Lydian Announces a Revised 43-101 Feasibility Study for the Amulsar Project

TORONTO, Sept. 16, 2019 (GLOBE NEWSWIRE) -- Lydian International Limited (TSX:LYD) (“Lydian” or the “Company”) is pleased to announce the results of an updated 43-101 Feasibility Study for its 100%-owned Amulsar Project in south-central Armenia. The results of the updated Feasibility Study show an increase in reserves from 102.6 million tonnes to 119.3 million tonnes to incorporate additional measured and indicated resources, and an increase of 192,000 oz. in recoverable gold.

Following a change in the Government of Armenia (“GOA”) in May 2018, demonstrations and road blockades occurred sporadically throughout the country, including at the Amulsar Project. A continuous illegal blockade at Amulsar has been in place since June 2018, causing construction activities to be suspended since that date. On September 9th, 2019, after a year-long investigation by the GOA Investigative Committee involving three separate audits, Prime Minister Nikol Pashinyan stated that access to the Amulsar Project site should be restored, the protesters blocking access should open the roads and there is no legal basis on which the GOA can prevent Lydian from advancing the Amulsar Project.

Edward Sellers, Lydian’s Interim President and CEO, commented at the time that “Lydian welcomes recognition from the Government of Armenia that there are no grounds to prevent Lydian from completing and operating the Amulsar Project. Lydian is looking forward to recovering and rebuilding its ability to complete construction and operate the Amulsar Project in accordance with its environmental performance standards.”

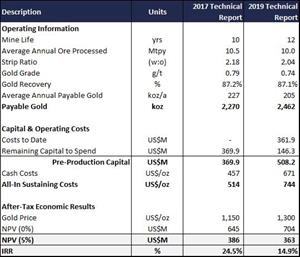

During the 15-month blockade, Lydian has looked at numerous restart options, both internally and with the assistance of JDS Mining & Energy. This included the development of a revised NI 43-101 Technical Report in September 2019 (the “2019 Technical Report”). Lydian recognized the need to update various parameters from the Company’s previous NI 43-101 Technical Report dated March 30, 2017 (the “2017 Technical Report”) to address the full impact of the blockade on construction, and the resulting delay in obtaining first gold and ramp up to full production. The 2019 Technical Report will be based on projected changes in pre-production capital, updated pit optimization work, construction and ramp up schedule changes and other parameters based on detailed reviews of projected construction, commissioning and operational stages of the Project.

Highlights of the 2019 Technical Report will include:

- Total recoverable gold of 2.46 million ounces over a 12-year mine life, which represents an increase of 192,000 ounces.

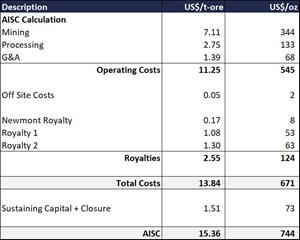

- All-in sustaining costs of US$744/oz of gold, which reflects actual labor costs and pricing of all consumables including Armenian sourced fuel realized in the pre-production stage of the Project.

- A revised mine plan which includes a lower 2.04:1 W:O stripping ratio and increases ore tonnes.

- Gold production averaging 246,000 ounces per year during the first five years and an overall average of 204,000 ounces per year over the life of mine.

- Accelerated projected after-tax cash flows of US$574 million during the first five years of operations to support early payback of project debt and equipment financing in under five years.

- After-tax NPV5% of US$363 million and IRR of 14.9% at a gold price of US$1,300 per ounce and an initial capital investment of US$508 million.

- After-tax NPV5% of US$600 million and IRR of 24.8% at a gold price of US$1,500 per ounce and an initial capital investment of US$508 million.

- Initial capital costs of US$508 million, includes the current incurred costs of US$362 million used to complete approximately 75% of the Project.

- Total ore production of 119.3 million tonnes.

