Orla Mining Advances Caballito and Pava Copper-Gold Sulphide Mineralized Zones at Cerro Quema Project, Panama

Selective Follow-up Drilling Planned at Promising Regional Targets

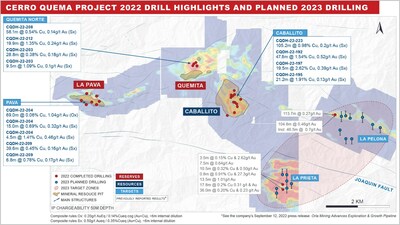

VANCOUVER, BC, Feb. 16, 2023 /CNW/ - Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) ("Orla" or the "Company") is pleased to provide an update on its 2022 exploration activities on its Cerro Quema Project and an overview of exploration plans for 2023.

2022 Exploration Highlights: Cerro Quema (Panama)

- Caballito Deposit: Drilling increased confidence and refined geometry, controls, and definition of the mineralization. Notable results:

- CQDH-22-223: 0.98% Cu, 0.20 g/t Au over 105.2 m (Sulphide) from 90.4 m

- CQDH-22-192: 1.54% Cu, 0.52 g/t Au over 47.8 m (Sulphide) from 100.5 m

- CQDH-22-197: 2.62% Cu, 0.39 g/t Au over 19.5 m (Sulphide) from 187.7 m

- CQDH-22-195: 1.91% Cu, 0.13 g/t Au over 21.2 m (Sulphide) from 94.7 m

- La Pava Sulphide Mineralization: Recent drill program combined with historical drilling defined zones of significant Cu-Au sulphide mineralization beneath the oxide gold deposits. Notable results:

- CQDH-22-204: 0.69% Cu, 0.32 g/t Au over 15.0 m (Sulphide) from 69.0 m and 1.41% Cu, 0.46 g/t Au over 4.5 m (Sulphide) from 97.1 m

- CQDH-22-209: 0.45% Cu, 0.16 g/t Au over 39.6 m (Sulphide) from 117.2 m and 0.78% Cu, 0.17 g/t Au over 6.8 m (Sulphide) from 167.7 m

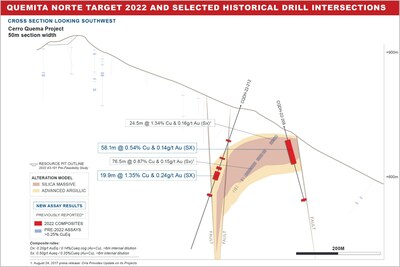

- Quemita Norte Target: Potential satellite sulphide mineralization highlighted by positive 2022 Cu-Au drill intersections over a 180-metre by 210-metre area. Mineralization remains open along strike. Notable results:

- CQDH-22-208: 0.54% Cu, 0.14 g/t Au over 58.1 m (Sulphide) from 30.0 m

- CQDH-22-212: 1.35% Cu, 0.24 g/t Au over 19.9 m (Sulphide) from 162.2 m

- CQDH-22-203: 0.38% Cu, 0.18 g/t Au over 28.8 m (Sulphide) from 137.2 m and 1.09% Cu, 0.10 g/t Au over 9.5 m (Sulphide) from 59.7 m

- La Pelona Target: Significant near-surface oxide drill intersections to be followed up with drilling in 2023 to define potential extent and size of the mineralization.

- La Prieta Target: Intrusion related Cu-Au mineralization intersected in first drill program highlights potential of the target and justifies follow-up drilling in 2023.

"The 2022 exploration program reinforced the potential for the definition and discovery of more oxide and sulphide resources on the property," said Sylvain Guerard, Senior Vice President Exploration of Orla. "In 2023, our focus will be follow-up drilling at La Pelona and La Prieta targets where we believe there is significant exploration upside yet to be defined."

2022 Exploration: Cerro Quema (Panama)

Cerro Quema consists of a pre-feasibility stage heap leach gold project, a copper-gold sulphide resource, and a suite of exploration targets on a prospective land package. The project is located on a 15,000-hectare concession on the Azuero Peninsula in the Los Santos Province of Southwestern Panama. In 2022, exploration drilling at Cerro Quema began with regional exploration at the La Prieta and La Pelona targets before moving to metallurgical, infill, and expansion drilling at Caballito and La Pava mineralized zones and early-stage follow-up drilling at Quemita Norte target. In total, 9,044 metres were drilled in Panama during the year.

Exploration at the Caballito and La Pava deposits and the Quemita Norte target in the second half of 2022 continued to generate significant drill intersections. These new drill results build on the previously reported 2022 positive drill results generated at the early stage La Pelona and La Prieta regional targets, (see news release dated September 12, 2022 - Orla Mining Advances Exploration & Growth Pipeline), and further highlight the presence of significant copper and gold mineralization at the Cerro Quema project.

La Prieta and La Pelona:

The 2022 exploration program began by drill testing two regional targets: La Pelona and La Prieta. As previously reported, both regional targets returned positive drill results, including new shallow oxide-hosted gold mineralization at La Pelona (0.46 g/t gold over 104.8m, and 0.27 g/t gold over 113.7m) and sulphide-hosted gold-copper mineralization at La Prieta (27.3 g/t gold and 0.91% Cu over 0.75m and 1.01 g/t gold over 13.5m) (see news release dated September 12, 2022 - Orla Mining Advances Exploration & Growth Pipeline). Follow-up drilling on these encouraging results from these regional exploration targets is planned for early 2023.

