Mammoth Reports Further Results from its Diamond Drilling Program at its Tenoriba Gold-Silver Property, Mexico

(TheNewswire)

Toronto, Canada – TheNewswire - March 3, 2022 - Mammoth Resources Corp. (TSXV:MTH), (OTC:MMMRF), (the “Company”, or “Mammoth”) is pleased to provide results from an additional three drill holes from its diamond drilling program at its 100% owned Tenoriba gold-silver property located in the prolific Sierra Madre precious metal belt, Mexico.

The drill program is designed to test up to five target zones which measure from hundreds of metres (m) to over one kilometre (km) in strike length along a 4 km, east-west trend of gold-silver mineralization identified in 3-dimensional (3D) modelling incorporating data from over 3,000 soil, chip and channel samples, 26 prior diamond drill holes, geological and structural mapping and the potential continuity at depth of surface mineralization as indicated by an Induced Polarization/Magnetometer (IP/Mag) geophysical survey (please refer to the descriptions of target zones in the press release dated July 22, 2021).

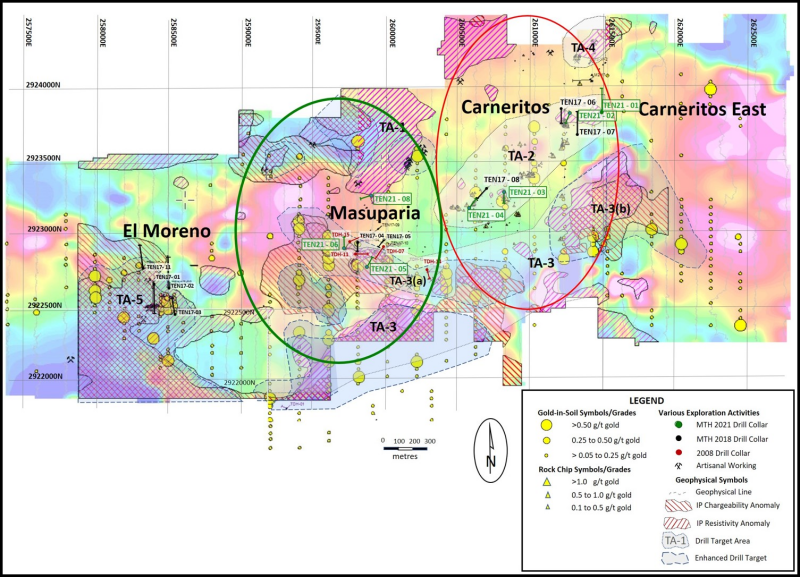

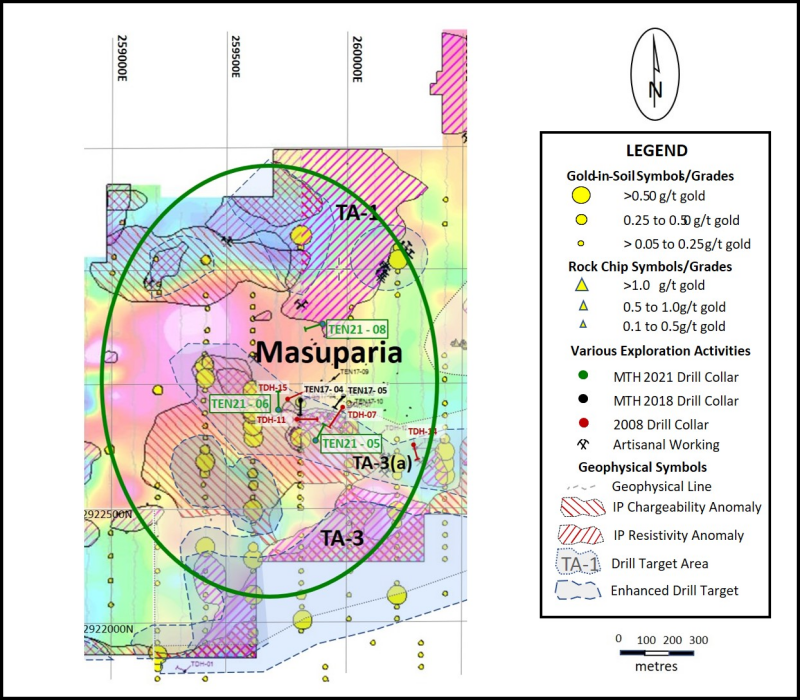

An additional three diamond drill holes have been completed for a total of 569.5 metres bringing the total metres (m) reported to date to 995.5 m in 7 holes. The first four holes tested the TA-2 target in the Carneritos area of the project (refer to press release dated November 18, 2021, Figure 1 and Figure 2) while these three holes tested the TA-3(a) target in the central Masuparia area of the project, approximately 700 m from the closest Carneritos drilling (refer to Figure 1 - Location Map, Location Map, Tenoriba Property Drilling, 2022 (drill holes TEN 21-05, 06 and 08) and Figure 2 - Location Map, Masuparia Area, Tenoriba Property Drilling, 2022 (drill holes TEN 21-05, 06 and 08). A summary of potentially economical intervals from these additional three holes are as follows.

