NV Gold Signs Binding LOI for Option to Acquire 100% of the Silver District Property in Arizona, USA

VANCOUVER, BC / ACCESSWIRE / January 13, 2020 / NV Gold Corporation (TSXV:NVX)(OTC:NVGLF) ("NV Gold" or the "Company") announces that it has entered into a Binding Letter of Intent ("LOI") with Magellan Gold Corporation (OTCQB: MAGE) ("Magellan") under which NV Gold has an option to acquire all of Magellan's interest in its Silver District Project located in La Paz County, Arizona, USA (the "Property").

"With continued optimism in the gold and silver market, NV Gold has reviewed the Silver District Project in Arizona, and believes the property provides a unique resource development opportunity for the Company and its shareholders. The Silver District project can be explored and developed year-round, it lies in close proximity to our other projects in Nevada, it hosts an unconfirmed historical resource totaling in excess of 15 million ounces of silver developed nearly 30 years ago and it is potentially open along strike and at depth in multiple vein systems, with very limited drilling below 40 meters," commented Peter A. Ball, President. "After securing positive terms for NV Gold to acquire the Silver District Project, including minimal cash and dilution components, we look forward to an in-depth review of the project during the four-month exclusive due diligence period. Our goal is to push forward to finalize a Definitive Agreement with Magellan, and quickly engage a third-party, independent technical consultant, to provide geological modelling and data verification."

Highlights of the Silver District Binding LOI Terms:

Magellan grants NV Gold the exclusive right to purchase an undivided 100% right, title and interest in and to the Property and the Property Data in consideration of NV Gold completing the following payments and work commitments:

Time for Payment | Cash | Shares | Shares CDN$ | Work Commitment |

Binding LOI | $25,000 | 120 Day Due Diligence / Exclusivity Period | ||

Definitive Agreement (DA) | $75,000 | 350,000 | ||

1st Year Anniversary of DA | $75,000 | $50,000 | ||

2nd Year Anniversary of DA | $25,000 | $75,000 | $50,000 | |

3rd Year Anniversary of DA | $25,000 | $100,000 | $50,000 | |

4th Year Anniversary of DA | $25,000 | $125,000 | $50,000 | |

5th Year Anniversary of DA | $25,000 | $150,000 | $25,000 | |

"As we continue to evaluate, explore and develop our core project portfolio and data library in Nevada, we see the Silver District as a promising strategic project and it expands our regional geographic horizon into Arizona. Southwestern Arizona is accessible 12 months of the year, ensuring year-round accessibility and continued news flow," stated John E. Watson, Chairman. "We continue to carefully manage and allocate capital with an emphasis on minimizing dilution. We will look to advance the Slumber and other projects this spring, as we currently focus on our initial review of the Silver District Project. Our technical team has completed an internal geological modelling exercise of the Slumber Gold Project and defined this asset as priority drill project, and we look forward to testing it with additional geophysics to develop a more comprehensive model."

About the Silver District Project and Historical Resource (*Please refer to disclaimer and disclosure below related to the Silver District Project):

- The Silver District Property consists of 108 unpatented mining claims, 3 patented claims and one state lease, totaling close to 2,000 acres. The property covers a majority of the historic Silver District in La Paz County, approximately 80 kilometers (50 miles) north of Yuma in southwest Arizona.

- The district-scale property position covers the heart of the historic Silver District and includes all of the important historical producers, most of the old mines and prospects and all of the known exploration targets, where historic recorded production during 1883-1893 from small underground mines was 1.56 million ounces silver and 2.33 million pounds lead.

- The Silver District Project in La Paz County was explored from 1973 - 1992, where New Jersey Zinc Company and Orbex Minerals Ltd., and its successor companies drilled a total of 465 shallow holes (limited to less than 40 m (130 ft)) for an aggregate length of approximately 19,162 meters (62,866 feet), conducted metallurgical test work (up to 65% recovery of silver) and carried out historical scoping studies.

- In 1991-1992, using polygonal methods, a historical silver resource was estimated by Gulf and Western Industries, Inc. as 3.56 million tons grading 4.46 oz/t silver or 15.9 million contained ounces silver, and fluorspar mineralization was estimated as 2.3 million tons grading 14.5% CaF2 or 328,450 tons contained fluorite, but neither estimate has been confirmed by the Company (see below). Included within this mineralization are substantial tonnages grading 17.0% barite (BaSO4) and 3.57% lead-zinc.

