to be tested during the drilling program.

The Guadalupe open pit proven and probable mineral reserve totals 34.5 million tonnes at 1.37 gpt containing 1.52 million ounces gold (refer to Appendix A for a breakdown into categories). The pit design also contains Inferred mineral resources of 17.5 Mt at 1.1 gpt with contained gold of 0.62 Moz gold.

The Guadalupe program also includes reverse circulation drilling in an area of skarn and intrusive that is only partially classified as Inferred resource. The opportunity is to enable additional material to be converted to resources and potentially be added to the reserve base.

Figure 3: Guadalupe Plan View Map

Figure 4: Guadalupe Cross Section 1625 NE

Qualified Persons

Doug Reddy, P.Geo., Leagold's Senior Vice President – Technical Services, is a Qualified Person under NI 43-101, and has reviewed and approved the technical contents of this news release on behalf of Leagold. The disclosure of the drill results contained in this news release is in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects.

The Los Filos mine complex employs industry standard drilling and sampling procedures. All exploration samples are sent to an ALS Global facility in Guadalajara for preparation, and to Vancouver for analyses by fire assay and ICP. A full quality control and assurance program and protocols are in place and are aligned with best practices including regular insertion of certified reference standards, blanks, and duplicates as documented in Leagold's most recent technical report for the Los Filos Mine Complex dated March 11, 2019.

About Leagold Mining Corporation

Leagold is a mid-tier gold producer with a focus on opportunities in Latin America. Leagold is based in Vancouver, Canada and owns four operating gold mines in Mexico and Brazil, along with a near-term gold mine restart project in Brazil and an expansion opportunity at the Los Filos mine complex in Mexico. Leagold is listed on the TSX under the trading symbol "LMC" and trades on the OTCQX market as "LMCNF".

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release contains "forward looking information" or "forward looking statements" within the meaning of applicable securities legislation. All statements other than statements of historical fact, included herein, including without limitation: the exploration results, potential mineralization, the possibility of: adding to inferred resources, converting inferred resources to indicated resources, converting resources to reserves and reduction of the strip ratio, estimated costs of drill programs; timing of commencement of stripping at the Guadalupe open pit; growth potential of Guadalupe open pit; and expected timing of completion of the drill programs. The material factors or assumptions used to develop forward looking information or statements are disclosed throughout this document.

Forward looking information and forward looking statements, while based on management's best estimates and assumptions, are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Leagold to be materially different from those expressed or implied by such forward-looking information or forward looking statements, including but not limited to: fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, failure to establish estimated mineral resources, the possibility that future exploration results will not be consistent with the Company's objectives, and other risks of the mining industry as well as those factors discussed in the section entitled "Description of the Business – Risk Factors" in Leagold's most recent AIF available on SEDAR at www.sedar.com.

Although Leagold has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information and forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information or statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information or statements. The Company has and continues to disclose in its Management's Discussion and Analysis and other publicly filed documents, changes to material factors or assumptions underlying the forward-looking information and forward-looking statements and to the validity of the information, in the period the changes occur. The forward-looking statements and forward-looking information are made as of the date hereof and Leagold disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements or forward-looking information contained herein to reflect future results. Accordingly, readers should not place undue reliance on forward-looking statements and information.

APPENDIX A

Table A-1: Mineral Reserves for Los Filos Mine Complex (Effective Date of October 31, 2018)

Area | Classification | Tonnes | Grade | Contained |

(kt) | (gpt Au) | (koz Au) | ||

Los Filos Open Pit | Proven | 23,384 | 0.67 | 506 |

Probable | 3,473 | 0.47 | 52 | |

Proven and Probable | 26,857 | 0.65 | 558 | |

Bermejal Open Pit | Proven | 1,172 | 0.48 | 18 |

Probable | 33,422 | 0.57 | 613 | |

Proven and Probable | 34,593 | 0.57 | 631 | |

Guadalupe Open Pit | Proven | 381 | 0.51 | 6 |

Probable | 34,096 | 1.38 | 1,514 | |

Proven and Probable | 34,477 | 1.37 | 1,520 | |

Los Filos Underground | Proven | 836 | 5.34 | 144 |

Probable | 1,073 | 5.63 | 194 | |

Proven and Probable | 1,910 | 5.50 | 338 | |

Bermejal Underground | Proven | 395 | 7.50 | 95 |

Probable | 5,989 | 6.51 | 1,253 | |

Proven and Probable | 6,383 | 6.57 | 1,348 | |

TOTAL | Proven | 26,168 | 0.91 | 769 |

Probable | 78,053 | 1.44 | 3,626 | |

Proven and Probable | 104,220 | 1.31 | 4,395 | |

Probable Leach Pad Inventory (recoverable) | 114 | |||

Total Proven and Probable | 4,509 | |||

Notes: | |

1. | CIM (2014) Definition Standards were followed for Mineral Reserves. |

2. | Mineral Reserves used a gold price of US$1,200/oz; exchange rate of Mex$19:US$1. |

3. | Tonnage and grade measurements are in metric units. Contained gold is reported as troy ounces. |

4. | Mineral Reserves are stated in terms of delivered tonnes and grade, before process recovery. The exception is leach pad inventory, which is stated in terms of recoverable gold ounces. |

5. | Mineral Reserves are quoted using a NSR break-even cut-off grade approach with minimum block NSR of $149.4/t for Bermejal underground. Cut-off grade for the Los Filos underground is 2.59 gpt. Mineral reserves for Los Filos, Bermejal and Guadalupe open pits are based on variable break-even cut-offs for ore revenue as generated by process destination and recoveries. Variables for revenue calculation include process cost, recovery, and estimated gold, copper and sulphur grades. Allowances for external dilution and mining recovery are applied. |

6. | Details of cut-off grades, bulk densities, mining widths, dilution, mining factors and process recovery assumptions applied to Mineral Reserves and Mineral Resources are provided in the "Independent Technical Report for the Los Filos Mine Complex, Mexico" by SRK Consulting (Canada) Inc., and dated March 11, 2019 with an effective date of October 31, 2018. Dr. G. Arseneau, P.Geo., E. Olin, RM-SME, T. Olson, FAusIMM, N. Winkelmann, FAusIMM, N. Lincoln, P.Eng., M. Rykaart, P.Eng., D. Nicholas, P.E. are the Qualified Persons that prepared or supervised preparation of the information contained in the Technical Report. |

7. | Summation errors may be present due to rounding. |

SOURCE Leagold Mining Corporation

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2019/12/c9849.html