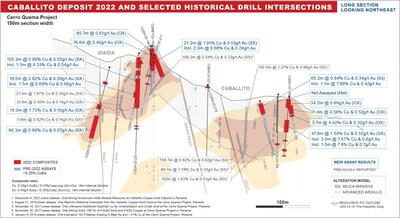

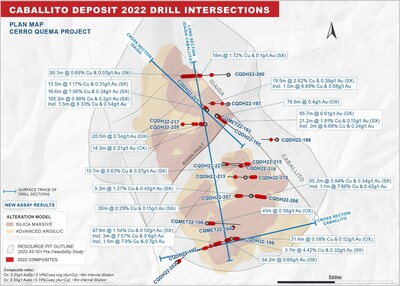

Caballito:

Orla completed 20 core drill holes (4,339 metres) including three drill holes (599 metres) for metallurgical study at the Caballito deposit in the second half of 2022. Infill drilling was undertaken to increase drilling density and to better define the geometry and extent of mineralization. These recent drill holes have helped to 1) improve the understanding within the core area of the deposit, the geological controls, continuity, and geometry of mineralization, and to 2) better define and constrain the extent of the boundaries of mineralization.

Notable results from 2022 drilling:

- CQDH-22-199: 0.58% Cu, 0.52 g/t Au over 31.4 m (Oxide) from 33.7 m

- CQDH-22-192: 0.04% Cu, 0.69 g/t Au over 34.2 m (Oxide) from 14.2 m and 1.54% Cu, 0.52 g/t Au over 47.8 m (Sulphide) from 100.5 m

- CQDH-22-195: 0.03% Cu, 0.61 g/t Au over 85.7 m (Oxide) from 9.0 m and 1.91% Cu, 0.13 g/t Au over 21.2 m (Sulphide) from 94.7 m

- CQDH-22-199: 0.58% Cu, 0.52 g/t Au over 31.4 m (Oxide) from 33.7 m

- CQDH-22-197: 2.62% Cu, 0.39 g/t Au over 19.5 m (Sulphide) from 187.7 m

- CQDH-22-200: 1.72% Cu, 0.10 g/t Au over 18.0 m (Sulphide) from 233.3 m and 0.89% Cu, 0.07 g/t Au over 90.3 m (Sulphide) from 282.8 m

- CQDH-22-206: 0.84% Cu, 0.34 g/t Au over 65.2 m (Sulphide) from 44.6 m

- CQDH-22-223: 0.17% Cu, 0.33 g/t Au over 24.7 m (Oxide) from 14.2 m and 0.98% Cu, 0.20 g/t Au over 105.2 m (Sulphide) from 90.4 m

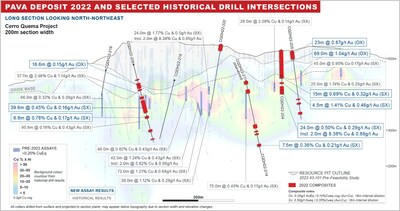

La Pava:

Orla completed eight core holes (1,343 metres) at La Pava in 2022, targeting potential extensions of sulphide mineralization defined by historical drilling beneath the oxide mineralization. The new drill results together with extensive historical drilling indicate the presence of significant copper-gold sulphide mineralization. The sulphide Cu-Au mineralization at La Pava is now defined over a strike length of approximately 800 metres, over a width of 280 metres, consisting of stacked sub horizontal lenticular shapes with thicknesses up to 35 metres, beneath the oxide gold mineralization. In addition, some of the 2022 drill holes cut oxide material while targeting the sulphide mineralization, confirming the upper oxide mineralization zone.

Notable 2022 drill results:

- CQDH-22-204: 0.06% Cu, 1.04 g/t Au over 69.0 m (Oxide) from 0.0 m1 and 0.69% Cu, 0.32 g/t Au over 15.0 m (Sulphide) from 69.0 m and 0.50% Cu, 0.29 g/t Au over 24.0 m (Sulphide) from 110.6 m

- CQDH-22-209: 0.45% Cu, 0.16 g/t Au over 39.6 m (Sulphide) from 117.2 m and 0.78% Cu, 0.17 g/t Au over 6.8 m (Sulphide) from 167.7 m

Selected historical2 drill results in sulphide below the La Pava oxide mineralization:

HOLE-ID | From | To | Core Length | Au g/t | Cu % | AuEq g/t | CuEq % |

PDH11006 | 144.00 | 182.00 | 38.00 | 0.29 | 1.12 | 1.90 | 1.33 |

PDH11013 | 90.00 | 118.00 | 28.00 | 0.14 | 2.08 | 3.10 | 2.17 |

PDH12028 | 61.00 | 106.00 | 45.00 | 0.17 | 0.95 | 1.53 | 1.07 |

PDH12033 | 100.00 | 172.00 | 72.00 | 0.68 | 1.21 | 2.41 | 1.69 |

PDH12040 | 133.00 | 179.00 | 46.00 | 0.43 | 0.82 | 1.61 | 1.12 |

PDH92009 | 148.30 | 186.00 | 37.70 | 1.14 | 2.46 | 4.65 | 3.25 |

PDH93014 | 97.00 | 121.00 | 24.00 | 0.50 | 1.77 | 3.03 | 2.12 |

PDH93017 | 85.00 | 127.00 | 42.00 | 0.43 | 1.24 | 2.20 | 1.54 |

PRH12250 | 14.00 | 39.00 | 25.00 | 0.25 | 1.74 | 2.74 | 1.91 |

Quemita Norte:

The Quemita Norte target is located 200 metres northwest of the Quemita Oxide gold deposit. Five core holes (1,328 metres) were completed, following-up on a historical and previously reported intersection obtained in hole CQDH-17-112[3] (1.36% Cu & 0.15 g/t Au over 26.5 metres and 0.60% Cu & 0.12 g/t Au over 124.4 metres (see the Company's August 24, 2017 news release – Orla Provides Update on its Projects). The 2022 drill program extended copper mineralization over approximately 180 metres on a northwest-southeast drill section and 210 metres along strike. The mineralization remains open along strike and additional drilling is required to further define the extent of mineralization.