Comparative Results

https://www.globenewswire.com/NewsRoom/AttachmentNg/c9ba21e2-1d0d-4951-aaf5-9a1170bed4ef

Mineral Resource Estimate

The basis of this Mineral Resource statement is a resource estimate completed in a previous Feasibility Study completed by AMC Consultants (UK) Limited with an effective date of February 27, 2017 (the “2017 AMC Report”). In the intervening period between 2017 and 2019, no material changes have occurred to the resource estimate. On this basis, a new estimate of Mineral Resources for the Amulsar Project was not required as no material change to Mineral Resources occurred. Mineral Resources have been restated at a lower cut-off grade to align with a reduction of the Mineral Reserves cut-off grade in this 2019 Technical Report as compared to the previous 2017 Technical Report.

Mineral Resources for the 2019 Technical Report have been estimated in conformity with generally accepted CIM “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and are classified according to the “CIM Definition Standards for Mineral Resources and Reserves: Definition and Guidelines” (May 2014).

MINERAL RESOURCE STATEMENT WGM, SEPTEMBER 13, 2019

| Classification | Quantity [t] | Au [gpt] | Ag [gpt] | Contained Gold (oz) | Contained Silver (oz) |

| Measured | 58,100,000 | 0.76 | 4.5 | 1,420,000 | 8,500,000 |

| Indicated | 104,200,000 | 0.66 | 3.2 | 2,210,000 | 10,800,000 |

| Total Measured+Indicated | 162,400,000 | 0.70 | 3.7 | 3,650,000 | 19,200,000 |

| Total Inferred | 85,900,000 | 0.50 | 3.1 | 1,380,000 | 8,600,000 |

The effective date of the Mineral Resource Statement is 13th September 2019.

| |||||

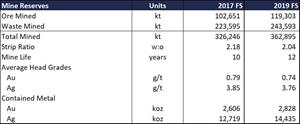

Mineral Reserves

The Mineral Reserve estimate is based on the 2017 AMC Report. The pit optimization work is based on revised operating costs developed and supplied by Lydian staff using updated cost estimates. The resources block model completed in 2017 by AMC using existing drill hole data and geologic interpretations was used in the pit optimization analysis. The measured and indicated resources were evaluated to determine the mineable portion by first using pit optimization techniques and then using the optimization templates to design pit phases and a final design. A production schedule was created from the design pit phases, which forms the basis of the economic evaluation for this study.

https://www.globenewswire.com/NewsRoom/AttachmentNg/5d1177df-18f0-421f-9786-35563a5dc20a

The 2019 Technical Report includes additional tonnage which was previously constrained within an artificial pit limit to keep the mine life at 10 years in the 2017 Technical Report. These limits were removed in the updated pit optimization for the Tigranes-Artavades shell to increase both ore tonnage and mine life. The stripping ratio in the new mine plan is reduced from 2.18 to 2.04 with an additional 16.7 million tonnes of ore being processed at the heap leach facility (“HLF”).

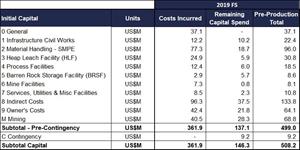

Pre-Production Capital Costs

Pre-production capital costs total US$508.2 million, of which US$362 million is the incurred cost of the Project. The remaining capital estimate of US$146.3 million addresses projected construction costs associated with the material handling system, HLF, barren rock storage facility (BRSF) and remaining owners cost. The mining cost are included in the remaining capital spend and include the costs for the completion of the mine haul road from the pits to the BRSF and stockpile area as well as the access ramps into the pits.

https://www.globenewswire.com/NewsRoom/AttachmentNg/69e37e29-7770-4940-9f33-c8f0119d7eb3

Operating Costs

Operating costs estimates were provided by qualified persons and Lydian personnel and updated with consumable costs from various suppliers as of June 2019.

https://www.globenewswire.com/NewsRoom/AttachmentNg/7fe56043-17bc-4f8c-a091-2228583873da

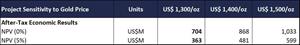

Sensitivity to Gold Price

The Project’s sensitivity to gold price is demonstrated in the following table of key after-tax financial parameters.

https://www.globenewswire.com/NewsRoom/AttachmentNg/63f18009-3526-4778-b41a-41733f9ae03f

Amulsar Project Description

The Amulsar Project is located in south-central Armenia roughly 115 km in a direct line to the southeast of the capital Yerevan or a 170 km drive by paved road. The Amulsar Project property comprises mountainous terrain with the prominent feature of an approximately seven km long northwest- southeast trending ridge. The gold ore deposit is located within three ridge peaks (Erato, Tigranes and Artavasdes) at 2,500 to 2,988 meters above sea level. The HLF is located in a valley at lower elevations providing nominal top surface elevations ranging from 1,664 to 1,856 meters above sea level.

