Orla Mining Reports Third Quarter 2022 Results

Record Quarterly Production and Camino Rojo Sulphide Development Update

VANCOUVER, BC, Nov. 10, 2022 /CNW/ - Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) ("Orla" or the "Company") today announces the results for the third quarter ended September 30, 2022.

(All amounts are in U.S. dollars unless otherwise stated)

HIGHLIGHTS:

- Record gold production of 28,876 ounces in the third quarter of 2022, and 77,580 ounces year to date.

- Total cash cost and all-in sustaining costs ("AISC") for the third quarter were $452 and $594 per ounce of gold sold1, respectively. Total cost of sales was $12.0 million.

- Gold production guidance for the full year 2022 has been increased to a range of 100,000 to 110,000 ounces from 90,000 to 100,000 ounces. AISC guidance for the year has been maintained at $600 to $700 per ounce of gold sold.

- During the quarter, cash flow from operating activities before changes in non-cash working capital was $15.5 million, and free cash flow1 totalled $25.2 million. Orla had a cash balance of $89.1 million at September 30, 2022.

- Adjusted earnings for the third quarter of $5.7 million or $0.02 per share.

- Net income of $8.9 million or $0.03 per share, which included $8.3 million in exploration expensed across the portfolio.

- Camino Rojo's processing throughput for the third quarter achieved an average of 19,200 tonnes per day, 107% of nameplate capacity.

- Completed acquisition of Gold Standard Ventures Corp. ("Gold Standard"), the owner of the South Railroad Project ("South Railroad"), a feasibility-stage, open pit, heap leach project located on the Carlin trend in Nevada.

1 Cash cost, AISC, free cash flow and adjusted earnings are non-GAAP measures. See the "Non-GAAP Measures" section of this news release for additional information. | ||

"Camino Rojo's continued outperformance has given us the confidence to increase annual production guidance in our first operating year," said Jason Simpson, President and Chief Executive Officer of Orla. "During the quarter, we were also pleased to complete the acquisition of Gold Standard, strengthening our growth pipeline."

FINANCIAL AND OPERATIONS UPDATE

Table 1: Financial and Operating Highlights | Q3 - 2022 | YTD 2022 | |

Operating | |||

Gold Produced | oz | 28,876 | 77,580 |

Gold Sold | oz | 28,749 | 75,064 |

Average Realized Gold Price1 | $/oz | $1,699 | $1,810 |

Cost of Sales – Operating Cost | $M | $12.0 | $32.1 |

Cash Cost per Ounce1,2 | $/oz | $452 | $446 |

All-in Sustaining Cost per Ounce1,2 | $/oz | $594 | $597 |

Financial | |||

Revenue | $M | $49.0 | $136.5 |

Net Income (loss) | $M | $8.9 | $27.1 |

Adjusted Earnings1 | $M | $5.7 | $36.5 |

Earnings (loss) per Share – basic | $/sh | $0.03 | $0.10 |

Adjusted Earnings per Share – basic1 | $/sh | $0.02 | $0.14 |

Cash Flow from Operating Activities before Changes in Non-Cash Working Capital | $M | $15.5 | $56.0 |

Free Cash Flow1 | $M | $25.2 | $70.3 |

Financial Position | Sept 30, 2022 | Dec 31, 2021 | |

Cash and Cash Equivalents | $M | $89.1 | $20.5 |

Net Debt1 | $M | $77.5 | $140.8 |

1. | "Average Realized Gold Price", "Cash Cost per Ounce", "All-in Sustaining Cost per Ounce", "Adjusted Earnings", |

2. | The Company declared commercial production at Camino Rojo effective April 1, 2022. Consequently, the "year to date" |

CAMINO ROJO OXIDE MINE UPDATE

The Company declared commercial production at Camino Rojo on April 1, 2022. Camino Rojo produced 28,876 ounces of gold in the third quarter, 2022. Year to date gold production totals 77,580 ounces and gold production guidance for the full year 2022 has been increased to a range of 100,000 to 110,000 ounces. Gold sold during the quarter totalled 28,749 ounces while year to date gold sold amounts to 75,064 ounces.

