Pasofino Gold Announces Results of Initial Fieldwork at the Bukon Jedeh Area

Toronto, Ontario--(Newsfile Corp. - August 22, 2022) - Pasofino Gold Limited (TSXV: VEIN) (OTCQB: EFRGF) (FSE: N07A) ("Pasofino" or the "Company") is pleased to announce results of 'rock-chip sampling at the Bukon Jedeh area on its Dugbe Gold Project in Liberia, with results up to 1 ounce gold per tonne.

Highlights

- 4.1km trend of artisanal gold mining dating back to the 1930's. Ten pits visited by Pasofino - at all of these, gold is extracted from fresh bedrock from up to 60 m depth.

- All pits except two gave rock-chip samples with over 3 g/t gold. The 'TBS' pit just north of main trend returned a sample with 31 g/t gold.

- The 2012/2013 historical Reverse Circulation drill-holes (described below) were mostly drilled 'off the trend' of the artisanal pits which have been excavated since that time.

- The work highlights the potential for discovery on the Dugbe Gold Project, which already hosts 3.4 million measured and indicated ounces and 0.6 million inferred ounces[1].

Daniel Limpitlaw, CEO, commented:

"These samples indicate the potential for additional zones of high-grade gold, and that exploration undertaken by prior operators largely missed what is now a string of pits on a 4 km-long zone. This is a clear opportunity to bring more gold to the planned 200koz gold per annum production from the nearby Tuzon and Dugbe F deposits, a production rate determined by our recently completed Feasibility Study[2]"

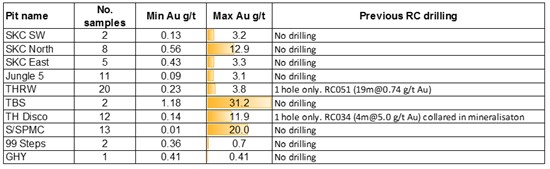

Table 1. Summary of recent Bukon Jedeh area rock chip results and summary of 2012/2012 RC results for each pit sampled.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6283/134440_pasofino_table1_550.jpg

The Bukon Jedeh Mining area

The Bukon Jedeh area was acquired by Hummingbird Liberia in late 2020 and is 7 km southeast of the Company's Tuzon and Dugbe F deposits (Fig. 1). The area is considered the oldest and largest artisanal mining area in Liberia and gold is presently produced by artisanal miners from many pits up to 60 m deep, and at least 10 pits have moved below the oxide zone to extract gold from fresh bedrock. These pits are labelled on figure 2. The results of the rock-chip samples from the pits are provided in Table 1. Figure 3 provides images of two of the pits. The main area has a strike length of 4.1 km. Despite these very positive indications exploration has been limited; reverse circulation (RC) drilling by a prior operator in 2012 and 2013 gave some promising intersections (Fig. 2) but work ceased in 2013 and no exploration has been carried out until now.

Figure 1. Location of the Bukon Jedeh area within the Dugbe Gold Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6283/134440_6f29d97fc4977acf_002full.jpg

Exploration

Hummingbird Liberia acquired the Bukon Jedeh area in November 2020[3] and it is now included in the Dugbe Project and the related Mineral Development Agreement (MDA). The recent visit is the first work carried out in the Bukon Jedeh area by the Company. The objective was to map out the fresh rock pits and collect samples from the pits for gold analysis. All samples were over 1 kilogram and are of fresh-rock. The work confirms the presence of excellent gold grades in almost every pit visited and importantly that only two of the pits were tested by the 2012/2013 drilling - by only two holes, both with good results (Table 1). The previous drilling was mostly 'off' the main trends defined by the pits - most of which did not exist in 2012/2013. There is an obvious opportunity to carry out drilling to test these pits. Airborne magnetic data collected in 2013 reveals a marked magnetic anomaly possibly at the hinge of the main fold (Fig. 2) - largely obscured by a 1km long zone of alluvial workings. These represent additional important drill targets which have not been tested to date. Structural mapping to understand the fold geometry and other structural controls should be carried out to guide a future drilling program.

Figure 2. Map showing the recent rock chip samples at the 10 pits sampled. Background image is airborne magnetic data.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6283/134440_6f29d97fc4977acf_003full.jpg

Geology

Pasofino's geologists observed mafic gneissic rocks of possible volcanic and metasedimentary origin and interpret them to be higher grade metamorphic equivalents of the 'Birimian' of West Africa which is one of the world's most prolific in terms of gold production. The dominant host rock is an orthopyroxene gneiss with sulphides and vein-like quartz.

