Pistol Bay Acquires Icefield Gold Project in Southern British Columbia

(TheNewswire)

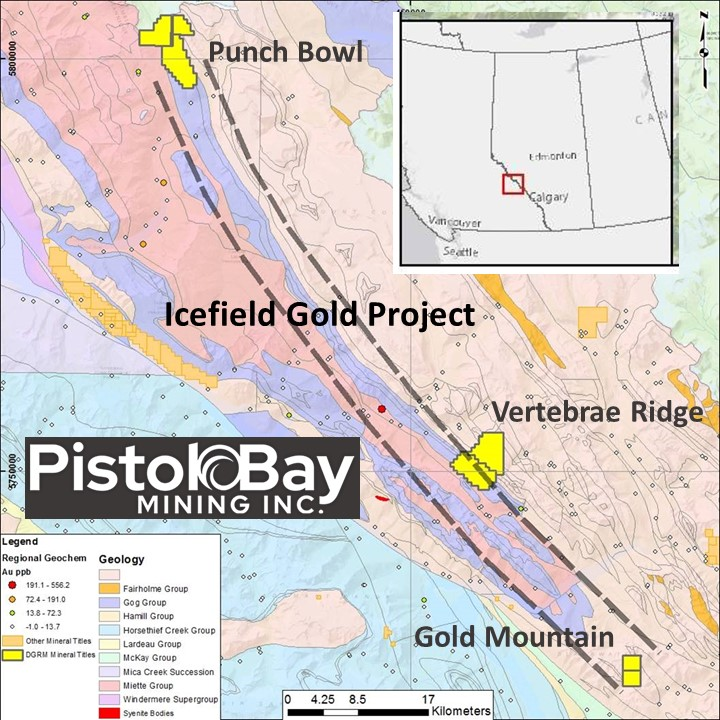

Vancouver, B.C. – TheNewswire - September 10, 2020 - Pistol Bay Mining Inc. (TSXV:PST); (Frankfurt - OQS2), (OTC:SLTFF) (“Pistol Bay” or the “Company”) is pleased to report that it has entered into an arm's-length letter of intent (LOI), with DG Resource Management Ltd., whereby the Company may acquire a 100-per-cent undivided interest in the Icefield Gold Project (the “Project”), located north of the community of Golden, British Columbia. The Project consists of three distinct claim groups totalling 6,752 ha; Punch Bowl (3,079 ha), Vertebrae (2,871 ha), and Gold Mountain (802 ha). The Project covers portions of an approximately 90 km long trend with highly anomalous gold occurrences reported from both outcrop and drill core.

Project highlights include:

-

--Punch Bowl – siliciclastic-hosted gold mineralization within variable quartz veins, which contain up to 500 g/t Au from grab samples;

-

--Vertebrae Ridge – structurally controlled copper mineralization hosted in carbonate rocks. Quartz veins, stockworks, and breccias traced over an approximate 2 km strike length (50 – 100 m wide), hosting chalcopyrite, bornite, and malachite; and

-

--Gold Mountain – historical exploration included trenching and eight (8) drill holes targeting a zone of quartz stockwork. Results include a drill hole intercept of

-

- 59.03 g/t Au, 7,530 g/t Ag, 16.9% Cu, and 8.95% Pb over 4.04 meters

Figure 1 Location of Icefield Gold Project, BC

Punch Bowl Claims

At Punch Bowl, gold mineralization is hosted by the McNaughton Formation (quartz dominated clastic units), of the Lower Cambrian Gog Group (quartzite, shale, conglomerate, carbonate). The Gog Group continues southerly through the eastern portions of the Vertebrae Ridge Property, to just north of the Gold Mountain Property.

Gold mineralization in the area was discovered in the late 1960’s in talus, which was later traced back to the source outcrop. Grab samples from this period returned a maximum value of 79 oz/t Au and 14.5 oz/t Ag from the mineralized veins at the main showing (Assessment Report 16242), which is located in the north-central area of the present-day Property. Exploration by Gamsan Resources in 1987/1989, re-sampled and verified the presence of numerous high-grade gold veins (Shaw and Morton, 1989):

“Gold-quartz mineralization outcropping on the southwest slope of McGillivray Ridge is contained in a series of discrete veins structures confined to quartzites +/- pelites of the McNaughton Formation …. over 20 veins have produced anomalous gold values… grading locally from nil to 500 g/t Au, with visible gold observed in many cases.”

Based on the geological setting and style of mineralization observed at Punch Bowl, the Company considers the prime exploration target to be a structurally controlled, sediment-hosted gold occurrence similar to those deposits within the Bendigo District, Australia. A notable example of this deposit type is Kirkland Lake’s Fosterville Mine with Proven and Probable Reserves of 2.72 Mt at 31.0 g/t Au (NI 43-101 Technical Report, Effective Date 2018-12-31).

The Company cautions that past results or discoveries on geologically similar properties (i.e. Fosterville) may not necessarily be indicative to the presence of mineralization on the Company’s properties (i.e. Punch Bowl). The Company also notes that it has not verified historical results documented on the present-day Punch Bowl Property, and that surface rock sample assays (i.e. grab) are selective by nature and represent a point location, and therefore may not necessarily be fully representative of the mineralized horizon (i.e. vein) sampled.

Charles Desjardins, President and CEO of Pistol Bay comments, “We are extremely excited to have acquired the Icefield Gold Project, which offers the opportunity to explore for Fosterville type gold occurrences in Canada, both at a regional setting and by revisiting showings with previously documented high-grades of gold mineralization in both outcrop and drill core.”