Notable sulphide results:

- CQDH-22-208: 0.54% Cu, 0.14 g/t Au over 58.1 m, from 30.0 m

- CQDH-22-212: 1.35% Cu, 0.24 g/t Au over 19.9 m from 162.2 m

- CQDH-22-203: 0.38% Cu, 0.18 g/t Au over 28.8 m from 137.2 m and 1.09% Cu, 0.10 g/t Au over 9.5 m from 59.7 m

2023 Exploration Plans & Strategy: Cerro Quema (Panama)

A $5 million exploration budget is planned in Panama in 2023 which would include approximately 5,500 metres of core drilling.

Targeting Discoveries:

The 2023 exploration program will follow-up on the encouraging results generated at La Pelona and La Prieta regional targets in 2022 (see news release dated September 12, 2022 - Orla Mining Advances Exploration & Growth Pipeline). Upon completion of the exploration and drilling campaign during the dry season of the first half of 2023, exploration and operational activities will be reduced in Panama. Data interpretation of the results will take place primarily in the second half of 2023 while on-the-ground activities will be minimal.

Drilling at La Pelona in 2022 confirmed high sulphidation type gold mineralization associated with argillic alteration, vuggy silica, overlying an Induced Polarization (IP) chargeability anomaly. Oxide gold mineralization has been intersected in drilling over a strike length of 300 metres and from surface to 150 metres vertically and remains open along strike and at depth within sulphide mineralization. In 2023, the drill program will consist of approximately 3,000 metres of core drilling to test the broader alteration, gold-in-rock, and IP chargeability anomalies over a strike length of approximately two kilometres.

Drilling at La Prieta in 2022 intercepted copper-gold mineralization associated with pyrite, chalcopyrite, and bornite in quartz stockworks, quartz veins and hydrothermal magnetite-pyrite matrix breccias hosted in a multi-phase dioritic intrusion. Multiple intercepts, ranging from surface to 490 metres down-hole, of anomalous gold (>100 ppb Au) and copper (>0.1% Cu) and significant mineralization (>0.5 g/t Au and/or >0.3% Cu) were intersected in 2022. In 2023, the drill program will consist of approximate 2,500 metres of core drilling to follow-up on encouraging 2022 results.

Qualified Persons Statement

The scientific and technical information in this news release has been reviewed and approved by Mr. Sylvain Guerard, P Geo., SVP Exploration of the Company, who is the Qualified Person as defined under the definitions of National Instrument 43-101 ("NI 43-101").

To verify the information related to the 2022 drilling programs at the Cerro Quema property, Mr. Guerard has visited the property in the past year; discussed logging, sampling, and sample shipping processes with responsible site staff; discussed and reviewed assay and Quality Assurance/Quality Control ("QA/QC") results with responsible personnel; and reviewed supporting documentation, including drill hole location and orientation and significant assay interval calculations.

Quality Assurance / Quality Control – Cerro Quema 2022 Drill Program

All gold results for Cerro Quema were obtained by ALS Minerals (Au-AA23) using fire assay fusion and an atomic absorption spectroscopy finish. All samples are also analyzed for multi-elements, including copper, using an Aqua Regia (ME-ICP41) method at ALS Laboratories in Peru. If samples are returned with Cu values in excess of 1% by ICP analysis, samples are re-run with AA46 aqua regia and atomic absorption analysis. If samples are returned with gold metal values in excess of 10 g/t by fire assay and atomic absorption spectroscopy finish, samples are re-run with Au-GRA21 gravimetric analysis and atomic absorption analysis. Drill program design, QA/QC and interpretation of results are performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices. Standards were inserted at a frequency of one in every 50 samples, duplicates at a frequency of one in every 50 samples, and blanks were inserted at a frequency of (at random) one in every 50 samples for QA/QC purposes by the Company as well as the lab. ALS Laboratories is independent of Orla. There are no known drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the drilling data at Cerro Quema.

About Orla Mining Ltd.

Orla is operating the Camino Rojo Oxide Gold Mine, a gold and silver open-pit and heap leach mine, located in Zacatecas State, Mexico. The property is 100% owned by Orla and covers over 160,000 hectares. The technical report for the 2021 Feasibility Study on the Camino Rojo oxide gold project entitled "Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico" dated January 11, 2021, is available on SEDAR and EDGAR under the Company's profile at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of Cerro Quema located in Panama which includes a gold production scenario and various exploration targets. Cerro Quema is a proposed open pit mine and gold heap leach operation. The technical report for the Pre-Feasibility Study on the Cerro Quema oxide gold project entitled "Project Pre-Feasibility Updated NI 43-101 Technical Report on the Cerro Quema Project, Province of Los Santos, Panama" dated January 18, 2022 (the "Cerro Quema Technical Report"), is available on SEDAR and EDGAR under the Company's profile at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of the South Railroad Project, a feasibility-stage, open pit, heap leach project located on the Carlin trend in Nevada. The technical report for the 2022 Feasibility Study entitled "South Railroad Project, Form 43-101F1 Technical Report Feasibility Study, Elko County, Nevada" dated March 23, 2022, is available on SEDAR and EDGAR under the Company's profile at www.sedar.com and www.sec.gov, respectively. The technical reports are available on Orla's website at www.orlamining.com.