All major infrastructural needs are readily accessible, including high tension power lines, a gas pipeline, a fiber optic internet cable, on-site sources of water, and regional labor sources. The sealed highway to Yerevan is immediately adjacent to the Amulsar Project site. The closest town to the Amulsar Project is Jermuk, which is situated approximately 11 km north from the Project’s infrastructure. There are also four rural communities in proximity to the Amulsar Project, including Kechut, Saravan (including Saralanj and Ughedzor), and Gndevaz.

The Company’s planned operations contemplate an owner-operated mining fleet delivering run-of-mine ore at a nominal rate of 10 Mtpy from the three open pits to the crushing facility. The ore will be reduced in size through a two-stage crushing facility to 100% passing 19 mm. The crushed ore will be transported approximately 5.3 km via overland conveyor to a crushed ore stockpile. From there, it will be reclaimed by belt feeders underneath the stockpile and transferred by conveyor to a loadout bin. Lime will be added to the ore for pH control and trucks will haul the ore approximately 0.5 km to the heap leach pad for stacking.

The HLF consists of the lined leach pad and collection ponds. The leach pad will be constructed in five phases with a total ore heap stacking capacity of 120 Mt over the 12 year project life. Currently, four phases are permitted under the approved environmental impact assessment (EIA) with the fifth and final phase to be permitted and approved during year 8 of the mine life. The collection ponds will include the process pond and three storm event ponds. Process solution and storm/snowmelt water will flow from the leach pad and will gravity-drain through a spillway from the pad to the process pond. Spillways will connect the ponds for potential runoff overflows. Make-up water for the HLF will be needed initially from offsite sources and abstraction permit applications have been submitted to the GOA for approval.

Stacked ore on the heap leach pad will be treated by applying leach solution. The design leaching cycle of the ore heap is 60 days. Over 80% of the recoverable gold is expected to be recovered during this leach cycle. Pregnant leach solution will be collected in the process pond and then pumped into the adjacent ADR plant for processing. Filter cake bearing the precipitated gold and silver will then be dried and smelted into doré bars. Doré will be shipped offsite to be refined and sold. Overall gold recovery is expected to be 87.1%.

Technical Information

The scientific and technical information in this news release has been reviewed and approved by Rodney Stuparyk P.Eng, who is a “qualified person” for the purposes of NI 43-101. A Technical Report prepared in accordance with NI 43-101 will be filed on SEDAR within 45 days. For further information with respect to the key assumptions, parameters, risks, the mineral reserve estimate and other technical information with respect to the Amulsar Project, please refer to the technical report when available at www.sedar.com. The following qualified persons, as that term is defined in NI 43-101, have or will have prepared or supervised the preparation of their relevant portions of the technical information in this news release and the related revised technical report when available:

Qualified Persons Company

| Qualified Person | Company | QP Responsibility |

| Ali Sheykholeslami, P.Eng. | JDS Energy & Mining | Project Management, Environmental/ Permitting/Social, OPEX, Economic Analysis |

| Richard Boehnke, P.Eng. | JDS Energy & Mining | Project Capex |

| Tysen Hantelmann, P.Eng. | JDS Energy & Mining | Mineral Reserve Estimate, Mining Methods |

| Mark Erickson, P.E. | Samuel Engineering | Metallurgy |

| Kelly McLeod, P. Eng. Richard Kiel, P.E. | JDS Energy & Mining Golder Associate Inc. | Recovery Methods |

| Richard Boehnke, P.Eng. | JDS Energy & Mining | Infrastructure |

| David Keller, P.Geo. | WGM Ltd. | Geology, Mineral Resource Estimate |

| Richard Kiel, P.E. | Golder Associate Inc. | Water Management |

| Richard Kiel, P.E. | Golder Associate Inc. | BRSF, Barren Rock Storage Facility |