Vertebrae Ridge Claims

At Vertebrae Ridge, two large, mapped syenite bodies are present with limited exploration documented. In 2014/2015, two structurally controlled zones of copper mineralization (No. 1 Copper Zone, and No. 2 Copper Zone) were discovered within carbonate rocks, approximately 3 kilometres to the northeast of the intrusive bodies.

The No. 1 Copper Zone has been traced in outcrop over a strike length of approximately 2 km, with a width of 50 - 100 m, and is described as a zone of quartz veins, stockworks, and breccias bearing pyrite, chalcopyrite, and bornite with significant malachite and azurite noted.

The No. 2 Copper Zone has been traced over a strike length of approximately 200 m and is described as quartz veining with abundant malachite, pyrite/chalcopyrite mineralization. No known samples have been collected for assay; however, photographs of the mineralization are available.

Figure 2 Visible copper mineralization, Vertebrae Ridge Property, BC.

Gold Mountain

At the south end of the Icefield Project, approximately 50 km north of Golden, BC and just north of Highway 1, are the Gold Mountain claims, which cover the historical Grizzly Prospect where gold and silver are hosted within polymetallic quartz/carbonate veins. Discovered in the 1930’s, one adit and two small open cuts were developed at the occurrence. During the 1980’s, significant surface exploration was completed including trenching and several shallow drill holes. This work outlined the North (Area “C”) and South (Area “A”) showings, which collectively outline a 600+ m long trend of quartz veins and stockworks.

Exploration in 1982 at the North Showing, near the adit, identified a 1 m wide quartz vein, which returned a chip sample of 4.87 g/t Au, 710 g/t Ag and 1.89% Cu. At the South Showing, five veins were exposed by trenches where “two select samples representing predominantly tetrahedrite and lead mineralization, assayed” 30.3 g/t Au, 13,001 g/t Ag and 32.5% Cu (sample “T”) and 13.0 g/t Au, 6,642 g/t Ag and 80.21% Pb (sample “L”) (Allen 1982 - Assessment Report 10954). The Showing is noted as hosting a two parallel veins and cross-veins over a 160 m by 50 m area.

Eight, shallow, back-pack style drill holes were completed in 1984 at the South (Area “A”) Showing. Although poor recoveries were noted, starting from surface results include:

-

- 4.04 meters of 59.03 g/t Au, 7,530 g/t Ag, 16.9% Cu, and 8.95% Pb (Drill hole A)

- 4.50 meters of 7.89 g/t Au, 1,034 g/t Ag, 2.30% Cu, and 5.26% Pb (Drill hole C)

-

(1)g/t values for Au and Ag have been converted from the reported ounce/ton using a multiplier of 34.2857

The Company notes that it has not verified historical results documented on the Gold Mountain Property. Further, the Company notes that surface rock sample assays (i.e. grab, and “select”) are selective by nature and represent a point location, and therefore may not necessarily be fully representative of the mineralized horizon (i.e. vein) sampled.

Transaction

Under the terms of the agreement, the Company may acquire a 100-per-cent interest in the Project by paying a total of $50,000, issuing an aggregate seven million common shares and two million transferable common share purchase warrants, exercisable at 5 cents and expiring three years from issuance as follows:

-

- $25,000 upon signing the agreement;

-

- one million consideration shares and one million consideration warrants upon receipt of TSX Venture Exchange approval of the agreement;

-

- $25,000 and one million consideration shares and one million consideration warrants on the one-year anniversary of exchange approval of the agreement; and

-

- five million consideration shares on the two-year anniversary of exchange approval of the agreement.

In the event that a gold equivalent resource of more than one million ounces is outlined within a National Instrument 43-101 resource estimate on the Project, the Company shall pay $1-million, payable in shares or cash or a combination of both, at the Company's discretion. In the case of a share issuance, the shares shall be issued at a price using the average market price of the previous 30 trading days preceding the share issuance.

The vendors shall retain a 2-per-cent net smelter return royalty (NSR) on the Project, of which the Company shall have the right to purchase half (1 per cent) for $1-million.

Darren L. Smith, MSc, PGeo, of Dahrouge Geological Consulting Ltd., consultant to the company and a qualified person as defined by NI 43-101, supervised the preparation of the technical information in this news release.

About Pistol Bay Mining Inc.

Pistol Bay Mining Inc. is a diversified Junior Canadian Mineral Exploration Company with a focus on zinc and base metal properties in North America. The company is also actively pursuing the right opportunity in other resources to enhance shareholders value. For additional information please visit the Company website at www.pistolbaymininginc.com or contact Charles Desjardins at pistolbaymining@gmail.com.

On Behalf of the Board of Directors

PISTOL BAY MINING INC.

Charles Desjardins,

President and Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements:

Statements included in this announcement, including statements concerning of the Company’s plans, intentions and expectations, which are not historical in nature are intended to be, and are hereby identified as, “forward-looking statements”. Forward-looking statements may be identified by words including “anticipates”, “believes”, “intends”, “estimates”, “expects” and similar expressions. The Company cautions readers that forward-looking statements, including without limitation those relating to the Company’s future operations and business prospects, are subject to certain risks and uncertainties that could cause actual results to differ materially from those indicated in the forward-looking statements.

Copyright (c) 2020 TheNewswire - All rights reserved.