Forward-looking Statements

This news release contains certain "forward-looking information" and "forward-looking statements" within the meaning of Canadian securities legislation and within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission, all as may be amended from time to time, including, without limitation, statements regarding the potential mineralization at Cerro Quema based on the 2022 drill program and statements regarding the Company's 2023 drill program, including the expected expenditures, timing and results thereof. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding the price of gold, silver, and copper; the accuracy of mineral resource and mineral reserve estimations; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: uncertainty and variations in the estimation of mineral resources and mineral reserves, including risks that the interpreted drill results may not accurately represent the actual continuity of geology or grade of the deposit, bulk density measurements may not be representative, interpreted and modelled metallurgical domains may not be representative, and metallurgical recoveries may not be representative; the Company's reliance on Camino Rojo; financing risks and access to additional capital; risks related to natural disasters, terrorist acts, health crises and other disruptions and dislocations, including by the COVID-19 pandemic; risks related to the Company's indebtedness; success of exploration, development, and operation activities; foreign country and political risks, including risks relating to foreign operations and expropriation or nationalization of mining operations; concession risks; permitting risks; environmental and other regulatory requirements; delays in or failures to enter into a subsequent agreement with Fresnillo Plc with respect to accessing certain additional portions of the mineral resource at Camino Rojo and to obtain the necessary regulatory approvals related thereto; the mineral resource estimations for Camino Rojo being only estimates and relying on certain assumptions; delays in or failure to get access from surface rights owners; risks related to guidance estimates and uncertainties inherent in the preparation of feasibility and pre-feasibility studies, including but not limited to, assumptions underlying the production estimates not being realized, changes to the cost of production, variations in quantity of mineralized material, grade or recovery rates, geotechnical or hydrogeological considerations during mining differing from what has been assumed, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to exchange, interest or tax rates, cost of labour, supplies, fuel and equipment rising, changes in project parameters, delays, and costs inherent to consulting and accommodating rights of local communities; uncertainty in estimates of production, capital, and operating costs and potential production and cost overruns; the fluctuating price of gold, silver, and copper; global financial conditions; uninsured risks; competition from other companies and individuals; uncertainties related to title to mineral properties; conflicts of interest; risks related to compliance with anti-corruption laws; volatility in the market price of the Company's securities; assessments by taxation authorities in multiple jurisdictions; foreign currency fluctuations; the Company's limited operating history; risks related to the Company's history of negative operating cash flow; litigation risks; intervention by non-governmental organizations; outside contractor risks; risks related to historical data; unknown labilities in connection with acquisitions; the Company's ability to identify, complete, and successfully integrate acquisitions; dividend risks; risks related to the Company's foreign subsidiaries; risks related to the Company's accounting policies and internal controls; the Company's ability to satisfy the requirements of the Sarbanes-Oxley Act of 2002; enforcement of civil liabilities; the Company's status as a passive foreign investment company for U.S. federal income tax purposes; information and cyber security; gold industry concentration; shareholder activism; risks associated with executing the Company's objectives and strategies, as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, as well as its annual information form dated March 18, 2022, which are available on www.sedar.com and www.sec.gov. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

This news release has been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the United States securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources", "indicated mineral resources", "measured mineral resources" and "mineral resources" used or referenced in this news release are Canadian mineral disclosure terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For United States reporting purposes, the United States Securities and Exchange Commission ("SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the Securities Exchange Act of 1934, as amended. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in Industry Guide 7 under the U.S. Securities Act. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multijurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and provides disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained in news release may not be comparable to similar information disclosed by United States companies.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the above terms are "substantially similar" to CIM Definition Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. There is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of Industry Guide 7. Accordingly, information contained in this news release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Appendix: Drill Results

Table 1: Cerro Quema Drill Composites

HOLE-ID | From | To | Core Length | Estimated True Width | Au g/t | Cu % | AuEq g/t | CuEq % | Including | Area | OX / SX | Cog |

CQDH-22-191 | 15.70 | 20.20 | 4.50 | 3.95 | 0.05 | 0.42 | 0.64 | 0.45 | Quemita | OX | 0.2 | |

CQDH-22-191 | 29.00 | 30.10 | 1.10 | 0.97 | 0.05 | 0.60 | 0.90 | 0.63 | Quemita | SX | 0.5 | |

CQDH-22-191 | 51.40 | 58.90 | 7.50 | 6.61 | 0.17 | 0.71 | 1.17 | 0.82 | Quemita | SX | 0.5 | |

CQDH-22-191 | 75.40 | 81.40 | 6.00 | 5.28 | 0.08 | 0.37 | 0.61 | 0.43 | Quemita | SX | 0.5 | |

CQDH-22-191 | 86.60 | 99.60 | 13.00 | 11.43 | 0.11 | 0.30 | 0.53 | 0.37 | Quemita | SX | 0.5 | |

CQDH-22-191 | 106.10 | 109.10 | 3.00 | 2.64 | 0.07 | 0.39 | 0.63 | 0.44 | Quemita | SX | 0.5 | |

CQDH-22-191 | 124.40 | 125.90 | 1.50 | 1.32 | 0.07 | 0.37 | 0.61 | 0.42 | Quemita | SX | 0.5 | |

CQDH-22-191 | 144.50 | 146.00 | 1.50 | 0.49 | 0.19 | 0.34 | 0.66 | 0.47 | Quemita | SX | 0.5 | |

CQDH-22-191 | 162.60 | 164.10 | 1.50 | 0.49 | 0.14 | 0.27 | 0.53 | 0.37 | Quemita | SX | 0.5 | |

CQDH-22-191 | 172.80 | 174.35 | 1.55 | 0.50 | 0.07 | 0.33 | 0.54 | 0.38 | Quemita | SX | 0.5 | |

CQDH-22-191 | 177.25 | 178.75 | 1.50 | 0.49 | 0.06 | 0.50 | 0.77 | 0.54 | Quemita | SX | 0.5 | |

CQDH-22-191 | 207.10 | 208.60 | 1.50 | 0.49 | 0.08 | 0.31 | 0.52 | 0.37 | Quemita | SX | 0.5 | |

CQDH-22-191 | 217.60 | 219.10 | 1.50 | 0.48 | 0.08 | 0.31 | 0.52 | 0.37 | Quemita | SX | 0.5 | |

CQDH-22-192 | 14.20 | 48.35 | 34.15 | 19.69 | 0.69 | 0.04 | 0.75 | 0.53 | Caballito | OX | 0.2 | |

CQDH-22-192 | 100.50 | 148.30 | 47.80 | 27.28 | 0.52 | 1.54 | 2.73 | 1.91 | 3m @ 0.6g/t Au & 7.57% Cu from 108m | Caballito | SX | 0.5 |