|

Hole |

Weighted Average Gold |

Weighted Average Silver |

Weighted Average Gold Equivalent* |

||||

|

Location |

Number |

From |

To |

Total |

Grade |

Grade |

Grade |

|

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(g/t) |

||

|

Masuparia |

TEN 21-05 |

12.0 |

28.5 |

16.5 |

0.27 |

4.6 |

0.34 |

|

172.5 |

195.0 |

22.5 |

0.22 |

3.0 |

0.26 |

||

|

TEN 21-06 |

0.0 |

18.0 |

18.0 |

1.21 |

1.5 |

1.23 |

|

|

(including) |

16.5 |

18.0 |

1.5 |

6.46 |

2.8 |

6.50 |

|

|

27.0 |

49.5 |

22.5 |

0.57 |

0.6 |

0.58 |

||

|

(including) |

27.0 |

39.0 |

12.0 |

0.83 |

0.5 |

0.84 |

|

|

TEN 21-08 |

60.0 |

73.5 |

13.5 |

0.30 |

6.4 |

0.40 |

|

|

103.5 |

111.0 |

7.5 |

0.22 |

1.3 |

0.24 |

Notes: Gold Equivalent where silver grade is converted to gold grade at 75 grams per tonne silver = 1 gram per tonne gold.

Mammoth attempts to drill as near perpendicular as believed to be the orientation of mineralized control features, however lengths shown are core lengths versus perpendicular true length of mineralized intersections.

Thomas Atkins, President and CEO of Mammoth commented on the initial results from the Tenoriba diamond drill program stating: "We continue to intersect potentially economical gold-silver grades over lengthy, tens of metre intervals at generally shallow depths in significant step-out distances from prior drilling. In this case, in addition to the interval lengths, we hit some impressive grades in hole 21-06. Although lower grades in holes 05 and 08, these intervals continue to be potentially economical and add to what would be an average grade taking into account the combination of higher-grade intervals such as those intersected in 21-06.

“It’s important to keep in mind that Tenoriba is a very large, at least 4 to 6 kilometre long mineralized system with gold-silver sampled in thousands of surface samples and as such an excellent candidate for large scale open pit mining. As evidenced in hole 21-06 and numerous other historic drill holes, we can often intersect tens of metres of higher-grade gold-silver mineralization at shallow depths, accompanied by similar intervals of more modest, yet still potentially economical grades.

“What’s encouraging about the higher-grade intervals at Tenoriba is that the mineralized trend being as large as it is and taking into account that we’re testing target areas that measure hundreds of metres to over a kilometre in length and drilling 60 to greater than 200 metres step-outs from sparse prior drilling, when one considers the that the drill core measures only 6.5 centimetres in diameter, hitting these higher grade intervals within this giant mineralized system at Tenoriba, in these large step-outs, we’re literally encountering needles in a haystack of mineralization at this stage of the drilling. However, as evidenced by these higher-grade intervals we’re able to intersect these ‘needles’ in this ‘haystack’ which bodes well for the potential of the project.”

Richard Simpson, Mammoth’s Vice President Exploration further commented on these results, stating: “Holes in the Masuparia target area were designed to test possible-interpreted structural and/or stratigraphic controls associated with gold-silver mineralized intervals encountered in prior drilling. All three holes intercepted anomalous gold-silver over tens of metres. In all holes the mineralization appears to be controlled by irregular sulphide enriched fractures-veinlets with minor quartz and/or alteration clay minerals typical to High Sulphidation mineral systems. Mineralization in the Masuparia area is complex given what appears the combination of structural and stratigraphic controls. Understanding these controls remains a work in-progress with our gaining further insights with every additional drill hole.”

