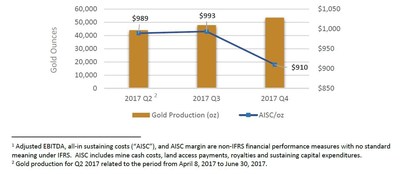

Leagold Reports Q4 2017 AISC of $910/oz and AISC Margin of $18.7 Million

(All amounts in US dollars, unless otherwise indicated)

- During Q4 2017, Los Filos generated:

- Gold production of 53,446 ounces at all-in sustaining costs1 ("AISC") of $910/oz

- Adjusted EBITDA1 of $13.8 million

- AISC margin1 of $18.7 million

- With full-year Los Filos gold production of 191,195 ounces ("oz"), Leagold delivered the mid-point of 2017 production guidance range of between 185,000 and 200,000 oz

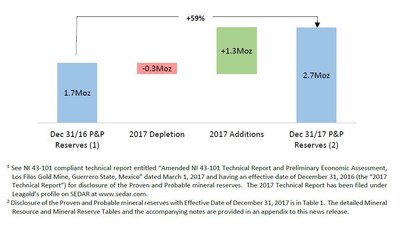

- As of December 31, 2017, Leagold's Proven and Probable mineral reserves ("P&P reserves") totaled 2.7 million ounces of gold (see Table 5), a 59% increase over the previous year

- Q4 2017 results show progressive improvements in AISC

- From the acquisition of Los Filos on April 8, 2017 to December 31, 2017, Leagold generated adjusted net earnings of $13.9 million

- Leagold generated positive free cash flow of $1.2 million during Q4 2017

- At December 31, 2017, Leagold had cash and cash equivalents of $54.0 million

VANCOUVER, March 8, 2018 /CNW/ - Leagold Mining Corporation (TSX:LMC; OTCQX:LMCNF) ("Leagold" or the "Company") reports Q4 2017 gold production of 53,446 ounces at its Los Filos mine at AISC of $910/oz, resulting in an AISC margin1 of $18.7 million. With full-year Los Filos gold production of 191,195 oz, Leagold has delivered the mid-point of the 2017 production guidance range of between 185,000 and 200,000 oz. Leagold had anticipated AISC of between $875/oz to $925/oz for H2 2017, and this guidance range was achieved for Q4 2017.

During Q4 2017, gold production improved compared to the prior quarter due to continued improvements in utilization rates, higher productivity of mining equipment, increased open pit and underground ore tonnes mined, and higher mined grades as shown in Table 1.