CQDH-22-192 | 184.20 | 185.70 | 1.50 | 0.86 | 0.21 | 0.21 | 0.51 | 0.35 | Caballito | SX | 0.5 | |

CQDH-22-192 | 223.05 | 227.10 | 4.05 | 2.30 | 0.62 | 1.19 | 2.32 | 1.62 | Caballito | SX | 0.5 | |

CQDH-22-192 | 243.95 | 244.90 | 0.95 | 0.54 | 0.06 | 0.86 | 1.28 | 0.90 | Caballito | SX | 0.5 | |

CQDH-22-195 | 9.00 | 94.70 | 85.70 | 81.67 | 0.61 | 0.03 | 0.65 | 0.46 | Caballito | OX | 0.2 | |

CQDH-22-195 | 94.70 | 115.90 | 21.20 | 20.18 | 0.13 | 1.91 | 2.87 | 2.01 | 2m @ 0.24g/t Au & 6.68% Cu from 96.2m | Caballito | SX | 0.5 |

CQDH-22-197 | 76.85 | 78.40 | 1.55 | 0.81 | 0.19 | 0.61 | 1.07 | 0.75 | Idaida | SX | 0.5 | |

CQDH-22-197 | 187.70 | 207.20 | 19.50 | 10.29 | 0.39 | 2.62 | 4.13 | 2.89 | 1.5m @ 0.68g/t Au & 6.69% Cu from 201.2m | Idaida | SX | 0.5 |

CQDH-22-198 | 71.10 | 72.05 | 0.95 | 0.62 | 0.35 | 0.56 | 1.14 | 0.80 | Caballito | SX | 0.5 | |

CQDH-22-199 | 33.70 | 65.05 | 31.35 | 31.19 | 0.52 | 0.58 | 1.34 | 0.94 | Caballito | OX | 0.2 | |

CQDH-22-199 | 70.10 | 73.80 | 3.70 | 3.68 | 0.32 | 4.42 | 6.64 | 4.65 | Caballito | SX | 0.5 | |

CQDH-22-200 | 138.35 | 147.95 | 9.60 | 4.01 | 0.23 | 0.40 | 0.80 | 0.56 | Idaida | SX | 0.5 | |

CQDH-22-200 | 233.30 | 251.30 | 18.00 | 7.12 | 0.10 | 1.72 | 2.55 | 1.79 | Idaida | SX | 0.5 | |

CQDH-22-200 | 282.80 | 373.05 | 90.25 | 32.45 | 0.07 | 0.89 | 1.34 | 0.94 | Idaida | SX | 0.5 | |

CQDH-22-201 | 94.50 | 99.00 | 4.50 | 3.96 | 0.10 | 0.65 | 1.03 | 0.72 | Quemita | SX | 0.5 | |

CQDH-22-201 | 115.50 | 129.00 | 13.50 | 11.83 | 0.06 | 0.34 | 0.55 | 0.39 | Quemita | SX | 0.5 | |

CQDH-22-201 | 205.50 | 207.00 | 1.50 | 0.53 | 0.15 | 0.25 | 0.51 | 0.35 | Quemita | SX | 0.5 | |

CQDH-22-201 | 210.00 | 214.50 | 4.50 | 1.60 | 0.15 | 0.24 | 0.50 | 0.35 | Quemita | SX | 0.5 | |

CQDH-22-201 | 223.50 | 225.00 | 1.50 | 0.54 | 0.09 | 0.32 | 0.55 | 0.38 | Quemita | SX | 0.5 | |

CQDH-22-201 | 226.50 | 228.00 | 1.50 | 0.54 | 0.14 | 0.35 | 0.64 | 0.45 | Quemita | SX | 0.5 | |

CQDH-22-202 | 4.50 | 25.50 | 21.00 | 20.07 | 0.07 | 0.50 | 0.78 | 0.54 | Caballito | OX | 0.2 | |

CQDH-22-203 | 59.70 | 69.20 | 9.50 | 8.84 | 0.10 | 1.09 | 1.66 | 1.16 | Quemita | SX | 0.5 | |

CQDH-22-203 | 76.70 | 88.45 | 11.75 | 10.93 | 0.12 | 0.30 | 0.56 | 0.39 | Quemita | SX | 0.5 | |

CQDH-22-203 | 92.65 | 95.35 | 2.70 | 2.51 | 0.11 | 0.29 | 0.53 | 0.37 | Quemita | SX | 0.5 | |

CQDH-22-203 | 99.60 | 101.10 | 1.50 | 1.39 | 0.10 | 0.39 | 0.66 | 0.46 | Quemita | SX | 0.5 | |

CQDH-22-203 | 117.70 | 119.20 | 1.50 | 1.39 | 0.16 | 0.28 | 0.56 | 0.40 | Quemita | SX | 0.5 | |

CQDH-22-203 | 137.15 | 165.95 | 28.80 | 22.27 | 0.18 | 0.38 | 0.71 | 0.50 | Quemita | SX | 0.5 | |

CQDH-22-203 | 172.15 | 173.65 | 1.50 | 1.17 | 0.13 | 0.31 | 0.58 | 0.41 | Quemita | SX | 0.5 | |

CQDH-22-203 | 182.80 | 184.30 | 1.50 | 1.18 | 0.10 | 0.32 | 0.56 | 0.39 | Quemita | SX | 0.5 | |

CQDH-22-203 | 191.80 | 194.80 | 3.00 | 2.36 | 0.15 | 0.35 | 0.64 | 0.45 | Quemita | SX | 0.5 | |

CQDH-22-204 | 0.00 | 69.00 | 69.00 | 61.79 | 1.04 | 0.06 | 1.12 | 0.79 | La Pava | OX | 0.2 | |

CQDH-22-204 | 69.00 | 84.00 | 15.00 | 13.43 | 0.32 | 0.69 | 1.30 | 0.91 | La Pava | SX | 0.5 | |