Mining rates have steadily increased, averaging 44,911 tonnes per day in the third quarter. The average grade mined, excluding low grade material that was stockpiled, was 0.77 g/t of gold during the quarter, which is in line with plan.

Camino Rojo achieved record quarterly processing throughput in the third quarter 2022. The average daily stacking rate for the third quarter was 19,200 tonnes per day, which is above the nameplate capacity of 18,000 tonnes per day. Mined ore tonnes are reconciling well to the block model and process recoveries to date are in line with the metallurgical recovery model. Additional ore is being generated from the conversion of previously modelled waste tonnes in the upper benches of the pit.

Third quarter cash costs and AISC totalled $452 and $594 per ounce of gold sold, respectively. The operations have experienced unit price increases across several key reagents and consumables, which have been largely offset by lower than budgeted consumption rates. Capital expenditures totalled $1.8 million in the third quarter which included $0.8 million in sustaining capital. AISC guidance for 2022 (Q2-Q4) remains unchanged at $600 to $700 per ounce of gold sold.

CAMINO ROJO SULPHIDE PROJECT UPDATE

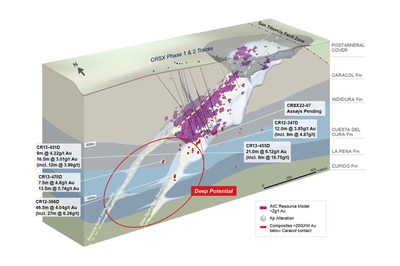

Historical drilling on the Camino Rojo Sulphides, conducted by the previous project owners, indicated the gold grade of the deposit to be widely disseminated and a large, open-pit mining scenario was the favoured development pathway. A lower grade open pit development scenario would necessitate higher capital expenditures for a large processing facility and extensive material handling. To understand if an alternative, more targeted development approach was possible, the presence of higher grades had to be confirmed. It was interpreted that portions of the deposit were comprised of higher grade steeply northwest dipping vein sets. To test for the higher grades and to confirm the geological model, Orla began drilling into the Camino Rojo Sulphides in the opposite (south) orientation of historical drilling. Since the fourth quarter 2020, two phases of drilling have been conducted with the results indicating the presence of continuous, higher-grade gold domains which could be amenable to underground mining, allowing for a smaller processing facility and less material handling. Most recently, the south oriented Phase 2 drill program has returned higher-grade gold intercepts (>2 g/t) over wide widths (>30m). These results are derived from an 8,750-metre drill program being conducted in 2022, to reinforce the geologic model and to continue to confirm the continuity of wide zones of higher-grade gold mineralization. Ten of the 15 diamond drill holes have been completed. Results from the first five drill holes are available on the Company's website and in the news release dated September 12, 2022 (Orla Mining Advances Exploration & Growth Pipeline). Results from the remaining drill holes are expected in early 2023. Selected significant results from the first five holes include:

- Hole CRSX22-05: 1.95 g/t Au over 61.2m, incl. 2.05 g/t Au over 19.5m

- Hole CRSX22-06: 2.56 g/t Au over 41.5m, incl. 4.00 g/t Au over 19.5m

- Hole CRSX22-07A: 3.20 g/t Au over 36.6m

- Hole CRSX22-07B: 2.13 g/t Au over 27.0m, incl. 4.43 g/t Au over 9.5m

- Hole CRSX22-08A: 3.08 g/t Au over 52.5m, incl. 4.37 g/t Au over 28.5m

The first metallurgical results from the Phase 2 drilling confirm the potential for a standalone processing option for the Camino Rojo Sulphides, thereby conserving the potential for the Company to retain 100% ownership in a potential project2. Metallurgical testing will continue as each new phase of drill core becomes available.