Table 1: Los Filos Operating Summary from April 8 to December 31, 2017

|

Physicals |

Unit |

Q2 20171 |

Q3 2017 |

Q4 2017 |

2017 |

|

Tonnes mined – open pit |

000s |

6,696 |

7,602 |

7,833 |

22,131 |

|

Tonnes of ore mined – open pit |

000s |

1,956 |

2,091 |

2,627 |

6,674 |

|

Avg. gold grade mined – open pit |

g/t |

0.57 |

0.67 |

0.76 |

0.68 |

|

Tonnes of ore mined – underground |

000s |

89 |

98 |

102 |

289 |

|

Avg. gold grade mined – underground |

g/t |

6.33 |

7.43 |

7.25 |

7.03 |

|

Tonnes of ore processed |

000s |

1,986 |

2,134 |

2,718 |

6,838 |

|

Recovery rate2 |

% |

82% |

76% |

67% |

74% |

|

Gold produced |

oz |

43,980 |

47,766 |

53,446 |

145,192 |

|

Unit Cost Analysis |

|||||

|

Mining cost - open pit |

$/t mined |

1.45 |

1.39 |

1.31 |

1.38 |

|

Mining cost - underground |

$/t ore |

100 |

104 |

102 |

102 |

|

Processing costs |

$/t placed |

10.93 |

9.75 |

7.67 |

9.27 |

|

Site G&A costs |

$/t placed |

2.12 |

1.74 |

1.85 |

1.89 |

|

1 Q2 2017 is for the period from April 8, 2017 to June 30, 2017 |

|

2 Based on total gold ounces produced in the period, including reprocessed ounces |

Table 2: Los Filos AISC Margin3 from April 8 to December 31, 2017

|

(in $000s) |

Q2 20171 |

Q3 2017 |

Q4 2017 |

2017 | ||

|

Gold revenue |

67,199 |

60,602 |

65,196 |

192,997 | ||

|

Mining costs – open pit |

9,681 |

10,583 |

10,225 |

30,489 | ||

|

Mining costs - underground |

8,889 |

10,176 |

10,434 |

29,499 | ||

|

Processing costs |

21,697 |

20,806 |

20,860 |

63,363 | ||

|

Site general and administration costs |

4,212 |

3,715 |

5,024 |

12,951 | ||

|

Inventory and other adjustments |

2,580 |

(4,864) |

(6,705) |

(8,989) | ||

|

Total cash costs2 |

47,059 |

40,416 |

39,838 |

127,313 | ||

|

Land access payments |

3,393 |

3,552 |

3,493 |

10,438 | ||

|

Royalties |

307 |

364 |

324 |

995 | ||

|

Sustaining capital2, 3 |

2,680 |

2,621 |

2,877 |

8,178 | ||

|

AISC2,3 |

53,439 |

46,953 |

46,532 |

146,924 | ||

|

AISC margin2,3 |

13,760 |

13,649 |

18,664 |

46,073 | ||

|

Cash cost per gold ounce sold2 |

$/oz |

871 |

855 |

779 |

835 | |

|

AISC per gold ounce sold2,3 |

$/oz |

989 |

993 |

910 |

964 | |

|

1 Q2 2017 includes the Los Filos operating period from April 8, 2017 to June 30, 2017. |

|

2 Q3 2017 cash costs and AISC exclude the impact of $1.6 million in non-recurring transition costs and include the impact of a $0.5 million reclassification of Q2 2017 operating costs to non-sustaining capital related to the Bermejal Underground expansion project. In addition, sustaining capital includes the impact of a $0.3 million reclassification of Q2 2017 sustaining capital to non-sustaining capital related to the Bermejal Underground expansion project. (Q2 2017 cash costs and AISC exclude the impact of $2.1 million in non-recurring transition costs and the impact of $2 million in certain inventory adjustments through purchase price allocation ("PPA") valuation relating to the acquisition of Los Filos). |

|

3 Sustaining capital, AISC and AISC margin are non-IFRS financial performance measures with no standard meaning under IFRS. |

Leagold Q4 Free Cash Flow and Cash Reconciliation

From the AISC margin of $18.7 million generated during Q4 2017, Leagold invested $8.1 million for the Bermejal Underground expansion project, most of which was related to drilling and infrastructure development, and $2.9 million for the agglomerator and overland conveyor projects and other optimization initiatives. Leagold generated positive free cash flow of $1.2 million during Q4 2017.

Table 3: Q4 2017 Los Filos Free Cash Flow and Cash Reconciliation

|

(In $000s) |

Three months ended | |

|

Gold revenue |

65,196 | |

|

Less: AISC1 |

(46,532) | |

|

AISC margin1 |

18,664 | |

|

Less: Non-sustaining investment capex |

||

|

Bermejal Underground expansion project |

(8,080) | |

|

Overland conveyors, agglomerator, other |

(2,862) | |

|

AISC margin after investment capex |

7,722 | |

|

Operating working capital changes (excluding VAT), net |

(4,095) | |

|

Decrease in VAT receivable |

2,869 | |

|

Taxes paid |

(137) | |

|

Interest paid on loan facility |

(3,195) | |

|

Corporate and administration |

(4,358) | |

|

Corporate working capital changes, other |

2,376 | |

|

Cash inflow for the period |

1,182 | |

|

Opening cash balance |

52,857 | |

|

Closing cash balance |

54,039 | |

|

1 AISC is a non-IFRS financial performance measure with no standard meaning under IFRS. AISC includes mine cash costs, land access payments, royalties and sustaining capital expenditures. |

2018 Los Filos Outlook

During 2018, Leagold will continue to focus on the advancement of the Bermejal Underground expansion project at the Los Filos mine. During 2017, Leagold completed a 56,000 metre infill and step-out drilling program, completed a portal and decline trade-off analysis and commenced the development of an exploration portal and ramp. Over 500 metres of development has been completed on the main ramp plus an additional 191 metres of secondary development (as of March 1, 2018). The cross cut to access the test mining area commenced in late February and is scheduled to reach mineralization by the end of Q2 2018.