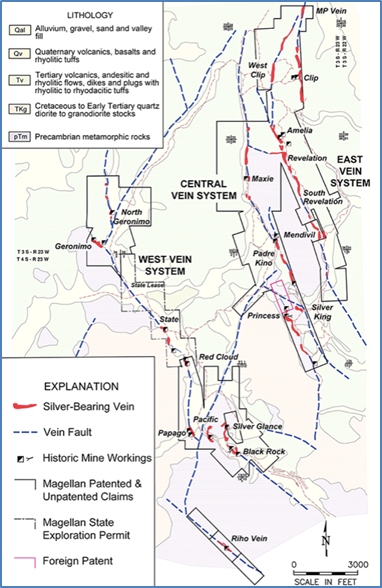

- Mineralization is controlled by three principal sub-parallel north-northwest trending epithermal vein systems cutting Tertiary volcanic rocks underlain by basement metamorphic rocks. The three vein structures extend over a collective strike length of 12.8 km (8 miles). The deposits containing silver, lead-zinc, fluorspar and barite occur along the veins in pod-like bodies commonly 15-50 feet or wider and hundreds of feet long.

- In 2014, Magellan drilled hole PA-01, which intersected 90 feet grading 6.05 oz/t silver (including 10 feet of 17.06 oz/t silver) and compared favorably to historic results. PA-01's 90-foot intercept also returned previously unreported zinc-lead values averaging 4.71% zinc and 1.56% lead over the 90 feet, including 10 feet grading 8.35% zinc and 4.02% lead.

- Conceptual development plans by past operators have involved multiple open pits feeding a central mill. Flow sheet designs employ fine grinding and cyanide leaching to recover silver, and conventional flotation to recover fluorspar and barite.

- NV Gold's management team does not view the Silver District project material to the Company at this time.

Disclosure of Historical Estimates*:

The Company considers the prior mineral resource estimate to be a historical estimate for purposes of NI 43-101. The Company plans to assess the historical estimate as it commences work on the Silver District Project to determine whether it can be verified as a current mineral resource estimate under NI 43-101 or the extent of the work that might be required if it can be verified. However, at this time a qualified person has not done sufficient work to classify the historical estimate as a current mineral resource on behalf of the Company and it should not be considered reliable. The estimate does not classify the resource as either a measured, indicated or inferred resource and, accordingly, readers should not assume it satisfies the requirements of any of such classifications. The Company is not treating the historical estimate as a current mineral resource but considers it relevant historical information in respect of the Project. Readers should be cautioned that there is no guarantee that the foregoing historical resource estimate will be verified or confirmed in accordance with the requirements of NI 43-101.

Furthermore, to the extent that the historical estimate is reliable, readers should be cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. The mineral resources at the Silver District Project are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is also no certainty that the historical mineral resource will be converted into mineral resources or mineral reserves, once economic considerations are applied; or that these mineral resources will be converted to measured and indicated and inferred categories through further drilling, or into mineral reserves, once economic considerations are applied.

View of Silver District Claims:

Note: Red Cloud Mine and related claims are not included in the Agreement.

Closing of the Transaction is subject to various conditions, including, without limitation, satisfaction of any regulatory requirements and receipt of the approval of the TSX Venture Exchange. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. All shares issued related to the transaction requires the statutory hold period of four months plus a day from the date they are issued.

About NV Gold Corporation

NV Gold is a junior exploration company based in Vancouver, British Columbia that is focused on delivering value through mineral discoveries and advancement. Leveraging its highly experienced in-house technical knowledge, NV Gold's geological team intends to utilize its geological databases, which contains a vast treasury of field knowledge spanning decades of research and exploration, combined with a portfolio of mineral properties in Nevada and Arizona, to prioritize key projects for focused exploration programs.

On behalf of the Board of Directors,

John E. Watson

Chairman

For further information, visit the Company's website at www.nvgoldcorp.com or contact:

Peter A. Ball, President & COO

Phone: 1-888-363-9883

Email: peter@nvgoldcorp.com.

Forward Looking Statements

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this release, including, without limitation, the plans to complete the Definitive Agreement to Acquire the Silver District Project, the historical resource at the Silver District Project and whether it can be confirmed in accordance with the requirements of NI-43-101 and a new current resource developed, the plans to complete exploration or development of the Project and other future plans and objectives of the Company, including exploration plans, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include regulatory issues, market prices, availability of capital and financing, general economic, market or business conditions, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

SOURCE: NV Gold Corporation

View source version on accesswire.com:

https://www.accesswire.com/572811/NV-Gold-Signs-Binding-LOI-for-Option-to-Acquire-100-of-the-Silver-District-Property-in-Arizona-USA