About Lydian International Limited

Lydian is a gold developer focused on construction at its 100%-owned Amulsar Project, located in south-central Armenia. However, illegal blockades have prevented access to Amulsar since late June 2018. Amulsar is expected to be a large-scale, low-cost operation with production targeted to average approximately 225,000 ounces annually over an initial 10-year mine life. Estimated mineral resources contain 3.5 million measured and indicated gold ounces and 1.3 million inferred gold ounces. Existing mineral resources beyond current reserves and open extensions provide opportunities to improve average annual production and extend the mine life. Lydian is committed to good international industry practices in all aspects of its operations including production, sustainability, and corporate social responsibility. For more information and to directly contact us, please visit www.lydianinternational.co.uk.

For further information, please contact:

| Edward Sellers, Interim President & CEO +3 741-054-6037 | Bill Dean, Chief Financial Officer +1 720-307-5089 |

Or: moreinfo@Lydianinternational.co.uk

Caution regarding forward-looking information

Certain information contained in this news release is “forward looking”. All statements in this news release, other than statements of historical fact, that address events, results, outcomes or developments that the Company expects to occur are “forward-looking statements”. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the use of forward-looking terminology such as “plans”, “expects”, “is expected”, “intends”, “anticipates” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “will”, “would”, “should”, or “occur” or the negative or other variations of such terms. Forward-looking statements in this news release include, among others, statements with respect to: the Company’s ability to regain access to the Amulsar Project and continue construction, of which there can be no assurances; the economic and feasibility parameters of the Amulsar Project, the cost and timing of development of the project, expected capital costs, sustaining capital costs, operating costs, production, cash flows, cash costs and all-in sustaining costs; the expected mine life, scale, construction, mining operations and plan, processing methods and rate, grades, recovery rates, total recovery, stripping ratio, average annual ore tonnes mined/processed, production and other attributes of the Amulsar Project; the tonnages and grades of mineral reserves and resources and the estimation of mineral reserves and resources; the timing of development of Amulsar in the future; the expected pre-tax and after-tax NPV, IRR and payback period associated with the Amulsar Project. Statements concerning mineral resource estimates may also be deemed to constitute forward-looking information to the extent that they involve estimates of the mineralization that will be encountered when the property is developed.

All forward-looking statements in this news release are based on the opinions and estimates made as of the date such statements and are made and are subject to important risk factors and uncertainties, many of which are beyond the Company's ability to control or predict. Material assumptions regarding forward looking statements are discussed in this news release, where applicable, and will also be discussed in our technical report, which will be filed on SEDAR within 45 days of this news release. Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. Such risks, uncertainties and factors include, without limitation: changes in gold and silver prices; adverse general economic, political, market or business conditions; failure to achieve the objectives of the future exploration and drilling programs; regulatory changes; as well as "Risk Factors" included in the disclosure documents filed on and available at www.sedar.com. Forward-looking statements are not guarantees of future performance, and actual results and future events could materially differ from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. All of the forward-looking statements contained in this news release are qualified by these cautionary statements. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, events or otherwise, except in accordance with applicable securities laws.

Cautionary Note Concerning Estimates of Measured, Indicated and Inferred Mineral Resources

This news release uses terms that comply with reporting standards in Canada and certain estimates are made in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes Canadian standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the requirements of the U.S. Securities and Exchange Commission (“SEC”), and mineral resource information contained herein may not be comparable to similar information disclosed by United States companies. This news release uses the terms “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” to comply with reporting standards in Canada. We advise United States investors that while such terms are recognized and required by Canadian regulations, the SEC does not recognize them. United States investors are cautioned not to assume that any part or all of the mineral deposits in such categories will ever be converted into mineral reserves under SEC definitions. These terms have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Therefore, United States investors are also cautioned not to assume that all or any part of the “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” exist. In accordance with Canadian rules, estimates of “inferred mineral resources” cannot form the basis of pre-feasibility or other economic studies. It cannot be assumed that all or any part of the “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” will ever be upgraded to a higher category.