2 In the event a project at the Camino Rojo Sulphides has been defined by the Company through a pre-feasibility study outlining a development scenario using the existing infrastructure at Peñasquito, Newmont Corporation ("Newmont") may, at its option, enter into a joint venture where it would own 70% of the project, with Orla owning 30%. See the Company's Management's Discussion and Analysis of the Company as at and for the year ended December 31, 2021, for additional information. | ||

Most of the gold mineralization at Camino Rojo has been defined in the Caracol Formation where auriferous veins are mostly constrained to a broad envelope of potassic alteration (Kp). Gold mineralization extends deeper into the underlying Indidura and Cuesta del Cura formations (and potentially deeper into other underlying units) along the Dike Zone and Breccia Fault Zone, suggesting these faults may be feeder-like structures for the Camino Rojo deposit.

All drill results presented in Figure 1 are historical in nature and are not treated by the Company as current. Such results were completed by Goldcorp Inc., a prior owner of the Camino Rojo Project. |

During the ongoing Orla Phase 2 drill program, selected holes were extended to test the continuity of gold mineralization where the Dike Zone crosscut the Indidura Formation. These drill holes have returned encouraging visual results (assays pending) of the sulphide veins crosscutting bedding and associated calc-silicate alteration within the Indidura Formation. Compilation of historical drill data has confirmed significant gold intercepts over significant widths with a similar style of mineralization elsewhere in the Indidura formation, as well as skarn and calc-silicate alteration associated with manto-type mineralization with semi-massive to massive sulphides replacing bedding in the Cuesta del Cura Formation.

Based on the positive results encountered in the Phase 1 and 2 programs, more closely spaced, south-oriented drilling will be required to fully capture the extent of a potential underground resource. To date, approximately 13,868 metres of directional drilling has been completed which has continued to inform Orla's perspective on the development approach to the deposit. Orla expects to provide details of a Phase 3 south-oriented drill program and metallurgical testwork program in early 2023. This drilling is expected to strengthen the confidence for a Preliminary Economic Assessment ("PEA") that contemplates underground mining. Upon the completion of additional south oriented directional drilling and testwork programs, a PEA is expected to be completed based on the optimal development method for Orla.

Drilling during the planned Phase 3 drill program will focus on infilling the Caracol hosted mineralization (existing resources) and also follow-up on this new and historical drill data, testing the down plunge extension potential of the Camino Rojo Sulphide deposit into the Indidura and Cuesta del Cura formations along the Dike and Breccia zones as well as further Orla's metallurgical planning.

GOLD STANDARD ACQUISITION / SOUTH RAILROAD PROJECT

On August 12, 2022, Orla completed the acquisition of Gold Standard by way of court-approved plan of arrangement (the "Transaction").

Gold Standard's key asset is the 100%-owned South Railroad Project, a feasibility-stage, open pit, heap leach project located on the Carlin trend in Nevada. A Feasibility Study on South Railroad was completed in February 2022 and permitting activities are currently underway. As part of the Transaction, Orla also acquired the Lewis Project ("Lewis"), a large, strategically located, prospective land package on the Battle Mountain trend in Nevada. Orla has begun integrating South Railroad into the Company's growth plans with key priorities for South Railroad to include project permitting, review of project schedule including critical path activities, and assessment of current exploration supporting resource expansion.

Through the remainder of the year, Orla will continue with Gold Standard's 2022 planned program of resource expansion and exploration drilling at key targets on the South Railroad Project. The Company will also commence an additional 5,000 metre RC and core drill program at South Railroad for an additional $1.5 million, bringing the total 2022 planned direct drilling cost spending to $3.0 million across 11,370 metres of drilling. The current and primary objectives are to upgrade and increase oxide resources at the Pinion SB, LT, POD, Sweet Hollow, Jasperoid Wash, and Dixie targets.

EXPLORATION PROGRAM

This year, drilling across the portfolio began in April after preparations and operational ramp-up during the first quarter.