Pasofino interprets a large east-west oriented overturned fold structure (Fig. 2) with a possible hinge in the west and the existing pits located on the north and south limbs. Some of the 2012/2013 RC holes intersected gold mineralisation in the area between the limbs suggesting multiple gold zones. The TBC pit where a sample with 31 g/t Au was collected is on a possible adjacent fold to the north of the main structure. The layers worked in the pits have a dominant north or northwest dip except for the TBC and SKC North pits where the layers dip southwards.

Figure 3. Photos of the pits showing steeply inclined mined zone on left and lower angled zone on right.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6283/134440_6f29d97fc4977acf_004full.jpg

QUALIFIED PERSONS STATEMENT

Scientific or technical information in this disclosure that relates to exploration results was prepared and approved by Mr. Andrew Pedley. Mr. Pedley is a consultant of Pasofino Gold Ltd.'s wholly-owned subsidiary ARX Resources Limited. He is a member in good standing with the South African Council for Natural Scientific Professions (SACNASP) and is as a Qualified Person under National Instrument 43-101.

ABOUT THE DUGBE GOLD PROJECT

The 2,559 km2 Dugbe Gold Project is in southern Liberia and situated within the southwestern corner of the Birimian Supergroup which is host to most West African gold deposits. To date, two deposits have been identified on the Project; Dugbe F and Tuzon discovered by Hummingbird in 2009 and 2011 respectively. The deposits are located within 4 km of the Dugbe Shear Zone which is thought to have played a role in large scale gold mineralization in the area.

A significant amount of exploration in the area was conducted by Hummingbird up until 2012 including 74,497 m of diamond coring. Pasofino drilled an additional 14,584 metres at Tuzon and Dugbe during 2021. Both deposits have Mineral Resource Estimates dated 17 November 2021 with total Measured and Indicated of 3.4 Moz with an average grade of 1.37 g/t Au, and 0.6 Moz in Inferred. Following the completion of the Definitive Feasibility Study in June 2022 a Mineral Reserve Estimate was declared, based on the open-pit mining of both deposits over a 14-year Life of Mine. A technical report for the Dugbe Gold Project was prepared in accordance with National Instrument 43-101 and filed on SEDAR at www.sedar.com and on the Company's website.

In addition to the existing deposits there are many gold prospects within the Project including the Bukon Jedeh area and the DSZ target on the Tuzon-Sackor trend where Pasofino has discovered a broad zone of surface gold mineralisation in trench and outcrop along strike from Tuzon. At this and several of the other prospects no drilling has been carried out to date.

In 2019, Hummingbird signed a 25-year Mineral Development Agreement ("MDA") with the Government of Liberia providing the necessary long-term framework and stabilization of taxes and duties. Under the terms of the MDA, the royalty rate on gold production is 3%, the income tax rate payable is 25% (with credit given for historic exploration expenditures), the fuel duty is reduced by 50%, and the Government of Liberia is granted a free carried interest of 10% in the Project.

ABOUT PASOFINO GOLD LTD.

Pasofino Gold Ltd. is a Canadian-based mineral exploration company listed on the TSX-V (VEIN).

Pasofino, through its wholly-owned subsidiary, is earning a 49% economic interest (prior to the issuance of the Government of Liberia's 10% carried interest) in the Dugbe Gold Project.

For further information, please visit www.pasofinogold.com or contact:

Lincoln Greenidge, CFO

T: 416 451 0049

E: lgreenidge@pasofinogold.com

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" that are based on expectations, estimates, projections and interpretations as at the date of this news release. Forward-looking statements are frequently characterised by words such as "plan", "expect", "project", "seek", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur, and include, without limitation, statements regarding the ability to raise the funds to finance its ongoing business activities including the acquisition of mineral projects and the exploration and development of its projects. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors may include, but are not limited to, the results of exploration activities; the ability of the Company to complete further exploration activities; timing and availability of external financing on acceptable terms and those risk factors outlined in the Company's Management Discussion and Analysis as filed on SEDAR. The Company does not undertake to update any forward-looking information except in accordance with applicable securities laws.

[1] Total Measured and Indicated Mineral Resource Estimate 3.4 Moz. Total Inferred 0.6 Moz.

[2] Pasofino announcement dated 13 June 2022

[3] Pasofino announcement dated 10 November 2020

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/134440