CQDH-22-204 | 97.05 | 101.55 | 4.50 | 4.03 | 0.46 | 1.41 | 2.47 | 1.73 | La Pava | SX | 0.5 | |

CQDH-22-204 | 110.55 | 134.50 | 23.95 | 21.45 | 0.29 | 0.50 | 1.01 | 0.71 | La Pava | SX | 0.5 | |

CQDH-22-205 | 0.00 | 23.00 | 23.00 | 21.53 | 0.87 | 0.03 | 0.91 | 0.64 | La Pava | OX | 0.2 | |

CQDH-22-205 | 141.50 | 143.00 | 1.50 | 1.42 | 0.11 | 0.46 | 0.77 | 0.54 | La Pava | SX | 0.5 | |

CQDH-22-205 | 153.50 | 156.50 | 3.00 | 2.83 | 0.38 | 1.64 | 2.73 | 1.91 | La Pava | SX | 0.5 | |

CQDH-22-205 | 180.50 | 186.50 | 6.00 | 5.65 | 0.19 | 0.67 | 1.14 | 0.80 | La Pava | SX | 0.5 | |

CQDH-22-206 | 44.55 | 109.70 | 65.15 | 64.89 | 0.34 | 0.84 | 1.54 | 1.08 | 1.1m @ 0.42g/t Au & 7.88% Cu from 50.1m | Caballito | SX | 0.5 |

CQDH-22-206 | 121.30 | 126.55 | 5.25 | 5.22 | 0.21 | 0.46 | 0.86 | 0.60 | Caballito | SX | 0.5 | |

CQDH-22-206 | 135.05 | 136.55 | 1.50 | 1.49 | 0.11 | 0.29 | 0.52 | 0.37 | Caballito | SX | 0.5 | |

CQDH-22-207 | 107.00 | 116.30 | 9.30 | 6.17 | 0.42 | 1.27 | 2.24 | 1.57 | Caballito | SX | 0.5 | |

CQDH-22-207 | 127.30 | 157.30 | 30.00 | 19.97 | 0.15 | 0.29 | 0.56 | 0.39 | Caballito | SX | 0.5 | |

CQDH-22-208 | 30.00 | 88.10 | 58.10 | 55.08 | 0.14 | 0.54 | 0.92 | 0.64 | Quemita | SX | 0.5 | |

CQDH-22-208 | 174.75 | 179.25 | 4.50 | 3.15 | 0.05 | 0.36 | 0.56 | 0.39 | Quemita | SX | 0.5 | |

CQDH-22-209 | 49.10 | 50.60 | 1.50 | 1.49 | 0.15 | 0.04 | 0.20 | 0.14 | La Pava | MX | 0.2 | |

CQDH-22-209 | 61.65 | 78.20 | 16.55 | 16.50 | 0.15 | 0.04 | 0.21 | 0.15 | La Pava | OX | 0.2 | |

CQDH-22-209 | 81.20 | 83.85 | 2.65 | 2.64 | 0.18 | 0.05 | 0.25 | 0.18 | La Pava | MX | 0.2 | |

CQDH-22-209 | 104.60 | 111.50 | 6.90 | 6.88 | 0.26 | 0.06 | 0.34 | 0.24 | La Pava | OX | 0.2 | |

CQDH-22-209 | 117.15 | 156.70 | 39.55 | 39.44 | 0.16 | 0.45 | 0.81 | 0.57 | La Pava | SX | 0.5 | |

CQDH-22-209 | 167.70 | 174.45 | 6.75 | 6.73 | 0.17 | 0.78 | 1.28 | 0.89 | La Pava | SX | 0.5 | |

CQDH-22-209 | 211.90 | 217.40 | 5.50 | 5.48 | 0.43 | 0.14 | 0.62 | 0.44 | La Pava | SX | 0.5 | |

CQDH-22-209 | 241.30 | 242.35 | 1.05 | 1.05 | 0.74 | 0.04 | 0.80 | 0.56 | La Pava | SX | 0.5 | |

CQDH-22-210 | 61.40 | 66.40 | 5.00 | 4.97 | 0.28 | 1.57 | 2.51 | 1.76 | Caballito | SX | 0.5 | |

CQDH-22-210 | 73.60 | 82.80 | 9.20 | 9.14 | 0.32 | 0.34 | 0.80 | 0.56 | Caballito | SX | 0.5 | |

CQDH-22-210 | 95.50 | 101.80 | 6.30 | 6.25 | 0.66 | 0.24 | 1.01 | 0.71 | Caballito | SX | 0.5 | |

CQDH-22-210 | 115.70 | 117.25 | 1.55 | 1.54 | 0.58 | 0.06 | 0.67 | 0.47 | Caballito | SX | 0.5 | |

CQDH-22-210 | 120.00 | 121.20 | 1.20 | 1.19 | 0.60 | 0.06 | 0.68 | 0.48 | Caballito | SX | 0.5 | |

CQDH-22-212 | 83.50 | 85.00 | 1.50 | 1.42 | 0.12 | 0.34 | 0.61 | 0.42 | Quemita | SX | 0.5 | |

CQDH-22-212 | 128.70 | 130.20 | 1.50 | 1.42 | 0.19 | 0.28 | 0.58 | 0.41 | Quemita | SX | 0.5 | |

CQDH-22-212 | 150.90 | 155.80 | 4.90 | 4.66 | 0.29 | 0.38 | 0.83 | 0.58 | Quemita | SX | 0.5 | |

CQDH-22-212 | 162.20 | 182.05 | 19.85 | 18.89 | 0.24 | 1.35 | 2.17 | 1.52 | Quemita | SX | 0.5 | |

CQDH-22-212 | 218.65 | 222.70 | 4.05 | 3.86 | 0.02 | 0.82 | 1.19 | 0.83 | Quemita | SX | 0.5 | |