Regional exploration work at Camino Rojo includes reverse circulation drilling ("RC") and continued target definition activities. RC drill testing of near-mine target areas near the Camino Rojo Oxide Mine is underway, with 40% of the program completed at September 30, 2022. The highest priority targets are expected to be drilled along the mine trend in the fourth quarter, 2022, subject to drill permits being issued. Phase 2 of the sulphide drill program is underway, with ten oriented diamond drill holes completed since the program began in April, the details of which are discussed above.

In the second quarter 2022, the planned drill program at Cerro Quema commenced with two diamond drill holes completed in La Pelona target and three holes in La Prieta targets. Drilling in both target areas has returned encouraging results and additional drilling will be planned for 2023. Assay results are available in Orla's news release dated September 12, 2022 (Orla Mining Advances Exploration & Growth Pipeline).

In the third quarter 2022, infill and expansion drilling at Caballito focused on converting resources from the inferred resource to the indicated resource category, providing material for metallurgical testing, and testing the continuity of mineralization and potential extensions of this deposit. This drilling, along with more limited drilling planned at La Pava and Quemita sulphide deposits, will continue through the fourth quarter 2022.

The initial 2022 exploration budget totalled $15 million, with $10 million allocated to Mexico and $5 million allocated to Panama. Supported by the recent exploration success and following the completion of the acquisition of Gold Standard, Orla increased the 2022 spending to $18.0 million.

GUIDANCE

On October 11, 2022 the Company issued a press release increasing production guidance for the full year 2022 (Orla Mining Provides Third Quarter 2022 Operational Results and Increases 2022 Annual Production Guidance). The Company also issued a press release on September 12, 2022, increasing annual exploration spending for 2022 to $18.0 million (Orla Mining Advances Exploration & Growth Pipeline). AISC guidance for the year is maintained at $600 to $700 per ounce of gold sold.

Table 2: 2022 Operational Guidance and Outlook1 | |||||

Original | Updated | ||||

Gold Production | oz | 90,000 – 100,000 | 100,000 – 110,000 | ||

All-in Sustaining Costs ("AISC")2,3 | $/oz Au sold | $600 - $700 | $600 - $700 | ||

Capital Expenditures3 | |||||

Sustaining Capital Expenditures | $M | $5 | $5 | ||

Non-Sustaining Capital Expenditures | $M | $20 | $20 | ||

Total Capital Expenditures | $M | $25 | $25 | ||

Exploration3 | |||||

Mexico | $M | $10 | $10 | ||

Panama | $M | $5 | $5 | ||

Nevada | $M | NA | $3 | ||

Total Exploration | $M | $15 | $18 | ||

1. | The outlook includes full-year 2022 figures except for AISC which is calculated from Q2-Q4 2022. |

2. | AISC is a non-GAAP measure. See the "Non-GAAP Measures" section of this news release for additional information. |

3. | Exchange rates used to forecast cost metrics include MXN/USD of 20.0 and CAD/USD of 1.25 |

CONSOLIDATED FINANCIAL STATEMENTS

Orla's unaudited interim financial statements and management's discussion and analysis for the three and nine months ended September 30, 2022, are available on the Company's website at www.orlamining.com, and under the Company's profiles on SEDAR and EDGAR.

Qualified Persons Statement

The scientific and technical information in this news release was reviewed and approved by Mr. J. Andrew Cormier, P. Eng., Chief Operating Officer of the Company, and Mr. Sylvain Guerard, P. Geo., Senior Vice President, Exploration of the Company, who are the Qualified Persons as defined under NI 43-101 standards.

THIRD QUARTER 2022 CONFERENCE CALL

Orla will host a conference call on Friday, November 11, 2022, at 10:00 AM, Eastern Time, to provide a corporate update following the release of its financial and operating results for the third quarter 2022:

Dial-In Numbers:

Conference ID: | 5844017 |

Toll Free: | 1 (888) 550-5302 |

International: | 1 (646) 960-0685 |

Webcast: https://orlamining.com/investors/presentations-and-events/

About Orla Mining Ltd.