The Los Filos mineral resources and mineral reserves at December 31, 2017 were reported in the March 8, 2018 news release. As of December 31, 2017, Leagold's P&P reserves totaled 2.7 million ounces ("Moz") of gold with an average grade of 1.26 g/t (see Table 5), a 59% increase over the previous year. With estimated depletion from mining of 0.3 Moz of gold during 2017, the estimated total addition to P&P reserves was 1.3 Moz of gold during 2017. This growth excludes the Bermejal Underground expansion project, which has M&I resources of 2.1 Moz of gold at an average grade of 5.96 g/t reported as of December 31, 2017 (see Table 6) and is currently in the mine design phase in preparation for declaration of reserves in mid-2018.

With the highly successful exploration programs in 2017 that increased both the size and grade of the mineral resources and mineral reserves at Los Filos, in late 2017 Leagold commenced an evaluation of the benefits of building a carbon-in-leach processing plant at Los Filos. A processing plant provides higher gold recoveries than the current heap leach process, with testwork to date supporting recovery rates around 90%, and can process a wider range of ore types. It is expected that Los Filos will continue with the heap leach pads for lower grade oxide ores in parallel with sending higher grade ores to the plant. Additional metallurgical testwork, engineering studies and design work is ongoing and is expected to be included in a new site-wide technical report by the end of Q2 2018.

At the Los Filos Underground, a $13 million infill, step-out and exploration drilling program of 62,000 metres plus 220 metres of development is under way. The objectives of the program are to expand the resource base and to upgrade classification of the Inferred resources to enable conversion to mineral reserves. The holes will be drilled from both underground and surface locations. Targets include down plunge and on strike extensions of known high grade mineral deposits as well as exploration of the mineralized skarn zone along the untested portions of the Los Filos intrusive contact.

2018 Production Outlook

In January 2018, Leagold reported 2018 gold production guidance at Los Filos of between 215,000 to 240,000 ounces at AISC of $875/oz to $925/oz, representing growth of 12% to 25% over the 191,195 oz produced in 2017. During Q2 2018, Leagold expects to begin realizing the benefits from the overland conveyor and agglomerator capital projects. In addition, the mine plan sequence is scheduling higher gold production during H2 2018. As a result of this production profile, higher AISC is expected during H1 2018 and lower AISC is expected during H2 2018.

On February 15, 2018, Leagold entered into a definitive agreement with Brio Gold Inc. ("Brio") to acquire, on a Brio Board supported basis by way of a statutory plan of arrangement, all of the issued and outstanding shares of Brio. The acquisition of Brio has the potential to transform Leagold into an intermediate gold producer with four mines and a development project with diversification across Mexico and Brazil. On a pro forma basis, Leagold is expecting to produce between 420,000 and 475,000 oz in 2018, based on market guidance provided by each of Leagold and Brio. Leagold will also have a strong platform for further growth in Mexico and Brazil.

Following completion of the acquisition of Brio and review of its operating plans, Leagold will provide revised 2018 production and AISC guidance.

Adjusted Net Earnings

Adjusted net earnings attributable to Leagold's shareholders have been adjusted for items that management believes are not reflective of the underlying operating performance of the Company, including the impact of foreign exchange gains and losses, deferred income tax recovery/expense, change in fair value of warrant derivatives, and other non-recurring items, such as transaction costs, share-based payments and one-time fair value adjustments from the acquisition of Los Filos.

Leagold's Q4 2017 adjusted net earnings1 were $2.3 million, or $0.01 per share. From the acquisition of Los Filos on April 8, 2018 to December 31, 2017, Leagold's adjusted net earnings1 were $13.9 million, or $0.09 per share.

Table 4: Q4 2017 and Acquisition to December 31, 2017 Adjusted Net Earnings1

|

(In $000s except shares and per share |

Three months ended |

Acquisition date to | ||

|

Basic weighted average shares outstanding |

Shares |

151,316,959 |

146,243,355 | |

|

Diluted weighted average shares outstanding |

Shares |

152,329,738 |

146,778,304 | |

|

Net earnings (loss) |

$ |

1,773 |

(5,533) | |

|

Adjustments: |

||||

|

Transaction and non-recurring costs |

$ |

- |

10,352 | |

|

Share based payments |

$ |

225 |

10,102 | |

|

Foreign exchange loss |

$ |

58 |

1,982 | |

|

Change in fair value of warrants derivatives |

$ |

(353) |

(276) | |

|

Current income tax expenses |

$ |

2,041 |

2,326 | |

|

Deferred income tax expense |

$ |

(1,475) |

(5,072) | |

|

Adjusted net earnings1 |

$ |

2,269 |

13,881 | |

|

Per share – basic |

$/share |

0.01 |

0.09 | |

|

Per share – diluted |

$/share |

0.01 |

0.09 | |

|

1 Adjusted net earnings is a non-IFRS financial performance measure with no standard meaning under IFRS. |

Financial statements and related MD&A are available on SEDAR and in the Investor Relations section of Leagold's website here.