CQDH-22-213 | 105.40 | 112.90 | 7.50 | 4.96 | 0.26 | 0.68 | 1.24 | 0.87 | Caballito | SX | 0.5 | |

CQDH-22-214 | 2.00 | 10.60 | 8.60 | 8.55 | 0.24 | 0.03 | 0.29 | 0.20 | La Pava | OX | 0.2 | |

CQDH-22-214 | 29.50 | 38.50 | 9.00 | 8.95 | 0.00 | 0.30 | 0.43 | 0.30 | La Pava | MX | 0.2 | |

CQDH-22-214 | 142.15 | 151.20 | 9.05 | 9.01 | 0.21 | 0.31 | 0.66 | 0.46 | La Pava | SX | 0.5 | |

CQDH-22-214 | 162.10 | 165.10 | 3.00 | 2.99 | 0.20 | 0.27 | 0.59 | 0.41 | La Pava | SX | 0.5 | |

CQDH-22-214 | 170.70 | 174.10 | 3.40 | 3.39 | 0.30 | 0.28 | 0.69 | 0.49 | La Pava | SX | 0.5 | |

CQDH-22-214 | 203.85 | 211.35 | 7.50 | 7.47 | 0.21 | 0.36 | 0.73 | 0.51 | La Pava | SX | 0.5 | |

CQDH-22-215 | 104.60 | 114.90 | 10.30 | 10.26 | 0.35 | 0.28 | 0.74 | 0.52 | Caballito | SX | 0.5 | |

CQDH-22-215 | 127.15 | 131.40 | 4.25 | 4.24 | 0.44 | 0.41 | 1.02 | 0.72 | Caballito | SX | 0.5 | |

CQDH-22-216 | 0.00 | 1.50 | 1.50 | 1.31 | 0.21 | 0.01 | 0.23 | 0.16 | La Pava | OX | 0.2 | |

CQDH-22-217 | 0.00 | 1.50 | 1.50 | 0.79 | 0.25 | 0.00 | 0.25 | 0.18 | Idaida | OX | 0.2 | |

CQDH-22-217 | 8.65 | 22.90 | 14.25 | 7.63 | 0.21 | 0.04 | 0.27 | 0.19 | Idaida | OX | 0.2 | |

CQDH-22-217 | 138.25 | 144.25 | 6.00 | 3.31 | 0.27 | 0.33 | 0.74 | 0.52 | Idaida | SX | 0.5 | |

CQDH-22-218 | 3.00 | 4.50 | 1.50 | 1.50 | 0.27 | 0.03 | 0.31 | 0.22 | Caballito | OX | 0.2 | |

CQDH-22-218 | 141.40 | 155.05 | 13.65 | 13.59 | 0.27 | 0.63 | 1.17 | 0.82 | Caballito | SX | 0.5 | |

CQDH-22-219 | 0.00 | 1.60 | 1.60 | 1.51 | 0.26 | 0.06 | 0.36 | 0.25 | La Pava | OX | 0.2 | |

CQDH-22-220 | 0.00 | 1.50 | 1.50 | 1.08 | 0.48 | 0.01 | 0.49 | 0.34 | Idaida | OX | 0.2 | |

CQDH-22-220 | 13.00 | 33.50 | 20.50 | 14.74 | 0.34 | 0.03 | 0.39 | 0.27 | Idaida | OX | 0.2 | |

CQDH-22-220 | 76.10 | 77.60 | 1.50 | 1.09 | 0.00 | 0.31 | 0.44 | 0.31 | Idaida | MX | 0.2 | |

CQDH-22-220 | 107.60 | 109.10 | 1.50 | 1.09 | 0.10 | 0.38 | 0.63 | 0.44 | Idaida | SX | 0.5 | |

CQDH-22-221 | 4.50 | 6.00 | 1.50 | 1.35 | 0.41 | 0.03 | 0.46 | 0.32 | Caballito | OX | 0.2 | |

CQDH-22-222 | 0.00 | 17.00 | 17.00 | 16.81 | 1.52 | 0.03 | 1.56 | 1.09 | La Pava | OX | 0.2 | |

CQDH-22-223 | 14.20 | 38.85 | 24.65 | 22.02 | 0.33 | 0.17 | 0.57 | 0.40 | Idaida | OX | 0.2 | |

CQDH-22-223 | 38.85 | 52.35 | 13.50 | 12.10 | 0.31 | 1.17 | 1.98 | 1.39 | Idaida | SX | 0.5 | |

CQDH-22-223 | 61.50 | 78.10 | 16.60 | 14.88 | 0.24 | 1.06 | 1.76 | 1.23 | Idaida | SX | 0.5 | |

CQDH-22-223 | 90.40 | 195.55 | 105.15 | 93.80 | 0.20 | 0.98 | 1.59 | 1.12 | 1.5m @ 0.54g/t Au & 8.33% Cu from 72.1m | Idaida | SX | 0.5 |

CQDH-22-223 | 260.35 | 261.85 | 1.50 | 1.34 | 0.03 | 0.42 | 0.63 | 0.44 | Idaida | SX | 0.5 | |

CQDH-22-223 | 269.80 | 271.10 | 1.30 | 1.16 | 0.07 | 2.05 | 3.01 | 2.10 | Idaida | SX | 0.5 | |

CQDH-22-223 | 323.30 | 324.80 | 1.50 | 1.34 | 0.03 | 0.41 | 0.61 | 0.43 | Idaida | SX | 0.5 | |

CQMET-22-193 | 9.00 | 85.60 | 76.60 | 69.09 | 0.40 | 0.05 | 0.47 | 0.33 | Idaida | OX | 0.2 | |

CQMET-22-194 | 174.00 | 178.90 | 4.90 | 4.45 | 0.43 | 0.67 | 1.39 | 0.98 | Caballito | SX | 0.5 | |

CQMET-22-196 | 7.50 | 48.50 | 41.00 | 40.80 | 0.58 | 0.04 | 0.64 | 0.45 | Caballito | OX | 0.2 |