Orla is operating the Camino Rojo Oxide Gold Mine, a gold and silver open-pit and heap leach mine, located in Zacatecas State, Mexico. The property is 100% owned by Orla and covers over 160,000 hectares. The technical report for the 2021 Feasibility Study on the Camino Rojo oxide gold project entitled "Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico" dated January 11, 2021, is available on SEDAR and EDGAR under the Company's profile at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of Cerro Quema located in Panama which includes a gold production scenario and various exploration targets. Cerro Quema is a proposed open pit mine and gold heap leach operation. The technical report for the Pre-Feasibility Study on the Cerro Quema oxide gold project entitled "Project Pre-Feasibility Updated NI 43-101 Technical Report on the Cerro Quema Project, Province of Los Santos, Panama" dated January 18, 2022, is available on SEDAR and EDGAR under the Company's profile at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of the South Railroad Project, a feasibility-stage, open pit, heap leach project located on the Carlin trend in Nevada. The technical report for the 2022 Feasibility Study entitled "South Railroad Project, Form 43-101F1 Technical Report Feasibility Study, Elko County, Nevada" dated March 23, 2022, is available on SEDAR and EDGAR under Gold Standard Ventures Corp.'s profile at www.sedar.com and www.sec.gov, respectively. The technical reports are available on Orla's website at www.orlamining.com.

Non-GAAP Measures

The Company has included certain performance measures in this news release which are not specified, defined, or determined under generally accepted accounting principles (in the Company's case, International Financial Reporting Standards ("IFRS"")). These are common performance measures in the gold mining industry, but because they do not have any mandated standardized definitions, they may not be comparable to similar measures presented by other issuers. Accordingly, the Company uses such measures to provide additional information and you should not consider them in isolation or as a substitute for measures of performance prepared in accordance with generally accepted accounting principles ("GAAP").

In this section, all currency figures in tables are in thousands, except per-share and per-ounce amounts.

AVERAGE REALIZED GOLD PRICE

Average realized gold price per ounce sold is calculated by dividing gold sales proceeds received by the Company for the relevant period by the ounces of gold sold. The Company believes the measure is useful in understanding the gold price realized by the Company throughout the period.

AVERAGE REALIZED GOLD PRICE | Three months ended | Nine months ended | |||

2022 | 2021 | 2022 | 2021 | ||

Revenue | $ 49,030 | — | $ 136,472 | — | |

Silver sales | (191) | — | (607) | — | |

Gold sales | 48,839 | — | 135,865 | — | |

Ounces of gold sold | 28,749 | — | 75,064 | — | |

AVERAGE REALIZED GOLD PRICE PER OUNCE SOLD | $ 1,699 | — | $ 1,810 | — | |

NET DEBT

Net debt is calculated as total debt adjusted for unamortized deferred financing charges less cash and cash equivalents and short-term investments at the end of the reporting period. This measure is used by management to measure the Company's debt leverage. The Company believes that in addition to conventional measures prepared in accordance with IFRS, net debt is useful to evaluate the Company's leverage.

NET DEBT | September 30, | December 31, | |

Current portion of long term debt | $ 37,200 | $ 25,293 | |

Long term debt | 129,448 | 136,060 | |

Less: Cash and cash equivalents | (89,148) | (20,516) | |

NET DEBT | $ 77,500 | $ 140,837 |

ADJUSTED EARNINGS (LOSS)

Adjusted earnings (loss) excludes deferred taxes, unrealized foreign exchange, changes in fair values of financial instruments, impairments and reversals due to net realizable values, restructuring and severance, and other items which are significant but not reflective of the underlying operational performance of the Company. We believe these measures are useful to investors because they are important indicators of the strength of our operations and the performance of our core business.