Drill Hole Description:

As previously discussed, Mammoth intends to initially drill 2 to 4 holes within each target zone then move to another target zone to drill a similar number of holes (please refer to press release dated July 22, 2021 for target zones). Company geologists intend to await the results from the initial 2 to 4 drill holes in a target area prior to returning to the area to follow up drilling of these areas. Where mineralized intervals are intersected in the initial sequence of drilling, or where holes fail to encounter mineralization as suggested by the data, follow up drilling will be based on field assessments combined with surface geology, sampling and geophysics data to assist in defining follow up drill collar locations with the aim of assisting in more clearly understanding and testing the controls and continuity to gold-silver mineralization.

Targets TEN 21-05 and 06 were drilled to test the interpreted F3, west-northwest fault as identified in the 3D geophysical interpretation within the generally west-northwest – east-southeast TA-3(a) mineralized trend/target area. In both holes the F3 fault was intercepted and coincides with highly fractured/grinded core intervals from 113 to 139 and 117 to 124 m core length in hole 21-05 and 21-06, respectively. These intervals were not mineralized. As a result, it can be said that the F3 fault appears to be an un-mineralized, late, normal fault (south block down) and the mineralization intervals encountered in these holes does not appear to be fault controlled, but may be an extension of the general west-northwest - east-southeast TA-3(a) mineralized trend.

The second target; TEN21-08 was drilled to test the north extension of the west-northwest trending Metalito structure which was observed in a small artisanal mine where surface samples assayed up to 1.3 grams/tonne (g/t) gold over 1.8 m and where dickite clay (an alteration clay commonly observed in High Sulphidation precious metal systems), was also observed. The Metalito structure was intercepted from 58 to 76 m and it was within this structure that the reported gold-silver values were encountered.

Drill Hole TEN 21-05

The hole was drilled to a depth of 220.5 m of a planned 200 to 250 m depth at 65 degrees decline/dip, azimuth 20 degrees and was collared approximately 170 m east-southeast of TDH-10 and 175 m southwest of TDH-07. This drill hole was collared to test the interpreted F3, west-northwest fault as identified in the 3D geophysical interpretation within what appears a possible west-northwest and east-southeast mineralized trend as identified in target area TA-3(a).

Historic drill hole TDH-10 returned 26.7 m grading 0.66 g/t gold equivalent (Eq) followed by 41.0 m grading 0.92 g/t gold Eq, while TDH-07 returned 47.0 m grading 2.17 g/t gold Eq followed by 11.5 m grading 2.32 g/t gold Eq.

TEN 21 - 05 intercepted from surface to 194 m core length crystal volcanic tuff with traces, to up 5% locally of pyrite in irregular veinlets with minor quartz throughout. From 113 to 139 m core length frequent intervals of broken and grinded core were noted which coincides with the interpretation of the F3 fault. As the fault interval was not mineralized it is interpreted to be a late, normal fault (south block down) and the mineralization interval encountered in this hole does not appear to be fault controlled but rather appears to be an extension of the generally west-northwest and east-southeast mineralized trend. Hole TEN 21 - 06 collared 200 m northwest of TEN 21-05 was drilled to further test this structure and the possible west-northwest and east-southeast mineralized trend as identified in target area TA-3(a).

Drill Hole TEN21-06

The hole was drilled to a depth of 196.5 m of a planned 200 to 250 m depth at 55 degrees decline/dip, azimuth 0 degrees and was collared approximately 75 m southeast of TEN17-15, 65 m west-southwest of collar TDH-11. This drill hole was collared to test the interpreted F3, west-northwest fault as identified in the 3D geophysical interpretation within what appears a possible west-northwest and east-southeast mineralized trend as identified in target area TA-3(a).

Historic drill hole TEN17-15 returned 12 m grading 0.71 g/t gold Eq followed by 13.6 m grading 0.47 g/t gold Eq, and TDH-11 returned 26.7 m grading 0.66 g/t gold Eq followed by 41 m grading 0.92 g/t gold Eq.

TEN 21-06 intercepted from the top to the bottom of the hole crystal volcanic tuff, generally weakly sericitized and or chloritized with less than 1% disseminated fine pyrite. From 117 to 124 m core length frequent intervals of broken and grinded core were noted which coincides with the interpretation of the F3 fault. As the fault interval was not mineralized it is interpreted to be a late, normal fault (south block down) and the mineralization intervals encountered in this hole does not appear to be fault controlled but rather is an extension of the generally west-northwest and east-southeast mineralized trend.