Criteria: OX and MX Domains, Cut off grade 0.2g/t AuEq, minimum length 1.5m, maximum consecutive internal waste 6m. |

SX Domain, Cut off grade 0.35% Cueq (0.5g/t AuEq), minimum length 1.5m, maximum consecutive internal waste 6m. |

Price Assumptions: Au = 1800usd oz, Cu = 3.75usd lb |

Table 2: Cerro Quema Drill Hole Collars

Drillhole | Easting | Northing | Elevation | Azimuth | Dip | Depth (m) |

CQDH-22-191 | 553245 | 836150 | 726 | 130.0 | -60.0 | 255 |

CQDH-22-192 | 554468 | 834565 | 577 | 250.0 | -60.0 | 309 |

CQMET-22-193 | 554409 | 835085 | 756 | 0.0 | -90.0 | 180 |

CQMET-22-194 | 554475 | 834611 | 584 | 0.0 | -90.0 | 190 |

CQDH-22-195 | 554406 | 835089 | 757 | 135.0 | -65.0 | 247 |

CQMET-22-196 | 554369 | 834631 | 560 | 90.0 | -60.0 | 229 |

CQDH-22-197 | 554456 | 835139 | 769 | 270.0 | -70.0 | 260 |

CQDH-22-198 | 554665 | 834986 | 708 | 270.0 | -60.0 | 169 |

CQDH-22-199 | 554470 | 834566 | 577 | 90.0 | -70.0 | 148 |

CQDH-22-200 | 554456 | 835264 | 747 | 270.0 | -60.0 | 373 |

CQDH-22-201 | 553142 | 836053 | 701 | 130.0 | -60.0 | 253 |

CQDH-22-202 | 554238 | 834464 | 464 | 45.0 | -60.0 | 199 |

CQDH-22-203 | 553141 | 836053 | 702 | 310.0 | -70.0 | 281 |

CQDH-22-204 | 550077 | 834816 | 524 | 25.0 | -65.0 | 139 |

CQDH-22-205 | 550153 | 834918 | 519 | 180.0 | -70.0 | 201 |

CQDH-22-206 | 554555 | 834748 | 621 | 90.0 | -65.0 | 169 |

CQDH-22-207 | 554553 | 834747 | 621 | 270.0 | -65.0 | 191 |

CQDH-22-208 | 553182 | 836107 | 720 | 304.0 | -75.0 | 181 |

CQDH-22-209 | 549770 | 835164 | 480 | 180.0 | -60.0 | 247 |

CQDH-22-210 | 554531 | 834826 | 634 | 90.0 | -60.0 | 148 |

CQDH-22-211 | 550078 | 835081 | 432 | 180.0 | -65.0 | 64 |

CQDH-22-212 | 553271 | 836053 | 769 | 124.0 | -70.0 | 358 |

CQDH-22-213 | 554529 | 834826 | 634 | 270.0 | -65.0 | 195 |

CQDH-22-214 | 550078 | 835080 | 432 | 180.0 | -60.0 | 235 |

CQDH-22-215 | 554477 | 834884 | 622 | 90.0 | -60.0 | 160 |

CQDH-22-216 | 549750 | 834809 | 446 | 0.0 | -60.0 | 195 |

CQDH-22-217 | 554351 | 835052 | 719 | 270.0 | -50.0 | 150 |

CQDH-22-218 | 554448 | 834881 | 616 | 90.0 | -70.0 | 211 |

CQDH-22-219 | 549595 | 834943 | 470 | 0.0 | -70.0 | 75 |

CQDH-22-220 | 554350 | 835052 | 720 | 270.0 | -65.0 | 198 |

CQDH-22-221 | 554449 | 834881 | 616 | 0.0 | -90.0 | 255 |

CQDH-22-222 | 549927 | 834898 | 541 | 320.0 | -80.0 | 187 |

CQDH-22-223 | 554363 | 835117 | 732 | 0.0 | -90.0 | 359 |

Table 3: Selected Historical La Pava Drill Hole Collars

Drillhole | Easting | Northing | Elevation | Azimuth | Dip | Depth (m) |

PDH11006 | 549929 | 834996 | 518 | 0.0 | -90.0 | 281 |

PDH11013 | 550096 | 834910 | 523 | 0.0 | -90.0 | 300 |

PDH12028 | 550142 | 834825 | 528 | 0.0 | -90.0 | 157 |

PDH12033 | 549923 | 835035 | 508 | 0.0 | -90.0 | 336 |

PDH12040 | 549862 | 834997 | 557 | 0.0 | -90.0 | 345 |

PDH92009 | 549736 | 834992 | 547 | 244.0 | -88.0 | 261 |

PDH93014 | 549928 | 834994 | 519 | 0.0 | -90.0 | 196 |

PDH93014 | 549928 | 834994 | 519 | 0.0 | -90.0 | 196 |

PDH93017 | 549927 | 835118 | 445 | 180.0 | -55.0 | 214 |

PRH12250 | 550251 | 834785 | 489 | 0.0 | -90.0 | 56 |

PDH135316 | 554410 | 835090 | 744 | 0.0 | -90.0 | 579 |

_____________________________ |

1 Oxide gold mineralization in hole CQDH-22-204 is part of and confirms strong oxide gold mineralization in the Pava oxide deposit. |

2 Drill results presented are historical in nature and were completed by Pershimco Resources Inc., the prior owner of the Cerro Quema Project. See Table 3 in the Appendix to this news release and the Cerro Quema Technical Report for additional information. Composites for the sulphide drilling were calculated using 0.35% Cueq (0.5 g/t AuEq) cut-off grade and maximum 6 metres consecutive waste. |

3 Historical drill intercept previously reported in news release dated August 24, 2017. |

SOURCE Orla Mining Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2023/16/c6047.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2023/16/c6047.html