Rathdowney Continues to Advance Olza Zinc-Lead Project in Poland

VANCOUVER, Aug. 1, 2018 /CNW/ - Rathdowney Resources Ltd. ("Rathdowney" or the "Company") (TSX‐V: RTH) is pleased to provide an update on progress at its 100% owned Olza Zinc-Lead Project in Poland.

"Rathdowney is continuing to advance Project Olza toward development," reports Chairman David Copeland. "Project activities are currently focused in key areas necessary to acquire project permits. Our teams are progressing with the Project Development Plan, and compiling the data and studies needed for the upcoming Environmental Impact Assessment process. We are working toward submitting our application in the third quarter of 2019."

In 2015, Rathdowney announced the results of a Preliminary Economic Assessment ("PEA")1 by SRK Consulting (UK) Ltd for Project Olza. The PEA reported strong potential financial returns for a 6,000 tonnes per day underground mine with conventional mill, including a post-tax Net Present Value of US$170 million with an Internal Rate of Return IRR 30% and payback in 2.4 years.

"The cost to produce a pound of zinc at Olza, on a byproduct basis would be US$0.47 per pound based the long-term forecast metal prices - US$1.00 per pound for zinc and US$0.95 for lead per pound - used in PEA," says Copeland. "Hence, Project Olza is very robust even at a zinc price much lower than the current US$1.19 per pound."

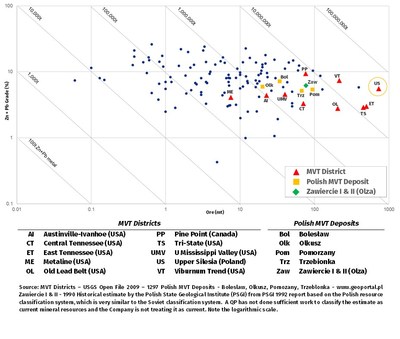

The strong returns anticipated from a mine at Olza are a result of the project's favourable location in a well-established brown fields mining district. The Upper Silesia District of Poland is well known for its large Mississippi Valley Type ("MVT") deposits with a history of solid production from world-class zinc mines. In 2009, the United States Geological Survey (USGS) released a compilation of mineral resource data on MVT deposits that shows the Upper Silesia as one of the world's largest MVT districts as ranked by its contained metal2. The graph below, derived from that publication, shows the USGS data as well as additional information on individual Polish deposits; it is also posted on the Company's website at

http://www.rathdowneyresources.com/rdr/MapsFigures.asp?ReportID=832767.

____________________________

1 The PEA uses an 8% discount rate and the median of consensus forecast prices of Zn $1.00-1.10/lb and Pb $0.95-1.00/lb. All values in US dollars and metric units. Further details are available in Rathdowney's April 20, 2015 news release and Preliminary Economic Assessment (PEA) Technical Report, effective date December 31, 2014, both of which are available on the Company website www.rathdowneyresources.com and the Company's profile at www.sedar.com.

2 USGS Open File Report 2009-1297.

This region of Poland has been mined since the 1200's: recently exploited deposits such as ZGHB's Pomorzany mine started production in the 1970's and, as befits the Silesia style of MVT, has yielded in excess of 90 million tonnes of ore3 from a concession footprint of similar size to Rathdowney's Project Olza.

Project Olza's deposit geology is simple: rocks formed from large platform reefs host a series pf very continuous mineralized zones, ranging in thickness between 2.5 and 8 metres, with strike lengths of 50-1000 metres, at shallow (on average 180 metres) depth. Testing of mineralized cores from Olza indicates that concentrates produced using conventional metallurgical treatment will be of high quality with no deleterious elements, and low iron.

All necessary infrastructure for development of a mine already exists in the immediate vicinity of Project Olza. Well-maintained highways provide easy access to the property. A spur of the national railway, connecting to its yards and services, crosses a portion of the project area. An electrical grid with substations that have underutilized capacity are also located in the immediate area. The local population have mining skill sets, including technical trades in the various disciplines needed and dependable contractors are at hand. Importantly, there is a young, skilled technical work force seeking additional training that would fit well into the rebirth of modern mining in the region.

___________________________________

3 www.geoportal.pl

"All these items will contribute to a substantial positive influence on mine availability, productivity, efficiency and cost, limiting the development and operational risk," said Copeland. "Project Olza's projected costs are well understood and controllable, and based on operations in the local area, and other Eastern European regions where similar work has been undertaken, and is ongoing."

Tabulated highlights of the after-tax PEA results are available on the Company website at http://www.rathdowneyresources.com/rdr/MapsFigures.asp?ReportID=832767. The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that the PEA will be realized.

Current Project Development Activities

Teams in the field and site offices are working to advance the Project Development Plan (PZZ) and compiling the data and studies needed for the Environmental Impact Assessment (EIA) process.

The PZZ is similar to a pre-feasibility study; however, as it leads to a decision on granting an extraction license or Polish mining permit, the PZZ focuses more on operational parameters, mining techniques and staffing as well as related service requirements. Work on routing services, as well as prioritizing site locations and mine design is advancing, with a target for completion mid next year.

The EIA work is ongoing. Field teams are gathering seasonal data as well as carrying out more detailed data collection at sites preferred for the proposed facilities. Our team also continues to coordinate closely with the environmental agencies in Poland as we advance toward submission of a permit application, anticipated to occur in the third quarter of 2019.

Technical Information in this release has been reviewed and approved by David Copeland, PEng, a qualified person, who is also the Chairman and a director of the Company.

On behalf of the Board of Directors

David Copeland

Chairman

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address exploration drilling, exploitation activities and events or developments that the Company expects, are forward looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Assumptions used by the Company to develop forward-looking statements include the following: the Olza project will obtain all required environmental and other permits and all land use and other licenses, studies and development of the Olza project will continue to be positive, and no geological or technical problems will occur. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continuity of mineralization, potential environmental issues and liabilities associated with exploration, development and mining activities, uncertainties related to the ability to obtain necessary permits, licenses and title and delays due to third party opposition, changes in government policies regarding mining and natural resource exploration and exploitation, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedar.com.

SOURCE Rathdowney Resources Ltd.

View original content with multimedia: http://www.newswire.ca/en/releases/archive/August2018/01/c5088.html