Drill Hole TEN21-08

The hole was drilled to a depth of 152.5 m of a planned 100 m depth at 60 degrees decline/dip, azimuth 250 degrees and was collared approximately 700 m northwest of TEN17-09. This drill hole was originally intended to be collared 400 m further northwest of its drilled location corresponding with both a large IP geophysics feature at this original location and what would be a lengthy lateral extension to the Metalito targeted structure. The hole was unable to be located at its original location due to the steepness of the ground at this location. This hole was instead collared along strike of the Metalito structure below a small mine working where dickite clay alteration (an alteration clay commonly observed in High Sulphidation precious metal systems) was present and numerous surface gold assays existed, the best result 1.3 g/t gold over 1.8 m.

Historic drill hole TEN17-09 intersecting the Metalito structure returned 3 m grading 0.42 g/t gold Eq.

TEN 21-08 intercepted from surface to 58 m core length, non-mineralized lithic volcanic tuff, followed by the Metalito structure from 58 to 76 m. The Metalito structure coincides with mineralized, brecciated volcanic tuff with abundant presence of pyrite veinlets and an approximate 1 m interval with white clay and sulfide veinlets at a 65° angle from the core axis. From 76 meters to the end of the hole there was a repeat of the same non-mineralized lithic volcanic tuff. This drill hole demonstrates lengthy lateral continuity of this Metalito mineralized structure, given its 700 m step-out from any prior drilling although with modest, yet potentially economical grade mineralization over a decent 13.5 m interval at a relatively shallow, less than 50 m vertical depth. The original, large IP geophysics feature, along strike with the Metalito structure located in the steep terrain 400 m to the northwest, remains to be tested.

Qualified Person / Quality Controls:

Richard Simpson, P.Geo., Vice-President Exploration for Mammoth Resources Corp. is Mammoth's Qualified Person, according to National Instrument 43-101 for the Tenoriba property and is responsible for and has reviewed any technical data mentioned in this news release.

Samples referenced in this press release were prepared and analyzed by ALS laboratories (ALS) in their facilities in Mexico and Canada, respectively. Samples generally consisted of a minimum of 2 kilograms of material. Drill core is mostly HQ diameter core with minor lengths of NQ diameter core. Core is sawn in half with a rock saw with one half used for sample analysis purposes. Where samples are taken these are most often 1.5 metres in length, only in poor recovery sections do they exceed this length, with rare exceptions exceeding a maximum of 4.5 metres in length. Samples are collected with sample ticket and deposited into plastic sample bags sealed with nylon zip lock ties, then loaded into grain sacs similarly sealed with a nylon zip lock tie prior to transport by Mammoth personnel to ALS’s facility in Chihuahua, Mexico for sample preparation. Gold and silver analyses are performed in ALS’s facility in Canada via a 30-gram fire assay with an atomic absorption finish. Silver, copper, lead and zinc are analyzed as part of a multi-element ICP package using a 4-acid digestion. Any over limit samples with greater than one percent copper, lead and zinc are re-analyzed using ore grade detection limits. Blank and duplicate samples are inserted randomly at approximately every 15 samples.

About Mammoth Resources:

Mammoth Resources (TSX-V: MTH) is a precious metal mineral exploration Company focused on acquiring and defining precious metal resources in Mexico and other attractive mining friendly jurisdictions in the Americas. The Company holds a 100% interest (subject to a 2% net smelter royalty purchasable anytime within two years from commencement of commercial production for US$1.5 million) in the 5,333-hectare Tenoriba gold property located in the Sierra Madre Precious Metal Belt in southwestern Chihuahua State, Mexico. Mammoth is seeking other opportunities to option exploration projects in the Americas on properties it deems to host above average potential for economic concentrations of precious metals mineralization.

To find out more about Mammoth Resources and to sign up to receive future press releases, please visit the company's website at: www.mammothresources.ca., or contact Thomas Atkins, President and CEO at: 416 509-4326.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Information: This news release may contain or refer to forward-looking information. All information other than statements of historical fact that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future are forward-looking statements; examples include the listing of its shares on a stock exchange and establishing mineral resources. These forward-looking statements are subject to a variety of risks and uncertainties beyond the Company's ability to control or predict that may cause actual events or results to differ materially from those discussed in such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, undue reliance should not be placed on these forward-looking statements due to the inherent uncertainty therein.

Figure 1 - Location Map, Tenoriba Property Drilling, 2022 (drill holes TEN 21-05, 06 and 08)

Figure 2 - Location Map, Masuparia Area, Tenoriba Property Drilling, 2022 (drill holes TEN 21-05, 06 and 08)

Copyright (c) 2022 TheNewswire - All rights reserved.