Table 5: Los Filos Mine Total Mineral Reserve Statement (December 31, 2017)

|

Classification |

Tonnes (kt) |

Au Grade (g/t) |

Au Contained |

Ag Grade (g/t) |

Ag Contained |

|

Proven |

14,440 |

0.97 |

449 |

3.38 |

1,568 |

|

Probable |

47,004 |

1.36 |

2,050 |

13.19 |

19,935 |

|

Subtotal Proven and Probable |

61,444 |

1.26 |

2,499 |

10.88 |

21,503 |

|

Probable Leach Pad Inventory |

216 |

||||

|

Total Proven and Probable |

2,715 |

||||

|

Notes: | ||

|

1. |

Mineral Reserves are based on Measured and Indicated Mineral Resources within pit designs and supported by a mine plan, featuring variable throughput rates (depending on the pit being mined), variable metallurgical recoveries (depending on geometallurgical domain), and cutoff optimization. | |

|

2. |

Metal price assumption for gold was US$1,200/oz. | |

|

3. |

Open Pit Mineral Reserves: | |

|

a. |

Los Filos Open Pit includes the mineralization within the planned 4P pit extension. Bermejal Open Pit includes the mineralization within the planned Guadalupe pit extension. | |

|

b. |

Los Filos Open Pit crush-leach ore is based on an operational 0.433 g/t Au cutoff grade; ROM ore is based on a variable 0.247 to 0.581 g/t Au operational cutoff grade that is determined by lithology. Los Filos Mineral Reserve is based on a 0.191 g/t Au cutoff grade. Bermejal Open Pit crush-leach ore is based on an operational 0.395 g/t Au cutoff grade; ROM ore is based on a variable 0.257 to 0.368 g/t Au operational cutoff grade that is determined by lithology. Bermejal Open Pit Mineral Reserve is based on a 0.20 g/t Au cutoff grade. | |

|

c. |

Process gold recoveries vary from 54% to 76% for crush-leach ore and from 30% to 64% for ROM ore at Los Filos Open Pit; recoveries at Bermejal Open Pit for crush-leach ore vary from 51% to 68 and from 42% to 58% for ROM ore. A 5% silver recovery is assumed from all geometallurgical domains. | |

|

4. |

Underground Mineral Reserves: | |

|

a. |

Are contained within stope designs that have a minimum horizontal continuity of 10 m, and minimum mining width of 3.5 m, and supported by a mine plan that features variable stope thicknesses depending on zone; and cutoff optimization. | |

|

b. |

Are reported based on a cutoff grade of 3.77 g/t Au for stopes within 100 m of planned ramp and 4.44 g/t Au for stopes requiring development. | |

|

c. |

Dilution is assigned an average of 14% at a 0 grade for Au and Ag. | |

|

d. |

Mining recovery is variable, based on stope width and can range from 75% to 100%. | |

|

e. |

Process gold recoveries are estimated at 80% for Los Filos Underground ore. A 5% silver recovery is assumed from all zones. | |

|

5. |

Tonnage and grade measurements are in metric units. Contained gold and silver ounces are reported as troy ounces. | |

|

6. |

Summation errors may be present due to rounding. | |

Table 6: Mineral Resources for the Bermejal Underground Deposit (below current open pit mine design, Effective Date of December 31, 2017)

|

Class |

Tonnes (kt) |

Au Grade (g/t) |

Au Contained |

Ag Grade (g/t) |

Ag Contained |

|

Measured |

429 |

7.50 |

103 |

27.27 |

376 |

|

Indicated |

10,384 |

5.90 |

1,969 |

19.28 |

6,437 |

|

Measured & Indicated |

10,812 |

5.96 |

2,073 |

19.60 |

6,812 |

|

Inferred |

3,643 |

4.65 |

545 |

16.36 |

1,916 |

|

Notes: | |

|

1. |

Mineral resources are inclusive of mineral reserves and do not include dilution. |

|

2. |

Metal price assumption for gold was US$1,400/oz. |

|

3. |

Mineral resources are reported to a gold cut-off grade of 3.0 g/t Au. |

|

4. |

Tonnage and grade measurements are in metric units. Contained gold and silver ounces are reported as troy ounces. |

|

5. |

Summation errors may be present due to rounding. |

|

6. |

This is the Bermejal Underground Deposit that is entirely below the current Mineral Reserves open pit. |

Qualified Persons

Doug Reddy, P.Geo, Leagold's Senior Vice President – Technical Services, is a Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"), and has reviewed and approved the technical contents of this news release on behalf of Leagold.