ADJUSTED EARNINGS | Three months ended | Nine months ended | |||

2022 | 2021 | 2022 | 2021 | ||

Net income (loss) for the period | $ 8,895 | $ (9,554) | $ 27,080 | $ (21,260) | |

Unrealized foreign exchange | (3,212) | 4,124 | (3,833) | 2,018 | |

Loss on early settlement of project loan | — | — | 13,219 | — | |

ADJUSTED EARNINGS (LOSS) | $ 5,683 | $ (5,430) | $ 36,466 | $ (19,242) | |

Millions of shares outstanding – basic | 282.5 | 246.0 | 261.4 | 239.3 | |

Adjusted earnings (loss) per share – basic | $ 0.02 | $ (0.02) | $ 0.14 | $ (0.08) | |

FREE CASH FLOW

The Company believes certain investors and analysts use Free Cash Flow to evaluate the Company's operating cash flow capacity to meet non-discretionary outflows of cash. Net Free Cash Flow is not meant to be a substitute for the cash flow information presented in accordance with IFRS. Free Cash Flow is calculated as the sum of cash flow from operating activities and cash flow from investing activities, excluding certain unusual transactions.

FREE CASH FLOW | Three months ended | Nine months ended | |||

2022 | 2021 | 2022 | 2021 | ||

Cash flow from operating activities | $ 23,046 | $ (2,909) | $ 63,475 | $ (7,655) | |

Cash flow from investing activities | 2,194 | (25,810) | 6,832 | (102,703) | |

FREE CASH FLOW | $ 25,240 | $ (28,719) | $ 70,307 | $ (110,358) | |

Millions of shares outstanding – basic | 282.5 | 246.0 | 261.4 | 239.3 | |

Free cash flow per share – basic | $ 0.09 | $ (0.12) | $ 0.27 | $ (0.46) | |

CASH COST

The Company calculates cash cost per ounce by dividing the sum of operating costs and royalty costs, net of by-product silver credits, by ounces of gold sold. Management believes that this measure is useful to external users in assessing operating performance. Figures are presented only from April 1, 2022, as the Camino Rojo Oxide Gold Mine commenced commercial production on that date.

CASH COST | Three months ended | Six months ended | |||

2022 | 2021 | 2022 | 2021 | ||

Cost of sales – operating costs | $ 11,973 | $ — | $ 22,749 | $ — | |

Related to previous quarter | — | — | (503) | — | |

Royalties | 1,217 | — | 2,316 | — | |

Silver sales | (191) | — | (388) | — | |

CASH COST | $ 12,999 | $ — | $ 24,174 | $ — | |

Ounces sold | 28,749 | — | 54,180 | — | |

Cash cost per ounce sold | $ 452 | $ n/a | $ 446 | $ n/a | |

ALL-IN SUSTAINING COST

The Company has provided an AISC performance measure that reflects all the expenditures that are required to produce an ounce of gold from operations. While there is no standardized meaning of the measure across the industry, the Company's definition conforms to the all-in sustaining cost definition as set out by the World Gold Council in its guidance dated November 14, 2018. Orla believes that this measure is useful to external users in assessing operating performance and the Company's ability to generate free cash flow from current operations. Figures are presented only from April 1, 2022, as the Camino Rojo Oxide Gold Mine commenced commercial production on that date.

ALL-IN SUSTAINING COST | Three months ended | Six months ended | |||

2022 | 2021 | 2022 | 2021 | ||

Cost of sales – operating costs | $ 11,973 | $ — | $ 22,749 | $ — | |

Related to previous quarter | — | — | (503) | — | |

Royalties | 1,217 | — | 2,316 | — | |

Silver sales | (191) | — | (388) | — | |

General and administrative | 2,342 | — | 4,893 | — | |

Share based payments | 518 | — | 1,056 | — | |

Accretion of site closure provision | 118 | — | 235 | — | |

Amortization of site closure provision | 224 | — | 343 | — | |

Sustaining capital | 759 | — | 1,417 | — | |

Lease payments | 103 | — | 226 | — | |

ALL-IN SUSTAINING COST | $ 17,063 | $ — | $ 32,344 | $ — | |

Ounces sold | 28,749 | — | 54,180 | — | |

All-in sustaining cost per ounce sold | $ 594 | $ n/a | $ 597 | $ n/a | |

Forward-looking Statements

This news release contains certain "forward-looking information" and "forward-looking statements" within the meaning of Canadian securities legislation and within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission, all as may be amended from time to time, including, without limitation, statements regarding the Company's 2022 guidance, including production, operating costs and capital costs; potential development scenarios for the Sulphide Project; exploration and study work planned at the Sulphide Project and the timing and results thereof; the Company's other exploration plans, including timing, expenditures and the goals thereof; and the Company's expectations regarding advancement, development and production its projects, including the timing thereof. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding the price of gold, silver, and copper; the accuracy of mineral resource and mineral reserve estimations; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: uncertainty and variations in the estimation of mineral resources and mineral reserves, including risks that the interpreted drill results may not accurately represent the actual continuity of geology or grade of the deposit, bulk density measurements may not be representative, interpreted and modelled metallurgical domains may not be representative, and metallurgical recoveries may not be representative; the Company's reliance on Camino Rojo and risks associated with its start-up phase; financing risks and access to additional capital; risks related to natural disasters, terrorist acts, health crises and other disruptions and dislocations, including by the COVID-19 pandemic; risks related to the Company's indebtedness; success of exploration, development, and operation activities; foreign country and political risks, including risks relating to foreign operations and expropriation or nationalization of mining operations; concession risks; permitting risks; environmental and other regulatory requirements; delays in or failures to enter into a subsequent agreement with Fresnillo Plc with respect to accessing certain additional portions of the mineral resource at Camino Rojo and to obtain the necessary regulatory approvals related thereto; the mineral resource estimations for Camino Rojo being only estimates and relying on certain assumptions; the Layback Agreement with Fresnillo Plc remaining subject to the transfer of surface rights; delays in or failure to get access from surface rights owners; risks related to guidance estimates and uncertainties inherent in the preparation of feasibility and pre-feasibility studies, including but not limited to, assumptions underlying the production estimates not being realized, changes to the cost of production, variations in quantity of mineralized material, grade or recovery rates, geotechnical or hydrogeological considerations during mining differing from what has been assumed, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to exchange, interest or tax rates, cost of labour, supplies, fuel and equipment rising, changes in project parameters, delays, and costs inherent to consulting and accommodating rights of local communities; uncertainty in estimates of production, capital, and operating costs and potential production and cost overruns; the fluctuating price of gold, silver, and copper; global financial conditions; uninsured risks; competition from other companies and individuals; uncertainties related to title to mineral properties; conflicts of interest; risks related to compliance with anti-corruption laws; volatility in the market price of the Company's securities; assessments by taxation authorities in multiple jurisdictions; foreign currency fluctuations; the Company's limited operating history; risks related to the Company's history of negative operating cash flow; litigation risks; intervention by non-governmental organizations; outside contractor risks; risks related to historical data; unknown labilities in connection with acquisitions, including the Company's acquisition of Gold Standard; the Company's ability to identify, complete, and successfully integrate acquisition, including the Company's ability to integrate the acquisition of Gold Standard; dividend risks; risks related to the Company's foreign subsidiaries; risks related to the Company's accounting policies and internal controls; the Company's ability to satisfy the requirements of the Sarbanes-Oxley Act of 2002; enforcement of civil liabilities; the Company's status as a passive foreign investment company for U.S. federal income tax purposes; information and cyber security; gold industry concentration; shareholder activism; risks associated with executing the Company's objectives and strategies, as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, as well as its annual information form dated March 18, 2022, which are available on www.sedar.com and www.sec.gov. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

This news release has been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the United States securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with Canadian National Instrument 43-101 — Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For United States reporting purposes, the United States Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by United States companies subject to the United States federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

SOURCE Orla Mining Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2022/10/c0973.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2022/10/c0973.html