The year-end mineral reserves and mineral resources are derived from the technical report entitled "Technical Report for Los Filos Gold Mine, Guerrero State, Mexico" dated March 7, 2018 and having an effective date of December 31, 2017 (the "Los Filos Technical Report"). The Los Filos Technical Report was prepared for Leagold by Doug Reddy (Leagold, SVP Technical Services), Rodolfo Balderrama Neder (Administración Los Filos, S.A.P.L de C.V., a wholly-owned subsidiary of the Company, Mine Operations Manager), Paul Sterling (Consultant to Leagold) and Dr. Gilles Arseneau (Associate Consultant with SRK Consulting (Canada) Inc., and independent of the Company), each of whom is a Qualified Person as that term is defined in NI 43-101. The Los Filos Technical Report has been filed with the securities regulatory authorities in each of the Provinces and Territories of Canada, other than Québec, and can be found under the Company's profile on SEDAR at www.sedar.com.

About Leagold Mining Corporation

Leagold is building a mid-tier gold producer with a focus on opportunities in Latin America. Leagold is based in Vancouver, Canada and is listed on the TSX under the trading symbol "LMC" and trades on the OTCQX market as "LMCNF". The 2017 acquisition of the Los Filos mine, a low-cost gold producer in Mexico, provides an excellent platform for growth.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release contains "forward looking information" or "forward looking statements" within the meaning of applicable securities legislation. Forward-looking information and forward looking statements include, but are not limited to, statements with respect to the Company's 2018 outlook, plans or future financial or operating performance, the estimation of mineral reserves and resources, the realization of mineral reserve estimates, realization of the benefits of certain capital projects, the timing and amount of estimated future production, costs of future production, future capital expenditures, expected AISC of a combined Brio Gold Inc. ("Brio")-Leagold entity, potential for further growth and expansion beyond Brazil and Mexico, expectations with respect to the benefits of a combination of the businesses of Leagold and Brio and expectations with respect to closing the acquisition of Brio. Generally, these forward looking information and forward looking statements can be identified by the use of forward looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", "will continue" or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Statements concerning mineral resource estimates may also be deemed to constitute forward looking information to the extent that they involve estimates of the mineralization that will be encountered. The material factors or assumptions used to develop forward looking information or statements are disclosed throughout this document.

Forward looking information and forward looking statements, while based on management's best estimates and assumptions, are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Leagold to be materially different from those expressed or implied by such forward-looking information or forward looking statements, including but not limited to: risks related to international operations; risks related to having to obtain regulatory, shareholder and other approvals in connection with the Acquisition, risks related to successful integration of Brio if the Acquisition is consummated, risks related to general economic conditions and credit availability, actual results of current exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, possible variations in mineral reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which the Company operates, actual resolutions of legal and tax matters, as well as those factors discussed in the section entitled "Description of the Business – Risk Factors" in Leagold's most recent AIF available on SEDAR at www.sedar.com.

Although Leagold has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information and forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information or statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information or statements. The Company has and continues to disclose in its Management's Discussion and Analysis and other publicly filed documents, changes to material factors or assumptions underlying the forward-looking information and forward-looking statements and to the validity of the information, in the period the changes occur. The forward-looking statements and forward looking information are made as of the date hereof and Leagold disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward looking statements or forward looking information contained herein to reflect future results. Accordingly, readers should not place undue reliance on forward-looking statements and information.

Cautionary Note Regarding Brio Information

The information concerning Brio contained in this presentation has been taken from, or is based upon, publicly available information filed by Brio with securities regulatory authorities in Canada or otherwise available in the public domain as of the date hereof and none of this information has been independently verified by Leagold. Although Leagold does not have any knowledge that such information may not be accurate, there can be no assurance that such information from Brio is complete or accurate. Brio has not reviewed this presentation and has not confirmed the accuracy and completeness of the Brio information contained herein.

Other Information

Cash costs and AISC are non-GAAP financial performance measures with no standard meaning under IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers.

SOURCE Leagold Mining Corporation

View original content with multimedia: http://www.newswire.ca/en/releases/archive/March2018/08/c7478.html